Synchrony Financial (NYSE: SYF) today announced third quarter

2017 net earnings of $555 million, or $0.70 per diluted share.

Highlights for the quarter included:

- Net interest income increased 11% from

the third quarter of 2016 to $3.9 billion

- Loan receivables grew $6 billion, or

9%, from the third quarter of 2016 to $77 billion

- Purchase volume increased 4% from the

third quarter of 2016

- Strong deposit growth continued, up $5

billion, or 9%, over the third quarter of 2016

- Renewed relationships: Yamaha,

BrandsMart U.S.A., Nautilus, Mars Petcare, and Evine

- Launched new programs with At Home and

zulily

- Launched new 2% Cash Back value

proposition at PayPal

- Launched new CareCredit Dual Card™

- Quarterly common stock dividend payment

of $0.15 per share and repurchased $390 million of Synchrony

Financial common stock

“Our focus on strong organic growth across our sales platforms

has helped deliver another solid quarter. Renewing key

relationships remains a priority—we recently renewed several

programs in addition to launching two new ones. Compelling value

propositions are integral to driving program growth and we are

pleased to continue to launch innovative solutions that provide

value to our partners and cardholders. Our deposit base comprises a

significant portion of our funding and, as such, generating deposit

growth through attractive rates and great customer service is a

priority,” said Margaret Keane, President and Chief Executive

Officer of Synchrony Financial. “We have maintained solid returns

and a strong balance sheet and remain focused on returning capital

to shareholders.”

Business and Financial Highlights for

the Third Quarter of 2017

All comparisons below are for the third quarter of 2017 compared

to the third quarter of 2016, unless otherwise noted.

Earnings

- Net interest income increased $395

million, or 11%, to $3.9 billion, primarily driven by strong loan

receivables growth. Net interest income after retailer share

arrangements increased 13%.

- Provision for loan losses increased

$324 million to $1.3 billion driven by credit normalization and

loan receivables growth.

- Other income was down $8 million to $76

million, primarily due to higher loyalty program expense, partially

offset by higher interchange revenue.

- Other expense increased $99 million to

$958 million, primarily driven by business growth.

- Net earnings totaled $555 million

compared to $604 million in the third quarter of 2016.

Balance Sheet

- Period-end loan receivables growth

remained strong at 9%, primarily driven by purchase volume growth

of 4% and average active account growth of 4%.

- Deposits grew to $54 billion, up $5

billion, or 9%, and comprised 73% of funding compared to 71% last

year.

- The Company’s balance sheet remained

strong with total liquidity (liquid assets and undrawn credit

facilities) of $22 billion, or 24% of total assets.

- The estimated Common Equity Tier 1

ratio under Basel III subject to transition provisions was 17.3%

and the estimated fully phased-in Common Equity Tier 1 ratio under

Basel III was 17.2%.

Key Financial Metrics

- Return on assets was 2.4% and return on

equity was 15.3%.

- Net interest margin increased 40 basis

points to 16.74%.

- Efficiency ratio was 30.4%, compared to

30.6% in the third quarter of 2016, driven by strong positive

operating leverage. Year-to-date efficiency ratio was 30.3%,

compared to 31.0% in the prior year.

Credit Quality

- Loans 30+ days past due as a percentage

of total period-end loan receivables were 4.80% compared to 4.26%

last year.

- Net charge-offs as a percentage of

total average loan receivables were 4.95% compared to 4.39% last

year.

- The allowance for loan losses as a

percentage of total period-end loan receivables was 6.97% compared

to 5.82% last year.

Sales Platforms

- Retail Card interest and fees on loans

increased 11%, driven primarily by period-end loan receivables

growth of 9%. Purchase volume growth was 4% and average active

account growth was 3%. Loan receivables growth was broad-based

across partner programs.

- Payment Solutions interest and fees on

loans increased 11%, driven primarily by period-end loan

receivables growth of 9%. Purchase volume growth was 6%, adjusted

to exclude the impact from the hhgregg bankruptcy, and average

active account growth was 9%. Loan receivables growth was led by

home furnishings and automotive.

- CareCredit interest and fees on loans

increased 9%, driven primarily by period-end loan receivables

growth of 10%. Purchase volume growth was 9% and average active

account growth was 9%. Loan receivables growth was led by dental

and veterinary.

Corresponding Financial Tables and

Information

No representation is made that the information in this news

release is complete. Investors are encouraged to review the

foregoing summary and discussion of Synchrony Financial's earnings

and financial condition in conjunction with the detailed financial

tables and information that follow and in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2016, as

filed February 23, 2017, and the Company’s forthcoming Quarterly

Report on Form 10-Q for the quarter ended September 30, 2017. The

detailed financial tables and other information are also available

on the Investor Relations page of the Company’s website at

www.investors.synchronyfinancial.com. This information is also

furnished in a Current Report on Form 8-K filed with the SEC

today.

Conference Call and Webcast

Information

On Friday, October 20, 2017, at 8:30 a.m. Eastern Time, Margaret

Keane, President and Chief Executive Officer, and Brian Doubles,

Executive Vice President and Chief Financial Officer, will host a

conference call to review the financial results and outlook for

certain business drivers. The conference call can be accessed via

an audio webcast through the Investor Relations page on the

Synchrony Financial corporate website,

www.investors.synchronyfinancial.com, under Events and

Presentations. A replay will be available on the website or by

dialing (888) 843-7419 (U.S. domestic) or (630) 652-3042

(international), passcode 32017#, and can be accessed beginning

approximately two hours after the event through November 3,

2017.

About Synchrony

Financial

Synchrony Financial (NYSE: SYF) is one of the nation’s

premier consumer financial services companies. Our roots in

consumer finance trace back to 1932, and today we are the largest

provider of private label credit cards in the United States based

on purchase volume and receivables.* We provide a range of

credit products through programs we have established with a diverse

group of national and regional retailers, local merchants,

manufacturers, buying groups, industry associations and healthcare

service providers to help generate growth for our partners and

offer financial flexibility to our customers. Through our partners’

over 365,000 locations across the United States and Canada, and

their websites and mobile applications, we offer our customers a

variety of credit products to finance the purchase of goods and

services. Synchrony Financial offers private label credit cards,

Dual Card™ and general purpose co-branded credit cards, promotional

financing and installment lending, loyalty programs and

FDIC-insured savings products through Synchrony Bank. More

information can be found at

www.synchronyfinancial.com, facebook.com/SynchronyFinancial,

www.linkedin.com/company/synchrony-financial and twitter.com/SYFNews.

