- Successfully Completed Acquisition of Cedar

Creek -- Net Sales of $893 million for the Quarter; Up $419 million

From Q2 2017 -- Gross Profit of $104 million for the Quarter; Up

$43 million From Q2 2017 -

BlueLinx Holdings Inc. (NYSE:BXC), a leading distributor of

building and industrial products in the United States, today

reported financial results for the fiscal second quarter ended June

30, 2018.

“We are pleased with our second quarter results during the

period in which we also completed the acquisition of Cedar Creek,”

said Mitch Lewis, President and Chief Executive Officer. “While we

are still early in our 18-month integration process, based on

specific opportunities we have identified and actions taken to

date, we are increasingly confident in our ability to generate at

least $50 million in annual synergies. We remain well-positioned to

continue our growth and drive enhanced value for our

shareholders.”

Susan O’Farrell, Senior Vice President and Chief Financial

Officer added, “The second quarter of 2018 was a pivotal quarter

for BlueLinx as we remain focused on growth while integrating the

two companies. The combined company generated pro forma net sales

of $948.6 million for the quarter, an increase of $99.9 million

over the prior year period. Pro forma net income for the

quarter was $9.2 million, and Pro forma Adjusted EBITDA was $37.6

million, up 53.9% and 23.0%, respectively, from this period a year

ago.”

BlueLinx completed the acquisition of Cedar Creek on April 13,

2018 (the “Closing Date”). Under generally accepted accounting

principles (GAAP), Cedar Creek’s financial results are only

included in the combined company’s reported financial results from

the Closing Date forward and are not reflected in the combined

company’s reported financial results for any periods prior to the

Closing Date. In this release, to supplement and aid in an

understanding of the combined company’s reported financial results,

BlueLinx is also providing certain GAAP-based and non-GAAP pro

forma financial information of the combined company that includes

Cedar Creek’s financial results for the relevant periods prior to

the Closing Date, as if the acquisition occurred on January 1,

2017. See “Use of Non-GAAP Measures and Supplementary Information”

below and the accompanying financial schedules for more

information, including descriptions of any such pro forma measures

that may be non-GAAP measures and reconciliations of those non-GAAP

measures to their most directly comparable GAAP measures.

Second Quarter 2018 Results Compared to Prior Year

PeriodThe Company reported net sales of $893.0 million for

the second quarter of 2018, up $419.0 million or 88.4% from the

prior year period. Pro forma net sales were $948.6 million,

up $99.9 million or 11.8%.

The Company recorded gross profit of $103.7 million during the

second quarter, up $43.1 million or 71.2% from the prior year

period, with a gross margin of 11.6%. Gross profit was negatively

impacted by acquisition related inventory step-up charges of $10.9

million. Excluding the effect of these acquisition related

inventory step-up charges, gross margin was 12.8%, equal to the

prior year period. Pro forma gross profit was $121.0 million during

the second quarter, up $8.3 million or 7.3%.

The Company incurred one-time charges during the second quarter

for legal, professional and other integration costs of $11.6

million related to the Cedar Creek acquisition. In addition, as a

result of the increase in the Company’s stock price, the Company

also incurred charges in the second quarter associated with

compensation expense from Stock Appreciation Rights (SARs) and

other share-based compensation of $3.8 million, which the Company

will pay out in 2018 and 2019. Taking these items into

account, as well as the acquisition related inventory step-up

charges of $10.9 million, the Company recorded a net loss of $8.6

million for the second quarter, compared to net income of $3.2

million in the prior year period. Pro forma net income for

the second quarter was $9.2 million, up $3.2 million or 53.9%.

Adjusted EBITDA, which is a non-GAAP measure, was $37.0 million

for the second quarter, up $24.2 million or 189.0% from this period

a year ago. Pro forma Adjusted EBITDA, also a non-GAAP measure, was

$37.6 million for the second quarter, up $7.0 million or 23.0%.

First Six Months of 2018 Compared to Prior Year

PeriodFor the first six months of 2018, the Company

generated net sales of $1.3 billion, up $427.8 million or 47.4%

from the prior year period. Pro forma net sales for the first six

months were $1.7 billion, up $114.4 million or 7.1%.

The Company recorded gross profit of $159.0 million during the

first six months of 2018, up $44.0 million or 38.3% from the prior

year period, with a gross margin of 11.9%. Excluding the

effect of acquisition related inventory step-up charges of $10.9

million, gross margin was 12.8%, up 10 basis points from the prior

year period. Pro forma gross profit for the first six months of

2018 was $220.7 million, up $17.3 million or 8.5%.

