UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

October 2023

Date of Report (Date of Earliest Event Reported)

Embotelladora Andina S.A.

(Exact name of registrant as specified in its charter)

Andina Bottling Company, Inc.

(Translation of Registrant´s name into English)

Avda. Miraflores 9153

Renca

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the Registrant is submitting

this Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Indicate by check mark whether the registrant by

furnishing the information contained in this Form 6-K is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934

Yes ¨ No x

EXECUTIVE SUMMARY

|  | The

quarter closed with a consolidated Sales Volume of 202.9 million unit cases*, increasing

0.5% compared to the same quarter of the previous year. Transactions reached 1,128.6 million

during the quarter, representing a 0.2% decrease regarding the same quarter of the previous

year. Accumulated consolidated Sales Volume reached 634.3 million unit cases, representing

a 1.9% increase regarding the previous year. Accumulated transactions reached 3,498.4 million,

representing a 1.9% increase. |

|  | Consolidated

results for the quarter were strongly affected by the depreciation of local currencies, especially

the Argentine peso and the Guarani, against the reporting currency. Isolating this effect,

i.e. on a currency neutral* basis, the company's figures are as follows: |

| · | Consolidated

net sales reached CLP 689,745 million, increasing 5.5% during the quarter. |

| · | Consolidated Operating Income* reached CLP 80,986 million, increasing

17.8% during the quarter. |

| · | Consolidated Adjusted EBITDA* reached CLP 114,575 million, increasing

15.4% during the quarter. |

| Company

figures reported are the following: |

| · | Consolidated

Net Sales reached CLP 670,333 million in the quarter, increasing by 2.6% over the same quarter

of the previous year. Accumulated consolidated Net Sales reached CLP 2,021,002 million, representing

a 4.6% increase regarding the previous year. |

| · | Consolidated Operating Income* reached

CLP 78,140 million in the quarter, representing a 13.6% increase over the same quarter of

the previous year. Accumulated consolidated Operating Income reached CLP 251,974 million,

an increase of 5.3% regarding the previous year. |

| · | Consolidated Adjusted EBITDA* increased

by 11.3% over the same quarter of the previous year, reaching CLP 110,520 million in the

quarter. Adjusted EBITDA Margin reached 16.5%, an expansion of 129 basis points compared

to the same quarter of the previous year. Accumulated consolidated Adjusted EBITDA reached

CLP 345,219 million, which represents an increase of 5.0% compared to the previous year.

Adjusted EBITDA Margin for the period reached 17.1%, an expansion of 6 basis points compared

to the previous year. |

| · | Net Income attributable to the owners

of the controller for the quarter reached CLP 63,708 million, representing an 87.4% increase

regarding the same quarter of the previous year. Accumulated Net Income attributable to the

owners of the controller was CLP 112,150 million, which represents a 24.4% increase regarding

the previous year. |

SUMMARY OF RESULTS FOR THE THIRD QUARTER 2023

AND ACCUMULATED AS OF THE THIRD QUARTER

| (Figures

in million CLP) | |

| 3Q22 | |

| 3Q23 | |

| Var

% | |

| 9M22 | |

| 9M23 | |

| Var

% | |

Sales

Volume

(Million Unit Cases) | |

| 201.8 | |

| 202.9 | |

| 0.5 | % |

| 622.6 | |

| 634.3 | |

| 1.9 | % |

| Net Sales | |

| 653,498 | |

| 670,333 | |

| 2.6 | % |

| 1,932,681 | |

| 2,021,002 | |

| 4.6 | % |

| Operating Income* | |

| 68,765 | |

| 78,140 | |

| 13.6 | % |

| 239,392 | |

| 251,974 | |

| 5.3 | % |

| Adjusted EBITDA* | |

| 99,290 | |

| 110,520 | |

| 11.3 | % |

| 328,880 | |

| 345,219 | |

| 5.0 | % |

| Net income attributable to the owners

of the controller | |

| 33,999 | |

| 63,708 | |

| 87.4 | % |

| 90,185 | |

| 112,150 | |

| 24.4 | % |

Comment of the Chief Executive Officer.

Mr. Miguel Ángel Peirano

"We finished the third quarter with

very good results. During the quarter, the Company's Consolidated Adjusted EBITDA increased by 11.3%, driven by operations in Brazil,

Paraguay, and Chile, which increased their EBITDA in local currency by 36.3%, 24.6%, and 11.9%, respectively. Argentina was the only

operation that did not show positive EBITDA growth in local currency (-4.8% in real terms), a country experiencing a severe economic

crisis, resulting in a drop in economic activity and hyperinflation, and where price controls prevent us from raising prices in line

with local inflation. Excluding the Argentine operation, the Company's EBITDA increased 19.4% over the same period the previous year.

Consolidated volume increased by 0.5% in

the quarter, owing to growth in our franchises in Paraguay (8.3%) and Brazil (5.0%), which was partially offset by volume decreases in

our franchises in Argentina and Chile. The volume reduction in Argentina (-3.5%) is explained by the country's economic situation, while

the volume reduction in Chile (-2.9%) is largely explained by a rainier winter than the previous year.

We successfully placed a CHF 170 million

5-year bond in the Swiss market in September at a rate of 2.7175%, which was fully redenominated into Brazilian reais via cross

currency swaps. A significant portion of the proceeds were used to refinance a USD 365 million bond issued by the Company in the United

States, which was also redenominated into Brazilian reais via cross currency swaps for the equivalent of BRL 840 million and that recently

matured.

* The definitions used can be found in the Glossary on page 16 of

this document.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -2- |

During this

quarter, Coca-Cola Andina Argentina received the "Sustainable Company" seal from the municipality of Godoy Cruz - Mendoza.

This certification recognizes organizations that help to achieve a safe, fair, and sustainable economy with a social floor and an environmental

ceiling. We are in the Top 10 of the MercoTalento ranking of organizations with the greatest capacity to attract and retain talent in

Chile this year 2023, taking 8th place and climbing 6 positions from the previous year. In Paraguay, we were recognized in the Large

Industries 2023 Awards as an innovative organization that promotes the country's development. For 58 years, our operation in Paraguay

has been on the path to sustainable economic development, becoming a key pillar of the local industry. In addition, we were named Employer

of the Year in Paraguay for the seventh consecutive year in August. This award recognizes our dedication to the development of the country

and our ability to create opportunities through job creation.

Finally,

we kept making steady progress with our digital transformation. Our B2B platform MiAndina is consistently growing in transactions across

all of our operations; today, our digital platforms account for approximately 14% of total Traditional Channel Revenues, with customer

satisfaction levels around 75%. We continue to use Artificial Intelligence, Data Analytics, and Robotic Process Automations to automate

internal tasks and processes, increasing efficiency and productivity in back-office, logistics, and supply chain operations. Furthermore,

we already have 90% of our management bases in the Cloud (AWS), where our employees can access real-time market, supply chain, and back

office data to make agile decisions."

BASIS OF PRESENTATION

Figures in the

following analysis are expressed in accordance with IFRS, in nominal Chilean pesos, both for consolidated results and for the results

of each of our operations. All variations with respect to 2022 are nominal.

Since Argentina

has been classified as a Hyperinflationary economy, pursuant to IAS 29, translation of figures from local to reporting currency was performed

using the closing exchange rate for the translation to Chilean pesos. Local currency figures for both 2023 and 2022 referred to in the

Argentina sections are expressed in September 2023 currency.

Finally, a devaluation

of local currencies regarding the U.S. dollar has a negative impact on our dollarized costs and a devaluation of local currencies regarding

the Chilean peso has a negative impact upon consolidating figures.

When we refer to

"Argentina", we mean our subsidiaries Embotelladora del Atlántico S.A. and Empaques Argentina S.A. When we refer to

"Chile", we mean our subsidiaries Embotelladora Andina S.A., VJ S.A., Vital Aguas S.A., Envases Central S.A. and Re-Ciclar

S.A.

