Current Report Filing (8-k)

October 27 2020 - 7:22AM

Edgar (US Regulatory)

0000936340false00009363402020-10-272020-10-270000936340dte:DTEElectricMember2020-10-272020-10-270000936340us-gaap:CommonStockMember2020-10-272020-10-270000936340dte:SeriesB20165.375JuniorSubordinatedDebenturesDue2076Member2020-10-272020-10-270000936340dte:SeriesF20166.00JuniorSubordinatedDebenturesDue2076Member2020-10-272020-10-270000936340dte:SeriesE20175.25JuniorSubordinatedDebenturesDue2077Member2020-10-272020-10-270000936340dte:CorporateUnits2019625Member2020-10-272020-10-270000936340dte:SeriesG20204375JuniorSubordinatedDebenturesDue2080Member2020-10-272020-10-2700009363402020-07-282020-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 27, 2020

Commission File Number: 1-11607

DTE Energy Company

|

|

|

|

|

|

|

|

|

|

|

Michigan

|

|

38-3217752

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S Employer Identification No.)

|

Commission File Number: 1-2198

DTE Electric Company

|

|

|

|

|

|

|

|

|

|

|

Michigan

|

|

38-0478650

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S Employer Identification No.)

|

Registrants address of principal executive offices: One Energy Plaza, Detroit, Michigan 48226-1279

Registrants telephone number, including area code: (313) 235-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Exchange on which Registered

|

|

Common stock, without par value

|

|

DTE

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

2016 Series B 5.375% Junior Subordinated Debentures due 2076

|

|

DTJ

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

2016 Series F 6.00% Junior Subordinated Debentures due 2076

|

|

DTY

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

2017 Series E 5.25% Junior Subordinated Debentures due 2077

|

|

DTW

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

2019 6.25% Corporate Units

|

|

DTP

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

2020 Series G 4.375% Junior Subordinated Debentures due 2080

|

|

DTB

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

DTE Energy Company (DTE Energy or the Company) is furnishing the Securities and Exchange Commission (SEC) with its earnings release issued October 27, 2020, announcing financial results for the quarter ended September 30, 2020. A copy of the earnings release and the slide presentation, including supplemental financial information, are furnished as Exhibits 99.1 and 99.2 to this Report and are incorporated herein by reference. In its earnings release and the slide presentation discussed below, DTE Energy increased its 2020 operating earnings guidance range from $6.47 - $6.75 to $6.90 - $7.10 per share. DTE Energy also announced its early outlook for 2021 operating earnings guidance range of $6.88 - $7.26.

Item 7.01. Regulation FD Disclosure.

On October 27, 2020, DTE Energy issued a press release announcing that its board of directors (the Board) unanimously authorized management to pursue a plan to separate DTE Energy’s non-utility natural gas pipelines, gathering and storage business into a new public company. A copy of the press release is furnished as Exhibit 99.3 to this Report and is incorporated herein by reference.

DTE Energy is furnishing the SEC with its earnings release, the slide presentation and the spin-off press release. A copy of the earnings release, slide presentation and spin-off press release are furnished as Exhibits 99.1, 99.2 and 99.3, respectively, to this Report and are incorporated herein by reference.

In its earnings release, slide presentation and this filing, DTE Energy discusses 2020 and 2021 operating earnings guidance. It is likely that certain items that impact the Company’s 2020 and 2021 reported results will be excluded from operating results. Reconciliations to the comparable 2020 and 2021 reported earnings guidance are not provided because it is not possible to provide a reliable forecast of specific line items (i.e., future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. In addition, early outlook for 2021 operating earnings guidance is with respect to the current consolidated pre-spin version of DTE Energy, the spin is currently expected to occur by mid-year 2021 and any post-spin guidance will be provided later in the process.

DTE Energy also discusses Adjusted EBITDA in its slide presentation. The reconciliation of net income to Adjusted EBITDA as projected for full-year 2020 is not provided. DTE Energy does not forecast net income as it cannot, without unreasonable efforts, estimate or predict with certainty the components of net income. These components, net of tax, may include, but are not limited to, impairments of assets and other charges, divesture costs, acquisition costs, or changes in accounting principles. All of these components could significantly impact such financial measures. At this time, DTE Energy is not able to estimate the aggregate impact, if any, of these items on future period reported earnings.

Accordingly, DTE Energy is not able to provide a corresponding GAAP equivalent for Adjusted EBITDA.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

Earnings Release of DTE Energy Company dated October 27, 2020.

|

|

|

|

|

|

Slide Presentation of DTE Energy Company dated October 27, 2020.

|

|

|

|

|

|

Spin-off Press Release of DTE Energy Company dated October 27, 2020.

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Forward-Looking Statements:

This Form 8-K contains forward-looking statements that are subject to various assumptions, risks and uncertainties. It should be read in conjunction with the “Forward-Looking Statements” section in DTE Energy’s and DTE Electric Company’s (DTE Electric) 2019 Form 10-K and 2020 Form 10-Qs (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric that discuss important factors that could cause DTE Energy’s and DTE Electric’s actual results to differ materially. DTE Energy and DTE Electric expressly disclaim any current intention to update any forward-looking statements contained in this report as a result of new information or future events or developments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: October 27, 2020

|

|

|

|

|

|

|

DTE ENERGY COMPANY

(Registrant)

|

|

|

|

|

|

/s/David Ruud

David Ruud

Senior Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

DTE ELECTRIC COMPANY

(Registrant)

|

|

|

|

|

|

/s/David Ruud

David Ruud

Senior Vice President and Chief Financial Officer

|

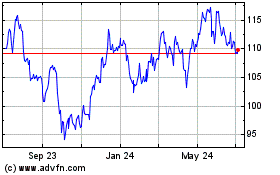

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Apr 2023 to Apr 2024