Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 24 2024 - 2:27PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

92.7%

Australia

:

15.7%

21,633

Ampol

Ltd.

$

487,494

0.6

60,208

ANZ

Group

Holdings

Ltd.

968,523

1.3

25,248

Aristocrat

Leisure

Ltd.

675,679

0.9

103,274

Aurizon

Holdings

Ltd.

240,902

0.3

46,228

BHP

Group

Ltd.

-

Class

DI

1,407,295

1.8

28,188

BlueScope

Steel

Ltd.

386,665

0.5

18,981

Brambles

Ltd.

167,272

0.2

3,249

Cochlear

Ltd.

585,980

0.8

37,756

Coles

Group

Ltd.

382,096

0.5

1,223

Commonwealth

Bank

of

Australia

84,487

0.1

30,066

Dexus

139,739

0.2

32,825

Fortescue

Metals

Group

Ltd.

539,017

0.7

179,396

GPT

Group

487,682

0.6

11,936

IGO

Ltd.

67,161

0.1

42,256

Lottery

Corp.

Ltd.

128,270

0.2

566

Macquarie

Group

Ltd.

63,050

0.1

50,332

National

Australia

Bank

Ltd.

942,753

1.2

60,493

QBE

Insurance

Group

Ltd.

615,515

0.8

21,938

Reece

Ltd.

279,856

0.4

7,143

Rio

Tinto

Ltd.

586,480

0.8

301,949

Scentre

Group

528,026

0.7

6,355

Sonic

Healthcare

Ltd.

122,976

0.2

157,462

South32

Ltd.

-

Class

DI

316,492

0.4

84,628

Stockland

230,625

0.3

4,230

Suncorp

Group

Ltd.

39,052

0.0

166,823

Telstra

Group

Ltd.

421,538

0.6

51,306

Treasury

Wine

Estates

Ltd.

362,842

0.5

146,508

Vicinity

Ltd.

183,362

0.2

4,724

WiseTech

Global

Ltd.

208,038

0.3

12,598

Woolworths

Group

Ltd.

290,388

0.4

11,939,255

15.7

China

:

26.1%

30,000

37

Interactive

Entertainment

Network

Technology

Group

Co.

Ltd.

-

Class

A

93,267

0.1

100,500

(1)

3SBio,

Inc.

93,342

0.1

100,000

Agricultural

Bank

of

China

Ltd.

-

Class

H

36,913

0.0

170,700

(2)

Alibaba

Group

Holding

Ltd.

1,586,727

2.1

180,000

Aluminum

Corp.

of

China

Ltd.

-

Class

H

88,896

0.1

3,600

Anhui

Yingjia

Distillery

Co.

Ltd.

-

Class

A

37,902

0.1

12,000

ANTA

Sports

Products

Ltd.

125,233

0.2

6,151

Autohome,

Inc.,

ADR

167,984

0.2

164,000

AviChina

Industry

&

Technology

Co.

Ltd.

-

Class

H

74,318

0.1

1,067,000

Bank

of

China

Ltd.

-

Class

H

390,937

0.5

160,300

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

148,789

0.2

114,700

(1)

Budweiser

Brewing

Co.

APAC

Ltd.

202,514

0.3

20,500

BYD

Co.

Ltd.

-

Class

H

550,971

0.7

75,795

By-health

Co.

Ltd.

-

Class

A

194,553

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

186,000

CECEP

Solar

Energy

Co.

Ltd.

-

Class

A

$

145,251

0.2

299,300

CECEP

Wind-Power

Corp.

-

Class

A

129,287

0.2

362,000

China

CITIC

Bank

Corp.

Ltd.

-

Class

H

163,526

0.2

580,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

247,122

0.3

1,045,960

China

Construction

Bank

Corp.

-

Class

H

604,767

0.8

217,000

China

Longyuan

Power

Group

Corp.

Ltd.

-

Class

H

162,297

0.2

138,000

China

Medical

System

Holdings

Ltd.

