false0000063908MCDONALDS CORP

0000063908

2019-10-22

2019-10-22

0000063908

us-gaap:DebtSecuritiesMember

2019-10-22

2019-10-22

0000063908

exch:XNYS

us-gaap:CommonStockMember

2019-10-22

2019-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 22, 2019

McDONALD’S CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Delaware | | 1-5231 | | 36-2361282 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

110 North Carpenter Street

Chicago, Illinois

(Address of Principal Executive Offices)

60607

(Zip Code)

(630) 623-3000

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

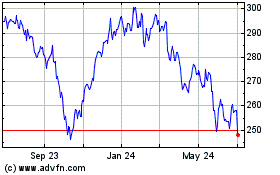

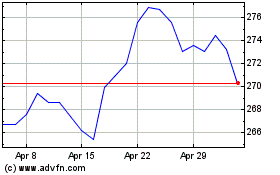

Common Stock, $0.01 par value | MCD | New York Stock Exchange |

0.17% Notes due 2024 | MCD | SIX Swiss Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| | | |

Emerging growth company

| ☐ | | |

|

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| o

|

Item 2.02. Results of Operations and Financial Condition.

On October 22, 2019, McDonald’s Corporation (the “Company”) issued an investor release reporting the Company’s results for the third quarter and nine months ended September 30, 2019. A copy of the related investor release is being filed as Exhibit 99.1 to this Form 8-K and is incorporated by reference in its entirety. Also filed herewith and incorporated by reference as Exhibit 99.2 is supplemental information for the quarter and nine months ended September 30, 2019. The information under this Item 2.02, including such Exhibits, shall be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended. Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | McDONALD’S CORPORATION |

| | | | (Registrant) |

Date: | October 22, 2019 | | | By: | | /s/ Catherine Hoovel |

| | | | | | Catherine Hoovel |

| | | | | | Corporate Vice President - Chief Accounting Officer |

Exhibit 99.1

|

| |

FOR IMMEDIATE RELEASE | FOR MORE INFORMATION CONTACT: |

10/22/2019 | Investors: Mike Cieplak, investor.relations@us.mcd.com |

| Media: Lauren Altmin, lauren.altmin@us.mcd.com |

McDONALD'S REPORTS THIRD QUARTER 2019 RESULTS

CHICAGO, IL - McDonald's Corporation today announced results for the third quarter ended September 30, 2019.

“Our third quarter performance was strong, and broad-based momentum continued with our 17th consecutive quarter of global comparable sales growth," said McDonald's President and Chief Executive Officer Steve Easterbrook. "Globally, our customers are rewarding our commitment of running better restaurants and executing our Velocity Growth Plan by visiting more often."

Third quarter highlights:

| |

• | Strong, global comparable sales of 5.9% demonstrated broad-based strength with the International Operated segment increase of 5.6%, the U.S. increase of 4.8%, and the International Developmental Licensed segment increase of 8.1%. |

| |

• | Consolidated revenues increased $61.2 million or 1% (3% in constant currencies) to $5.4 billion. |

| |

• | Systemwide sales increased $1.3 billion or 5% (7% in constant currencies) to $26.0 billion.* |

| |

• | GAAP diluted earnings per share of $2.11 was relatively flat with the prior year (increased 2% in constant currencies).** |

| |

• | The Company returned $2.4 billion to shareholders through share repurchases and dividends. This brings the cumulative return to shareholders to $22.5 billion against our targeted return of about $25 billion for the three-year period ending 2019. In addition, the Company announced an 8% increase in its quarterly dividend to $1.25 per share beginning in the third quarter 2019. |

Steve Easterbrook concluded, "As we work to build an even better McDonald’s experience for customers by providing convenience on their terms, we continue to embrace the culture of innovation that helped launch our company over 60 years ago. That culture is rooted in a mission to provide delicious food, served with hospitality, to over 65 million customers who honour us with their business every day.”

| |

* | Refer to page 3 for a definition of Systemwide sales. |

| |

** | Refer to page 2 for additional details. |

KEY HIGHLIGHTS - CONSOLIDATED

Dollars in millions, except per share data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended September 30, | | | Nine Months Ended September 30, | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| | | Inc/ (Dec) Excluding Currency Translation | | | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| | | Inc/ (Dec) Excluding Currency Translation | |

Revenues | $ | 5,430.6 |

| | $ | 5,369.4 |

| | 1 |

| % | | 3 | % | | $ | 15,727.5 |

| | $ | 15,862.2 |

| | (1 | ) | % | | 3 | % |

Operating income | 2,409.3 |

| | 2,417.7 |

| | 0 |

| | | 2 | | | 6,777.2 |

| | 6,823.1 |

| | (1 | ) | | | 3 | |

Net income | 1,607.9 |

| | 1,637.3 |

| | (2 | ) | | | 0 | | | 4,453.2 |

| | 4,509.0 |

| | (1 | ) | | | 2 | |

Earnings per share-diluted* | $ | 2.11 |

| | $ | 2.10 |

| | 0 |

| % | | 2 | % | | $ | 5.80 |

| | $ | 5.72 |

| | 1 |

| % | | 5 | % |

| |

* | See table below for additional details. |

Results for the quarter and nine months in constant currencies reflected stronger operating performance primarily due to an increase in sales-driven franchised margin dollars, partly offset by lower gains on sales of restaurant businesses, mostly in the U.S.

Results for the nine months 2019 included $80 million of pre-tax strategic charges, or $0.07 per share, primarily related to impairment associated with the purchase of our joint venture partner's interest in the India Delhi market, partly offset by gains on the sales of property at the former Corporate headquarters. Results for 2018 reflected income tax costs associated with adjustments to the provisional amounts recorded in December 2017 under the Tax Act of $47 million, or $0.06 per share, for the quarter and $99 million, or $0.12 per share, for the nine months. Results for the nine months 2018 also included $94 million of pre-tax strategic restructuring charges, or $0.09 per share.

Excluding the above items, net income for the quarter decreased 4% (3% in constant currencies) and diluted earnings per share decreased 2% (1% in constant currencies), and for the nine months net income decreased 4% (flat in constant currencies) and diluted earnings per share decreased 1% (increased 2% in constant currencies).

Foreign currency translation had a negative impact of $0.03 and $0.19 on diluted earnings per share for the quarter and nine months, respectively.

EARNINGS PER SHARE-DILUTED RECONCILIATION

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended September 30, | | | Nine Months Ended September 30, | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| | | Inc/ (Dec) Excluding Currency Translation |

| | | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| | | Inc/ (Dec) Excluding Currency Translation | |

GAAP earnings per share-diluted | $ | 2.11 |

| | $ | 2.10 |

| | 0 |

| % | | 2 |

| % | | $ | 5.80 |

| | $ | 5.72 |

| | 1 |

| % | | 5 | % |

Income tax costs | — |

| | 0.06 |

| | | | | | | | — |

| | 0.12 |

| | | | | | |

Strategic charges | — |

| | — |

| | | | | | | | 0.07 |

| | 0.09 |

| | | | | | |

Non-GAAP earnings per share-diluted | $ | 2.11 |

| | $ | 2.16 |

| | (2 | ) | % | | (1 | ) | % | | $ | 5.87 |

| | $ | 5.93 |

| | (1 | ) | % | | 2 | % |

THE FOLLOWING DEFINITIONS APPLY TO THESE TERMS AS USED THROUGHOUT THIS RELEASE

Comparable sales represent sales at all restaurants and comparable guest counts represent the number of transactions at all restaurants, whether operated by the Company or by franchisees, in operation at least thirteen months including those temporarily closed. Some of the reasons restaurants may be temporarily closed include reimaging or remodeling, rebuilding, road construction and natural disasters. Comparable sales exclude the impact of currency translation and sales from hyper-inflationary markets (currently, only Venezuela). Management generally identifies hyper-inflationary markets as those markets whose cumulative inflation rate over a three-year period exceeds 100%. Management believes that these exclusions more accurately reflect the underlying business trends. Comparable sales are driven by changes in guest counts and average check, which is affected by changes in pricing and product mix. Management reviews the increase or decrease in comparable sales and comparable guest counts compared with the same period in the prior year to assess business trends.

