Li Ka-shing Flagship CK Hutchison Defends O2 Deal

February 03 2016 - 11:20PM

Dow Jones News

HONG KONG—CK Hutchison Holdings Ltd., the flagship company of

Hong Kong tycoon Li Ka-shing, on Thursday defended its proposed $15

billion deal to buy cellphone operator O2 after the U.K.'s

telecommunications regulator warned against the deal.

In a statement, CK Hutchison Managing Director Canning Fok said

the combination of O2 and Three, CK Hutchison's existing British

carrier, wouldn't result in a price increase for consumers for five

years. He added that the combined company would also invest £ 5

billion ($7.3 billion) in the business over the same period.

Mr. Fok said his company will also allow competitors to buy

fractional ownership stakes in its U.K. mobile network as opposed

to buying wholesale network capacity. Such a move would cut out the

middleman and allow competitors on CK Hutchison's mobile network to

offer lower prices to consumers.

Last week, the chief executive of U.K. telecommunications

regulator Ofcom warned that the proposed merger could raise prices

for consumers and hurt competition among U.K. mobile carriers.

Write to Wayne Ma at wayne.ma@wsj.com

(END) Dow Jones Newswires

February 03, 2016 23:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

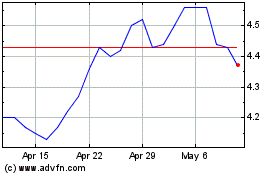

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

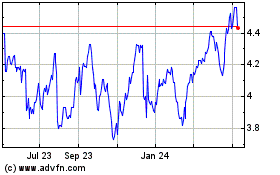

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024