The Company incurred one-time charges during the first six

months of 2018 for legal, professional and other integration costs

of $15.2 million related to the Cedar Creek acquisition.

Additionally, the Company incurred $13.0 million in share based

compensation expense and $10.9 million of acquisition related

inventory step-up charges. Taking these items into account, the

Company recorded a net loss of $22.0 million for the first six

months of 2018, compared to net income of $3.8 million in the prior

year period. Pro forma net loss for the first six months of 2018

was $1.4 million, a $28.9 million or 95.2% improvement over the

prior year period.

Adjusted EBITDA was $45.1 million for the first six months of

2018, up $24.9 million or 124.0% from the prior year period. Pro

forma Adjusted EBITDA was $56.6 million, up $4.6 million or

8.9%.

Capital Structure and LiquidityDuring the

second quarter of 2018, the Company used net proceeds from debt

issuance under its amended $750 million asset-based revolving

credit facility (inclusive of a $150 million uncommitted accordion)

and a new $180 million term loan to fund the purchase price for the

Cedar Creek acquisition, repay debt, and to pay certain related

transaction fees and expenses. Excess availability under the

amended ABL and cash on hand as of June 30, 2018, was approximately

$134 million.

Conference CallBlueLinx will host a conference

call today at 10:00 a.m. Eastern Time, accompanied by a supporting

slide presentation. Participants can access the live conference

call via telephone at (877) 873-5864, using Conference ID #

5957634. Investors can also listen to the live audio of the

conference call and view the accompanying slide presentation by

visiting the BlueLinx website, www.BlueLinxCo.com, and selecting

the conference link on the Investor Relations page. After the

conference call has concluded, an archived recording will be

available on the BlueLinx website.

Use of Non-GAAP Measures and Supplementary

InformationThe Company reports its financial results in

accordance with accounting principles generally accepted in the

United States (“GAAP”). The Company also believes that presentation

of certain non-GAAP measures and GAAP-based and non-GAAP

supplemental financial measures may be useful to investors and may

provide a more complete understanding of the factors and

trends affecting the business than using reported GAAP results

alone. Any non-GAAP measures used herein are reconciled herein or

in the financial tables accompanying this news release to their

most directly comparable GAAP measures. The Company cautions that

non-GAAP measures and supplemental financial measures should be

considered in addition to, but not as a substitute for, the

Company’s reported GAAP results.

Adjusted EBITDA and Pro forma Adjusted EBITDA

We define Adjusted EBITDA as an amount equal to net income plus

interest expense and all interest expense related items, income

taxes, depreciation and amortization, and further adjusted to

exclude certain non-cash items, and other adjustments to

Consolidated Net Income, including compensation expense from SARs,

and one-time charges associated with the legal, consulting, and

professional fees related to the Cedar Creek acquisition, and

interest charges on debt modification fees under the CMBS mortgage

payoff in the first quarter of fiscal 2018.

We present Adjusted EBITDA because it is a primary measure used

by management to evaluate operating performance and, we believe,

helps to enhance investors’ overall understanding of the financial

performance and cash flows of our business. We believe Adjusted

EBITDA is helpful in highlighting operating trends. We also

believe that Adjusted EBITDA is frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies, many of which present an Adjusted EBITDA

measure when reporting their results. However, Adjusted EBITDA is

not a presentation made in accordance with GAAP, and is not

intended to present a superior measure of the financial condition

from those determined under GAAP. Adjusted EBITDA, as used herein,

is not necessarily comparable to other similarly titled captions of

other companies due to differences in methods of calculation.

Pro forma Adjusted EBITDA for any period is calculated in the

same manner as Adjusted EBITDA, but also combines the historical

results of BlueLinx for the three and six months ended June 30,

2018, and July 1, 2017, with the historical results of Cedar Creek

for the three month period ended March 31, 2018, and thirteen day

period ended April 13, 2018, and the three and six months ended

July 1, 2017, respectively, giving effect to the Cedar Creek

acquisition and related adjustments as if the acquisition occurred

on January 1, 2017.

Supplemental Financial Measures

We completed the acquisition of Cedar Creek on April 13, 2018.

