Report of Foreign Issuer (6-k)

February 23 2016 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2016

Commission File Number: 001-33632

BROOKFIELD INFRASTRUCTURE PARTNERS L.P.

(Exact name of registrant as specified in its charter)

73 Front Street

Fifth Floor Bermuda

Hamilton, HM 12

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82.

The information contained in Exhibit 99.1 of this Form 6-K is incorporated by reference into the registrant’s following registration statements on Form F-3: File No. 333-167860.

The following documents, which are attached as exhibits hereto, are incorporated by reference herein:

|

Exhibit

|

|

Title

|

| |

|

|

|

|

|

ANNOUNCEMENT REGARDING ASCIANO TRANSACTION

|

| 99.2 |

|

ASCIANO ANNOUNCES DISCUSSIONS WITH BROOKFIELD CONSORTIUM AND QUBE CONSORTIUM IN RESPECT OF POTENTIAL TRANSACTION |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

BROOKFIELD INFRASTRUCTURE PARTNERS L.P.

by its general partner, BROOKFIELD

INFRASTRUCTURE PARTNERS LIMITED

|

| |

|

|

|

Date: February 22, 2016

|

|

By:

|

/s/ Jane Sheere

|

| |

|

|

Name: Jane Sheere

|

| |

|

|

Title: Secretary

|

ANNOUNCEMENT REGARDING ASCIANO TRANSACTION

Brookfield, News, February 22, 2016 – Brookfield Infrastructure (NYSE:BIP) (TSX:BIP.UN) notes the announcement today, February 23rd (Australian time) by Asciano Limited ("Asciano") (See Exhibit 99.2) disclosing receipt by Asciano of letters from each of Brookfield and the Qube Consortium regarding discussions that are taking place that may lead to the development of a joint proposal to acquire Asciano by way of a Scheme of Arrangement. Brookfield Infrastructure notes that the proposal described is non-binding and conditional and there is no certainty that a transaction on the terms described will be completed.

– ends –

Brookfield Infrastructure Partners is a leading global infrastructure company that owns and operates high quality, long-life assets in the utilities, transport, energy and communications sectors across North and South America, Australia and Europe. We are focused on assets that generate stable cash flows and require minimal maintenance capital expenditures. Brookfield Infrastructure Partners is listed on the New York and Toronto stock exchanges. Further information is available at www.brookfieldinfrastructure.com. Important information may be disseminated exclusively via the website; investors should consult the site to access this information.

Brookfield Infrastructure is the flagship listed infrastructure company of Brookfield Asset Management, a leading global alternative asset manager with approximately $225 billion of assets under management. For more information, go to www.brookfield.com

For more information, please visit our website at www.brookfieldinfrastructure.com or contact:

|

Media:

Andrew Willis

Senior Vice President, Communications and Media

Tel: (416) 369-8263

Email: andrew.willis@brookfield.com

|

Investors:

Melissa Low

Vice President, Investor Relations & Communications

Tel: (416) 956-5239

Email: melissa.low@brookfield.com

|

Note: This news release contains forward-looking statements and information within the meaning of Canadian securities laws. The words, "will", "expected", "intends", "tend to," "targets" or derivations thereof and other expressions which are predictions of or indicate future events, trends or prospects and which do not relate to historical matters identify the above mentioned and other forward-looking statements. Forward-looking statements in this news release include statements regarding the possibility of developing a joint proposal to acquire Asciano, statements with respect to Brookfield Infrastructure's assets tending to appreciate in value over time and the level of distribution growth over the next several years. Although Brookfield Infrastructure believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on them, or any other forward looking statements or information in this news release. The future performance and prospects of Brookfield Infrastructure are subject to a number of known and unknown risks and uncertainties and the potential proposal referred to may not eventuate or complete. Factors that could cause actual results of Brookfield Infrastructure to differ materially from those contemplated or implied by the statements in this news release are described in the documents filed by Brookfield Infrastructure with the securities regulators in Canada and the United States including under "Risk Factors" in Brookfield Infrastructure's most recent Annual Report on Form 20-F and other risks and factors that are described therein. Except as required by law, Brookfield Infrastructure undertakes no obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise.

