Oil-Dri Corporation of America (NYSE: ODC), producer and marketer

of sorbent mineral products, today announced results for its second

quarter and first six-months of fiscal year 2024.

| |

Second Quarter |

Year to Date |

| (in thousands, except per

share amounts) |

Ended January 31, |

Ended January 31, |

|

|

2024 |

2023 |

Change |

2024 |

2023 |

Change |

|

Consolidated Results |

|

|

|

|

|

|

|

Net Sales |

$ |

105,668 |

$ |

101,669 |

4% |

$ |

217,106 |

$ |

200,208 |

8% |

|

Net Income Attributable to Oil-Dri |

$ |

12,382 |

$ |

3,856 |

221% |

$ |

23,124 |

$ |

9,097 |

154% |

|

Net Income Attributable to Oil-Dri Excluding Nonrecurring Events

† |

$ |

12,844 |

$ |

5,833 |

120% |

$ |

23,586 |

$ |

11,074 |

113% |

|

Diluted EPS - Common |

$ |

1.70 |

$ |

0.56 |

204% |

$ |

3.19 |

$ |

1.34 |

138% |

|

Diluted EPS - Common, Excluding Nonrecurring Events † |

$ |

1.77 |

$ |

0.85 |

108% |

$ |

3.25 |

$ |

1.63 |

99% |

|

Business to Business |

|

|

|

|

|

|

|

Net Sales |

$ |

36,234 |

$ |

35,154 |

3% |

$ |

75,395 |

$ |

68,841 |

10% |

|

Segment Operating Income |

$ |

10,985 |

$ |

7,734 |

42% |

$ |

22,108 |

$ |

14,991 |

47% |

|

Retail and Wholesale |

|

|

|

|

|

|

|

Net Sales |

$ |

69,434 |

$ |

66,515 |

4% |

$ |

141,711 |

$ |

131,367 |

8% |

|

Segment Operating Income |

$ |

11,877 |

$ |

8,682 |

37% |

$ |

23,208 |

$ |

16,256 |

43% |

† Please refer to Reconciliation of Non-GAAP Financial Measures

below for a reconciliation of Non-GAAP items to the comparable GAAP

measures.

Daniel S. Jaffee, President and Chief Executive

Officer, stated, “I am pleased to report another exceptional

quarter, marked by growth in consolidated net sales, gross profit,

and net income. Increased sales of renewable diesel and cat litter

products pushed our revenues to record highs for the second

quarter. Our strategic initiatives to improve gross margins yielded

positive results in the second quarter of fiscal 2024 which

generated cash to help fund the replacement of aging manufacturing

assets. Our net income more than tripled in the second quarter of

fiscal 2024, compared to the prior year. These achievements can be

attributed to our team’s ongoing dedication and the diverse product

offerings derived from our unique minerals. In the periods ahead,

we remain committed to sustaining this momentum, investing in our

manufacturing infrastructure, and delivering our value- added

products and services to our loyal customers.”

Consolidated ResultsConsolidated

net sales reached $105.7 million, a 4% increase over the prior

year, which was a record for the second quarter. This growth was

primarily driven by elevated sales of fluids purification and cat

litter products, including co-packaged items. Revenues from

industrial & sports products remained flat, while sales from

the animal health and agricultural businesses declined in the

second quarter compared to last year. Higher prices across all

principal products helped contribute to the improvement in net

sales, as well as increased volumes within the Business to Business

(“B2B”) Products Group.

Consolidated gross profit of $30.9 million was an

all-time high for the second quarter, an increase of $7.9 million,

or 34%, over the prior year. Gross margins expanded to 29.3% in

fiscal 2024 from 22.6% in fiscal 2023. This increase was driven by

higher selling prices across multiple products and improved product

mix. During the three months ended January 31, 2024, domestic cost

of goods sold per ton increased by 1% compared to the prior year.

This was a result of higher per ton freight and non-fuel

manufacturing costs, such as labor and repairs, which offset lower

natural gas and packaging costs.

Selling, general and administrative (“SG&A”)

expenses were $15.8 million during the second quarter of fiscal

2024 and remained relatively flat compared to the same period last

year.

In the second quarter of fiscal 2024, consolidated

operating income more than doubled to $15.2 million from $7.3

million in the second quarter of fiscal 2023.