*Source: The Nilson Report (June 2017, Issue # 1112) - based on

2016 data.

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains certain forward-looking statements as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which are subject to the "safe harbor" created by those sections.

Forward-looking statements may be identified by words such as

“expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,”

“targets,” “outlook,” “estimates,” “will,” “should,” “may” or words

of similar meaning, but these words are not the exclusive means of

identifying forward-looking statements. Forward-looking statements

are based on management’s current expectations and assumptions, and

are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict. As a result, actual

results could differ materially from those indicated in these

forward-looking statements. Factors that could cause actual results

to differ materially include global political, economic, business,

competitive, market, regulatory and other factors and risks, such

as: the impact of macroeconomic conditions and whether industry

trends we have identified develop as anticipated; retaining

existing partners and attracting new partners, concentration of our

revenue in a small number of Retail Card partners, promotion and

support of our products by our partners, and financial performance

of our partners; cyber-attacks or other security breaches; higher

borrowing costs and adverse financial market conditions impacting

our funding and liquidity, and any reduction in our credit ratings;

our ability to securitize our loans, occurrence of an early

amortization of our securitization facilities, loss of the right to

service or subservice our securitized loans, and lower payment

rates on our securitized loans; our ability to grow our deposits in

the future; changes in market interest rates and the impact of any

margin compression; effectiveness of our risk management processes

and procedures, reliance on models which may be inaccurate or

misinterpreted, our ability to manage our credit risk, the

sufficiency of our allowance for loan losses and the accuracy of

the assumptions or estimates used in preparing our financial

statements; our ability to offset increases in our costs in

retailer share arrangements; competition in the consumer finance

industry; our concentration in the U.S. consumer credit market; our

ability to successfully develop and commercialize new or enhanced

products and services; our ability to realize the value of

strategic investments; reductions in interchange fees; fraudulent

activity; failure of third parties to provide various services that

are important to our operations; disruptions in the operations of

our computer systems and data centers; international risks and

compliance and regulatory risks and costs associated with

international operations; alleged infringement of intellectual

property rights of others and our ability to protect our

intellectual property; litigation and regulatory actions; damage to

our reputation; our ability to attract, retain and motivate key

officers and employees; tax legislation initiatives or challenges

to our tax positions and state sales tax rules and regulations; a

material indemnification obligation to GE under the tax sharing and

separation agreement with GE if we cause the split-off from GE or

certain preliminary transactions to fail to qualify for tax-free

treatment or in the case of certain significant transfers of our

stock following the split-off; regulation, supervision, examination

and enforcement of our business by governmental authorities, the

impact of the Dodd-Frank Wall Street Reform and Consumer Protection

Act and the impact of the Consumer Financial Protection Bureau’s

regulation of our business; impact of capital adequacy rules and

liquidity requirements; restrictions that limit our ability to pay

dividends and repurchase our common stock, and restrictions that

limit Synchrony Bank’s ability to pay dividends to us; regulations

relating to privacy, information security and data protection; use

of third-party vendors and ongoing third-party business

relationships; and failure to comply with anti-money laundering and

anti-terrorism financing laws.

For the reasons described above, we caution you against relying

on any forward-looking statements, which should also be read in

conjunction with the other cautionary statements that are included

elsewhere in this news release and in our public filings, including

under the heading “Risk Factors” in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2016, as filed on

February 23, 2017. You should not consider any list of such factors

to be an exhaustive statement of all of the risks, uncertainties,

or potentially inaccurate assumptions that could cause our current

expectations or beliefs to change. Further, any forward-looking

statement speaks only as of the date on which it is made, and we

undertake no obligation to update or revise any forward-looking

statement to reflect events or circumstances after the date on

which the statement is made or to reflect the occurrence of

unanticipated events, except as otherwise may be required by

law.

Non-GAAP Measures

The information provided herein includes measures we refer to as

“tangible common equity” and certain capital ratios, which are not

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). For a reconciliation of these non-GAAP

measures to the most directly comparable GAAP measures, please see

the detailed financial tables and information that follow. For a

statement regarding the usefulness of these measures to investors,

please see the Company’s Current Report on Form 8-K filed with the

SEC today.

SYNCHRONY FINANCIAL FINANCIAL SUMMARY

(unaudited, in millions, except per share statistics)

Quarter Ended Nine Months Ended Sep 30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

3Q'17 vs. 3Q'16 Sep 30,

2017

Sep 30,

2016

YTD'17 vs. YTD'16

EARNINGS

Net interest income $ 3,876 $ 3,637 $ 3,587 $ 3,628 $ 3,481

$ 395 11.3 % $ 11,100 $ 9,902 $ 1,198 12.1 % Retailer share

arrangements (805 ) (669 ) (684 ) (811

) (757 ) (48 ) 6.3 % (2,158 )

