false000094414800009441482024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

February 15, 2024

Date of Report (Date of earliest event reported)

CBIZ, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-32961 | | 22-2769024 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

5959 Rockside Woods, Blvd. N. Suite 600

Independence, Ohio 44131

(Address of principal executive offices, including zip code)

216-447-9000

(Registrant's telephone number, including area code)

Note Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

On which registered |

| Common Stock, $0.01 per value | | CBZ | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 15, 2024, CBIZ, Inc. (the "Company") issued a press release announcing its financial results for the three and twelve months ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1. The exhibit contains, and may implicate, forward-looking statements regarding the Company and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release of CBIZ, Inc. dated February 15, 2024, announcing its financial results for the three and twelve months ended December 31, 2023. 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 15, 2024

CBIZ, Inc.

| | | | | | | | |

| By: | | /s/ Ware H. Grove |

| Name: | | Ware H. Grove |

| Title: | | Chief Financial Officer |

Exhibit 99.1

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | |

| FOR IMMEDIATE RELEASE | | | CONTACT: | | Ware Grove |

| | | | | Chief Financial Officer |

| | | | | -or- |

| | | | | Lori Novickis |

| | | | | Director, Corporate Relations |

| | | | | CBIZ, Inc. |

| | | | | Cleveland, Ohio |

| | | | | (216) 447-9000 |

CBIZ REPORTS FOURTH-QUARTER AND FULL-YEAR 2023 RESULTS

FOURTH-QUARTER HIGHLIGHTS:

•TOTAL REVENUE UP 11.0%; SAME-UNIT REVENUE UP 6.8%

FULL-YEAR HIGHLIGHTS:

•TOTAL REVENUE UP 12.7%; SAME-UNIT REVENUE UP 7.4%

•GAAP EPS UP 18.9%; ADJUSTED EPS UP 13.1%

•NET INCOME UP 14.8%; ADJUSTED EBITDA UP 17.7%

2024 OUTLOOK:

•TOTAL REVENUE UP 7% TO 9%

•GAAP EPS UP 13% TO 15%; or $2.70 TO $2.75

•ADJUSTED EPS UP 12% TO 14%; or $2.70 TO $2.75

CLEVELAND (February 15, 2024) – CBIZ, Inc., (NYSE: CBZ) (“CBIZ”, or the “Company”), a leading provider of financial, insurance and advisory services, today announced fourth-quarter and full-year results for the period ended December 31, 2023.

For the 2023 fourth quarter, CBIZ recorded revenue of $327.5 million, an increase of $32.5 million, or 11.0%, compared with $295.0 million reported for the same period in 2022. Acquired operations contributed $12.6 million, or 4.2%, to fourth-quarter 2023 revenue growth. Same-unit revenue increased by $19.9 million, or 6.8%, for the quarter, compared with the same period a year ago. Net loss was $12.7 million in the 2023 fourth quarter, compared with a net loss of $11.5 million for the same period a year ago.

For the full year ended December 31, 2023, CBIZ recorded revenue of $1,591.2 million, an increase of $179.2 million, or 12.7%, over the $1,412.0 million for the same period in 2022. Acquired operations contributed $75.2 million, or 5.3%, to revenue growth in the twelve months ended December 31, 2023. Same-unit revenue increased by $104.0 million, or 7.4%, compared with the same period a year ago. Net

Page 1 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

income was $121.0 million, or $2.39 per diluted share, for the twelve months ended December 31, 2023, compared with $105.4 million, or $2.01 per diluted share, for the same period a year ago.

Excluding non-recurring transaction and first-year integration expenses related to the acquisitions of Marks Paneth in January 2022 and Somerset in February 2023, as well as certain non-recurring gains and losses, Adjusted net loss was $13.3 million in the fourth quarter of 2023 compared with Adjusted net loss of $10.7 million for the same period a year ago. Adjusted loss per share was $0.26 in the fourth quarter of 2023, compared with Adjusted loss per share of $0.21 for the same period a year ago. Adjusted EBITDA for the fourth quarter was a loss of $5.4 million, compared with a loss of $4.4 million for the same period in 2022.

Adjusted net income was $121.9 million, or $2.41 per diluted share, for the full year ended December 31, 2023, compared with $111.4 million, or $2.13 per diluted share, for the same period a year ago. Adjusted EBITDA for the twelve months ended December 31, 2023, was $223.8 million, compared with $190.1 million for the same period in 2022.