Total other expense, net was $500,000 for the three

months ended January 31, 2024 compared to total other expense, net

of $2.3 million in the same period last year. In the second quarter

of fiscal 2023, the Company recorded a reserve of $2.5 million for

modification costs to address capacity issues at its sole landfill

located in Ochlocknee, Georgia. In the second quarter of fiscal

year 2024, the landfill reserve accrual was increased, but

partially offset by higher interest income.

Income tax expense increased to $2.3 million in the

second quarter of fiscal year 2024 compared to $1.2 million in the

same period last year due to the Company’s higher taxable

income.

The Company set a record for the highest second

quarter net income attributable to Oil-Dri of $12.4 million in

fiscal 2024, more than triple the prior year’s second quarter

bottom line of $3.9 million. Excluding nonrecurring items, net

income attributable to Oil-Dri for the second quarter of fiscal

year 2024 was $12.8 million compared to $5.8 million in the same

period last year, or a 120% increase.

Cash and cash equivalents for the three month

period ending January 31, 2024, totaled $27.8 million compared to

$14.0 million in the prior year. This $13.8 million increase was

driven by higher earnings. Significant uses of cash during the

second quarter of fiscal 2024 include capital investments for

manufacturing infrastructure improvements and dividends.

Product Group ReviewThe Business

to Business Products Group’s second quarter of fiscal 2024 revenues

were $36.2 million, or 3% higher than the prior year, driven

primarily from an increase in volume, and to a lesser extent, from

higher prices. Elevated revenues from fluids purification products

more than offset sales declines in the agricultural and animal

health businesses. During the second quarter of fiscal 2024,

revenues from fluid purification products reached a record $22.7

million, or a 19% increase over the prior year. This was primarily

due to increased demand for renewable diesel, edible oil, and jet

fuel products within North America, combined with higher prices in

the region. The Company acquired several new customers as a result

of the recently established renewable diesel plants within the U.S.

which helped drive this growth. In the second quarter of fiscal

2024, sales of agricultural products were $9.3 million, or a 5%

decrease from the prior year. This decline was a result of softer

volumes. Amlan International, the Company’s animal health business,

generated $4.2 million in sales during the second quarter of fiscal

2024, reflecting a 33% decrease from last year. Despite this

decline, double digit revenue gains were achieved within North

America where the Company has made significant investments to grow

the business. Sales improved within this region through higher

prices and increased demand of Sorbiam products. These gains were

more than offset by revenue declines within Asia (including China),

Latin America, and Mexico as a result of timing of orders and lower

demand. Due to the transition from sales through Oil-Dri’s

subsidiary in China to a master distributor model, future sales to

China will be directly through the Company and captured under the

Asia region.

During the second quarter of fiscal 2024, SG&A

costs within the B2B Products Group increased by $200,000, or 7%,

over the prior year. This was mainly driven by higher

compensation-related expenses, partially offset by a reduction in

the allocation of technical support costs.

Operating income for the B2B Products Group was

$11.0 million in the second quarter of fiscal 2024 compared to $7.7

million in fiscal 2023, reflecting a 42% increase. This $3.3

million gain can be attributed to higher sales and a favorable

product mix, partially offset by elevated SG&A expenses.

The Retail and Wholesale (“R&W”) Products

Group’s second quarter revenues reached $69.4 million, a 4%

increase over the prior year. This increase was driven by higher

prices across product offerings. A significant portion of this

growth can be attributed to record high sales from co-packaged

coarse cat litter products. A combination of higher prices and the

shift in the timing of sales from a key customer who was impacted

by a cyberattack during the first quarter of fiscal 2024 generated

these sales gains. In addition, domestic cat litter sales,

excluding the Company’s co-packaged coarse cat litter business,

grew to $50.2 million, or a 3% increase over the prior year. Higher

prices across the domestic cat litter product portfolio drove the

increase. Revenues from combined domestic branded and private label

lightweight litter items rose 3% in the second quarter of fiscal

2024 versus the prior year. However, retail sales of these products

grew 8% compared to the lightweight litter segment sales growth of

7% for the 13-week period ended January 27, 2024, according to

third-party research data for retail sales1. While shipment growth

trailed the lightweight litter segment consumption growth this

quarter, the Company continued to increase its share of the

lightweight litter segment. In addition, Oil-Dri expanded

distribution of its newly launched EPA approved Cat’s Pride

Antibacterial Clumping Litter. Sales of both branded and private

label coarse cat litter increased during the second quarter

compared to the same period last year. Domestic industrial and

sports product revenues were $9.6 million in the second quarter of

fiscal 2024 and flat compared to the prior year. Sales from the

Company’s Canadian subsidiary also remained relatively flat in the

three months ended January 31, 2024, compared to the same period

last year. Slightly higher revenues from cat litter products were

offset by softer sales from industrial floor absorbents.