(2,091 ) (67 ) 3.2 %

Net interest income, after

retailer share arrangements 3,071 2,968 2,903 2,817 2,724 347

12.7 % 8,942 7,811 1,131 14.5 % Provision for loan losses

1,310 1,326 1,306 1,076

986 324 32.9 %

3,942 2,910 1,032 35.5 %

Net interest income, after retailer share arrangements and

provision for loan losses 1,761 1,642 1,597 1,741 1,738 23 1.3

% 5,000 4,901 99 2.0 % Other income 76 57 93 85 84 (8 ) (9.5 )% 226

259 (33 ) (12.7 )% Other expense 958 911

908 918 859

99 11.5 % 2,777 2,498

279 11.2 %

Earnings before provision for

income taxes 879 788 782 908 963 (84 ) (8.7 )% 2,449 2,662 (213

) (8.0 )% Provision for income taxes 324 292

283 332 359

(35 ) (9.7 )% 899 987 (88

) (8.9 )%

Net earnings $ 555 $ 496 $

499 $ 576 $ 604 $ (49 ) (8.1 )% $ 1,550

$ 1,675 $ (125 ) (7.5 )%

Net

earnings attributable to common stockholders $ 555 $ 496

$ 499 $ 576 $ 604 $ (49 ) (8.1

)% $ 1,550 $ 1,675 $ (125 ) (7.5

)%

COMMON SHARE

STATISTICS

Basic EPS $ 0.70 $ 0.62 $ 0.61 $ 0.70 $ 0.73 $ (0.03 ) (4.1 )% $

1.93 $ 2.01 $ (0.08 ) (4.0 )% Diluted EPS $ 0.70 $ 0.61 $ 0.61 $

0.70 $ 0.73 $ (0.03 ) (4.1 )% $ 1.93 $ 2.01 $ (0.08 ) (4.0 )%

Dividend declared per share $ 0.15 $ 0.13 $ 0.13 $ 0.13 $ 0.13 $

0.02 15.4 % $ 0.41 $ 0.13 $ 0.28 NM Common stock price $ 31.05 $

29.82 $ 34.30 $ 36.27 $ 28.00 $ 3.05 10.9 % $ 31.05 $ 28.00 $ 3.05

10.9 % Book value per share $ 18.40 $ 18.02 $ 17.71 $ 17.37 $ 16.94

$ 1.46 8.6 % $ 18.40 $ 16.94 $ 1.46 8.6 % Tangible common equity

per share(1) $ 16.15 $ 15.79 $ 15.47 $ 15.34 $ 14.90 $ 1.25 8.4 % $

16.15 $ 14.90 $ 1.25 8.4 % Beginning common shares

outstanding 795.3 810.8 817.4 825.5 833.9 (38.6 ) (4.6 )% 817.4

833.8 (16.4 ) (2.0 )% Issuance of common shares - - - - - - - % - -

- - % Stock-based compensation 0.1 0.2 - - 0.1 - - % 0.3 0.2 0.1

50.0 % Shares repurchased (12.8 ) (15.7 ) (6.6

) (8.1 ) (8.5 ) (4.3 ) 50.6 %

(35.1 ) (8.5 ) (26.6 ) NM Ending common

shares outstanding 782.6 795.3 810.8 817.4 825.5 (42.9 ) (5.2 )%

782.6 825.5 (42.9 ) (5.2 )% Weighted average common shares

outstanding 787.3 804.0 813.1 820.5 828.4 (41.1 ) (5.0 )% 801.3

832.1 (30.8 ) (3.7 )% Weighted average common shares outstanding

(fully diluted) 790.9 807.4 817.1 823.8 830.6 (39.7 ) (4.8 )% 805.0

834.1 (29.1 ) (3.5 )%

(1) Tangible Common Equity ("TCE") is a non-GAAP measure.

For corresponding reconciliation of TCE to a GAAP financial

measure, see Reconciliation of Non-GAAP Measures and Calculations

of Regulatory Measures.

SYNCHRONY

FINANCIAL SELECTED METRICS (unaudited, $ in millions,

except account data) Quarter Ended Nine Months

Ended Sep 30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

3Q'17 vs. 3Q'16 Sep 30,

2017

Sep 30,

2016

YTD'17 vs. YTD'16

PERFORMANCE

METRICS

Return on assets(1) 2.4 % 2.2 % 2.3 % 2.6 % 2.8 % (0.4 )% 2.3 % 2.7

% (0.4 )% Return on equity(2) 15.3 % 13.8 % 14.1 % 16.2 % 17.3 %

(2.0 )% 14.4 % 16.6 % (2.2 )% Return on tangible common equity(3)

17.4 % 15.7 % 16.1 % 18.4 % 19.6 % (2.2 )% 16.4 % 18.9 % (2.5 )%

Net interest margin(4) 16.74 % 16.20 % 16.18 % 16.26 % 16.34 % 0.40

% 16.38 % 16.05 % 0.33 % Efficiency ratio(5) 30.4 % 30.1 % 30.3 %

31.6 % 30.6 % (0.2 )% 30.3 % 31.0 % (0.7 )% Other expense as a % of

average loan receivables, including held for sale 4.99 % 4.93 %

4.97 % 5.04 % 4.93 % 0.06 % 4.96 % 4.95 % 0.01 % Effective income

tax rate 36.9 % 37.1 % 36.2 % 36.6 % 37.3 % (0.4 )% 36.7 % 37.1 %

(0.4 )%

CREDIT QUALITY

METRICS

Net charge-offs as a % of average loan receivables, including held

for sale 4.95 % 5.42 % 5.33 % 4.65 % 4.39 % 0.56 % 5.23 % 4.54 %

0.69 % 30+ days past due as a % of period-end loan receivables(6)