Schedules reconciling Adjusted net income, Adjusted earnings per share and Adjusted EBITDA to the most directly comparable GAAP measures can be found in the tables included at the end of this release.

For the full year ended December 31, 2023, the Company repurchased a total of 1.3 million shares of its common stock on the open market. The balance outstanding on the Company’s unsecured credit facility on December 31, 2023, was $312.4 million, with $272.0 million of unused borrowing capacity.

Jerry Grisko, CBIZ President and Chief Executive Officer, said, “Our continued strong performance in 2023 demonstrates the strength and resilience of our business model. Despite economic uncertainty throughout much of the year brought on by rising interest rates, threats of a recession and global unrest, demand remained strong for both our essential, recurring services and our more project-based advisory services. We also benefited from the three acquisitions and two ‘tuck in’ transactions we completed during the year which added approximately $67.3 million of annualized revenue. We are pleased to have recently announced the acquisition of Erickson, Brown & Kloster, LLC, (EBK), a CPA firm providing a broad range of accounting and tax services located in Colorado Springs, Colorado. This acquisition, effective February 1, 2024, will complement our growing Denver Financial Services practice.”

Grisko continued, “As we head into 2024, we expect the economic climate to remain generally favorable for the types of services that we provide to our clients. Our full-year outlook for revenue, GAAP EPS and adjusted EPS reflect our confidence in our ability to continue to post strong results in business climates that may present some level of uncertainty, including the inherent uncertainty that often exists during an election year.”

2024 Outlook

•The Company expects total revenue to grow within a range of 7% to 9% over the prior year.

•The Company expects an effective tax rate of approximately 28%.

•The Company expects a weighted average fully diluted share count of approximately 50.0 to 50.5 million shares.

•The Company expects GAAP fully diluted earnings per share to grow within a range of 13% to 15%, to $2.70 to $2.75 per share over the $2.39 per share reported for 2023.

Page 2 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

•The Company expects Adjusted fully diluted earnings per share to grow within a range of 12% to 14%, to $2.70 to $2.75 per share over the Adjusted earnings per share of $2.41 per share reported for 2023.

Conference Call

CBIZ will host a conference call at 11:00 a.m. (ET) today to discuss its results. Participants may register for the conference call at https://dpregister.com/sreg/10186120/fb802b0968.The call will be webcast and an archived replay will be available at https://cbiz.gcs-web.com/investor-overview.

About CBIZ

CBIZ is a leading provider of financial, insurance and advisory services to businesses throughout the United States. Financial services include accounting, tax, government health care consulting, transaction advisory, risk advisory, and valuation services. Insurance services include employee benefits consulting, retirement plan consulting, property and casualty insurance, payroll, and human capital consulting. With more than 120 offices in 33 states, CBIZ is one of the largest accounting and insurance brokerage providers in the U.S. For more information, visit www.cbiz.com.

Forward-Looking Statements

Forward-looking statements in this release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. Such risks and uncertainties include, but are not limited to: we may be more sensitive to revenue fluctuations than other companies, which could result in fluctuations in the market price of our common stock; payments on accounts receivable may be slower than expected, or amounts due on receivables or notes may not be fully collectible; we are dependent on the services of our executive officers, other key employees, producers and service personnel, the loss of whom may have a material adverse effect on our business, financial condition and results of operations; restrictions imposed by independence requirements and conflict of interest rules may limit our ability to provide services to clients of the attest firms with which we have contractual relationships and the ability of such attest firms to provide attestation services to our clients; our goodwill and intangible assets could become impaired, which could lead to material non-cash charges against earnings; our goodwill and intangible assets could become impaired, which could lead to material non-cash charges against earnings; certain liabilities resulting from acquisitions are estimated and could lead to a material non-cash impact on earnings; governmental regulations and interpretations are subject to changes, which could have a material adverse effect on our clients, our business, our business services operations, our business models, or our revenue; changes in the United States healthcare or public health environment, including new healthcare legislation or regulations, may adversely affect the revenue and margins in our or our clients’ businesses; we are subject to risks relating to processing customer transactions for our payroll and other transaction processing businesses; cyber-attacks or other security breaches involving our computer systems or the systems of one or more of our vendors or clients could materially and adversely affect our business; we are subject to risk as it relates to software that we license from third parties; we could be held liable for errors and omissions, contract claims, or other litigation judgments or expenses; the future issuance of additional shares could adversely affect the price of our common stock; our principal stockholders may have substantial control over our operations; we require a significant amount of cash for interest payments on our debt and to expand our business as planned; terms of our credit facility may adversely affect our ability to run our business and/or reduce stockholder returns; our failure to satisfy covenants in our debt instruments will cause a default under those instruments; we are