Systemwide sales include sales at all restaurants, whether operated by the Company or by franchisees. While franchised sales are not recorded as revenues by the Company, management believes the information is important in understanding the Company's financial performance, because these sales are the basis on which the Company calculates and records franchised revenues and are indicative of the financial health of the franchisee base. The Company's revenues consist solely of sales by Company-operated restaurants and fees from franchised restaurants operated by conventional franchisees, developmental licensees and foreign affiliates.

Information in constant currency is calculated by translating current year results at prior year average exchange rates. Management reviews and analyzes business results excluding the effect of foreign currency translation, impairment and other strategic charges and gains, as well as income tax provision adjustments related to the Tax Act, and bases incentive compensation plans on these results, because the Company believes this better represents underlying business trends.

RELATED COMMUNICATIONS

This press release should be read in conjunction with Exhibit 99.2 in the Company's Form 8-K filing for supplemental information related to the Company's results for the quarter and nine months ended September 30, 2019. McDonald’s Corporation will broadcast its investor earnings conference call live over the Internet at 10:00 a.m. (Central Time) on October 22, 2019. A link to the live webcast will be available at www.investor.mcdonalds.com. There will also be an archived webcast available for a limited time thereafter.

UPCOMING COMMUNICATIONS

For important news and information regarding McDonald's, including the timing of future investor conferences and earnings calls, visit the Investor Relations section of the Company's Internet home page at www.investor.mcdonalds.com. McDonald's uses this website as a primary channel for disclosing key information to its investors, some of which may contain material and previously non-public information.

ABOUT McDONALD’S

McDonald’s is the world’s leading global foodservice retailer with over 38,000 locations in over 100 countries. Approximately 93% of McDonald’s restaurants worldwide are owned and operated by independent local business men and women.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements, which reflect management's expectations regarding future events and operating performance and speak only as of the date hereof. These forward-looking statements involve a number of risks and uncertainties. Factors that could cause actual results to differ materially from our expectations are detailed in the Company’s filings with the Securities and Exchange Commission, including the risk factors discussed in Exhibit 99.2 in the Company’s Form 8-K filing on October 22, 2019. The Company undertakes no obligation to update such forward-looking statements, except as may otherwise be required by law.

McDONALD'S CORPORATION

CONDENSED CONSOLIDATED STATEMENT OF INCOME (UNAUDITED)

|

| | | | | | | | | | | | | | |

Dollars and shares in millions, except per share data | | | | | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

Revenues | | | | | | | |

Sales by Company-operated restaurants | $ | 2,416.6 |

| | $ | 2,511.0 |

| | $ | (94.4 | ) | | (4 | )% |

Revenues from franchised restaurants | 3,014.0 |

| | 2,858.4 |

| | 155.6 |

| | 5 |

|

| | | | | | | |

TOTAL REVENUES | 5,430.6 |

| | 5,369.4 |

| | 61.2 |

| | 1 |

|

| | | | | | | |

Operating costs and expenses | | | | | | | |

Company-operated restaurant expenses | 1,967.7 |

| | 2,047.9 |

| | (80.2 | ) | | (4 | ) |

Franchised restaurants-occupancy expenses | 559.5 |

| | 499.4 |

| | 60.1 |

| | 12 |

|

Selling, general & administrative expenses | 543.6 |

| | 515.2 |

| | 28.4 |

| | 6 |

|

Other operating (income) expense, net | (49.5 | ) | | (110.8 | ) | | 61.3 |

| | 55 |

|

Total operating costs and expenses | 3,021.3 |

| | 2,951.7 |

| | 69.6 |

| | 2 |

|

| | | | | | | |

OPERATING INCOME | 2,409.3 |

| | 2,417.7 |

| | (8.4 | ) | | 0 |

|

| | | | | | | |

Interest expense | 280.6 |

| | 250.1 |

| | 30.5 |

| | 12 |

|

Nonoperating (income) expense, net | (23.5 | ) | | 8.9 |

| | (32.4 | ) | | n/m |

|

| | | | | | | |

Income before provision for income taxes | 2,152.2 |

| | 2,158.7 |

| | (6.5 | ) | | 0 |

|

Provision for income taxes | 544.3 |

| | 521.4 |

| | 22.9 |

| | 4 |

|

| | | | | | | |

NET INCOME | $ | 1,607.9 |

| | $ | 1,637.3 |

| | $ | (29.4 | ) | | (2 | )% |

| | | | | | | |

EARNINGS PER SHARE-DILUTED | $ | 2.11 |

| | $ | 2.10 |

| | $ | 0.01 |

| | 0 | % |

| | | | | | | |

Weighted average shares outstanding-diluted | 763.9 |

| | 779.6 |

| | (15.7 | ) | | (2 | )% |

n/m Not meaningful

McDONALD'S CORPORATION

CONDENSED CONSOLIDATED STATEMENT OF INCOME (UNAUDITED)

|

| | | | | | | | | | | | | | |

Dollars and shares in millions, except per share data | | | | | |

Nine Months Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

Revenues | | | | | | | |

Sales by Company-operated restaurants | $ | 7,057.5 |

| | $ | 7,641.5 |

| | $ | (584.0 | ) | | (8 | )% |

Revenues from franchised restaurants | 8,670.0 |

| | 8,220.7 |

| | 449.3 |

| | 5 |

|

| | | | | | | |

TOTAL REVENUES | 15,727.5 |

| | 15,862.2 |

| | (134.7 | ) | | (1 | ) |

| | | | | | | |

Operating costs and expenses | | | | | | | |

Company-operated restaurant expenses | 5,821.0 |

| | 6,309.3 |

| | (488.3 | ) | | (8 | ) |

Franchised restaurants-occupancy expenses | 1,637.3 |

| | 1,463.6 |

| | 173.7 |

| | 12 |

|

Selling, general & administrative expenses | 1,575.8 |

| | 1,590.4 |

| | (14.6 | ) | | (1 | ) |

Other operating (income) expense, net | (83.8 | ) | | (324.2 | ) | | 240.4 |

| | 74 |

|

Total operating costs and expenses | 8,950.3 |

| | 9,039.1 |

| | (88.8 | ) | | (1 | ) |

| | | | | | | |

OPERATING INCOME | 6,777.2 |

| | 6,823.1 |

| | (45.9 | ) | | (1 | ) |

| | | | | | | |

Interest expense | 838.9 |

| | 727.1 |

| | 111.8 |

| | 15 |

|

Nonoperating (income) expense, net | (53.0 | ) | | 31.3 |

| | (84.3 | ) | | n/m |

|

| | | | | | | |

Income before provision for income taxes | 5,991.3 |

| | 6,064.7 |

| | (73.4 | ) | | (1 | ) |

Provision for income taxes | 1,538.1 |

| | 1,555.7 |

| | (17.6 | ) | | (1 | ) |

| | | | | | | |

NET INCOME | $ | 4,453.2 |

| | $ | 4,509.0 |

| | $ | (55.8 | ) | | (1 | )% |

| | | | | | | |

EARNINGS PER SHARE-DILUTED | $ | 5.80 |

| | $ | 5.72 |

| | $ | 0.08 |

| | 1 | % |

| | | | | | | |

Weighted average shares outstanding-diluted | 768.1 |

| | 788.5 |

| | (20.4 | ) | | (3 | )% |

n/m Not meaningful

Exhibit 99.2

McDonald's Corporation

Supplemental Information (Unaudited)

Quarter and Nine Months Ended September 30, 2019

|

| |

Impact of Foreign Currency Translation | |

| |

Net Income and Diluted Earnings per Share | |

| |

Revenues | |

| |

Comparable Sales | |

| |

Systemwide Sales and Franchised Sales | |

| |

Restaurant Margins | |

| |

Selling, General & Administrative Expenses | |

| |

Other Operating (Income) Expense, Net | |

| |

Operating Income | |

| |

Interest Expense | |

| |

Nonoperating (Income) Expense, Net | |

| |

Income Taxes | |

| |

Outlook | |

| |

Restaurant Information | |

| |

Risk Factors and Cautionary Statement Regarding Forward-Looking Statements | |

SUPPLEMENTAL INFORMATION

The purpose of this exhibit is to provide additional information related to the results of McDonald's Corporation (the “Company”) for the quarter and nine months ended September 30, 2019. This exhibit should be read in conjunction with Exhibit 99.1. Effective January 1, 2019, the Company operates under an organizational structure with the global business segments listed below.

