Current Report Filing (8-k)

March 22 2023 - 6:01AM

Edgar (US Regulatory)

DIEBOLD NIXDORF, Inc false 0000028823 0000028823 2023-03-21 2023-03-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 21, 2023

Diebold Nixdorf, Incorporated

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Ohio |

|

1-4879 |

|

34-0183970 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

|

|

|

50 Executive Parkway, P.O. Box 2520

Hudson, OH |

|

44236 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (330) 490-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common shares, $1.25 par value per share |

|

DBD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On March 21, 2023 (the “Closing Date”), Diebold Nixdorf, Incorporated (the “Company”) and certain of its subsidiaries entered into an amendment and limited waiver (the “Amendment”) to the Revolving Credit and Guaranty Agreement (as amended, restated, supplemented or otherwise modified from time to time, the “ABL Credit Agreement”), among the Company, JPMorgan Chase Bank, N.A., as administrative agent and collateral agent, GLAS AMERICAS LLC, as European collateral agent, the subsidiary borrowers (together with the Company, the “ABL Borrowers”) and guarantors party thereto and the lenders party thereto.

The Amendment provides for an additional tranche (the “FILO Tranche”) of commitments under the ABL Credit Agreement consisting of a senior secured “last out” term loan facility (the “FILO Facility”). Commitments under the FILO Facility were $55 million and were borrowed in full and cancelled on the Closing Date. Proceeds of the loans made under the FILO Facility will be used to finance the ongoing working capital requirements of the Company and its subsidiaries and for other general corporate purposes.

The FILO Facility will mature on June 4, 2023. Loans under the FILO Facility bear interest determined by reference to, at the Company’s option, either (x) adjusted term SOFR plus a margin of 8.00% or (y) an alternative base rate plus a margin of 7.00%. On the Closing Date the Company paid an upfront fee to the lenders providing the FILO Facility, which fee was capitalized and added to the outstanding balance under the FILO Facility. The obligations of the Company under the FILO Facility benefit from the same guarantees and security as the existing obligations under the ABL Credit Agreement.

Pursuant to the Amendment, among other things, for a 75-day period ending on June 4, 2023 (the “Waiver Period”), the Company will be permitted to maintain outstanding borrowings and letters of credit in excess of its then-current borrowing base in an amount not to exceed $233.8 million (inclusive of amounts outstanding under the FILO Facility but before giving effect to any payment in kind of interest or fees added thereto). During the Waiver Period, the Company will not be permitted to borrow any additional amounts under the ABL Credit Agreement and must maintain an actual borrowing base of at least $140 million. In addition, during the Waiver Period, the Company will not be required to comply with certain reporting provisions required by the ABL Credit Agreement.

The description above is only a summary of the material provisions of the Amendment and is qualified in its entirety by reference to the Amendment, which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Diebold Nixdorf, Incorporated |

|

|

|

|

| Date: March 21, 2023 |

|

|

|

By: |

|

/s/ Jonathan B. Leiken |

|

|

|

|

|

|

Jonathan B. Leiken |

|

|

|

|

|

|

Executive Vice President, Chief Legal Officer and Secretary |

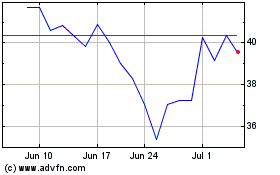

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

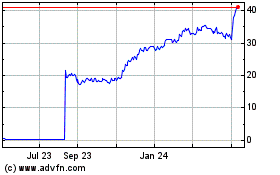

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024