Date: 23 February 2016

ASCIANO ANNOUNCES DISCUSSIONS WITH BROOKFIELD CONSORTIUM AND QUBE CONSORTIUM IN RESPECT OF POTENTIAL TRANSACTION

Asciano Limited (Asciano) (ASX: AIO, OTCUS: AIOYY) today announces receipt of the attached letters regarding preliminary discussions between Asciano and each of:

|

●

|

Brookfield Infrastructure Partners L.P. (and certain of its affiliates), GIC Private Limited (and certain of its affiliates), British Columbia Investment Management Corporation and their consortium vehicle, Nitro Corporation Pty Limited ACN 607 605 701 (together, the Brookfield Consortium); and |

|

●

|

Canada Pension Plan Investment Board, Global Infrastructure Management, LLC, Qube Holdings Limited and China Investment Corporation (together, the Qube Consortium).

|

|

|

|

The discussions relate to a potential transaction under which the Brookfield Consortium and the Qube Consortium would together facilitate the acquisition of 100% of the issued capital of Asciano by way of scheme of arrangement for all cash consideration of A$9.28 per Asciano share, reduced by the cash value of any interim and/or special dividend paid by Asciano (Potential Transaction). Further details are contained in the attached letters.

The Asciano Board considers that the A$9.28 per Asciano share cash consideration associated with the Potential Transaction is likely to be attractive to Asciano shareholders. However, Asciano notes that the discussions are preliminary and a number of steps would need to occur prior to any binding proposal eventuating. These would include finalisation of terms, agreement of full transaction documentation, relevant board /investment approvals and the Brookfield Consortium and Qube Consortium obtaining appropriate ASIC approvals and waivers. Asciano expects that any binding proposal would also be subject to a number of conditions, including FIRB and ACCC approval.

In the absence of any alternative superior proposal capable of acceptance, the Asciano Board continues to recommend the Qube Consortium Proposal as announced on 16 February 2016, subject to an independent expert opining that the takeover offer under the Qube Consortium Proposal and the associated sale of each of the Ports and BAPS businesses are fair and reasonable to Asciano shareholders.

Investor and Analyst Enquiries:

Kelly Hibbins

Phone: + 61 2 8484 8046

Email: Kelly_hibbins@asciano.com.au

|

Media Enquiries:

Richard Baker

Phone: + 61 408 985 008

Email: media@asciano.com.au

|

|

Page | 2

The Asciano Board remains committed to maximising value for Asciano shareholders and will continue to keep the market informed of any further material developments.

Further information

Asciano shareholders can obtain further information by contacting the Asciano Shareholder Information Line on 1300 729 310 for shareholders located in Australia, and +61 3 9415 4608 for shareholders located outside Australia.

For further information, please contact

|

Investors and analysts

|

Media

|

|

Kelly Hibbins

|

Richard Baker

|

|

tel: +61 2 8484 8046

|

tel: +61 2 8484 8103

|

|

mobile: +61 414 609 192

|

mobile: +61 408 985 008

|

|

email: kelly hibbins@asciano.com.au

|

email: media@asciano.com.au

|

23 February 2016

Mr Malcolm Broomhead

Chairman

Asciano Limited

Level 6, 15 Blue Street

North Sydney NSW 2060

STRICTLY PRIVATE AND CONFIDENTIAL

Dear Malcolm,

Commencement of discussions

You have encouraged us for the benefit all Asciano shareholders to seek to develop a proposal which provides an improved and all-cash consideration, and which reduces ACCC uncertainty associated with a transaction.

