Beazer Homes USA, Inc. (NYSE: BZH) (www.beazer.com) today announced its financial

results for the quarter and fiscal year ended September 30,

2014.

The Company reported net income from continuing operations of

$34.9 million for full year fiscal 2014, a year-over-year increase

of $67.1 million, and the Company’s first full year of

profitability since 2006. Adjusted EBITDA was $128.3 million for

the year, up $42.0 million from fiscal 2013. Financial results for

the quarter and year ended September 30, 2014 included $4.9 million

in unexpected warranty charges.

“We are very pleased to report positive net income for fiscal

year 2014,” said Allan Merrill, CEO of Beazer Homes. “Returning to

profitability represents a key milestone for our employees and

shareholders - particularly because it was achieved from fewer new

home communities, lower home closings and in a challenging home

sales environment. With an expanded community count as we enter

fiscal 2015, I’m confident we have built a foundation that will

deliver greater profitability in the years ahead.”

One year ago, the company introduced a multi-year target to

achieve $2 billion in revenue and a 10% Adjusted EBITDA margin

leading to $200 million in Adjusted EBITDA, which it called the

"2B-10 Plan". At that time, revenue for the trailing twelve months

was $1.288 billion, the Adjusted EBITDA margin was 6.7% and

Adjusted EBITDA was $86 million. Speaking to the progress made in

year one of the 2B-10 Plan, Mr. Merrill continued, “Higher average

selling prices, stronger than expected homebuilding gross margins

and sustained solid sales absorption rates allowed us to make

significant progress against our 2B-10 targets in the past year.

For fiscal 2014, improvements in both revenue and Adjusted EBITDA

margin led to Adjusted EBITDA of $128 million, up $42 million,

allowing us to close 37% of the 2B-10 gap in Adjusted EBITDA."

Looking ahead to fiscal 2015 and beyond Mr. Merrill continued,

"Our higher community count should lead to growth in new home

orders, closings and average selling prices, allowing us to make

further improvements in Adjusted EBITDA in 2015 and positioning us

to reach our 2B-10 objectives by the end of 2016.”

Q4 Results from Continuing Operations

(unless otherwise specified)

The Company closed out fiscal 2014 with $60.3 million in net

income for the fourth quarter, compared with $11.3 million a year

earlier. Adjusted EBITDA improved $15.0 million to $56.5 million

for the quarter. Homebuilding gross margin, excluding impairments,

abandonments and interest amortized to cost of sales was 21.3% for

the quarter.

The Company's fourth quarter and full year net income included

several significant items:

- A loss on extinguishment of debt of

$19.9 million

- An IRS appeals case was approved in our

favor resulting in a cash refund and income tax benefit of $28.5

million

- Beazer Pre-Owned Homes was sold

generating a gain of $6.3 million

- Reserves for uncertain tax positions

were reversed due to lapses in statutes of limitation and closing

of audits during fiscal year 2014 resulting in a non-cash tax

benefit of $13.9 million

- Impairments and abandonments of $8.3

million for the fiscal year with $5.4 million occurring in the

fourth quarter

- Unexpected warranty reserves totaling

$4.9 million in cost of sales during the fourth quarter

The unexpected warranty charges indicated above related to water

intrusion issues in homes built, on average, more than 7 years ago

located in Florida and New Jersey. While the Company believes these

costs are non-recurring in nature, they were included in cost of

sales and therefore reduced all measurements of income in fourth

quarter homebuilding gross margin, Adjusted EBITDA and Net Income.

Excluding these charges, the quarter’s homebuilding gross margin

would have been 22.3% and Adjusted EBITDA would have been $61.4

million.

