Bunge Looking to Cut Costs as Revenue Slides

February 11 2016 - 2:19PM

Dow Jones News

By Jacob Bunge

Bunge Ltd. aims to cut costs in its grain and food businesses

and look at joint ventures in some businesses as the agribusiness

giant navigates turbulent economic conditions.

Slowing U.S. grain exports and food-ingredient sales in Brazil

are likely to continue pressuring the White Plains, N.Y., company

in 2016, its chief executive said, prompting the company to dial

back long-term profit expectations.

"In the current challenging environment, modest growth is the

right indication," Bunge CEO Soren Schroder said in an

interview.

A broad collapse in commodity prices has pressured Bunge and

other top traders of crops and agricultural products, such as

Cargill Inc. and Archer Daniels Midland Co. While three-straight

years of bumper crops in North America and elsewhere have

replenished global grain supplies and reduced costs for grain

companies that make vegetable oil, animal feed and ethanol, farmers

have built more bins to store crops rather than sell at cut-rate

prices, and U.S. grain has become less competitive on global

markets as the U.S. dollar rises and currencies of other

crop-producing nations have fallen.

Bunge on Thursday reported $203 million, or $1.30 a share, in

profit for the quarter ended Dec. 31, compared with a loss of $54

million, or 43 cents a share for the year-earlier period. The

results undershot analysts' expectations of $1.56 a share, and the

company's mixed outlook for 2016 sent its shares plunging 16% to

$49.02 after hitting their lowest level since late 2009.

A prior target to deliver $8.50 in earnings per share by 2018

now is uncertain given pressures on multiple fronts, Mr. Schroder

said. "We can see how we get there, but we are not going to put a

date on it," he said. "It's too difficult in the current

environment to predict that accurately."

Double-digit earnings growth in 2016 is "not impossible," he

told analysts on a post-earnings conference call.

Mr. Schroder said Bunge plans to cut $125 million in annual

expenses this year by managing transport more efficiently across

its grain-trading and ingredients operations, while running its

soybean-crushing plants and packaging facilities more efficiently.

Tough business conditions are prompting other companies to reassess

their own portfolios, which could create openings for more joint

ventures and partnerships that would let grain firms share the cost

of maintaining assets like ports and transport networks, he

said.

"There's an understanding that it pays off to be smart about how

you deploy capital," Mr. Schroder said. Bunge's deal last year, in

which it joined with a Sauri Arabian investment firm to buy a

majority stake in the Canadian Wheat Board, is an example and part

of Bunge's ongoing strategy, he said.

Last week, ADM said it had started a strategic review of its

corn dry mills that make ethanol and animal feed.

Despite the challenges, Mr. Schroder said a wholesale

restructuring of Bunge's business wasn't needed or feasible. "I

don't believe there's one big silver bullet thing you could do to

restructure and make a massive difference," he said. "The pieces

fit together and I don't believe they can operate on their

own."

For the fourth quarter, earnings in Bunge's core agribusiness

division, which trades and processes grains and oilseeds, dropped

15%. Profit from edible oil and milling products plunged 28% and

42%, respectively. Meanwhile, earnings from fertilizer rose 4.8%,

while sugar and bioenergy swung to a profit.

Executives said that conditions in the sugar business, where

Bunge has been considering the sale of its Brazilian mills for more

than two years, are improving as Brazil's ethanol market improves

and sugar prices rebound globally.

Revenue, linked to the prices of the commodities that Bunge

deals, declined 16% to $11.13 billion.

Anne Steele contributed to this article.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

February 11, 2016 14:04 ET (19:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

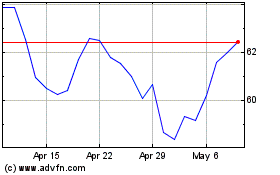

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

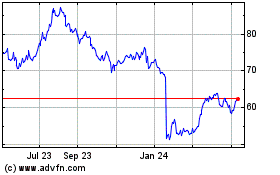

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024