Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 28 2022 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

July, 2022

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on Conduct Adjustment Agreement with ANP

—

Rio de Janeiro, July 27, 2022 – Petróleo

Brasileiro S.A. – Petrobras, informs that it approved today the execution, with the National Agency of Petroleum, Natural Gas and

Biofuels (ANP), of a Conduct Adjustment Agreement (TAC) for compensation of local content fines related to 22 concessions in which Petrobras

has 100% working interest, located in the Barreirinhas, Campos, Espírito Santo, Parecis, Potiguar, Recôncavo, Santos, Sergipe-Alagoas

and Solimões basins.

The TAC provides for the conversion of fines for non-compliance

with the local content clause of these 22 concessions into commitments of investments in Exploration and Production with local content.

Under the terms of the agreement, Petrobras commits to invest approximately R$ 1 billion in local content by 12/31/2026, in accordance

with the provisions of ANP Resolution 848/2021. With this, all administrative proceedings related to the collection of fines arising from

non-compliance with local content in these concessions will be terminated, resulting in a reduction in the liability of R$ 639 million

in the financial statements of June 30, 2022, which will be disclosed to the market on July 28, 2022.

The commitments of acquisition of goods and services of

the TAC proposal are concentrated in the activities of exploration and development of production in areas of Round Zero, whose contracts

do not establish minimum percentages of local content. The signature of the TAC does not alter the investments foreseen in the Strategic

Plan 2022-26, disclosed by Petrobras on November 24, 2021, and is in line with the strategy of generating value by managing the Company's

liabilities and improving its capital allocation.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A.

– PETROBRAS | Investor Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 –

19th floor – 20031-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 27, 2022

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

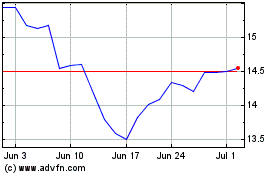

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

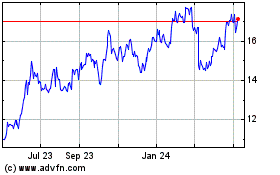

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024