Wynn Resorts, Limited (NASDAQ: WYNN) today reported financial

results for the fourth quarter and year ended December 31,

2017.

Net revenues were $1.69 billion for the fourth quarter of 2017,

an increase of 29.9%, or $388.7 million, from $1.30 billion for the

same period of 2016. The increase in net revenues was the result of

increases of $274.7 million from Wynn Palace and $120.2 million

from Wynn Macau, partially offset by a decrease of $6.2 million

from our Las Vegas Operations.

On a U.S. generally accepted accounting principles ("GAAP")

basis, net income attributable to Wynn Resorts, Limited was $491.7

million, or $4.77 per diluted share, for the fourth quarter of

2017, compared to $113.8 million, or $1.12 per diluted share, for

the same period of 2016. The increase in net income attributable to

Wynn Resorts, Limited was primarily the result of the income tax

benefit from U.S. tax reform and increases in operating income from

Wynn Palace and Wynn Macau, partially offset by a smaller decrease

in the Redemption Note fair value. Adjusted net income attributable

to Wynn Resorts, Limited (1) was $144.3 million, or $1.40 per

diluted share, for the fourth quarter of 2017, compared to $50.8

million, or $0.50 per diluted share, for the same period of

2016.

During the fourth quarter of 2017, legislation commonly known as

the U.S. Tax Cuts and Jobs Act ("U.S. tax reform") was enacted. As

a result, fourth quarter 2017 results reflect an estimated net tax

benefit of $339.9 million in accordance with GAAP as a result of

revaluing the Company's U.S. deferred tax assets and liabilities.

This estimated net benefit is based on the Company's initial

analysis of the U.S. tax reform and may be adjusted in future

periods as the Company collects additional information and

evaluates any regulatory guidance.

Adjusted Property EBITDA (2) was $480.2 million for the fourth

quarter of 2017, an increase of 40.9%, or $139.3 million, from

$340.9 million for the same period of 2016, primarily the result of

increases of $112.6 million from Wynn Palace and $37.2 million from

Wynn Macau, partially offset by a decrease of $10.5 million from

our Las Vegas Operations.

For the full year, net revenues were $6.31 billion in 2017, an

increase of 41.2%, or $1.84 billion, from $4.47 billion for the

same period of 2016. The increase in net revenues was the result of

increases of $1.56 billion, $221.7 million and $62.5 million from

Wynn Palace, which opened in August 2016, Wynn Macau and our Las

Vegas Operations, respectively.

On a GAAP basis, net income attributable to Wynn Resorts,

Limited was $747.2 million, or $7.28 per diluted share, in 2017,

compared to $242.0 million, or $2.38 per diluted share, for the

same period of 2016. The increase in net income attributable to

Wynn Resorts, Limited was primarily the result of the income tax

benefit from U.S. tax reform and increases in operating income from

Wynn Palace, Wynn Macau and our Las Vegas Operations, partially

offset by increases in the Redemption Note fair value and interest

expense as the Company is no longer capitalizing interest on Wynn

Palace. Adjusted net income attributable to Wynn Resorts, Limited

(1) was $560.5 million, or $5.46 per diluted share, in 2017,

compared to $345.9 million, or $3.40 per diluted share, for the

same period of 2016.

Adjusted Property EBITDA (2) was $1.81 billion in 2017, an

increase of 43.8%, or $551.4 million, from $1.26 billion for the

same period of 2016. The increase in Adjusted Property EBITDA was

the result of increases of $424.5 million, $79.2 million, $47.7

million from Wynn Palace, Wynn Macau and our Las Vegas Operations,

respectively.

Wynn Resorts, Limited also announced today that the Company has

approved a cash dividend of $0.50 per share, payable on February

27, 2018 to stockholders of record as of February 15, 2018.

Macau Operations

Wynn Macau

Net revenues from Wynn Macau were $618.6 million for the fourth

quarter of 2017, a 24.1% increase from $498.4 million for the same

period of 2016. Adjusted Property EBITDA from Wynn Macau was $186.0

million for the fourth quarter of 2017, a 25.0% increase from

$148.9 million for the same period of 2016.

