Current Report Filing (8-k)

October 10 2019 - 6:51AM

Edgar (US Regulatory)

DOVER Corp false 0000029905 0000029905 2019-10-04 2019-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 4, 2019

Dover Corporation

Dover Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-4018

|

|

53-0257888

|

|

(State or other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

3005 Highland Parkway

Downers Grove, Illinois

|

|

|

|

60515

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

(630) 541-1540

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock

|

|

DOV

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

See the information set forth in Item 2.03, which is incorporated by reference herein.

|

Item 1.02

|

Termination of a Material Definitive Agreement

|

See the information set forth in Item 2.03, which is incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

|

Replacing a similar existing credit facility with a remaining term of one year, on October 4, 2019, Dover Corporation (the “Company”) entered into a $1 billion five-year unsecured revolving credit facility with a syndicate of thirteen banks (the “Lenders”), pursuant to a Credit Agreement dated as of October 4, 2019 (the “Credit Agreement”) among the Company, the Lenders, the Borrowing Subsidiaries party thereto from time to time and JPMorgan Chase Bank, N.A. as Administrative Agent (the “Agent”). The commitments of the Lenders under the Credit Agreement may be increased by an additional aggregate amount of up to $500 million during the term of the Credit Agreement. The Credit Agreement replaced an existing $1 billion five-year unsecured credit facility pursuant to a credit agreement dated as of November 10, 2015 for which JPMorgan Chase Bank, N.A. was administrative agent. The existing credit agreement was terminated by the Company upon execution of the Credit Agreement.

The aggregate amount of the Lenders’ commitments under the Credit Agreement is the same as the aggregate commitment amount under the prior facility that it replaced. The Credit Agreement is intended to be used primarily as liquidity back-up for the Company’s commercial paper program. Letters of credit are also available under the Credit Agreement, subject to a $250 million subcap. The currencies available are the US Dollar, Euro, Sterling, Canadian Dollars, and Swedish Kronor.

The Lenders’ commitments under the Credit Agreement will terminate on October 4, 2024 (the “Maturity Date”). The Company may ratably reduce from time to time or terminate the Lenders’ commitments under the Credit Agreement. Any such termination or reduction of the commitments will be permanent. In the event of a drawdown under the Credit Agreement, the outstanding principal balance of all such drawings will be due on the Maturity Date. However, if any event of default under the Credit Agreement, as described further below, has occurred and is continuing, the Lenders may accelerate and declare all of the Company’s obligations under the Credit Agreement due and payable, may require all outstanding letters of credit to be secured by cash collateral, and may terminate the commitments.

Certain subsidiaries of the Company who agree to become parties to the Credit Agreement are also entitled to draw funds and have letters of credit issued under the Credit Agreement and are termed Borrowing Subsidiaries. The obligations of the Borrowing Subsidiaries in respect of their borrowings are guaranteed by the Company. As of the date hereof, there are no Borrowing Subsidiaries.

The Company may elect to have loans under the Credit Agreement bear interest at a rate based on a benchmark interbank offered screen rate (specified for each currency) and, in the case of US Dollars, an Alternate Base Rate (as defined in the Credit Agreement) based on a prime rate. In each case, a specified applicable margin is added to the rate, ranging from 0.805% to 1.20%, set on the bases of the credit rating given to the Company’s senior unsecured debt by S&P and Moody’s.

The screen rates are as follows: for US dollars loans, LIBOR; for Sterling loans, LIBOR; for Euros loans, EURIBOR; for Canadian Dollars loans, CDOR; for Swedish Kronor loans, STIBOR. As noted above, the Company may also select the Alternate Base Rate as the base interest for the US dollars loans. The Company will also pay a facility fee with a rate ranging from 0.070% to 0.175% (set on the basis of the rating accorded the Company’s senior unsecured debt by S&P and Moody’s) on the total amount of the commitments.