265,082

0.4

12,000

China

Mengniu

Dairy

Co.

Ltd.

37,601

0.1

106,000

China

Merchants

Bank

Co.

Ltd.

-

Class

H

369,942

0.5

106,000

China

Oilfield

Services

Ltd.

-

Class

H

113,904

0.2

45,000

China

Overseas

Property

Holdings

Ltd.

36,675

0.0

408,000

China

Railway

Group

Ltd.

-

Class

H

179,075

0.2

8,000

China

Resources

Beer

Holdings

Co.

Ltd.

36,063

0.0

16,000

China

Resources

Land

Ltd.

58,579

0.1

1,696,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

175,818

0.2

123,000

CITIC

Securities

Co.

Ltd.

-

Class

H

255,329

0.3

252,000

CMOC

Group

Ltd.

-

Class

H

143,998

0.2

1,300

Contemporary

Amperex

Technology

Co.

Ltd.

-

Class

A

30,447

0.0

222,500

COSCO

SHIPPING

Holdings

Co.

Ltd.

-

Class

H

204,991

0.3

50,480

CSPC

Pharmaceutical

Group

Ltd.

45,462

0.1

41,300

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

291,270

0.4

346,000

Far

East

Horizon

Ltd.

253,336

0.3

117,900

Focus

Media

Information

Technology

Co.

Ltd.

-

Class

A

108,069

0.1

97,000

Geely

Automobile

Holdings

Ltd.

105,544

0.1

2,844

GoodWe

Technologies

Co.

Ltd.

-

Class

A

43,054

0.1

82,100

GRG

Banking

Equipment

Co.

Ltd.

-

Class

A

140,518

0.2

21,500

Hengan

International

Group

Co.

Ltd.

78,496

0.1

31,800

Hengdian

Group

DMEGC

Magnetics

Co.

Ltd.

-

Class

A

60,365

0.1

27,800

Hisense

Visual

Technology

Co.

Ltd.

-

Class

A

91,251

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

26,000

(1)

Huatai

Securities

Co.

Ltd.

-

Class

H

$

32,520

0.0

23,300

Hubei

Jumpcan

Pharmaceutical

Co.

Ltd.

-

Class

A

104,275

0.1

498,414

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

237,159

0.3

24,604

JD.com,

Inc.

-

Class

A

335,601

0.4

12,800

Jiangsu

Yuyue

Medical

Equipment

&

Supply

Co.

Ltd.

-

Class

A

61,346

0.1

78,800

Kingsoft

Corp.

Ltd.

251,669

0.3

52,730

(1)(2)

Meituan

-

Class

B

610,429

0.8

1,429

MINISO

Group

Holding

Ltd.,

ADR

36,197

0.0

78,000

Minth

Group

Ltd.

168,963

0.2

29,100

NetEase,

Inc.

656,449

0.9

11,600

(1)

Nongfu

Spring

Co.

Ltd.

-

Class

H

66,164

0.1

44,500

Offshore

Oil

Engineering

Co.

Ltd.

-

Class

A

40,044

0.1

6,259

(2)

PDD

Holdings,

Inc.,

ADR

922,827

1.2

7,800

People.cn

Co.

Ltd.

-

Class

A

37,147

0.1

928,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

300,607

0.4

358,000

PetroChina

Co.

Ltd.

-

Class

H

234,266

0.3

298,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

346,170

0.5

107,500

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

493,065

0.7

13,051

Qifu

Technology,

Inc.,

ADR

202,552

0.3

17,900

Risen

Energy

Co.

Ltd.

-

Class

A

40,520

0.1

31,000

Sany

Heavy

Equipment

International

Holdings

Co.

Ltd.

32,225

0.0

18,300

Shanghai

Baosight

Software

Co.

Ltd.

-

Class

B

34,450

0.0

298,900

Shanghai

Construction

Group

Co.

Ltd.

-

Class

A

104,715

0.1

121,700

Shanghai

Pharmaceuticals

Holding

Co.

Ltd.

