UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

April, 2021

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras concludes the sale of a 10% stake in NTS

—

Rio de Janeiro, April 30 , 2021

- Petróleo Brasileiro S.A. – Petrobras, following up on the release disclosed on April 28, 2021, informs that it has entered

into a contract and completed today the sale of its remaining 10% interest in Nova Transportadora do Sudeste S.A. (NTS) to Nova Infraestrutura

Gasodutos Participações S.A. (NISA), a company formed by Nova Infraestrutura Fundo de Investimentos em Participações

Multiestratégia (FIP), an investment fund managed by Brookfield Brasil Asset Management Investimentos Ltda., and Itaúsa

S.A., the current controlling shareholders of NTS.

As disclosed, the transaction value

was R$ 1.8 billion. Considering the discount of dividends, interest on equity, and restitution through capital reduction received by Petrobras

throughout 2020 and 2021, and the other adjustments foreseen in the contract in accordance with the base date, the transaction was concluded

for R$ 1.5 billion, fully paid on today's date.

This transaction represents another

important milestone for the opening of the natural gas sector in Brazil, and with it Petrobras meets, 7 months ahead of schedule, one

of the commitments made under the Term of Cessation Commitment entered into with the Administrative Council for Economic Defense (CADE)

on July 08, 2019.

This disclosure complies with Petrobras' divestment

guidelines and the special regime of assets divestment by federal mixed capital companies, provided for in Decree 9,188/2017.

This operation is adherent to the company's Strategic

Plan and aligned with the optimization of the portfolio and the improvement of the company's capital allocation, aiming at the generation

of value for our shareholders.

About NTS

NTS is a company that operates in

the natural gas transportation sector, currently holding long-term authorizations to operate and manage a pipeline system of about 2,000

km and with capacity to transport 158.2 million m³/d of natural gas.

The NTS pipelines are located in

the states of Rio de Janeiro, Minas Gerais and São Paulo (responsible for 50% of natural gas consumption in Brazil) and are connected

to the Brasil-Bolivia pipeline, to the TAG transportation network, to the Baía de Guanabara LNG regasification terminal and to

the processing plants of natural gas produced in the Campos Basin and in the Santos Basin pre-salt.

With the sale, NTS will have the

following shareholder composition: NISA with a 10% stake; FIP, an investment fund managed by Brookfield Brasil Asset Management Investimentos

Ltda., with an 82.35% stake; and Itaúsa with a 7.65% stake.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803 –

20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 30, 2021

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

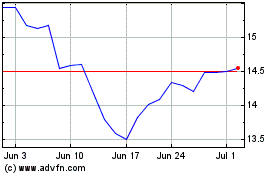

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

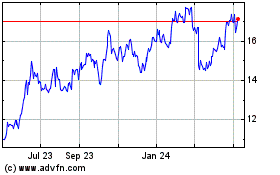

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024