•U.S. - the Company's largest market.

| |

• | International Operated Markets - comprised of wholly-owned markets, or countries in which the Company operates restaurants, including Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain and the U.K. |

| |

• | International Developmental Licensed Markets & Corporate - comprised of primarily developmental license and affiliate markets in the McDonald’s system. Corporate activities are also reported in this segment. |

Management reviews and analyzes business results excluding the effect of foreign currency translation, impairment and other strategic charges and gains, as well as income tax provision adjustments related to the Tax Cuts and Jobs Act of 2017 ("Tax Act"), and bases incentive compensation plans on these results, because the Company believes this better represents underlying business trends.

Impact of Foreign Currency Translation

While changes in foreign currency exchange rates affect reported results, McDonald's mitigates exposures, where practical, by purchasing goods and services in local currencies, financing in local currencies and hedging certain foreign-denominated cash flows. Results excluding the effect of foreign currency translation (also referred to as constant currency) are calculated by translating current year results at prior year average exchange rates.

IMPACT OF FOREIGN CURRENCY TRANSLATION

Dollars in millions, except per share data

|

| | | | | | | | | | | |

| | | | Currency Translation Benefit/ (Cost) | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| 2019 | |

Revenues | $ | 5,430.6 |

| | $ | 5,369.4 |

| | $ | (117.2 | ) |

Company-operated margins | 448.9 |

| | 463.1 |

| | (9.9 | ) |

Franchised margins | 2,454.5 |

| | 2,359.0 |

| | (54.6 | ) |

Selling, general & administrative expenses | 543.6 |

| | 515.2 |

| | 6.0 |

|

Operating income | 2,409.3 |

| | 2,417.7 |

| | (59.0 | ) |

Net income | 1,607.9 |

| | 1,637.3 |

| | (28.2 | ) |

Earnings per share-diluted | $ | 2.11 |

| | $ | 2.10 |

| | $ | (0.03 | ) |

| | | | | |

| | | | Currency Translation Benefit/ (Cost) | |

| | | | | |

Nine Months Ended September 30, | 2019 |

| | 2018 |

| 2019 | |

Revenues | $ | 15,727.5 |

| | $ | 15,862.2 |

| | $ | (569.5 | ) |

Company-operated margins | 1,236.5 |

| | 1,332.2 |

| | (50.8 | ) |

Franchised margins | 7,032.7 |

| | 6,757.1 |

| | (226.9 | ) |

Selling, general & administrative expenses | 1,575.8 |

| | 1,590.4 |

| | 26.5 |

|

Operating income | 6,777.2 |

| | 6,823.1 |

| | (252.8 | ) |

Net income | 4,453.2 |

| | 4,509.0 |

| | (151.1 | ) |

Earnings per share-diluted | $ | 5.80 |

| | $ | 5.72 |

| | $ | (0.19 | ) |

The negative impact of foreign currency translation on consolidated operating results for the quarter and nine months primarily reflected the weakening of the Euro and most major currencies.

Net Income and Diluted Earnings per Share

For the quarter, net income decreased 2% (flat in constant currencies) to $1,607.9 million, and diluted earnings per share was relatively flat (increased 2% in constant currencies) at $2.11. Foreign currency translation had a negative impact of $0.03 on diluted earnings per share.

For the nine months, net income decreased 1% (increased 2% in constant currencies) to $4,453.2 million, and diluted earnings per share increased 1% (5% in constant currencies) to $5.80. Foreign currency translation had a negative impact of $0.19 on diluted earnings per share.

Results for the quarter and nine months in constant currencies reflected stronger operating performance primarily due to an increase in sales-driven franchised margin dollars, partly offset by lower gains on sales of restaurant businesses, mostly in the U.S.

Results for the nine months 2019 included $80 million of pre-tax strategic charges, or $0.07 per share, primarily related to impairment associated with the purchase of our joint venture partner's interest in the India Delhi market, partly offset by gains on the sales of property at the former Corporate headquarters. Results for 2018 reflected income tax costs associated with adjustments to the provisional amounts recorded in December 2017 under the Tax Act of $47 million, or $0.06 per share, for the quarter and $99 million, or $0.12 per share, for the nine months. Results for the nine months 2018 also included $94 million of pre-tax strategic restructuring charges, or $0.09 per share.

Excluding the above items, net income for the quarter decreased 4% (3% in constant currencies) and diluted earnings per share decreased 2% (1% in constant currencies), and for the nine months net income decreased 4% (flat in constant currencies) and diluted earnings per share decreased 1% (increased 2% in constant currencies).

Diluted earnings per share for both periods benefited from a decrease in diluted weighted average shares outstanding due to share repurchases. During the quarter, the Company repurchased 7.1 million shares of stock for $1.5 billion, bringing total purchases for the nine months to 17.9 million shares or $3.6 billion. In addition, the Company paid a quarterly dividend of $1.16 per share, or $876.9 million, bringing total dividends paid for the nine months to $2.6 billion.

Revenues

The Company's revenues consist of sales by Company-operated restaurants and fees from franchised restaurants operated by conventional franchisees, developmental licensees and foreign affiliates. Revenues from conventional franchised restaurants include rent and royalties based on a percent of sales with minimum rent payments, and initial fees. Revenues from restaurants licensed to developmental licensees and foreign affiliates include a royalty based on a percent of sales, and may include initial fees. Initial franchise fees are recognized evenly over the franchise term.

Franchised restaurants represent approximately 93% of McDonald's restaurants worldwide at September 30, 2019. The Company's current mix of Company-owned and franchised restaurants enables the Company to generate stable and predictable revenue and cash flow streams. Refranchising to a greater percentage of franchised restaurants may negatively impact consolidated revenues as Company-operated sales are replaced by franchised revenues, where the Company receives rent and/or royalty revenue based on a percent of sales.