-

Class

H

176,418

0.2

2,400

Shanxi

Xinghuacun

Fen

Wine

Factory

Co.

Ltd.

-

Class

A

80,339

0.1

9,600

Shenzhen

Kstar

Science

And

Technology

Co.

Ltd.

-

Class

A

34,160

0.0

5,003

Shenzhen

Mindray

Bio-

Medical

Electronics

Co.

Ltd.

-

Class

A

203,786

0.3

35,200

Sichuan

Road

and

Bridge

Group

Co.

Ltd.

-

Class

A

38,065

0.1

54,000

Sinopharm

Group

Co.

Ltd.

-

Class

H

133,826

0.2

121,500

Sinotruk

Hong

Kong

Ltd.

252,044

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

31,000

SITC

International

Holdings

Co.

Ltd.

$

46,812

0.1

2,900

Sungrow

Power

Supply

Co.

Ltd.

-

Class

A

33,797

0.0

13,400

Sunresin

New

Materials

Co.

Ltd.

-

Class

A

94,552

0.1

73,700

Tencent

Holdings

Ltd.

3,070,280

4.0

26,000

Tingyi

Cayman

Islands

Holding

Corp.

32,722

0.0

69,000

(1)

Topsports

International

Holdings

Ltd.

56,078

0.1

82,000

TravelSky

Technology

Ltd.

-

Class

H

138,144

0.2

15,727

Trina

Solar

Co.

Ltd.

-

Class

A

59,462

0.1

52,000

Uni-President

China

Holdings

Ltd.

33,260

0.0

163,500

Western

Mining

Co.

Ltd.

-

Class

A

294,323

0.4

21,200

(1)

WuXi

AppTec

Co.

Ltd.

-

Class

H

247,995

0.3

356,000

Xinyi

Solar

Holdings

Ltd.

204,232

0.3

122,000

(1)

Yadea

Group

Holdings

Ltd.

229,414

0.3

74,000

Yankuang

Energy

Group

Co.

Ltd.

-

Class

H

137,468

0.2

1,137

Yum

China

Holdings,

Inc.

49,096

0.1

145,200

Yutong

Bus

Co.

Ltd.

-

Class

A

274,106

0.4

50,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

31,662

0.0

2,600

Zhongji

Innolight

Co.

Ltd.

-

Class

A

34,637

0.0

38,600

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

121,888

0.2

24,000

Zijin

Mining

Group

Co.

Ltd.

-

Class

H

38,007

0.1

19,865,398

26.1

Hong

Kong

:

4.0%

82,974

AIA

Group

Ltd.

713,338

0.9

234,000

Bosideng

International

Holdings

Ltd.

98,123

0.1

52,000

CK

Hutchison

Holdings

Ltd.

260,885

0.4

200,000

Hang

Lung

Properties

Ltd.

267,393

0.4

6,400

Jardine

Matheson

Holdings

Ltd.

247,869

0.3

83,400

Link

REIT

411,899

0.5

100,000

Power

Assets

Holdings

Ltd.

521,673

0.7

179,200

Swire

Properties

Ltd.

348,001

0.5

17,000

Techtronic

Industries

Co.

Ltd.

172,719

0.2

3,041,900

4.0

India

:

14.2%

11,525

Adani

Ports

&

Special

Economic

Zone

Ltd.

114,249

0.2

50,419

Axis

Bank

Ltd.

650,960

0.9

547

Bajaj

Auto

Ltd.

40,025

0.1

5,718

Bajaj

Finance

Ltd.

488,809

0.6

127,177

Bank

of

Baroda

301,048

0.4

34,771

Bharat

Petroleum

Corp.

Ltd.

181,991

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

32,457

CG

Power

&

Industrial

Solutions

Ltd.

$

175,020

0.2

2,646

Cholamandalam

Investment

and

Finance

Co.

Ltd.

35,517

0.0

1,572

Colgate-Palmolive

India

Ltd.

41,461

0.1

35,774

HCL

Technologies

Ltd.

