Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN), a specialty

pharmaceutical company focused on developing and commercializing

products for the treatment of central nervous system (CNS)

diseases, today reported financial results for fourth quarter and

full year 2016 and associated Company developments.

Commercial Update

Fourth quarter 2016 product prescriptions for Trokendi XR® and

Oxtellar XR®, as reported by IMS, totaled 136,145, a 22.0% increase

over the fourth quarter of 2015. Full year 2016 product

prescriptions for Trokendi XR and Oxtellar XR totaled 506,542, a

33.9% increase over full year 2015.

| |

|

Prescriptions |

|

|

|

Prescriptions |

|

|

|

|

|

Q4 2016 |

|

Q4 2015 |

|

Change % |

|

FY 2016 |

|

FY 2015 |

|

Change % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trokendi XR |

|

102,727 |

|

83,899 |

|

22.4% |

|

381,226 |

|

279,782 |

|

36.3% |

|

Oxtellar XR |

|

33,418 |

|

27,728 |

|

20.5% |

|

125,316 |

|

98,391 |

|

27.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

136,145 |

|

111,627 |

|

22.0% |

|

506,542 |

|

378,173 |

|

33.9% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Source: IMS |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net product sales for the fourth quarter of 2016 were $61.1

million, a 43.4% increase over $42.6 million in the same period the

prior year. Net product sales for full year 2016 were $210.1

million, a 46.4% increase over $143.5 million in 2015.

| |

|

Net Product Sales ($mil.) |

|

|

|

Net Product Sales ($mil.) |

|

|

|

|

|

Q4 2016 |

|

Q4 2015 |

|

Change % |

|

FY 2016 |

|

FY 2015 |

|

Change % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trokendi XR |

|

$46.7 |

|

$33.3 |

|

40.3% |

|

$158.4 |

|

$110.3 |

|

43.6% |

|

Oxtellar XR |

|

$14.4 |

|

$9.3 |

|

54.7% |

|

$51.7 |

|

$33.2 |

|

55.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$61.1 |

|

$42.6 |

|

43.4% |

|

$210.1 |

|

$143.5 |

|

46.4% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

In August 2016, the Food and Drug Administration (FDA) granted

tentative approval to the Company's Supplemental New Drug

Application requesting a label expansion for Trokendi XR to include

prophylaxis of migraine headache in adults. The Company plans to

launch the migraine indication soon after receiving full FDA

approval, which the Company anticipates in the second quarter of

2017.

“2016 was another year of strong commercial performance with

full year net product sales growth of 46% and an increase in

operating income of 160% over full year 2015,” said Jack Khattar,

President and CEO of Supernus Pharmaceuticals. “This growth was

achieved while we continued to advance our pipeline and prepare for

the launch of the migraine indication for Trokendi XR.”

Khattar added, “In addition, we continued to vigorously defend

our novel products and build upon our strong intellectual property

position, as evidenced by the favorable court rulings on Oxtellar

XR and the issuance of four U.S. patents for Trokendi XR and

Oxtellar XR over the past 12 months. We have established a solid

foundation for sustainable growth, and we expect 2017 to be another

year of strong net product sales and operating income growth.”

Progress of Product Pipeline

Enrollment continues in both Phase III trials for SPN-810, which

is currently in development for Impulsive Aggression in patients

aged 6 to 12 years who have ADHD. Steps taken in the second half of

2016 to facilitate identifying, contacting, and prescreening

appropriate patients, as well as educating patient caregivers, have

increased patient enrollment. In addition, the Company has received

FDA approval for revisions to the Phase III protocol, which are

expected to improve patient retention during the screening period

and in turn improve patient enrollment. Enrollment is expected to

continue through 2017.

Regarding SPN-812, currently in development for patients aged 6

to 12 years with ADHD, the Company announced in October 2016

positive topline results from its Phase IIb clinical trial in

children with ADHD. Supernus plans to have an end-of-Phase II

meeting with the FDA, most likely in the second quarter of 2017,

after which it will initiate Phase III clinical testing during the

second half of 2017.

“We continued to advance our two late-stage clinical products in

2016, including achieving positive results from our Phase IIb

clinical trial for SPN-812 and increasing enrollment during the

second half of 2016 in the Phase III clinical trials for SPN-810,”

said Jack Khattar. “We are also excited about our plan that is

underway to initiate in 2017 an exploratory trial investigating

Oxtellar XR in patients with bipolar disorder. This would be

another step towards realizing the full potential of Oxtellar XR in

the treatment of patients with psychiatric and neurological

disorders.”

