Q1false0001070985--12-31MDTNOctober 31, 2028October 31, 2028October 31, 2027April 30, 2026April 30, 2029January 31, 2040October 31, 2028January 31, 20400001070985cxw:IdleFacilitiesMember2024-01-012024-03-310001070985cxw:SafetySegmentMembercxw:IdledNonCoreFacilitiesMember2024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001070985us-gaap:OperatingSegmentsMembercxw:CommunitySegmentMember2023-01-012023-03-310001070985cxw:PropertiesSegmentMember2023-12-310001070985cxw:MarionAdjustmentCenterMember2024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2024-03-310001070985cxw:SafetySegmentMembercxw:IdledNonCoreFacilitiesMember2024-01-012024-03-310001070985us-gaap:MaterialReconcilingItemsMember2024-01-012024-03-310001070985cxw:BankCreditFacilityMember2023-10-112023-10-110001070985us-gaap:OperatingSegmentsMember2023-01-012023-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2023-12-310001070985srt:MaximumMember2022-08-020001070985cxw:MidwestRegionalReceptionCenterMember2023-12-310001070985cxw:EmployeesAndNonEmployeeDirectorsMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001070985us-gaap:RestrictedStockMember2023-01-012023-12-310001070985cxw:BankCreditAgreementMembercxw:TermLoanMember2023-10-110001070985srt:MaximumMember2022-08-022022-08-020001070985us-gaap:RestrictedStockMemberus-gaap:OperatingExpenseMember2024-01-012024-03-310001070985cxw:MarionAdjustmentCenterMember2023-12-310001070985cxw:IdleFacilitiesMembercxw:CommunitySegmentMember2024-03-310001070985us-gaap:CorporateAndOtherMember2024-03-310001070985cxw:BankCreditFacilityMemberus-gaap:SubsequentEventMember2024-04-012024-06-300001070985us-gaap:RestrictedStockMember2023-01-012023-03-310001070985us-gaap:RestrictedStockMembercxw:EmployeeMemberus-gaap:OperatingExpenseMember2024-01-012024-03-310001070985cxw:IdleFacilitiesMember2023-01-012023-03-310001070985cxw:IdleFacilitiesMember2023-12-3100010709852022-01-012022-12-310001070985cxw:FacilityInColoradoAndCorecivicCommunitySegmentMember2024-01-012024-03-310001070985us-gaap:CommonStockMember2023-03-310001070985cxw:ShareRepurchaseProgramMember2024-03-310001070985cxw:CommunitySegmentMember2023-01-012023-03-310001070985cxw:SafetySegmentMember2023-01-012023-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2024-03-122024-03-120001070985us-gaap:RestrictedStockMember2024-01-012024-03-310001070985cxw:BankCreditFacilityMember2023-10-110001070985cxw:LansingCorrectionalCenterNonRecourseMortgageNoteFourPointFourThreePercentDueTwentyFortyMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2024-01-012024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2023-12-310001070985us-gaap:OperatingSegmentsMembercxw:SafetySegmentMember2024-01-012024-03-310001070985cxw:PreviousRevolvingCreditFacilityMember2023-10-100001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2024-03-310001070985cxw:EmployeesAndNonEmployeeDirectorsMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2024-01-012024-03-310001070985us-gaap:RestrictedStockMemberus-gaap:OperatingExpenseMember2023-01-012023-03-310001070985us-gaap:RetainedEarningsMember2023-12-310001070985cxw:WestTennesseeDetentionFacilityMember2023-12-310001070985us-gaap:OperatingSegmentsMembercxw:PropertiesSegmentMember2023-01-012023-03-310001070985us-gaap:CommonStockMember2024-03-310001070985us-gaap:OperatingSegmentsMembercxw:SafetySegmentMember2023-01-012023-03-3100010709852023-01-012023-03-310001070985cxw:SafetySegmentMember2023-12-310001070985cxw:BankCreditFacilityMembersrt:MinimumMember2023-10-112023-10-1100010709852024-01-012024-03-310001070985cxw:IdleFacilitiesMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2021-04-140001070985us-gaap:BaseRateMembercxw:BankCreditFacilityMemberus-gaap:SubsequentEventMember2024-04-012024-06-300001070985cxw:SeniorNotesFourPointSeventyFivePercentDueTwentyTwentySevenMember2017-10-012017-10-310001070985us-gaap:OperatingSegmentsMembercxw:CommunitySegmentMember2024-01-012024-03-310001070985us-gaap:PrivatePlacementMembercxw:NonRecourseSeniorSecuredNotesMember2024-03-310001070985cxw:SeniorNotesFourPointSeventyFivePercentDueTwentyTwentySevenMember2023-12-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2022-12-310001070985cxw:DiamondbackCorrectionalFacilityMember2023-12-310001070985cxw:BankCreditFacilityMembercxw:BloombergShortTermBankYieldIndexMember2023-10-102023-10-100001070985cxw:LansingCorrectionalCenterNonRecourseMortgageNoteFourPointFourThreePercentDueTwentyFortyMember2023-12-310001070985cxw:CommunitySegmentMember2023-12-310001070985cxw:ThreeCommunityCorrectionsFacilitiesAndOneVacantParcelOfLandMember2023-01-012023-12-310001070985cxw:IdledCorrectionalFacilitiesMember2024-01-012024-03-310001070985cxw:SecuredOvernightFinancingRateMembercxw:BankCreditFacilityMember2023-10-112023-10-110001070985cxw:SeniorNotesEightPointTwoFivePercentMember2023-12-310001070985us-gaap:RestrictedStockMembercxw:NonEmployeeDirectorsMember2024-01-012024-03-310001070985us-gaap:RevolvingCreditFacilityMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2021-12-310001070985cxw:SafetySegmentMember2024-03-310001070985cxw:RevolvingCreditFacilityDueInOctoberTwentyTwentyEightMember2024-03-310001070985cxw:SecuredOvernightFinancingRateMembercxw:BankCreditFacilityMemberus-gaap:SubsequentEventMember2024-04-012024-06-300001070985cxw:SeniornotesfourpointseventyfivepercentMember2023-12-310001070985us-gaap:PrivatePlacementMembercxw:NonRecourseSeniorSecuredNotesMember2018-04-192018-04-200001070985cxw:ThreeCommunityCorrectionsFacilitiesAndOneVacantParcelOfLandMember2023-12-310001070985us-gaap:PrivatePlacementMembercxw:NonRecourseSeniorSecuredNotesMember2018-04-200001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-120001070985cxw:WestTennesseeDetentionFacilityMember2024-03-310001070985cxw:EmployeesAndNonEmployeeDirectorsMemberus-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001070985cxw:PropertiesSegmentMember2024-01-012024-03-310001070985cxw:OtherEmployeesMemberus-gaap:RestrictedStockMember2024-01-012024-03-310001070985cxw:UnusedParcelOfLandInTexasMember2024-03-310001070985us-gaap:RetainedEarningsMember2023-03-310001070