Current Report Filing (8-k)

January 11 2021 - 7:34AM

Edgar (US Regulatory)

0001326380false00013263802021-01-112021-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2021

GameStop Corp.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-32637

|

|

20-2733559

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

625 Westport Parkway, Grapevine, TX 76051

(817) 424-2000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Class A Common Stock

|

|

GME

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 10, 2021, GameStop Corp. (the “Company”) entered into an agreement (the “Agreement”) with RC Ventures LLC and Ryan Cohen (together, “RC Ventures”).

Pursuant to the Agreement, the Company has agreed to increase the size of its board of directors (the “Board”) by three directors to a total of 13 directors and appoint Alain (Alan) Attal, Ryan Cohen and James (Jim) Grube (the “New Directors”) as members of the Board, each with a term expiring at the Company’s 2021 annual meeting of stockholders (the “2021 Annual Meeting”). The Company has further agreed that, effective at the 2021 Annual Meeting, the size of the Board will be reduced by four directors to a total of nine directors. The Board will nominate each of the New Directors (or their replacements appointed in accordance with the terms of the Agreement) and current directors Paul Evans, Reginald Fils-Aimé, George Sherman, William Simon, Carrie Teffner and Kurt Wolf for election as directors at the 2021 Annual Meeting.

As part of the Agreement, RC Ventures has agreed to customary standstill provisions, which provide that from the date of the Agreement until the earlier of (a) the date that is 30 calendar days prior to the deadline for the submission of director nominations by stockholders for the Company’s 2022 annual meeting of stockholders and (b) the date that is 120 days prior to the first anniversary of the 2021 Annual Meeting (such period, the “Standstill Period”), RC Ventures will not, among other things: (i) acquire beneficial ownership in, or aggregate economic exposure to, directly or indirectly, more than 19.9% of the Company’s outstanding common stock; (ii) make any proposal for consideration by stockholders at any annual or special meeting of stockholders of the Company; (iii) make any offer or proposal with respect to any extraordinary transactions; or (iv) seek, alone or in concert with others, the appointment, election or removal of any directors in opposition to any recommendation of the Board, in each case as further described in the Agreement. As part of the Agreement, the Company has permitted RC Ventures to acquire, whether in a single transaction or multiple transactions from time to time, additional shares of the Company’s common stock to the extent such acquisitions would result in RC Ventures having beneficial ownership of less than 20.0% of the outstanding shares, without triggering the restrictions that would otherwise be imposed under Section 203 of the Delaware General Corporation Law (the “DGCL”), and RC Ventures has agreed that upon acquiring beneficial ownership 20.0% or more of the outstanding shares of the Company’s common stock, the restrictions under Section 203 of the DGCL would apply to a potential business combination with RC Ventures as an “interested stockholder” (as defined in Section 203 of the DGCL).

RC Ventures has also agreed that, during the Standstill Period, it will, and will cause its affiliates and associates to, vote its shares of the Company’s common stock at any meeting of the Company’s stockholders in favor of each director nominated and recommended by the Board for election at any such meeting and, subject to certain exceptions, in support of other proposals as recommended by the Board.

Pursuant to the Agreement, the New Directors will receive the same benefits and the same compensation as other non-management directors on the Board, provided, that Mr. Cohen has waived his right to compensation for his service as a director of the Company.

A copy of the Agreement is filed with this Form 8-K as Exhibit 10.1 and incorporated by reference herein. The foregoing description of the Agreement is qualified in its entirety by reference to the full text of the Agreement.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the Agreement, effective as of January 10, 2021, the Board (a) voted to increase the size of the Board to 13 directors, creating a total of three vacancies, and (b) appointed Alain (Alan) Attal, Ryan Cohen and James (Jim) Grube to fill the resulting vacancies, with terms expiring at the 2021 Annual Meeting. In addition, Mr. Attal was appointed to the Compensation Committee of the Board, Mr. Cohen was appointed to the Nominating and Corporate Governance Committee of the Board and Mr. Grube was appointed to the Audit Committee of the Board, each effective as of January 10, 2021.

Other than as described in Item 1.01 of this Form 8-K and the Agreement, there are no arrangements or understandings between any of the New Directors or any other persons pursuant to which any of the New Directors were named a director of the Company. None of the New Directors or their immediate family members have any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

Item 1.01 of this Form 8-K is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

A copy of the joint press release of the Company and RC Ventures announcing the entry into the Agreement is furnished with this Form 8-K as Exhibit 99.1.

The information furnished herewith pursuant to this Item 7.01 of this Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAMESTOP CORP.

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 11, 2021

|

By:

|

/s/ James A. Bell

|

|

|

|

|

|

Name: James A. Bell

Title: Executive Vice President and Chief Financial Officer

|

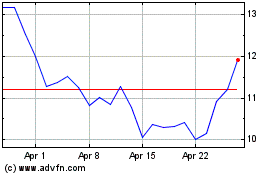

GameStop (NYSE:GME)

Historical Stock Chart

From Mar 2024 to Apr 2024

GameStop (NYSE:GME)

Historical Stock Chart

From Apr 2023 to Apr 2024