Collaboration Update

Shire announced that SHP-465 for the treatment of ADHD is

expected to be launched in the second half of 2017 after SHP-465

receives FDA approval, which is expected on or around June 20,

2017. Based on the agreement between Supernus and Shire, Shire will

pay to Supernus a single-digit percentage royalty on net sales of

the product.

Operating Expenses

Research and development expenses in the fourth quarter of 2016

were $13.3 million, as compared to $9.4 million in the same quarter

last year, and, for the full year, $42.8 million, as compared to

$29.1 million for 2015. The increases in both periods are primarily

due to increased costs associated with the Phase III trials for

SPN-810, which were initiated during the third quarter of 2015;

increased costs associated with the Phase IIb trial for SPN-812,

which was initiated during the fourth quarter of 2015; and the

open-label extension studies associated with both product

candidates.

Selling, general and administrative expenses in the fourth

quarter of 2016 were $29.1 million, as compared to $23.6 million in

the same quarter last year, and, for the full year, $106.0 million

as compared to $89.1 million in 2015. The increases in both periods

are primarily due to work done in anticipation of launching the

migraine headache indication for Trokendi XR, including marketing

program development and sample production.

Operating Income, Cash Flows From Operations, and

Earnings Per Share

Operating income in the fourth quarter of 2016 was $16.3

million, a 106.8% increase over $7.9 million in the same period the

prior year. Operating income in full year 2016 was $54.2 million, a

160.1% increase over $20.8 million for full year 2015. This

improvement in operating income for both periods is primarily due

to increased net product sales.

Diluted earnings per share for the fourth quarter of 2016 were

$0.26 compared to $0.14 in the same period last year. Diluted

earnings per share were $1.76 in 2016, compared to diluted earnings

per share of $0.28 in 2015. Diluted earnings per share in 2016 were

favorably impacted by the release of the valuation allowance

against deferred tax assets, which resulted in a full year 2016

income tax benefit of $40.9 million.

Weighted-average diluted common shares outstanding were

approximately 52.0 million and 51.7 million in the fourth quarter

and full year of 2016, respectively, as compared to approximately

51.2 million in each of the respective periods the prior year.

Cash generated from operations for full year 2016 was $66.8

million, as compared to $34.5 million for full year 2015.

Capital Resources

As of December 31, 2016, the Company had $165.5 million in cash,

cash equivalents, marketable securities, and long term marketable

securities, as compared to $117.2 million at December 31, 2015.

As of February 28, 2017, approximately $3.6 million of the

Company’s six year, $90 million notes remain outstanding.

Financial Guidance

For full year 2017, the Company estimates net product sales,

R&D expenses and operating income as set forth below:

- Net product sales in the range of $265 million to $275

million.

- Research and development expense of approximately $55

million.

- Operating income in the range of $75 million to $80 million.

This includes approximately $5 million of non-cash royalty

revenue.

Annual Report on Form 10-K Filing Update

In fiscal year 2016, the Company became a large accelerated

filer pursuant to the Securities Exchange Act of 1934.

Consequently, the Company has a shortened filing deadline of 60

days rather than 75 days, and is unable to timely file its Annual

Report on Form 10-K for the fourth quarter and full year ended

December 31, 2016. Accordingly, the Company will timely file

a Notification of Late Filing on Form 12b-25. The Company’s delay

in filing the Form 10-K is due principally to the need to complete

all steps and tasks necessary to finalize the Company’s annual

financial statements and other disclosures required to be in the

filing, including, for the first time, the requirements as a

consequence of becoming subject to Section 404(b) of the

Sarbanes-Oxley Act of 2002.

Conference Call Details

The Company will hold a conference call hosted by Jack Khattar,

President and Chief Executive Officer, and Greg Patrick, Vice

President and Chief Financial Officer, to discuss these results at

9:00 a.m. ET, on Wednesday, March 1, 2017. An accompanying webcast

also will be provided.

Please refer to the information below for conference call

dial-in information and webcast registration. Callers should dial

in approximately 10 minutes prior to the start of the call.

Conference dial-in: (877) 288-1043

International dial-in: (970) 315-0267

Conference ID: 70744734

Conference Call Name: Supernus Pharmaceuticals Fourth

Quarter and Full Year 2016 Earnings Conference Call

Following the live call, a replay will be available on the

Company's website, www.supernus.com, under ‘Investors’.