4.80 % 4.25 % 4.25 % 4.32 % 4.26 % 0.54 % 4.80 % 4.26 % 0.54 % 90+

days past due as a % of period-end loan receivables(6) 2.22 % 1.90

% 2.06 % 2.03 % 1.89 % 0.33 % 2.22 % 1.89 % 0.33 % Net charge-offs

$ 950 $ 1,001 $ 974 $ 847 $ 765 $ 185 24.2 % $ 2,925 $ 2,292 $ 633

27.6 % Loan receivables delinquent over 30 days(6) $ 3,694 $ 3,208

$ 3,120 $ 3,295 $ 3,008 $ 686 22.8 % $ 3,694 $ 3,008 $ 686 22.8 %

Loan receivables delinquent over 90 days(6) $ 1,707 $ 1,435 $ 1,508

$ 1,546 $ 1,334 $ 373 28.0 % $ 1,707 $ 1,334 $ 373 28.0 %

Allowance for loan losses (period-end) $ 5,361 $ 5,001 $ 4,676 $

4,344 $ 4,115 $ 1,246 30.3 % $ 5,361 $ 4,115 $ 1,246 30.3 %

Allowance coverage ratio(7) 6.97 % 6.63 % 6.37 % 5.69 % 5.82 % 1.15

% 6.97 % 5.82 % 1.15 %

BUSINESS

METRICS

Purchase volume(8) $ 32,893 $ 33,476 $ 28,880 $ 35,369 $ 31,615 $

1,278 4.0 % $ 95,249 $ 90,099 $ 5,150 5.7 % Period-end loan

receivables $ 76,928 $ 75,458 $ 73,350 $ 76,337 $ 70,644 $ 6,284

8.9 % $ 76,928 $ 70,644 $ 6,284 8.9 % Credit cards $ 73,946 $

72,492 $ 70,587 $ 73,580 $ 67,858 $ 6,088 9.0 % $ 73,946 $ 67,858 $

6,088 9.0 % Consumer installment loans $ 1,561 $ 1,514 $ 1,411 $

1,384 $ 1,361 $ 200 14.7 % $ 1,561 $ 1,361 $ 200 14.7 % Commercial

credit products $ 1,384 $ 1,386 $ 1,311 $ 1,333 $ 1,385 $ (1 ) (0.1

)% $ 1,384 $ 1,385 $ (1 ) (0.1 )% Other $ 37 $ 66 $ 41 $ 40 $ 40 $

(3 ) (7.5 )% $ 37 $ 40 $ (3 ) (7.5 )% Average loan receivables,

including held for sale $ 76,165 $ 74,090 $ 74,132 $ 72,476 $

69,316 $ 6,849 9.9 % $ 74,803 $ 67,364 $ 7,439 11.0 % Period-end

active accounts (in thousands)(9) 69,008 69,277 67,905 71,890

66,781 2,227 3.3 % 69,008 66,781 2,227 3.3 % Average active

accounts (in thousands)(9) 69,331 68,635 69,629 68,701 66,639 2,692

4.0 % 69,319 66,204 3,115 4.7 %

LIQUIDITY

Liquid assets Cash and equivalents $ 13,915 $ 12,020 $

11,392 $ 9,321 $ 13,588 $ 327 2.4 % $ 13,915 $ 13,588 $ 327 2.4 %

Total liquid assets $ 16,391 $ 15,274 $ 16,158 $ 13,612 $ 16,362 $

29 0.2 % $ 16,391 $ 16,362 $ 29 0.2 %

Undrawn credit

facilities Undrawn credit facilities $ 5,650 $ 6,650 $ 5,600 $

6,700 $ 7,150 $ (1,500 ) (21.0 )% $ 5,650 $ 7,150 $ (1,500 ) (21.0

)%

Total liquid assets and undrawn credit facilities $

22,041 $ 21,924 $ 21,758 $ 20,312 $ 23,512 $ (1,471 ) (6.3 )% $

22,041 $ 23,512 $ (1,471 ) (6.3 )% Liquid assets % of total assets

17.71 % 16.76 % 18.14 % 15.09 % 18.77 % (1.06 )% 17.71 % 18.77 %

(1.06 )% Liquid assets including undrawn credit facilities % of

total assets 23.82 % 24.06 % 24.43 % 22.52 % 26.98 % (3.16 )% 23.82

% 26.98 % (3.16 )%

(1) Return on assets represents

net earnings as a percentage of average total assets. (2) Return on

equity represents net earnings as a percentage of average total

equity. (3) Return on tangible common equity represents net

earnings as a percentage of average tangible common equity.

Tangible common equity ("TCE") is a non-GAAP measure. For

corresponding reconciliation of TCE to a GAAP financial measure,

see Reconciliation of Non-GAAP Measures and Calculations of

Regulatory Measures. (4) Net interest margin represents net

interest income divided by average interest-earning assets. (5)

Efficiency ratio represents (i) other expense, divided by (ii) net

interest income, after retailer share arrangements, plus other

income. (6) Based on customer statement-end balances extrapolated

to the respective period-end date. (7) Allowance coverage ratio

represents allowance for loan losses divided by total period-end

loan receivables. (8) Purchase volume, or net credit sales,

represents the aggregate amount of charges incurred on credit cards

or other credit product accounts less returns during the period.

(9) Active accounts represent credit card or installment loan

accounts on which there has been a purchase, payment or outstanding

balance in the current month.

