Current Report Filing (8-k)

December 30 2021 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

December 24, 2021

BAIN CAPITAL SPECIALTY FINANCE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

DELAWARE

|

|

814-01175

|

|

81-2878769

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

200 CLARENDON STREET, 37TH FLOOR,

BOSTON, MA

|

|

02116

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (617) 516-2000

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

|

BCSF

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

o Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company ¨

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 24, 2021, Bain Capital Specialty Finance, Inc. (the “Company”),

entered into a senior secured revolving credit agreement (the “Credit Agreement”) as Borrower, with Sumitomo Mitsui Banking

Corporation, as Administrative Agent and Sole Book Runner, and with Sumitomo Mitsui Banking Corporation and MUFG Union Bank, N.A., as

Joint Lead Arrangers. The Credit Agreement is effective as of December 24, 2021.

The facility amount under the Credit Agreement is $300,000,000 with

an accordion provision to permit increases to the total facility amount up to $1,000,000,000. Proceeds of the loans under the Credit Agreement

may be used for general corporate purposes of the Company, including, without limitation, repaying outstanding indebtedness, making distributions,

contributions and investments, and acquisition and funding, and such other uses as permitted under the Credit Agreement. The maturity

date is December 24, 2026.

Interest under the Credit Agreement is equal to (i) an “alternate

base rate” (as described therein) plus 0.75% or 0.875% per annum, (ii) the applicable Eurocurrency Rate (as defined therein) for

the relevant currency in which the applicable loans are denominated plus 1.75% or 1.875% per annum or (iii) for loans denominated in Pound

Sterling, RFR (as defined therein) plus 1.8693% or 1.9943% per annum, in each case, depending on the Company’s rate option election

(for loans denominated in US Dollars) and the borrowing base (as of the most recently delivered borrowing base certificate delivered under

the Credit Agreement).

The Credit Agreement includes customary affirmative and negative covenants,

including certain limitations on the incurrence of additional indebtedness and liens, as well as usual and customary events of default

for revolving credit facilities of this nature.

The description above is only a summary of the material provisions

of the Credit Agreement and is qualified in its entirety by reference to a copy of the Credit Agreement, which will be filed with the

Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

On December 27, 2021, the Company repaid in full

all outstanding amounts due in connection with, and terminated all commitments under, the Loan and Security Agreement, dated April 30,

2019, with the amendments thereto, by and among BCSF Complete Financing Solution LLC, JPMorgan Chase Bank, National Association as Administrative

Agent, and Wells Fargo Bank, National Association as Collateral Administrator, Collateral Agent, Securities Intermediary and Bank.

|

Item 2.03.

|

Creation of Direct Financial Obligation

|

The information included under Item 1.01 above regarding the Credit

Agreement is incorporated by reference into this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

Bain Capital Specialty Finance, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

BAIN CAPITAL SPECIALTY FINANCE, INC.

|

|

|

|

|

Date: December 30, 2021

|

By:

|

/s/ Michael Treisman

|

|

|

|

Name:

|

Michael Treisman

|

|

|

|

Title:

|

Secretary

|

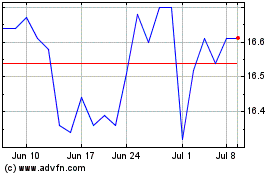

Bain Capital Specialty F... (NYSE:BCSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

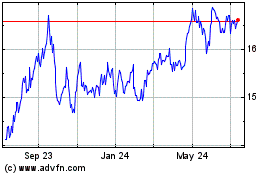

Bain Capital Specialty F... (NYSE:BCSF)

Historical Stock Chart

From Apr 2023 to Apr 2024