Quarter Ended September 30, 2014

2013 Change New Home Orders

1,173 1,192 (1.6 )% Average active community count 149 135 10.4 %

QTD orders per month per community 2.6 3.0 (13.3 )% Cancellation

rates 23.4 % 23.9 % -50 bps Total Home Closings 1,695 1,657

2.3 % Average sales price from closings (in thousands) $ 295.4 $

263.2 12.2 % Homebuilding revenue (in millions) $ 500.6 $ 436.2

14.8 % Homebuilding gross profit margin, excluding impairments and

abandonments (I&A) 18.2 % 18.3 % -10 bps Homebuilding gross

profit margin, excluding I&A and interest amortized to cost of

sales 21.3 % 21.4 % -10 bps Homebuilding gross profit margin,

excluding I&A, interest amortized to cost of sales and

unexpected warranty costs 22.3 % 21.4 % 90 bps Income from

continuing operations before income taxes (in millions) $ 20.3 $

8.9 $ 11.4 Benefit from income taxes (in millions) $ 40.0 $ 2.5 $

37.5 Net income from continuing operations (in millions) $ 60.3 $

11.3 $ 49.0 Basic Income Per Share $ 2.28 $ 0.46 $ 1.82 Diluted

Income Per Share $ 1.90 $ 0.36 $ 1.54 Loss on debt extinguishment

(in millions) $ — $ (1.0 ) $ 1.0 Inventory impairments (in

millions) $ (5.4 ) $ (0.4 ) $ (5.0 ) Net income from continuing

operations excluding loss on debt extinguishment and inventory

impairments (in millions) $ 65.7 $ 12.7 $ 53.0 Land and land

development spending (in millions) $ 169.7 $ 160.8 $ 8.9 Total

Company Adjusted EBITDA (in millions) $ 56.5 $ 41.5 $ 15.0 Total

Company Adjusted EBITDA, excluding unexpected warranty costs (in

millions) $ 61.4 $ 41.5 $ 19.9

Full Year Results from Continuing

Operations (unless otherwise specified)

The Company reported significantly improved results for fiscal

2014. In addition to reporting positive net income and Adjusted

EBITDA, which reflected a 49% increase over fiscal 2013,

homebuilding gross margin, excluding impairments, abandonments and

interest amortized to cost of sales improved 190 basis points to

21.9%, and average selling prices improved 12.6% to $284.8

thousand.

Excluding the $4.9 million in unexpected warranty charges noted

before the fourth quarter results table, full year gross margin,

excluding impairments, abandonments and interest amortized to cost

of sales, would have been 22.2% and full year Adjusted EBITDA would

have been $133.2 million.