985cxw:CommunitySegmentMember2024-03-310001070985us-gaap:DebtInstrumentRedemptionPeriodThreeMembercxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2024-01-012024-03-310001070985us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2024-01-012024-03-310001070985cxw:TwoThousandTwentyTwoAndTwoThousandTwentyThreeMembercxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-310001070985cxw:PropertiesSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001070985cxw:KitCarsonCorrectionalCenterMember2024-03-3100010709852022-05-122023-12-3100010709852022-12-3100010709852023-12-310001070985us-gaap:RetainedEarningsMember2024-03-310001070985us-gaap:BaseRateMembercxw:BankCreditFacilityMembersrt:MinimumMember2023-10-112023-10-110001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-01-012024-03-310001070985srt:MaximumMembercxw:BankCreditFacilityMember2023-10-112023-10-110001070985cxw:EmployeesAndNonEmployeeDirectorsMemberus-gaap:RestrictedStockMember2024-01-012024-03-310001070985cxw:HuerfanoCountyCorrectionalCenterMember2023-12-310001070985cxw:LansingCorrectionalCenterNonRecourseMortgageNoteFourPointFourThreePercentDueTwentyFortyMember2024-01-012024-03-3100010709852024-05-030001070985cxw:IdleFacilitiesMembercxw:CommunitySegmentMember2024-01-012024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-040001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-150001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2023-12-310001070985us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockMember2023-01-012023-03-310001070985us-gaap:RevolvingCreditFacilityMember2023-10-110001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentMember2024-03-120001070985us-gaap:CorporateAndOtherMember2023-01-012023-03-310001070985us-gaap:BaseRateMembercxw:BankCreditFacilityMember2023-10-112023-10-110001070985us-gaap:OperatingSegmentsMember2024-01-012024-03-310001070985us-gaap:CorporateAndOtherMember2023-12-310001070985cxw:ShareRepurchaseProgramMember2022-05-122024-03-310001070985cxw:NorthForkCorrectionalFacilityMember2023-12-310001070985cxw:RevolvingCreditFacilityDueInOctoberTwentyTwentyEightMember2023-12-310001070985cxw:FacilityInColoradoAndCorecivicCommunitySegmentMember2024-03-310001070985cxw:SeniorNotesFourPointSeventyFivePercentDueTwentyTwentySevenMember2024-03-310001070985cxw:PropertiesSegmentMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2024-03-122024-03-120001070985us-gaap:RetainedEarningsMember2023-01-012023-03-310001070985cxw:TermLoanDueInOctoberTwentyTwentyEightMember2024-03-310001070985cxw:PrairieCorrectionalFacilityMember2024-03-310001070985cxw:BankCreditFacilityMember2023-10-102023-10-100001070985cxw:TermLoanDueInOctoberTwentyTwentyEightMember2024-01-012024-03-310001070985cxw:PropertiesSegmentMember2023-01-012023-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-01-012024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2022-12-310001070985cxw:TermLoanMember2024-03-310001070985cxw:NorthForkCorrectionalFacilityMember2024-03-310001070985cxw:HuerfanoCountyCorrectionalCenterMember2024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMemberus-gaap:SubsequentEventMember2024-04-152024-04-150001070985us-gaap:RestrictedStockMembercxw:OfficersAndExecutiveOfficersMember2024-01-012024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2023-03-310001070985us-gaap:CommonStockMember2024-01-012024-03-310001070985cxw:CommunitySegmentMember2024-01-012024-03-310001070985cxw:SecuredOvernightFinancingRateMembercxw:BankCreditFacilityMembersrt:MinimumMember2023-10-112023-10-110001070985cxw:UnusedParcelOfLandInTexasMember2024-01-012024-03-310001070985us-gaap:CommonStockMember2022-12-310001070985cxw:UnitedStatesMarshalsServiceMemberus-gaap:GovernmentContractsConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001070985us-gaap:CommonStockMember2023-01-012023-03-310001070985us-gaap:RestrictedStockMemberus-gaap:OperatingExpenseMembercxw:EmployeeMember2023-01-012023-12-310001070985us-gaap:RestrictedStockMembersrt:MinimumMember2024-01-012024-03-310001070985us-gaap:BaseRateMembercxw:BankCreditFacilityMember2023-10-102023-10-1000010709852022-05-120001070985us-gaap:CommonStockMember2023-12-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2021-04-300001070985cxw:DiamondbackCorrectionalFacilityMember2024-03-310001070985us-gaap:CorporateAndOtherMember2024-01-012024-03-310001070985cxw:SeniorNotesFourPointSeventyFivePercentDueTwentyTwentySevenMember2017-10-310001070985cxw:MidwestRegionalReceptionCenterMember2024-03-3100010709852023-03-310001070985us-gaap:RevolvingCreditFacilityMembercxw:RevolvingCreditFacilityDueInOctoberTwentyTwentyEightMember2024-01-012024-03-310001070985cxw:PrairieCorrectionalFacilityMember2023-12-310001070985cxw:SeniorNotesEightPointTwoFivePercentMember2024-03-040001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentySixMember2021-04-012021-04-3000010709852024-03-310001070985srt:MaximumMembercxw:SecuredOvernightFinancingRateMembercxw:BankCreditFacilityMember2023-10-112023-10-110001070985srt:MaximumMemberus-gaap:RestrictedStockMember2024-01-012024-03-310001070985us-gaap:RetainedEarningsMember2024-01-012024-03-310001070985us-gaap:BaseRateMembersrt:MaximumMembercxw:BankCreditFacilityMember2023-10-112023-10-110001070985cxw:TermLoanDueInOctoberTwentyTwentyEightMember2023-12-310001070985us-gaap:MaterialReconcilingItemsMember2023-01-012023-03-310001070985cxw:SafetySegmentMember2024-01-012024-03-310001070985cxw:SeniorNotesEightPointTwoFivePercentDueTwentyTwentyNineMember2024-03-120001070985cxw:SeniorNotesFourPointSeventyFivePercentDueTwentyTwentySevenMember2024-01-012024-03-310001070985cxw:UnitedStatesMarshalsServiceMemberus-gaap:GovernmentContractsConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-310001070985us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001070985us-gaap:RetainedEarningsMember2022-12-310001070985cxw:KitCarsonCorrectionalCenterMember2023-12-31xbrli:purecxw:Segmentcxw:Facilityxbrli:sharescxw:Bedcxw:Propertyiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED: MARCH 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-16109

