ConocoPhillips to Halt Legal Action Against Venezuela's PdVSA--2nd Update

August 20 2018 - 5:19PM

Dow Jones News

By Kimberly Chin and Kejal Vyas

ConocoPhillips will halt further legal actions against the

troubled state-run energy giant Petroleós de Venezuela SA over an

unpaid $2 billion arbitration award after both sides agreed on a

payment plan.

The Venezuelan company, known as PdVSA, agreed to make initial

payments of about $500 million within 90 days following the closing

of the settlement, and make quarterly payments over the next 4 1/2

years in compensation for two oil projects that Venezuela's leftist

government nationalized in 2007, ConocoPhillips said Monday.

But analysts who track Venezuela said they still questioned its

capacity to make the payments. Roiled by a punishing economic

crisis, the South American country has already defaulted on some $6

billion in debt and its lifeblood oil industry is seeing production

drop precipitously due to what critics say is underinvestment and

rampant corruption.

"This buys Venezuela time," said Russ Dallen, managing partner

at the investment bank Caracas Capital Markets. "But, of course,

they just may default on it again."

There was no immediate response from PdVSA or the Information

Ministry in Caracas, where government offices were closed Monday

for a holiday.

A tribunal representing the Paris-based International Chamber of

Commerce handed ConocoPhillips the $2 billion arbitration award in

April. A month later, a series of court orders permitted the

Houston company to seize Venezuela's oil assets on Dutch Caribbean

islands.

The orders resulted in severe operational hurdles for PdVSA,

forcing its oil tankers to avoid its refining and storage

facilities in the Caribbean, whose deep-sea ports it relies on to

load large Asia-bound ships -- especially those going to China,

which receives Venezuelan crude as debt repayment.

But by settling with ConocoPhillips, Venezuela could regain

access to those Caribbean facilities and clear up backlogs that had

hit its oil rigs. "As a result, we believe this settlement could

potentially slow the decline rate of Venezuela's oil production,"

analysts at ClearView Energy Partners said in a statement.

The International Energy Agency reported that Venezuelan oil

output at 1.2 million barrels a day in July, a 22% decline from

January.

ConocoPhillips, which also has a separate arbitration case

pending against Venezuela at a World Bank tribunal, is only one of

several creditors to have won large judgments against Caracas.

The rulings have set off a scramble for the country's remaining

foreign assets as its economy crumbles. President Nicolás Maduro

and his aides, meanwhile, are facing toughening U.S. sanctions over

alleged human-rights abuses and graft that has left the country

broke to pay for imports of food, medicines and other basics.

Last week, a Spokane, Wash.-based mining company called Gold

Reserve Inc. said it received an estimated $88.5 million in

government bonds instead of cash as partial payment for the $1

billion it is owed. The move has perplexed Venezuela watchers

because U.S. sanctions last year barred similar transactions using

bonds, whose value in debt markets has plummeted.

Others like Crystallex International Corp. are looking at

PdVSA's U.S.-based refining unit, Citgo. The defunct Canadian gold

mining company won a U.S. court ruling earlier this month allowing

it to seize Citgo, to satisfy its $1.4 billion arbitration award

for a nationalized mining project.

In addition to creditors' claims and Washington's sanctions,

PdVSA faces other legal and regulatory troubles in the U.S.

Multiple PdVSA executives have pleaded guilty or are charged in

a continuing U.S. criminal investigation into bribery allegations

at the company. Separately, in late July, prosecutors filed charges

in an alleged billion-dollar scheme to launder funds from PdVSA

using, among other things, real estate in Miami.

Court documents in that case say that former PdVSA officials

were among the alleged conspirators, and they joined money

managers, brokerage firms, banks and real-estate-investment firms

in the U.S. and elsewhere to operate "as a network of professional

money launderers."

Write to Kimberly Chin at kimberly.chin@wsj.com and Kejal Vyas

at kejal.vyas@wsj.com

(END) Dow Jones Newswires

August 20, 2018 17:04 ET (21:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

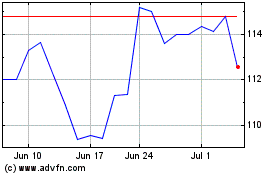

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

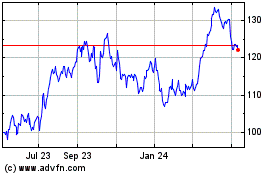

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024