Page 3 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

reliant on information processing systems and any failure of these systems could have a material adverse effect on our business, financial condition and results of operations; we may not be able to acquire and finance additional businesses which may limit our ability to pursue our business strategy; the business services industry is competitive and fragmented; if we are unable to compete effectively, our business, financial condition and results of operations may be negatively impacted; there is volatility in our stock price. A more detailed description of such risks and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission at www.sec.gov.

All forward-looking statements made in this release are made only as of the date hereof. The Company does not undertake any obligation to publicly update or correct any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Page 4 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

THREE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands, except percentages and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | % | | 2022 | | % |

| Revenue | | $ | 327,547 | | | 100.0 | % | | $ | 295,043 | | | 100.0 | % |

Operating expenses (1) | | 340,844 | | | 104.1 | | | 302,560 | | | 102.5 | |

| Gross loss | | (13,297) | | | (4.1) | | | (7,517) | | | (2.5) | |

Corporate general and administrative expenses (1) | | 13,438 | | | 4.1 | | | 11,895 | | | 4.0 | |

| | | | | | | | |

| | | | | | | | |

| Operating loss | | (26,735) | | | (8.2) | | | (19,412) | | | (6.5) | |

| Other (expense) income: | | | | | | | | |

| Interest expense | | (5,108) | | | (1.6) | | | (2,830) | | | (0.9) | |

| Gain on sale of operations, net | | — | | | — | | | 102 | | | — | |

| | | | | | | | |

Other income, net (1) (2) | | 12,774 | | | 3.9 | | | 5,689 | | | 1.9 | |

| Total other income, net | | 7,666 | | | 2.3 | | | 2,961 | | | 1.0 | |

| Loss before income tax benefit | | (19,069) | | | (5.9) | | | (16,451) | | | (5.5) | |

| Income tax benefit | | (6,332) | | | | | (4,953) | | | |

| Net loss | | (12,737) | | | (3.9) | % | | (11,498) | | | (3.9) | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted loss per share | | $ | (0.26) | | | | | $ | (0.23) | | | |

| | | | | | | | |

| Diluted weighted average common shares outstanding | | 49,795 | | | | | 50,538 | | | |

| Other data: | | | | | | | | |

Adjusted EBITDA (3) | | $ | (5,434) | | | | | $ | (4,356) | | | |

Adjusted EPS (3) | | $ | (0.26) | | | | | $ | (0.21) | | | |

| | | | | | | | |

Page 5 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

(1)CBIZ sponsors a deferred compensation plan, under which a CBIZ employee's compensation deferral is held in a rabbi trust and invested as directed by the employee. Income and expenses related to the deferred compensation plan are included in "Operating expenses" and "Corporate general and administrative expenses," and are directly offset by deferred compensation gains in "Other income, net." The deferred compensation plan has no impact on "Loss before income tax benefit."

Income and expenses related to the deferred compensation plan for the three months ended December 31, 2023, and 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | % of Revenue | | 2022 | | % of Revenue |

| Operating expenses | | $ | 10,339 | | | 3.2 | % | | $ | 5,748 | | | 1.9 | % |

| Corporate general and administrative expenses | | 1,475 | | | 0.5 | % | | 926 | | | 0.3 | % |

| Other income, net | | 11,814 | | | 3.7 | % | | 6,674 | | | 2.2 | % |

Excluding the impact of the above-mentioned income and expenses related to the deferred compensation plan, the operating results for the three months ended December 31, 2023, and 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| As Reported | | Deferred Compensation Plan | | Adjusted | | % of Revenue | | As Reported | | Deferred Compensation Plan | | Adjusted | | % of Revenue |

| Gross (loss) margin | $ | (13,297) | | | $ | 10,339 | | | $ | (2,958) | | | (0.9) | % | | $ | (7,517) | | | $ | 5,748 | | | $ | (1,769) | | | (0.6) | % |

| Operating loss | (26,735) | | | 11,814 | | | (14,921) | | | (4.6) | % | | (19,412) | | | 6,674 | | | (12,738) | | | (4.3) | % |

| Other income (expense), net | 12,774 | | | (11,814) | | | 960 | | | 0.3 | % | | 5,689 | | | (6,674) | | | (985) | | | (0.3) | % |

| Loss before income tax benefit | (19,069) | | | — | | | (19,069) | | | (5.8) | % | | (16,451) | | | — | | | (16,451) | | | (5.6) | % |

(2)Included in "Other income, net" for the three months ended December 31, 2023 and 2022, is expense of $0.7 million and $0.5 million, respectively, related to net changes in the fair value of contingent consideration related to CBIZ's prior acquisitions.