CONSOLIDATED RESULTS: 3rd Quarter

2023 vs. 3rd Quarter 2022

| (Figures

in million CLP) | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | |

| Net Sales | |

| 653,498 | | |

| 670,333 | | |

| 2.6 | % |

| Operating Income | |

| 68,765 | | |

| 78,140 | | |

| 13.6 | % |

| Adjusted EBITDA | |

| 99,290 | | |

| 110,520 | | |

| 11.3 | % |

| Net income attributable

to the owners of the controller | |

| 33,999 | | |

| 63,708 | | |

| 87.4 | % |

During the quarter,

consolidated Sales Volume was 202.9 million unit cases, which represented an increase of 0.5% compared to the same period of 2022, mainly

explained by the volume increase of the operations in Paraguay and Brazil, partially offset by the volume decrease of the operations

in Argentina and Chile. The Non-Alcoholic Beverages Segment represented 94.4% of consolidated Sales Volume and grew 0.3%, mainly explained

by the growth of the segment in Paraguay and Brazil, partially offset by the decrease in Argentina and Chile. The Alcoholic Beverages

Segment represented 5.6% of total volume and grew 4.3% explained by the growth of Brazil and Chile. Transactions reached 1,128.6 million

during the quarter, representing a 0.2% decrease compared to the same quarter of the previous year.

Consolidated Net

Sales reached CLP 670,333 million, an increase of 2.6%, explained by the revenue growth in Brazil, Chile and Paraguay, which was partially

offset by the reduction in revenues in Argentina, as well as by the effect of translating figures from the local currencies of Argentina,

Brazil and Paraguay to the reporting currency.

Consolidated Cost

of Sales increased 1.3%, which is mainly explained by (i) a higher cost of concentrate due to price increases in Brazil and Paraguay,

(ii) the shift in the mix towards higher unit cost products in Brazil, Chile and Paraguay, and (iii) a higher cost of sugar

in Brazil and Paraguay. This was partially offset by (i) a lower cost of Pet resin in the four countries where we operate, (ii) a

lower cost of sugar in Argentina, (iii) a lower cost of concentrate in Argentina, and (iv) the effect of translating figures

from the local currencies of Argentina, Brazil and Paraguay to the reporting currency.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -3- |

Consolidated Distribution Costs and Administrative

Expenses increased 1.3%, which is mainly explained by (i) higher distribution expenses in Brazil, Chile and Paraguay, (ii) higher

labor costs, and (iii) higher marketing expenses in Argentina, Chile and Paraguay. This was partially offset by (i) lower freight

expenses in Argentina, and (ii) the effect of translating figures from the local currencies of Argentina, Brazil and Paraguay to

the reporting currency.

The aforementioned effects led to a consolidated

Operating Income of CLP 78,140 million, an increase of 13.6%. Operating Margin was 11.7%.

Consolidated Adjusted EBITDA reached CLP 110,520

million, increasing by 11.3%. Adjusted EBITDA margin was 16.5%, an expansion of 129 basis points.

Net income attributable to the owners of the

controller for the quarter was CLP 63,708 million, an increase of 87.4%, and Net Margin reached 9.5%, an expansion of 430 basis points.

ARGENTINA: 3rd Quarter 2023 vs. 3rd Quarter 2022

| | |

| 3Q22 | | |

| 3Q23 | | |

| Var % | | |

| 3Q22 | | |

| 3Q23 | | |

| Var % | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (Figures in million CLP) | | |

| (Figures in million ARS of September 2023) | |

| Net Sales | |

| 178,437 | | |

| 159,472 | | |

| -10.6 | % | |

| 65,579 | | |

| 62,313 | | |

| -5.0 | % |

| Operating Income | |

| 17,921 | | |

| 14,893 | | |

| -16.9 | % | |

| 6,586 | | |

| 5,819 | | |

| -11.6 | % |

| Adjusted EBITDA | |

| 26,985 | | |

| 24,175 | | |

| -10.4 | % | |

| 9,917 | | |

| 9,446 | | |

| -4.8 | % |

Sales volume in the quarter decreased 3.5%, reaching

44.4 million unit cases, explained by the volume decrease in the Soft Drinks and Juices and other non-alcoholic beverages categories,

partially offset by the increase in the Water category. Transactions amounted to 212.4 million, representing a decrease of 4.1%.

Net sales amounted to CLP 159,472 million, down

10.6%. In local currency, they decreased by 5.0%, which was mainly explained by the aforementioned decrease in volume and to a lesser

extent by the decrease in the average revenue per unit case sold, as a result of price increases slightly below local inflation during

the quarter.

Cost of Sales decreased 12.3%, while in local

currency it decreased 6.8%, which is mainly explained by (i) the lower sales volume, (ii) a lower cost of Pet resin, and (iii) a

lower cost of concentrate. This was offset by (i) higher labor costs, and (ii) higher sugar costs.

Distribution Costs and Administrative Expenses

decreased 6.2% in the reporting currency, while in local currency they decreased 0.2%, which is mainly explained by (i) lower freight

expenses, due to lower volumes sold, and (ii) lower marketing expenses. This was offset by higher labor expenses.

The aforementioned effects led to an Operating

Income of CLP 14,893 million, a decrease of 16.9% compared to the same period of the previous year. Operating Margin was 9.3%. In local

currency, Operating Income decreased 11.6%.

Adjusted EBITDA amounted to CLP 24,175 million,

a decrease of 10.4%. Adjusted EBITDA margin was 15.2%, an expansion of 4 basis points. Adjusted EBITDA in local currency decreased 4.8%.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -4- |

BRAZIL: 3rd Quarter 2023 vs. 3rd

Quarter 2022

| | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (Figures

in million CLP) | | |

| (Figures

in million BRL) | |

| Net Sales | |

| 162,292 | | |

| 181,272 | | |

| 11.7 | % | |

| 919 | | |

| 1,036 | | |

| 12.7 | % |

| Operating Income | |

| 17,084 | | |

| 25,152 | | |

| 47.2 | % | |

| 97 | | |

| 144 | | |

| 48.2 | % |

| Adjusted EBITDA | |

| 24,880 | | |

| 33,638 | | |

| 35.2 | % | |

| 141 | | |

| 192 | | |

| 36.3 | % |

Sales volume for

the quarter reached 70.4 million unit cases, an increase of 5.0%, explained by the increase in the Soft Drinks, Juices and other non-alcoholic

beverages and Beer and other alcoholic beverages categories. The Non-Alcoholic Beverages Segment represented 98.0% of total sales volume,

and grew 4.8%, which was explained by the growth of the Soft Drinks and Juices and other non-alcoholic beverages categories. The Alcoholic

Beverages segment represented 2.0% of total volume and grew 17.9%, explained by the increase in the Other alcoholic beverages category.

Transactions amounted to 391.8 million, an increase of 4.2%.

Net sales amounted

to CLP 181,272 million, an increase of 11.7%. In local currency, Net Sales increased by 12.7%, which was mainly explained by the increase

in the average revenue per unit case sold and the aforementioned increase in volume. Net Sales of the Non-Alcoholic Beverages segment

increased 11.7% in local currency, representing 94.3% of total sales. Net Sales of the Alcoholic Beverages Segment increased 33.1% in

local currency, representing 5.7% of total sales.

Cost of Sales increased

7.0%, while in local currency it increased 8.0%, which is mainly explained by (i) higher sales volume, (ii) a higher cost of

concentrate due to price increases, and (iii) a higher cost of sugar. This was partially offset by a lower cost of raw materials,

especially Pet resin.

Distribution Costs

and Administrative Expenses increased 8.9% in the reporting currency. In local currency, they increased 10.0%, which is mainly explained

by (i) higher labor expenses, (ii) higher depreciation, and (iii) higher distribution expenses, both due to higher volumes

and higher tariffs.

The aforementioned

effects led to an Operating Income of CLP 25,152 million, an increase of 47.2%. Operating Margin was 13.9%. In local currency, Operating

Income increased 48.2%.

Adjusted EBITDA

reached CLP 33,638 million, an increase of 35.2% over the previous year. Adjusted EBITDA margin was 18.6%, an expansion of 323 basis

points. In local currency, Adjusted EBITDA increased 36.3%.

