Medtronic Revenue Continues to Grow on Acquisition

May 31 2016 - 8:30AM

Dow Jones News

Medtronic PLC gave a rosy revenue outlook for the year and

reported better-than-expected growth in its fourth quarter, helped

by its acquisition of Covidien PLC.

For 2017, the company expects revenue to grow 5% to 6%, above

analysts' expectations for 3% growth. Medtronic expects adjusted

earnings of $4.60 to $4.70 a share, compared with analysts'

expectations for $4.70 a share.

Medtronic's results have taken a boon in recent quarters from

the device manufacturer's $50 billion acquisition of Covidien. A

year out from the deal's close, Tuesday's report marks the first

quarter in which the medical device maker's results are included in

both quarters.

In all for its fiscal fourth quarter, Medtronic reported a

profit of $1.1 billion, or 78 cents a share, compared with a loss

of $1 billion, or flat, a year earlier. Excluding certain items,

adjusted earnings were $1.27 a share, edging above analysts'

expectations for $1.26 a share.

Revenue rose 3.6% to $7.57 billion. The company said revenue

rose 6% excluding a $179 million dent from foreign currency, better

than its projection for revenue growth for the fourth quarter

between 5% and 5.5% on a constant-currency basis.

In the latest quarter, the minimally invasive therapies group,

formerly the Covidien Group, posted sales of $2.46 billion, a 3%

increase, or a 6% increase on a constant-currency basis, helped by

"above-market growth" in surgical solutions.

Revenue in Medtronic's cardio-and-vascular group segment grew 5%

to $2.74 billion, or 8% on an adjusted basis, driven by growth

across all three of its divisions.

The restorative-therapies group posted revenue growth of 1% to

$1.88 billion, or 3% on an adjusted basis, on strong growth in

neurovascular and surgical technologies and improved results in

spine.

Sales in the diabetes group grew 6% to $496 million, or an

adjusted 10%.

Shares, inactive premarket, have added 5.6% over the past three

months.

The Covidien acquisition involved Medtronic reincorporating from

Minneapolis to Dublin, a so-called inversion deal that reduces the

company's tax burden. Medtronic Inc. said last month the Treasury

Department's new proposed tax regulations on inversion deals won't

have a material financial impact on the medical supply company,

which moved its corporate address abroad in the deal last year.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 31, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

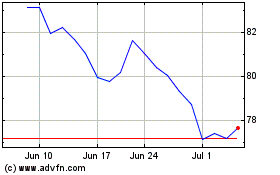

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

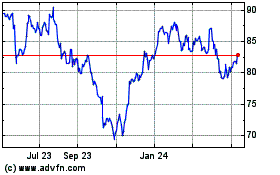

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024