SYNCHRONY

FINANCIAL STATEMENTS OF EARNINGS (unaudited, $ in

millions) Quarter Ended Nine Months Ended Sep

30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

3Q'17 vs. 3Q'16 Sep 30,

2017

Sep 30,

2016

YTD'17 vs. YTD'16 Interest income: Interest and fees

on loans $ 4,182 $ 3,927 $ 3,877 $ 3,919 $ 3,771 $ 411 10.9 % $

11,986 $ 10,763 $ 1,223 11.4 % Interest on investment securities

51 43 36 28

25 26 104.0 % 130

68 62 91.2 % Total interest

income 4,233 3,970 3,913 3,947 3,796 437 11.5 % 12,116 10,831 1,285

11.9 %

Interest expense: Interest on deposits 219 202

194 188 188 31 16.5 % 615 539 76 14.1 % Interest on borrowings of

consolidated securitization entities 65 63 65 64 63 2 3.2 % 193 180

13 7.2 % Interest on third-party debt 73 68

67 67 64 9

14.1 % 208 210 (2

) (1.0 )% Total interest expense 357 333 326 319 315 42 13.3

% 1,016 929 87 9.4 %

Net interest

income 3,876 3,637 3,587 3,628 3,481 395 11.3 % 11,100 9,902 1,198

12.1 % Retailer share arrangements (805 ) (669

) (684 ) (811 ) (757 ) (48 ) 6.3

% (2,158 ) (2,091 ) (67 ) 3.2 % Net

interest income, after retailer share arrangements 3,071 2,968

2,903 2,817 2,724 347 12.7 % 8,942 7,811 1,131 14.5 %

Provision for loan losses 1,310 1,326

1,306 1,076 986

324 32.9 % 3,942 2,910

1,032 35.5 % Net interest income, after

retailer share arrangements and provision for loan losses 1,761

1,642 1,597 1,741 1,738 23 1.3 % 5,000 4,901 99 2.0 %

Other income: Interchange revenue 164 165 145 167 154 10 6.5

% 474 435 39 9.0 % Debt cancellation fees 67 68 68 68 67 - - % 203

194 9 4.6 % Loyalty programs (168 ) (206 ) (137 ) (157 ) (145 ) (23

) 15.9 % (511 ) (390 ) (121 ) 31.0 % Other 13

30 17 7 8 5

62.5 % 60 20 40

NM Total other income 76

57 93 85 84

(8 ) (9.5 )% 226 259 (33

) (12.7 )%

Other expense: Employee costs 335

321 325 315 311 24 7.7 % 981 892 89 10.0 % Professional fees 161

158 151 164 174 (13 ) (7.5 )% 470 474 (4 ) (0.8 )% Marketing and

business development 124 124 94 130 92 32 34.8 % 342 293 49 16.7 %

Information processing 96 88 90 88 87 9 10.3 % 274 250 24 9.6 %

Other 242 220 248

221 195 47 24.1 %

710 589 121 20.5 % Total

other expense 958 911 908 918 859 99 11.5 % 2,777 2,498 279 11.2 %

Earnings before provision for income

taxes 879 788 782 908 963 (84 ) (8.7 )% 2,449 2,662 (213 ) (8.0

)% Provision for income taxes 324 292

283 332 359 (35 )

(9.7 )% 899 987 (88 )

(8.9 )%

Net earnings attributable to common

shareholders

$ 555 $ 496 $ 499 $ 576 $ 604 $

(49 ) (8.1 )% $ 1,550 $ 1,675 $ (125 )

(7.5 )%

SYNCHRONY FINANCIAL STATEMENTS OF FINANCIAL POSITION

(unaudited, $ in millions) Quarter Ended

Sep 30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

Sep 30, 2017 vs.

Sep 30, 2016

Assets Cash and equivalents $ 13,915 $ 12,020 $ 11,392 $

9,321 $ 13,588 $ 327 2.4 % Investment securities 3,317 3,997 5,328

5,110 3,356 (39 ) (1.2 )% Loan receivables: Unsecuritized loans

held for investment 53,997 52,550 50,398 52,332 47,517 6,480 13.6 %

Restricted loans of consolidated securitization entities

22,931 22,908 22,952

24,005 23,127 (196 ) (0.8 )%

Total loan receivables 76,928 75,458 73,350 76,337 70,644 6,284 8.9

% Less: Allowance for loan losses (5,361 ) (5,001 )

(4,676 ) (4,344 ) (4,115 ) (1,246 )

30.3 % Loan receivables, net 71,567 70,457 68,674 71,993

66,529 5,038 7.6 % Goodwill 991 991 992 949 949 42 4.4 % Intangible

assets, net 772 787 826 712 733 39 5.3 % Other assets 1,986

2,888 1,838 2,122

2,004 (18 ) (0.9 )% Total assets $

92,548 $ 91,140 $ 89,050 $ 90,207 $

87,159 $ 5,389 6.2 %

Liabilities and

Equity Deposits: Interest-bearing deposit accounts $ 54,232 $

52,659 $ 51,359 $ 51,896 $ 49,611 $ 4,621 9.3 %

Non-interest-bearing deposit accounts 222 226

246 159 204

18 8.8 % Total deposits 54,454 52,885 51,605 52,055

49,815 4,639 9.3 % Borrowings: Borrowings of consolidated

securitization entities 11,891 12,204 12,433 12,388 12,411 (520 )

(4.2 )% Bank term loan - - - - - - - % Senior unsecured notes

8,008 8,505 7,761

7,759 7,756 252 3.2 %

Total borrowings 19,899 20,709 20,194 20,147 20,167 (268 ) (1.3 )%

Accrued expenses and other liabilities 3,793

3,214 2,888 3,809 3,196

597 18.7 % Total liabilities 78,146

76,808 74,687 76,011 73,178 4,968 6.8 % Equity: Common stock 1 1 1

1 1 - - % Additional paid-in capital 9,429 9,415 9,405 9,393 9,381

48 0.5 % Retained earnings 6,543 6,109 5,724 5,330 4,861 1,682 34.6

% Accumulated other comprehensive income: (40 ) (49 ) (55 ) (53 )

(24 ) (16 ) 66.7 % Treasury Stock (1,531 ) (1,144 )

(712 ) (475 ) (238 ) (1,293 ) NM

Total equity 14,402 14,332

14,363 14,196 13,981

421 3.0 % Total liabilities and equity $

92,548 $ 91,140 $ 89,050 $ 90,207 $

87,159 $ 5,389 6.2 %

SYNCHRONY FINANCIAL AVERAGE BALANCES, NET INTEREST INCOME

AND NET INTEREST MARGIN (unaudited, $ in millions)

Quarter Ended

Sep 30, 2017 Jun 30, 2017 Mar 31, 2017 Dec

31, 2016 Sep 30, 2016 Interest Average

Interest Average Interest Average

Interest Average Interest Average

Average Income/ Yield/ Average

Income/ Yield/ Average Income/

Yield/ Average Income/ Yield/

Average Income/ Yield/ Balance

Expense Rate Balance Expense

Rate Balance Expense Rate

Balance Expense Rate Balance

Expense Rate Assets Interest-earning

assets: Interest-earning cash and equivalents $ 11,895 $ 37

1.23 % $ 10,758 $ 28 1.04 % $ 10,552 $ 21 0.81 % $ 12,210 $ 17 0.55

% $ 12,480 $ 16 0.51 % Securities available for sale 3,792 14 1.46

% 5,195 15 1.16 % 5,213 15 1.17 % 4,076 11 1.07 % 2,960 9 1.21 %

Loan receivables: Credit cards, including held for

sale 73,172 4,111 22.29 % 71,206 3,858 21.73 % 71,365 3,811 21.66 %

69,660 3,851 21.99 % 66,519 3,705 22.16 % Consumer installment

loans 1,543 35 9.00 % 1,461 34 9.33 % 1,389 32 9.34 % 1,373 31 8.98

% 1,333 31 9.25 % Commercial credit products 1,392 36 10.26 % 1,378

34 9.90 % 1,317 34 10.47 % 1,386 36 10.33 % 1,401 35 9.94 % Other

58 - - % 45 1 NM

61 - - % 57 1 NM

63 - - %

Total loan receivables, including

held for sale 76,165 4,182 21.78 %

74,090 3,927 21.26 % 74,132

3,877 21.21 % 72,476 3,919 21.51 %

69,316 3,771 21.64 %

Total interest-earning

assets 91,852 4,233 18.28 % 90,043

3,970 17.68 % 89,897 3,913 17.65

% 88,762 3,947 17.69 % 84,756

3,796 17.82 %

Non-interest-earning assets:

Cash and due from banks 877 829 802 739 862 Allowance for loan

losses (5,125 ) (4,781 ) (4,408 ) (4,228 ) (3,933 ) Other assets

3,517 3,303 3,177

3,479 3,189

Total non-interest-earning

assets (731 ) (649 ) (429 ) (10 )

118

Total

assets $ 91,121 $ 89,394 $ 89,468 $ 88,752

$ 84,874

Liabilities

Interest-bearing liabilities: Interest-bearing deposit

accounts $ 53,294 $ 219 1.63 % $ 51,836 $ 202 1.56 % $ 51,829 $ 194

1.52 % $ 51,006 $ 188 1.47 % $ 47,895 $ 188 1.56 % Borrowings of

consolidated securitization entities 11,759 65 2.19 % 12,213 63

2.07 % 12,321 65 2.14 % 12,389 64 2.06 % 12,254 63 2.05 % Bank term

loan - - - % - - - % - - - % - - - % - - - % Senior unsecured notes

8,251 73 3.51 % 7,933 68

3.44 % 7,760 67 3.50 % 7,757

67 3.44 % 7,448 64 3.42 %

Total

interest-bearing liabilities 73,304 357

1.93 % 71,982 333 1.86 % 71,910

326 1.84 % 71,152 319 1.78 %

67,597 315 1.85 %

Non-interest-bearing

liabilities Non-interest-bearing deposit accounts 232 218 240

176 204 Other liabilities 3,154 2,752

2,995 3,321 3,175

Total non-interest-bearing liabilities 3,386

2,970 3,235 3,497

3,379

Total

liabilities 76,690 74,952

75,145 74,649 70,976

Equity Total equity 14,431 14,442 14,323 14,103

13,898

Total liabilities and

equity $ 91,121 $ 89,394 $ 89,468 $ 88,752

$ 84,874

Net interest income $ 3,876 $ 3,637 $

3,587 $ 3,628 $ 3,481

Interest rate spread(1)

16.35 % 15.82 % 15.81 % 15.91 % 15.97 %

Net interest

margin(2) 16.74 % 16.20 % 16.18 % 16.26 % 16.34 %

(1) Interest rate spread represents the

difference between the yield on total interest-earning assets and

the rate on total interest-bearing liabilities. (2) Net interest

margin represents net interest income divided by average

interest-earning assets.

SYNCHRONY FINANCIAL

AVERAGE BALANCES, NET INTEREST INCOME AND NET INTEREST

MARGIN (unaudited, $ in millions)

Nine Months Ended

Sep 30, 2017

Nine Months Ended

Sep 30, 2016

Interest Average Interest Average

Average Income/ Yield/ Average

Income/ Yield/ Balance Expense

Rate Balance Expense Rate Assets

Interest-earning assets: Interest-earning cash and

equivalents $ 11,073 $ 86 1.04 % $ 12,132 $ 46 0.51 % Securities

available for sale 4,732 44 1.24 % 2,932 22 1.00 %

Loan

receivables: Credit cards, including held for sale 71,920

11,780 21.90 % 64,701 10,573 21.83 % Consumer installment loans

1,465 101 9.22 % 1,240 86 9.26 % Commercial credit products 1,363

104 10.20 % 1,367 103 10.06 % Other 55 1 2.43

% 56 1 2.39 %

Total loan receivables,

including held for sale 74,803 11,986

21.42 % 67,364 10,763 21.34 %

Total

interest-earning assets 90,608 12,116

17.88 % 82,428 10,831 17.55 %

Non-interest-earning assets: Cash and due from banks 836

1,041 Allowance for loan losses (4,774 ) (3,752 ) Other assets

3,334 3,222

Total

non-interest-earning assets (604 ) 511

Total assets $ 90,004 $ 82,939

Liabilities Interest-bearing liabilities:

Interest-bearing deposit accounts $ 52,325 $ 615 1.57 % $ 45,915 $

539 1.57 % Borrowings of consolidated securitization entities

12,096 193 2.13 % 12,441 180 1.93 % Bank term loan(1) - - - % 742

31 5.58 % Senior unsecured notes 7,983 208

3.48 % 6,957 179 3.44 %

Total

interest-bearing liabilities 72,404 1,016

1.88 % 66,055 929 1.88 %

Non-interest-bearing liabilities Non-interest-bearing

deposit accounts 230 215 Other liabilities 2,971

3,211

Total non-interest-bearing liabilities

3,201 3,426

Total

liabilities 75,605 69,481

Equity Total equity 14,399 13,458

Total liabilities and equity $ 90,004 $ 82,939

Net interest income $ 11,100 $ 9,902

Interest rate

spread(2) 16.00 % 15.67 %

Net interest

margin(3) 16.38 % 16.05 %

(1)

The effective interest rate for the Bank term loan for the 9 months

ended September 30, 2016 was 2.48%. The Bank term loan effective

rate excludes the impact of charges incurred in connection with

prepayments of the loan. (2) Interest rate spread represents the

difference between the yield on total interest-earning assets and

the rate on total interest-bearing liabilities. (3) Net interest

margin represents net interest income divided by average

interest-earning assets.

SYNCHRONY FINANCIAL BALANCE SHEET

STATISTICS (unaudited, $ in millions, except per share

statistics) Quarter Ended Sep 30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

Sep 30, 2017 vs.

