Filed by International Game Technology PLC

(SEC File No. 001-36906)

pursuant to Rule 425

under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934,

as amended

Subject Company: International Game Technology

PLC

(SEC File No. 001-36906)

EMAIL

From: Desk of Vince Sadusky

Date: February 29, 2024

Audience: All employees worldwide

Subject: Strategic Evaluation Update

Hello everybody,

I am excited to announce that we have reached a decision on our evaluation

of potential strategic alternatives for our Global Gaming and PlayDigital businesses.

After exploring a variety of options, we have decided to combine our

Global Gaming and PlayDigital businesses with Everi, a Las Vegas-based provider of innovative gaming, fintech and loyalty solutions.

We will effect this combination by spinning off our Global Gaming and

PlayDigital businesses to our existing shareholders and then immediately combining such businesses with Everi in a merger. We expect the

spin-off and merger to be completed in late 2024 or early 2025, subject to receipt of regulatory approvals, the approval by Everi stockholders

and IGT shareholders, and satisfaction of other customary closing conditions.

The consolidated gaming operations will maintain the IGT brand, while

a new identity is created for our lottery operations.

As you will recall, we initiated our strategic evaluation to unlock

the full, intrinsic value of our portfolio. We believe we are satisfying this goal.

Global Gaming, PlayDigital and Everi have complementary

strengths, and each organization has an outstanding reputation. Together, they will create a comprehensive and diverse global gaming and

fintech enterprise.

The combined company, which is enabled by the excellent momentum Global

Gaming has built in recent years, will provide new and existing customers with a one-stop-shop offering across land- based gaming, iGaming,

sports betting and fintech. In addition to operating with a premier intellectual property portfolio, the combined company will move forward

with a large installed base with approximately 70,000 electronic gaming machines along with opportunities to bring Everi’s existing

content and fintech solutions to customers outside of the United States.

Meanwhile, our lottery operations will emerge as a premier pure play

business with a diversified contract mix, broad global reach, and a strong presence across markets. The lottery operations will be supported

by a scope of capabilities, a high-performing suite of products and value-added solutions, and our proven ability to maximize proceeds

for lottery customers. Our lottery operations will have a focused and compelling business model with infrastructure-like characteristics,

including recurring revenue streams backed by long-term contracts and long- standing customer relationships.

Following the business combination with Everi, existing IGT shareholders

will maintain 100% ownership of IGT’s lottery operations, and will own approximately 54% of the shares in the combined company.

I am so enthusiastic about the potential of this combined company that

I have agreed to lead the organization as CEO. I will remain CEO of our existing IGT organization until the transaction closes, while

the board of directors searches for IGT PLC’s next Global CEO. Fabio Celadon, our existing EVP of Strategy and Corporate Development,

will join me as CFO of the combined company.

Once the transaction closes, Michael Rumbolz, Everi’s Executive

Chairman, will be Chairman of the Board of Directors of the combined company, which will be headquartered in Las Vegas.

Randy Taylor, Everi CEO, will be a member of the combined company’s

Board of Directors and Mark Labay, Everi’s existing CFO, will assume the role of Chief Integration Officer.

Renato Ascoli will be CEO of IGT’s Global Lottery business, effective

immediately, and Max Chiara will remain CFO of IGT. Renato will be supported by our existing team of long-standing lottery industry experts

and brings with him extensive industry experience. Before leading Global Gaming, Renato led North American lottery, including operations,

product development, manufacturing, technology and delivery. He also previously led lottery operations in Italy. This background, combined

with Renato’s reputation across the industry, makes him the perfect choice to lead our new standalone lottery business.

Enrico Drago will continue as CEO of PlayDigital, reporting to me.

We will announce further details of each organization’s leadership

structure in the weeks/months to come. In the meantime, all my former direct reports as interim CEO of Global Lottery will report to Renato.

My existing direct reports for corporate functions will continue to report to me. Renato’s former direct reports in Global Gaming

will report to Nick Khin, our Chief Operating Officer for Gaming, who will report directly to me.

Please know that senior leaders and I are committed to providing as

much information as we can in the weeks to come, recognizing that there is still significant work to be done in establishing our new organizations,

and in preparing to close the transaction. It will take time to iron out every detail.

We are providing

people leaders and people partners companywide with answers to what we believe will be common questions about today’s news, and

the road ahead. Please connect with them. You can also reach out anonymously through YourIGT, and in the coming days, we

will establish a dedicated mailbox for questions about everything from today’s announcement, the spin off and merger of our Global

Gaming and PlayDigital businesses, and what the future looks like for employees who will continue supporting lottery.

I will share more about this announcement today during a special live

event at 11 a.m. Eastern. Calendar invitations will be distributed separately.

Additionally, please be on the lookout for meeting invitations from

senior leaders in your respective functions. Over the next couple of weeks, leaders will host dedicated meetings about this news, focusing

on what it means to various departments and teams in each organization.

Thank you for your patience as we worked through our evaluation, and

as we begin the work of establishing two singularly focused companies. We are confident the steps we have taken in recent months are foundational

to making us even more competitive than we are today.

