By Caitlin Ostroff and Rebecca Elliott

Tesla Inc. said Monday that it bought $1.5 billion in bitcoin, a

disclosure that follows Chief Executive Elon Musk's promotion of

the cryptocurrency and other digital-currency alternatives on

Twitter.

The electric-vehicle company also said it expects to start

accepting bitcoin as payment for its products soon. Bitcoin prices

jumped more than 10% after the announcement, according to

cryptocurrency research and news site CoinDesk.

Tesla disclosed the bitcoin purchase in its latest annual

report, saying the move aims to "diversify and maximize returns on

our cash that is not required to maintain adequate operating

liquidity." Tesla said a board committee had approved changes to

company rules on investments, adding that it can also invest cash

in gold bullion and gold exchange-traded funds among other

assets.

The bitcoin purchase, likely among the largest by a public

company, comes after a rally in 2020 when the price more than

quadrupled. The cryptocurrency continues to experience big

swings.

Tesla said it would account for its bitcoin holdings as

long-term intangible assets but warned that its exposure to bitcoin

could make its financial reports more volatile. The company will

analyze its holdings in the cryptocurrency each quarter to see

whether impairments are warranted based on bitcoin prices, it said

in the report.

Bitcoin recently traded Monday at $43,602.68, according to

CoinDesk. In January, its price averaged $34,730.12. The current

price is more than eight times higher than bitcoin's 2020 low,

which was a little under $5,000.

Mr. Musk has shown interest in bitcoin, including by changing

his Twitter biography last month to "#bitcoin," which sent prices

for it higher, before removing that reference.

"I think bitcoin is really on the verge of getting broad

acceptance by sort of the conventional finance people," he said

last week on the social-networking app Clubhouse. Mr. Musk said he

needed to be cautious with his public statements about

cryptocurrencies because "some of these things can really move the

market."

Tesla didn't immediately respond to a request for comment.

"He's already telegraphed it to the market," said Meltem

Demirors, chief strategy officer at London-based asset management

firm CoinShares, referring to when Mr. Musk mentioned bitcoin in

his Twitter biography. "One of the world's largest corporations

doing this -- I think it opens the floodgates."

Tesla has previously struggled to maintain cash while ramping up

vehicle production. But the company's shares soared some 480% in

the year ended Friday as investors piled into electric-vehicle

makers and Tesla reported a string of quarterly profits. Tesla took

advantage of that surge by selling billions of dollars in new

stock, shoring up its cash position. The company's cash holdings

totaled around $19.4 billion at the end of last year, up from

around $6.3 billion at the end of 2019.

Mr. Musk's tweets have drawn regulatory and legal scrutiny. A

British spelunker sued Mr. Musk over one post, accusing the

billionaire of defamation. A jury cleared Mr. Musk, who had deleted

the tweet and apologized.

The Securities and Exchange Commission took issue with tweets

Mr. Musk posted in 2018 saying he had secured funding to take Tesla

private. Mr. Musk and the SEC later settled in a deal requiring the

company to sign off on any written statements Mr. Musk made that

could be deemed material.

The businessman has since used Twitter to mock the

regulator.

Tesla didn't immediately respond to a request for comment about

whether Mr. Musk had sought approval for his bitcoin

commentary.

The SEC is unlikely to challenge Mr. Musk over his bitcoin

tweets, said John Coffee Jr., a Columbia University law professor

who specializes in securities law, especially after a federal judge

rebuked the commission when it sought to hold the CEO in contempt

in 2019.

"I don't think the commission would dare push it that far," he

said.

Recently, Mr. Musk's tweets about dogecoin, a cryptocurrency

started in 2013 as a joke, have helped drive up that virtual

currency's price.

Mr. Musk's online comments can move markets. After saying in

January that he liked online shopping site Etsy Inc., where he said

he had bought a cap for his dog, the stock rose more than 8% on the

open. Shares in CD Projekt SA, the maker of the troubled Cyberpunk

2077 game, rose more than 15% after Mr. Musk gave the game a

shout-out. Both stocks retreated later.