Casino revenues from Wynn Macau were $582.9 million for the

fourth quarter of 2017, a 25.3% increase from $465.3 million for

the same period of 2016. Table games turnover in VIP operations was

$15.62 billion, a 44.7% increase from $10.80 billion for the fourth

quarter of 2016. VIP table games win as a percentage of turnover

(calculated before commissions) was 2.89%, within the expected

range of 2.7% to 3.0% and below the 3.08% we experienced in the

fourth quarter of 2016. Table drop in mass market operations was

$1.25 billion, a 14.1% increase from $1.10 billion for the fourth

quarter of 2016. Table games win in mass market operations was

$230.1 million, an 18.6% increase from $193.9 million for the

fourth quarter of 2016. Table games win percentage in mass market

operations was 18.4%, above the 17.7% experienced for the fourth

quarter of 2016. Slot machine handle was $937.6 million, a 16.8%

increase from $802.6 million for the fourth quarter of 2016, while

slot machine win increased 25.3% to $40.8 million.

Non-casino revenues before promotional allowances from Wynn

Macau were $73.9 million for the fourth quarter of 2017, a 14.5%

increase from the $64.6 million for the same period of 2016. Room

revenues were flat at $25.9 million for the fourth quarter of 2017,

compared to the same period of 2016. Our average daily rate ("ADR")

was $258, a 1.5% decrease from $262 for the fourth quarter of 2016.

Occupancy increased to 99.4% for the fourth quarter of 2017, from

96.3% for the same period of 2016. Revenue per available room

("REVPAR") was $257, a 2.0% increase from $252 for the fourth

quarter of 2016.

Wynn Palace

Net revenues from Wynn Palace were $693.4 million for the fourth

quarter of 2017, a 65.6% increase from $418.7 million for the same

period of 2016. Adjusted Property EBITDA from Wynn Palace was

$190.1 million for the fourth quarter of 2017, a 145.3% increase

from $77.5 million for the same period of 2016.

Casino revenues from Wynn Palace were $648.6 million for the

fourth quarter of 2017, a 73.8% increase from $373.2 million for

the same period of 2016. Table games turnover in VIP operations was

$16.23 billion, a 57.1% increase from $10.33 billion for the fourth

quarter of 2016. VIP table games win as a percentage of turnover

(calculated before commissions) was 3.02%, above the expected range

of 2.7% to 3.0% and the 2.68% we experienced in the fourth quarter

of 2016. Table drop in mass market operations was $1.12 billion, a

55.1% increase from $725.0 million for the fourth quarter of 2016.

Table games win in mass market operations was $264.5 million, a

65.7% increase from $159.6 million for the fourth quarter of 2016.

Table games win percentage in mass market operations was 23.5%,

above the 22.0% experienced for the fourth quarter of 2016. Slot

machine handle was $920.6 million, a 72.3% increase from $534.4

million for the fourth quarter of 2016, while slot machine win

increased 96.2% to $55.0 million.

Non-casino revenues before promotional allowances from Wynn

Palace were $90.8 million for the fourth quarter of 2017, a 5.5%

increase from $86.1 million for the same period of 2016. Room

revenues were $38.9 million for the fourth quarter of 2017, a 4.1%

decrease from $40.6 million for the same period of 2016. ADR was

$236, a 13.2% decrease from $272 for the fourth quarter of 2016.

Occupancy increased to 96.8% for the fourth quarter of 2017, from

88.4% for the same period of 2016. REVPAR was $228, a 5.4% decrease

from $241 for the fourth quarter of 2016.

Las Vegas Operations

Net revenues from our Las Vegas Operations were $377.0 million

for the fourth quarter of 2017, a 1.6% decrease from $383.3 million

for the same period of 2016. Adjusted Property EBITDA from our Las

Vegas Operations was $104.1 million for the fourth quarter of 2017,

a 9.2% decrease from $114.6 million for the same period of

2016.

Casino revenues from our Las Vegas Operations were $142.7

million for the fourth quarter of 2017, a 14.1% decrease from

$166.0 million for the same period of 2016. Table games drop was

$430.8 million, a 4.8% decrease from $452.5 million for the fourth

quarter of 2016. Table games win was $101.3 million, an 18.6%

decrease from $124.5 million for the fourth quarter of 2016. Table

games win percentage was 23.5%, within the expected range of 21% to

25% and below the 27.5% experienced for the fourth quarter of 2016.

Slot machine handle was $833.2 million, a 3.3% decrease from $862.1

million for the fourth quarter of 2016, while slot win decreased

1.2% to $56.6 million.