REVENUES

Dollars in millions

|

| | | | | | | | | | | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

Company-operated sales | | | | | |

U.S. | $ | 624.8 |

| | $ | 637.3 |

| (2 | )% | (2 | )% |

International Operated Markets | 1,639.7 |

| | 1,695.4 |

| (3 | ) | (1 | ) |

International Developmental Licensed Markets & Corporate | 152.1 |

| | 178.3 |

| (15 | ) | (9 | ) |

Total | $ | 2,416.6 |

| | $ | 2,511.0 |

| (4 | )% | (2 | )% |

| | | | | |

| |

| | |

| | |

Franchised revenues | |

| | |

| | |

U.S. | $ | 1,365.6 |

| | $ | 1,292.7 |

| 6 | % | 6 | % |

International Operated Markets | 1,326.2 |

| | 1,266.8 |

| 5 |

| 9 |

|

International Developmental Licensed Markets & Corporate | 322.2 |

| | 298.9 |

| 8 |

| 10 |

|

Total | $ | 3,014.0 |

| | $ | 2,858.4 |

| 5 | % | 8 | % |

| | | | | |

| |

| | |

| | |

Total revenues | |

| | |

| | |

U.S. | $ | 1,990.4 |

| | $ | 1,930.0 |

| 3 | % | 3 | % |

International Operated Markets | 2,965.9 |

| | 2,962.2 |

| 0 |

| 3 |

|

International Developmental Licensed Markets & Corporate | 474.3 |

| | 477.2 |

| (1 | ) | 3 |

|

Total | $ | 5,430.6 |

| | $ | 5,369.4 |

| 1 | % | 3 | % |

| | | | | |

|

| | | | | | | | | | | |

Nine Months Ended September 30, | 2019 |

| | 2018 |

| Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

Company-operated sales | | | | | |

U.S. | $ | 1,857.2 |

| | $ | 2,042.8 |

| (9 | )% | (9 | )% |

International Operated Markets | 4,749.5 |

| | 5,085.0 |

| (7 | ) | (1 | ) |

International Developmental Licensed Markets & Corporate | 450.8 |

| | 513.7 |

| (12 | ) | (6 | ) |

Total | $ | 7,057.5 |

| | $ | 7,641.5 |

| (8 | )% | (4 | )% |

| | | | | |

| |

| | |

| | |

Franchised revenues | |

| | |

| | |

U.S. | $ | 3,987.0 |

| | $ | 3,715.6 |

| 7 | % | 7 | % |

International Operated Markets | 3,763.7 |

| | 3,623.6 |

| 4 |

| 10 |

|

International Developmental Licensed Markets & Corporate | 919.3 |

| | 881.5 |

| 4 |

| 10 |

|

Total | $ | 8,670.0 |

| | $ | 8,220.7 |

| 5 | % | 9 | % |

| | | | | |

| |

| | |

| | |

Total revenues | |

| | |

| | |

U.S. | $ | 5,844.2 |

| | $ | 5,758.4 |

| 1 | % | 1 | % |

International Operated Markets | 8,513.2 |

| | 8,708.6 |

| (2 | ) | 3 |

|

International Developmental Licensed Markets & Corporate | 1,370.1 |

| | 1,395.2 |

| (2 | ) | 4 |

|

Total | $ | 15,727.5 |

| | $ | 15,862.2 |

| (1 | )% | 3 | % |

| | | | | |

| |

• | Revenues: Revenues increased 1% (3% in constant currencies) for the quarter and decreased 1% (increased 3% in constant currencies) for the nine months. The increase in constant currencies across all segments was primarily due to strong comparable sales, partly offset by the impact of refranchising. |

Comparable Sales

Comparable sales is a key performance indicator used within the retail industry and is reviewed by management to assess business trends. Comparable sales exclude the impact of currency translation and sales from hyper-inflationary markets (currently, only Venezuela). Increases or decreases in comparable sales represent the percent change in constant currency sales from the same period in the prior year for all restaurants, whether operated by the Company or by franchisees, in operation at least thirteen months, including those temporarily closed. Comparable sales are driven by changes in guest counts and average check, which is affected by changes in pricing and product mix.

COMPARABLE SALES |

| | | | | | | | | | | | |

| | Increase/(Decrease) |

| | Quarters Ended | | Nine Months Ended |

| | September 30, | | September 30, |

Quarters Ended September 30, | | 2019 |

| | 2018 |

| | 2019 |

| | 2018 |

|

U.S. | | 4.8 | % | | 2.4 | % | | 5.0 | % | | 2.6 | % |

International Operated Markets | | 5.6 |

| | 5.7 |

| | 6.1 |

| | 6.2 |

|

International Developmental Licensed Markets & Corporate | | 8.1 |

| | 5.1 |

| | 7.3 |

| | 5.5 |

|

Total | | 5.9 | % | | 4.2 | % | | 5.9 | % | | 4.5 | % |

| |

• | Comparable Sales: Global comparable sales increased 5.9% for both the quarter and nine months, reflecting strong top-line performance across all segments. |

| |

• | U.S.: Comparable sales increased 4.8% for the quarter and 5.0% for the nine months, reflecting national and local deal offerings and promotions, the continued positive impact from our Experience of the Future ("EOTF") deployment, as well as menu price increases. |

| |

• | International Operated Markets: Comparable sales increased 5.6% for the quarter and 6.1% for the nine months, reflecting positive results across all markets, primarily driven by the U.K. and France. |

| |

• | International Developmental Licensed Markets: Comparable sales increased 8.1% for the quarter and 7.3% for the nine months, reflecting strong sales performance across all geographic regions. |

Systemwide Sales and Franchised Sales

The following tables present Systemwide sales growth rates and franchised sales. Systemwide sales include sales at all restaurants, whether operated by the Company or by franchisees. While franchised sales are not recorded as revenues by the Company, management believes the information is important in understanding the Company's financial performance, because these sales are the basis on which the Company calculates and records franchised revenues and are indicative of the financial health of the franchisee base.

SYSTEMWIDE SALES*

|

| | | | | | | | | | | | |

| | Quarter Ended | | Nine Months Ended |

| | September 30, 2019 | | September 30, 2019 |

Quarter Ended March 31, | | Inc/ (Dec) |

| | Inc/ (Dec)

Excluding

Currency

Translation |

| | Inc/ (Dec) |

| | Inc/ (Dec)

Excluding

Currency

Translation |

|

U.S. | | 5 | % | | 5 | % | | 5 | % | | 5 | % |

International Operated Markets | | 3 |

| | 7 |

| | 2 |

| | 8 |

|

International Developmental Licensed Markets & Corporate | | 9 |

| | 11 |

| | 4 |

| | 9 |

|

Total | | 5 | % | | 7 | % | | 4 | % | | 7 | % |

| |

* | Unlike comparable sales, the Company has not excluded hyper-inflationary market results (currently, only Venezuela) from Systemwide sales as these sales are the basis on which the Company calculates and records revenues. |