During the second quarter of fiscal 2024, SG&A

expenses within the R&W Products Group increased by $800,000 or

25% over the prior year. This was driven by higher advertising

costs to promote Cat’s Pride lightweight litter, including the

newly launched Cat’s Pride Antibacterial Clumping Litter product.

The Company expects advertising costs for the full fiscal year 2024

to be higher than fiscal year 2023, though spread more evenly over

four quarters.

Operating income for the R&W Products Group

reached $11.9 million in the second quarter of fiscal year 2024

compared to $8.7 million in the prior year, reflecting a 37%

increase. This $3.2 million increase can be attributed to higher

sales, partially offset by increased cost of goods sold and

SG&A expenses.

Oil-Dri will host its second quarter of fiscal year

2024 earnings discussion via a live webcast on Friday, March 8,

2024 at 10:00 a.m. Central Time. Participation details are

available on the Company’s website’s Events page.

1Based in part on data reported by NielsenIQ

through its Scantrack Service for the Cat Litter Category in the

13-week period ended January 27, 2024, for the U.S. xAOC+Pet Supers

market. Copyright © 2024 NielsenIQ.

“Oil-Dri”, “Cat’s Pride”, “Sorbiam”, and “Amlan”

are registered trademarks of Oil-Dri Corporation of America.

About Oil-Dri Corporation of

AmericaOil-Dri Corporation of America is a leading

manufacturer and supplier of specialty sorbent products for the pet

care, animal health and nutrition, fluids purification,

agricultural ingredients, sports field, industrial and automotive

markets. Oil-Dri is vertically integrated which enables the Company

to efficiently oversee every step of the process from research and

development to supply chain to marketing and sales. With over 80

years of experience, the Company continues to fulfill its mission

to Create Value from Sorbent Minerals.

Forward-Looking StatementsCertain

statements in this press release may contain forward-looking

statements, within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995, that are

based on our current expectations, estimates, forecasts and

projections about our future performance, our business, our beliefs

and our management’s assumptions. In addition, we, or others on our

behalf, may make forward-looking statements in other press releases

or written statements, or in our communications and discussions

with investors and analysts in the normal course of business

through meetings, webcasts, phone calls and conference calls.

Forward-looking statements can be identified by words such as

“expect,” “outlook,” “forecast,” “would,” “could,” “should,”

“project,” “intend,” “plan,” “continue,” “believe,” “seek,”

“estimate,” “anticipate,” “may,” “assume,” “potential,” “strive,”

and similar references to future periods.

Such statements are subject to certain risks,

uncertainties and assumptions that could cause actual results to

differ materially, including, but not limited to, those described

in Item 1A, “Risk Factors” of our Quarterly Report on Form 10-Q for

the quarter ended January 31, 2024 and our most recent Annual

Report on Form 10-K and from time to time in our other filings with

the Securities and Exchange Commission. Should one or more of these

or other risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those anticipated, intended, expected, believed, estimated,

projected, planned or otherwise expressed in any forward-looking

statements. Investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. Except to the extent required by law, we do

not have any intention or obligation to update publicly any

forward-looking statements after the distribution of this press

release, whether as a result of new information, future events,

changes in assumptions, or otherwise.

