UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 7, 2014

SPECTRUM PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35006 |

|

93-0979187 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

11500 S. Eastern Ave., Ste. 240, Henderson, NV 89052

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (702) 835-6300

Not Applicable

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 7, 2014, Spectrum

Pharmaceuticals, Inc. issued a press release, which, among other matters, sets forth our results of operations for the quarter ended June 30, 2014. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by

reference.

The foregoing information, including Exhibit 99.1, is being furnished under Item 2.02 and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated August 7, 2014. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: August 7, 2014 |

|

|

|

SPECTRUM PHARMACEUTICALS, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Kurt A. Gustafson |

|

|

|

|

|

|

Kurt A. Gustafson |

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer |

3

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated August 7, 2014. |

4

Exhibit 99.1

COMPANY CONTACTS

Shiv

Kapoor

Vice President, Strategic Planning & Investor Relations

702-835-6300

InvestorRelations@sppirx.com

Spectrum Pharmaceuticals Reports 45% Sales Growth in the Second Quarter,

Launches Fifth Product and Moves Closer to a Decision on a Potential Blockbuster

| |

• |

|

Total product sales for the three months ended June 30, 2014 were $46.9 million, compared to $32.2 million in the same period last year, an increase of 45%. |

| |

• |

|

Sequential quarter sales were up 17%, driven primarily by end-user product demand. |

| |

• |

|

Non-GAAP diluted EPS was $0.09, and GAAP EPS was ($0.06). |

| |

• |

|

Spectrum’s fifth drug, BeleodaqTM (belinostat) for Injection was approved and launched in July. |

| |

• |

|

Captisol-EnabledTM melphalan met its primary endpoint; the company had a meeting with the FDA and is making good progress on preparing the NDA submission.

|

| |

• |

|

Spectrum is advancing toward a Phase 3 Go/No-Go decision and expects to meet with the FDA this year for its novel long-acting GCSF drug, SPI-2012. |

HENDERSON, Nevada – August 7, 2014 – Spectrum Pharmaceuticals, Inc. (NasdaqGS: SPPI), a biotechnology company with fully integrated

commercial and drug development operations with a primary focus in hematology and oncology, announced today financial results for the three-month period ended June 30, 2014.

“The first half of the year has delivered significant growth and we are excited about the Company’s sales trajectory,” said Rajesh C.

Shrotriya, MD, Chairman and Chief Executive Officer of Spectrum Pharmaceuticals. “With the approval and launch of our fifth drug, Beleodaq, we are now a leader in lymphoma treatment. More and more cancer patients are being treated with Spectrum

products which brings us closer to our mission. I am equally excited about the second half of the year when we expect to achieve significant additional milestones. We are moving forward with our CE Melphalan NDA file after a productive meeting with

the FDA. In addition, we expect to make a Phase 3 Go/No-Go decision by the end of the year for SPI-2012, a novel long-acting GCSF drug which could be a potential blockbuster. It is an exciting time for Spectrum; we believe we are in a prime position

to continue the growth and diversification of the company.”

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

Three-Month Period Ended June 30, 2014 (All numbers are approximate)

GAAP Results

Product sales and total revenues were

$46.9 million in the second quarter of 2014. Total revenue increased 41% from $33.2 million in the second quarter of 2013, while product sales increased 45% from $32.2 million in the second quarter of 2013.

Product sales in second quarter included: FUSILEV® (levoleucovorin) net sales of $26.6 million,

FOLOTYN® (pralatrexate injection) net sales of $12.6 million, ZEVALIN® (ibritumomab tiuxetan) net sales of $6.3 million and MARQIBO® (vinCRIStine sulfate LIPOSOME injection) net sales of $1.4 million.

Spectrum recorded net loss of

$3.6 million, or ($0.06) per basic and diluted share in the three-month period ended June 30, 2014, compared to net loss of $9.7 million, or ($0.16) per basic and diluted share in the comparable period in 2013. Total research and development

expenses were $11.3 million in the quarter, as compared to $10.5 million in the same period in 2013. Selling, general and administrative expenses were $25.4 million in the quarter, compared to $22.6 million in the same period in 2013.