(3)Refer to the financial highlights tables for a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP financial measure, and for additional information as to the usefulness of the Non-GAAP financial measures to stockholders and investors.

Page 6 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

CBIZ, INC.

FINANCIAL HIGHLIGHTS (UNAUDITED)

TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(In thousands, except percentages and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | % | | 2022 | | % |

| Revenue | | $ | 1,591,194 | | | 100.0 | % | | $ | 1,411,979 | | | 100.0 | % |

Operating expenses (1) | | 1,367,990 | | | 86.0 | | | 1,188,612 | | | 84.2 | |

| Gross margin | | 223,204 | | | 14.0 | | | 223,367 | | | 15.8 | |

Corporate general and administrative expenses (1) | | 57,965 | | | 3.6 | | | 55,023 | | | 3.8 | |

| | | | | | | | |

| Operating income | | 165,239 | | | 10.4 | | | 168,344 | | | 12.0 | |

| Other income (expense): | | | | | | | | |

| Interest expense | | (20,131) | | | (1.3) | | | (8,039) | | | (0.6) | |

| Gain on sale of operations, net | | 176 | | | — | | | 413 | | | — | |

Other income (expense), net (1) (2) | | 21,019 | | | 1.3 | | | (19,243) | | | (1.4) | |

| Total other income (expense), net | | 1,064 | | | — | | | (26,869) | | | (2.0) | |

| Income before income tax expense | | 166,303 | | | 10.4 | | | 141,475 | | | 10.0 | |

| Income tax expense | | 45,335 | | | | | 36,121 | | | |

| Net income | | 120,968 | | | 7.6 | % | | 105,354 | | | 7.5 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted income per share | | $ | 2.39 | | | | | $ | 2.01 | | | |

| | | | | | | | |

| Diluted weighted average common shares outstanding | | 50,557 | | | | | 52,388 | | | |

| Other data: | | | | | | | | |

Adjusted EBITDA (3) | | $ | 223,788 | | | | | $ | 190,125 | | | |

Adjusted EPS (3) | | $ | 2.41 | | | | | $ | 2.13 | | | |

| | | | | | | | |

Page 7 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

(1)CBIZ sponsors a deferred compensation plan, under which a CBIZ employee's compensation deferral is held in a rabbi trust and invested as directed by the employee. Income and expenses related to the deferred compensation plan are included in "Operating expenses" and "Corporate general and administrative expenses," and are directly offset by deferred compensation gains in "Other income (expense), net." The deferred compensation plan has no impact on "Income before income tax expense."

Income and expenses related to the deferred compensation plan for the twelve months ended December 31, 2023, and 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | % of Revenue | | 2022 | | % of Revenue |

| Operating expenses (income) | | $ | 17,192 | | | 1.1 | % | | $ | (17,252) | | | (1.2) | % |

| Corporate general and administrative expenses (income) | | 2,296 | | | 0.1 | % | | (2,393) | | | (0.2) | % |

| Other income (expense), net | | 19,488 | | | 1.2 | % | | (19,645) | | | (1.4) | % |

Excluding the impact of the above-mentioned income and expenses related to the deferred compensation plan, the operating results for the twelve months ended December 31, 2023, and 2022 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, |

| 2023 | | 2022 |

| As Reported | | Deferred Compensation Plan | | Adjusted | | % of Revenue | | As Reported | | Deferred Compensation Plan | | Adjusted | | % of Revenue |

| Gross margin | $ | 223,204 | | | $ | 17,192 | | | $ | 240,396 | | | 15.1 | % | | $ | 223,367 | | | $ | (17,252) | | | $ | 206,115 | | | 14.6 | % |

| Operating income | 165,239 | | | 19,488 | | | 184,727 | | | 11.6 | % | | 168,344 | | | (19,645) | | | 148,699 | | | 10.5 | % |

| Other income (expense), net | 21,019 | | | (19,488) | | | 1,531 | | | 0.1 | % | | (19,243) | | | 19,645 | | | 402 | | | — | % |

| Income before income tax expense | 166,303 | | | — | | | 166,303 | | | 10.5 | % | | 141,475 | | | — | | | 141,475 | | | 10.0 | % |

(2)Included in "Other income (expense), net" for the twelve months ended December 31, 2023 and 2022, is expense of $2.7 million and $2.4 million, respectively, related to net changes in the fair value of contingent consideration related to CBIZ's prior acquisitions.