Contact:Leslie A. GarberDirector of Investor

RelationsOil-Dri Corporation of

AmericaInvestorRelations@oildri.com(312) 321-1515

| |

|

|

|

|

| |

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per

share amounts) |

|

| |

Second Quarter Ended January 31, |

| |

|

2024 |

|

|

% of Sales |

|

|

2023 |

|

|

% of Sales |

|

Net Sales |

$ |

105,668 |

|

|

100.0 |

% |

|

$ |

101,669 |

|

|

100.0 |

% |

| Cost of Goods

Sold |

|

(74,726 |

) |

|

(70.7 |

)% |

|

|

(78,653 |

) |

|

(77.4 |

)% |

| Gross

Profit |

|

30,942 |

|

|

29.3 |

% |

|

|

23,016 |

|

|

22.6 |

% |

| Selling, General and

Administrative Expenses |

|

(15,777 |

) |

|

(14.9 |

)% |

|

|

(15,710 |

) |

|

(15.5 |

)% |

| Operating

Income |

|

15,165 |

|

|

14.4 |

% |

|

|

7,306 |

|

|

7.2 |

% |

| Other Expense,

Net |

|

(483 |

) |

|

(0.5 |

)% |

|

|

(2,267 |

) |

|

(2.2 |

)% |

| Income Before Income

Taxes |

|

14,682 |

|

|

13.9 |

% |

|

|

5,039 |

|

|

5.0 |

% |

| Income Taxes

Expense |

|

(2,300 |

) |

|

(2.2 |

)% |

|

|

(1,193 |

) |

|

(1.2 |

)% |

| Net

Income |

|

12,382 |

|

|

11.7 |

% |

|

|

3,846 |

|

|

3.8 |

% |

| Net Loss Attributable

to Noncontrolling Interest |

|

— |

|

|

— |

% |

|

|

(10 |

) |

|

— |

% |

| Net Income

attributable to Oil-Dri |

$ |

12,382 |

|

|

11.7 |

% |

|

$ |

3,856 |

|

|

3.8 |

% |

| |

|

|

|

|

|

|

|

| Net Income Per Share:

Basic Common |

$ |

1.84 |

|

|

|

|

$ |

0.58 |

|

|

|

|

Basic Class B |

$ |

1.38 |

|

|

|

|

$ |

0.44 |

|

|

|

|

Diluted Common |

$ |

1.70 |

|

|

|

|

$ |

0.56 |

|

|

|

|

Diluted Class B |

$ |

1.38 |

|

|

|

|

$ |

0.43 |

|

|

|

| Avg Shares

Outstanding: Basic Common |

|

4,883 |

|

|

|

|

|

4,829 |

|

|

|

|

Basic Class B |

|

1,977 |

|

|

|

|

|

1,964 |

|

|

|

|

Diluted Common (1) |

|

6,860 |

|

|

|

|

|

4,965 |

|

|

|

|

Diluted Class B |

|

1,977 |

|

|

|

|

|

1,985 |

|

|

|

| |

|

|

|

|

|

|

|

(1) Please see Note 1 of the unaudited Notes to the

Condensed Consolidated Financial Statements in our Quarterly Report

on Form 10-Q for the three months ended January 31, 2024.

| |

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per

share amounts) |

|

| |

|

|

|

|

|

|

|

| |

Six Months Ended January 31, |

| |

|

2024 |

|

|

% of Sales |

|

|

2023 |

|

|

% of Sales |

|

Net Sales |

$ |

217,106 |

|

|

100.0 |

% |

|

$ |

200,208 |

|

|

100.0 |

% |

| Cost of Goods

Sold |

|

(155,173 |

) |

|

(71.5 |

)% |

|

|

(154,882 |

) |

|

(77.4 |

)% |

| Gross

Profit |

|

61,933 |

|

|

28.5 |

% |

|

|

45,326 |

|

|

22.6 |

% |

| Selling, General and

Administrative Expenses |

|

(33,612 |

) |

|

(15.5 |

)% |

|

|

(31,451 |

) |

|

(15.7 |

)% |

| Operating

Income |

|

28,321 |

|

|

13.0 |

% |

|

|

13,875 |

|

|

6.9 |

% |

| Other Expense,

Net |

|

(809 |

) |

|

(0.4 |

)% |

|

|

(2,399 |

) |

|

(1.2 |

)% |

| Income Before Income

Taxes |

|

27,512 |

|

|

12.7 |

% |

|

|

11,476 |

|

|

5.7 |

% |

| Income Taxes

Expense |

|

(4,388 |

) |

|

(2.0 |

)% |

|

|

(2,400 |

) |

|

(1.2 |

)% |

| Net

Income |

|

23,124 |

|

|

10.7 |

% |

|

|

9,076 |

|

|

4.5 |

% |

| Net Loss Attributable

to Noncontrolling Interest |

|

— |

|

|

— |

% |

|

|

(21 |

) |

|

— |

% |

| Net Income

Attributable to Oil-Dri |

$ |

23,124 |

|

|

10.7 |

% |

|

$ |

9,097 |

|

|

4.5 |

% |

| |

|

|

|

|

|

|

|

| Net Income Per Share:

