3D Systems Corporation (NYSE: DDD) announced today its financial

results for the second quarter ended June 30, 2019.

For the second quarter of 2019, the company reported GAAP

revenue of $157.3 million, compared to $176.6 million in the second

quarter of the previous year. The company reported a GAAP loss of

$0.21 per share in the second quarter of 2019 compared to a GAAP

loss of $0.08 per share in the second quarter of 2018, and non-GAAP

earnings of $0.00 per share in the second quarter of 2019 compared

to $0.06 per share in the second quarter of 2018.

"We continue to see strength in customer demand for our core and

new products and solutions, but as expected, year over year revenue

growth was impacted by ordering patterns of a large enterprise

customer, the delay in shipping Factory metals systems as we

complete technical enhancements and weaker macro-economic

conditions in some areas of our market," commented Vyomesh Joshi

("VJ"), president and chief executive officer, 3D Systems.

The company reported 46.4 percent higher printer unit sales,

driven by sales of the Figure 4 platform. Printer revenue decreased

27.4 percent compared to the second quarter of the prior year

driven by year over year timing of large enterprise customer orders

and the softer macro industrial environment. Excluding the impact

of the large enterprise customer's order patterns, healthcare

solutions revenue increased 11.4 percent in the second quarter

compared to the prior year. During the second quarter, materials

revenue decreased 8.5 percent, on demand services decreased 12.4

percent and software decreased 0.5 percent compared to the second

quarter of the prior year.

The company reported GAAP gross profit margin of 46.6 percent

for the second quarter of 2019, a decrease of 220 basis points

compared to the second quarter of 2018. Non-GAAP gross profit

margin was 47.4 percent in the second quarter of 2019 compared to

48.9 percent in the second quarter of the prior year.

For the second quarter of 2019, GAAP operating expenses

decreased 1.5 percent to $92.5 million compared to $93.9 million in

the prior year period. GAAP SG&A expenses increased 0.7 percent

to $71.7 million, including a $3.5 million dollar litigation

settlement during the second quarter of 2019. GAAP R&D expenses

decreased 8.4 percent from the second quarter of the prior year to

$20.8 million. The company continues to execute its cost reduction

plans, and as a result of these actions, non-GAAP operating

expenses decreased 9.3 percent to $71.7 million compared to $79.0

million in the second quarter of 2018.

"I am pleased with the progress we are making on our cost

structure, and we will continue to be laser focused on additional

reduction opportunities in the second half of the year," continued

Joshi.

The company generated $18.7 million of cash from operations

during the quarter and had $150.4 million of unrestricted cash on

hand at June 30, 2019. Cash generation during the second

quarter was driven by improvements in working capital, including

planned reductions of inventory.

"We remain confident in our broad portfolio of additive

capabilities, workflow solutions and overall market opportunities;

and we remain keenly focused on executing on our strategy, reducing

costs and driving long-term profitable growth," concluded

Joshi.

Q2 2019 Conference Call and WebcastThe company

expects to file its Form 10-Q for the quarter ended June 30,

2019 with the Securities and Exchange Commission on August 7,

2019. 3D Systems plans to hold a conference call and simultaneous

webcast to discuss these results on Wednesday, August 7, 2019,

at 4:30 p.m. Eastern Time.

Date: Wednesday, August 7, 2019Time: 4:30 p.m. Eastern

TimeListen via Internet: www.3dsystems.com/investorParticipate via

telephone:Within the U.S.: 1-877-407-8291Outside the

U.S.: 1-201-689-8345

A replay of the webcast will be available approximately two

hours after the live presentation at

www.3dsystems.com/investor.

Forward-Looking StatementsCertain statements

made in this release that are not statements of historical or

current facts are forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance or achievements of the company to be materially

different from historical results or from any future results or

projections expressed or implied by such forward-looking

statements. In many cases, forward looking statements can be

identified by terms such as “believes,” “belief,” “expects,” “may,”

“will,” “estimates,” “intends,” “anticipates” or “plans” or the

negative of these terms or other comparable terminology.

