American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, reported results of operations for the

second quarter ended June 30, 2015. ARL announced today that the

Company reported net income applicable to common shares of $0.9

million, including $3.0 million in gains on the sale of land, or

$0.05 per diluted earnings per share, as compared to net income

applicable to common shares of $0.9 million, including $7.0 million

in gains on the sale of income-producing properties or $0.07 per

diluted earnings per share for the same period ended 2014.

For the six months ended June 30, 2015, we reported a net income

applicable to common shares of $3.8 million or $0.22 per diluted

earnings per share, as compared to a net income applicable to

common shares of $3.8 million or $0.33 per diluted earnings per

share for the same period ended 2014.

During the three months ended June 30, 2015, we acquired five

income-producing properties. We are diligent in our mission to

provide high-quality living opportunities to our tenants as

reflected in our occupancy rates being over 95%. The Company

continues to demonstrate an unwavering commitment to fortify the

portfolio and streamline operational activity, while at the same

time maintaining our commitment to creating value. “We believe our

second quarter 2015 operating results, combined with our recent

acquisitions, demonstrates another quarter of stabilized

performance for the Company. We believe the portfolio is well

positioned to deliver solid financial returns for the remainder of

2015,” said Danny Moos, the Company’s Chief Executive Officer and

President. We are pleased that we are seeing continued improvements

in our operations from these endeavors and will continue to adapt

to market challenges with an eye on both near-term economic

challenges and long-term prospects as the real estate market

improves.

In the Company’s commercial portfolio, we are seeing the benefit

of our efforts with new leases executed and increasing rents as

first year concessions expire. The Company also acquired a new

commercial property during the three months ended June 30, 2015. We

believe that we will continue to see growth in our commercial

portfolio as the economic conditions improve and we capitalize on

the influx of attractive prospects in the pipeline.

Rental and other property revenues were $24.2 million for the

three months ended June 30, 2015. This represents an increase of

$4.7 million, as compared to the prior period revenues of $19.5

million. This change, by segment, is an increase in the apartment

portfolio of $2.5 million, and an increase in the commercial

portfolio of $2.2 million. Within the apartment portfolio there was

an increase of $2.2 million in the acquired property portfolio and

an increase of $0.3 million in the same property portfolio. The

apartment portfolio continues to thrive in the current economic

conditions with occupancies averaging over 95%. We have been able

to surpass expectations due to the high-quality product offered,

strength of our management team and our commitment to our tenants.

This increase in apartment portfolio is also due to the acquisition

of new properties. Within the commercial portfolio, there was an

increase of $0.2 million in the acquired property portfolio and

increase of $2.0 million in the same store properties. We are

continuing to market our properties aggressively to attract new

tenants and strive for continuous improvement of our properties in

order to maintain our existing tenants.

Property operating expenses were $11.3 million for the three

months ended June 30, 2015. This represents an increase of $1.3

million, as compared to the prior period operating expenses of $10

million. This change, by segment, is an increase in the apartment

portfolio of $1.2 million, and an increase in the commercial

portfolio of $0.1 million. Within the apartment portfolio there was

an increase of $0.9 million in the acquired properties portfolio

and an increase of $0.3 million in the same property portfolio.

Within the commercial portfolio, there was an increase of $0.1

million in the same store properties.

General and administrative expenses were $1.6 million dollars

for the three months ended June 30, 2015. This represents a

decrease of $1.6 million, as compared to the prior period general

and administrative expenses of $3.2 million. This change, by

segment, is a decrease in the other portfolio of $1.4 million, and

a decrease in the land portfolio of $0.2 million. Within the other

portfolio, the decrease of $1.4 million was mainly due to lower

professional fees.

Mortgage and loan interest expense, including deferred borrowing

costs amortization, was $9.8 million for the three months ended

June 30, 2015. This represents an increase of $0.1 million, as

compared to the prior period expense of $9.7 million. This change

by segment is an increase in the other portfolio of $0.8 million,

and a decrease in the apartment portfolio of $0.7 million. Within

the other portfolio, the majority of this increase is due to the

securing of a new loan in the current period, which was utilized to

drive the acquisition and development activities of the Company.

The decrease in the apartment portfolio is the result of mortgage

refinances to lower interest rates.

Interest income was $4.5 million for the three months ended June

30, 2015. This represents a decrease of $1.5 million, as compared

to the prior year income of $6.0 million due to principal pay downs

made during the period on our outstanding notes and interest

receivable.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

For the Three Months Ended

For the Six Months Ended June 30, June 30,

2015 2014 2015

2014 (dollars in thousands, except per share amounts)

Revenues: Rental and other property revenues (including $173

and $175 for the three months and $343 and $350 for the six months

ended 2015 and 2014, respectively, from related parties) $ 24,241 $

19,500 $ 47,397 $ 38,659

Expenses: Property operating

expenses (including $187 and $158 for the three months and $349 and

$313 for the six months ended 2015 and 2014, respectively, from

related parties) 11,301 9,983 22,969 19,911 Depreciation and

amortization 5,137 4,323 9,841 8,636 General and administrative

(including $912 and $842 for the three months and $1,920 and $1,760

for the six months ended 2015 and 2014, respectively, from related

parties) 1,596 3,195 3,798 5,179 Net income fee to related party 45

210 335 700 Advisory fee to related party 2,309

2,202 4,601 4,445 Total

operating expenses 20,388 19,913

41,544 38,871 Net operating income (loss)

3,853 (413 ) 5,853 (212 )

Other income (expenses):

Interest income (including $4,246 and $5,959 for the three months

and $9,113 and $9,994 for the six months ended 2015 and 2014,

respectively, from related parties) 4,535 6,041 9,772 10,158 Other

income 14 232 4,111 406 Mortgage and loan interest (including $920

and $933 for the three months and $1,815 and $1,730 for the six

ended 2015 and 2014, respectively, from related parties) (9,794 )