As a result, Cedar Creek’s financial results are only included in

the combined company’s reported financial results from the Closing

Date forward. To supplement these reported results, we have

provided GAAP-based and non-GAAP pro forma financial information of

the combined company in this news release that includes Cedar

Creek’s financial results for the relevant periods prior to the

Closing Date. This pro forma information combines the historical

results of BlueLinx for the three and six months ended June 30,

2018, and July 1, 2017, with the historical results of Cedar Creek

for the three month period ended March 31, 2018, and thirteen day

period ended April 13, 2018, and the three and six months ended

July 1, 2017, respectively, giving effect to the Cedar Creek

acquisition and related adjustments as if the acquisition occurred

on January 1, 2017.

About BlueLinx Holdings Inc.BlueLinx (NYSE:

BXC) is a leading wholesale distributor of building and industrial

products in the United States with over 50,000 branded and

private-label SKUs, and a broad distribution footprint servicing 40

states. BlueLinx has a differentiated distribution platform,

value-driven business model and extensive cache of products across

the building products industry. Headquartered in Atlanta, Georgia,

BlueLinx has over 2,500 associates and distributes its

comprehensive range of structural and specialty products to

approximately 15,000 national, regional, and local dealers, as well

as specialty distributors, national home centers, industrial, and

manufactured housing customers. BlueLinx encourages investors to

visit its website, www.BlueLinxCo.com, which is updated regularly

with financial and other important information about BlueLinx.

Contacts:Investors:Susan O’Farrell, SVP, CFO

& TreasurerBlueLinx Holdings Inc.(770) 953-7000

Mary Moll, Investor RelationsBlueLinx Holdings Inc.(866)

671-5138investor@bluelinxco.com

Forward-looking StatementsThis press release

includes “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate or imply future

results, performance, liquidity levels or achievements, and may

contain the words “believe,” “anticipate,” “expect,” “estimate,”

“intend,” “project,” “plan,” “will be,” “will likely continue,”

“will likely result” or words or phrases of similar meaning. The

forward-looking statements in this release include statements about

expectations regarding the integration of the Cedar Creek business,

expected synergies from the acquisition of Cedar Creek, and our

confidence in our growth and business prospects. All of these

forward-looking statements are based on estimates and assumptions

made by our management that, although believed by BlueLinx to be

reasonable, are inherently uncertain. Forward-looking statements

involve risks and uncertainties, including, but not limited to,

economic, competitive, governmental, and technological factors

outside of BlueLinx’s control that may cause its business, strategy

or actual results to differ materially from the forward-looking

statements. These risks and uncertainties may include, among other

things: changes in the prices, supply and/or demand for products

that it distributes, inventory management and commodities pricing;

new housing starts and inventory levels of existing homes for sale;

general economic and business conditions in the United States; the

imposition or threat of protectionist trade policies or import or

export tariffs; modified or new global or regional trade

agreements; our ability to successfully integrate the Cedar Creek

business and realize anticipated synergies from the acquisition;

the significant indebtedness that we have incurred in connection

with the Cedar Creek acquisition; acceptance by our customers of

our privately branded products; financial condition and

creditworthiness of our customers; supply from our key vendors;

reliability of the technologies we utilize; the activities of

competitors; changes in significant operating expenses; fuel costs;

risk of losses associated with accidents; exposure to product

liability claims; changes in the availability of capital and

interest rates; adverse weather patterns or conditions; acts of

cyber intrusion; variations in the performance of the financial

markets, including the credit markets; and other factors described

in the “Risk Factors” section in the Company’s Annual Report on

Form 10-K for the year ended December 30, 2017, its Quarterly

Reports on Form 10-Q, and in its periodic reports filed with the

Securities and Exchange Commission from time to time. Given these

risks and uncertainties, you are cautioned not to place undue

reliance on forward-looking statements. BlueLinx undertakes no

obligation to publicly update or revise any forward-looking

statement as a result of new information, future events, and

changes in expectations or otherwise, except as required by

law.

|

|

| BLUELINX HOLDINGS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In thousands, except per share