Forward-looking statements are based upon management’s beliefs,

assumptions and current expectations and may include comments as to

the company’s beliefs and expectations as to future events and

trends affecting its business and are necessarily subject to

uncertainties, many of which are outside the control of the

company. The factors described under the headings

“Forward-Looking Statements” and “Risk Factors” in the company’s

periodic filings with the Securities and Exchange Commission, as

well as other factors, could cause actual results to differ

materially from those reflected or predicted in forward-looking

statements. Although management believes that the expectations

reflected in the forward-looking statements are reasonable,

forward-looking statements are not, and should not be relied upon

as a guarantee of future performance or results, nor will they

necessarily prove to be accurate indications of the times at which

such performance or results will be achieved. The forward-looking

statements included are made only as the date of the statement. 3D

Systems undertakes no obligation to update or review any

forward-looking statements made by management or on its behalf,

whether as a result of future developments, subsequent events or

circumstances or otherwise.

Presentation of Information in This Press

ReleaseTo facilitate a better understanding of the impact

that strategic acquisitions, non-recurring charges and certain

non-cash expenses had on its financial results, the company

reported non-GAAP measures excluding the impact of amortization of

intangibles, non-cash interest expense, acquisition and severance

expenses, stock-based compensation expense, litigation settlements

and charges related to strategic decisions and portfolio

realignment. A reconciliation of GAAP to non-GAAP results is

provided in the accompanying schedule.

About 3D Systems3D Systems provides

comprehensive 3D products and services, including 3D printers,

print materials, on-demand manufacturing services and digital

design tools. Its ecosystem supports advanced applications from the

product design shop to the factory floor to the operating room. 3D

Systems’ precision healthcare capabilities include simulation,

Virtual Surgical Planning, and printing of medical and

dental devices as well as patient-specific surgical

instruments. As the originator of 3D printing and a shaper of

future 3D solutions, 3D Systems has spent its 30 year history

enabling professionals and companies to optimize their designs,

transform their workflows, bring innovative products to market and

drive new business models.

More information on the company is available

at www.3dsystems.com

Tables Follow

3D Systems

CorporationUnaudited Condensed Consolidated

Balance SheetsJune 30, 2019 and December 31,

2018

| (in thousands, except

par value) |

June 30,2019 |

|

December 31,2018 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

150,397 |

|

|

$ |

109,998 |

|

|

Accounts receivable, net of reserves — $8,509 (2019) and $8,423

(2018) |

114,093 |

|

|

126,618 |

|

|

Inventories |

133,936 |

|

|

133,161 |

|

|

Prepaid expenses and other current assets |

29,471 |

|

|

27,697 |

|

|

Total current assets |

427,897 |

|

|

397,474 |

|

| Property and equipment, net

(1) |

97,664 |

|

|

103,252 |

|

| Intangible assets, net |

57,267 |

|

|

68,275 |

|

| Goodwill |

222,293 |

|

|

221,334 |

|

| Right of use assets (1) |

37,626 |

|

|

4,466 |

|

| Deferred income tax asset |

5,420 |

|

|

4,217 |

|

| Other assets, net |

29,384 |

|

|

26,814 |

|

|

Total assets |

$ |

877,551 |

|

|

$ |

825,832 |

|

|

LIABILITIES AND EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current portion of long term debt |

$ |

4,050 |

|

|

$ |

— |

|

|

Current right of use liabilities (1) |

11,451 |

|

|

654 |

|

|

Accounts payable |

59,197 |

|

|

66,722 |

|

|

Accrued and other liabilities |

59,730 |

|

|

59,265 |

|

|

Customer deposits |

4,882 |

|

|

4,987 |

|

|

Deferred revenue |

41,690 |

|

|

32,432 |

|

|

Total current liabilities |

181,000 |

|

|

164,060 |

|

| Long-term debt |

75,378 |

|

|

25,000 |

|

| Long-term right of use

liabilities (1) |

35,273 |

|

|

6,392 |

|

| Deferred income tax

liability |

6,541 |

|

|

6,190 |

|

| Other liabilities |

42,041 |

|

|

39,331 |

|

|

Total liabilities |

340,233 |

|

|

240,973 |

|

| Redeemable noncontrolling

interests |

8,872 |

|

|

8,872 |

|

| Commitments and contingencies

(Note 13) |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value, authorized 220,000 shares; issued