CHILE: 3rd Quarter 2023 vs. 3rd Quarter

2022

| | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | |

| | |

| | | |

| | | |

| | |

| | |

| (Figures

in million CLP) | |

| Net Sales | |

| 261,897 | | |

| 276,771 | | |

| 5.7 | % |

| Operating Income | |

| 25,088 | | |

| 28,056 | | |

| 11.8 | % |

| Adjusted EBITDA | |

| 35,020 | | |

| 39,176 | | |

| 11.9 | % |

During the quarter,

Sales Volume reached 69.8 million unit cases, a decrease of 2.9%, explained by the decrease in the Soft Drinks and Juices and other non-alcoholic

beverages categories, partially offset by the increase in the Water and Beer and other alcoholic beverages categories. Transactions amounted

to 408.7 million, representing a decrease of 4.3%. The volume of the Non-Alcoholic Beverages Segment represented 85.8% of total Sales

Volume, and decreased by 3.6%, which was explained by the decrease in the Soft Drinks and Juices and other non-alcoholic beverages categories,

partially offset by the increase in the Waters category. The volume of the Alcoholic Beverages Segment represented 14.2% of total sales

volume, and grew by 1.4%, explained by the Other alcoholic beverages and Beers categories.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -5- |

Net Sales reached CLP 276,771 million, an increase

of 5.7%, which is mainly explained by the increase in the average revenue per unit case sold, as a result of price increases. Net Sales

of the Non-Alcoholic Beverages segment increased 4.5%, representing 73.5% of total sales. Net Sales of the Alcoholic Beverages Segment

increased 9.1%, representing 26.5% of total sales.

Cost of Sales increased 5.3%, which is mainly

explained by a shift in the mix towards higher unit cost products. This was partially offset by (i) the lower volume sold, and (ii) a

lower cost of raw materials, especially Pet resin.

Distribution Costs and Administrative Expenses

increased 4.2%, which is mainly explained by (i) a higher cost of labor and services provided by third parties, and (ii) higher

distribution and transportation expenses, as a result of higher tariffs. This was partially offset by lower marketing expenses.

The aforementioned effects led to an Operating

Income of CLP 28,056 million, 11.8% higher when compared to the previous year. Operating Margin was 10.1%.

Adjusted EBITDA reached CLP 39,176 million, an

increase of 11.9%. Adjusted EBITDA Margin was 14.2%, an expansion of 78 basis points.

PARAGUAY: 3rd Quarter 2023 vs. 3rd Quarter

2022

| | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | | |

| 3Q22 | | |

| 3Q23 | | |

| Var

% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| (Figures in million CLP) | | |

| (Figures in million PGY) | |

| Net Sales | |

| 52,574 | | |

| 54,147 | | |

| 3.0 | % | |

| 392,064 | | |

| 461,220 | | |

| 17.6 | % |

| Operating Income | |

| 10,551 | | |

| 12,028 | | |

| 14.0 | % | |

| 78,747 | | |

| 102,343 | | |

| 30.0 | % |

| Adjusted EBITDA | |

| 14,285 | | |

| 15,590 | | |

| 9.1 | % | |

| 106,549 | | |

| 132,770 | | |

| 24.6 | % |

During the quarter, Sales Volume reached 18.3

million unit cases, an increase of 8.3%, explained by the volume increase in all categories. Transactions reached 115.7 million, an increase

of 8.2%.

Net sales amounted to CLP 54,147 million, an increase of 3.0%. In

local currency, Net Sales increased 17.6%, which was mainly explained by a higher average revenue per unit case sold and the aforementioned

increase in volume.

Cost of Sales in the reporting currency increased

0.9%. In local currency, it increased 15.3%, which is mainly explained by (i) the higher volume sold, (ii) a higher cost of

concentrate due to price increases, (iii) a higher cost of sugar and fructose, and (iv) the shift in the mix towards higher

unit cost products. This was partially offset by a lower cost of Pet resin.

Distribution Costs and Administrative Expenses

decreased 1.5%, and in local currency they increased 12.6%. This is mainly explained by (i) a higher cost of labor and services

provided by third parties, (ii) a higher marketing expense, and (iii) a higher distribution expense, due to the higher volume

sold and higher tariffs.

The aforementioned effects led to an Operating

Income of CLP 12,028 million, 14.0% higher when compared to the previous year. Operating Margin reached 22.2%. In local currency, Operating

Income increased 30.0%.

Adjusted EBITDA reached CLP 15,590 million, an

increase of 9.1%, and Adjusted EBITDA Margin was 28.8%, an expansion of 162 basis points. In local currency Adjusted EBITDA increased

24.6%.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -6- |

ACCUMULATED RESULTS: as of September 30,

2023 vs. as of September 30, 2022

| (Figures in million CLP) | |

| 9M22 | | |

| 9M23 | | |

| Var

% | |

| Net Sales | |

| 1,932,681 | | |

| 2,021,002 | | |

| 4.6 | % |

| Operating Income | |

| 239,392 | | |

| 251,974 | | |

| 5.3 | % |

| Adjusted EBITDA | |

| 328,880 | | |

| 345,219 | | |

| 5.0 | % |

| Net income attributable to the owners

of the controller | |

| 90,185 | | |

| 112,150 | | |

| 24.4 | % |

Consolidated Sales Volume was 634.3 million unit

cases, which represented an increase of 1.9% compared to the same period of 2022, mainly explained by the volume increase in the Brazilian

and Paraguayan operations, partially offset by the volume decrease in the Argentine and Chilean operations. The Non-Alcoholic Beverages

Segment represented 94.8% of consolidated Sales Volume and grew 2.1%, explained by the growth of the Segment in Brazil and Paraguay,

partially offset by the decrease in Argentina and Chile. The Alcoholic Beverages Segment represented 5.2% of total volume and decreased

1.6%, which was mainly explained by the reduction of the Segment's volume in the Chilean operation, and was partially offset by the growth

of the Segment in the Brazilian operation. Transactions amounted to 3,498.4 million, an increase of 1.9%. Consolidated Net Sales reached

CLP 2,021,002 million, an increase of 4.6%.

Consolidated Cost of Sales increased by 4.3%,

which is mainly explained by (i) the higher cost of concentrate due to price increases in Brazil, Chile and Paraguay, (ii) the

shift in the mix towards higher unit cost products in Brazil, Chile and Paraguay, and (iii) a higher cost of sugar in Brazil and

Paraguay. This was partially offset by (i) a lower cost of Pet resin in the four countries where we operate, (ii) a lower cost

of sugar in Argentina, (iii) a lower cost of concentrate in Argentina, and (iv) the effect of translating figures from the

local currencies of Argentina, Brazil and Paraguay to the reporting currency.

Consolidated Distribution Costs and Administrative

Expenses increased 4.9%, which is mainly explained by (i) higher distribution expenses in Brazil, Chile and Paraguay, (ii) higher

labor costs, and (iii) higher marketing expenses in Argentina, Chile and Paraguay. This was partially offset by (i) lower freight

expenses in Argentina, and (ii) the effect of translating figures from the local currencies of Argentina, Brazil and Paraguay to

the reporting currency.

The aforementioned effects led to a consolidated

Operating Income of CLP 251,974 million, an increase of 5.3%. Operating Margin was 12.5%.

Consolidated Adjusted EBITDA reached CLP 345,219

million, an increase of 5.0%. Adjusted EBITDA Margin was 17.1%, an expansion of 6 basis points.

Net income attributable to the owners of the

controller was CLP 112,150 million, an increase of 24.4%, and net margin reached 5.5%, an expansion of 88 basis points.

Argentina

| | |

9M22 | | |

9M23 | | |

Var

% | | |

9M22 | | |

9M23 | | |

Var

% | |

| | |

(Figures

in million CLP) | | |

(Figures

in million ARS of September 2023) | |

| Net Sales | |

552,479 | | |

507,796 | | |

-8.1 | % | |

203,046 | | |

198,418 | | |

-2.3 | % |

| Operating Income | |

75,923 | | |

69,052 | | |

-9.0 | % | |

27,903 | | |

26,982 | | |

-3.3 | % |

| Adjusted EBITDA | |

103,781 | | |

96,028 | | |

-7.5 | % | |

38,141 | | |

37,522 | | |

-1.6 | % |

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -7- |

Sales volume decreased 1.6%, reaching 140.8 million

unit cases, explained by the decrease in the volume of the Soft Drinks and Juices and other non-alcoholic beverages category, partially

offset by the increase in the volume of the Waters category. Transactions amounted to 673.9 million, an increase of 0.5%.

Net Sales amounted to CLP 507,796 million, a

decrease of 8.1%, while in local currency, Net Sales decreased 2.3%, which was mainly explained by the aforementioned decrease in volume

and to a lesser extent by the decrease in the average revenue per unit case sold.