576,447

0.8

33,969

HDFC

Bank

Ltd.

636,830

0.8

26,021

Hindalco

Industries

Ltd.

161,373

0.2

50,821

(2)

Hindustan

Petroleum

Corp.

Ltd.

212,080

0.3

94,800

ICICI

Bank

Ltd.

1,058,701

1.4

192,996

Indian

Oil

Corp.

Ltd.

259,103

0.3

15,225

Infosys

Ltd.

266,119

0.4

75,225

ITC

Ltd.

393,247

0.5

22,177

Kotak

Mahindra

Bank

Ltd.

467,526

0.6

18,316

Larsen

&

Toubro

Ltd.

683,747

0.9

56,287

Oil

&

Natural

Gas

Corp.

Ltd.

131,533

0.2

7,977

PI

Industries

Ltd.

360,704

0.5

162,885

Power

Finance

Corp.

Ltd.

654,722

0.9

144,704

Power

Grid

Corp.

of

India

Ltd.

362,925

0.5

128,613

REC

Ltd.

537,970

0.7

1,329

Reliance

Industries

Ltd.

37,932

0.1

20,243

Shriram

Finance

Ltd.

487,667

0.6

16,346

State

Bank

of

India

110,915

0.1

16,627

Tata

Consultancy

Services

Ltd.

696,689

0.9

171,288

Tata

Steel

Ltd.

263,228

0.3

9,270

Torrent

Pharmaceuticals

Ltd.

235,987

0.3

61,312

Vedanta

Ltd.

171,901

0.2

10,796,426

14.2

Indonesia

:

0.6%

1,104,200

Bank

Rakyat

Indonesia

Persero

Tbk

PT

375,786

0.5

313,300

Sumber

Alfaria

Trijaya

Tbk

PT

57,974

0.1

433,760

0.6

Malaysia

:

1.3%

244,600

CIMB

Group

Holdings

Bhd

296,609

0.4

238,600

Genting

Bhd

239,771

0.3

576,900

Genting

Malaysia

Bhd

330,733

0.4

127,400

Public

Bank

Bhd

116,780

0.2

983,893

1.3

New

Zealand

:

0.4%

19,037

Fisher

&

Paykel

Healthcare

Corp.

Ltd.

276,586

0.4

Philippines

:

0.4%

76,800

Ayala

Land,

Inc.

43,202

0.1

177,680

Metropolitan

Bank

&

Trust

Co.

159,941

0.2

4,960

PLDT,

Inc.

114,595

0.1

317,738

0.4

Singapore

:

3.2%

29,000

(1)

BOC

Aviation

Ltd.

208,654

0.3

215,800

CapitaLand

Ascendas

REIT

458,338

0.6

779,800

Genting

Singapore

Ltd.

533,354

0.7

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Singapore

(continued)

119,000

Keppel

Corp.

Ltd.

$

593,637

0.8

9,000

Oversea-Chinese

Banking

Corp.

Ltd.

84,455

0.1

117,100

Sembcorp

Industries

Ltd.

450,083

0.6

15,900

Singapore

Exchange

Ltd.

112,228

0.1

2,440,749

3.2

South

Korea

:

8.8%

467

Amorepacific

Corp.

46,653

0.1

2,143

BGF

retail

Co.

Ltd.

223,834

0.3

4,355

DB

Insurance

Co.

Ltd.

280,991

0.4

5,508

Doosan

Bobcat,

Inc.

193,830

0.3

56

Ecopro

Co.

Ltd.

32,306

0.0

5,448

Hankook

Tire

&

Technology

Co.

Ltd.

190,685

0.2

597

Hanmi

Pharm

Co.

Ltd.

141,756

0.2

759

Hanmi

Semiconductor

Co.

Ltd.

37,247

0.0

37,897

Hanon

Systems

212,067

0.3

1,728

Hanwha

Aerospace

Co.

Ltd.

169,001

0.2

6,336

HD

Hyundai

Co.

Ltd.