Vince Sadusky CEO

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed

Transaction”) between Everi Holdings Inc. (“Everi”), International Game Technology PLC

(“IGT”), Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (”Merger Sub”), Everi, IGT and

Spinco will file relevant materials with the Securities and Exchange Commission (”SEC”). Everi will file a registration

statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will

constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be

mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY

HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS

FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and

security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when

available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by

contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way,

Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on

IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology

PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended

to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an

invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or

approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance

or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the ”Securities Act”),

and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security

holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants

in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of

Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of

stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management

of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants

in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained

in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements

This communication contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended,

related to Everi, IGT and the proposed spin-off of IGT's Global Gaming and PlayDigital Businesses (the "Spinco Business"),

and the proposed acquisition of the Spinco Business by Everi. All statements other than statements of historical fact are forward-looking

statements for purposes of federal and state securities laws. These forward-looking statements involve risks and uncertainties that could

significantly affect the financial or operating results of Everi, IGT, the Spinco Business, or the combined company. These forward-looking

statements may be identified by terms such as “anticipate,” “believe,” “foresee,” “estimate,”

“expect,” “intend,” “plan,” “project,” “forecast,” “may,” “will,”

“would,” “could” and “should” and the negative of these terms or other similar expressions. Forward-looking

statements in this communication include, among other things, statements about the potential benefits and synergies of the Proposed Transaction,

including future financial and operating results, plans, objectives, expectations and intentions; and the anticipated timing of closing

of the Proposed Transaction. In addition, all statements that address operating performance, events or developments that IGT expects or

anticipates will occur in the future — including statements relating to creating value for stockholders and shareholders, benefits

of the Proposed Transaction to customers, employees, stockholders and other constituents of the combined company and IGT, separating and

integrating the companies, cost savings and the expected timetable for completing the Proposed Transaction — are forward-looking

statements.

These forward-looking statements involve substantial risks and

uncertainties that could cause actual results, including the actual results of Everi, IGT, the Spinco Business, or the combined

company, to differ materially from those expressed or implied by such statements. These risks and uncertainties include, among other

things, risks related to the possibility that the conditions to the consummation of the Proposed Transaction will not be satisfied

(including the failure to obtain necessary regulatory, stockholder and shareholder approvals or any necessary waivers, consents, or

transfers, including for any required licenses or other agreements) in the anticipated timeframe or at all; risks related to the

ability to realize the anticipated benefits of the Proposed Transaction, including the possibility that Everi and IGT may be unable

to achieve the expected benefits, synergies and operating efficiencies in connection with the Proposed Transaction within the

expected timeframes or at all and to successfully separate and/or integrate the Spinco Business; the ability to retain key

personnel; negative effects of the announcement or the consummation of the proposed acquisition on the market price of the capital

stock of Everi and IGT and on Everi and IGT’s operating results; risks relating to the value of Everi’s shares to be

issued in the Proposed Transaction; the occurrence of any event, change or other circumstances that could give rise to the

termination of the merger agreement relating to the Proposed Transaction (the ”Merger Agreement”); changes in the extent

and characteristics of the common stockholders of Everi and ordinary shareholders of IGT and its effect pursuant to the Merger

Agreement for the Proposed Transaction on the number of shares of Everi common stock issuable pursuant to the Proposed Transaction,

magnitude of the dividend payable to Everi stockholders pursuant to the Proposed Transaction and the extent of indebtedness to be

incurred by Everi in connection with the Proposed Transaction; significant transaction costs, fees, expenses and charges (including

unknown liabilities and risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures,

revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects); expected or targeted future financial

and operating performance and results; operating costs, customer loss, and business disruption (including, without limitation,

difficulties in maintaining employee, customer, or other business, contractual, or operational relationships following the Proposed

Transaction announcement or closing of the Proposed Transaction); failure to consummate or delay in consummating the Proposed

Transaction for any reason; risks relating to any resurgence of the COVID-19 pandemic or similar public health crises; risks related

to competition in the gaming and lottery industry; dependence on significant licensing arrangements, customers, or other third

parties; issues and costs arising from the separation and integration of acquired companies and businesses and the timing and impact

of accounting adjustments; risks related to the financing of the Proposed Transaction, Everi’s overall debt levels and its

ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Proposed

Transaction; economic changes in global markets, such as currency exchange, inflation and interest rates, and recession; government

policies (including policy changes affecting the gaming industry, taxation, trade, tariffs, immigration, customs, and border

actions) and other external factors that Everi and IGT cannot control; regulation and litigation matters relating to the Proposed

Transaction or otherwise impacting Everi, IGT, Spinco, the combined company or the gaming industry generally; unanticipated

liabilities of acquired businesses; unanticipated adverse effects or liabilities from business divestitures; effects on earnings of

any significant impairment of goodwill or intangible assets; risks related to intellectual property, privacy matters, and cyber

security (including losses and other consequences from failures, breaches, attacks, or disclosures involving information technology

infrastructure and data); other business effects (including the effects of industry, market, economic, political, or regulatory

conditions); and other risks and uncertainties, including, but not limited to, those described in Everi’s Annual Report on

Form 10-K on file with the SEC and from time to time in other filed reports including Everi’s Quarterly Reports on

Form 10-Q, and those described in IGT’s Annual Report on Form 20-F on file with the SEC and from time to time in

other filed reports including IGT’s Current Reports on Form 6-K.

A further

description of risks and uncertainties relating to Everi can be found in its most recent Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K, and relating to IGT can be found in its most recent Annual Report on Form 20-F

and Current Reports on Form 6-K, all of which are filed with the SEC and available at www.sec.gov.

IGT does not intend to update the forward-looking statements contained

in this communication as the result of new information or future events or developments, except as required by law.

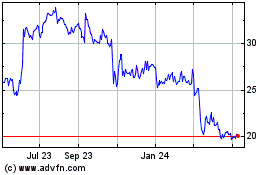

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

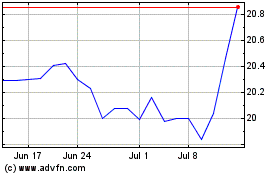

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Apr 2023 to Apr 2024