data) |

| (Unaudited) |

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, 2018 |

|

July 1, 2017 |

|

June 30, 2018 |

|

July 1, 2017 |

| Net sales |

$ |

892,952 |

|

|

$ |

474,001 |

|

|

$ |

1,330,439 |

|

|

$ |

902,609 |

|

| Cost of sales |

789,301 |

|

|

413,455 |

|

|

1,171,463 |

|

|

787,629 |

|

| Gross profit |

103,651 |

|

|

60,546 |

|

|

158,976 |

|

|

114,980 |

|

| Operating expenses

(income): |

|

|

|

|

|

|

|

| Selling,

general, and administrative |

91,723 |

|

|

49,151 |

|

|

150,963 |

|

|

102,202 |

|

| Gains

from sales of property |

— |

|

|

— |

|

|

— |

|

|

(6,700 |

) |

|

Depreciation and amortization |

7,444 |

|

|

2,253 |

|

|

10,109 |

|

|

4,616 |

|

| Total

operating expenses |

99,167 |

|

|

51,404 |

|

|

161,072 |

|

|

100,118 |

|

| Operating income

(loss) |

4,484 |

|

|

9,142 |

|

|

(2,096 |

) |

|

14,862 |

|

| Non-operating expenses

(income): |

|

|

|

|

|

|

|

| Interest

expense |

12,194 |

|

|

5,367 |

|

|

20,674 |

|

|

10,609 |

|

| Other

income, net |

(94 |

) |

|

(139 |

) |

|

(188 |

) |

|

(278 |

) |

| Income (loss) before

provision for (benefit from) income taxes |

(7,616 |

) |

|

3,914 |

|

|

(22,582 |

) |

|

4,531 |

|

| Provision for (benefit

from) income taxes |

942 |

|

|

676 |

|

|

(597 |

) |

|

709 |

|

| Net income (loss) |

$ |

(8,558 |

) |

|

$ |

3,238 |

|

|

$ |

(21,985 |

) |

|

$ |

3,822 |

|

| |

|

|

|

|

|

|

|

| Basic earnings (loss)

per share |

$ |

(0.93 |

) |

|

$ |

0.36 |

|

|

$ |

(2.40 |

) |

|

$ |

0.42 |

|

| Diluted earnings (loss)

per share |

$ |

(0.93 |

) |

|

$ |

0.35 |

|

|

$ |

(2.40 |

) |

|

$ |

0.42 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| BLUELINX HOLDINGS INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (In thousands, except share data) |

| (Unaudited) |

| |

|

|

|

| |

June 30, 2018 |

|

December 30, 2017 |

| ASSETS |

| Current assets: |

|

|

|

| Cash |

$ |

5,210 |

|

|

$ |

4,696 |

|

|

Receivables, less allowances of $4,554 and $2,761,

respectively |

329,980 |

|

|

134,072 |

|

|

Inventories, net |

409,713 |

|

|

187,512 |

|

| Other

current assets |

43,734 |

|

|

17,124 |

|

| Total current

assets |

788,637 |

|

|

343,404 |

|

| Property and

equipment: |

|

|

|

| Land and

land improvements |

23,534 |

|

|

30,802 |

|

|

Buildings |

179,894 |

|

|

84,781 |

|

| Machinery

and equipment |

113,278 |

|

|

70,596 |

|

|

Construction in progress |

742 |

|

|

570 |

|

| Property and equipment,

at cost |

317,448 |

|

|

186,749 |

|

|

Accumulated depreciation |

(98,820 |

) |

|

(102,977 |

) |

| Property and equipment,

net |

218,628 |

|

|

83,772 |

|

| Goodwill and other

intangibles, net |

76,271 |

|

|

— |

|

| Deferred tax asset |

43,763 |

|

|

53,853 |

|

| Other non-current

assets |

17,818 |

|

|

13,066 |

|

| Total assets |

$ |

1,145,117 |

|

|

$ |

494,095 |

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

156,068 |

|

|

$ |

70,623 |

|

| Bank

overdrafts |

32,512 |

|

|

21,593 |

|

| Accrued

compensation |

11,502 |

|

|

9,229 |

|

| Current

maturities of long-term debt, net of discount of $64 and $0,

respectively |

1,736 |

|

|

— |

|

| Capital

leases - short-term |

8,239 |

|

|

3,552 |

|

| Real

estate deferred gains - short-term |

5,330 |

|

|

1,836 |

|

| Other

current liabilities |

21,905 |

|

|

10,772 |

|

| Total current

liabilities |

237,292 |

|

|

117,605 |

|

| Non-current

liabilities: |

|

|

|

| Long-term

debt, net of discount of $12,311 and $3,792, respectively |

615,055 |

|

|

276,677 |

|

| Capital

leases - long-term |

147,073 |

|

|

14,007 |

|

| Real

estate deferred gains - long-term |

88,355 |

|

|

10,485 |

|

| Pension

benefit obligation |

27,621 |

|

|

30,360 |

|

| Other

non-current liabilities |

17,365 |

|

|

9,959 |

|

| Total liabilities |

1,132,761 |

|

|

459,093 |

|

| |

|

|

|

| Commitments and

Contingencies |

|

|

|

| |

|

|

|

|

STOCKHOLDERS’ EQUITY |

| Common

Stock, $0.01 par value, Authorized - 20,000,000 shares,

Issued and Outstanding - 9,219,470 and 9,100,923, respectively |

92 |

|

|

91 |

|

|

Additional paid-in capital |

258,525 |

|

|

259,588 |

|

|

Accumulated other comprehensive loss |

(36,106 |

) |

|

(36,507 |

) |

|

Accumulated stockholders’ deficit |

(210,155 |

) |

|

(188,170 |

) |

| Total stockholders’