CORECIVIC, INC.

(Exact name of registrant as specified in its charter)

|

|

MARYLAND |

62-1763875 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

5501 VIRGINIA WAY BRENTWOOD, TENNESSEE |

37027 (Zip Code) |

(Address of principal executive offices) |

|

(615) 263-3000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

CXW |

New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

|

|

|

|

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each class of Common Stock as of May 3, 2024:

Shares of Common Stock, $0.01 par value per share: 111,256,728 shares outstanding.

CORECIVIC, INC.

FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

INDEX

PART I – FINANCIAL INFORMATION

ITEM 1. – FINANCIAL STATEMENTS.

CORECIVIC, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

ASSETS |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Cash and cash equivalents |

|

$ |

111,399 |

|

|

$ |

121,845 |

|

Restricted cash |

|

|

7,978 |

|

|

|

7,111 |

|

Accounts receivable, net of credit loss reserve of $6,349 and $6,827, respectively |

|

|

274,311 |

|

|

|

312,174 |

|

Prepaid expenses and other current assets |

|

|

32,612 |

|

|

|

26,304 |

|

Assets held for sale |

|

|

— |

|

|

|

7,480 |

|

Total current assets |

|

|

426,300 |

|

|

|

474,914 |

|

Real estate and related assets: |

|

|

|

|

|

|

Property and equipment, net of accumulated depreciation of $1,846,456

and $1,821,015, respectively |

|

|

2,095,606 |

|

|

|

2,114,522 |

|

Other real estate assets |

|

|

199,248 |

|

|

|

201,561 |

|

Goodwill |

|

|

4,844 |

|

|

|

4,844 |

|

Other assets |

|

|

301,360 |

|

|

|

309,558 |

|

Total assets |

|

$ |

3,027,358 |

|

|

$ |

3,105,399 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

254,066 |

|

|

$ |

285,857 |

|

Current portion of long-term debt |

|

|

110,487 |

|

|

|

11,597 |

|

Total current liabilities |

|

|

364,553 |

|

|

|

297,454 |

|

Long-term debt, net |

|

|

984,085 |

|

|

|

1,083,476 |

|

Deferred revenue |

|

|

17,761 |

|

|

|

18,315 |

|

Non-current deferred tax liabilities |

|

|

91,799 |

|

|

|

96,915 |

|

Other liabilities |

|

|

125,237 |

|

|

|

131,673 |

|

Total liabilities |

|

|

1,583,435 |

|

|

|

1,627,833 |

|

Commitments and contingencies |

|

|

|

|

|

|

Preferred stock – $0.01 par value; 50,000 shares authorized; none issued and outstanding

at March 31, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

Common stock – $0.01 par value; 300,000 shares authorized; 111,568 and 112,733

shares issued and outstanding at March 31, 2024 and December 31, 2023,

respectively |

|

|

1,116 |

|

|

|

1,127 |

|

Additional paid-in capital |

|

|

1,742,111 |

|

|

|

1,785,286 |

|

Accumulated deficit |

|

|

(299,304 |

) |

|

|

(308,847 |

) |

Total stockholders' equity |

|

|

1,443,923 |

|

|

|

1,477,566 |

|

Total liabilities and stockholders' equity |

|

$ |

3,027,358 |

|

|

$ |

3,105,399 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CORECIVIC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED AND AMOUNTS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

REVENUE |

|

$ |

500,686 |

|

|

$ |

458,002 |

|

EXPENSES: |

|

|

|

|

|

|

Operating |

|

|

378,103 |

|

|

|

354,537 |

|

General and administrative |

|

|

36,465 |

|

|

|

32,679 |

|

Depreciation and amortization |

|

|

31,730 |

|

|

|

31,042 |

|

|

|

|

446,298 |

|

|

|

418,258 |

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

Interest expense, net |

|

|

(18,613 |

) |

|

|

(19,151 |

) |

Expenses associated with debt repayments

and refinancing transactions |

|

|

(27,242 |

) |

|

|

— |

|

Gain on sale of real estate assets, net |

|

|

568 |

|

|

|

— |

|

Other expense |

|

|

(58 |

) |

|

|

(47 |

) |

INCOME BEFORE INCOME TAXES |

|

|

9,043 |

|

|

|

20,546 |

|

Income tax benefit (expense) |

|

|

500 |

|

|

|

(8,146 |

) |

NET INCOME |

|

$ |

9,543 |

|

|

$ |

12,400 |

|

BASIC EARNINGS PER SHARE |

|

$ |

0.08 |

|

|

$ |

0.11 |

|

DILUTED EARNINGS PER SHARE |

|

$ |

0.08 |

|

|

$ |

0.11 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CORECIVIC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED AND AMOUNTS IN THOUSANDS)

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income |

|

$ |

9,543 |

|

|

$ |

12,400 |

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

31,730 |

|

|

|

31,042 |

|

Amortization of debt issuance costs and other non-cash interest |

|

|

974 |

|

|

|

1,198 |

|

Expenses associated with debt repayments and refinancing

transactions |

|

|

27,242 |

|

|

|

— |

|

Gain on sale of real estate assets, net |

|

|

(568 |

) |

|

|

— |

|

Deferred income taxes |

|

|

(5,116 |

) |

|

|

1,565 |

|

Non-cash revenue and other income |

|

|

(696 |

) |

|

|

(695 |

) |

Non-cash equity compensation |

|

|

6,081 |

|

|

|

4,884 |

|

Other expenses and non-cash items |

|

|

1,847 |

|

|

|

1,842 |

|

Changes in assets and liabilities, net: |

|

|

|

|

|

|

Accounts receivable, prepaid expenses and other assets |

|

|

30,720 |

|

|

|

60,720 |

|

Accounts payable, accrued expenses and other liabilities |

|

|

(31,403 |

) |

|

|

(23,128 |

) |

Net cash provided by operating activities |

|

|

70,354 |

|

|

|

89,828 |

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Expenditures for facility development and expansions |

|

|

(3,558 |

) |

|

|

(2,380 |

) |

Expenditures for other capital improvements |

|

|

(8,524 |

) |

|

|

(6,815 |

) |

Net proceeds from sale of assets |

|

|

8,243 |

|

|

|

59 |

|

Decrease (increase) in other assets |

|

|

86 |

|

|

|

(1,371 |

) |

Net cash used in investing activities |

|

|

(3,753 |

) |

|

|

(10,507 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of debt and borrowings from credit facility |

|

|

500,000 |

|

|

|

70,000 |

|

Scheduled principal repayments |

|

|

(2,836 |

) |

|

|

(2,412 |

) |

Principal repayments of credit facility |

|

|

— |

|

|

|

(60,000 |

) |

Other repayments of debt |

|

|

(494,339 |

) |

|

|

(153,754 |

) |

Payment of debt defeasance, issuance and other refinancing and related costs |

|

|

(29,865 |

) |

|

|

(35 |

) |

Payment of lease obligations for financing leases |

|

|

(150 |

) |

|

|

(146 |

) |

Dividends paid on restricted stock units |

|

|

(20 |

) |

|

|

(131 |

) |

Purchase and retirement of common stock |

|

|

(48,970 |

) |

|

|

(29,832 |

) |

Net cash used in financing activities |

|

|

(76,180 |

) |

|

|

(176,310 |

) |

NET DECREASE IN CASH, CASH EQUIVALENTS AND

RESTRICTED CASH |

|

|

(9,579 |

) |

|

|

(96,989 |

) |

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, beginning of period |

|

|

128,956 |

|

|

|

162,165 |

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, end of period |

|

$ |

119,377 |

|

|

$ |

65,176 |

|

NON-CASH INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

Establishment of right of use assets and lease liabilities |

|

$ |

— |

|

|

$ |

224 |

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

Interest |

|

$ |

22,324 |

|

|

$ |

6,333 |

|

Income taxes (refunded) paid |

|

$ |

(96 |

) |

|

$ |

200 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CORECIVIC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

(UNAUDITED AND AMOUNTS IN THOUSANDS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|

|

Common Stock |

|

|

Paid-in |

|

|

Accumulated |

|

|

Stockholders' |

|

|

|

Shares |

|

|

Par Value |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

Balance as of December 31, 2023 |

|

|

112,733 |

|

|

$ |

1,127 |

|

|

$ |

1,785,286 |

|

|

$ |

(308,847 |

) |

|

$ |

1,477,566 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,543 |

|

|

|

9,543 |

|

Retirement of common stock |

|

|

(3,381 |

) |

|

|

(33 |

) |

|

|

(49,234 |

) |

|

|

— |

|

|

|

(49,267 |

) |

Restricted stock compensation, net of forfeitures |

|

|

— |

|

|

|

— |

|

|

|

6,081 |

|

|

|

— |

|

|

|

6,081 |

|

Restricted stock grants |

|

|

2,216 |

|

|

|

22 |

|

|

|

(22 |

) |

|

|

— |

|

|

|

— |

|

Balance as of March 31, 2024 |

|

|

111,568 |

|

|

$ |

1,116 |

|

|

$ |

1,742,111 |

|

|

$ |

(299,304 |

) |

|

$ |

1,443,923 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CORECIVIC, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2023