Last year, Mr. Musk tweeted that he thought Tesla's share price

was too high. The market agreed, and the stock fell before

recovering.

An affinity for bitcoin is a seeming natural fit for Mr. Musk,

who has at times bristled at government constraints. In addition to

sparring with the SEC, last year he battled local authorities in

California that ordered his lone U.S. car plant closed as part of

broader measures to curb the pandemic. Mr. Musk reopened the

facility after several weeks, daring authorities to arrest him.

They didn't.

Mr. Musk tweeted in early 2018 that he didn't own cryptocurrency

other than a quarter of a bitcoin that a friend had given him. At

today's valuation, that would be worth more than $10,000.

Part of bitcoin's appeal for some holders is that it isn't

circulated or controlled by a government or nation. Unlike opening

up a bank account to store dollars, euros or yen, starting a

bitcoin account does require providing identifying information.

Bitcoin is effectively anonymous, and law enforcement can't freeze

a bitcoin account as they could a bank account.

Tesla is joining a handful of other companies that have

disclosed bitcoin holdings. Software company MicroStrategy Inc.

acquired about $425 million worth of bitcoin last summer, and its

CEO, Michael Saylor, has become an outspoken proponent.

Payments company Square Inc., which shares bitcoin advocate Jack

Dorsey as its CEO with Twitter Inc., acquired about $50 million

worth for its corporate treasury in October. Massachusetts Mutual

Life Insurance Co. acquired $100 million worth in December to hold

in its general investment account.

Bitcoin remains prone to sharp changes in its valuation, which

might be why companies have acquired millions, rather than

billions, of dollars' worth of the cryptocurrency, said Michel

Rauchs, founder of Luxembourg-based digital-assets consulting firm

Paradigma Sarl. "It is definitely greater risk but greater reward

there."

Companies might have grown more optimistic about bitcoin after

the March 2020 selloff, when it recovered faster than the broader

stock market, said Joel Kruger, a currency strategist at LMAX

Group.

The added wrinkle with Tesla is the plan to accept bitcoin from

customers. Few companies now accept bitcoin directly as payment;

Overstock.com Inc. is among the few that do. A number of large

companies experimented with bitcoin payments in 2014 and 2015, like

Dell Technologies Inc. and Expedia Group Inc., but most later

dropped it for lack of use.

Now, bitcoin is becoming more accessible to the public through

companies -- such as PayPal Holdings Inc. -- that enable users to

directly buy and sell bitcoin and other cryptocurrencies for their

digital wallets. Square also allows users to buy bitcoin through

its Cash App.

For Tesla, accepting bitcoin would dovetail with the wider trend

of using cryptocurrencies to fund large purchases -- and serve as

something of a status symbol. For example, a luxury auto dealer in

Las Vegas regularly accepts bitcoin as payment for clients buying

high-end sports cars like Bugattis.

While Tesla's move would be high profile, a more substantial

development is expected later this year, when PayPal plans to allow

its customers to use their bitcoin holdings for payments.

"Bitcoin sentiment has already shifted so dramatically over the

last year, but over the last three months that's only accelerated,"

Ms. Demirors said.

Mr. Musk has past ties to the financial-services industry.

During the 1990s dot-com boom, he and his brother Kimbal started an

internet business called Zip2, which helped newspapers go online.

In 1999, they sold it to Compaq Computer Corp., enabling Mr. Musk

to walk away with $22 million at age 27. He spent $1 million on a

McLaren F1 supercar and bet the rest on his next startup, X.com,

which became PayPal.

EBay Inc. bought PayPal for $1.4 billion in 2002. As the largest

shareholder, Mr. Musk collected more than $100 million. He was

31.

He used the money to start Tesla and Space Exploration

Technologies Corp., or SpaceX, the rocket company he also runs, as

well as solar-cell company SolarCity, now part of Tesla.

Micah Maidenberg and Paul Vigna contributed to this article.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com and Rebecca

Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

February 08, 2021 14:41 ET (19:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

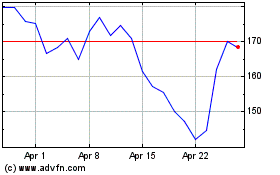

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024