equity |

12,356 |

|

|

35,002 |

|

| Total liabilities and

stockholders’ equity |

$ |

1,145,117 |

|

|

$ |

494,095 |

|

| |

|

|

|

|

|

|

|

| |

| BLUELINX HOLDINGS INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| (Unaudited) |

| |

|

| |

Six Months Ended |

| |

June 30,2018 |

|

July 1,2017 |

| Net cash used

in operating activities |

(98,470 |

) |

|

(53,892 |

) |

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Proceeds

from sale of assets |

107,960 |

|

|

27,598 |

|

|

Acquisition of business, net of cash acquired |

(353,094 |

) |

|

— |

|

| Property

and equipment investments |

(577 |

) |

|

(189 |

) |

| Net cash

provided by (used in) investing activities |

(245,711 |

) |

|

27,409 |

|

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

Borrowings from revolving credit facilities |

534,380 |

|

|

227,654 |

|

|

Repayments on revolving credit facilities |

(267,449 |

) |

|

(172,932 |

) |

|

Borrowings from term loan |

180,000 |

|

|

— |

|

|

Repayments on term loan |

(450 |

) |

|

— |

|

| Principal

payments on mortgage |

(97,847 |

) |

|

(28,976 |

) |

| Bank

overdrafts |

10,919 |

|

|

599 |

|

| Debt

financing costs |

(9,775 |

) |

|

— |

|

| Cash

released from escrow related to the mortgage |

— |

|

|

1,490 |

|

|

Repurchase of shares to satisfy employee tax withholdings |

(1,821 |

) |

|

(226 |

) |

| Payments

on capital lease obligations |

(3,262 |

) |

|

(1,889 |

) |

| Net cash

provided by financing activities |

344,695 |

|

|

25,720 |

|

| |

|

|

|

| Net change in cash |

514 |

|

|

(763 |

) |

| Cash at beginning of

period |

4,696 |

|

|

5,540 |

|

| Cash at end of

period |

$ |

5,210 |

|

|

$ |

4,777 |

|

| |

|

|

|

|

|

|

|

| |

| BLUELINX HOLDINGS INC. |

| SUPPLEMENTARY INFORMATION |

| (In thousands) |

| (Unaudited) |

| |

|

Pro Forma Sales, Gross Profit and Net Income

(Loss) |

|

|

| The

following unaudited consolidated pro forma information presents

consolidated information as if the Cedar Creek acquisition had

occurred on January 1, 2017: |

| |

|

|

| |

|

Proforma (1) |

| |

|

Quarter Ended |

|

Six Months Ended |

| (In

thousands) |

|

June 30, 2018 |

|

July 1, 2017 |

|

June 30, 2018 |

|

July 1, 2017 |

| Net sales |

|

$ |

948,555 |

|

|

$ |

848,644 |

|

|

$ |

1,732,822 |

|

|

$ |

1,618,383 |

|

| Gross Profit |

|

120,990 |

|

|

112,719 |

|

|

220,698 |

|

|

203,411 |

|

| Net income (loss) |

|

9,180 |

|

|

5,963 |

|

|

(1,439 |

) |

|

(30,290 |

) |

________________________(1) The pro forma

amounts above have been calculated in accordance with GAAP after

applying the Company's accounting policies and adjusting: (i) the

three and six months ending June 30, 2018, to reflect a $10.9

million charge related to an inventory step-up adjustment, and the

three and six months ended July 1, 2017, for $0 and $11.6 million,

respectively; (ii) the three and six months ending June 30, 2018,

for $30.4 million and $34.0 million, respectively, for transaction

related costs, and the three and six months ended July 1, 2017, for

$0 and $34.0 million, respectively. Due to the net loss for the

six-month periods ended June 30, 2018 and 2017, $0.1 million

of incremental shares from share-based compensation arrangements

were excluded from the computation of diluted weighted average

shares outstanding, in both periods, because their effect would be

anti-dilutive. The pro forma amounts do not include any potential

synergies, cost savings or other expected benefits of the

acquisition, are presented for illustrative purposes only, and are

not necessarily indicative of results that would have been achieved

had the acquisition occurred as of January 1, 2017, or of future

operating performance.