120,506 (2019) and 118,650 (2018) |

120 |

|

|

117 |

|

|

Additional paid-in capital |

1,361,569 |

|

|

1,355,503 |

|

|

Treasury stock, at cost — 3,182 shares (2019) and 2,946 shares

(2018) |

(16,519 |

) |

|

(15,572 |

) |

|

Accumulated deficit |

(771,025 |

) |

|

(722,701 |

) |

|

Accumulated other comprehensive loss |

(37,313 |

) |

|

(38,978 |

) |

|

Total 3D Systems Corporation stockholders' equity |

536,832 |

|

|

578,369 |

|

| Noncontrolling interests |

(8,386 |

) |

|

(2,382 |

) |

|

Total stockholders’ equity |

528,446 |

|

|

575,987 |

|

| Total liabilities, redeemable

noncontrolling interests and stockholders’ equity |

$ |

877,551 |

|

|

$ |

825,832 |

|

(1) For comparative purposes, prior year finance

lease assets have been reclassified from "Property and equipment,

net" to "Right of use assets". Prior year finance lease liabilities

have been reclassified as right of use liabilities.

3D Systems

CorporationUnaudited Condensed Consolidated

Statements of OperationsQuarter and Six Months

Ended June 30, 2019 and 2018

| |

Quarter Ended June 30, |

|

Six Months Ended June 30, |

| (in thousands, except

per share amounts) |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Revenue: |

|

|

|

|

|

|

|

|

Products |

$ |

93,758 |

|

|

$ |

110,785 |

|

|

$ |

186,105 |

|

|

$ |

216,231 |

|

|

Services |

63,514 |

|

|

65,783 |

|

|

123,147 |

|

|

126,206 |

|

|

Total revenue |

157,272 |

|

|

176,568 |

|

|

309,252 |

|

|

342,437 |

|

| Cost of sales: |

|

|

|

|

|

|

|

|

Products |

53,005 |

|

|

57,500 |

|

|

108,765 |

|

|

113,618 |

|

|

Services |

30,968 |

|

|

32,906 |

|

|

61,483 |

|

|

64,788 |

|

|

Total cost of sales |

83,973 |

|

|

90,406 |

|

|

170,248 |

|

|

178,406 |

|

| Gross profit |

73,299 |

|

|

86,162 |

|

|

139,004 |

|

|

164,031 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

71,654 |

|

|

71,172 |

|

|

136,982 |

|

|

140,625 |

|

|

Research and development |

20,811 |

|

|

22,712 |

|

|

42,714 |

|

|

48,594 |

|

| Total operating expenses |

92,465 |

|

|

93,884 |

|

|

179,475 |

|

|

189,219 |

|

| Loss from operations |

(19,166 |

) |

|

(7,722 |

) |

|

(40,471 |

) |

|

(25,188 |

) |

| Interest and other (expense)