Sep 30, 2016

BALANCE SHEET

STATISTICS

Total common equity $ 14,402 $ 14,332 $ 14,363 $ 14,196 $ 13,981 $

421 3.0 % Total common equity as a % of total assets 15.56 % 15.73

% 16.13 % 15.74 % 16.04 % (0.48 )% Tangible assets $ 90,785

$ 89,362 $ 87,232 $ 88,546 $ 85,477 $ 5,308 6.2 % Tangible common

equity(1) $ 12,639 $ 12,554 $ 12,545 $ 12,535 $ 12,299 $ 340 2.8 %

Tangible common equity as a % of tangible assets(1) 13.92 % 14.05 %

14.38 % 14.16 % 14.39 % (0.47 )% Tangible common equity per

share(1) $ 16.15 $ 15.79 $ 15.47 $ 15.34 $ 14.90 $ 1.25 8.4 %

REGULATORY

CAPITAL RATIOS(2)

Basel III Transition Total risk-based capital ratio(3) 18.7

% 18.7 % 19.3 % 18.5 % 19.5 % Tier 1 risk-based capital ratio(4)

17.3 % 17.4 % 18.0 % 17.2 % 18.2 % Tier 1 leverage ratio(5) 14.6 %

14.8 % 14.8 % 15.0 % 15.4 % Common equity Tier 1 capital ratio(6)

17.3 % 17.4 % 18.0 % 17.2 % 18.2 %

Basel III Fully

Phased-in Common equity Tier 1 capital ratio(6) 17.2 % 17.2 %

17.7 % 17.0 % 17.9 %

(1) Tangible common equity ("TCE") is a non-GAAP measure. We

believe TCE is a more meaningful measure of the net asset value of

the Company to investors. For corresponding reconciliation of TCE

to a GAAP financial measure, see Reconciliation of Non-GAAP

Measures and Calculations of Regulatory Measures. (2) Regulatory

capital metrics at September 30, 2017 are preliminary and therefore

subject to change. (3) Total risk-based capital ratio is the ratio

of total risk-based capital divided by risk-weighted assets. (4)

Tier 1 risk-based capital ratio is the ratio of Tier 1 capital

divided by risk-weighted assets. (5) Tier 1 leverage ratio is the

ratio of Tier 1 capital divided by total average assets, after

certain adjustments. Tier 1 leverage ratios are based upon the use

of daily averages for all periods presented. (6) Common equity Tier

1 capital ratio is the ratio of common equity Tier 1 capital to

total risk-weighted assets, each as calculated under Basel III

rules. Common equity Tier 1 capital ratio (fully phased-in) is a

preliminary estimate reflecting management’s interpretation of the

final Basel III rules adopted in July 2013 by the Federal Reserve

Board, which have not been fully implemented, and our estimate and

interpretations are subject to, among other things, ongoing

regulatory review and implementation guidance.