Cost of Sales decreased 10.9%. In local currency,

it decreased 5.2%, which is mainly explained by (i) the reduction in volume sold, (ii) a lower cost of sugar, (iii) a

lower cost of concentrate, and (iv) a lower cost of Pet resin. This was partially offset by higher labor costs.

Distribution Costs and Administrative Expenses

decreased 3.1% in the reporting currency. In local currency, these increased 3.0%, which is mainly explained by (i) higher advertising

expenses, and (ii) higher labor expenses. This was partially offset by a lower distribution cost due to lower sales volume.

The aforementioned effects led to an Operating

Income of CLP 69,052 million, a decrease of 9.0%. Operating Margin was 13.6%. In local currency, Operating Income decreased 3.3%.

Adjusted EBITDA reached CLP 96,028 million, a

decrease of 7.5%. Adjusted EBITDA margin was 18.9%, an expansion of 13 basis points. Adjusted EBITDA in local currency decreased 1.6%.

Brazil

| | |

9M22 | | |

9M23 | | |

Var

% | | |

9M22 | | |

9M23 | | |

Var

% | |

| | |

(Figures

in million CLP) | | |

(Figures

in million BRL) | |

| Net Sales | |

444,024 | | |

501,779 | | |

13.0 | % | |

2,641 | | |

3,055 | | |

15.7 | % |

| Operating Income | |

50,743 | | |

67,000 | | |

32.0 | % | |

302 | | |

407 | | |

34.8 | % |

| Adjusted EBITDA | |

73,537 | | |

90,806 | | |

23.5 | % | |

438 | | |

552 | | |

26.1 | % |

Sales volume increased 7.2%, reaching 212.1 million

unit cases, explained by the increase in volume of all categories. The Non-Alcoholic Beverages segment represented 98.1% of total sales

volume, and grew 7.0%, which was explained by the growth of all categories in the segment. The Alcoholic Beverages segment represented

1.9% of total volume and grew 15.0%, which was explained by the growth of all the categories in the segment. Transactions amounted to

1,167.4 million, representing an increase of 7.2%.

Net Sales reached CLP 501,779 million, an increase

of 13.0%. In local currency, Net Sales increased 15.7%, due to a higher average price as a result of the price increases we have implemented

and the aforementioned increase in volume. Net Sales of the Non-Alcoholic Beverages segment increased 14.9% in local currency, representing

94.2% of total sales. Net Sales of the Alcoholic Beverages segment increased 30.1% in local currency, representing 5.8% of total sales.

Cost of Sales increased 9.9%, while in local

currency it increased 12.6%, which is mainly explained by (i) the higher sales volume, (ii) a higher cost of concentrate due

to price increases, (iii) a higher cost of sugar, and (iv) the shift in the mix towards higher unit cost products. This was

partially offset by a lower cost of Pet resin.

Distribution Costs and Administrative Expenses

increased 12.1% in the reporting currency, and in local currency they increased 14.7%, which is mainly explained by (i) higher labor

costs, (ii) higher distribution and transportation expenses, and (iii) higher depreciation charges.

The aforementioned effects led to an Operating

Income of CLP 67,000 million, an increase of 32.0%. Operating Margin was 13.4%. In local currency, Operating Income increased 34.8%.

Adjusted EBITDA reached CLP 90,806 million, an

increase of 23.5% over the previous year. Adjusted EBITDA margin was 18.1%, an expansion of 154 basis points. In local currency Adjusted

EBITDA increased 26.1%.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -8- |

Chile

| | |

9M22 | | |

9M23 | | |

Var

% | |

| | |

(Figures

in million CLP) |

| |

| Net Sales | |

790,999 | | |

859,500 | | |

8.7 | % |

| Operating Income | |

83,508 | | |

85,336 | | |

2.2 | % |

| Adjusted EBITDA | |

112,697 | | |

118,109 | | |

4.8 | % |

Sales volume reached 226.7 million unit cases,

a decrease of 1.0%, explained by the decrease in the volume of the Soft Drinks, Juices and other non-alcoholic beverages and Beers and

other alcoholic beverages categories, partially offset by the increase in the Waters category. Transactions amounted to 1,318.7 million,

representing a decrease of 2.7%. The Non-Alcoholic Beverages Segment represented 87.4% of total Sales Volume, and decreased by 0.5%,

which was explained by the decrease in the volume of the Soft Drinks and Juices and other non-alcoholic beverages categories, partially

offset by the increase in the Waters category. The Alcoholic Beverages segment represented 12.6% of total sales volume and decreased

4.3%, explained by the decrease in the Beer and Other alcoholic beverages categories.

Net Sales amounted to CLP 859,500 million, an

increase of 8.7%, which is explained by a higher average price in the period, due to price increases. Net Sales of the Non-Alcoholic

Beverages segment increased 9.3%, representing 76.0% of total sales. Net Sales of the Alcoholic Beverages Segment increased 6.8%, representing

24.0% of total sales.

Cost of Sales increased 9.5%, which is mainly

explained by (i) a shift in the mix towards higher unit cost products, and (ii) a higher cost of concentrate due to price increases.

This was partially offset by a lower cost of raw materials, especially Pet resin.

Distribution Costs and Administrative Expenses

increased 9.1%, which is mainly explained by (i) a higher cost of labor and services provided by third parties, (ii) higher

distribution and transportation expenses, as a consequence of higher tariffs, and (iii) higher marketing expenses.

The aforementioned effects led to an Operating

Income of CLP 85,336 million, 2.2% higher when compared to the previous year. Operating Margin was 9.9%.

Adjusted EBITDA reached CLP 118,109 million,

an increase of 4.8%. Adjusted EBITDA Margin was 13.7%, a contraction of 51 basis points.

Paraguay

| | |

9M22 | | |

9M23 | | |

Var

% | | |

9M22 | | |

9M23 | | |

Var

% | |

| | |

(Figures

in million CLP) | | |

(Figures

in million PGY) | |

| Net Sales | |

148,921 | | |

154,610 | | |

3.8 | % | |

1,202,836 | | |

1,365,085 | | |

13.5 | % |

| Operating Income | |

34,245 | | |

35,853 | | |

4.7 | % | |

279,075 | | |

316,627 | | |

13.5 | % |

| Adjusted EBITDA | |

43,892 | | |

45,790 | | |

4.3 | % | |

356,415 | | |

404,417 | | |

13.5 | % |

Sales volume reached 54.8 million unit cases,

an increase of 3.8%, explained by the increase in volume in all categories. Transactions totaled 338.5 million, an increase of 6.3%.

Net Sales amounted to CLP 154,610 million, an

increase of 3.8%. In local currency, Net Sales increased 13.5%, which is explained by a higher average price, and to a lesser extent

by the aforementioned increase in Sales Volume.

Cost of Sales increased 4.4% and in local currency

it increased 14.4%, which is mainly explained by (i) a higher cost of concentrate due to price increases, (ii) a shift in the

mix towards higher unit cost products, and (iii) a higher cost of sweeteners. This was partially offset by a lower cost of Pet resin.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -9- |

Distribution Costs and Administrative Expenses

increased 1.3% in the reporting currency. In local currency they increased 11.3%, which is mainly explained by (i) higher distribution

expenses, mainly due to higher tariffs, (ii) higher labor expenses and services provided by third parties, and (iii) higher

marketing expenses.

The aforementioned effects led to an Operating

Income of CLP 35,853 million, 4.7% higher when compared to the previous year. Operating Margin reached 23.2%. In local currency, operating

income increased 13.5%.

Adjusted EBITDA reached CLP 45,790 million, 4.3%

higher when compared to the previous year, and Adjusted EBITDA Margin was 29.6%, an expansion of 14 basis points. In local currency Adjusted

EBITDA increased 13.5%.

NON-OPERATING RESULTS FOR THE QUARTER

Net Financial Income and Expenses account recorded

an expense of CLP 16,039 million, which compares to an expense of CLP 9,935 million in the same quarter of the previous year, mainly

due to higher debt in our subsidiary in Argentina.

Share of Profit or Loss from Investments Accounted

for by the Equity Method went from a gain of CLP 252 million to a loss of CLP 846 million, which is mainly explained by lower results

of subsidiaries in Chile, and partially offset by higher results of subsidiaries in Brazil.

Other Income and Expenses account recorded a

loss of CLP 8,632 million, compared to a gain of CLP 1,613 million in the same quarter of the previous year, the difference being mainly

explained by reversals of provisions in Brazil in the same quarter of the previous year, which were not repeated this year, as well as

a change in the useful life of packaging in Paraguay.