Year Ended September 30, 2014

2013 Change New Home Orders

4,748 5,026 (5.5 )% Active community count at period end 155 134

15.7 % Average active community count 142 145 (2.1 )% LTM orders

per month per community 2.8 2.9 (3.4 )% Cancellation rates 21.3 %

21.8 % -50 bps Total Home Closings 4,951 5,056 (2.1 )%

Average sales price from closings (in thousands) $ 284.8 $ 253.0

12.6 % Homebuilding revenue (in millions) $ 1,409.9 $ 1,279.2 10.2

% Homebuilding gross profit margin, excluding impairments and

abandonments (I&A) 19.1 % 16.8 % 230 bps Homebuilding gross

profit margin, excluding I&A and interest amortized to cost of

sales 21.9 % 20.0 % 190 bps Homebuilding gross profit margin,

excluding I&A, interest amortized to cost of sales and

unexpected warranty costs 22.2 % 20.0 % 220 bps Loss from

continuing operations before income taxes (in millions) $ (6.9 ) $

(35.7 ) $ 28.8 Benefit from income taxes (in millions) $ 41.8 $ 3.5

$ 38.3 Net income (loss) from continuing operations (in millions) $

34.9 $ (32.2 ) $ 67.1 Basic Income (Loss) Per Share $ 1.35 $ (1.30

) $ 2.65 Diluted Income (Loss) Per Share $ 1.10 $ (1.30 ) $ 2.40

Loss on debt extinguishment (in millions) $ (19.9 ) $ (4.6 ) $

(15.3 ) Inventory impairments (in millions) $ (8.3 ) $ (2.6 ) $

(5.7 ) Net income (loss) from continuing operations excluding loss

on debt extinguishment and inventory impairments (in millions) $

63.1 $ (25.0 ) $ 88.1 Land and land development spending (in

millions) $ 551.2 $ 475.2 $ 76.0 Total Company Adjusted EBITDA (in

millions) $ 128.3 $ 86.3 $ 42.0 Total Company Adjusted EBITDA,

excluding unexpected warranty costs (in millions) $ 133.2 $ 86.3 $

46.9

As of September 30,

2014

- Total cash and cash equivalents: $387.1

million, including unrestricted cash of approximately $324.2

million

- Stockholders' equity: $279.1

million

- Total backlog from continuing

operations: 1,690 homes with a sales value of $515.9 million,

compared to 1,893 homes with a sales value of $528.1 million as of

September 30, 2013

- Land and lots controlled: 28,187 lots

(78.1% owned), an increase of 0.7% from September 30,

2013

Conference Call

The Company will hold a conference call on November 12, 2014 at

10:00 am ET to discuss these results. Interested parties may listen

to the conference call and view the Company’s slide presentation

over the Internet by visiting the “Investor Relations” section of

the Company’s website at www.beazer.com.

To access the conference call by telephone, listeners should

dial 800-619-8639 (for international callers, dial 312-470-7002).

To be admitted to the call, verbally supply the passcode “BZH.” A

replay of the call will be available shortly after the conclusion

of the live call. To directly access the replay, dial 866-491-2944

or 203-369-1730 and enter the passcode “3740” (available until

10:59 pm ET on November 19, 2014), or visit www.beazer.com. A replay of the webcast will be

available at www.beazer.com for at

least 30 days.

Headquartered in Atlanta, Beazer Homes is one of the

country's 10 largest single-family homebuilders. The Company's

homes meet or exceed the benchmark for energy-efficient home

construction as established by ENERGY STAR® and are designed with

Choice Plans to meet the personal preferences and lifestyles of its

buyers. In addition, the Company is committed to providing a range

of preferred lender choices to facilitate transparent competition

between lenders and enhanced customer service. The Company offers

homes in 16 states, including Arizona, California, Delaware,

Florida, Georgia, Indiana, Maryland, Nevada, New Jersey, New York,

North Carolina, Pennsylvania, South Carolina, Tennessee, Texas and

Virginia. Beazer Homes is listed on the New York Stock Exchange

under the ticker symbol “BZH.” For more info visit Beazer.com, or

check out Beazer on Facebook and Twitter.

Forward Looking Statements

This press release contains forward-looking statements. These

forward-looking statements represent our expectations or beliefs

concerning future events, and it is possible that the results

described in this press release will not be achieved. These

forward-looking statements are subject to risks, uncertainties and

other factors, many of which are outside of our control, that could

cause actual results to differ materially from the results

discussed in the forward-looking statements, including, among other

things, (i) the availability and cost of land and the risks

associated with the future value of our inventory such as

additional asset impairment charges or writedowns; (ii) economic

changes nationally or in local markets, including changes in

consumer confidence, declines in employment levels, inflation and

increases in the quantity and decreases in the price of new homes

and resale homes in the market; (iii) the cyclical nature of the

homebuilding industry and a potential deterioration in homebuilding

industry conditions; (iv) estimates related to homes to be

delivered in the future (backlog) are imprecise as they are subject

to various cancellation risks which cannot be fully controlled; (v)

shortages of or increased prices for labor, land or raw materials

used in housing production; (vi) our cost of and ability to access

capital and otherwise meet our ongoing liquidity needs including

the impact of any downgrades of our credit ratings or reductions in

our tangible net worth or liquidity levels; (vii) our ability to

comply with covenants in our debt agreements or satisfy such

obligations through repayment or refinancing; (viii) a substantial

increase in mortgage interest rates, increased disruption in the

availability of mortgage financing, a change in tax laws regarding

the deductibility of mortgage interest, or an increased number of

foreclosures; (ix) increased competition or delays in reacting to

changing consumer preference in home design; (x) factors affecting

margins such as decreased land values underlying land option

agreements, increased land development costs on communities under

development or delays or difficulties in implementing initiatives

to reduce production and overhead cost structure; (xi) estimates

related to the potential recoverability of our deferred tax assets;