295,319

0.4

2,055

Hyundai

Mobis

Co.

Ltd.

363,448

0.5

3,074

Hyundai

Motor

Co.

437,689

0.6

1,631

JYP

Entertainment

Corp.

121,107

0.2

6,274

KB

Financial

Group,

Inc.

253,676

0.3

8,614

Kia

Corp.

572,298

0.8

2,196

Korea

Investment

Holdings

Co.

Ltd.

101,550

0.1

812

LG

Chem

Ltd.

314,134

0.4

2,811

LG

Electronics,

Inc.

222,887

0.3

2,533

NAVER

Corp.

407,164

0.5

39,550

NH

Investment

&

Securities

Co.

Ltd.

313,586

0.4

385

Orion

Corp./Republic

of

Korea

34,813

0.0

775

POSCO

Holdings,

Inc.

289,420

0.4

817

Posco

International

Corp.

36,099

0.0

3,183

Samsung

C&T

Corp.

293,491

0.4

1,800

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

361,788

0.5

17,113

Samsung

Securities

Co.

Ltd.

518,795

0.7

2,478

SK

Hynix,

Inc.

257,121

0.3

6,722,755

8.8

Taiwan

:

15.1%

283,000

Acer,

Inc.

319,239

0.4

44,000

ASE

Technology

Holding

Co.

Ltd.

179,679

0.2

32,000

Asustek

Computer,

Inc.

403,475

0.5

77,000

China

Airlines

Ltd.

52,040

0.1

228,000

Compal

Electronics,

Inc.

225,540

0.3

43,000

Delta

Electronics,

Inc.

434,915

0.6

3,000

eMemory

Technology,

Inc.

240,561

0.3

264,000

Eva

Airways

Corp.

264,522

0.3

50,000

Gigabyte

Technology

Co.

Ltd.

398,244

0.5

1,000

Global

Unichip

Corp.

52,657

0.1

187,000

Hon

Hai

Precision

Industry

Co.

Ltd.

607,391

0.8

122,000

Inventec

Corp.

165,382

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan

(continued)

117,000

Lite-On

Technology

Corp.

$

411,284

0.5

26,000

MediaTek,

Inc.

785,187

1.0

65,000

Micro-Star

International

Co.

Ltd.

381,601

0.5

32,000

Novatek

Microelectronics

Corp.

522,703

0.7

7,000

President

Chain

Store

Corp.

60,339

0.1

65,000

Quanta

Computer,

Inc.

420,755

0.6

274,627

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

5,023,510

6.6

224,000

United

Microelectronics

Corp.

350,283

0.5

70,000

Wistron

Corp.

203,946

0.3

11,503,253

15.1

Thailand

:

2.8%

275,300

Bangkok

Dusit

Medical

Services

PCL

-

Foreign

-

Class

F

205,582

0.3

10,600

Bumrungrad

Hospital

PCL

-

Foreign

67,188

0.1

200,700

Charoen

Pokphand

Foods

PCL

113,429

0.2

405,500

Indorama

Ventures

PCL

282,463

0.4

73,400

Kasikornbank

PCL

267,059

0.4

324,200

Krung

Thai

Bank

PCL

167,816

0.2

84,100

Krungthai

Card

PCL

111,812

0.1

53,800

Osotspa

PCL

34,972

0.0

7,800

PTT

Exploration

&

Production

PCL

-

Foreign

Shares

33,483

0.0

334,400

PTT

Global

Chemical

PCL

366,754

0.5

158,500

SCB

X

PCL

447,350

0.6

2,097,908

2.8

United

States

:

0.1%

1,343

(2)

James

Hardie

Industries

PLC

42,888

0.1

Total

Common

Stock

(Cost

$69,588,506)

70,462,509

92.7

EXCHANGE-TRADED

FUNDS

:

1.7%

19,278

iShares

MSCI

All

Country

Asia

ex

Japan

ETF

1,260,974

1.7

Total

Exchange-Traded

Funds

(Cost

$1,265,481)

1,260,974

1.7

PREFERRED

STOCK

:

3.5%

South

Korea

:

3.5%

58,858

Samsung

Electronics

Co.