(3)Refer to the financial highlights tables for a reconciliation of Non-GAAP financial measures to the most directly comparable GAAP financial measure, and for additional information as to the usefulness of the Non-GAAP financial measures to stockholders and investors.

CBIZ, INC.

Page 8 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

FINANCIAL HIGHLIGHTS (UNAUDITED)

(In thousands)

SELECT SEGMENT DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | | |

| Financial Services | | $ | 228,298 | | | $ | 202,016 | | | 1,160,686 | | | 1,010,068 | |

| Benefits and Insurance Services | | 86,426 | | | 81,746 | | | 382,605 | | | 358,007 | |

| National Practices | | 12,823 | | | 11,281 | | | 47,903 | | | 43,904 | |

| Total | | $ | 327,547 | | | $ | 295,043 | | | $ | 1,591,194 | | | $ | 1,411,979 | |

| | | | | | | | |

| Gross Margin | | | | | | | | |

Financial Services (1) | | (9,210) | | | (8,242) | | | 185,610 | | | $ | 160,030 | |

| Benefits and Insurance Services | | 10,849 | | | 12,357 | | | 72,095 | | | 67,620 | |

| National Practices | | 1,558 | | | 1,298 | | | 4,843 | | | 4,703 | |

Operating expenses - unallocated (2) | | | | | | | | |

| Other expense | | (6,155) | | | (7,182) | | | (22,152) | | | (26,238) | |

| Deferred compensation | | (10,339) | | | (5,748) | | | (17,192) | | | 17,252 | |

| Total | | $ | (13,297) | | | $ | (7,517) | | | $ | 223,204 | | | $ | 223,367 | |

| | | | | | | | |

(1)Gross margin for the Financial Services practice group included approximately $0.1 million and $1.2 million of one-time and non-recurring integration and retention costs related to Somerset for the three months and twelve months ended December 31, 2023, respectively. Gross margin for the Financial Services practice group included approximately $0.8 million and $6.7 million of one-time and non-recurring integration and retention costs related to Marks Paneth for the three months and twelve months ended December 31, 2022, respectively.

(2)Represents operating expenses not directly allocated to individual businesses, including stock-based compensation, consolidation and integration charges, and certain advertising expenses. "Operating expenses - unallocated" also includes gains or losses attributable to the assets held in a rabbi trust associated with the Company's deferred compensation plan. These gains or losses do not impact "Income before income tax expense" as they are directly offset by the same adjustment to "Other income, net" in the Consolidated Statements of Comprehensive Income. Net gains/losses recognized from adjustments to the fair value of the assets held in the rabbi trust are recorded as compensation expense in "Operating expenses" and “Corporate, general and administrative expenses,” and offset in "Other income, net."

Page 9 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

CBIZ, INC.

SELECT CASH FLOW DATA

(In thousands)

| | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | 2022 |

| Net income | | $ | 120,968 | | | $ | 105,354 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization expense | | 36,269 | | | 32,895 | |

| Gain on sale of operations, net | | (176) | | | (413) | |

| Bad debt expense, net of recoveries | | 1,551 | | | 1,173 | |

| Adjustments to contingent earnout liability, net | | 2,743 | | | 2,435 | |

| Stock-based compensation expense | | 12,286 | | | 14,689 | |

| Other noncash adjustments | | 8,908 | | | 12,042 | |

| Net income, after adjustments to reconcile net income to net cash provided by operating activities | | 182,549 | | | 168,175 | |

| Changes in assets and liabilities, net of acquisitions and divestitures | | (29,042) | | | (42,043) | |

| | | | |

| | | | |

| Net cash provided by operating activities | | 153,507 | | | 126,132 | |

| Net cash used in investing activities | | (79,393) | | | (99,118) | |

| Net cash used in financing activities | | (77,111) | | | (17,343) | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | | (2,997) | | | 9,671 | |