Results by Adjustment Units and Exchange Rate

Differences account went from a loss of CLP 11,583 million to a gain of CLP 20,468 million. This gain is mainly explained by (i) the

effect of lower inflation in Chile (0.30% in 3Q23 and 3.54% in 3Q22), which had a lower impact than in the previous year on the UF debt,

(ii) the effect of the price-level restatement of balance sheet accounts and income in Argentina, and (iii) exchange gains

on net assets in US dollars in Chile. This effect was partially offset by losses in Argentina for net liabilities in U.S. dollars.

Income Tax went from -CLP 14,577 million to -CLP

9,541 million, a variation that is mainly explained by the positive tax effect in Chile of both the exchange rate difference and lower

inflation. These effects were partially offset by higher operating income.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -10- |

CONSOLIDATED BALANCE

The following are the balances of Assets and Liabilities as of the

closing date of these financial statements:

| | |

12.31.2022 | | |

09.30.2023 | | |

Variation | |

| Assets | |

million

CLP | | |

million

CLP | | |

million

CLP | |

| Current assets | |

| 1,161,729 | | |

| 892,482 | | |

| -269,247 | |

| Non-current assets | |

| 1,848,971 | | |

| 1,973,113 | | |

| 124,142 | |

| Total Assets | |

| 3,010,701 | | |

| 2,865,595 | | |

| -145,105 | |

| | |

| | | |

| | | |

| | |

| | |

12.31.2022 | | |

09.30.2023 | | |

Variation | |

| Liabilities | |

million

CLP | | |

million

CLP | | |

million

CLP | |

| Current liabilities | |

| 949,245 | | |

| 611,173 | | |

| -338,072 | |

| Non-current liabilities | |

| 1,178,053 | | |

| 1,291,604 | | |

| 113,552 | |

| Total Liabilities | |

| 2,127,298 | | |

| 1,902,777 | | |

| -224,520 | |

| | |

| | | |

| | | |

| | |

| | |

12.31.2022 | | |

09.30.2023 | | |

Variation | |

| Equity | |

million

CLP | | |

million

CLP | | |

million

CLP | |

| Non-controlling interests | |

| 28,143 | | |

| 33,587 | | |

| 5,445 | |

| Equity attributable to the owners of the controller | |

| 855,260 | | |

| 929,230 | | |

| 73,970 | |

| Total Equity | |

| 883,403 | | |

| 962,818 | | |

| 79,415 | |

At

the closing of September 2023, with respect to the closing of 2022, the Argentine peso depreciated 88.8% with respect to

the Chilean peso, which generated a decrease in assets, liabilities and equity accounts, due to the effect of translation of figures

to the reporting currency. Additionally, the figures for Argentina, in accordance with IAS 29, prior to the translation of figures, are

adjusted for accumulated inflation as of the end of 2022, until the closing currency of this report (September 2023), increasing

the figures in local currency by 80.1%. On the other hand, the Brazilian real and the Paraguayan guarani appreciated against the Chilean

peso by 8.3% and 5.1%, respectively, which generated an increase in assets, liabilities and equity accounts, due to the effect of translation

of figures to the reporting currency.

In September, one of the 144A/RegS format bonds

issued in the United States matured. The maturity was for USD 365 million at a rate of 5.00% [USD], a bond that was redenominated through

derivatives into Brazilian reais for a total of BRL 840 million at a fixed rate of 13.51% [BRL]. This maturity was refinanced through

the issuance, in September, of a new bond in the Swiss market for a total of CHF 170 million at a fixed rate of 2.7175% [CHF] for a term

of 5 years, these conditions were redenominated through the use of derivatives, to Brazilian reais for a total of BRL 920 million at

a fixed rate of 11.27% [BRL].

Assets

Total assets decreased by CLP 145,105 million,

by 4.8% compared to December 2022.

Current assets decreased by CLP 269,247 million,

23.2% compared to December 2022, which is mainly explained by the decrease in Other current financial assets (-CLP 195,450 million),

due to the liquidation of the cross currency swap associated with the 144A bond that matured in September of this year, and by the

decrease in Cash and cash equivalents (-CLP 66,906 million) mainly due to the payment of the bond that matured, the payment of dividends

and investment activities, which were partially offset by the cash inflow from the placement of the recently issued Swiss bond.

Non-current assets increased by CLP 124,142 million,

6.7% compared to December 2022, mainly due to the increase in Property, plant and equipment (CLP 87,800 million) for investments

made (CLP 141,389 million), due to the effect of translating figures and restatement for IAS29, which was partially offset by the Depreciation

account. In addition to this increase, there was an increase in Intangible assets other than goodwill (CLP 26,698 million) due to the

positive effect of translating figures from our foreign subsidiaries to the reporting currency.

Liabilities and Equity

Total liabilities decreased by CLP 224,520 million,

10.6% compared to December 2022.

Current liabilities decreased by CLP 338,072

million, 35.6% compared to December 2022, mainly due to the decrease in Other current financial liabilities (-CLP 297,910 million),

mainly explained by the maturity payment of the 144A bond, and the decrease in Trade and other current accounts payable (-CLP 27,153

million), due to seasonal factors considering that December is the month with the highest sales of the year, and therefore, a month

with high accounts payable to suppliers.

On the other hand, non-current liabilities increased

by CLP 113,552 million, 9.6% compared to December 2022, mainly due to the increase in Other non-current financial liabilities (CLP

108,406 million), which is mainly explained by the placement of the Swiss Bond, which is partially offset by the decrease in the mark

to market liability of the cross currency swap of the bond issued in the United States in 2020 (Senior Notes due 2050).

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -11- |

Equity increased by CLP 79,415 million, 9.0%

compared to December 2022, explained by the increase in Accumulated Earnings as a result of the profits obtained in the period,

the restatement of equity balances in our subsidiary in Argentina, in accordance with IAS 29 (CLP 102,763 million) and the distribution

of dividends (-CLP 136,164 million). The increase in Accumulated earnings was partially offset by the decrease in Other reserves (-CLP

4,778 million).

FINANCIAL ASSETS AND LIABILITIES

| CONSOLIDATED NET FINANCIAL DEBT | |

(million

USD) | |

| Total

Financial Assets | |

361 | |

| Cash and Cash Equivalent (1) | |

251 | |

| Other current financial assets (1) | |

72 | |

| Net valuation of Hedge Derivatives (2) | |

38 | |

| | |

| |

| Financial

Debt | |

1,149 | |

| Bonds on the international market | |

484 | |

| Bonds on the local market (Chile) | |

593 | |

| Bank Debt and Others | |

72 | |

| | |

| |

| Net Financial Debt | |

788 | |

(1)

Financial Assets corresponding to Cash and Cash Equivalents and Other current financial assets are held invested in low-risk instruments

such as time deposits, short-term fixed-income mutual funds and others.

(2) Considers

the net effect of valuations in favor of and against hedge derivatives.

CURRENCY

EXPOSURE (%)

| | |

Financial

Assets (1) | | |

Financial

Debt (3) | |

| CLP (Chile) | |

| 51 | % | |

| 27 | % |

Unidad

de Fomento (CLP

indexed to inflation) | |

| 11 | % | |

| 53 | % |

| BRL (Brazil) | |

| 16 | % | |

| 17 | % |

| PGY (Paraguay) | |

| 12 | % | |

| 0 | % |

| ARS (Argentina) | |

| 2 | % | |

| 3 | % |

| USD (United States) | |

| 9 | % | |

| 0 | % |

| Total | |

| 100 | % | |

| 100 | % |

(3) Includes valuation of hedge derivatives.

RISK

RATING

| Local rating agencies | |

| Rating | |

| ICR | |

| AA+ | |

| Fitch Chile | |

| AA+ | |

| International

rating agencies | |

| Rating | |

| Standard & Poors | |

| BBB | |

| Fitch Ratings, Inc. | |

| BBB+ | |

DEBT

AMORTIZATION PROFILE

CASH FLOW

| | |

09.30.2022 | | |

09.30.2023 | | |

Variation | |

| Cash flow | |

million

CLP | | |

million

CLP | | |

million

CLP | | |

% | |

| Operating | |

243,275 | | |

198,397 | | |

-44,878 | | |

-18.4 | % |

| Investment | |

-29,311 | | |

-80,920 | | |

-51,609 | | |

176.1 | % |

| Financing | |

-248,459 | | |

-164,075 | | |

84,385 | | |

-34.0 | % |

| Net Cash Flow for the period | |

-34,495 | | |

-46,597 | | |

-12,102 | | |

35.1 | % |

During the period, the Company generated a negative

net cash flow of CLP 46,597 million, which is explained as follows:

Operating activities generated a positive net

cash flow of CLP 198,397 million, lower than the CLP 243,275 million recorded in the same period of 2022, mainly due to higher operating

payments and payments to suppliers, partially offset by higher collections from sale of goods.