FRANCHISED SALES

Dollars in millions

|

| | | | | | | | | | | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

U.S. | $ | 9,721.7 |

| | $ | 9,240.5 |

| 5 | % | 5 | % |

International Operated Markets | 7,569.1 |

| | 7,225.8 |

| 5 |

| 9 |

|

International Developmental Licensed Markets & Corporate | 6,325.8 |

| | 5,789.2 |

| 9 |

| 11 |

|

Total | $ | 23,616.6 |

| | $ | 22,255.5 |

| 6 | % | 8 | % |

| | | | | |

Ownership type | | | | | |

Conventional franchised | $ | 17,172.5 |

| | $ | 16,366.0 |

| 5 | % | 7 | % |

Developmental licensed | 3,769.3 |

| | 3,463.5 |

| 9 |

| 13 |

|

Foreign affiliated | 2,674.8 |

| | 2,426.0 |

| 10 |

| 10 |

|

Total | $ | 23,616.6 |

| | $ | 22,255.5 |

| 6 | % | 8 | % |

| | | | | |

Nine Months Ended September 30, | 2019 |

| | 2018 |

| Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

U.S. | $ | 28,283.0 |

| | $ | 26,699.8 |

| 6 | % | 6 | % |

International Operated Markets | 21,430.3 |

| | 20,652.2 |

| 4 |

| 10 |

|

International Developmental Licensed Markets & Corporate | 17,889.4 |

| | 17,122.5 |

| 4 |

| 10 |

|

Total | $ | 67,602.7 |

| | $ | 64,474.5 |

| 5 | % | 8 | % |

| | | | | |

Ownership type | | | | | |

Conventional franchised | $ | 49,448.8 |

| | $ | 47,222.8 |

| 5 | % | 7 | % |

Developmental licensed | 10,648.9 |

| | 10,149.0 |

| 5 |

| 13 |

|

Foreign affiliated | 7,505.0 |

| | 7,102.7 |

| 6 |

| 8 |

|

Total | $ | 67,602.7 |

| | $ | 64,474.5 |

| 5 | % | 8 | % |

Restaurant Margins

FRANCHISED AND COMPANY-OPERATED RESTAURANT MARGINS

Dollars in millions

|

| | | | | | | | | | | | | | | |

| Percent | | Amount | | Inc/ (Dec) Excluding Currency Translation |

|

Quarters Ended September 30, | 2019 |

| 2018 |

| | 2019 |

| 2018 |

| Inc/ (Dec) |

|

Franchised * | | | | | | | |

U.S. | 78.8 | % | 81.5 | % | | $ | 1,076.2 |

| $ | 1,052.9 |

| 2 | % | 2 | % |

International Operated Markets | 80.2 |

| 80.1 |

| | 1,063.1 |

| 1,015.2 |

| 5 |

| 9 |

|

International Developmental Licensed Markets & Corporate | 97.8 |

| 97.3 |

| | 315.2 |

| 290.9 |

| 8 |

| 11 |

|

Total | 81.4 | % | 82.5 | % | | $ | 2,454.5 |

| $ | 2,359.0 |

| 4 | % | 6 | % |

Company-operated | |

| |

| | |

| |

| | |

|

U.S. | 15.6 | % | 12.8 | % | | $ | 97.8 |

| $ | 81.3 |

| 20 | % | 20 | % |

International Operated Markets | 21.3 |

| 21.9 |

| | 348.8 |

| 371.3 |

| (6 | ) | (3 | ) |

International Developmental Licensed Markets & Corporate | n/m |

| n/m |

| | n/m |

| n/m |

| n/m |

| n/m |

|

Total | 18.6 | % | 18.4 | % | | $ | 448.9 |

| $ | 463.1 |

| (3 | )% | (1 | )% |

| | | | | | | |

| Percent | | Amount | | Inc/ (Dec) Excluding Currency Translation |

|

Nine Months Ended September 30, | 2019 |

| 2018 |

| | 2019 |

| 2018 |

| Inc/ (Dec) |

|

Franchised * | | | | | | | |

U.S. | 79.0 | % | 81.6 | % | | $ | 3,148.9 |

| $ | 3,033.0 |

| 4 | % | 4 | % |

International Operated Markets | 79.4 |

| 79.1 |

| | 2,986.6 |

| 2,866.7 |

| 4 |

| 10 |

|

International Developmental Licensed Markets & Corporate | 97.6 |

| 97.3 |

| | 897.2 |

| 857.4 |

| 5 |

| 10 |

|

Total | 81.1 | % | 82.2 | % | | $ | 7,032.7 |

| $ | 6,757.1 |

| 4 | % | 7 | % |

Company-operated | |

| |

| | |

| |

| | |

|

U.S. | 15.3 | % | 14.9 | % | | $ | 284.8 |

| $ | 304.6 |

| (7 | )% | (7 | )% |

International Operated Markets | 19.9 |

| 19.9 |

| | 946.2 |

| 1,013.6 |

| (7 | ) | (2 | ) |

International Developmental Licensed Markets & Corporate | n/m |

| n/m |

| | n/m |

| n/m |

| n/m |

| n/m |

|

Total | 17.5 | % | 17.4 | % | | $ | 1,236.5 |

| $ | 1,332.2 |

| (7 | )% | (3 | )% |

n/m Not meaningful

* The adoption of Leases, Topic 842, ("new lease standard") had no impact on franchised margin dollars, but had a negative impact on the Company's franchised margin percent for the quarter and nine months of approximately 1.3% in the U.S. and 0.7% on a consolidated basis. The new lease standard clarified the presentation of sub-lease income and lease expense, requiring the straight-line impact of fixed rent escalations to be presented on a gross basis in lease income and lease expense. The Company expects this negative impact on the franchised margin percent to continue through 2019.

| |

• | Franchised: Franchised margin dollars increased $95.5 million or 4% (6% in constant currencies) for the quarter and increased $275.6 million or 4% (7% in constant currencies) for the nine months. Both periods benefited from strong comparable sales performance across all segments, as well as expansion and the impact of refranchising. |

| |

• | U.S.: The decrease in the franchised margin percent for the quarter and nine months was primarily due to higher depreciation costs related to investments in EOTF and the impact of the new lease standard, partly offset by the benefit from strong comparable sales. |

| |

• | International Operated Markets: The increase in the franchised margin percent for the quarter and nine months primarily reflected the benefit from strong comparable sales. |

| |

• | Company-operated: Company-operated margin dollars decreased $14.2 million or 3% (1% in constant currencies) for the quarter and decreased $95.7 million or 7% (3% in constant currencies) for the nine months. |

| |

• | U.S.: The increase in the Company-operated margin percent for the quarter and nine months primarily reflected the benefit from positive comparable sales, partly offset by higher wages, commodity costs and depreciation expense associated with EOTF deployment. |

| |

• | International Operated Markets: The Company-operated margin percent decreased for the quarter and was flat for the nine months. Both periods reflected strong comparable sales offset by higher commodity, labor and occupancy & other costs. |

The following table presents Company-operated restaurant margin components as a percent of sales.

CONSOLIDATED COMPANY-OPERATED RESTAURANT EXPENSES AND MARGINS AS A PERCENT OF SALES |

| | | | | | | | | | |

| Quarters Ended September 30, | | Nine Months Ended September 30, |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | 2019 |

| 2018 |

|

Food & paper | 31.5 | % | | 31.2 | % | | 31.7 | % | 31.4 | % |

Payroll & employee benefits | 28.1 |

| | 28.8 |

| | 28.9 |

| 29.4 |

|

Occupancy & other operating expenses | 21.8 |

| | 21.6 |

| | 21.9 |

| 21.8 |

|

Total expenses | 81.4 | % | | 81.6 | % | | 82.5 | % | 82.6 | % |

Company-operated margins | 18.6 | % | | 18.4 | % | | 17.5 | % | 17.4 | % |

Selling, General & Administrative Expenses

| |

• | Selling, general and administrative expenses increased $28.4 million or 6% (7% in constant currencies) for the quarter and decreased $14.6 million or 1% (increased 1% in constant currencies) for the nine months. The constant currency increase for both periods primarily reflected investments in technology and research & development. The nine months also reflected the benefit from comparison to prior year costs related to the 2018 Worldwide Owner/Operator Convention and sponsorship of the 2018 Winter Olympics. |

| |

• | Selling, general and administrative expenses as a percent of Systemwide sales was 2.1% and 2.2% for the nine months ended 2019 and 2018, respectively. |

Other Operating (Income) Expense, Net

OTHER OPERATING (INCOME) EXPENSE, NET

Dollars in millions

|

| | | | | | | | | | | | | | | |

| Quarters Ended September 30, | | Nine Months Ended September 30, |

Quarters Ended March 31, | 2019 |

| | 2018 |

| | 2019 |

| | 2018 |

|

Gains on sales of restaurant businesses | $ | (17.4 | ) | | $ | (68.0 | ) | | $ | (90.4 | ) | | $ | (256.7 | ) |

Equity in earnings of unconsolidated affiliates | (42.8 | ) | | (38.6 | ) | | (112.0 | ) | | (116.2 | ) |

Asset dispositions and other (income) expense, net | 9.1 |

| | (4.7 | ) | | 38.4 |

| | (45.1 | ) |

Impairment and other charges, net | 1.6 |

| | 0.5 |

| | 80.2 |

| | 93.8 |

|

Total | $ | (49.5 | ) | | $ | (110.8 | ) | | $ | (83.8 | ) | | $ | (324.2 | ) |

| |

• | Gains on sales of restaurant businesses for the quarter and nine months decreased primarily due to fewer restaurant sales in the U.S. |

| |

• | The change in asset dispositions and other (income) expense, net for the nine months was primarily due to the comparison to prior year gains on the strategic sales of restaurant properties in the U.S. and Australia. |

| |

• | Impairment and other charges, net for the nine months 2019 primarily reflected $99.4 million of impairment associated with the purchase of our joint venture partner's interest in the India Delhi market. Impairment was recorded to reflect the write-down of net assets to fair value in accordance with accounting rules. This was partly offset by $19.5 million of gains on the sales of property at the former Corporate headquarters which were impaired in 2015 based on estimated fair values. Results for the nine months 2018 reflected the strategic restructuring charge in the U.S. of $85.0 million. |

Operating Income

OPERATING INCOME

Dollars in millions

|

| | | | | | | | | | | | |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

U.S. | $ | 1,038.7 |

| | $ | 1,061.8 |

| | (2 | )% | (2 | )% |

International Operated Markets | 1,284.0 |

| | 1,246.9 |

| | 3 |

| 7 |

|

International Developmental Licensed Markets & Corporate | 86.6 |

| | 109.0 |

| | (21 | ) | (15 | ) |

Total | $ | 2,409.3 |

| | $ | 2,417.7 |

| | 0 | % | 2 | % |

Nine Months Ended September 30, | 2019 |

| | 2018 |

| | Inc/ (Dec) |

| Inc/ (Dec) Excluding Currency Translation |

|

U.S. | $ | 3,039.4 |

| | $ | 3,059.0 |

| | (1 | )% | (1 | )% |

International Operated Markets | 3,550.8 |

| | 3,485.0 |

| | 2 |

| 8 |

|

International Developmental Licensed Markets & Corporate | 187.0 |

| | 279.1 |

| | (33 | ) | (17 | ) |

Total | $ | 6,777.2 |

| | $ | 6,823.1 |

| | (1 | )% | 3 | % |

| |

• | Operating Income: Operating income decreased $8.4 million or was relatively flat compared to prior year (increased 2% in constant currencies) for the quarter and decreased $45.9 million or 1% (increased 3% in constant currencies) for the nine months. The nine months 2019 was negatively impacted by $80 million of net impairment and strategic charges. |

| |

• | U.S.: Excluding the strategic restructuring charge of $85 million in the prior year, operating income decreased 3% for the nine months. Results for both the quarter and nine months reflected lower gains on sales of restaurant businesses, partly offset by higher franchised margin dollars. |

| |

• | International Operated Markets: The constant currency operating income increase for the quarter and nine months was primarily due to sales-driven improvements in franchised margin dollars across all markets. |

| |

• | Operating Margin: Operating margin is defined as operating income as a percent of total revenues. Operating margin was 43.1% and 43.0% for the nine months ended 2019 and 2018, respectively. Excluding the impact of the current year impairment and strategic charges and the prior year strategic restructuring charges, operating margin was 43.6% for the nine months ended 2019 and 2018. |

