Current Report Filing (8-k)

February 18 2020 - 4:33PM

Edgar (US Regulatory)

false 0000789570 0000789570 2020-02-18 2020-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2020

MGM Resorts International

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-10362

|

|

88-0215232

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. employer

identification no.)

|

|

|

|

|

|

3600 Las Vegas Boulevard South,

Las Vegas, Nevada

|

|

89109

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(702) 693-7120

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock (Par Value $0.01)

|

|

MGM

|

|

New York Stock Exchange (NYSE)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On February 18, 2019, MGM Resorts International (the “Company”) issued a press release announcing the commencement of cash tender offers (the “Tender Offers”) to purchase up to $750,000,000 in aggregate principal amount (the “Aggregate Maximum Tender Amount”) of its outstanding 5.750% Senior Notes due 2025 (the “5.750% Notes”), 5.500% Senior Notes due 2027 (the “5.500% Notes”) and 4.625% Senior Notes due 2026 (the “4.625% Notes” and, collectively with the 5.750% Notes and the 5.500% Notes, the “Notes”). In addition, the Company will only accept for purchase (i) 5.750% Notes having an aggregate principal amount of up to $325,000,000, (ii) 5.500% Notes having an aggregate principal amount of up to $325,000,000 and (iii) 4.625% Notes having an aggregate principal amount of up to $100,000,000 (each a “Tender Cap” and, collectively, the “Tender Caps”). The Company may increase the Aggregate Maximum Tender Amount or the Tender Caps at any time in its sole discretion. The acceptance of Notes purchased in the Tender Offers will be based on the priority levels set forth in the Offer to Purchase, dated February 18, 2020 (the “Offer to Purchase”).

The terms and conditions of the Tender Offers are described in the Offer to Purchase. The Company intends to fund the Tender Offers with the net cash proceeds from its contribution of MGM Grand Las Vegas to the newly formed joint venture between MGM Growth Properties Operating Partnership LP and BCORE Windmill Parent LLC, which was formed in connection with a transaction that closed on February 14, 2020, and, if necessary, any other sources of available funds, which may include cash on hand or borrowings under the Company’s revolving credit facility.

A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

Neither this report nor the exhibit hereto is a recommendation to buy or sell any of the Company’s securities and shall not constitute an offer to purchase or the solicitation of an offer to sell any securities of the Company. The Tender Offers are being made exclusively pursuant to the Offer to Purchase.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: February 18, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MGM Resorts International

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Andrew Hagopian III

|

|

|

|

|

|

Name:

|

|

Andrew Hagopian III

|

|

|

|

|

|

Title:

|

|

Chief Corporate Counsel & Assistant Secretary

|

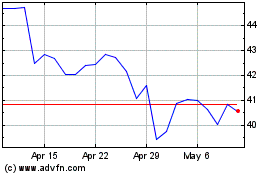

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

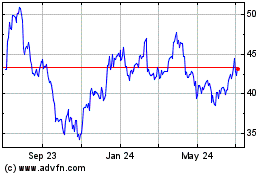

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024