Investing activities generated a negative cash

flow of CLP 80,920 million, with a negative variation of CLP 51,609 million with respect to the previous period, which is mainly explained

by lower redemptions of financial instruments compared to 2022 for CLP 41,166 million, added to a higher investment in Capex for CLP

15,773 million.

Financing activities generated a negative cash

flow of CLP 164,075 million, with a positive variation of CLP 84,385 million with respect to the previous period, which is mainly explained

by the placement of a CHF 170 million bond in the Swiss market in September 2023, in addition to obtaining short-term financing

in Argentina and lower dividend payments than in 2022. This was partially offset by the maturity payment of the US Bond for USD 365 million.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -12- |

MAIN INDICATORS

| INDICATOR |

Definition |

Unit |

Sep

23 |

Dec

22 |

Sep

22 |

Sep

23 vs Dec 22 |

Sep

23 vs Sep 22 |

| LIQUIDITY |

|

|

|

|

|

|

|

| |

Current

liquidity |

Current

Asset |

Times |

1.5 |

1.2 |

1.6 |

19.3% |

-11.0% |

| |

|

Current

Liability |

|

|

|

|

|

|

| |

Acid

ratio |

Current

Asset – Inventory |

Times |

1.0 |

1.0 |

1.2 |

6.8% |

-14.5% |

| |

|

Current

Liability |

|

|

|

|

|

|

| ACTIVITY |

|

|

|

|

|

|

|

| |

Investment |

|

Million

CLP |

141,389 |

173,675 |

118,420 |

-18.6% |

19.4% |

| |

|

|

|

|

|

|

|

|

| |

Inventory

turnover |

Cost

of Sales |

Times |

4.8

|

7.4

|

5.5 |

-34.9% |

-11.1% |

| |

|

Average

Inventory |

|

|

|

|

|

|

| INDEBTEDNESS |

|

|

|

|

|

|

|

| |

Indebtedness

ratio |

Net

Financial Debt* |

Times |

0.7 |

0.7 |

0.6 |

3.5% |

15.4% |

| |

|

Total

Equity* |

|

|

|

|

|

|

| |

Financial

exp. coverage |

Adjusted

EBITDA (12M) |

Times |

14.8 |

19.9 |

19.7 |

-25.7% |

-24.9% |

| |

|

Financial

Expenses* (12M) – Financial Income* (12M) |

|

|

|

|

|

|

| |

Net

financial debt / |

Net

Financial Debt |

Times |

1.5 |

1.3 |

1.4 |

9.0% |

6.6% |

| |

Adjusted

EBITDA |

Adjusted

EBITDA (12M) |

|

|

|

|

|

|

| PROFITABILITY

|

|

|

|

|

|

|

|

| |

On

Equity |

Net

Income Fiscal Year (12M) |

% |

16.5% |

13.0% |

15.8% |

3.5

pp |

0.7

pp |

| |

|

Average

Equity |

|

|

|

|

|

|

| |

On

Total Assets |

Net

Income Fiscal Year (12M) |

% |

5.0% |

4.2% |

5.4% |

0.8

pp |

(0.4

pp) |

| |

|

Average

Equity |

|

|

|

|

|

|

Liquidity

Current Liquidity showed a positive variation

of 19.3% with respect to December 2022, explained by the 35.6% decrease in current liabilities, which was greater than the decrease

in current assets (23.2%).

The Acid Ratio showed an increase of 6.8% compared

to December 2022, for the reasons explained above, in addition to the increase in inventories (6.8%) in the period. Current assets

excluding inventories showed a decrease of 31.2% compared to December 2022.

Activity

At the closing of September 2023, investments

reached CLP 141,389 million, which corresponds to an increase of 19.4% compared to the same period of 2022, mainly explained by higher

investments in containers and production investments.

Inventory turnover reached 4.8 times, showing

a decrease of 11.1% compared to the same period of 2022, mainly explained by the increase in average inventory of 17.3% compared to the

same period of 2022, which was higher than the increase in the cost of sales (4.3%).

Indebtedness

The indebtedness ratio reached 0.7 times at the

closing of September 2023, which corresponds to an increase of 3.5% compared to the closing of December 2022. This is mainly

due to the 12.8% increase in net debt, together with a 9.0% increase in equity.

The Financial Expense Coverage indicator shows

a decrease of 25.7% when compared to December 2022, reaching 14.8 times. This is explained by an increase in net financial expenses

(rolling 12 months) of 39.3%, which was higher than the increase in Adjusted EBITDA (rolling 12 months) of 3.5% for the period.

Net financial debt/Adjusted EBITDA reached 1.5

times, which represents an increase of 9.0% compared to December 2022. This is due to the 12.8% increase in net financial debt,

which was higher than the 3.5% increase in Adjusted EBITDA for the period.

*Definitions

used are contained in the Glossary on page 16 of this document.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -13- |

Profitability

Return on equity reached 16.5%, 3.5 percentage

points higher than the indicator measured in December 2022. This result is due to the increase in net income for the 12-month period

(17.5%), combined with the decrease in average equity (7.6%).

Return on Total Assets was 5.0%, 0.8 percentage

points higher than the indicator measured in December 2022, explained by the increase in Net Income for the 12 rolling months, together

with the decrease in Average Assets (1.4%).

MACROECONOMIC INFORMATION

| INFLATION | |

| |

| | |

Accumulated

9M23 | | |

LTM | |

| Argentina* | |

| 102.98 | % | |

| 137.90 | % |

| Brazil | |

| 3.50 | % | |

| 5.19 | % |

| Chile | |

| 3.24 | % | |

| 5.10 | % |

| Paraguay | |

| 2.48 | % | |

| 3.47 | % |

*Official inflation reported by the National

Institute of Statistics and Censuses of Argentina (INDEC). It should be mentioned that the inflation used to restate Argentina's figures

in accordance with IAS 29 corresponds to inflation estimated by the Central Bank of the Argentine Republic (in its Survey of Market Expectations

report), which is also adjusted for the difference between the estimate (by the Central Bank) and the actual inflation of the previous

month (INDEC).

| | |

Local

currency/USD | | |

CLP/local

currency | |

| EXCHANGE | |

(Average

exchange rate*) | | |

(Average

exchange rate*) | |

| RATES USED | |

3Q22 | | |

3Q23 | | |

3Q22 | | |

3Q23 | |

| Argentina | |

| 147.3 | | |

| 350.0 | | |

| 6.5 | | |

| 2.6 | |

| Brazil | |

| 5.25 | | |

| 4.88 | | |

| 176.56 | | |

| 174.72 | |

| Chile | |

| 927 | | |

| 853 | | |

| N.A | | |

| N.A | |

| Paraguay | |

| 6,911 | | |

| 7,278 | | |

| 0.13 | | |

| 0.12 | |

*Except

Argentina, where the closing exchange rate is used, in accordance with IAS 29.

| | |

Local

currency/USD | | |

CLP/local

currency | |

| EXCHANGE | |

(Average

exchange rate*) | | |

(Average

exchange rate*) | |

| RATES

USED | |

9M22 | | |

9M23 | | |

9M22 | | |

9M23 | |

| Argentina | |

| 147.3 | | |

| 350.0 | | |

| 6.5 | | |

| 2.6 | |

| Brazil | |

| 5.13 | | |

| 5.01 | | |

| 167.41 | | |

| 163.98 | |

| Chile | |

| 860 | | |

| 821 | | |

| N.A | | |

| N.A | |

| Paraguay | |

| 6,915 | | |

| 7,261 | | |

| 0.12 | | |

| 0.11 | |

*Except

Argentina, where the closing exchange rate is used, in accordance with IAS 29.

