Chapter 11 rules essentially put a lid on compensation to

California wildfire payouts

By Peg Brickley and Gretchen Morgenson | Photographs by Rachel Bujalski for The Wall Street Journal

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 9, 2019).

As many as 100,000 California residents who lost property, jobs

and loved ones in fires linked to PG&E Corp. will get their day

in court. It will be in bankruptcy court, where rules shield the

utility giant from potentially crippling jury payouts.

PG&E isn't broke. It is following the survival strategy used

by other troubled companies to put a lid on damage claims. For

victims, that amounts to a loss of negotiating power and likely

means a fraction of the compensation they might receive in a jury

trial.

California investigators have connected PG&E equipment to

fires that killed more than 100 people, destroyed 26,000 buildings

and burned at least 330,000 acres in 2017 and 2018. Lawyers for

fire victims estimate that the utility, which filed for chapter 11

bankruptcy protection in January, is liable for as much as $54

billion in wildfire claims.

Before filing, PG&E told investors its fire-related

liabilities could total more than $30 billion. The company is now

offering $20.4 billion to cover all damages, including

reimbursement to insurance companies. Of that, $7.5 billion is for

residents and business owners hurt by the fires.

Richard Kelly, then the company's chairman, said bankruptcy was

"the only viable option to address the company's responsibilities

to stakeholders."

PG&E's financial statements at the time it filed for

bankruptcy showed the utility was solvent, with assets exceeding

liabilities. The company's most recent annual report, filed in

February, showed nearly $77 billion in total assets, including

properties that could be used as collateral for loans -- enough to

cover $17.7 billion in debt and the $30 billion it estimated for

fire claims. PG&E says it will pay all it owes.

Bankruptcy rules are designed to give troubled companies a fresh

start by allowing them to negotiate with creditors rather than

answering to a jury. Wildfire victims are considered creditors owed

a debt by the utility.

Lawyers for PG&E and fire victims say there are between

70,000 and 100,000 people eligible to file wildfire claims against

the company. Other companies that have sought chapter 11 survived

waves of lawsuits filed by victims of asbestos and silicon breast

implants, among others.

The amount that fire victims are owed will be decided in a

proceeding known as an estimation. Only a handful of them will get

the chance to testify about their harm. Unless there is a

settlement, a federal judge will decide how much PG&E must set

aside for fire damage.

In the estimation hearings, lawyers for the utility will try to

reduce the compensation sum; lawyers for victims will seek more.

Another judge, who is overseeing the bankruptcy, will be asked to

approve a reorganization plan that frees the utility of

liability.

"I would love to get back what it's cost me," said Raymond

Rinaldi, a 78-year-old retired jockey whose home burned in 2017.

"But you know how it is when you fight these big companies --

they'll wait you out until you die."

Mr. Rinaldi estimates PG&E owes him roughly $200,000, the

amount he spent on the new mobile home he shares with his wife,

Betty Record, 83, in Marysville, Calif. His estimate is over and

above the $90,000 he received from the couple's homeowners

insurance.

PG&E said it was "committed to working with the remaining

individual plaintiffs to fairly and reasonably resolve their

claims." The utility has so far paid out $21 million through an

emergency fund to fire victims.

Mr. Rinaldi is among thousands of people yet to receive

compensation for the Cascade Fire sparked by PG&E equipment two

years ago. Those victims have been joined by tens of thousands of

others in the Camp Fire a year ago. State investigators determined

that it was started by a faulty PG&E transmission line. The

fire burned away the town of Paradise, Calif., in a matter of hours

last Nov. 8. Survivors marked the first anniversary Friday.

Possibly adding to its liabilities, PG&E disclosed that one

of its transmission lines failed in the area where the Kincade Fire

broke out last month in Sonoma County and burned more than 400

buildings.

Bankruptcy rules put victims of the Kincade Fire ahead of

others. By law, claims made after PG&E's January filing must be

fully paid on or before the day the utility exits bankruptcy.

Victims of the 2017 and 2018 fires may have to wait longer to

collect.

The utility's bankruptcy is complicated by a fight for control

of the company. PG&E and its shareholders are allied against

bondholders led by hedge fund Elliott Management Corp., which

alleges that the company is protecting shareholders at the expense

of fire victims and a safe operation.

The two sides have competing plans to settle claims, reorganize

PG&E and exit bankruptcy. Creditors will vote, and a bankruptcy

judge will decide.

Fire victims have agreed to back the bondholder plan, which

would pay them $13.5 billion, more than what PG&E offered. The

utility revealed Thursday that settlement talks could result in a

payout close to $13.5 billion.

California Gov. Gavin Newsom has urged the two sides to reach a

compromise that improves safety before the next fire season, and he

threatened a state takeover.

Todd Vincze, a 66-year-old former mechanic, is among those

waiting. A year ago, he escaped Paradise on a bicycle, leaving

behind his house, violins, guitars, guns, a Jaguar, a Lincoln and

all of his tools -- everything but his wallet and a leather jacket.

He figured his total loss was about $380,000.

As he awaits news about his PG&E and insurance claims,

living at a friend's place, Mr. Vincze drinks beer, he said, and

tries "to keep from going bats -- t crazy."

Escape route

When the Camp Fire engulfed Paradise, Calif., Bob Abercrombie

and his wife, June, fled with only the clothes they wore. The blaze

killed 85 people.