(UNAUDITED AND AMOUNTS IN THOUSANDS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|

|

Common Stock |

|

|

Paid-in |

|

|

Accumulated |

|

|

Stockholders' |

|

|

|

Shares |

|

|

Par Value |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

Balance as of December 31, 2022 |

|

|

114,988 |

|

|

$ |

1,150 |

|

|

$ |

1,807,689 |

|

|

$ |

(376,431 |

) |

|

$ |

1,432,408 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

12,400 |

|

|

|

12,400 |

|

Retirement of common stock |

|

|

(2,980 |

) |

|

|

(30 |

) |

|

|

(29,924 |

) |

|

|

— |

|

|

|

(29,954 |

) |

Dividends on RSUs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6 |

) |

|

|

(6 |

) |

Restricted stock compensation, net of forfeitures |

|

|

— |

|

|

|

— |

|

|

|

4,884 |

|

|

|

— |

|

|

|

4,884 |

|

Restricted stock grants |

|

|

1,677 |

|

|

|

17 |

|

|

|

(17 |

) |

|

|

— |

|

|

|

— |

|

Balance as of March 31, 2023 |

|

|

113,685 |

|

|

$ |

1,137 |

|

|

$ |

1,782,632 |

|

|

$ |

(364,037 |

) |

|

$ |

1,419,732 |

|

The accompanying notes are an integral part of these consolidated financial statements.

CORECIVIC, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

MARCH 31, 2024

1.ORGANIZATION AND OPERATIONS

CoreCivic, Inc. (together with its subsidiaries, the "Company" or "CoreCivic") is the nation's largest owner of partnership correctional, detention, and residential reentry facilities and one of the largest prison operators in the United States ("U.S."). Through three segments, CoreCivic Safety, CoreCivic Community, and CoreCivic Properties, the Company provides a broad range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America's recidivism crisis, and government real estate solutions. As of March 31, 2024, through its CoreCivic Safety segment, the Company operated 43 correctional and detention facilities, 39 of which the Company owned, with a total design capacity of approximately 65,000 beds. Through its CoreCivic Community segment, the Company operated 23 residential reentry centers with a total design capacity of approximately 5,000 beds. In addition, through its CoreCivic Properties segment, the Company owned 6 properties, with a total design capacity of approximately 10,000 beds.

In addition to providing fundamental residential services, CoreCivic's correctional, detention, and reentry facilities offer a variety of rehabilitation and educational programs, including basic education, faith-based services, life skills and employment training, and substance abuse treatment. These services are intended to help reduce recidivism and to prepare offenders for their successful reentry into society upon their release. CoreCivic also provides or makes available to offenders certain health care (including medical, dental, and mental health services), food services, and work and recreational programs.

2.BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited interim consolidated financial statements have been prepared by the Company and, in the opinion of management, reflect all normal recurring adjustments necessary for a fair presentation of results for the unaudited interim periods presented. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been condensed or omitted. The results of operations for the interim period are not necessarily indicative of the results to be obtained for the full fiscal year. Reference is made to the audited financial statements of CoreCivic included in its Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (the "SEC") on February 20, 2024 (the "2023 Form 10-K") with respect to certain significant accounting and financial reporting policies as well as other pertinent information of the Company.

Risks and Uncertainties

On January 26, 2021, President Biden issued the Executive Order on Reforming Our Incarceration System to Eliminate the Use of Privately Operated Criminal Detention Facilities ("Private Prison EO"). The Private Prison EO directs the Attorney General to not renew United States Department of Justice ("DOJ") contracts with privately operated criminal detention facilities. The United States Marshals Service ("USMS") is an agency of the DOJ that utilizes CoreCivic's facilities and services, and accounted for 20% and 21% of CoreCivic's total revenue for the three months ended March 31, 2024 and the twelve months ended December 31, 2023, respectively. Another federal agency that utilizes CoreCivic's facilities and services, U.S. Immigration and Customs Enforcement ("ICE"), is not covered by the Private Prison EO, as ICE is an agency of the Department of Homeland Security ("DHS"), not the DOJ.

CoreCivic currently has two detention facilities that have direct contracts with the USMS. Because of the lack of alternative bed capacity, one of the contracts was renewed upon its expiration in September 2023 and now expires in September 2028. The second direct contract with the USMS expires in September 2025. It is too early to predict the outcome of the expiration of the contract scheduled to expire in September 2025, and future developments could occur prior to the scheduled expiration date.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No 2023-07, "Improvements to Reportable Segment Disclosures (Topic 280)" ("ASU 2023-07"). ASU 2023-07 updates reportable segment disclosure requirements by requiring disclosures of significant reportable segment expenses that are regularly provided to the Chief Operating Decision Maker ("CODM") and included within each reported measure of a segment's profit or loss. ASU 2023-07 also requires disclosure of the title and position of the individual identified as the CODM and an explanation of how the CODM uses the reported measures of a segment's profit or loss in assessing segment performance and deciding how to allocate resources. ASU 2023-07 is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Adoption of ASU 2023-07 should be applied retrospectively to all prior periods presented in the financial statements. Early adoption is also permitted. The Company is currently evaluating the impact of adopting ASU 2023-07 and expects to adopt it for the year ending December 31, 2024, including any additional required disclosures.

In December 2023, the FASB issued ASU No. 2023-09, "Improvements to Income Tax Disclosures (Topic 740)" ("ASU 2023-09"). ASU 2023-09 requires disaggregated information about a reporting entity's effective tax rate reconciliation as well as additional information on income taxes paid. ASU 2023-09 is effective on a prospective basis for annual periods beginning after December 15, 2024. Early adoption is also permitted for annual financial statements that have not yet been issued or made available for issuance. ASU 2023-09 will result in the required additional disclosures being included in the Company's consolidated financial statements, once adopted. The Company is currently evaluating the impact of adopting ASU 2023-09 and expects to adopt it for the year ending December 31, 2025, including any additional required disclosures.

In March 2024, the SEC adopted final rules designed to enhance public company disclosures related to the risks and impacts of climate-related matters (the "Climate Disclosure Rules"). The Climate Disclosure Rules include disclosures relating to climate-related risks and risk management as well as the board and management's governance of such risks. In addition, the Climate Disclosure Rules include requirements to disclose, in the audited consolidated financial statements, the financial effects of severe weather events and other natural conditions meeting certain thresholds, as well as carbon offsets and renewable energy credits. Larger registrants, including CoreCivic, will also be required to disclose information about greenhouse gas emissions, which will be subject to a phased-in assurance requirement. Applicability of the Climate Disclosure Rules begins for CoreCivic for the fiscal year ending December 31, 2025. On April 4, 2024, the SEC announced that it would stay the Climate Disclosure Rules as it faces legal challenges regarding implementation of such rules. The Company is currently assessing the impact of these rules on the Company's consolidated financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the American Institute of Certified Public Accountants and the SEC applicable to financial statements beginning January 1, 2024 or later did not, or are not expected to, have a material effect on the Company's results of operations or financial position.

