By Randall Smith

Target-date funds, which adjust allocations of stocks and bonds

over time, based on their investors' ages, have become a staple in

retirement accounts.

Broadly speaking, such accounts operate on the principle that

younger investors should have higher allocations of stock, and thus

accept more risk, to take advantage of equities' long-term record

of outperforming bonds and other assets; older investors, in turn,

should have less of their nest eggs in stock, and thus less risk,

because they have less time to make up for losses from down

markets.

The current market turmoil has cast a new light on the

allocation strategies of target-date funds for investors expected

to retire this year. The stock allocations among the half-dozen

largest funds for those retiring this year range from 55% at T.

Rowe Price Group Inc. to 33% at JPMorgan Chase & Co.

"There's a massive disparity in equity allocations," says Scott

Colangelo, chairman of Prime Capital Advisers, which advises

retirement plans and individuals. In this kind of market, he adds,

having an aggressive allocation risks leading some investors to

"sell at the worst times because they don't have the stomach to

hold tight."

A look at the varying equity allocations of the top six

target-date fund managers, by assets -- holders of an estimated 83%

share of this market, according to Morningstar Inc. -- amounts to a

close view of the potential damage that serious market upheaval can

cause as investors near retirement.

Youth movement?

Further, if the recent slide in stocks persists, it could begin

to test whether younger 401(k) participants will be willing to ride

out the storm with portfolios heavily weighted to stocks, or if

some will sell out because the glide paths of their target-date

funds are too aggressive for them as well.

At present, many 401(k) participants using target-date options

don't understand how risky their funds can be, Mr. Colangelo

says.

While investors in these funds have held on in the past, notably

during the 2007-09 financial crisis, assets in target-date funds

mushroomed during the nearly 11-year bull market that just ended.

Such funds accounted for an estimated 30% of 401(k) assets last

year, up from 17% in 2014, according to Cerulli, a research and

consulting firm. The increase, observers say, is fueled by

government rules adopted in 2008 allowing employers to designate

such funds as default choices for employees in their plans.

"Target-dates are becoming the de facto pension plans," says

Anne Lester, a portfolio manager at JPMorgan who has overseen her

firm's target-date glide paths since 2005. Ms. Lester predicts the

assets in such funds may exceed those in traditional pension plans

in 10 or 15 years.

Over a 10-year period ended Dec. 31, having the highest equity

allocation helped the T. Rowe Price Retirement 2020 fund (TRRBX) to

top its largest rivals, with an annualized return of 8.6%, ahead of

the more conservative JPMorgan SmartRetirement 2020 (JTTIX) at

7.6%, according to Morningstar Direct.

While that difference might look small, it adds up to $19,833 on

a $100,000 initial investment over the full decade, with T. Rowe's

fund increasing the value of the initial $100,000 to $228,626,

compared with $208,793 for the JPMorgan fund.

The tables turned, however, in the first quarter of this year,

when the JPMorgan fund fell only 10.1%, compared with a decline of

14.2% in the T. Rowe fund. Yet even with this quarter's losses,

taking the longer view, the T. Rowe fund would still be well ahead

of the JPMorgan fund, $196,128 to $187,793.

Target-date-fund managers generally adjust their allocation

strategies from time to time, based on market cycles, models based

on past investor behavior, and surveys that ask employers what

investment styles work best for their workers. Vanguard Group, in

2006, raised stock allocations by 10 percentage points for all of

its target-date funds; Fidelity Investments, in 2014, raised its

stock allocations as much as 16 percentage points in some funds for

investors at midcareer.

Nest-egg concern

But what works for middle-aged and young plan participants isn't

necessarily a good idea for those closer to the end of their

careers. As retirement nears, and the nest egg may be at its

fattest, "that's when a steep drop in the market is going to harm

you the most," says Richard Weiss, chief investment officer for

multiasset strategies at target-date-fund managers American Century

Investments.