(xii) potential delays or increased costs in obtaining necessary

permits as a result of changes to, or complying with, laws,

regulations, or governmental policies and possible penalties for

failure to comply with such laws, regulations and governmental

policies; (xiii) the results of litigation or government

proceedings and fulfillment of the obligations in the consent

orders with governmental authorities and other settlement

agreements; (xiv) the impact of construction defect and home

warranty claims; (xv) the cost and availability of insurance and

surety bonds; (xvi) the performance of our unconsolidated entities

and our unconsolidated entity partners; (xvii) delays in land

development or home construction resulting from adverse weather

conditions; (xviii) the impact of information technology failures

or data security breaches; (xix) effects of changes in accounting

policies, standards, guidelines or principles; or (xx) terrorist

acts, acts of war and other factors over which the Company has

little or no control.

Any forward-looking statement speaks only as of the date on

which such statement is made, and, except as required by law, we do

not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. New factors emerge from time to time

and it is not possible for management to predict all such

factors.

-Tables Follow-

BEAZER HOMES USA, INC. UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share

data) Three Months

Ended Fiscal Year Ended September 30,

September 30, 2014 2013

2014

2013 Total revenue

$ 545,905 $ 438,334

$ 1,463,767 $ 1,287,577 Home construction and land

sales expenses

452,706 357,884

1,192,001 1,070,814

Inventory impairments and option contract abandonments

5,386

404

8,307 2,633 Gross profit

87,813 80,046

263,459 214,130 Commissions

20,789 17,516

58,028 52,922 General and

administrative expenses

39,431 36,428

136,463 121,163

Depreciation and amortization

4,141 4,023

13,279 12,784 Operating income

23,452

22,079

55,689 27,261 Equity in income (loss) of

unconsolidated entities

6,324 93

6,545 (113 ) Loss on

extinguishment of debt

— (998 )

(19,917 )

(4,636 ) Other expense, net

(9,502 ) (12,307 )

(49,191 ) (58,165 ) Income (loss) from continuing

operations before income taxes

20,274 8,867

(6,874

) (35,653 ) Benefit from income taxes

(40,014

) (2,461 )

(41,797 ) (3,489 ) Income (loss)

from continuing operations

60,288 11,328

34,923

(32,164 ) (Loss) income from discontinued operations, net of tax

(441 ) 620

(540 ) (1,704 ) Net

income (loss)

$ 59,847 $ 11,948

$ 34,383 $ (33,868 ) Weighted average number

of shares: Basic

26,425 24,888

25,795 24,651 Diluted

31,782 31,560

31,795 24,651 Income (loss) per share:

Basic income (loss) per share from continuing operations

$

2.28 $ 0.46

$ 1.35 $ (1.30 ) Basic (loss)

income per share from discontinued operations

$ (0.02

) $ 0.02

$ (0.02 ) $ (0.07 ) Basic

income (loss) per share

$ 2.26 $ 0.48

$

1.33 $ (1.37 ) Diluted income (loss) per share from

continuing operations

$ 1.90 $ 0.36

$

1.10 $ (1.30 ) Diluted (loss) income per share from

discontinued operations

$ (0.02 ) $ 0.02

$ (0.02 ) $ (0.07 ) Diluted income (loss) per

share

$ 1.88 $ 0.38

$ 1.08 $ (1.37 )