Non-casino revenues before promotional allowances from our Las

Vegas Operations were $275.2 million for the fourth quarter of

2017, a 5.8% increase from $260.2 million for the same period of

2016. Room revenues were $107.8 million for the fourth quarter of

2017, a 1.9% increase from $105.7 million for the same period of

2016. ADR was $305, a 4.8% increase from $291 for the fourth

quarter of 2016. Occupancy decreased to 82.1% for the fourth

quarter of 2017, from 84.1% for the same period of 2016. REVPAR was

$250, a 2.0% increase from $245 for the fourth quarter of 2016.

Food and beverage revenues increased 9.9%, to $108.0 million for

the fourth quarter of 2017, compared to the same period of 2016.

Entertainment, retail and other revenues increased 5.8%, to $59.5

million for the fourth quarter of 2017, compared to the same period

of 2016.

Retail Joint Venture

In December 2016, the Company entered into a joint venture

arrangement (the “Retail Joint Venture”), of which the Company owns

50.1%, with Crown Acquisitions Inc. ("Crown") to own and operate

approximately 88,000 square feet of existing retail space at Wynn

Las Vegas. In November 2017, the Company contributed approximately

74,000 square feet of additional retail space to the Retail Joint

Venture, the majority of which is currently under construction at

Wynn Las Vegas, and received cash of $180.0 million from

Crown. The Company expects to open the additional retail space

in the third quarter of 2018. Based on the applicable

accounting guidance, the Company will continue to consolidate the

Retail Joint Venture in its consolidated financial statements.

Wynn Boston Harbor Project in Massachusetts

The Company is currently constructing Wynn Boston Harbor, an

integrated resort in Everett, Massachusetts, located adjacent to

Boston along the Mystic River. The resort will contain a hotel, a

waterfront boardwalk, meeting and convention space, casino space, a

spa, retail offerings and food and beverage outlets. The total

project budget, including gaming license fees, construction costs,

capitalized interest, pre-opening expenses and land costs, is

estimated to be approximately $2.4 billion. As of December 31,

2017, we have incurred $1.13 billion in total project costs. We

expect to open Wynn Boston Harbor in mid-2019.

Balance Sheet

Our cash and cash equivalents, restricted cash and investment

securities as of December 31, 2017 totaled $3.13 billion.

Total debt outstanding at the end of the quarter was $9.63

billion, including $3.60 billion of Macau related debt, $3.16

billion of Wynn Las Vegas debt and $2.87 billion at the parent

company and other.

During the fourth quarter of 2017, Wynn Macau, Limited redeemed

the remaining $403.6 million of untendered 5 1/4 % Senior Notes,

due 2021 and recorded a $12.3 million loss on extinguishment of

debt.

In December 2017, we reached agreements to acquire approximately

38 acres of land on the Las Vegas Strip directly across from Wynn

Las Vegas for $336.2 million, approximately 16 acres of which are

subject to a ground lease that expires in 2097. We currently expect

to complete these transactions in the first quarter of 2018.

Conference Call Information

The Company will hold a conference call to discuss its results

on January 22, 2018 at 9:00 a.m. PT (12:00 p.m. ET).

Interested parties are invited to join the call by accessing a live

audio webcast at http://www.wynnresorts.com.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, our dependence on Stephen A. Wynn,

general global political and economic conditions, adverse tourism

trends, dependence on a limited number of resorts, competition in

the casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction risks, extensive regulation of our business, pending

or future legal proceedings, cybersecurity risk, the impact of the

U.S. tax reform, and our leverage and debt service. Additional

information concerning potential factors that could affect the

Company’s financial results is included in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2017 and

the Company’s other periodic reports filed with the Securities and

Exchange Commission. The Company is under no obligation to (and

expressly disclaims any such obligation to) update or revise its

forward-looking statements as a result of new information, future

events or otherwise.

Non-GAAP Financial Measures

(1) “Adjusted net income attributable to Wynn Resorts, Limited”

is net income attributable to Wynn Resorts, Limited before

pre-opening expenses, property charges and other, change in

interest rate swap fair value, change in Redemption Note fair

value, loss on extinguishment of debt, foreign currency

remeasurement gain (loss), the impact from enactment of U.S. tax

reform, net of noncontrolling interests and income taxes calculated

using the specific tax treatment applicable to the adjustments

based on their respective jurisdictions. Adjusted net income

attributable to Wynn Resorts, Limited and adjusted net income

attributable to Wynn Resorts, Limited per diluted share are

presented as supplemental disclosures to financial measures in

accordance with GAAP because management believes that these

non-GAAP financial measures are widely used to measure the

performance, and as a principal basis for valuation, of gaming

companies. These measures are used by management and/or evaluated

by some investors, in addition to income and earnings per share

computed in accordance with GAAP, as an additional basis for

assessing period-to-period results of our business. Adjusted net

income attributable to Wynn Resorts, Limited and adjusted net

income attributable to Wynn Resorts, Limited per diluted share may

be different from the calculation methods used by other companies

and, therefore, comparability may be limited.

