Tribune Holders Vote to Re-Elect Board

June 02 2016 - 2:10PM

Dow Jones News

Tribune Publishing Co. said shareholders voted, as expected, to

re-elect the company's board nominees at its annual meeting

Thursday.

But the publisher of the Chicago Tribune and Los Angeles Times

didn't give the exact breakdown of the vote, giving no indication

of how much support Gannett Co. garnered for its "withhold"

campaign. Gannett was encouraging shareholders to withhold their

votes for the board as a symbolic gesture of no confidence and

support for Gannett's takeover attempt.

Gannett was unable to offer a competing slate of directors as it

had initiated its unsolicited pursuit of Tribune after the deadline

had passed to wage a proxy fight.

USA Today owner Gannett has said it would review whether to

proceed with its takeover approach after the result of the vote,

after Tribune rejected bids at $12.25 and $15 a share—63% and 99%

premiums, respectively, over Tribune's share price before Gannett

made its first bid public.

A representative from Gannett couldn't immediately be reached

for comment Thursday.

Tribune has argued that Gannett's offers undervalued the company

and that more value could be derived from Mr. Ferro's plan to

modernize its 11 newsrooms—revolving around a technology platform

called "Tronc," using things like artificial intelligence and

"machine vision" technology—if it is given the time to take

hold.

The company last week took the unorthodox approach of selling

4.7 million shares of its stock to medical doctor and billionaire

investor Patrick Soon-Shiong at $15 apiece—the price Gannett had

proposed in its sweetened bid.

Dr. Soon-Shiong's investment in Tribune, a 12.9% stake at $70.5

million, made him the company's second-largest shareholder. It also

made the company more expensive for Gannett to purchase, as it

would presumably have to purchase Dr. Soon-Shiong's additional

shares, which could push the total cost of the company up.

As part of the deal, Dr. Soon-Shiong was slated to take a seat

on Tribune Publishing's board as vice chairman, starting Thursday

after the shareholder meeting.

Mr. Ferro had marshaled the support of three proxy-advisory

firms, Institutional Shareholder Services, Glass, Lewis & Co.

and Egan-Jones Rating Co., and big institutional investors often

follow the recommendations of those firms.

Meanwhile, a Tribune shareholder, Capital Structures Realty

Advisors LLC, filed a lawsuit against Mr. Ferro and the rest of the

Tribune board, seeking to block the sale of stock to Dr.

Soon-Shiong. Dr. Soon-Shiong, in an interview, said he had only

heard of the lawsuit through the media Thursday morning and had not

reviewed the complaint.

A merger of the two companies would tie household their

household news outlets up under one firm, as newspaper companies

have struggled in recent years in part from disruptions caused by

the internet.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Lukas I.

Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

June 02, 2016 13:55 ET (17:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

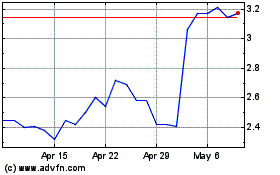

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

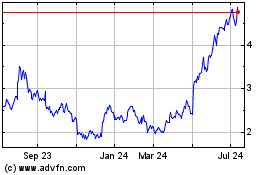

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024