SYNCHRONY FINANCIAL PLATFORM RESULTS (unaudited, $

in millions) Quarter Ended Nine Months Ended

Sep 30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

3Q'17 vs. 3Q'16 Sep 30,

2017

Sep 30,

2016

YTD'17 vs. YTD'16

RETAIL

CARD

Purchase volume(1)(2) $ 26,347 $ 27,101 $ 22,952 $ 28,996 $ 25,285

$ 1,062 4.2 % $ 76,400 $ 72,246 $ 4,154 5.7 % Period-end loan

receivables $ 52,119 $ 51,437 $ 49,905 $ 52,701 $ 48,010 $ 4,109

8.6 % $ 52,119 $ 48,010 $ 4,109 8.6 % Average loan receivables,

including held for sale $ 51,817 $ 50,533 $ 50,644 $ 49,476 $

47,274 $ 4,543 9.6 % $ 51,002 $ 46,119 $ 4,883 10.6 % Average

active accounts (in thousands)(2)(3) 54,471 54,058 55,049 54,489

52,959 1,512 2.9 % 54,639 52,834 1,805 3.4 % Interest and

fees on loans(2) $ 3,102 $ 2,900 $ 2,888 $ 2,909 $ 2,790 $ 312 11.2

% $ 8,890 $ 7,989 $ 901 11.3 % Other income(2) $ 61 $ 25 $ 77 $ 70

$ 70 $ (9 ) (12.9 )% $ 163 $ 218 $ (55 ) (25.2 )% Retailer share

arrangements(2) $ (795 ) $ (657 ) $ (681 ) $ (801 ) $ (752 ) $ (43

) 5.7 % $ (2,133 ) $ (2,069 ) $ (64 ) 3.1 %

PAYMENT

SOLUTIONS

Purchase volume(1) $ 4,178 $ 3,930 $ 3,686 $ 4,194 $ 4,152 $ 26 0.6

% $ 11,794 $ 11,447 $ 347 3.0 % Period-end loan receivables $

16,153 $ 15,595 $ 15,320 $ 15,567 $ 14,798 $ 1,355 9.2 % $ 16,153 $

14,798 $ 1,355 9.2 % Average loan receivables $ 15,848 $ 15,338 $

15,424 $ 15,076 $ 14,367 $ 1,481 10.3 % $ 15,538 $ 13,786 $ 1,752

12.7 % Average active accounts (in thousands)(3) 9,183 9,031 9,090

8,844 8,461 722 8.5 % 9,108 8,261 847 10.3 % Interest and

fees on loans $ 559 $ 533 $ 515 $ 523 $ 505 $ 54 10.7 % $ 1,607 $

1,429 $ 178 12.5 % Other income $ 2 $ 6 $ 4 $ 3 $ 3 $ (1 ) (33.3 )%

$ 12 $ 10 $ 2 20.0 % Retailer share arrangements $ (9 ) $ (9 ) $ (1

) $ (9 ) $ (3 ) $ (6 ) NM $ (19 ) $ (17 ) $ (2 ) 11.8 %

CARECREDIT

Purchase volume(1) $ 2,368 $ 2,445 $ 2,242 $ 2,179 $ 2,178 $ 190

8.7 % $ 7,055 $ 6,406 $ 649 10.1 % Period-end loan receivables $

8,656 $ 8,426 $ 8,125 $ 8,069 $ 7,836 $ 820 10.5 % $ 8,656 $ 7,836

$ 820 10.5 % Average loan receivables $ 8,500 $ 8,219 $ 8,064 $

7,924 $ 7,675 $ 825 10.7 % $ 8,263 $ 7,459 $ 804 10.8 % Average

active accounts (in thousands)(3) 5,677 5,546 5,490 5,368 5,219 458

8.8 % 5,572 5,109 463 9.1 % Interest and fees on loans $ 521

$ 494 $ 474 $ 487 $ 476 $ 45 9.5 % $ 1,489 $ 1,345 $ 144 10.7 %

Other income $ 13 $ 26 $ 12 $ 12 $ 11 $ 2 18.2 % $ 51 $ 31 $ 20

64.5 % Retailer share arrangements $ (1 ) $ (3 ) $ (2 ) $ (1 ) $ (2

) $ 1 (50.0 )% $ (6 ) $ (5 ) $ (1 ) 20.0 %

TOTAL

SYF

Purchase volume(1)(2) $ 32,893 $ 33,476 $ 28,880 $ 35,369 $ 31,615

$ 1,278 4.0 % $ 95,249 $ 90,099 $ 5,150 5.7 % Period-end loan

receivables $ 76,928 $ 75,458 $ 73,350 $ 76,337 $ 70,644 $ 6,284

8.9 % $ 76,928 $ 70,644 $ 6,284 8.9 % Average loan receivables,

including held for sale $ 76,165 $ 74,090 $ 74,132 $ 72,476 $

69,316 $ 6,849 9.9 % $ 74,803 $ 67,364 $ 7,439 11.0 % Average

active accounts (in thousands)(2)(3) 69,331 68,635 69,629 68,701

66,639 2,692 4.0 % 69,319 66,204 3,115 4.7 % Interest and

fees on loans(2) $ 4,182 $ 3,927 $ 3,877 $ 3,919 $ 3,771 $ 411 10.9

% $ 11,986 $ 10,763 $ 1,223 11.4 % Other income(2) $ 76 $ 57 $ 93 $

85 $ 84 $ (8 ) (9.5 )% $ 226 $ 259 $ (33 ) (12.7 )% Retailer share

arrangements(2) $ (805 ) $ (669 ) $ (684 ) $ (811 ) $ (757 ) $ (48

) 6.3 % $ (2,158 ) $ (2,091 ) $ (67 ) 3.2 %

(1) Purchase volume, or net credit sales, represents

the aggregate amount of charges incurred on credit cards or other

credit product accounts less returns during the period. (2)

Includes activity and balances associated with loan receivables

held for sale. (3) Active accounts represent credit card or

installment loan accounts on which there has been a purchase,

payment or outstanding balance in the current month.

SYNCHRONY FINANCIAL

RECONCILIATION OF NON-GAAP MEASURES AND CALCULATIONS OF

REGULATORY MEASURES(1) (unaudited, $ in millions,

except per share statistics) Quarter Ended Sep

30,

2017

Jun 30,

2017

Mar 31,

2017

Dec 31,

2016

Sep 30,

2016

COMMON EQUITY

MEASURES

GAAP Total common equity $ 14,402 $ 14,332 $ 14,363 $ 14,196 $

13,981 Less: Goodwill (991 ) (991 ) (992 ) (949 ) (949 ) Less:

Intangible assets, net (772 ) (787 ) (826 )

(712 ) (733 )

Tangible common equity $ 12,639

$ 12,554 $ 12,545 $ 12,535 $ 12,299 Adjustments for certain

deferred tax liabilities and certain items in accumulated

comprehensive income (loss) 344 337

340 337 299

Basel III

- Common equity Tier 1 (fully phased-in) $ 12,983 $

12,891 $ 12,885 $ 12,872 $ 12,598

Adjustment related to capital components during transition

142 146 154 263

273

Basel III - Common equity Tier 1

(transition) $ 13,125 $ 13,037 $ 13,039 $

13,135 $ 12,871

RISK-BASED

CAPITAL

Common equity Tier 1 $ 13,125 $ 13,037 $ 13,039 $ 13,135 $ 12,871

Add: Allowance for loan losses includible in risk-based capital

1,001 985 954 994

923

Risk-based capital $ 14,126

$ 14,022 $ 13,993 $ 14,129 $ 13,794

ASSET

MEASURES

Total average assets(2) $ 91,121 $ 89,394 $ 89,468 $ 88,752 $

84,874 Adjustments for:

Disallowed goodwill and other disallowed

intangible assets (net of related deferred tax liabilities) and

other

(1,304 ) (1,325 ) (1,358 ) (1,059 )

(1,117 )

Total assets for leverage purposes $ 89,817

$ 88,069 $ 88,110 $ 87,693 $ 83,757

Risk-weighted assets - Basel III (fully

phased-in)(3) $ 75,614 $ 74,748 $ 72,596 $ 75,941 $ 70,448

Risk-weighted assets - Basel III (transition)(3) $ 75,729 $

74,792 $ 72,627 $ 76,179 $ 70,660

TANGIBLE COMMON

EQUITY PER SHARE

GAAP book value per share $ 18.40 $ 18.02 $ 17.71 $ 17.37 $ 16.94

Less: Goodwill (1.27 ) (1.25 ) (1.22 ) (1.16 ) (1.14 ) Less:

Intangible assets, net (0.98 ) (0.98 ) (1.02 )

(0.87 ) (0.90 ) Tangible common equity per share $

16.15 $ 15.79 $ 15.47 $ 15.34 $ 14.90

(1) Regulatory measures at September

30, 2017 are presented on an estimated basis. (2) Total average

assets are presented based upon the use of daily averages. (3) Key

differences between Basel III transitional rules and fully

phased-in Basel III rules in the calculation of risk-weighted

assets include, but not limited to, risk weighting of deferred tax

assets and adjustments for certain intangible assets.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171020005107/en/

Synchrony FinancialInvestor Relations:Greg Ketron,

203-585-6291orMedia RelationsLisa Lanspery, 203-585-6143

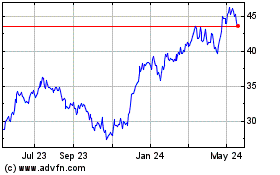

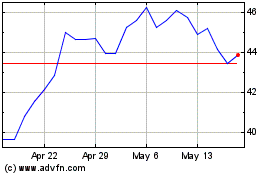

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Synchrony Financiall (NYSE:SYF)

Historical Stock Chart

From Apr 2023 to Apr 2024