| Cash, cash equivalents and restricted cash at beginning of year | | $ | 160,145 | | | $ | 150,474 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 157,148 | | | $ | 160,145 | |

| | | | |

| Reconciliation of cash, cash equivalents and restricted cash to the consolidated balance sheet: |

| Cash and cash equivalents | | $ | 8,090 | | | $ | 4,697 | |

| Restricted cash | | 30,362 | | | 28,487 | |

| Cash equivalents included in funds held for clients | | 118,696 | | | 126,961 | |

| Total cash, cash equivalents and restricted cash | | $ | 157,148 | | | $ | 160,145 | |

Page 10 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

CBIZ, INC.

SELECT FINANCIAL DATA AND RATIOS

(In thousands)

| | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | | 8,090 | | | 4,697 | |

| Restricted cash | | 30,362 | | | 28,487 | |

| Accounts receivable, net | | 380,152 | | | 334,498 | |

| Current assets before funds held for clients | | 453,499 | | | 397,113 | |

| Funds held for clients | | 159,186 | | | 171,313 | |

| Goodwill and other intangible assets, net | | 1,008,604 | | | 951,702 | |

| | | | |

| Total assets | | 2,043,592 | | | 1,879,124 | |

| | | | |

| Current liabilities before client fund obligations | | 352,028 | | | 338,940 | |

| Client fund obligations | | 159,893 | | | 173,467 | |

| Total long-term debt, net | | 310,826 | | | 263,654 | |

| | | | |

| Total liabilities | | 1,251,974 | | | 1,165,672 | |

| | | | |

| Treasury stock | | (899,093) | | | (824,778) | |

| | | | |

| Total stockholders' equity | | 791,618 | | | 713,452 | |

| | | | |

| Debt to equity | | 39.3 | % | | 37.0 | % |

Days sales outstanding (DSO) (1) | | 78 | | | 74 | |

| | | | |

| Shares outstanding | | 49,814 | | | 50,180 | |

| Basic weighted average common shares outstanding | | 49,989 | | | 51,502 | |

| Diluted weighted average common shares outstanding | | 50,557 | | | 52,388 | |

| | | | |

(1)DSO is provided for continuing operations and represents accounts receivable, net, at the end of the period, divided by trailing twelve-month daily revenue. The Company has included DSO data because such data is commonly used as a performance measure by analysts and investors and as a measure of the Company's ability to collect on receivables in a timely manner. DSO should not be regarded as an alternative or replacement to any measurement of performance under GAAP.

Page 11 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

CBIZ, INC.

GAAP RECONCILIATION

Net (Loss) Income and Diluted Earnings Per Share (“EPS”) to Adjusted Net (Loss), EPS and EBITDA(1)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Three Months Ended

December 31, 2022 |

| Amounts | | EPS | | Amounts | | EPS |

| Net loss | $ | (12,737) | | | $ | (0.26) | | | $ | (11,498) | | | $ | (0.23) | |

| Adjustments: | | | | | | | |

| | | | | | | |

| Gain on sale of assets, net | (1,363) | | | (0.03) | | | — | | | — | |

| | | | | | | |

| | | | | | | |

Integration and retention costs related to acquisitions (2) | 331 | | | 0.01 | | | 1,179 | | | $ | 0.02 | |

Facility optimization costs (3) | 255 | | | 0.01 | | | — | | | — | |

| Income tax effect related to adjustments | 258 | | | 0.01 | | | (355) | | | — | |

| Adjusted net loss | $ | (13,256) | | | $ | (0.26) | | | $ | (10,674) | | | $ | (0.21) | |

| Interest expense | $ | 5,108 | | | | | $ | 2,830 | | | |

| Income tax benefit | (6,332) | | | | | (4,953) | | | |

| Gain on sale of operations, net | — | | | | | (102) | | | |

| Tax effect related to the adjustments above | (258) | | | | | 355 | | | |

| Depreciation | 3,301 | | | | | 2,853 | | | |

| Amortization | 6,003 | | | | | 5,335 | | | |

| Adjusted EBITDA | $ | (5,434) | | | | | $ | (4,356) | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 | | Twelve Months Ended