Fair Value of Financial Instruments

To meet the reporting requirements of Accounting Standards Codification ("ASC") 825, "Financial Instruments", regarding fair value of financial instruments, CoreCivic calculates the estimated fair value of financial instruments using market interest rates, quoted market prices of similar instruments, or discounted cash flow techniques with observable Level 1 inputs for publicly traded debt and Level 2 inputs for all other financial instruments, as defined in ASC 820, "Fair Value Measurement". At March 31, 2024 and December 31, 2023, there were no material differences between the carrying amounts and the estimated fair values of CoreCivic's financial instruments, other than as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

Carrying

Amount |

|

|

Fair Value |

|

|

Carrying

Amount |

|

|

Fair Value |

|

Note receivable from Agecroft Prison Management, LTD |

|

$ |

2,861 |

|

|

$ |

3,034 |

|

|

$ |

2,886 |

|

|

$ |

3,061 |

|

Debt |

|

$ |

(1,109,516 |

) |

|

$ |

(1,111,845 |

) |

|

$ |

(1,106,691 |

) |

|

$ |

(1,090,326 |

) |

3.REAL ESTATE TRANSACTIONS

Assets Held For Sale and Dispositions

In January 2024, CoreCivic completed the sale of a facility in Colorado and reported in its CoreCivic Community segment. The sale generated net sales proceeds of $8.0 million, resulting in a gain on sale of $0.5 million reported in the first quarter of 2024. The facility was classified as held for sale as of December 31, 2023. CoreCivic will continue to operate the facility through the expiration of the current management contract in June 2024. In addition, in March 2024, CoreCivic completed the sale of an unused parcel of land in Texas. The sale generated net sales proceeds of $0.2 million, resulting in a gain on sale of $0.1 million also reported in the first quarter of 2024.

During the full year 2023, CoreCivic completed the sales of three community corrections facilities leased to government agencies and reported in CoreCivic's Properties segment and one vacant parcel of land. The sales of these four assets generated aggregate net sales proceeds of $10.8 million, resulting in an aggregate net gain on sale of $0.8 million after transaction costs.

Idle Facilities

As of March 31, 2024, CoreCivic had eight idle correctional facilities that are currently available and being actively marketed as solutions to meet the needs of potential customers. The following table summarizes each of the idled facilities and their respective design capacities, carrying values, excluding equipment and other assets that could generally be transferred and used at other facilities CoreCivic owns without significant cost (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Carrying Values |

|

|

|

Design |

|

|

March 31, |

|

|

December 31, |

|

Facility |

|

Capacity |

|

|

2024 |

|

|

2023 |

|

Prairie Correctional Facility |

|

|

1,600 |

|

|

$ |

13,019 |

|

|

$ |

13,230 |

|

Huerfano County Correctional Center |

|

|

752 |

|

|

|

14,148 |

|

|

|

14,058 |

|

Diamondback Correctional Facility |

|

|

2,160 |

|

|

|

33,312 |

|

|

|

33,764 |

|

Marion Adjustment Center |

|

|

826 |

|

|

|

10,054 |

|

|

|

9,968 |

|

Kit Carson Correctional Center |

|

|

1,488 |

|

|

|

47,643 |

|

|

|

47,638 |

|

West Tennessee Detention Facility |

|

|

600 |

|

|

|

18,321 |

|

|

|

18,568 |

|

Midwest Regional Reception Center |

|

|

1,033 |

|

|

|

49,466 |

|

|

|

49,736 |

|

North Fork Correctional Facility |

|

|

2,400 |

|

|

|

59,352 |

|

|

|

60,044 |

|

|

|

|

10,859 |

|

|

$ |

245,315 |

|

|

$ |

247,006 |

|

As of March 31, 2024, CoreCivic also had one idled non-core facility in its Safety segment containing 240 beds with a net book value of $2.8 million, and two idled facilities in its Community segment, containing an aggregate of 450 beds with an aggregate net book value of $3.3 million. CoreCivic incurred operating expenses at these idled facilities of approximately $3.5 million and $2.9 million during the period they were idle for the three months ended March 31, 2024 and 2023, respectively.

On December 6, 2022, the Company received notice from the California Department of Corrections and Rehabilitation ("CDCR") of its intent to terminate the lease agreement for the Company's 2,560-bed California City Correctional Center by March 31, 2024, due to the state's declining inmate population. The California City facility was idled effective April 1, 2024, and the Company is marketing the facility to potential customers.

The Company estimated undiscounted cash flows for each facility with an impairment indicator, including the idle facilities described above. The Company's estimated undiscounted cash flows reflect the Company’s most recent expectations around potential utilization and/or sale of the facilities and projected cash flows based on historical cash flows, cash flows of comparable facilities, and recent contract negotiations for utilization, as applicable. The Company concluded that the estimated undiscounted cash flows exceeded carrying values for each facility as of March 31, 2024 and December 31, 2023.

CoreCivic evaluates, on a quarterly basis, market developments for the potential utilization of each of its idle properties in order to identify events that may cause CoreCivic to reconsider its assumptions with respect to the recoverability of book values as compared to undiscounted cash flows. CoreCivic considers the cancellation of a contract in its Safety or Community segment or an expiration and non-renewal of a lease agreement in its CoreCivic Properties segment as indicators of impairment and tests each of the idled properties for impairment when it is notified by the respective customers or tenants that they would no longer be utilizing such property.

Debt outstanding as of March 31, 2024 and December 31, 2023 consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Revolving Credit Facility maturing October 2028. Interest

payable periodically at variable interest rates. |

|

$ |

— |

|

|

$ |

— |

|

Term Loan maturing October 2028. Interest payable

periodically at variable interest rates. The rate at

March 31, 2024 and December 31, 2023 was 8.7%.

Unamortized debt issuance costs amounted to $1.4 million and

$1.5 million at March 31, 2024 and December 31, 2023, respectively. |

|

|

123,437 |

|

|

|

125,000 |

|

4.75% Senior Notes maturing October 2027. Unamortized debt

issuance costs amounted to $1.4 million and $1.5 million at

March 31, 2024 and December 31, 2023, respectively. |

|

|

243,068 |

|

|

|

243,068 |

|

8.25% Senior Notes maturing April 2026. Unamortized debt

issuance costs amounted to $5.8 million at December 31, 2023.