| BLUELINX HOLDINGS INC. |

| RECONCILIATION OF NON-GAAP

MEASUREMENTS |

| (In thousands) |

| (Unaudited) |

|

|

| The

following schedule reconciles net income to Adjusted EBITDA: |

|

|

| |

Quarter Ended |

|

Six Months Ended |

| |

June 30, 2018 |

|

July 1, 2017 |

|

June 30, 2018 |

|

July 1, 2017 |

| Net income (loss) |

$ |

(8,558 |

) |

|

$ |

3,238 |

|

|

$ |

(21,985 |

) |

|

$ |

3,822 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

7,444 |

|

|

2,253 |

|

|

10,109 |

|

|

4,616 |

|

| Interest

expense |

12,194 |

|

|

5,367 |

|

|

20,674 |

|

|

10,609 |

|

| Provision

for (benefit from) income taxes |

942 |

|

|

676 |

|

|

(597 |

) |

|

709 |

|

| Gain from

sales of property |

— |

|

|

— |

|

|

— |

|

|

(6,700 |

) |

|

Amortization of deferred gain |

(1,300 |

) |

|

— |

|

|

(2,470 |

) |

|

— |

|

|

Share-based compensation expense |

3,763 |

|

|

695 |

|

|

12,963 |

|

|

1,459 |

|

|

Multi-employer pension withdrawal |

— |

|

|

1,000 |

|

|

— |

|

|

5,500 |

|

| Inventory

step-up adjustment |

10,918 |

|

|

— |

|

|

10,918 |

|

|

— |

|

| Merger

and acquisition costs (1) |

11,642 |

|

|

— |

|

|

15,234 |

|

|

— |

|

|

Restructuring, severance, and legal |

(47 |

) |

|

(427 |

) |

|

225 |

|

|

108 |

|

| Adjusted EBITDA |

$ |

36,998 |

|

|

$ |

12,802 |

|

|

$ |

45,071 |

|

|

$ |

20,123 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________

(1) Reflects primarily legal, professional and

other integration costs related to the Cedar Creek acquisition

The following table reconciles our pro forma net income to pro

forma Adjusted EBITDA:

| |

|

|

|

| |

Quarter Ended |

|

Six Months Ended |

| |

June 30, 2018 |

|

July 1, 2017 |

|

June 30, 2018 |

|

July 1, 2017 |

| Pro forma net income

(loss) |

$ |

9,180 |

|

|

$ |

5,963 |

|

|

$ |

(1,439 |

) |

|

$ |

(30,290 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

8,670 |

|

|

7,847 |

|

|

17,644 |

|

|

17,640 |

|

| Interest

expense |

12,604 |

|

|

10,850 |

|

|

26,611 |

|

|

21,487 |

|

| Provision

for (benefit from) income taxes |

4,773 |

|

|

4,886 |

|

|

3,104 |

|

|

(2,871 |

) |

| Gain from

sales of property |

— |

|

|

— |

|

|

— |

|

|

(6,700 |

) |

|

Amortization of deferred gain |

(1,300 |

) |

|

(453 |

) |

|

(2,470 |

) |

|

(453 |

) |

|

Share-based compensation expense |

3,763 |

|

|

695 |

|

|

12,963 |

|

|

1,459 |

|

|

Multi-employer pension withdrawal |

— |

|

|

1,000 |

|

|

— |

|

|

5,500 |

|

| Inventory

step-up adjustment |

— |

|

|

— |

|

|

— |

|

|

11,600 |

|

| Merger

and acquisition costs (1) |

— |

|

|

— |

|

|

— |

|

|

34,044 |

|

|

Restructuring, severance, and legal |

(47 |

) |

|

(183 |

) |

|

226 |

|

|

605 |

|

| Pro forma adjusted

EBITDA |

$ |

37,643 |

|

|

$ |

30,605 |

|

|

$ |

56,639 |

|

|

$ |

52,021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________

(1) Reflects primarily legal, professional and

other integration costs related to the Cedar Creek acquisition

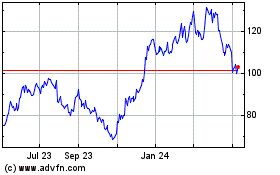

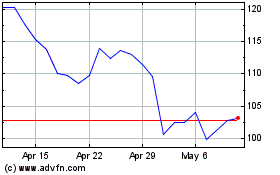

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024