"I don't know if we should expect anything out of PG&E,"

said Mr. Abercrombie, an 85-year-old retired insurance agent who

nonetheless filed a claim.

He had insurance for his house and everything that burned

inside, but none for the couple's antique-car collection, which

included a 1929 Ford Model A.

State investigators have found that PG&E equipment caused

more than a dozen fires, including the Cascade Fire, which killed

four people and destroyed 264 structures in October 2017.

Faced with troubles of similar scale, dozens of companies have

filed for bankruptcy protection against an onslaught of damage

claims.

Dow Corning Corp. filed for chapter 11 in 1995 under a flood of

lawsuits for its silicone breast implants. It exited bankruptcy in

2004, after reaching a deal to pay $3.2 billion to 175,000 women.

W.R. Grace & Co. faced more than 129,000 lawsuits related to

its asbestos products. The company filed for chapter 11 in 2001,

and it emerged 13 years later with its equity intact and two trusts

for victims totaling $4 billion.

Like those companies, PG&E entered bankruptcy to settle

claims, Cecily Dumas, a lawyer for the committee representing fire

victims in the bankruptcy, told the court in May. What is

different, she said, is that "this debtor is still manufacturing

the dangerous product," referring to aged power lines.

Popular sentiment has turned against the company after

publicized safety lapses. Under the threat of wildfires this year,

the utility staged mass blackouts last month, pulling the plug on

millions of customers. The utility services 70,000 square miles in

Northern and Central California.

The utility last faced jurors in a criminal trial over the

explosion of a gas pipeline in San Bruno, Calif. The 2010 disaster

killed eight people and wrecked a neighborhood. After PG&E was

found guilty of violating federal safety rules, the judge ordered

the company to pay a $3 million fine and run TV ads publicizing the

felony conviction.

PG&E has since settled with plaintiffs in civil lawsuits,

often on the courthouse steps shortly before trials were set to

begin.

"They are terrified of seeing a jury," said Jared Ellias, a law

professor at the University of California's Hastings College of

Law. "It's difficult to overstate the antipathy toward PG&E

here. I can't imagine a less popular company."

A PG&E spokeswoman declined to comment on how the utility

views jury trials.

Making amends

U.S. Bankruptcy Judge Dennis Montali is presiding over the

utility's chapter 11 proceeding. To execute a final plan allowing

PG&E to exit bankruptcy, he first needs to know the extent of

its liabilities. So this summer he took the unusual step of

ordering a state trial to hear claims by victims of the 2017 Tubbs

Fire in Northern California's wine country.

State investigators had found PG&E likely wasn't the cause

of the fire, which killed 22 people and burned nearly 37,000 acres.

But lawyers for victims have argued otherwise, saying evidence has

surfaced that points responsibility to nearby PG&E power

lines.

If a jury finds the utility liable for the fire, PG&E would

add as much as $18 billion to what it owes, according to lawyers

for fire victims. After Judge Montali ordered the Tubbs Fire trial,

PG&E shares plunged 25%.

The trial, which is scheduled to begin Jan. 7 in San Francisco,

will be the only opportunity for fire victims to accuse PG&E of

wrongdoing before a jury. No matter how much money victims are

awarded in the case, however, they can collect only from the fund

PG&E sets aside for all fire victims in its bankruptcy

plan.

U.S. District Judge James Donato will calculate the final dollar

amount owed all victims in the estimation hearings, set to start

Feb. 18. His determination will be the sum PG&E must hold for

payment before it can exit bankruptcy. Arguments over ground rules

for the hearings have been heated.

Judge Donato last month criticized the way PG&E notified

fire victims about filing claims. At the time, only about half of

the 100,000 potentially eligible people had filed ahead of the Oct.

21 deadline.

"Maybe PG&E should have gone to each of the trailers"

provided by government emergency services and asked, "How do we

help you fill out your form?" the judge said. The utility has since

extended the deadline to Dec. 31.

Arriving at a figure for fire damages will involve weeks of

debate among experts on such matters as the cost a square foot to

replace homes destroyed, and the proper compensation for lives

lost.

Lawyers for fire victims say PG&E should pay punitive

damages because it knew its lines posed a public threat.

"PG&E strongly disagrees with the suggestion PG&E knew

of specific maintenance conditions that caused the Camp Fire and

nonetheless deferred work that would have addressed those

conditions," the PG&E spokeswoman said.

Victims also say PG&E should pay for emotional damage,

another decision for Judge Donato. The PG&E claim form asks

fire victims if they had been diagnosed with mental or emotional

injury as a result of the fires.

Lianna Price was 12 weeks pregnant when she and her husband

escaped Paradise with their three children, ages 5 and under. The

kids are still troubled by what happened.

"We drive somewhere, and there's a dust cloud, and they say,

'Mommy, is that a fire? Do we have to go?' " Ms. Price said.

--Elisa Cho and Jim Oberman contributed to this article.

Write to Peg Brickley at peg.brickley@wsj.com and Gretchen

Morgenson at gretchen.morgenson@wsj.com

(END) Dow Jones Newswires

November 09, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

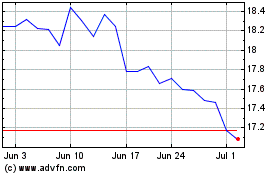

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

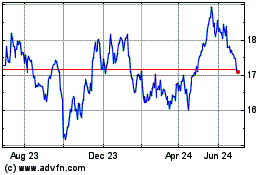

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024