Travelers Profit Rises, Catastrophe Losses Fall -- WSJ

January 24 2020 - 3:02AM

Dow Jones News

By Nicole Friedman and Allison Prang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 24, 2020).

Travelers Cos.'s earnings rose in the fourth quarter, but the

company said it faced higher-than-expected claims payments for

lawsuits and jury awards.

The insurance industry in recent months has become increasingly

concerned about "social inflation." The term encompasses a greater

willingness to sue insurers and a higher expectation among juries

of what insurance companies should pay to injured parties,

according to industry executives. Liability insurance policies

typically cover legal defense and damages if companies are found

liable for negligent acts.

Travelers has been the most prominent insurer so far to

attribute losses to the rise of social inflation, adding to its

reserves in both the third and fourth quarters to account for

increased claims payments in some lines of business. Its

competitors haven't moved as aggressively, leading investors to

debate whether the company's results are unusual or whether other

insurers are likely to add to their reserves too.

"We continue to believe that social inflation is an

environmental issue driven primarily by a more aggressive

plaintiffs' bar," said Travelers CEO Alan Schnitzer on an earnings

call Thursday.

Travelers shares recently fell 4.9% to $134.48. Other U.S.

insurers traded down, with American International Group Inc. down

1.6% and Hartford Financial Services Group Inc. down 2.2%.

Travelers mostly sells commercial insurance to companies with

500 or fewer employees. Insurers are used to fighting drawn-out

lawsuits over big insurance policies, but now "we are feeling the

heat in those policies that have limits of $2 million or less," Mr.

Schnitzer said on the call. "What we're seeing now is the attorney

participation spreading into, across these small accounts."

Travelers said it is raising insurance prices and changing

litigation strategies in response.

The social-inflation issue has been most prominent in commercial

auto insurance, according to insurers, and trucking companies have

faced double-digit-percentage price increases in the past year. But

Travelers said it also increased its loss estimates for general

liability and commercial multi-peril insurance.

Travelers, part of the Dow Jones Industrial Average, is among

the largest sellers of insurance to U.S. businesses and sells car

and home insurance to individuals and families. It is one of the

first big property-casualty insurers to report quarterly earnings,

and its results are watched closely as a bellwether for others.

The company said Thursday its fourth-quarter profit was $873

million, or $3.35 a share. It increased from $621 million, or $2.32

a share, a year earlier.

Travelers' pretax catastrophe losses, net of reinsurance, were

$85 million in the latest quarter, down from $610 million a year

earlier.

Total revenue, which includes investment income, rose to $8.06

billion from $7.8 billion.

Core operating earnings were $867 million, or $3.32 a share,

beating the $3.29 a share analysts polled by FactSet were looking

for. In the year-earlier period, core income was $571 million, or

$2.13 a share.

Core earnings are a closely watched metric because they exclude

realized capital gains or losses on companies' investment

portfolios as well as items that aren't considered recurring in

nature.

Net premiums written, an important measure of revenue growth,

rose 5.7% to $7.08 billion.

Write to Nicole Friedman at nicole.friedman@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 24, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

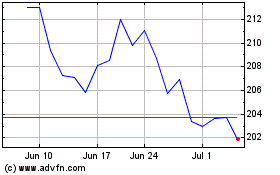

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024