About Supernus Pharmaceuticals, Inc.

Supernus Pharmaceuticals, Inc. is a specialty pharmaceutical

company focused on developing and commercializing products for the

treatment of central nervous system diseases. The Company has two

marketed products for epilepsy, Oxtellar XR® (extended-release

oxcarbazepine) and Trokendi XR® (extended-release topiramate). The

Company is also developing several product candidates to address

large market opportunities in psychiatry, including SPN-810 for the

treatment of Impulsive Aggression in ADHD patients and SPN-812 for

the treatment of ADHD.

Forward-Looking Statements:

This press release includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements do not convey historical information, but

relate to predicted or potential future events that are based upon

management's current expectations. These statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. In

addition to the factors mentioned in this press release, such risks

and uncertainties include, but are not limited to, the Company’s

ability to sustain and increase its profitability; the Company’s

ability to raise sufficient capital to fully implement its

corporate strategy; the implementation of the Company’s corporate

strategy; the Company’s future financial performance and projected

expenditures; the Company’s ability to increase the number of

prescriptions written for each of its products; the Company’s

ability to increase its net revenue; the Company’s ability to enter

into future collaborations with pharmaceutical companies and

academic institutions or to obtain funding from government

agencies; the Company’s product research and development

activities, including the timing and progress of the Company’s

clinical trials, and projected expenditures; the Company’s ability

to receive, and the timing of any receipt of, regulatory approvals

to develop and commercialize the Company’s product candidates; the

Company’s ability to protect its intellectual property and operate

its business without infringing upon the intellectual property

rights of others; the Company’s expectations regarding federal,

state and foreign regulatory requirements; the therapeutic

benefits, effectiveness and safety of the Company’s product

candidates; the accuracy of the Company’s estimates of the size and

characteristics of the markets that may be addressed by its product

candidates; the Company’s ability to increase its manufacturing

capabilities for its products and product candidates; the Company’s

projected markets and growth in markets; the Company’s product

formulations and patient needs and potential funding sources; the

Company’s staffing needs; and other risk factors set forth from

time to time in the Company’s SEC filings made pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934, as amended. The

Company undertakes no obligation to update the information in this

press release to reflect events or circumstances after the date

hereof or to reflect the occurrence of anticipated or unanticipated

events.

| Supernus Pharmaceuticals, Inc. |

| Consolidated Balance Sheets |

| (in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2016 |

|

December 31, 2015 |

| |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents

and marketable securities |

|

$ |

90,121 |

|

$ |

62,190 |

| Accounts receivable,

net |

|

|

41,527 |

|

|

25,908 |

| Inventories, net |

|

|

16,801 |

|

|

12,587 |

| Prepaid expenses and

other current assets |

|

|

2,955 |

|

|

5,261 |

| Total

current assets |

|

|

151,404 |

|

|

105,946 |

|

|

|

|

|

|

|

|

| Long term marketable

securities |

|

|

75,410 |

|

|

55,009 |

| Property and equipment,

net |

|

|

4,344 |

|

|

3,874 |

| Deferred legal

fees |

|

|

19,860 |

|

|

22,503 |

| Intangible assets,

net |

|

|

16,490 |

|

|

976 |

| Other non-current

assets |

|

|

331 |

|

|

318 |

| Deferred income

tax |

|

|

41,729 |

|

|

— |

| |

|

|

|

|

|

|

| Total assets |

|

$ |

309,568 |

|

$ |

188,626 |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

8,055 |

|

$ |

4,314 |

| Accrued sales

deductions |

|

|

41,943 |

|

|

26,794 |

| Accrued expenses |

|

|

27,434 |

|

|

25,153 |

| Non-recourse liability

related to sale of future royalties, current portion |

|

|

3,101 |

|

|

497 |

| Deferred licensing

revenue |

|

|

209 |

|

|

176 |

| Total

current liabilities |

|

|

80,742 |

|

|

56,934 |

|

|

|

|

|

|

|

|

| Deferred licensing

revenue, net of current portion |

|

|

1,501 |

|

|

1,390 |

| Convertible notes,

net |

|

|

4,165 |

|

|

7,085 |

| Non-recourse liability

related to sale of future royalties, long term |

|

|

27,289 |

|

|

30,031 |

| Other non-current

liabilities |

|

|

4,002 |

|

|

4,325 |

| Derivative

liabilities |

|

|

114 |

|

|

854 |

| Total liabilities |

|

|

117,813 |

|

|

100,619 |

| |

|

|

|

|

|

|

| Total stockholders'