(2) “Adjusted Property EBITDA” is net income before interest,

income taxes, depreciation and amortization, pre-opening expenses,

property charges and other, management and license fees, corporate

expenses and other (including intercompany golf course and water

rights leases), stock-based compensation, loss on extinguishment of

debt, change in interest rate swap fair value, change in Redemption

Note fair value and other non-operating income and expenses, and

includes equity in income from unconsolidated affiliates. Adjusted

Property EBITDA is presented exclusively as a supplemental

disclosure because management believes that it is widely used to

measure the performance, and as a basis for valuation, of gaming

companies. Management uses Adjusted Property EBITDA as a measure of

the operating performance of its segments and to compare the

operating performance of its properties with those of its

competitors, as well as a basis for determining certain incentive

compensation. The Company also presents Adjusted Property EBITDA

because it is used by some investors as a way to measure a

company’s ability to incur and service debt, make capital

expenditures and meet working capital requirements. Gaming

companies have historically reported EBITDA as a supplement to

GAAP. In order to view the operations of their casinos on a more

stand-alone basis, gaming companies, including Wynn Resorts,

Limited, have historically excluded from their EBITDA calculations

pre-opening expenses, property charges, corporate expenses and

stock-based compensation, that do not relate to the management of

specific casino properties. However, Adjusted Property EBITDA

should not be considered as an alternative to operating income as

an indicator of the Company’s performance, as an alternative to

cash flows from operating activities as a measure of liquidity, or

as an alternative to any other measure determined in accordance

with GAAP. Unlike net income, Adjusted Property EBITDA does not

include depreciation or interest expense and therefore does not

reflect current or future capital expenditures or the cost of

capital. The Company has significant uses of cash flows, including

capital expenditures, interest payments, debt principal repayments,

income taxes and other non-recurring charges, which are not

reflected in Adjusted Property EBITDA. Also, Wynn Resorts’

calculation of Adjusted Property EBITDA may be different from the

calculation methods used by other companies and, therefore,

comparability may be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income attributable to

Wynn Resorts, Limited to adjusted net income attributable to Wynn

Resorts, Limited, (ii) operating income to Adjusted Property

EBITDA, and (iii) net income attributable to Wynn Resorts, Limited

to Adjusted Property EBITDA.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(in thousands, except per share

data)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31, 2017

2016 2017 2016 Operating revenues:

Casino $ 1,374,260 $ 1,004,533 $ 4,948,319 $ 3,268,141 Rooms

172,644 172,225 704,202 603,272 Food and beverage 153,135 132,442

690,942 601,514 Entertainment, retail and other 114,147

106,172 424,783 363,428 Gross revenues

1,814,186 1,415,372 6,768,246 4,836,355 Less: promotional

allowances (125,090 ) (114,939 ) (461,878 ) (370,058 ) Net revenues

1,689,096 1,300,433 6,306,368 4,466,297

Operating expenses: Casino 894,294 651,208 3,197,729

2,079,740 Rooms 43,117 41,967 177,511 157,904 Food and beverage

86,985 80,754 410,825 375,234 Entertainment, retail and other

47,342 45,018 177,328 161,144 General and administrative 182,848

166,985 685,485 548,141 (Benefit) provision for doubtful accounts

(2,118 ) 7,387 (6,711 ) 8,203 Pre-opening 7,247 4,221 26,692

154,717 Depreciation and amortization 136,880 140,543 552,368

404,730 Property charges and other (8,918 ) 23,456 29,576

54,822 Total operating expenses 1,387,677

1,161,539 5,250,803 3,944,635 Operating income

301,419 138,894 1,055,565 521,662 Other

income (expense): Interest income 9,195 3,596 31,193 13,536

Interest expense, net of amounts capitalized (96,789 ) (95,667 )

