GM Raises Profit Guidance for 2018--Update

January 11 2019 - 11:38AM

Dow Jones News

By Mike Colias

General Motors Co. said Friday it is increasing its full-year

profit guidance for 2018 and predicting even stronger performance

this year, with executives anticipating a restructuring in the U.S.

that includes plant closures and job cuts will lift earnings.

The company forecasts its earnings per share this year at $6.50

to $7.00, above the average analyst estimate of below $6. The

continued U.S. rollout of overhauled pickup-truck models -- the

company's most lucrative products -- should help it boost profits

in 2019, along with savings generated from its efforts to trim its

North American workforce.

GM's shares rose more than 8% in morning trading.

GM Chief Executive Mary Barra drew sharp criticism from

President Donald Trump and several members of Congress in November

when the nation's largest auto maker by sales announced an

operational restructuring plan for North America that is expected

to result in thousands of layoffs.

On Friday, GM said the move should add at least $2 billion to

GM's operating profit this year.

The Detroit-based auto maker said its profit could slip this

year in China, the world's largest auto market, where GM's sales

declined 25% in the fourth quarter. But Ms. Barra on Friday

downplayed fears of continued weakness in the Chinese car market in

2019, saying she is encouraged by recent trade talks between the

U.S. and China, and Beijing's signal it could roll out a potential

consumer stimulus.

"There are a lot of factors that will allow us to achieve

appropriate earnings this year" in China, she said.

For 2018, GM said its pretax earnings per share, adjusted for

one-time items, would exceed its previous estimate of $5.80 to

$6.20, set last summer. Robust sales of pickup trucks and

sport-utility vehicles helped drive results beyond the original

forecast, the company said. The company plans to announce

fourth-quarter and full-year results on Feb. 6.

Five years into her tenure, Ms. Barra has led the company to

record profits, in part by jettisoning slow-growing or unprofitable

business units, including GM's money-losing European division in a

2017 sale.

Now, she is focused on squeezing costs and improving cash flow

to sustain strong results if its key U.S. market cools, while still

funneling money toward future bets on electric and self-driving

vehicles.

GM's restructuring includes idling five factories in the U.S.

and Canada this year, part of a broader plan that could cut around

14,000 employees en route to slashing $6 billion in annual cash

costs by 2020. Ms. Barra has said she wants to proactively rein in

costs while the economy and company are in good shape.

GM said it would continue spending heavily on autonomous-vehicle

development this year, likely matching the roughly $1 billion it

was expected to spend in 2018. Executives reiterated plans to begin

a commercial robot-taxi service in an undisclosed U.S. city

sometime this year.

The auto maker also is doubling its spending on electric

vehicles in coming years, though it hasn't quantified the

investment. On Friday, GM said its luxury Cadillac brand would

serve as its "lead electric-vehicle brand" without detailing plans

for specific models.

Slowing growth in China has rattled U.S. companies and the stock

market, exacerbated by Apple Inc.'s revenue warning to start the

year, which the phone maker blamed largely on a slowdown in the

Chinese market.

GM posted strong results in China through the first three

quarters of 2018, despite a slowdown in the Chinese auto market

that hurt the bottom lines of some rivals. GM has said a bigger

proportion of its sales are SUVs and luxury Cadillac vehicles --

which carry higher profit margins -- and that it is strong in the

largest cities, where demand has held up better than in smaller

markets.

GM projected industrywide U.S. sales this year to come close to

the 17.3 million vehicles sold in 2018, a historically strong

number.

RBC Capital analyst Joe Spak said GM's 2019 profit outlook is

stronger than he expected, but said the company's bullish view

relies on continued strength in the world's two biggest car

markets, China and the U.S.

"We, and we believe the market, have taken a more conservative

approach to thinking about 2019," Mr. Spak wrote in a research

note.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

January 11, 2019 11:23 ET (16:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

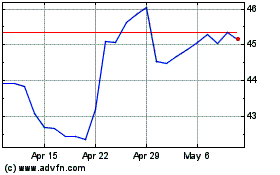

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

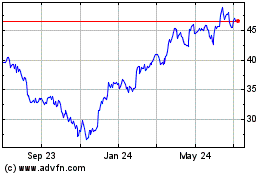

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024