MARKET RISK ANALYSIS

The Company’s risk management is the responsibility

of the office of the Chief Executive Officer, (through the areas of Corporate Management Control, Sustainability and Risks, which depends

on the office of the Chief Financial Officer), as well as each of the management areas of Coca-Cola Andina. The main risks that the Company

has identified and that could possibly affect the business are as follows:

Relationship with The Coca-Cola Company

A large part of the Company’s sales derives

from the sale of products whose trademarks are owned by The Coca-Cola Company, which has the ability to exert an important influence

on the business through its rights under the Licensing or Bottling Agreements. In addition, we depend on The Coca-Cola Company to renew

these Bottling Agreements.

Non-alcoholic beverage business environment

Consumers, public health officials, and government

officials in our markets are increasingly concerned about the public health consequences associated with obesity, which can affect demand

for our products, especially those containing sugar.

The Company has developed a large portfolio of

sugar-free products and has also made reformulations to some of its sugary products, significantly reducing the sugar contents of its

products.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -14- |

Raw material prices and exchange rate

Many raw materials are used in the production

of beverages and packaging, including sugar and Pet resin, the prices of which may present great volatility. In the case of sugar, the

Company sets the price of a part of the volume that it consumes with some anticipation, in order to avoid having large fluctuations of

cost that cannot be anticipated.

In addition, these raw materials are traded in

dollars; the Company has a policy of hedging in the futures market a portion of the dollars it uses to buy raw materials.

Instability in the supply of utilities and

raw materials

In the countries in which we operate, our operations

depend on a stable supply of utilities, fuel and raw materials. Power outages or water shut offs as well as the lack of raw materials

may result in interruptions of our production. The Company has mitigation plans to reduce the effects of eventual interruptions in the

supply of utilities and raw materials.

Economic conditions of the countries where

we operate

The Company maintains operations in Argentina,

Brazil, Chile and Paraguay. The demand for our products largely depends on the economic situation of these countries. Moreover, economic

instability can cause depreciation of the currencies of these countries, as well as inflation, which may eventually affect the Company’s

financial situation.

New tax laws or modifications to tax incentives

We cannot ensure that any government authority

in any of the countries in which we operate will not impose new taxes or increase existing taxes on our raw materials, products or containers.

Likewise, we cannot assure that these authorities are going to uphold and/or renew tax incentives that currently benefit some of our

operations.

A devaluation of the currencies of the countries

where we have our operations, regarding the Chilean peso, can negatively affect the results reported by the Company in Chilean pesos

The Company reports its results in Chilean pesos,

while a large part of its revenues and Adjusted EBITDA comes from countries that use other currencies. Should currencies devaluate regarding

the Chilean peso, this would have a negative effect on the results of the Company, upon the translation of results into Chilean pesos.

The imposition of exchange controls could

restrict the entry and exit of funds to and from the countries in which we operate, which could significantly limit our financial capacity

The imposition of exchange controls in the countries

in which we operate could affect our ability to repatriate profits, which could significantly limit our ability to pay dividends to our

shareholders. Additionally, it may limit the ability of our foreign subsidiaries to finance payments of U.S. dollar denominated liabilities

required by foreign creditors.

Price control policies in Argentina may be

accentuated, which may have a material and adverse effect on the results of our Argentine operations

The Argentine government has from time to time

established price controls on consumer products. To the extent that the price of our products in Argentina are restricted by government

imposed price controls the results of our Argentine operations may be materially affected. We cannot assure that price controls in Argentina

will not continue or be expected to include additional consumer products. Nor can we assure you the effect to which government imposed

price controls will affect the profitability of our Argentina operations.

Civil unrest in Chile could have a material

adverse effect on general economic conditions in Chile and our business and financial condition

Since October 18, 2019, there have been

protests and demonstrations in Chile, seeking to reduce inequality, including claims about better pensions, improvement in health plans

and reduced health care costs, reduction in the cost of public transportation, better wages, among others. Sometimes demonstrations have

been violent, causing damage to public and private property.

We cannot predict the extent to which the Chilean

economy will be affected by the civil unrest, nor can we predict if government policies enacted as a response to the civil unrest will

have a negative impact on the Chilean economy and our business. Neither can we assure that demonstrations and vandalism will not cause

damage to our logistics and production infrastructure. So far, the Company has not been affected in any material respect.

Our business is subject to risks arising from the COVID-19 pandemic

The COVID-19 pandemic has resulted in the countries

where we operate taking extraordinary measures to contain the spread of COVID-19, including travel restrictions, closing borders, restrictions

or bans on social gathering events, instructions to citizens to practice social distancing, non-essential business closure, quarantine

implementation, and other similar actions. The impact of this pandemic has substantially increased uncertainty regarding the development

of economies and is most likely to cause a global recession. We cannot predict how long this pandemic will last, or how long the restrictions

imposed by the countries where we operate will last.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -15- |

Since the impact of COVID-19 is very uncertain,

we cannot accurately predict the extent of impact this pandemic will have on our business and our operations. There is a risk that our

collaborators, contractors and suppliers may be restricted or prevented from carrying out their activities for an indefinite period of

time, due to shutdowns mandated by the authorities. Although our operations have not been materially disrupted to date, eventually the

pandemic and the measures taken by governments to contain the virus could affect the continuity of our operations. In addition, some

measures taken by governments have negatively affected some of our sales channels, especially the closing of restaurants and bars, as

well as the prohibition of social gathering events, which affects our sales volumes to these channels. We cannot predict the effect that

the pandemic and these measures will have on our sales to these channels, nor whether these channels will recover once the pandemic is

over. Nor can we predict how long our consumers will change their consumer spending pattern as a result of the pandemic.

Additionally,

a possible outbreak of other epidemics in the future, such as SARS, Zika or the Ebola virus, could also result in a similar impact

on our business than COVID-19.

A more detailed analysis of business risks is

available in the Company’s 20-F and Annual Report, available on our website.

RECENT EVENTS

Interim Dividend 227

On August 25, 2023, the Company paid Interim

Dividend 227: CLP 29.0 per Series A share; and CLP 31.9 per Series B share.

Interim Dividend 228

On October 26, 2023, the Company paid Interim

Dividend 228: CLP 29.0 per Series A share; and CLP 31.9 per Series B share.

Bond placement abroad

During September, we successfully placed a CHF

170 million 5-year bond in the Swiss market at a rate of 2.7175%, which was completely redenominated into Brazilian reais through cross

currency swaps. A large part of the proceeds were used to refinance a USD 365 million bond that the Company had placed in the United

States, which was also redenominated into Brazilian reais through cross currency swaps, for the equivalent of 840 million reais and which

recently matured.

GLOSSARY

Adjusted

EBITDA: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial Statements

submitted to Chile’s Financial Market Commission and determined in accordance with IFRS, plus Depreciation.

Currency-neutral

of a quarter q for a Q year is calculated using the same ratio of local currencies to the Chilean peso as the q

quarter of the Q-1 year. In the case of Argentina, given that it is a hyperinflationary economy, the result of the

q quarter is also deflated by inflation of the last 12 months.

Financial

Expenses: correspond to interest generated by the Company’s financial debt.

Financial

Income: corresponds to the interest generated by the Company's cash.

Net

Financial Debt: considers the consolidated financial liability that accrues interest, i.e.: (i) other current financial

liabilities, plus (ii) other non-current financial liabilities, less (iii) the sum of cash and cash equivalent; plus other

current financial assets; plus other non-current financial assets (to the extent that they correspond to the balances of assets for derivative

financial instruments, taken to cover exchange rate risk and/or interest rate of financial liabilities).

Operating

Income: includes Revenue, Costs of Sales, Distribution Costs and Administrative Expenses, included in the Financial

Statements submitted to Chile Financial Market Commission and determined in accordance with IFRS.

Total

Equity: corresponds to the equity attributable to the owners of the controller plus non-controlling interests.

Transactions:

refers to the number of units sold, regardless of size.