The 8.25% Senior Notes were redeemed on April 15, 2024, as

further described below. |

|

|

98,774 |

|

|

|

593,113 |

|

8.25% Senior Notes maturing April 2029. Unamortized debt

issuance costs amounted to $9.6 million at March 31, 2024. |

|

|

500,000 |

|

|

|

— |

|

4.43% Lansing Correctional Facility Non-Recourse Mortgage

Note maturing January 2040. Unamortized debt issuance

costs amounted to $2.5 million and $2.6 million at

March 31, 2024 and December 31, 2023, respectively. |

|

|

144,237 |

|

|

|

145,510 |

|

Total debt |

|

|

1,109,516 |

|

|

|

1,106,691 |

|

Unamortized debt issuance costs |

|

|

(14,944 |

) |

|

|

(12,052 |

) |

Net unamortized original issue premium |

|

|

— |

|

|

|

434 |

|

Current portion of long-term debt |

|

|

(110,487 |

) |

|

|

(11,597 |

) |

Long-term debt, net |

|

$ |

984,085 |

|

|

$ |

1,083,476 |

|

Bank Credit Facility. On October 11, 2023, CoreCivic entered into a Fourth Amended and Restated Credit Agreement (referred to herein as the "Bank Credit Facility") in an aggregate principal amount of $400.0 million, consisting of a $125.0 million term loan (the "Term Loan") and a revolving credit facility with a borrowing capacity of $275.0 million (the "Revolving Credit Facility"). The Bank Credit Facility has a maturity of October 2028. The Bank Credit Facility includes an option to increase the availability under the Revolving Credit Facility and to request additional term loans from the lenders in an aggregate amount not to exceed the greater of (a) $200.0 million and (b) 50% of consolidated EBITDA for the most recently ended four-quarter period, subject to, among other things, the receipt of commitments for the increased amount. At CoreCivic's option, interest on outstanding borrowings under the Bank Credit Facility is based on either a base rate plus a margin ranging from 1.75% to 3.5% based upon the Company’s then-current total leverage ratio, or at Term SOFR (as defined in the Bank Credit Facility), which is a forward-looking term rate based on the Secured Overnight Financing Rate ("SOFR") plus a margin ranging from 2.75% to 4.5% based on the Company’s then-current total leverage ratio. The Revolving Credit Facility includes a $25.0 million sublimit for swing line loans that enables CoreCivic to borrow at the base rate plus the applicable margin from the Administrative Agent (as defined in the Bank Credit Facility) on same-day notice.

Based on the Company's total leverage ratio, interest on loans under the previous bank credit facility through October 10, 2023, was at a base rate plus a margin of 2.25% or at the Bloomberg Short-Term Bank Yield ("BSBY") plus a margin of 3.25%, and a commitment fee equal to 0.45% of the unfunded balance of the then-existing revolving credit facility, which had a borrowing capacity of $250.0 million. Since October 11, 2023, loans under the Bank Credit Facility bore interest at a base rate plus a margin of 2.25% or at Term SOFR plus a margin of 3.25%, and a commitment fee equal to 0.45% of the unfunded balance of the Revolving Credit Facility, as the interest rate spreads were fixed under the terms of the Bank Credit Facility until the first calculation date occurring after the first full fiscal quarter after the closing date of the Bank Credit Facility. Based on the Company's total leverage ratio at March 31, 2024, during the second quarter of 2024 the interest rate spread for base rate loans will decline to 2.00%, the interest rate spread for Term SOFR loans will reduce to 3.00%, and the commitment fee will decrease to 0.40%. The Revolving Credit Facility also has a $100.0 million sublimit for the issuance of standby letters of credit. As of March 31, 2024, CoreCivic had no borrowings outstanding under the Revolving Credit Facility. As of March 31, 2024, CoreCivic had $18.0 million in letters of credit outstanding resulting in $257.0 million available under the Revolving Credit Facility. The Term Loan, which had an outstanding principal balance of $123.4 million as of March 31, 2024, requires scheduled quarterly principal payments through October 2028, and is pre-payable without penalty.

The Bank Credit Facility requires CoreCivic to meet certain financial covenants, including, without limitation, a total leverage ratio of not more than 4.50 to 1.00, a secured leverage ratio of not more than 2.50 to 1.00, and a fixed charge coverage ratio of not less than 1.75 to 1.00. As of March 31, 2024, CoreCivic was in compliance with all such covenants. The Bank Credit Facility is secured by a pledge of all of the capital stock (or other ownership interests) of CoreCivic's domestic restricted subsidiaries, 65% of the capital stock (or other ownership interests) of CoreCivic's "first-tier" foreign subsidiaries, all of the accounts receivable of the Company and its domestic restricted subsidiaries, and substantially all of the deposit accounts of the Company and its domestic restricted subsidiaries. In the event that (a) the consolidated total leverage equals or exceeds 4.25 to 1.00 or (b) the Company incurs certain debt above a specified threshold, each known as a "springing lien" event, certain intangible assets and unencumbered real estate assets that meet a 50% loan-to-value requirement are required to be added as collateral. In addition, the Bank Credit Facility contains certain covenants that, among other things, limit the incurrence of additional indebtedness, payment of dividends and other customary restricted payments, permitted investments, transactions with affiliates, asset sales, mergers and consolidations, liquidations, prepayments and modifications of other indebtedness, liens and other encumbrances and other matters customarily restricted in such agreements, and in each case subject to customary carveouts. The Bank Credit Facility is subject to cross-default provisions with respect to the terms of certain of CoreCivic's other material indebtedness and is subject to acceleration upon the occurrence of a change of control.

Senior Notes. Interest on the $243.1 million remaining aggregate principal amount of CoreCivic's 4.75% senior unsecured notes issued in October 2017 with an original principal amount of $250.0 million (the "4.75% Senior Notes") accrues at the stated rate and is payable in April and October of each year. The 4.75% Senior Notes are scheduled to mature on October 15, 2027. During 2023, the Company purchased $6.9 million principal amount of the 4.75% Senior Notes through open market purchases, reducing the outstanding balance of the 4.75% Senior Notes to $243.1 million as of December 31, 2023. Interest on the $98.8 million remaining aggregate principal amount of CoreCivic's 8.25% senior unsecured notes issued in April and September 2021 with an original principal amount of $675.0 million (the "Old 8.25% Senior Notes") accrued at the stated rate and was payable in April and October of each year. The Old 8.25% Senior Notes were scheduled to mature on April 15, 2026. During 2022 and 2023, the Company purchased $81.9 million principal amount of the Old 8.25% Senior Notes through open market purchases reducing the outstanding balance of the Old 8.25% Senior Notes to $593.1 million.

On March 4, 2024, the Company commenced a cash tender offer (the "Tender Offer") for any and all of the $593.1 million outstanding principal amount of its outstanding Old 8.25% Senior Notes. As a result of the Tender Offer, $494.3 million aggregate principal amount of the Old 8.25% Senior Notes, or approximately 83.3% of the aggregate principal amount of the Old 8.25% Senior Notes outstanding, had been validly tendered and not validly withdrawn. The Company accepted for purchase and paid for all of the Old 8.25% Senior Notes that were validly tendered and not validly withdrawn. Holders of the Old 8.25% Senior Notes who validly tendered received in cash $1,043.75 per $1,000 principal amount of the Old 8.25% Senior Notes validly tendered, plus accrued and unpaid interest from the October 15, 2023 interest payment date for the Old 8.25% Senior Notes up to, but not including, the settlement date, March 12, 2024. On March 15, 2024, the Company announced that it delivered an irrevocable notice to the holders of all CoreCivic's Old 8.25% Senior Notes that had not been validly tendered or had been validly withdrawn in the Tender Offer, that CoreCivic had elected to redeem in full the Old 8.25% Senior Notes that remained outstanding on April 15, 2024. The remaining principal amount of the outstanding Old 8.25% Senior Notes, which amounted to $98.8 million, was redeemed on April 15, 2024, at a redemption price equal to 104.125% of the principal amount of the outstanding Old 8.25% Senior Notes, plus accrued and unpaid interest on such Old 8.25% Senior Notes to, but not including, April 15, 2024.