December 31, 2022 |

| Amounts | | EPS | | Amounts | | EPS |

| Net income | $ | 120,968 | | | $ | 2.39 | | | $ | 105,354 | | | $ | 2.01 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| Gain on sale of assets, net | (2,863) | | | (0.06) | | | (2,391) | | | (0.05) | |

| | | | | | | |

Transaction costs related to acquisitions (2) | 611 | | | 0.01 | | | 1,329 | | | 0.03 | |

Integration and retention costs related to acquisitions (2) | 2,782 | | | 0.06 | | | 9,191 | | | 0.18 | |

Facility optimization costs (3) | 731 | | | 0.02 | | | — | | | — | |

| Income tax effect related to adjustments | (344) | | | (0.01) | | | (2,075) | | | (0.04) | |

| Adjusted net income | $ | 121,885 | | | $ | 2.41 | | | $ | 111,408 | | | $ | 2.13 | |

| Interest expense | $ | 20,131 | | | | | $ | 8,039 | | | |

| Income tax expense | 45,335 | | | | | 36,121 | | | |

| Gain on sale of operations, net | (176) | | | | | (413) | | | |

| Tax effect related to the adjustments above | 344 | | | | | 2,075 | | | |

| Depreciation | 12,475 | | | | | 11,231 | | | |

| Amortization | 23,794 | | | | | 21,664 | | | |

| Adjusted EBITDA | $ | 223,788 | | | | | $ | 190,125 | | | |

| | | | | | | |

Page 12 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

(1)CBIZ reports its financial results in accordance with GAAP. This table reconciles Adjusted net (loss) income, Adjusted EPS, and Adjusted EBITDA to the most directly comparable GAAP financial measures, “Net (loss) income” and "Diluted earnings per share." Adjusted net (loss) income, Adjusted EPS and Adjusted EBITDA are not defined by GAAP and should not be regarded as an alternative or replacement to any financial information determined under GAAP. Adjusted net (loss) income, Adjusted EPS and Adjusted EBITDA exclude significant non-operating related gains and losses that management does not consider on-going in nature. These Non-GAAP financial measures are used by the Company as a performance measure to evaluate, assess and benchmark the Company's operational results and to evaluate results relative to employee compensation targets. Accordingly, the Company believes the presentation of these Non-GAAP financial measures allows its stockholders, debt holders, and other interested parties to meaningfully compare the Company’s period-to-period operating results.

(2)These costs include, but are not limited to, certain consulting, technology, personnel, as well as other first year operating and general administrative costs that are non-recurring in nature. Amounts reported in 2023 related to the costs incurred related to the Somerset acquisition and those reported in 2022 related to the Marks Paneth acquisition.

(3)These costs related to incremental non-recurring lease expense incurred as a result of CBIZ's real estate optimization efforts.

CBIZ, INC.

GAAP RECONCILIATION

Full Year 2024 Diluted Earnings Per Share (“EPS”) Guidance to Full Year 2024 Adjusted Diluted EPS

| | | | | | | | | | | |

| Full Year 2024 Guidance |

| Low | | High |

| Diluted EPS - GAAP Guidance | $ | 2.70 | | | $ | 2.75 | |

| Adjusted Diluted EPS Guidance | $ | 2.70 | | | $ | 2.75 | |

| | | |

| GAAP Diluted EPS for 2023 | $ | 2.39 | | | $ | 2.39 | |

| Adjusted Diluted EPS for 2023 | $ | 2.41 | | | $ | 2.41 | |

| GAAP Diluted EPS Range | 13 | % | | 15 | % |

| Adjusted Diluted EPS Range | 12 | % | | 14 | % |

| | | |

Page 13 of 13

NYSE: CBZ ● www.cbiz.com ● Twitter @cbz

Cover

|

Feb. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 15, 2024

|

| Entity Registrant Name |

CBIZ, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-32961

|

| Entity Tax Identification Number |

22-2769024

|

| Entity Address, Address Line One |

5959 Rockside Woods, Blvd. N. Suite 600

|

| Entity Address, City or Town |

Independence

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44131

|

| City Area Code |

216

|

| Local Phone Number |

447-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 per value

|

| Trading Symbol |

CBZ

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000944148

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

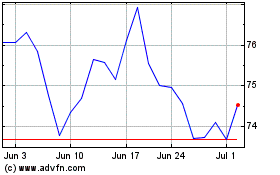

CBIZ (NYSE:CBZ)

Historical Stock Chart

From Apr 2024 to May 2024

CBIZ (NYSE:CBZ)

Historical Stock Chart

From May 2023 to May 2024