Non-GAAP Results

Spectrum recorded non-GAAP net

income of $6.8 million, or $0.11 per basic and $0.09 per diluted share in the three-month period ended June 30, 2014, compared to a non-GAAP net loss of $5.3 million, or ($0.09) per basic and diluted share in the comparable period in 2013.

Non-GAAP research and development expenses were $10.8 million, as compared to $12.4 million in the same period of 2013. Non-GAAP selling, general and administrative expenses were $21.8 million, as compared to $18.7 million in the same period in

2013.

Conference Call

Thursday,

August 7, 2014 @ 4:30 p.m. Eastern/1:30 p.m. Pacific

|

|

|

| Domestic: |

|

(877) 837-3910, Conference ID# 73878916 |

|

|

| International: |

|

(973) 796-5077, Conference ID# 73878916 |

This conference call will also be webcast. Listeners may access the webcast, which will be available on the investor relations

page of Spectrum Pharmaceutical’s website: www.sppirx.com on August 7, 2014 at 4:30 p.m. Eastern/1:30 p.m. Pacific.

On the conference call, management will review the financial results, provide an update on the Company’s business and discuss expectations for the

future.

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

About Spectrum Pharmaceuticals, Inc.

Spectrum Pharmaceuticals is a leading biotechnology company focused on acquiring, developing, and commercializing drug products, with a primary focus in

oncology and hematology. Spectrum and its affiliates market five oncology drugs— FUSILEV® (levoleucovorin) for Injection in the U.S.;

FOLOTYN® (pralatrexate injection), also marketed in the U.S.; ZEVALIN® (ibritumomab tiuxetan) Injection for intravenous use, for which

the Company has worldwide marketing rights; MARQIBO® (vinCRIStine sulfate LIPOSOME injection) for intravenous infusion, for which the Company has worldwide marketing rights and

BELEODAQ™ (belinostat) for Injection in the U.S. Spectrum’s strong track record in in-licensing and acquiring differentiated drugs, and expertise in clinical development have generated a robust, diversified, and growing pipeline of

product candidates in advanced-stage Phase 2 and Phase 3 studies. More information on Spectrum is available at www.sppirx.com.

About

BELEODAQTM

Beleodaq is a histone deacetylase (HDAC) inhibitor. HDACs catalyze the removal

of acetyl groups from the lysine residues of histones and some non-histone proteins. In vitro, belinostat caused the accumulation of acetylated histones and other proteins, inducing cell cycle arrest and/or apoptosis of some transformed

cells. Belinostat shows preferential cytotoxicity towards tumor cells compared to normal cells. Belinostat inhibited the enzymatic activity of histone deacetylases at nanomolar concentrations (<250 nM).

Please see Beleodaq Full Prescribing Information at www.beleodaq.com.

Indications and Usage

Beleodaq is a histone deacetylase

inhibitor indicated for the treatment of patients with relapsed or refractory peripheral T-cell lymphoma (PTCL). This indication is approved under accelerated approval based on tumor response rate and duration of response. An improvement in survival

or disease-related symptoms has not been established. Continued approval for this indication may be contingent upon verification and description of clinical benefit in the confirmatory trial.

Important Beleodaq Safety Information

Warnings and Precautions

| |

• |

|

Beleodaq can cause thrombocytopenia, leukopenia (neutropenia and lymphopenia), and/or anemia; monitor blood counts weekly during treatment, and modify dosage as necessary. |

| |

• |

|

Serious and sometimes fatal infections, including pneumonia and sepsis, have occurred with Beleodaq. Do not administer Beleodaq to patients with an active infection. Patients with a history of extensive or intensive

chemotherapy may be at higher risk of life threatening infections. |

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

| |

• |

|

Beleodaq can cause fatal hepatotoxicity and liver function test abnormalities. Monitor liver function tests before treatment and before the start of each cycle. Interrupt or adjust dosage until recovery, or permanently

discontinue Beleodaq based on the severity of the hepatic toxicity. |

| |

• |

|

Tumor lysis syndrome has occurred in Beleodaq-treated patients in the clinical trial of patients with relapsed or refractory PTCL. Monitor patients with advanced stage disease and/or high tumor burden and take

appropriate precautions. |

| |

• |

|

Nausea, vomiting and diarrhea occur with Beleodaq and may require the use of antiemetic and antidiarrheal medications. |

| |

• |

|

Beleodaq can cause fetal harm when administered to a pregnant woman. Women of childbearing potential should be advised to avoid pregnancy while receiving Beleodaq. If this drug is used during pregnancy, or if the

patient becomes pregnant while taking this drug, the patient should be apprised of potential hazard to the fetus. |