Ltd.

2,640,454

3.5

Total

Preferred

Stock

(Cost

$2,118,375)

2,640,454

3.5

Shares

RA

Value

Percentage

of

Net

Assets

RIGHT

:

—%

Taiwan

:

—%

56

Wistron

Corp.

$

—

—

Total

Right

(Cost

$–)

—

—

Total

Long-Term

Investments

(Cost

$72,972,362)

74,363,937

97.9

SHORT-TERM

INVESTMENTS

:

2.5%

Mutual

Funds

:

2.5%

1,930,000

(3)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.260%

(Cost

$1,930,000)

$

1,930,000

2.5

Total

Short-Term

Investments

(Cost

$1,930,000)

1,930,000

2.5

Total

Investments

in

Securities

(Cost

$74,902,362)

$

76,293,937

100.4

Liabilities

in

Excess

of

Other

Assets

(331,191)

(0.4)

Net

Assets

$

75,962,746

100.0

ADR

American

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

s

ecurity.

(3)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2023.

Sector

Diversification

Percentage

of

Net

Assets

Financials

21.9

%

Information

Technology

21.6

Consumer

Discretionary

11.9

Materials

8.2

Industrials

7.8

Communication

Services

7.4

Health

Care

4.3

Real

Estate

4.2

Consumer

Staples

3.7

Energy

2.9

Utilities

2.3

Exchange-Traded

Funds

1.7

Short-Term

Investments

2.5

Liabilities

in

Excess

of

Other

Assets

(0.4)

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

11,939,255

$

—

$

11,939,255

China

1,448,028

18,417,370

—

19,865,398

Hong

Kong

—

3,041,900

—

3,041,900

India

360,704

10,435,722

—

10,796,426

Indonesia

57,974

375,786

—

433,760

Malaysia

—

983,893

—

983,893

New

Zealand

—

276,586

—

276,586

Philippines

159,941

157,797

—

317,738

Singapore

—

2,440,749

—

2,440,749

South

Korea

—

6,722,755

—

6,722,755

Taiwan

—

11,503,253

—

11,503,253

Thailand

—

2,097,908

—

2,097,908

United

States

—

42,888

—

42,888

Total

Common

Stock

2,026,647

68,435,862

—

70,462,509

Exchange-Traded

Funds

1,260,974

—

—

1,260,974

Preferred

Stock

—

2,640,454

—

2,640,454

Short-Term

Investments

1,930,000

—

—

1,930,000

Total

Investments,

at

fair

value

$

5,217,621

$

71,076,316

$

—

$

76,293,937

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(318,271)

$

—

$

(318,271)

Total

Liabilities

$

—

$

(318,271)

$

—

$

(318,271)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

At

November

30,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Asia

Pacific

High

Dividend

Equity

Income

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Australia

ETF

BNP

Paribas

Call

12/15/23

USD

22.210

67,537

USD

1,516,206

$

30,871

$

(32,953)

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

12/15/23

USD

39.360

442,073

USD

17,488,408

337,744

(285,318)

$

368,615

$

(318,271)

Currency

Abbreviations:

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

9,512,065

Gross

Unrealized

Depreciation

(8,120,490)

Net

Unrealized

Appreciation

$

1,391,575

Voya Asia Pacific High D... (NYSE:IAE)

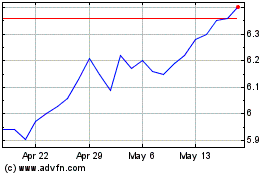

Historical Stock Chart

From Mar 2024 to Apr 2024

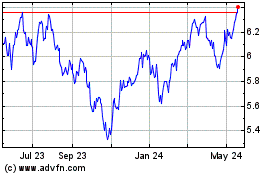

Voya Asia Pacific High D... (NYSE:IAE)

Historical Stock Chart

From Apr 2023 to Apr 2024