(388,664 ) (289,365 ) Change in interest rate swap fair value —

2,126 (1,056 )

433

Change in Redemption Note fair value 10,282 84,282 (59,700 ) 65,043

Loss on extinguishment of debt (12,299 ) — (55,360 ) — Equity in

income from unconsolidated affiliates — — — 16 Other (1,869 ) 318

(21,709 )

(728

)

Other income (expense), net (91,480 ) (5,345 ) (495,296 )

(211,065

)

Income before income taxes 209,939 133,549 560,269 310,597 Benefit

(provision) for income taxes 334,025 (6,983 ) 328,985

(8,128

)

Net income 543,964 126,566 889,254 302,469 Less: net income

attributable to noncontrolling interests (52,282 ) (12,766 )

(142,073 )

(60,494

)

Net income attributable to Wynn Resorts, Limited $ 491,682 $

113,800 $ 747,181 $ 241,975 Basic and diluted

income per common share: Net income attributable to Wynn Resorts,

Limited: Basic $ 4.80 $ 1.12 $ 7.32 $ 2.39 Diluted $ 4.77 $ 1.12 $

7.28 $ 2.38 Weighted average common shares outstanding: Basic

102,402 101,509 102,071 101,445 Diluted 103,065 101,910 102,598

101,855 Dividends declared per common share: $ 0.50 $ 0.50 $ 2.00 $

2.00

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME ATTRIBUTABLE TO

WYNN RESORTS, LIMITED

(in thousands, except per share

data)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31, 2017

2016 2017 2016 Net income attributable

to Wynn Resorts, Limited $ 491,682 $ 113,800 $ 747,181 $ 241,975

Pre-opening expenses 7,247 4,221 26,692 154,717 Property charges

and other (8,918 ) 23,456 29,576 54,822 Change in interest rate

swap fair value — (2,126 ) 1,056 (433 ) Change in Redemption Note

fair value (10,282 ) (84,282 ) 59,700 (65,043 ) Loss on

extinguishment of debt 12,299 — 55,360 — Foreign currency

remeasurement (gain) loss 1,869 (318 ) 21,709 728 Income tax impact

on adjustments (8,158 ) (4,611 ) (19,911 ) (3,013 ) Impact of U.S.

tax reform (339,921 ) — (339,921 ) — Noncontrolling interests

impact on adjustments (1,489 ) 635 (20,972 ) (37,838 )

Adjusted net income attributable to Wynn Resorts, Limited $ 144,329

$ 50,775 $ 560,470 $ 345,915 Adjusted

net income attributable to Wynn Resorts, Limited per diluted share

$ 1.40 $ 0.50 $ 5.46 $ 3.40

Weighted average common shares outstanding - diluted 103,065

101,910 102,598 101,855

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME

(LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

Three Months Ended December 31, 2017

Operating income

(loss)

Pre-openingexpenses

Depreciation and

amortization

Propertycharges andother

Managementand license

fees

Corporateexpense and

other

Stock-basedcompensation

Adjusted Property

EBITDA

Macau Operations: Wynn Macau $ 133,923 $ — $ 23,249 $ (1,244 ) $

24,042 $ 3,499 $ 2,560 $ 186,029 Wynn Palace 101,443 — 64,475

(7,590 ) 27,014 3,213 1,541 190,096 Other Macau (2,686 ) —

1,107 16 — 1,395 168 — Total

Macau Operations 232,680 — 88,831 (8,818 ) 51,056 8,107 4,269

376,125 Las Vegas Operations 37,338 (522 ) 45,318 (5,059 ) 17,352

8,995 679 104,101 Corporate and Other 31,401 7,769

2,731 4,959 (68,408 ) 11,815 9,733 —

Total $ 301,419 $ 7,247 $ 136,880 $ (8,918 ) $

— $ 28,917 $ 14,681 $ 480,226

Three Months Ended December 31, 2016

Operating income

(loss)

Pre-openingexpenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expense and

other

Stock-basedcompensation

Adjusted Property

EBITDA

Macau Operations: Wynn Macau $ 95,622 $ — $ 23,997 $ 1,291 $ 18,846

$ 4,643 $ 4,467 $ 148,866 Wynn Palace (8,035 ) (1,371 ) 64,722 243

16,510 4,360 1,060 77,489 Other Macau (2,755 ) — 1,130

1 — 1,644 (20 ) — Total Macau

Operations 84,832 (1,371 ) 89,849 1,535 35,356 10,647 5,507 226,355

Las Vegas Operations 40,046 75 47,768 7,848 12,072 5,751 1,029

114,589 Corporate and Other 14,016 5,517 2,926

14,073 (47,428 ) 3,070 7,826 — Total $ 138,894

$ 4,221 $ 140,543 $ 23,456 $ — $

19,468 $ 14,362 $ 340,944

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME

(LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands) (unaudited)