Adverse Reactions

| |

• |

|

The most common adverse reactions observed in the trial in patients with relapsed or refractory PTCL treated with Beleodaq were nausea (42%), fatigue (37%), pyrexia (35%), anemia (32%), and vomiting (29%).

|

| |

• |

|

Sixty-one patients (47.3%) experienced serious adverse reactions while taking Beleodaq or within 30 days after their last dose of Beleodaq. |

Drug Interactions

| |

• |

|

Beleodaq is primarily metabolized by UGT1A1. Avoid concomitant administration of Beleodaq with strong inhibitors of UGT1A1. |

Use in Specific Populations

| |

• |

|

It is not known whether Beleodaq is excreted in human milk. Because of the potential for serious adverse reactions in nursing infants from Beleodaq, a decision should be made whether to discontinue nursing or

discontinue drug, taking into account the importance of the drug to the mother. |

About Captisol-Enabled Melphalan

Captisol-enabled, PG-free melphalan is a novel intravenous formulation of melphalan being investigated for the multiple myeloma transplant setting, for which

it has been granted an Orphan Drug Designation by the FDA. This formulation eliminates the use of propylene glycol, which has been reported to cause renal and cardiac side effects that limit the ability to deliver higher doses of therapeutic

compounds. The use of the Captisol® technology to reformulate melphalan also improves its stability and is anticipated to allow for slower infusion rates and longer administration durations,

potentially enabling clinicians to safely achieve a higher dose intensity for pre-transplant chemotherapy.

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

About Captisol®

Captisol is a patent-protected, chemically modified cyclodextrin with a structure designed to optimize the solubility and stability of drugs. Captisol was

invented and initially developed by scientists in the laboratories of Dr. Valentino Stella at the University of Kansas’ Higuchi Biosciences Center for specific use in drug development and formulation. This unique technology has enabled

seven FDA-approved products, including Onyx Pharmaceuticals’ Kyprolis®, Baxter International’s Nexterone® and Merck’s

NOXAFIL IV. There are also more than 30 Captisol-enabled products currently in clinical development.

Forward-looking statement — This press

release may contain forward-looking statements regarding future events and the future performance of Spectrum Pharmaceuticals that involve risks and uncertainties that could cause actual results to differ materially. These statements are based on

management’s current beliefs and expectations. These statements include, but are not limited to, statements that relate to our business and its future, including sales of Spectrum’s drug products, certain company milestones,

Spectrum’s ability to identify, acquire, develop and commercialize a broad and diverse pipeline of late-stage clinical and commercial products, leveraging the expertise of partners and employees around the world to assist us in the execution of

our strategy, and any statements that relate to the intent, belief, plans or expectations of Spectrum or its management, or that are not a statement of historical fact. Risks that could cause actual results to differ include the possibility that our

existing and new drug candidates may not prove safe or effective, the possibility that our existing and new applications to the FDA and other regulatory agencies may not receive approval in a timely manner or at all, the possibility that our

existing and new drug candidates, if approved, may not be more effective, safer or more cost efficient than competing drugs, the possibility that our efforts to acquire or in-license and develop additional drug candidates may fail, our lack of

sustained revenue history, our limited marketing experience, our customer concentration, the possibility for fluctuations in customer orders, evolving market dynamics, our dependence on third parties for clinical trials, manufacturing, distribution,

information and quality control and other risks that are described in further detail in the Company’s reports filed with the Securities and Exchange Commission. We do not plan to update any such forward-looking statements and expressly disclaim

any duty to update the information contained in this press release except as required by law.

SPECTRUM PHARMACEUTICALS, INC.®, FUSILEV®, FOLOTYN®,

ZEVALIN®, and MARQIBO® are registered trademarks of Spectrum Pharmaceuticals, Inc and its affiliates. BELEODAQ™, REDEFINING CANCER

CARE™ and the Spectrum Pharmaceuticals logos are trademarks owned by Spectrum Pharmaceuticals, Inc. Any other trademarks are the property of their respective owners.