Interest Expense

| |

• | Interest expense increased 12% (13% in constant currencies) for the quarter and increased 15% (17% in constant currencies) for the nine months, reflecting higher average debt balances and the impact of interest incurred on certain Euro denominated deposits due to the current interest rate environment. |

Nonoperating (Income) Expense, Net

NONOPERATING (INCOME) EXPENSE, NET

Dollars in millions

|

| | | | | | | | | | | | | | | |

| Quarters Ended September 30, | | Nine Months Ended September 30, |

Quarters Ended September 30, | 2019 |

| | 2018 |

| | 2019 |

| | 2018 |

|

Interest income | $ | (8.9 | ) | | $ | 1.2 |

| | $ | (29.6 | ) | | $ | (4.4 | ) |

Foreign currency and hedging activity | (18.8 | ) | | (2.9 | ) | | (38.5 | ) | | 16.3 |

|

Other expense, net | 4.2 |

| | 10.6 |

| | 15.1 |

| | 19.4 |

|

Total | $ | (23.5 | ) | | $ | 8.9 |

| | $ | (53.0 | ) | | $ | 31.3 |

|

Income Taxes

| |

• | The effective income tax rate was 25.3% and 24.2% for the quarters ended 2019 and 2018, respectively, and 25.7% for both the nine months ended 2019 and 2018. |

| |

• | Results for the third quarter and nine months 2018 reflected $47 million and $99 million, respectively, of income tax costs associated with adjustments to the provisional amounts recorded in December 2017 under the Tax Act. |

| |

• | Excluding the impact of the adjustments to the prior year provisional amounts recorded in December 2017, the effective income tax rate was 22.0% for the third quarter 2018 and 24.0% for the nine months 2018. The lower effective income tax rate for the quarter 2018 primarily reflected new regulations issued in the third quarter of 2018. |

2019 Outlook

The following information is provided to assist in forecasting the Company’s future results.

| |

• | Changes in Systemwide sales are driven by comparable sales, net restaurant unit expansion, and the potential impacts of hyper-inflation. The Company expects net restaurant additions to add approximately 1 percentage point to 2019 Systemwide sales growth (in constant currencies). |

| |

• | The Company does not generally provide specific guidance on changes in comparable sales. However, as a perspective, assuming no change in cost structure, a 1 percentage point change in comparable sales for either the U.S. or the International Operated segment would change annual diluted earnings per share by about 6 to 7 cents. |

| |

• | With about 75% of McDonald's grocery bill comprised of 10 different commodities, a basket of goods approach is the most comprehensive way to look at the Company's commodity costs. For the full year 2019, costs for the total basket of goods are expected to increase about 2% to 3% in the U.S. and about 2.5% in the Big Five international markets. |

| |

• | The Company expects full year 2019 selling, general and administrative expenses to increase about 1% to 2% in constant currencies as the Company invests in technology and research & development, including operating costs associated with newly acquired Dynamic Yield and Apprente. |

| |

• | Based on current interest and foreign currency exchange rates, the Company expects interest expense for the full year 2019 to increase about 13% to 15% reflecting the impact of higher average debt balances and interest incurred on certain Euro denominated deposits due to the current interest rate environment. |

| |

• | A significant part of the Company's operating income is generated outside the U.S., and about 40% of its total debt is denominated in foreign currencies. Accordingly, earnings are affected by changes in foreign currency exchange rates, particularly the Euro, British Pound, Australian Dollar and Canadian Dollar. Collectively, these currencies represent approximately 80% of the Company's operating income outside the U.S. If all four of these currencies moved by 10% in the same direction, the Company's annual diluted earnings per share would change by about 35 cents. |

| |

• | The Company expects the effective income tax rate for the full year 2019 to be in the 25% to 26% range. |

| |

• | The Company expects capital expenditures for 2019 to be approximately $2.3 billion. About $1.5 billion will be dedicated to our U.S. business, nearly two-thirds of which is allocated to approximately 2,000 EOTF projects. Globally, we expect to open roughly 1,200 restaurants. We will spend approximately $600 million in our wholly owned markets to open 300 restaurants and our developmental licensee and affiliated markets will contribute capital towards the remaining 900 restaurant openings in their respective markets. The Company expects about 800 net restaurant additions in 2019. |

The Company has other long-term targets that are detailed in its Form 10-K for the year ended December 31, 2018.