Three Months Ended

Fiscal Year Ended September 30, September 30,

2014 2013

2014 2013

Capitalized interest in inventory, beginning of period

$

84,083 $ 50,019

$ 52,562 $ 38,190 Interest

incurred

30,329 28,715

126,906 115,076 Capitalized

interest impaired

(245 ) —

(245 ) —

Interest expense not qualified for capitalization and included as

other expense

(9,672 ) (12,749 )

(50,784

) (59,458 ) Capitalized interest amortized to house

construction and land sales expenses

(16,876 )

(13,423 )

(40,820 ) (41,246 ) Capitalized interest in

inventory, end of period

$ 87,619 $ 52,562

$ 87,619 $ 52,562

BEAZER HOMES USA, INC. UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS (in thousands, except share and per share

data)

September 30, 2014

September 30, 2013

ASSETS Cash and cash equivalents

$ 324,154 $

504,459 Restricted cash

62,941 48,978 Accounts receivable

(net of allowance of $1,245 and $1,651, respectively)

34,429

22,342 Income tax receivable

46 2,813 Inventory Owned

inventory

1,557,496 1,304,694 Land not owned under option

agreements

3,857 9,124 Total inventory

1,561,353 1,313,818 Investments in marketable securities and

unconsolidated entities

38,341 44,997 Deferred tax assets,

net

2,823 5,253 Property, plant and equipment, net

18,673 17,000 Other assets

23,460 27,129

Total assets

$ 2,066,220 $ 1,986,789

LIABILITIES AND STOCKHOLDERS’ EQUITY Trade

accounts payable

$ 106,237 $ 83,800 Other liabilities

142,516 145,623 Obligations related to land not owned under

option agreements

2,916 4,633 Total debt (net of discounts

of $4,399 and $5,160, respectively)

1,535,433

1,512,183 Total liabilities

$ 1,787,102

$ 1,746,239 Stockholders’ equity: Preferred stock

(par value $.01 per share, 5,000,000 shares authorized, no shares

issued)

$ — $ — Common stock (par value $0.001 per

share, 63,000,000 shares authorized, 27,173,421 and 25,245,945

issued and outstanding, respectively)

27 25 Paid-in capital

851,624 846,165 Accumulated deficit

(571,257 )

(605,640 ) Accumulated other comprehensive loss

(1,276

) — Total stockholders’ equity

279,118

240,550 Total liabilities and stockholders’ equity

$

2,066,220 $ 1,986,789 Inventory

Breakdown Homes under construction

$ 282,095 $

262,476 Development projects in progress

786,768 578,453

Land held for future development

301,048 341,986 Land held

for sale

51,672 31,331 Capitalized interest

87,619

52,562 Model homes

48,294 37,886 Land not owned under option

agreements

3,857 9,124 Total inventory

$ 1,561,353 $ 1,313,818

BEAZER HOMES USA, INC. CONSOLIDATED OPERATING AND

FINANCIAL DATA – CONTINUING OPERATIONS Quarter

Ended Fiscal Year Ended September 30,

September 30, SELECTED OPERATING DATA 2014

2013

2014 2013 Closings: West region

594 724

1,996 2,277 East region

622 523

1,600 1,629 Southeast region

479 410

1,355 1,150 Continuing Operations

1,695

1,657

4,951 5,056 New orders, net of

cancellations: West region

428 480

1,815 2,176 East

region

389 403

1,539 1,543 Southeast region

356 309

1,394 1,307 Continuing

Operations

1,173 1,192

4,748

5,026 Backlog units at end of period: West region

557

738

557 738 East region

600 661

600 661

Southeast region

533 494

533

494 Continuing Operations

1,690 1,893

1,690 1,893 Dollar value of backlog at end of

period (in millions)