Basic Common |

$ |

3.44 |

|

|

|

|

$ |

1.37 |

|

|

|

|

Basic Class B |

$ |

2.58 |

|

|

|

|

$ |

1.03 |

|

|

|

|

Diluted Common |

$ |

3.19 |

|

|

|

|

$ |

1.34 |

|

|

|

|

Diluted Class B |

$ |

2.58 |

|

|

|

|

$ |

1.02 |

|

|

|

| Avg Shares

Outstanding: Basic Common |

|

4,856 |

|

|

|

|

|

4,817 |

|

|

|

|

Basic Class B |

|

1,971 |

|

|

|

|

|

1,953 |

|

|

|

|

Diluted Common (1) |

|

6,827 |

|

|

|

|

|

4,937 |

|

|

|

|

Diluted Class B |

|

1,971 |

|

|

|

|

|

1,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Please see Note 1 of the unaudited Notes to the

Condensed Consolidated Financial Statements in our Quarterly Report

on Form 10-Q for the six-months ended January 31, 2024.

| |

|

|

|

|

CONSOLIDATED BALANCE SHEETS |

| (in thousands, except per

share amounts) |

|

|

|

| |

As of January 31, |

|

|

|

2024 |

|

|

2023 |

| Current

Assets |

|

|

|

|

Cash and Cash Equivalents |

$ |

27,800 |

|

$ |

13,951 |

|

Accounts Receivable, Net |

|

59,336 |

|

|

57,179 |

|

Inventories |

|

46,230 |

|

|

37,938 |

|

Prepaid Expenses and Other Assets |

|

6,067 |

|

|

7,602 |

|

Total Current Assets |

|

139,433 |

|

|

116,670 |

| Property, Plant and

Equipment, Net |

|

125,027 |

|

|

114,597 |

| Other Noncurrent

Assets |

|

31,692 |

|

|

24,777 |

| Total

Assets |

$ |

296,152 |

|

$ |

256,044 |

| |

|

|

|

| Current

Liabilities |

|

|

|

|

Current Maturities of Notes Payable |

$ |

1,000 |

|

$ |

1,000 |

|

Accounts Payable |

|

12,009 |

|

|

11,048 |

|

Dividends Payable |

|

1,963 |

|

|

1,858 |

|

Other Current Liabilities |

|

31,191 |

|

|

35,635 |

|

Total Current Liabilities |

|

46,163 |

|

|

49,541 |

| Noncurrent

Liabilities |

|

|

|

|

Notes Payable |

|

30,851 |

|

|

31,809 |

|

Other Noncurrent Liabilities |

|

23,100 |

|

|

17,720 |

|

Total Noncurrent Liabilities |

|

53,951 |

|

|

49,529 |

| Stockholders'

Equity |

|

196,038 |

|

|

156,974 |

| Total Liabilities and

Stockholders' Equity |

$ |

296,152 |

|

$ |

256,044 |

| |

|

|

|

| Book Value Per Share

Outstanding |

$ |

28.72 |

|

$ |

23.19 |

| |

|

|

|

| Acquisitions

of: |

|

|

|

| Property, Plant and

Equipment |

|

|

|

|

Second Quarter |

$ |

7,482 |

|

$ |

5,903 |

|

Year To Date |

$ |

15,546 |

|

$ |

12,640 |

| Depreciation and

Amortization Charges |

|

|

|

|

Second Quarter |

$ |

4,486 |

|

$ |

3,751 |

|

Year To Date |

$ |

8,854 |

|

$ |

7,274 |

|

|

|

|

|

|

|

Certain amounts in the prior period financial

statements have been reclassified to conform to the presentation of

the current period financial statements.

