AEL Confirms Receipt of Acquisition Proposal From Brookfield Reinsurance

June 27 2023 - 6:30AM

Business Wire

American Equity Investment Life Holding Company (“American

Equity”) (NYSE: AEL), a leading issuer of fixed index annuities

(FIAs), today issued the following statement regarding the

acquisition proposal it received from Brookfield Reinsurance Ltd.

(“Brookfield Reinsurance”):

“American Equity’s Board of Directors today confirmed that it

has received a proposal from Brookfield Reinsurance to acquire all

outstanding shares of American Equity that Brookfield Reinsurance

does not already own for $55.00 per share comprised of $38.85 per

share in cash and $16.15 per share in Brookfield Asset Management

Ltd. (NYSE, TSX: BAM) (“BAM”) Class A limited voting shares (the

“BAM Shares”), based on the unaffected 90-day volume-weighted

average price as of June 23, 2023. The number of BAM Shares to be

issued at closing is subject to adjustment, which will result in

the aggregate value of the consideration as of the closing of the

transaction being not less than $54.00 and not greater than $56.50

per share based on BAM’s stock price shortly preceding the closing.

The American Equity Board has granted Brookfield Reinsurance a

limited waiver of Brookfield Reinsurance’s standstill obligation

under its existing investment agreement with American Equity to

permit Brookfield Reinsurance to make this proposal.

“The Board will carefully review Brookfield Reinsurance’s

proposal in accordance with its fiduciary duties and in

consultation with its independent financial and legal advisors.

American Equity will have no further comment on the proposal until

the Board has completed its review. It is important to note that

there is no guarantee that an agreement will be reached or on what

terms.”

American Equity shareholders need not take any action at this

time.

Ardea Partners and J.P. Morgan are serving as financial advisors

to AEL and Sullivan & Cromwell LLP is serving as legal

advisor.

About American Equity

At American Equity Investment Life Holding Company, our

policyholders work with over 40,000 independent agents and advisors

affiliated with independent market organizations (IMOs), banks and

broker-dealers through our wholly-owned operating subsidiaries.

Advisors and agents choose one of our leading annuity products best

suited for their clients' personal needs to create financial

dignity in retirement. To deliver on its promises to policyholders,

American Equity has re-framed its investment focus — building a

stronger emphasis on insurance liability driven asset allocation

and specializing in alternate, private asset management while

partnering with world renowned, public fixed income asset managers.

American Equity is headquartered in West Des Moines, Iowa with

additional offices in Charlotte, NC and New York, NY. For more

information, please visit www.american-equity.com.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the federal securities laws. Statements such

as “will”, “anticipate”, “intends”, “build”, “create”, “believe”,

“potential”, “expect”, “may”, “would”, “should”, “can”,

“delivering”, “continuing”, or similar words, as well as specific

projections of future events or results qualify as forward-looking

statements. Forward-looking statements are based on assumptions and

expectations that involve risks and uncertainties, including the

“Risk Factors” the Company describes in its U.S. Securities and

Exchange Commission filings. The Company’s future results could

differ, and it has no obligation to correct or update any of these

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230626602905/en/

Investors: Steven D. Schwartz, Vice President, Investor

Relations (515) 273-3763, sschwartz@american-equity.com

Media: Jared Levy/Robin Weinberg FGS Global

AEL@FGSGlobal.com

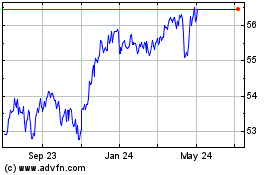

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

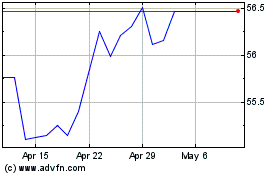

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Apr 2023 to Apr 2024