As you know, discussions have recently commenced involving:

|

●

|

Qube Holdings Limited (Qube), Global Infrastructure Management, LLC (on behalf of itself and its managed funds and clients) (GIP), Canada Pension Plan Investment Board (CPPIB) and CIC Capital Corporation (CiC Capital) (collectively the Qube Consortium); |

|

●

|

Brookfield Infrastructure Partners Limited as general partner of Brookfield Infrastructure Partners L.P. (Brookfield), for itself and on behalf of its consortium partners (the Brookfield Consortium); and

|

|

●

|

Asciano Limited (Asciano),

|

to identify whether the parties can develop the terms of an improved proposal that could be put to Asciano shareholders. The basis for the discussions is to seek to develop a proposal that delivers all-cash consideration at a premium to the current implied value of the existing Qube Consortium offer, is capable of achieving expeditious ACCC review and provides greater certainty as to timing of completion.

The discussions remain preliminary, indicative and non-binding, and there is no agreement, arrangement or understanding between the parties at this stage on the terms of any new proposal. However, you have asked us to write this letter to Asciano setting out the indicative terms currently under discussion in order that the market can be informed of those terms while the discussions continue.

Those indicative terms are:

|

●

|

all-cash consideration of $9.28 per Asciano share (less any dividends paid after the date of this letter);

|

|

●

|

GIP, CPPIB, CIC Capital and certain members of the Brookfield Consortium other than Brookfield to acquire the rail business of Asciano. This would be effected by way of a scheme of arrangement. The scheme would be subject to conditions consistent with those applicable under the existing Qube Consortium takeover proposal as well as the normal court and Asciano shareholder approvals; and

|

|

·

|

Asciano's Ports business to be acquired for $3.84 billion (on a cash and debt free basis) as follows:

|

|

·

|

a Terminals Consortium comprising Qube, Brookfield and members of the Brookfield consortium (or entities controlled by them) would acquire 100% of Asciano's Patrick container terminal business excluding the 50% ACFS interest for $2.915 billion;

|

|

·

|

Brookfield and members of the Brookfield Consortium (or entities controlled by them) would acquire 100% of BAPS, the 50% ACFS interest and the 50% AAT interest (including the related shareholder loans provided by Asciano to AAT) for $925 million; and

|

|

·

|

the sales referred to above would complete upon implementation of the scheme of arrangement.

|

Any proposal that may be developed would need to be unanimously recommended by the Asciano board, and be subject to receipt of any necessary ASIC relief.

The parties will undertake negotiations as expeditiously as possible to determine whether an improved proposal can be developed. In the event that the Proposal described here is not able to be developed, nothing prevents Brookfield and its consortium partners from continuing to develop a proposal consistent with the one we outlined in our letter to you of 7 February 2016 (being a cash proposal at $9.28 less dividends and any break fee payable to any other parties).

We appreciate Asciano's involvement in and support of the discussions.

Yours sincerely,

Sam Pollock

Chief Executive Officer and Senior Managing Partner

Brookfield Infrastructure

23 February 2016

Mr Malcolm Broomhead

Chairman

Asciano Limited

Level 6, 15 Blue Street

North Sydney NSW 2060

STRICTLY PRIVATE AND CONFIDENTIAL

Dear Malcolm,

Commencement of discussions

You have encouraged us for the benefit of all Asciano shareholders to seek to develop a proposal which provides an improved and all-cash consideration, and which reduces ACCC uncertainty associated with a transaction.

As you know, discussions have recently commenced involving:

|

§

|

Qube Holdings Limited (Qube), Global Infrastructure Management, LLC (on behalf of itself and its managed funds and clients) (GIP), Canada Pension Plan Investment Board (CPPIB) and CIC Capital Corporation (CIC Capital) (collectively the Qube Consortium);

|

|

§

|

Brookfield Infrastructure Partners Limited as general partner of Brookfield Infrastructure Partners L.P. (Brookfield), for itself and on behalf of its consortium partners (the Brookfield Consortium); and

|

|

§

|

Asciano Limited (Asciano),

|

to identify whether the parties can develop the terms of an improved proposal that could be put to Asciano shareholders. The basis for the discussions is to seek to develop a proposal that delivers all-cash consideration at a premium to the current implied value of the existing Qube Consortium offer, is capable of achieving expeditious ACCC review and provides greater certainty as to timing of completion.