equity |

|

|

191,755 |

|

|

88,007 |

| |

|

|

|

|

|

|

| Total liabilities and

stockholders' equity |

|

$ |

309,568 |

|

$ |

188,626 |

| |

|

|

|

|

|

|

| Supernus Pharmaceuticals, Inc. |

| Consolidated Statements of Operations |

| (in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

product sales |

|

$ |

61,100 |

|

|

$ |

42,612 |

|

|

$ |

210,078 |

|

|

$ |

143,526 |

|

| Royalty

revenue |

|

|

1,222 |

|

|

|

1,031 |

|

|

|

4,686 |

|

|

|

3,038 |

|

| Licensing

revenue |

|

|

52 |

|

|

|

44 |

|

|

|

239 |

|

|

|

901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenue |

|

|

62,374 |

|

|

|

43,687 |

|

|

|

215,003 |

|

|

|

147,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

product sales |

|

|

3,771 |

|

|

|

2,795 |

|

|

|

11,986 |

|

|

|

8,423 |

|

| Research

and development |

|

|

13,252 |

|

|

|

9,445 |

|

|

|

42,791 |

|

|

|

29,135 |

|

| Selling,

general and administrative |

|

|

29,055 |

|

|

|

23,566 |

|

|

|

106,010 |

|

|

|

89,063 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and

expenses |

|

|

46,078 |

|

|

|

35,806 |

|

|

|

160,787 |

|

|

|

126,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

16,296 |

|

|

|

7,881 |

|

|

|

54,216 |

|

|

|

20,844 |

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

409 |

|

|

|

224 |

|

|

|

1,482 |

|

|

|

643 |

|

| Interest

expense |

|

|

33 |

|

|

|

(225 |

) |

|

|

(543 |

) |

|

|

(1,229 |

) |

| Interest

expense-nonrecourse |

|

|

|

|

|

|

|

|

|

|

|

|

| liability

related to sale of future royalties |

|

|

(984 |

) |

|

|

(1,011 |

) |

|

|

(4,548 |

) |

|

|

(3,541 |

) |

| Changes

in fair value of derivative liabilities |

|

|

100 |

|

|

|

127 |

|

|

|

448 |

|

|

|

193 |

|

| Loss on

extinguishment of debt |

|

|

(289 |

) |

|

|

62 |

|

|

|

(671 |

) |

|

|

(2,338 |

) |

| Other

(expense) income |

|

|

(13 |

) |

|

|

8 |

|

|

|

(15 |

) |

|

|

38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total other

expense |

|

|

(744 |

) |

|

|

(815 |

) |

|

|

(3,847 |

) |

|

|

(6,234 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income

taxes |

|

|

15,552 |

|

|

|

7,066 |

|

|

|

50,369 |

|

|

|

14,610 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income

tax expense (benefit) |

|

|

1,232 |

|

|

|

213 |

|

|

|

(40,852 |

) |

|

|

666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

14,320 |

|

|

$ |

6,853 |

|

|

$ |

91,221 |

|

|

$ |

13,944 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

|

$ |

0.14 |

|

|

$ |

1.84 |

|

|

$ |

0.29 |

|

|

Diluted |

|

$ |

0.26 |

|

|

$ |

0.14 |

|

|

$ |

1.76 |

|

|

$ |

0.28 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

49,702,207 |

|

|

|

48,891,847 |

|

|

|

49,472,434 |

|

|

|

47,485,258 |

|

|

Diluted |

|

|

52,020,596 |

|

|

|

49,598,030 |

|

|

|

51,708,983 |

|

|

|

51,160,380 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

CONTACTS:

Jack A. Khattar, President and CEO

Gregory S. Patrick, Vice President and CFO

Supernus Pharmaceuticals, Inc.

Tel: (301) 838-2591

or

INVESTOR CONTACT:

Peter Vozzo

Westwicke Partners

Office: (443) 213-0505

Mobile: (443) 377-4767

Email: peter.vozzo@westwicke.com

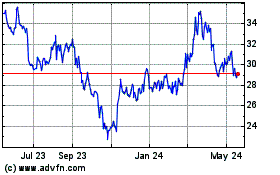

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

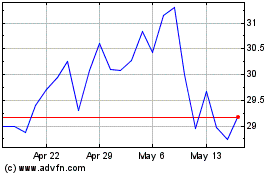

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Apr 2023 to Apr 2024