Two Nuveen Closed-End Funds Propose New VRDP Actions

January 10 2017 - 4:30PM

Business Wire

The Nuveen New Jersey Quality Municipal Income Fund (NYSE: NXJ)

and Nuveen Virginia Quality Municipal Income Fund (NYSE: NPV), as

part of Nuveen’s regular leverage management process, propose to

transition each of their Series 1 Variable Rate Demand Preferred

Shares (VRDP Shares) to a special rate period, through a mandatory

remarketing of the VRDP Shares from existing holders through the

remarketing agent to an institutional purchaser.

If and when each fund reaches an agreement to proceed, as

anticipated, each fund will provide existing holders of the

applicable VRDP Shares with advance notice of the mandatory

remarketing in accordance with the governing documents of the VRDP

Shares. During the special rate period, the VRDP Shares will not be

remarketed by a remarketing agent, be subject to optional or

mandatory tender events, or supported by a liquidity provider. The

proposed transitions may take place as early as late January 2017;

however, the timing and completion of the proposed transition by

each fund are subject to market conditions, as well as to reaching

final agreement with the purchaser and satisfaction of customary

closing conditions.

No VRDP Shares have been registered under the Securities Act of

1933 (the Securities Act) or any state securities laws. Unless so

registered, no VRDP Shares may be offered or sold in the United

States except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release is neither an offer to sell nor a

solicitation of an offer to buy any of these securities.

Nuveen provides investment solutions designed to help secure the

long-term goals of individual investors and the advisors who serve

them. Through the investment expertise of leading asset managers

across traditional and alternative asset classes, Nuveen is

committed to delivering consultative guidance that aligns with

client needs. Securities offered through Nuveen Securities, LLC,

Member FINRA and SIPC. Nuveen is an operating division of TIAA

Global Asset Management. For more information, please visit the

Nuveen website at www.nuveen.com.

The information contained on the Nuveen website is not a part of

this press release.

FORWARD LOOKING STATEMENTS

Certain statements made or referenced in this release may be

forward-looking statements. Actual future results or occurrences

may differ significantly from those anticipated in any

forward-looking statements due to numerous factors. These include,

but are not limited to:

- market developments;

- legal and regulatory developments;

and

- other additional risks and

uncertainties.

Nuveen and the closed-end funds managed by Nuveen and its

affiliates undertake no responsibility to update publicly or revise

any forward-looking statements.

The Annual and Semi-Annual Reports and other regulatory filings

of the Nuveen closed-end funds with the Securities and Exchange

Commission (SEC) are accessible on the SEC's website at www.sec.gov

and on Nuveen`s website at www.nuveen.com/cef and may discuss the

above-mentioned or other factors that affect the Nuveen closed-end

funds. The information contained on those websites is not a part of

this press release.

21832-INV-O-01/18

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170110006347/en/

NuveenMedia Contact:Kristyna Munoz(312)

917-8343kristyna.munoz@nuveen.com

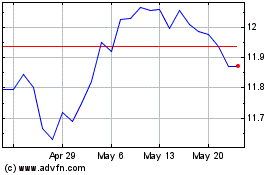

Nuveen New Jersey Qualit... (NYSE:NXJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nuveen New Jersey Qualit... (NYSE:NXJ)

Historical Stock Chart

From Apr 2023 to Apr 2024