| |

|

|

|

| CONSOLIDATED

STATEMENTS OF CASH FLOWS |

|

|

|

| (in thousands) |

|

|

|

| |

For the Six Months Ended |

| |

January 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

| Net

Income |

$ |

23,124 |

|

|

$ |

9,076 |

|

| Adjustments to

reconcile net income to net cash |

|

|

|

| provided by operating

activities: |

|

|

|

|

Depreciation and Amortization |

|

8,854 |

|

|

|

7,274 |

|

|

Increase in Accounts Receivable |

|

(64 |

) |

|

|

(5,738 |

) |

|

Increase in Inventories |

|

(3,666 |

) |

|

|

(2,717 |

) |

|

(Increase) Decrease in Prepaid Expenses |

|

(3,217 |

) |

|

|

626 |

|

|

(Decrease) Increase in Accounts Payable |

|

(3,243 |

) |

|

|

180 |

|

|

(Decrease) Increase in Accrued Expenses |

|

(7,582 |

) |

|

|

3,891 |

|

|

Other |

|

3,739 |

|

|

|

1,625 |

|

|

Total Adjustments |

|

(5,179 |

) |

|

|

5,141 |

|

| Net Cash Provided by

Operating Activities |

|

17,945 |

|

|

|

14,217 |

|

| |

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

Capital Expenditures |

|

(15,546 |

) |

|

|

(12,640 |

) |

|

Other |

|

— |

|

|

|

5 |

|

| Net Cash Used in

Investing Activities |

|

(15,546 |

) |

|

|

(12,635 |

) |

| |

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

Dividends Paid |

|

(3,889 |

) |

|

|

(3,711 |

) |

|

Purchases of Treasury Stock |

|

(2,575 |

) |

|

|

(225 |

) |

| Net Cash Used In

Financing Activities |

|

(6,464 |

) |

|

|

(3,936 |

) |

| |

|

|

|

| Effect of exchange

rate changes on Cash and Cash Equivalents |

|

111 |

|

|

|

7 |

|

| |

|

|

|

| Net Decrease in Cash

and Cash Equivalents |

|

(3,954 |

) |

|

|

(2,347 |

) |

| Cash and Cash

Equivalents, Beginning of Period |

|

31,754 |

|

|

|

16,298 |

|

| Cash and Cash

Equivalents, End of Period |

$ |

27,800 |

|

|

$ |

13,951 |

|

| |

|

|

|

|

|

|

|

Certain amounts in the prior period financial

statements have been reclassified to conform to the presentation of

the current period financial statements.

| |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

| (in thousands) |

|

|

|

|

|

|

|

| |

Second Quarter |

|

Year to Date |

| |

Ended January 31, |

|

Ended January 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| CONSOLIDATED

RESULTS |

|

|

|

|

|

|

|

| GAAP: Net Income

Attributable to Oil-Dri |

$ |

12,382 |

|

$ |

3,856 |

|

$ |

23,124 |

|

$ |

9,097 |

| Landfill Modification

Loss, Net of Tax |

$ |

462 |

|

$ |

1,977 |

|

$ |

462 |

|

$ |

1,977 |

| Non-GAAP: Net Income

Attributable to Oil-Dri excluding Nonrecurring Events |

$ |

12,844 |

|

$ |

5,833 |

|

$ |

23,586 |

|

$ |

11,074 |

| |

|

|

|

|

|

|

|

| GAAP: Diluted EPS -

Common |

$ |

1.70 |

|

$ |

0.56 |

|

$ |

3.19 |

|

$ |

1.34 |

| Landfill Modification

Loss, Net of Tax |

$ |

0.07 |

|

$ |

0.29 |

|

$ |

0.06 |

|

$ |

0.29 |

| Non-GAAP: Diluted EPS

- Common, excluding Nonrecurring Events |

$ |

1.77 |

|

$ |

0.85 |

|

$ |

3.25 |

|

$ |

1.63 |

| |

|

|

|

|

|

|

|

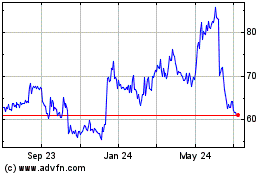

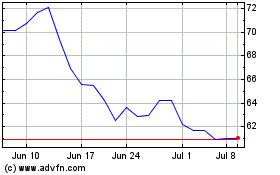

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oil Dri Corp of America (NYSE:ODC)

Historical Stock Chart

From Apr 2023 to Apr 2024