income, net |

(2,755 |

) |

|

1,661 |

|

|

(3,957 |

) |

|

108 |

|

| Loss before income taxes |

(21,921 |

) |

|

(6,061 |

) |

|

(44,428 |

) |

|

(25,080 |

) |

| Provision for income

taxes |

(1,938 |

) |

|

(2,539 |

) |

|

(3,782 |

) |

|

(4,493 |

) |

| Net loss |

(23,859 |

) |

|

(8,600 |

) |

|

(48,210 |

) |

|

(29,573 |

) |

| Less: net income attributable

to noncontrolling interests |

70 |

|

|

262 |

|

|

114 |

|

|

246 |

|

| Net loss attributable to 3D

Systems Corporation |

$ |

(23,929 |

) |

|

$ |

(8,862 |

) |

|

$ |

(48,324 |

) |

|

$ |

(29,819 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share available

to 3D Systems Corporation common stockholders - basic and

diluted |

$ |

(0.21 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3D Systems

CorporationUnaudited Condensed Consolidated

Statements of Cash FlowsSix Months Ended June 30,

2019 and 2018

| |

Six Months Ended June 30, |

| (in

thousands) |

2019 |

|

2018 |

|

Cash flows from operating activities: |

|

|

|

|

Net loss |

$ |

(48,210 |

) |

|

$ |

(29,573 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

26,574 |

|

|

29,948 |

|

|

Stock-based compensation |

13,592 |

|

|

13,734 |

|

|

Lower of cost or market adjustment |

— |

|

|

— |

|

|

Provision for bad debts |

1,169 |

|

|

1,356 |

|

|

Loss on the disposition of property, equipment and other

assets |

1,103 |

|

|

— |

|

|

Provision for deferred income taxes |

(852 |

) |

|

(2,287 |

) |

|

Impairment of assets |

1,728 |

|

|

1,411 |

|

|

Changes in operating accounts: |

|

|

|

|

Accounts receivable |

11,213 |

|

|

(3,384 |

) |

|

Inventories |

(3,124 |

) |

|

(14,937 |

) |

|

Prepaid expenses and other current assets |

(1,494 |

) |

|

(6,739 |

) |

|

Accounts payable |

(7,560 |

) |

|

2,762 |

|

|

Deferred revenue and customer deposits |

9,300 |

|

|

4,268 |

|

|

Accrued and other current liabilities |

(2,333 |

) |

|

14,940 |

|

|

All other operating activities |

2,445 |

|

|

(2,328 |

) |

|

Net cash provided by operating activities |

3,551 |

|

|

9,171 |

|

|

Cash flows from investing activities: |

|

|

|

|

Purchases of property and equipment |

(14,353 |

) |

|

(18,095 |

) |

|

Other investing activities |

105 |

|

|

(514 |

) |

|

Net cash used in investing activities |

(14,248 |

) |

|

(18,609 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Proceeds from borrowings |

100,000 |

|

|

— |

|

|

Repayment of borrowings/long term debt |

(45,000 |

) |

|

— |

|

|

Purchase of noncontrolling interest |

(2,500 |

) |

|

— |

|

|

Payments on earnout consideration |

— |

|

|

(2,675 |

) |

|

Other financing activities |

(1,898 |

) |

|

(2,148 |

) |

|

Net cash provided by (used in) financing activities |

50,602 |

|

|

(4,823 |

) |

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

517 |

|

|

(2,502 |

) |

|

Net increase (decrease) in cash, cash equivalents and restricted

cash |

40,422 |

|

|

(16,763 |

) |

|

Cash, cash equivalents and restricted cash at the beginning of the

period (a) |

110,919 |

|

|

136,831 |

|

|

Cash, cash equivalents and restricted cash at the end of the period

(a) |

$ |

151,341 |

|

|

$ |

120,068 |

|

- The amounts for cash and cash equivalents shown above include

restricted cash of $944 and $755 as of June 30, 2019 and 2018,

respectively, and $921 and $487 as of December 31, 2017, and

2016, respectively, which were included in other assets, net in the

condensed consolidated balance sheets.