Restaurant Information

SYSTEMWIDE RESTAURANTS

|

| | | | | | |

At September 30, | 2019 |

| 2018 |

| Inc/ (Dec) |

|

U.S. | 13,876 |

| 13,948 |

| (72 | ) |

| | | |

International Operated Markets | | | |

Germany | 1,486 |

| 1,487 |

| (1 | ) |

Canada | 1,476 |

| 1,465 |

| 11 |

|

France | 1,473 |

| 1,451 |

| 22 |

|

United Kingdom | 1,310 |

| 1,282 |

| 28 |

|

Australia | 986 |

| 971 |

| 15 |

|

Russia | 692 |

| 660 |

| 32 |

|

Italy | 590 |

| 575 |

| 15 |

|

Spain | 520 |

| 511 |

| 9 |

|

Other | 1,807 |

| 1,755 |

| 52 |

|

Total International Operated Markets | 10,340 |

| 10,157 |

| 183 |

|

| | | |

International Developmental Licensed Markets & Corporate | | | |

China | 3,249 |

| 2,886 |

| 363 |

|

Japan | 2,902 |

| 2,899 |

| 3 |

|

Brazil | 984 |

| 940 |

| 44 |

|

Philippines | 652 |

| 603 |

| 49 |

|

South Korea | 411 |

| 416 |

| (5 | ) |

Other | 5,884 |

| 5,708 |

| 176 |

|

Total International Developmental Licensed Markets & Corporate | 14,082 |

| 13,452 |

| 630 |

|

| |

|

|

Systemwide restaurants | 38,298 |

| 37,557 |

| 741 |

|

| | |

| |

|

Countries | 119 |

| 120 |

| (1 | ) |

SYSTEMWIDE RESTAURANTS BY TYPE

|

| | | | | | |

At September 30, | 2019 |

| 2018 |

| Inc/ (Dec) |

|

U.S. | |

| |

| |

Conventional franchised | 13,215 |

| 13,255 |

| (40 | ) |

Company-operated | 661 |

| 693 |

| (32 | ) |

Total U.S. | 13,876 |

| 13,948 |

| (72 | ) |

| | | |

International Operated Markets | |

| |

| |

|

Conventional franchised | 8,423 |

| 8,156 |

| 267 |

|

Developmental licensed | 234 |

| 211 |

| 23 |

|

Total Franchised | 8,657 |

| 8,367 |

| 290 |

|

Company-operated | 1,683 |

| 1,790 |

| (107 | ) |

Total International Operated Markets | 10,340 |

| 10,157 |

| 183 |

|

| | | |

International Developmental Licensed Markets & Corporate | |

| |

| |

|

Conventional franchised | 120 |

| 175 |

| (55 | ) |

Developmental licensed | 7,239 |

| 6,892 |

| 347 |

|

Foreign affiliated | 6,432 |

| 6,056 |

| 376 |

|

Total Franchised | 13,791 |

| 13,123 |

| 668 |

|

Company-operated | 291 |

| 329 |

| (38 | ) |

Total International Developmental Licensed Markets & Corporate | 14,082 |

| 13,452 |

| 630 |

|

| | | |

Systemwide | |

| |

| |

|

Conventional franchised | 21,758 |

| 21,586 |

| 172 |

|

Developmental licensed | 7,473 |

| 7,103 |

| 370 |

|

Foreign affiliated | 6,432 |

| 6,056 |

| 376 |

|

Total Franchised | 35,663 |

| 34,745 |

| 918 |

|

Company-operated | 2,635 |

| 2,812 |

| (177 | ) |

Total Systemwide | 38,298 |

| 37,557 |

| 741 |

|

Risk Factors and Cautionary Statement Regarding Forward-Looking Statements

The information in this report includes forward-looking statements about future events and circumstances and their effects upon revenues, expenses and business opportunities. Generally speaking, any statement in this report not based upon historical fact is a forward-looking statement. Forward-looking statements can also be identified by the use of forward-looking words, such as “may,” “will,” “expect,” “believe,” “anticipate” and “plan” or similar expressions. In particular, statements regarding our plans, strategies, prospects and expectations regarding our business and industry, including those under “Outlook,” are forward-looking statements. They reflect our expectations, are not guarantees of performance and speak only as of the date of this report. Except as required by law, we do not undertake to update them. Our expectations (or the underlying assumptions) may change or not be realized, and you should not rely unduly on forward-looking statements. Our business results are subject to a variety of risks, including those that are reflected in the following considerations and factors, as well as elsewhere in our filings with the SEC. If any of these considerations or risks materialize, our expectations may change and our performance may be adversely affected.

If we do not successfully evolve and execute against our business strategies, including under the Velocity Growth Plan, we may not be able to increase operating income.

To drive operating income growth, our business strategies must be effective in maintaining and strengthening customer appeal, delivering sustainable guest count growth and driving a higher average check. Whether these strategies are successful depends mainly on our System’s ability to:

| |

• | Continue to innovate and differentiate the McDonald’s experience, including by preparing and serving our food in a way that balances value and convenience to our customers with profitability; |

| |

• | Capitalize on our global scale, iconic brand and local market presence to enhance our ability to retain, regain and convert key customer groups; |

| |

• | Utilize our organizational structure to build on our progress and execute against our business strategies; |

| |

• | Augment our digital and delivery initiatives, including mobile ordering, along with Experience of the Future (“EOTF”), particularly in the U.S.; |

| |

• | Identify and develop restaurant sites consistent with our plans for net growth of Systemwide restaurants; |

| |

• | Operate restaurants with high service levels and optimal capacity while managing the increasing complexity of our restaurant operations and create efficiencies through innovative use of technology; and |

| |

• | Accelerate our existing strategies, including through growth opportunities, acquisitions, investments and partnerships. |

If we are delayed or unsuccessful in executing our strategies, or if our strategies do not yield the desired results, our business, financial condition and results of operations may suffer.

Our investments to enhance the customer experience, including through technology, may not generate the expected returns.

Our long-term business objectives depend on the successful Systemwide execution of our strategies. We continue to build upon our investments in technology and modernization, including in EOTF (which focuses on restaurant modernization), digital engagement and delivery, in order to transform the customer experience. As part of these investments, we are placing renewed emphasis on improving our service model and strengthening relationships with customers, in part through digital channels and loyalty initiatives, as well as mobile ordering and payment systems. We also continue to refine our delivery initiatives, including through growing awareness and trial, and to enhance our drive thru technologies, which may not generate expected returns. If these initiatives are not well executed, or if we do not fully realize the intended benefits of these significant investments, our business results may suffer.

If we do not anticipate and address evolving consumer preferences and effectively execute our pricing, promotional and marketing plans, our business could suffer.

Our continued success depends on our System’s ability to retain, regain and convert customers. In order to do so, we need to anticipate and respond effectively to continuously shifting consumer demographics, and trends in food sourcing, food preparation, food offerings and consumer preferences in the “informal eating out” (“IEO”) segment. If we are not able to quickly and effectively respond to these changes, or our competitors respond more effectively, our financial results could be adversely impacted.

Our ability to retain, regain and convert customers also depends on the impact of pricing, promotional and marketing plans across the System, and the ability to adjust these plans to respond quickly and effectively to evolving customer preferences, as well as shifting economic and competitive conditions. Existing or future pricing strategies, and the value proposition they represent, are expected to continue to be important components of our business strategy; however, they may not be successful in retaining, regaining and converting customers, or may not be as successful as the efforts of our competitors, and could negatively impact sales, guest counts and market share.

Additionally, we operate in a complex and costly advertising environment. Our marketing and advertising programs may not be successful in retaining, regaining and converting customers. Our success depends in part on whether the allocation of our advertising and marketing resources across different channels allows us to reach our customers effectively. If the advertising and marketing programs are not successful, or are not as successful as those of our competitors, our sales, guest counts and market share could decrease.

Failure to preserve the value and relevance of our brand could have an adverse impact on our financial results.

To be successful in the future, we believe we must preserve, enhance and leverage the value of our brand. Brand value is based in part on consumer perceptions. Those perceptions are affected by a variety of factors, including the nutritional content and preparation of our food, the ingredients we use, the manner in which we source commodities and our general business practices. Consumer acceptance of our offerings is subject to change for a variety of reasons, and some changes can occur rapidly. For example, nutritional, health and other scientific studies and conclusions, which constantly evolve and may have contradictory implications, drive popular opinion, litigation and regulation (including initiatives intended to drive consumer behavior) in ways that affect the IEO segment or perceptions of our brand generally or relative to available alternatives. Consumer perceptions may also be affected by adverse commentary from third parties, including through social media or conventional media outlets, regarding the quick-service category of the IEO segment, our brand, our operations, our suppliers or our franchisees. If we are unsuccessful in addressing adverse commentary, whether or not accurate, our brand and our financial results may suffer.

Additionally, the ongoing relevance of our brand may depend on the success of our sustainability initiatives, which require Systemwide coordination and alignment. If we are not effective in addressing social and environmental responsibility matters or achieving relevant sustainability goals, consumer trust in our brand may suffer. In particular, business incidents or practices whether actual or perceived, that erode consumer trust or confidence, particularly if such incidents or practices receive considerable publicity or result in litigation, can significantly reduce brand value and have a negative impact on our financial results.

We face intense competition in our markets, which could hurt our business.

We compete primarily in the IEO segment, which is highly competitive. We also face sustained, intense competition from traditional, fast casual and other competitors, which may include many non-traditional market participants such as convenience stores, grocery stores and coffee shops. We expect our environment to continue to be highly competitive, and our results in any particular reporting period may be impacted by new or continuing actions or product offerings of our competitors, which may have a short- or long-term impact on our results.

We compete on the basis of product choice, quality, affordability, service and location. In particular, we believe our ability to compete successfully in the current market environment depends on our ability to improve existing products, successfully develop and introduce new products, price our products appropriately, deliver a relevant customer experience, manage the complexity of our restaurant operations and respond effectively to our competitors’ actions or offerings or to unforeseen disruptive actions. There can be no assurance these strategies will be effective, and some strategies may be effective at improving some metrics while adversely affecting other metrics, which could have the overall effect of harming our business.

Unfavorable general economic conditions could adversely affect our business and financial results.

Our results of operations are substantially affected by economic conditions, which can vary significantly by market and can impact consumer disposable income levels and spending habits. Economic conditions can also be impacted by a variety of factors including hostilities, epidemics and actions taken by governments to manage national and international economic matters, whether through austerity, stimulus measures or trade measures, and initiatives intended to control wages, unemployment, credit availability, inflation, taxation and other economic drivers. Sustained adverse economic conditions or periodic adverse changes in economic conditions in our markets could pressure our operating performance, and our business and financial results may suffer.

Our results of operations are also affected by fluctuations in currency exchange rates and unfavorable currency fluctuations could adversely affect reported earnings.

Supply chain interruptions may increase costs or reduce revenues.

We depend on the effectiveness of our supply chain management to assure reliable and sufficient supply of quality products on favorable terms. Although many of the products we sell are sourced from a wide variety of suppliers in countries around the world, certain products have limited suppliers, which may increase our reliance on those suppliers. Supply chain interruptions, including shortages and transportation issues, and price increases can adversely affect us as well as our suppliers and franchisees whose performance may have a significant impact on our results. Such shortages or disruptions could be caused by factors beyond the control of our suppliers, franchisees or us. If we experience interruptions in our System’s supply chain, our costs could increase and it could limit the availability of products critical to our System’s operations.