In connection with the Tender Offer, on March 12, 2024, the Company completed an underwritten registered public offering of $500.0 million aggregate principal amount of 8.25% senior unsecured notes due 2029 (the "New 8.25% Senior Notes"), which are guaranteed by all the Company's subsidiaries that guarantee the Bank Credit Facility, the 4.75% Senior Notes, and the Old 8.25% Senior Notes (until their repayment and satisfaction on April 15, 2024). The New 8.25% Senior Notes were offered pursuant to CoreCivic's shelf registration statement on Form S-3, which became effective upon filing with the SEC on March 4, 2024. The net proceeds from the issuance of the New 8.25% Senior Notes totaled approximately $490.3 million, after deducting underwriting discounts and offering expenses. The Company used the net proceeds from the offering of the New 8.25% Senior Notes, together with borrowings under the Revolving Credit Facility and cash on hand, to fund the Tender Offer, and to redeem the remaining outstanding balance of the Old 8.25% Senior Notes on April 15, 2024. CoreCivic recorded charges totaling $27.2 million during the first quarter of 2024 associated with the Tender Offer and redemption of the Old 8.25% Senior Notes, including the non-cash write-off of loan issuance costs and original issue premium.

The 4.75% Senior Notes, the New 8.25% Senior Notes, and the Old 8.25% Senior Notes (until their repayment and satisfaction on April 15, 2024) (collectively, the "Senior Notes") are senior unsecured obligations of the Company and are guaranteed by all of the Company's existing and future subsidiaries that guarantee the Bank Credit Facility. CoreCivic may redeem all or part of the 4.75% Senior Notes at any time prior to three months before their maturity date at a "make-whole" redemption price, plus accrued and unpaid interest thereon to, but not including, the redemption date. Thereafter, the 4.75% Senior Notes are redeemable at CoreCivic's option, in whole or in part, at a redemption price equal to 100% of the aggregate principal amount of the notes to be redeemed plus accrued and unpaid interest thereon to, but not including, the redemption date. The Company may redeem all or part of the New 8.25% Senior Notes at any time prior to April 15, 2026, in whole or in part, at a "make-whole" redemption price, plus accrued and unpaid interest thereon to, but not including, the redemption date. Thereafter, the New 8.25% Senior Notes are redeemable at CoreCivic's option, in whole or in part, at a redemption price expressed as a percentage of the principal amount thereof, which percentage is 104.125% beginning on April 15, 2026, 102.063% beginning on April 15, 2027, and 100% beginning on April 15, 2028, plus, in each such case, accrued and unpaid interest thereon to, but not including, the redemption date.

The indentures governing the Senior Notes contain certain customary covenants that, subject to certain exceptions and qualifications, restrict CoreCivic's ability to, among other things, create or permit to exist certain liens and consolidate, merge or transfer all or substantially all of CoreCivic's assets. In addition, if CoreCivic experiences specific kinds of changes in control, CoreCivic must offer to repurchase all or any portion of the Senior Notes. The offer price for the Senior Notes in connection with a change in control would be 101% of the aggregate principal amount of the notes repurchased plus accrued and unpaid interest, if any, on the notes repurchased to the date of purchase. The indenture related to the Old 8.25% Senior Notes (until their repayment and satisfaction on April 15, 2024) and the indenture related to the New 8.25% Senior Notes additionally limit CoreCivic's ability to incur indebtedness, make restricted payments and investments and prepay certain indebtedness. The Senior Notes are also subject to cross-default provisions with certain of CoreCivic's other indebtedness, which includes the Bank Credit Facility.

Lansing Correctional Facility Non-Recourse Mortgage Note. On April 20, 2018, CoreCivic of Kansas, LLC (the "Issuer"), a wholly-owned unrestricted subsidiary of the Company, priced $159.5 million in aggregate principal amount of non-recourse senior secured notes of the Issuer (the "Kansas Notes"), in a private placement pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended. The Kansas Notes have a yield to maturity of 4.43% and are scheduled to mature in January 2040, 20 years following completion of the project, which occurred in January 2020. Principal and interest on the Kansas Notes are payable in quarterly payments, which began in July 2020 and continue until maturity. CoreCivic may redeem all or part of the Kansas Notes at any time upon written notice of not less than 30 days and not more than 60 days prior to the date fixed for such prepayment, with a "make-whole" amount, together with interest on the Kansas Notes accrued to, but not including, the redemption date. Because the Issuer has been designated as an unrestricted subsidiary of the Company under terms of the Bank Credit Facility, the issuance and service of the Kansas Notes, and the revenues and expenses associated with the facility lease, do not impact the financial covenants associated with the Bank Credit Facility. As of March 31, 2024, the outstanding balance of the Kansas Notes was $144.2 million.

Debt Maturities. Scheduled principal payments as of March 31, 2024 for the remainder of 2024, the next five years, and thereafter were as follows (in thousands):

|

|

|

|

|

2024 (remainder) |

|

$ |

107,536 |

|

2025 |

|

|

12,073 |

|

2026 |

|

|

15,701 |

|

2027 |

|

|

262,423 |

|

2028 |

|

|

97,995 |

|

2029 |

|

|

507,985 |

|

Thereafter |

|

|

105,803 |

|

Total debt |

|

$ |

1,109,516 |

|

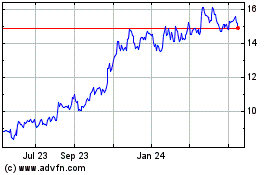

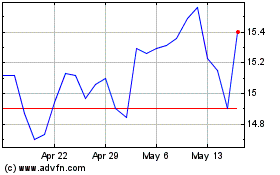

Share Repurchase Program

On May 12, 2022, the Company's Board of Directors ("BOD") approved a share repurchase program to repurchase up to $150.0 million of the Company's common stock. On August 2, 2022, the BOD increased the authorization to repurchase under the share repurchase program by up to an additional $75.0 million of the Company's common stock, or a total aggregate authorized amount to repurchase up to $225.0 million of the Company's common stock. Repurchases of the Company's outstanding common stock will be made in accordance with applicable securities laws and may be made at the Company's discretion based on parameters set by the BOD from time to time in the open market, through privately negotiated transactions, or otherwise. The share repurchase program has no time limit and does not obligate the Company to purchase any particular amount of its common stock. The authorization for the share repurchase program may be terminated, suspended, increased or decreased by the BOD in its discretion at any time. Through December 31, 2023, the Company repurchased 10.1 million shares of its common stock at a total cost of $112.6 million, excluding costs associated with the share repurchase program, or $11.16 per share. During the three months ended March 31, 2024, the Company repurchased 2.7 million shares of its common stock at a total cost of $39.4 million, excluding costs associated with the share repurchase program, or $14.52 per share. As of March 31, 2024, the Company had repurchased a total of 12.8 million common shares at an aggregate cost of approximately $152.0 million, or $11.87 per share, and had approximately $73.0 million of repurchase authorization available under the share repurchase program.

Restricted Stock Units

During the three months ended March 31, 2024, CoreCivic issued approximately 1.5 million restricted common stock units ("RSUs") to certain of its employees and non-employee directors, with an aggregate value of $23.0 million, including 1.4 million RSUs to employees and non-employee directors whose compensation is charged to general and administrative expense and 0.1 million RSUs to employees whose compensation is charged to operating expense. During the full year 2023, CoreCivic issued approximately 2.0 million RSUs to certain of its employees and non-employee directors, with an aggregate value of $22.3 million, including 1.8 million RSUs to employees and non-employee directors whose compensation is charged to general and administrative expense and 0.2 million RSUs to employees whose compensation is charged to operating expense.