If the Agent determines that (a) the screen rate used to set the interest rate applicable to any loan is not ascertainable or does not adequately and fairly reflect the cost of making or maintaining such loans and such circumstances are unlikely to be temporary, (b) the supervisor for the administrator of the applicable screen rate has made a public statement that the administrator of the applicable screen rate is insolvent (and there is no successor administrator that will continue publication of the applicable screen rate), (c) the supervisor for the administrator or the administrator of the applicable screen rate has made a public statement identifying a specific date after which the applicable screen rate will permanently or indefinitely cease to be published or (d) the supervisor for the administrator of the applicable screen rate or a governmental authority having jurisdiction over the Agent has made a public statement identifying a specific date after which the applicable screen rate may no longer be used for determining interest rates for loans denominated in the applicable currency, then the Agent and the Company will endeavor to establish an alternate rate of interest to the applicable screen rate for such currency that gives due consideration to the then prevailing market convention in the United States for determining a rate of interest for syndicated loans denominated in the applicable currency at such time. The Agent and the Company will enter into an amendment to the Credit Agreement to reflect such alternate rate of interest and any applicable related changes to the Credit Agreement. Such amendment will become effective so long as the Agent does not receive a written notice of objection to the amendment from the Lenders with a majority of the outstanding commitments and exposure within ten business days of the Lenders’ receipt of the amendment.

Interest on loans under the Credit Agreement that accrues at a rate based on a screen rate will be due and payable on the last day of the applicable interest period (the period commencing on the date the loan is made or the last day of the preceding interest period and ending one, two (other than for an EURIBOR loan), three or six months thereafter, as the Company or Borrowing Subsidiary may elect) or, if an interest period is in excess of three months, each day prior to the last day of such interest period that occurs at intervals of three months after the first day thereof. Interest on loans that accrues at the Alternate Base Rate will be due and payable on the last day of each of March, June, September, and December. The principal balance of loans and any accrued and unpaid interest will be due and payable in full on the Maturity Date or, if earlier, the date on which all of the Company’s obligations are accelerated.

Up to US $250 million under the Credit Agreement will be available for the issuance of letters of credit. The face amount of outstanding letters of credit (and any unpaid drawing in respect thereof) will reduce availability under the Credit Agreement on a dollar-for-dollar basis. A letter of credit fee will accrue and be payable on the daily aggregate face amount of outstanding letters of credit, payable in arrears at the end of each quarter and upon termination of the Credit Agreement. The per annum rate at which the letter of credit fee will accrue is the Applicable Rate for LIBOR-based loans. No letter of credit may extend past five days prior to the Maturity Date.

The Credit Agreement imposes various restrictions on the Company that are substantially similar to those in the replaced facility, including usual and customary limitations on the ability of the Company or any of its subsidiaries to grant liens upon their assets, a prohibition on certain consolidations, mergers and sales and transfers of assets by the Company and limitations on changes in the existing lines of business of the Company and the Borrowing Subsidiaries without the consent of the Lenders. In addition, the Company must maintain a minimum interest coverage ratio of EBITDA to consolidated net interest expense of not less than 3.00:1.00. The Credit Agreement includes usual and customary events of default for facilities of this nature (with specified grace periods in certain cases) and provides that, upon the occurrence and continuation of an event of default, payment of all amounts payable under the Credit Agreement may be accelerated, require letters of credit to be secured by cash collateral, and/or the Lenders’ commitments may be terminated. In addition, upon the occurrence of certain insolvency or bankruptcy related events of default, all amounts payable under the Credit Agreement will automatically become immediately due and payable, the letters of credit will be required to be secured by cash collateral, and the Lenders’ commitments will automatically terminate.

The Company has customary corporate and commercial banking relationships with the Lenders and the Agent.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the full text of the Credit Agreement, which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.03.

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: October 10, 2019

|

|

|

|

DOVER CORPORATION

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Ivonne M. Cabrera

|

|

|

|

|

|

|

|

Ivonne M. Cabrera

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel & Secretary

|

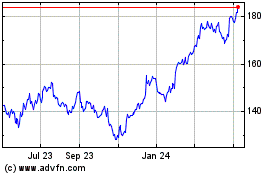

Dover (NYSE:DOV)

Historical Stock Chart

From Aug 2024 to Sep 2024

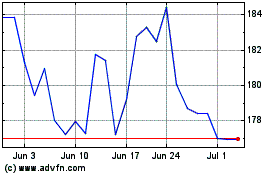

Dover (NYSE:DOV)

Historical Stock Chart

From Sep 2023 to Sep 2024