(9,693 ) (21,439 ) (20,332 ) Earnings from unconsolidated

subsidiaries and investees 151 (124 ) 196 (54 ) Litigation

settlement (expense) (45 ) (86 ) (117 )

3,752 Total other expenses (5,139 ) (3,630 )

(7,477 ) (6,070 ) Loss before gain on land sales,

non-controlling interest, and taxes (1,286 ) (4,043 ) (1,624 )

(6,282 ) Gain on land sales 3,027 (159 )

5,903 594 Net income (loss) from

continuing operations before taxes 1,741 (4,202 ) 4,279 (5,688 )

Income tax benefit (expense) (12 ) 2,195

91 4,244 Net income (loss) from

continuing operations 1,729 (2,007 ) 4,370 (1,444 ) Discontinued

operations: Net income (loss) from discontinued operations (34 )

(732 ) 260 (931 ) Gain on sale of real estate from discontinued

operations - 7,003 - 13,057 Income tax benefit (expense) from

discontinued operations 12 (2,195 ) (91

) (4,244 ) Net income (loss) from discontinued operations

(22 ) 4,076 169

7,882 Net income 1,707 2,069 4,539 6,438 Net income (loss)

attributable to non-controlling interest (540 ) (551

) (32 ) (1,370 ) Net income attributable to American

Realty Investors, Inc. 1,167 1,518 4,507 5,068 Preferred dividend

requirement (275 ) (613 ) (665 ) (1,226

) Net income applicable to common shares $ 892 $ 905

$ 3,842 $ 3,842

Earnings per share -

basic Net income (loss) from continuing operations $ 0.06 $

(0.28 ) $ 0.25 $ (0.35 ) Net income from discontinued operations

- 0.35 0.01 0.68

Net income applicable to common shares $ 0.06 $ 0.07

$ 0.26 $ 0.33

Earnings per share -

diluted Net income (loss) from continuing operations $ 0.05 $

(0.28 ) $ 0.21 $ (0.35 ) Net income (loss) from discontinued

operations - 0.35 0.01

0.68 Net income applicable to common shares $ 0.05

$ 0.07 $ 0.22 $ 0.33 Weighted

average common shares used in computing earnings per share

15,367,320 11,525,389 14,701,170 11,525,389 Weighted average common

shares used in computing diluted earnings per share 17,844,339

11,525,389 17,178,190 11,525,389

Amounts

attributable to American Realty Investors, Inc. Net income

(loss) from continuing operations $ 1,189 $ (2,558 ) $ 4,338 $

(2,814 ) Net income (loss) from discontinued operations (22

) 4,076 169 7,882 Net

income applicable to American Realty Investors, Inc. $ 1,167

$ 1,518 $ 4,507 $ 5,068

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED BALANCE

SHEETS (unaudited) June 30,

December 31, 2015 2014

(dollars in thousands, except share and par value amounts)

Assets Real estate, at cost $ 921,843 $ 810,214 Real estate

subject to sales contracts at cost, net of depreciation ($2,475 for

2015 and $2,300 for 2014) 19,032 19,026 Less accumulated

depreciation (138,961 ) (129,477 ) Total real estate

801,914 699,763 Notes and interest receivable Performing (including

$130,587 in 2015 and $139,466 in 2014 from related parties) 140,483

149,484 Non-performing 3,181 3,161 Less allowance for doubtful

accounts (including $15,537 in 2015 and 2014 from related parties)

(18,279 ) (18,279 ) Total notes and interest

receivable 125,385 134,366 Cash and cash equivalents 19,157 12,299

Restricted cash 52,183 49,266 Investments in unconsolidated

subsidiaries and investees 1,299 4,279 Receivable from related

party 37,360 21,414 Other assets 39,320 44,111

Total assets $ 1,076,618 $ 965,498

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 755,508 $ 638,891 Notes related to assets held

for sale 910 1,552 Notes related to subject to sales contracts

18,251 18,616 Deferred revenue (including $72,564 in 2015 and 2014

from sales to related parties) 72,633 74,409 Accounts payable and

other liabilities (including $6,732 in 2015 and $11,024 in 2014 to

related parties) 43,916 52,442 891,218

785,910 Shareholders’ equity: Preferred stock, Series A:

$2.00 par value, authorized 15,000,000 shares, issued and

outstanding 2,000,614 and 2,461,252 shares in 2015 and 2014

(liquidation preference $10 per share), including 900,000 shares in

2015 and 2014 held by ARL or subsidiaries. 2,205 3,126 Common

stock, $0.01 par value, authorized 100,000,000 shares; issued

15,930,145 and 14,443,404 shares; outstanding 15,514,360 and

14,027,619 shares in 2015 and 2014, respectively; including 140,000

shares held by TCI (consolidated) in 2015 and 2014. 156 141

Treasury stock at cost; 415,785 shares (6,395 ) (6,395 ) Paid-in

capital 110,546 108,378 Retained earnings 23,597

19,090 Total American Realty Investors, Inc.

shareholders' equity 130,109 124,340 Non-controlling interest

55,291 55,248 Total shareholders'

equity 185,400 179,588 Total

liabilities and shareholders' equity $ 1,076,618 $ 965,498

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150812006333/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

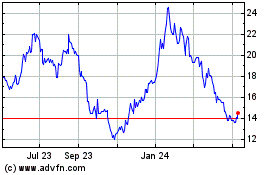

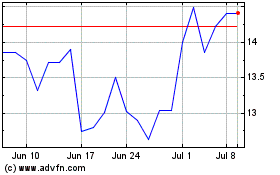

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024