Volume:

expressed in Unit Cases (UCs), which is the conventional measurement used to measure sales volume in the Coca-Cola System

worldwide.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -16- |

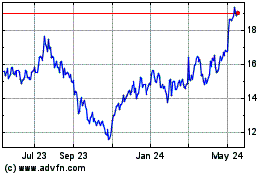

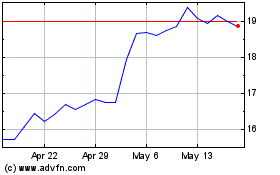

ADDITIONAL INFORMATION

| STOCK

EXCHANGES ON WHICH WE TRADE |

|

ANDINA-A

ANDINA-B

|

AKO/A

AKO/B

|

|

|

| |

|

|

|

| ESG

INDICES IN WHICH WE PARTICIPATE |

Dow

Jones Sustainability Index Chile

Dow Jones Sustainability MILA Pacific Alliance Index. |

|

|

|

| |

|

|

|

| NUMBER

OF SHARES |

|

|

|

| TOTAL:

946,570,604 |

SERIES

A: 473,289,301 |

SERIES

B: 473,281,303 |

SHARES

PER ADR: 6 |

| |

|

|

|

ABOUT COCA-COLA ANDINA

Coca-Cola Andina is among the three largest Coca-Cola

bottlers in Latin America, servicing franchised territories with almost 55.7 million people, delivering 873.6 million unit cases or 4,960

million liters of soft drinks, juices, bottled water, beer and other alcoholic beverages during 2022. Coca-Cola Andina has the franchise

to produce and commercialize Coca-Cola products in certain territories in Argentina (through Embotelladora del Atlántico), in

Brazil (through Rio de Janeiro Refrescos), in Chile, (through Embotelladora Andina) and in all of Paraguay (through Paraguay Refrescos).

The Chadwick Claro, Garcés Silva, Said Handal and Said Somavía families control Coca-Cola Andina in equal parts. The Company's

value generation proposal is to become a Total Beverage Company, using existing resources efficiently and sustainably, developing a relationship

of excellence with consumers of its products, as well as with its collaborators, customers, suppliers, the community in which it operates

and with its strategic partner The Coca-Cola Company, in order to increase ROIC for shareholders in the long term. For more company information

visit www.koandina.com.

This document may contain projections reflecting

Coca-Cola Andina’s good faith expectations and are based on currently available information. However, the results that are finally

obtained are subject to diverse variables, many of which are beyond the Company's control, and which could materially impact the current

performance. Among the factors that could change the performance are the political and economic conditions on mass consumption, pricing

pressures resulting from competitive discounts of other bottlers, weather conditions in the Southern Cone and other risk factors that

would be applicable from time to time, and which are periodically informed in reports filed before the appropriate regulatory authorities,

and which are available on our website.

COCA-COLA ANDINA

3Q23 EARNINGS RELEASE

www.koandina.com | -17- |

Embotelladora Andina S.A.

Third Quarter Results for the period ended September 30, 2023. Reported figures, IFRS GAAP.

(In

nominal million Chilean pesos, except per share)

| | |

July-September 2023 | | |

July-September 2022 | | |

| |

| | |

Chilean

Operations | | |

Brazilian

Operations | | |

Argentine

Operations | | |

Paraguay

Operations | | |

Total (1) | | |

Chilean

Operations | | |

Brazilian

Operations | | |

Argentine

Operations | | |

Paraguay

Operations | | |

Total (1) | | |

% Ch. | |

| Volume total beverages (Million UC) | |

| 69.8 | | |

| 70.4 | | |

| 44.4 | | |

| 18.3 | | |

| 202.9 | | |

| 71.8 | | |

| 67.0 | | |

| 46.1 | | |

| 16.9 | | |

| 201.8 | | |

| 0.5 | % |

| Transactions (Million) | |

| 408.7 | | |

| 391.8 | | |

| 212.4 | | |

| 115.7 | | |

| 1,128.6 | | |

| 427.0 | | |

| 376.0 | | |

| 221.4 | | |

| 106.9 | | |

| 1,131.3 | | |

| -0.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

| 276,771 | | |

| 181,272 | | |

| 159,472 | | |

| 54,147 | | |

| 670,333 | | |

| 261,897 | | |

| 162,292 | | |

| 178,437 | | |

| 52,574 | | |

| 653,498 | | |

| 2.6 | % |

| Cost of sales | |

| (185,071 | ) | |

| (111,849 | ) | |

| (86,438 | ) | |

| (30,271 | ) | |

| (412,230 | ) | |

| (175,732 | ) | |

| (104,554 | ) | |

| (98,554 | ) | |

| (30,000 | ) | |

| (407,138 | ) | |

| 1.3 | % |

| Gross profit | |

| 91,699 | | |

| 69,424 | | |

| 73,035 | | |

| 23,875 | | |

| 258,103 | | |

| 86,165 | | |

| 57,738 | | |

| 79,884 | | |

| 22,574 | | |

| 246,361 | | |

| 4.8 | % |

| Gross margin | |

| 33.1 | % | |

| 38.3 | % | |

| 45.8 | % | |

| 44.1 | % | |

| 38.5 | % | |

| 32.9 | % | |

| 35.6 | % | |

| 44.8 | % | |

| 42.9 | % | |

| 37.7 | % | |

| | |

| Distribution and administrative expenses | |

| (63,643 | ) | |

| (44,272 | ) | |

| (58,141 | ) | |

| (11,848 | ) | |

| (177,904 | ) | |

| (61,077 | ) | |

| (40,654 | ) | |

| (61,962 | ) | |

| (12,024 | ) | |

| (175,716 | ) | |

| 1.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Corporate expenses (2) | |

| | | |

| | | |

| | | |

| | | |

| (2,059 | ) | |

| | | |

| | | |

| | | |

| | | |

| (1,879 | ) | |

| 9.6 | % |

| Operating income (3) | |

| 28,056 | | |

| 25,152 | | |

| 14,893 | | |

| 12,028 | | |

| 78,140 | | |

| 25,088 | | |

| 17,084 | | |

| 17,921 | | |

| 10,551 | | |

| 68,765 | | |

| 13.6 | % |

| Operating margin | |

| 10.1 | % | |

| 13.9 | % | |

| 9.3 | % | |

| 22.2 | % | |

| 11.7 | % | |

| 9.6 | % | |

| 10.5 | % | |

| 10.0 | % | |

| 20.1 | % | |

| 10.5 | % | |

| | |

| Adjusted EBITDA (4) | |

| 39,176 | | |

| 33,638 | | |

| 24,175 | | |

| 15,590 | | |

| 110,520 | | |

| 35,020 | | |

| 24,880 | | |

| 26,985 | | |

| 14,285 | | |

| 99,290 | | |

| 11.3 | % |

| Adjusted EBITDA margin | |

| 14.2 | % | |

| 18.6 | % | |

| 15.2 | % | |

| 28.8 | % | |

| 16.5 | % | |

| 13.4 | % | |

| 15.3 | % | |

| 15.1 | % | |

| 27.2 | % | |

| 15.2 | % | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial (expenses) income (net) | |

| | | |

| | | |

| | | |

| | | |

| (16,039 | ) | |

| | | |

| | | |

| | | |

| | | |

| (9,935 | ) | |

| 61.4 | % |

| Share of (loss) profit of investments accounted for using the equity method | |

| | | |

| | | |

| | | |

| | | |

| (846 | ) | |

| | | |

| | | |

| | | |

| | | |

| 252 | | |

| -436.0 | % |

| Other income (expenses) (5) | |

| | | |

| | | |

| | | |

| | | |

| (8,632 | ) | |

| | | |

| | | |

| | | |

| | | |

| 1,613 | | |

| -635.1 | % |

| Results by readjustement unit and exchange rate

difference | |

| | | |

| | | |

| | | |

| | | |

| 20,468 | | |

| | | |

| | | |

| | | |

| | | |

| (11,583 | ) | |

| -276.7 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income before income taxes | |

| | | |

| | | |

| | | |

| | | |

| 73,091 | | |

| | | |

| | | |

| | | |

| | | |

| 49,112 | | |

| 48.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| | | |

| | | |

| | | |

| | | |

| (9,541 | ) | |

| | | |

| | | |

| | | |

| | | |

| (14,577 | ) | |

| -34.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

| 63,550 | | |

| | | |

| | | |

| | | |

| | | |

| 34,535 | | |

| 84.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to non-controlling interests | |

| | | |

| | | |

| | | |

| | | |

| 158 | | |

| | | |

| | | |

| | | |

| | | |

| (536 | ) | |

| -129.4 | % |

| Net income attributable to equity holders of the parent | |

| | | |

| | | |

| | | |

| | | |

| 63,708 | | |

| | | |

| | | |

| | | |

| | | |

| 33,999 | | |

| 87.4 | % |

| Net margin | |

| | | |