(continued)

Twelve Months Ended December 31, 2017

Operating income

(loss)

Pre-openingexpenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expense and

other

Stock-basedcompensation

Adjusted Property

EBITDA

Macau Operations: Wynn Macau $ 540,341 $ — $ 97,292 $ 6,688 $

96,769 $ 11,085 $ 8,577 $ 760,752 Wynn Palace 157,886 — 258,224

12,663 83,534 9,957 5,319 527,583 Other Macau (15,201 ) —

4,483 179 — 9,875 664 — Total

Macau Operations 683,026 — 359,999 19,530 180,303 30,917 14,560

1,288,335 Las Vegas Operations 242,457 226 181,879 4,598 64,598

26,578 2,061 522,397 Corporate and Other 130,082 26,466

10,490 5,448 (244,901 ) 45,065 27,350

— Total $ 1,055,565 $ 26,692 $ 552,368

$ 29,576 $ — $ 102,560 $ 43,971 $

1,810,732

Twelve Months Ended December 31,

2016

Operating income

(loss)

Pre-openingexpenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expense and

other

Stock-basedcompensation

Adjusted Property

EBITDA

Macau Operations: Wynn Macau $ 465,112 $ — $ 98,527 $ 5,497 $

86,000 $ 13,839 $ 12,534 $ 681,509 Wynn Palace (162,637 ) 129,773

105,884 430 23,064 5,207 1,315 103,036 Other Macau (16,777 ) —

3,509 1 — 12,311 956 —

Total Macau Operations 285,698 129,773 207,920 5,928 109,064 31,357

14,805 784,545 Las Vegas Operations 178,379 2,274 185,117 34,837

51,035 20,075 3,065 474,782 Corporate and Other 57,585

22,670 11,693 14,073 (160,099 ) 28,730

25,348 — Total $ 521,662 $ 154,717 $ 404,730

$ 54,838 $ — $ 80,162 $ 43,218 $

1,259,327

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31, 2017

2016 2017 2016 Net income attributable

to Wynn Resorts, Limited $ 491,682 $ 113,800 747,181 $ 241,975 Net

income attributable to noncontrolling interests 52,282 12,766

142,073 60,494 Pre-opening expenses 7,247 4,221 26,692 154,717

Depreciation and amortization 136,880 140,543 552,368 404,730

Property charges and other (8,918 ) 23,456 29,576 54,822 Corporate

expense and other 28,917 19,468 102,560 80,162 Stock-based

compensation 14,681 14,362 43,971 43,218 Interest income (9,195 )

(3,596 ) (31,193 ) (13,536 ) Interest expense, net of amounts

capitalized 96,789 95,667 388,664 289,365 Change in interest rate

swap fair value — (2,126 ) 1,056 (433 ) Change in Redemption Note

fair value (10,282 ) (84,282 ) 59,700 (65,043 ) Loss on

extinguishment of debt 12,299 — 55,360 — Other 1,869 (318 ) 21,709

728 (Benefit) provision for income taxes (334,025 ) 6,983

(328,985 ) 8,128 Adjusted Property EBITDA $ 480,226 $

340,944 $ 1,810,732 $ 1,259,327

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win

per unit per day, ADR and REVPAR)

(unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31, 2017

2016 2017 2016

Macau Operations:

Wynn Macau: VIP: Average number of table games 102 83 96 149 VIP

turnover $ 15,622,932 $ 10,796,516 $ 58,303,836 $ 47,048,754 VIP

table games win $ 451,486 $ 332,586 $ 1,907,625 $ 1,547,261 VIP

table games win as a % of turnover 2.89 % 3.08 % 3.27 % 3.29 %

Table games win per unit per day (1) $ 48,267 $ 43,419 $ 54,726 $

28,332 Mass market: Average number of table games 202 182 204 216

Table drop (2) $ 1,250,994 $ 1,096,204 $ 4,525,727 $ 4,585,476

Table games win $ 230,053 $ 193,921 $ 880,964 $ 881,797 Table games

win % 18.4 % 17.7 % 19.5 % 19.2 % Table games win per unit per day

(1) $ 12,370 $ 11,590 $ 11,820 $ 11,131 Average number of slot

machines 934 845 914 802 Slot machine handle $ 937,622 $ 802,630 $

3,526,747 $ 3,386,973 Slot machine win $ 40,818 $ 32,582 $ 154,425

$ 145,680 Slot machine win per unit per day (3) $ 475 $ 419 $ 463 $

497 Room statistics: Occupancy 99.4 % 96.3 % 97.5 % 94.4 % ADR (4)

$ 258 $ 262 $ 257 $ 293 REVPAR (5) $ 257 $ 252 $ 251 $ 277

Wynn Palace (6): VIP: Average number of table games 112 86 104 81

VIP turnover $ 16,232,654 $ 10,329,574 $ 52,573,258 $ 14,480,023

VIP table games win $ 489,643 $ 276,499 $ 1,486,674 $ 396,954 VIP

table games win as a % of turnover 3.02 % 2.68 % 2.83 % 2.74 %

Table games win per unit per day (1) $ 47,395 $ 35,151 $ 39,325 $

37,009 Mass market: Average number of table games 197 233 202 245

Table drop (2) $ 1,124,702 $ 724,982 $ 3,490,363 $ 1,000,881 Table

games win $ 264,492 $ 159,620 $ 795,159 $ 211,146 Table games win %

23.5 % 22.0 % 22.8 % 21.1 % Table games win per unit per day (1) $

14,623 $ 7,461 $ 10,759 $ 6,527 Average number of slot machines 983

888 1,026 962 Slot machine handle $ 920,641 $ 534,391 $ 3,053,614 $

738,907 Slot machine win $ 55,042 $ 28,054 $ 165,754 $ 40,664 Slot

machine win per unit per day (3) $ 609 $ 344 $ 443 $ 320 Room

statistics: Occupancy 96.8 % 88.4 % 96.2 % 83.2 % ADR (4) $ 236 $

272 $ 237 $ 276 REVPAR (5) $ 228 $ 241 $ 227 $ 230

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win

per unit per day, ADR and REVPAR)

(continued) (unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31,

2017 2016 2017 2016

Las Vegas Operations:

Average number of table games 235

232

236 235 Table drop (2) $ 430,821 $ 452,517 $ 1,804,988 $ 1,838,479

Table games win $ 101,290 $ 124,469 $ 465,664 $ 465,041 Table games

win % 23.5 % 27.5 % 25.8 % 25.3 % Table games win per unit per day

(1) $ 4,692 $ 5,837 $ 5,415 $ 5,406 Average number of slot machines

1,834 1,908 1,856 1,893 Slot machine handle $ 833,207 $ 862,052 $

3,183,369 $ 3,148,610 Slot machine win $ 56,557 $ 57,238 $ 218,897

$ 208,024 Slot machine win per unit per day (3) $ 335 $ 326 $ 323 $

300 Room statistics: Occupancy 82.1 % 84.1 % 86.9 % 85.3 % ADR (4)

$ 305 $ 291 $ 305 $ 296 REVPAR (5) $ 250 $ 245 $ 265 $ 252

(1) Table games win per unit per day is shown before discounts

and commissions, as applicable.(2) In Macau, table drop is the

amount of cash that is deposited in a gaming table’s drop box plus

cash chips purchased at the casino cage. In Las Vegas, table drop

is the amount of cash and net markers issued that are deposited in

a gaming table’s drop box.(3) Slot machine win per unit per day is

calculated as gross slot machine win minus progressive accruals and

free play.(4) ADR is average daily rate and is calculated by

dividing total room revenues including the retail value of

promotional allowances (less service charges, if any) by total

rooms occupied including complimentary rooms.(5) REVPAR is revenue

per available room and is calculated by dividing total room

revenues including the retail value of promotional allowances (less

service charges, if any) by total rooms available.(6) Wynn Palace

opened on August 22, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180122005966/en/

Wynn Resorts, LimitedRobert Amerine,

702-770-7555investorrelations@wynnresorts.com

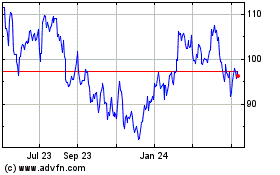

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024