Another potential drawback of such funds is the

"one-size-fits-all" approach that pushes investors to accept the

same allocations without regard to their ability to stomach

volatility, says Jud Doherty, CEO of Stadion Money Management,

which offers managed accounts for 401(k) plans. A fund with a

target retirement date of 2020, in other words, will have the same

stock allocation whether it is offered in the 401(k) of a

manufacturing company that employs mostly blue-collar workers, or

of a law firm where participants not only might earn more but could

work more years if they experience losses.

The T. Rowe 2020 fund, geared to 65-year-olds retiring this

year, has a 55% stock allocation because its investors may need to

make their money last another 30 years. They need "a reasonable

allocation of growth-seeking assets," says Wyatt Lee, head of T.

Rowe's target-date business.

"I completely agree it's pretty scary if somebody opens a

statement at the end of March and sees their assets down 20% from

the beginning of the year," Mr. Lee says. But the investors are

still "better off having been in that portfolio" because of the

greater returns it generated in the past five or 10 years when the

market was rising, Mr. Lee says.

Jason Kephart, a multiasset analyst at Morningstar, says 2020

funds with higher stock allocations do tend to lower them as

investors move through retirement. The T. Rowe 2020 fund moves to

45% at age 70 and 35% at 80.

Vanguard Target Retirement 2020 fund (VTWNX) currently has a 50%

stock allocation, says Matt Brancato, global head of portfolio

review at Vanguard. Investors in or approaching retirement still

need substantial stock exposure "to protect against inflation,

longevity risk and rising health care costs," Mr. Brancato says in

an email. The fund had an 8% annualized return for the 10-year

period ended Dec. 31.

In a comparison of fund performances, however, more stock

doesn't always translate to better returns even after a nearly

11-year bull market. Fidelity Freedom 2020 fund (FFFDX), despite

being near the top of the group in terms of current stock

allocation, with 51%, trailed other top-tier rivals, finishing just

behind JPMorgan at a 7.5% annualized return for the decade ended in

2019.

Fidelity managers attribute the results to having less exposure

in U.S. stocks and more in overseas and emerging-markets stocks at

times during the decade, and to having more exposure in commodities

and other inflation-sensitive assets during a decade of low

inflation.

Managers of the JPMorgan 2020 fund calculated that its more

conservative 33% stock allocation will maximize the number of

investors who can maintain their lifestyle after retiring. "Recent

market volatility reinforces the JPM philosophy that the biggest

risk to potential retirees is that they lose money when they can

least afford to," portfolio manager Daniel Oldroyd says in an

email. "At the point of retirement, losing money hurts much more

than making a bit more helps."

Less time to recover losses

Another of the more risk-averse funds in this group is run by

BlackRock Inc., whose LifePath Index Retirement (LIRKX) for all

retirees has a 40% stock allocation. "You have to take risk in your

20s and 30s, but not in your 50s and 60s," says Nicholas Nefouse,

BlackRock's target-date co-head. In sudden downturns like this

year's, he adds, retirees "have less time and less savings to make

up for that loss."

Principal Financial Group set its current 48% stock allocation

for its Principal LifeTime 2020 fund (PTBAX) partly based on an

estimate of how big a downturn retired investors in the fund could

absorb without selling everything, says Principal target-date

manager James Fennessey. The answer they came up with: two years of

12% annualized declines. "We want to avoid the risk of abandonment"

Mr. Fennessey says.

"I do anticipate on the heels of this market, you're going to

have a pretty significant base of people who are not happy" with

their target-date funds, says Stadion's Mr. Doherty. But he says it

doesn't change the fact that they are "a great long-term vehicle.

This is normal. We haven't had a bear market in 11 years. They do

come along, and they're always different."

Mr. Smith, a former financial reporter for The Wall Street

Journal, is a writer in New York. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

April 05, 2020 22:29 ET (02:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

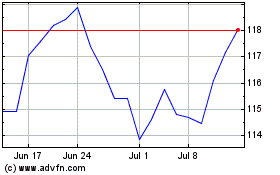

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Apr 2023 to Apr 2024