Food safety concerns may have an adverse effect on our business.

Our ability to increase sales and profits depends on our System’s ability to meet expectations for safe food and on our ability to manage the potential impact on McDonald’s of food-borne illnesses and food or product safety issues that may arise in the future, including in the supply chain, restaurants or delivery. Food safety is a top priority, and we dedicate substantial resources to ensure that our customers enjoy safe food products, including as our menu and service model evolve. However, food safety events, including instances of food-borne illness, occur within the food industry and our System from time to time and, in addition, could occur in the future. Instances of food tampering, food contamination or food-borne illness, whether actual or perceived, could adversely affect our brand and reputation as well as our revenues and profits.

Our franchise business model presents a number of risks.

The Company's success as a heavily franchised business relies to a large degree on the financial success and cooperation of our franchisees, including our developmental licensees and affiliates. Our restaurant margins arise from two sources: fees from franchised restaurants (e.g., rent and royalties based on a percentage of sales) and, to a lesser degree, sales from Company-operated restaurants. Our franchisees and developmental licensees manage their businesses independently, and therefore are responsible for the day-to-day operation of their restaurants. The revenues we realize from franchised restaurants are largely dependent on the ability of our franchisees to grow their sales. Business risks affecting our operations also affect our franchisees. If our franchisees do not experience sales growth, our revenues and margins could be negatively affected as a result. Also, if sales trends worsen for franchisees, their financial results may deteriorate, which could result in, among other things, restaurant closures, or delayed or reduced payments to us.

Our success also relies on the willingness and ability of our independent franchisees and affiliates to implement major initiatives, which may include financial investment, and to remain aligned with us on operating, value/promotional and capital-intensive reinvestment plans. The ability of franchisees to contribute to the achievement of our plans is dependent in large part on the availability to them of funding at reasonable interest rates and may be negatively impacted by the financial markets in general, by the creditworthiness of our franchisees or the Company or by banks’ lending practices. If our franchisees are unwilling or unable to invest in major initiatives or are unable to obtain financing at commercially reasonable rates, or at all, our future growth and results of operations could be adversely affected.

Our operating performance could also be negatively affected if our franchisees experience food safety or other operational problems or project an image inconsistent with our brand and values, particularly if our contractual and other rights and remedies are limited, costly to exercise or subjected to litigation and potential delays. If franchisees do not successfully operate restaurants in a manner consistent with our required standards, our brand’s image and reputation could be harmed, which in turn could hurt our business and operating results.

Our ownership mix also affects our results and financial condition. The decision to own restaurants or to operate under franchise or license agreements is driven by many factors whose interrelationship is complex. The benefits of our more heavily franchised structure depend on various factors including whether we have effectively selected franchisees, licensees and/or affiliates that meet our rigorous standards, whether we are able to successfully integrate them into our structure and whether their performance and the resulting ownership mix supports our brand and financial objectives.

Challenges with respect to talent management could harm our business.

Effective succession planning is important to our long-term success. Failure to effectively identify, develop and retain key personnel, recruit high-quality candidates and ensure smooth management and personnel transitions could disrupt our business and adversely affect our results.

Challenges with respect to labor, including availability and cost, could impact our business and results of operations.

Our success depends in part on our System’s ability to proactively recruit, motivate and retain qualified individuals to work in McDonald's restaurants and to maintain appropriately-staffed restaurants in an intensely competitive environment. Increased costs associated with recruiting, motivating and retaining qualified employees to work in our Company-operated restaurants could have a negative impact on our Company-operated margins. Similar concerns apply to our franchisees.

We are also impacted by the costs and other effects of compliance with U.S. and international regulations affecting our workforce, which includes our staff and employees working in our Company-operated restaurants. These regulations are increasingly focused on employment issues, including wage and hour, healthcare, immigration, retirement and other employee benefits and workplace practices. Claims of non-compliance with these regulations could result in liability and expense to us. Our potential exposure to reputational and other harm regarding our workplace practices or conditions or those of our independent franchisees or suppliers, including those giving rise to claims of sexual harassment or discrimination (or perceptions thereof) could have a negative impact on consumer perceptions of us and our business. Additionally, economic action, such as boycotts, protests, work stoppages or campaigns by labor organizations, could adversely affect us (including our ability to recruit and retain talent) or the franchisees and suppliers that are also part of the McDonald's System and whose performance may have a material impact on our results.

Information technology system failures or interruptions, or breaches of network security, may impact our operations.

We are increasingly reliant on technological systems, such as point-of-sale and other systems or platforms, technologies supporting McDonald’s digital and delivery solutions, as well as technologies that facilitate communication and collaboration, with affiliated entities, customers, employees, franchisees, suppliers, service providers or other independent third parties to conduct our business, including technology-enabled systems provided to us by third parties. Any failure or interruption of these systems could significantly impact our operations and customer experience and perceptions.

Despite the implementation of security measures, those technology systems and solutions could become vulnerable to damage, disability or failures due to theft, fire, power loss, telecommunications failure or other catastrophic events. Our increasing reliance on third party systems also present the risks faced by the third party’s business, including the operational, security and credit risks of those parties. If those systems were to fail or otherwise be unavailable, and we were unable to recover in a timely manner, we could experience an interruption in our operations.

Furthermore, security incidents or breaches have from time to time occurred and may in the future occur involving our systems, the systems of the parties we communicate or collaborate with (including franchisees), or those of third party providers. These may include such things as unauthorized access, account takeovers, denial of service, computer viruses, introduction of malware or ransomware and other disruptive problems caused by hackers. Our information technology systems contain personal, financial and other information that is entrusted to us by our customers, our employees, our franchisees and other third parties, as well as financial, proprietary and other confidential information related to our business. An actual or alleged security breach could result in disruptions, shutdowns, theft or unauthorized disclosure of personal, financial, proprietary or other confidential information. The occurrence of any of these incidents could result in reputational damage, adverse publicity, loss of consumer confidence, reduced sales and profits, complications in executing our growth initiatives and regulatory and legal risk, including criminal penalties or civil liabilities.

The global scope of our business subjects us to risks that could negatively affect our business.

We encounter differing cultural, regulatory, geopolitical and economic environments within and among the more than 100 countries where McDonald’s restaurants operate, and our ability to achieve our business objectives depends on the System's success in these environments. Meeting customer expectations is complicated by the risks inherent in our global operating environment, and our global success is partially dependent on our System’s ability to leverage operating successes across markets and brand perceptions. Planned initiatives may not have appeal across multiple markets with McDonald's customers and could drive unanticipated changes in customer perceptions and guest counts.

Disruptions in operations or price volatility in a market can also result from governmental actions, such as price, foreign exchange or changes in trade-related tariffs or controls, sanctions and counter sanctions, government-mandated closure of our, our franchisees’ or our suppliers’ operations, and asset seizures. The cost and disruption of responding to governmental investigations or inquiries, whether or not they have merit, or the impact of these other measures, may impact our results and could cause reputational or other harm. Our international success depends in part on the effectiveness of our strategies and brand-building initiatives to reduce our exposure to such governmental investigations or inquiries.

Additionally, challenges and uncertainties are associated with operating in developing markets, which may entail a relatively higher risk of political instability, economic volatility, crime, corruption and social and ethnic unrest. Such challenges may be exacerbated in many cases by a lack of an independent and experienced judiciary and uncertainties in how local law is applied and enforced, including in areas most relevant to commercial transactions and foreign investment. An inability to manage effectively the risks associated with our international operations could have a material adverse effect on our business and financial condition.

We may also face challenges and uncertainties in developed markets. For example, as a result of the U.K.’s decision to leave the European Union, whether through a negotiated exit over a period of time or without any agreement in place to govern post-exit relations, it is possible that there will be increased regulatory complexities, particularly in the event that the U.K. leaves the European Union without any agreement in place, as well as potential additional referenda in the U.K. and/or other European countries, that could cause uncertainty in European or worldwide economic conditions. The decision created volatility in certain foreign currency exchange rates that may or may not continue. Any of these effects, and others we cannot anticipate, could adversely affect our business, results of operations, financial condition and cash flows.

If we do not effectively manage our real estate portfolio, our operating results may be negatively impacted.