3D Systems

CorporationSchedule 1Loss Per

ShareQuarter and Six Months Ended June 30, 2019

and 2018

| |

Quarter Ended June 30, |

|

Six Months Ended June 30, |

| (in thousands, except

per share amounts) |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Numerator for basic and

diluted net loss per share: |

|

|

|

|

|

|

|

|

Net loss attributable to 3D Systems Corporation |

$ |

(23,929 |

) |

|

$ |

(8,862 |

) |

|

$ |

(48,324 |

) |

|

$ |

(29,819 |

) |

| |

|

|

|

|

|

|

|

| Denominator for basic and

diluted net loss per share: |

|

|

|

|

|

|

|

| Weighted average shares |

113,433 |

|

|

111,920 |

|

|

113,350 |

|

|

111,870 |

|

| |

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

$ |

(0.21 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3D Systems

CorporationSchedule 2Unaudited

Reconciliations of GAAP to Non-GAAP

MeasuresQuarter and Six Months Ended June 30, 2019

and 2018

| |

Quarter Ended June 30, |

|

Six Months Ended June 30, |

| (in millions, except

per share amounts) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

GAAP Net loss attributable to 3D Systems Corporation |

$ |

(23.9 |

) |

|

$ |

(8.9 |

) |

|

$ |

(48.3 |

) |

|

$ |

(29.8 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Amortization, stock-based compensation & other 1 |

12.6 |

|

|

14.5 |

|

|

24.8 |

|

|

29.6 |

|

|

Legal, acquisition and divestiture related 2 |

6.8 |

|

|

(0.4 |

) |

|

7.2 |

|

|

— |

|

|

Cost optimization plan, including severance costs 3 |

3.9 |

|

|

1.0 |

|

|

5.6 |

|

|

1.6 |

|

|

Impairment of cost-method investments 4 |

— |

|

|

— |

|

|

— |

|

|

1.4 |

|

| Non-GAAP net income

attributable to 3D Systems Corporation |

$ |

(0.6 |

) |

|

$ |

6.2 |

|

|

$ |

(10.7 |

) |

|

$ |

2.8 |

|

| Non-GAAP net income per share

available to 3D Systems common stock holders - basic and diluted

5 |

$ |

— |

|

|

$ |

0.06 |

|

|

$ |

(0.09 |

) |

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

1 For the quarter ended June 30, 2019, the adjustment included

$0.1 in COGS and $12.5 in SG&A. For the quarter ended June 30,

2018, the adjustment included $0.1 in COGS and $14.4 in SG&A.

For the six months ended June 30, 2019, the adjustment included

$0.2 in COGS and $24.6 in SG&A. For the six months ended June

30, 2018, the adjustment included $0.2 in COGS and $29.4 in

SG&A.2 For the quarter ended June 30, 2019, the adjustment

included $(0.9) in Revenues, $1.4 in COGS, $4.6 in SG&A and

$1.8 in other income (expense). For the quarter ended June 30,

2018, the adjustment included $(0.4) in COGS. For the six months

ended June 30, 2019, the adjustment included $(2.7) in Revenues,

$3.3 in COGS, $5.3 in SG&A, and $1.3 in other income

(expense).3 For the quarter ended June 30, 2019, the adjustment

included $0.3 in COGS, $3.3 in SG&A and $0.3 in R&D. For

the quarter ended June 30, 2018, the adjustment included $0.2 in

COGS, $0.7 in SG&A and $0.1 in R&D. For the six months

ended June 30, 2019, the adjustment included $0.8 in COGS, $4.6 in

SG&A and $0.3 in R&D. For the six months ended June 30,

2018, the adjustment included $0.3 in COGS, $1.1 in SG&A and

$0.2 in R&D.4 For the quarter and six months ended June

30, 2018, the adjustment included $0.0 and $1.4 in interest and

other income (expense), net. No impairment was recorded in 2019.5

Denominator based on weighted average shares used in the GAAP EPS

calculation.

* Tables may not foot due to rounding; amounts calculated based

on dollars in thousands.

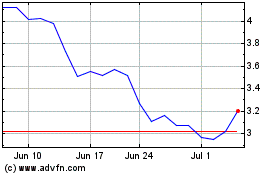

3D Systems (NYSE:DDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

3D Systems (NYSE:DDD)

Historical Stock Chart

From Apr 2023 to Apr 2024