$ 515.9 $ 528.1

$ 515.9 $ 528.1 Homebuilding Revenue

(in thousands): West region

$ 161,118 $ 183,472

$ 537,149 $ 543,524 East region

209,047

158,134

525,439 482,468 Southeast region

130,467

94,581

347,292 253,220 Total

homebuilding revenue

$ 500,632 $ 436,187

$ 1,409,880 $ 1,279,212

BEAZER HOMES USA, INC. CONSOLIDATED OPERATING AND

FINANCIAL DATA – CONTINUING OPERATIONS (Dollars in

thousands)

Quarter Ended September 30,

Fiscal Year Ended September 30, SUPPLEMENTAL FINANCIAL

DATA 2014 2013

2014

2013

Revenues: Homebuilding

$ 500,632 $

436,187

$ 1,409,880 $ 1,279,212 Land sales and other

45,273 2,147

53,887 8,365 Total

$ 545,905 $ 438,334

$

1,463,767 $ 1,287,577

Gross profit:

Homebuilding

$ 85,969 $ 79,583

$

260,746 $ 212,054 Land sales and other

1,844

463

2,713 2,076 Total

$ 87,813

$ 80,046

$ 263,459 $ 214,130

Reconciliation of homebuilding gross profit before impairments

and abandonments and interest amortized to cost of sales and the

related gross margins to homebuilding gross profit and gross

margin, the most directly comparable GAAP measure, is provided for

each period discussed below:

Quarter Ended September 30,

Fiscal Year Ended September 30, 2014

2013

2014 2013 Homebuilding gross

profit

$ 85,969 17.2 % $

79,583 18.2 %

$ 260,746

18.5 % $ 212,054 16.6 % Inventory

impairments and lot option abandonments (I&A)

5,386

404

8,307 2,633 Homebuilding

gross profit before I&A

91,355 18.2 %

79,987 18.3 %

269,053 19.1 % 214,687 16.8 %

Interest amortized to cost of sales

15,311 13,423

39,255 41,246 Homebuilding gross profit

before I&A and interest amortized to cost of sales

$

106,666 21.3 % $ 93,410 21.4 %

$ 308,308 21.9 % $ 255,933

20.0 %

Reconciliation of Adjusted EBITDA (earnings before interest,

taxes, depreciation, amortization, debt extinguishment, impairments

and abandonments) to total company net income (loss), the most

directly comparable GAAP measure, is provided for each period

discussed below. Management believes that Adjusted EBITDA assists

investors in understanding and comparing the operating

characteristics of homebuilding activities by eliminating many of

the differences in companies' respective capitalization, tax

position and level of impairments.

Quarter Ended September 30,

Fiscal Year Ended September 30, 2014

2013

2014 2013 Net income (loss)

$ 59,847 $ 11,948

$ 34,383 $ (33,868 )

Benefit from income taxes

(40,137 ) (2,587 )

(41,802 ) (3,684 ) Interest amortized to home

construction and land sales expenses, capitalized interest

impaired, and interest expense not qualified for capitalization

26,793 26,172

91,849 100,704 Depreciation and

amortization and stock compensation amortization

4,849 4,606

15,866 15,642 Inventory impairments and option contract

abandonments

5,141 404

8,062 2,650 Loss on debt

extinguishment

— 998

19,917 4,636 Joint venture

impairment and abandonment charges

— —

— 181

Adjusted EBITDA $

56,493 $ 41,541

$ 128,275

$ 86,261

Beazer Homes USA, Inc.Carey Phelps, 770-829-3700Director,

Investor Relations & Corporate Communicationsinvestor.relations@beazer.com

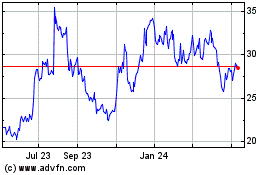

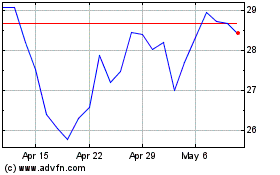

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Apr 2023 to Apr 2024