The discussions remain preliminary, indicative and non-binding, and there is no agreement, arrangement or understanding between the parties at this stage on the terms of any new proposal. However, you have asked us to write this letter to Asciano setting out the indicative terms currently under discussion in order that the market can be informed of those terms while the discussions continue.

Those indicative terms are:

|

§

|

all-cash consideration of $9.28 per Asciano share (less any dividends paid after the date of this letter);

|

|

§

|

GIP, CPPIB, CIC Capital and certain members of the Brookfield Consortium other than Brookfield to acquire the rail business of Asciano. This would be effected by way of a scheme of arrangement. The scheme would be subject to conditions consistent with those applicable under the existing Qube Consortium takeover proposal as well as the normal court and Asciano shareholder approvals; and

|

|

§

|

Asciano's Ports business to be acquired for $3.84 billion (on a cash and debt free basis) as follows:

|

|

§

|

Terminals Consortium comprising Qube and Brookfield (or entities controlled by them) would acquire 100% of Asciano's Patrick container terminal business excluding the 50% ACFS interest for $2.915 billion;

|

|

§

|

Brookfield and members of the Brookfield Consortium (or entities controlled by them) would acquire 100% of BAPS, the 50% ACFS interest and the 50% AAT interest (including the related shareholder loans provided by Asciano to AAT) for $925 million; and

|

|

§

|

the sales referred to above would complete upon implementation of the scheme of arrangement.

|

Any proposal that may be developed would need to be unanimously recommended by the Asciano board, and be subject to receipt of any necessary ASIC relief.

The parties will undertake negotiations as expeditiously as possible to determine whether an improved proposal can be developed. In the event that no such proposal is able to be developed, the Qube Consortium proposal which was unanimously recommended by the Asciano board on 16 February 2016 will continue in accordance with the terms of the Bid Implementation Deed with Asciano.

We appreciate Asciano's involvement and support.

Yours sincerely,

|

Maurice James

Manning Director

Qube Holdings Limited

|

Adebayo Ogunlesi

Chairman and Managing Partner

Global Infrastructure Management, LLC

|

Mark Jenkins

Global Head of Private Investments Canada Pension Plan Investment Board

|

Bao Jianmin

Managing Director CIC Capital Corporation

|

We appreciate Asciano's involvement and support of the discussions.

Yours sincerely,

|

Maurice James

Managing Director

Qube Holdings Limited

|

Adeoayo Ogunlesi

Chairman and Managing Partner

Global Infrastructure Management, LLC

|

Mark Jenkins

Global Head of Private Investments Canada Pension Plan Investment Board

|

Bao Jianmin

Managing Director CIC Capital Corporation

|

We appreciate Asciano's involvement and support of the discussions.

Yours sincerely,

|

Maurice James

Managing Director

Qube Holdings Limited

|

Adeoayo Ogunlesi

Chairman and Managing Partner

Global Infrastructure Management, LLC

|

Mark Jenkins

Global Head of Private Investments Canada Pension Plan Investment Board

|

Bao Jianmin

Managing Director CIC Capital Corporation

|

We appreciate Asciano's involvement and support of the discussions.

Yours sincerely,

|

Maurice James

Managing Director

Qube Holdings Limited

|

Adeoayo Ogunlesi

Chairman and Managing Partner

Global Infrastructure Management, LLC

|

Mark Jenkins

Global Head of Private Investments Canada Pension Plan Investment Board

|

Bao Jianmin

Managing Director CIC Capital Corporation

|

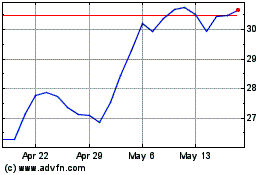

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

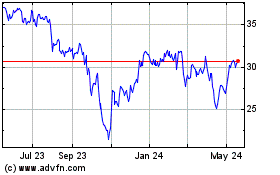

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Apr 2023 to Apr 2024