CoreCivic has established performance-based vesting conditions on a portion of the RSUs awarded to its officers and executive officers that, unless earlier vested under the terms of the agreements, are subject to vesting over a three-year period based upon the satisfaction of certain annual performance criteria. The RSUs awarded to officers and executive officers in 2022, 2023 and 2024 consist of a combination of awards with performance-based conditions and time-based conditions. Unless earlier vested under the terms of the RSU agreements, the RSUs with time-based vesting conditions vest in equal amounts over three years on the later of (i) the anniversary date of the grant or (ii) the delivery of the audited financial statements by the Company's independent registered public accountant for the applicable fiscal year. The RSUs with performance-based vesting conditions are divided into one-third increments, each of which is subject to vesting based upon satisfaction of certain annual performance criteria established at the beginning of the fiscal years ending December 31, 2022, 2023, and 2024 for the 2022 awards, December 31, 2023, 2024, and 2025 for the 2023 awards, and December 31, 2024, 2025, and 2026 for the 2024 awards, and which can be increased up to 150% or decreased to 0% based on performance relative to the annual performance criteria, and further increased or decreased using a modifier of 80% to 120% based on CoreCivic's total shareholder return relative to a peer group. Because the performance criteria for the fiscal years ending December 31, 2025 and 2026 have not yet been established, the values of the third RSU increment of the 2023 awards and of the second and third increments of the 2024 awards for financial reporting purposes will not be determined until such criteria are established. A portion of the RSU award granted to CoreCivic's chief executive officer in 2024 contains a single performance-based vesting condition that results in full vesting on the later of (i) the second anniversary of the award or (ii) the delivery of the audited financial statements by the Company's independent registered public accountant for the fiscal year ending December 31, 2025, if the performance criteria is met for the year ending December 31, 2025, or no vesting if the performance criteria is not met for such year. Time-based RSUs issued to other employees, unless earlier vested under the terms of the agreements, generally vest in equal amounts over three years on the later of (i) the anniversary date of the grant or (ii) the delivery of the audited financial statements by the Company's independent registered public accountant for the applicable fiscal year. RSUs issued to non-employee directors generally vest one year from the date of award. As of March 31, 2024, approximately 3.3 million RSUs remained outstanding and subject to vesting.

During the three months ended March 31, 2024, CoreCivic expensed $6.1 million, net of forfeitures, relating to RSUs ($0.6 million of which was recorded in operating expenses and $5.5 million of which was recorded in general and administrative expenses). During the three months ended March 31, 2023, CoreCivic expensed $4.9 million, net of forfeitures, relating to RSUs ($0.5 million of which was recorded in operating expenses and $4.4 million of which was recorded in general and administrative expenses).

Basic earnings per share is computed by dividing net income by the weighted average number of common shares outstanding during the year. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity. For CoreCivic, diluted earnings per share is computed by dividing net income by the weighted average number of common shares after considering the additional dilution related to restricted stock-based awards.

A reconciliation of the numerator and denominator of the basic earnings per share computation to the numerator and denominator of the diluted earnings per share computation is as follows (in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

NUMERATOR |

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

Net income |

|

$ |

9,543 |

|

|

$ |

12,400 |

|

Diluted: |

|

|

|

|

|

|

Net income |

|

$ |

9,543 |

|

|

$ |

12,400 |

|

DENOMINATOR |

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

112,306 |

|

|

|

114,533 |

|

Diluted: |

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

112,306 |

|

|

|

114,533 |

|

Effect of dilutive securities: |

|

|

|

|

|

|

Restricted stock-based awards |

|

|

1,181 |

|

|

|

937 |

|

Weighted average shares and assumed conversions |

|

|

113,487 |

|

|

|

115,470 |

|

BASIC EARNINGS PER SHARE |

|

$ |

0.08 |

|

|

$ |

0.11 |

|

DILUTED EARNINGS PER SHARE |

|

$ |

0.08 |

|

|

$ |

0.11 |

|

7.COMMITMENTS AND CONTINGENCIES

Legal Proceedings

The nature of CoreCivic's business results in claims and litigation alleging that it is liable for damages arising from the conduct of its employees, offenders or others. The nature of such claims includes, but is not limited to, claims arising from employee or offender misconduct, medical malpractice, employment matters, property loss, contractual claims, including claims regarding compliance with contract performance requirements, and personal injury or other damages resulting from contact with CoreCivic's facilities, personnel or offenders, including damages arising from an offender's escape or from a disturbance at a facility. CoreCivic maintains insurance to cover many of these claims, which may mitigate the risk that any single claim would have a material effect on CoreCivic's consolidated financial position, results of operations, or cash flows, provided the claim is one for which coverage is available. The combination of self-insured retentions and deductible amounts means that, in the aggregate, CoreCivic is subject to self-insurance risk.

Based upon management's review of the potential claims and outstanding litigation, and based upon management's experience and history of estimating losses, and taking into consideration CoreCivic's self-insured retention amounts, management believes a loss in excess of amounts already recognized would not be material to CoreCivic's consolidated financial statements. Adversarial proceedings and litigation are, however, subject to inherent uncertainties, and unfavorable decisions and rulings resulting from legal proceedings could occur which could have a material impact on CoreCivic's consolidated financial position, results of operations, or cash flows for the period in which such decisions or rulings occur, or future periods. Expenses associated with legal proceedings may also fluctuate from quarter to quarter based on changes in CoreCivic's assumptions, new developments, or by the effectiveness of CoreCivic's litigation and settlement strategies.

CoreCivic records a liability in the consolidated financial statements for loss contingencies when a loss is known or considered probable, and the amount can be reasonably estimated. If the reasonable estimate of a known or probable loss is a range, and no amount within the range is a better estimate than any other, the minimum amount of the range is accrued. If a loss is reasonably possible but not known or probable, and can be reasonably estimated, the estimated loss or range of loss is disclosed. When determining the estimated loss or range of loss, significant judgment is required to estimate the amount and timing of a loss to be recorded. Any receivable for insurance recoveries is recorded separately from the corresponding litigation reserve, and only if recovery is determined to be probable and the amount of payment can be determined. CoreCivic does not accrue for anticipated legal fees and costs and expenses those items as incurred.

ICE Detainee Labor and Related Matters. On May 31, 2017, two former ICE detainees, who were detained at the Company's Otay Mesa Detention Center ("OMDC") in San Diego, California, filed a class action lawsuit against the Company in the United States District Court for the Southern District of California. The complaint alleged that the Company forces detainees to perform labor under threat of punishment in violation of state and federal anti-trafficking laws and that OMDC's Voluntary Work Program ("VWP") violates state labor laws including state minimum wage laws. ICE requires that CoreCivic offer and operate the VWP in conformance with ICE standards and ICE prescribes the minimum rate of pay for VWP participants. The Plaintiffs seek compensatory damages, exemplary damages, restitution, penalties, and interest as well as declaratory and injunctive relief on behalf of former and current detainees. On April 1, 2020, the district court certified a nationwide anti-trafficking claims class of former and current detainees who participated in an ICE VWP at a CoreCivic facility. It also certified a state law class of former and current detainees who participated in a VWP wherever the Company held ICE detainees in California. The Company has exhausted appeals of the class certification order. The claims resulting in certified classes will now proceed in the United States District Court for the Southern District of California, where the discovery process has commenced. A second California lawsuit concerning OMDC has been stayed pending the outcome of class proceedings in the first California case described above.

Due to the stage of the ongoing proceedings, the Company cannot reasonably predict the outcomes, nor can it estimate the amount of loss or range of loss, if any, that may result. As a result, the Company has not recorded an accrual relating to these matters at this time, as losses are not considered probable or reasonably estimable at this stage of these lawsuits.