© 2014 Spectrum Pharmaceuticals, Inc. All Rights Reserved.

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

SPECTRUM PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product sales, net |

|

$ |

46,855 |

|

|

$ |

32,213 |

|

|

$ |

86,951 |

|

|

$ |

61,559 |

|

| License fees and service revenue |

|

|

— |

|

|

|

1,019 |

|

|

|

28 |

|

|

|

10,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

46,855 |

|

|

$ |

33,232 |

|

|

$ |

86,979 |

|

|

$ |

71,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of product sales (excludes amortization and impairment of intangible assets) |

|

|

6,156 |

|

|

|

7,268 |

|

|

|

12,434 |

|

|

|

14,050 |

|

| Selling, general and administrative |

|

|

25,399 |

|

|

|

22,584 |

|

|

|

48,802 |

|

|

|

44,598 |

|

| Research and development |

|

|

11,335 |

|

|

|

10,460 |

|

|

|

40,832 |

|

|

|

22,343 |

|

| Amortization and impairment of intangible assets |

|

|

5,361 |

|

|

|

5,449 |

|

|

|

10,721 |

|

|

|

9,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

48,251 |

|

|

|

45,761 |

|

|

|

112,789 |

|

|

|

90,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(1,396 |

) |

|

|

(12,529 |

) |

|

|

(25,810 |

) |

|

|

(18,986 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(1,976 |

) |

|

|

(397 |

) |

|

|

(4,043 |

) |

|

|

(818 |

) |

| Change in fair value of contingent consideration related to acquisitions |

|

|

(1,005 |

) |

|

|

— |

|

|

|

(1,729 |

) |

|

|

— |

|

| Other expense |

|

|

(487 |

) |

|

|

234 |

|

|

|

(845 |

) |

|

|

(663 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other expense |

|

|

(3,468 |

) |

|

|

(163 |

) |

|

|

(6,617 |

) |

|

|

(1,481 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

|

(4,864 |

) |

|

|

(12,692 |

) |

|

|

(32,427 |

) |

|

|

(20,467 |

) |

| Benefit (provision) for income taxes |

|

|

1,301 |

|

|

|

2,971 |

|

|

|

1,223 |

|

|

|

5,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,563 |

) |

|

$ |

(9,721 |

) |

|

$ |

(31,204 |

) |

|

$ |

(15,157 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.26 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

64,609,197 |

|

|

|

58,977,295 |

|

|

|

64,119,441 |

|

|

|

58,995,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

SPECTRUM PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and par value amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2014 |

|

|

December 31,

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

132,405 |

|

|

$ |

156,306 |

|

| Marketable securities |

|

|

3,306 |

|

|

|

3,471 |

|

| Accounts receivable, net of allowance for doubtful accounts of $177 and $206, respectively |

|

|

56,742 |

|

|

|

49,483 |

|

| Other receivables |

|

|

11,802 |

|

|

|

7,539 |

|

| Inventories |

|

|

10,881 |

|

|

|

13,519 |

|

| Prepaid expenses and other current assets |

|

|

3,410 |

|

|

|

3,213 |

|

| Deferred tax assets |

|

|

1,587 |

|

|

|

1,659 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

220,133 |

|

|

|

235,190 |

|

| Property and equipment, net of accumulated depreciation |

|

|

1,407 |

|

|

|

1,535 |

|

| Intangible assets, net of accumulated amortization |

|

|

219,735 |

|

|

|

231,352 |

|

| Goodwill |

|

|

18,476 |

|

|

|

18,501 |

|

| Other assets |

|

|

15,197 |

|

|

|

12,577 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

474,948 |

|

|

$ |

499,155 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and other accrued liabilities |

|

$ |

69,178 |

|

|

$ |

79,837 |

|

| Accrued payroll and benefits |

|

|

5,149 |

|

|

|

6,872 |

|

| Deferred revenue |

|

|

33 |

|

|

|

156 |

|

| Drug development liability |

|

|

3,119 |

|

|

|

3,119 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

77,479 |

|

|

|

89,984 |

|

| Drug development liability, less current portion |

|

|

14,069 |

|

|

|

14,623 |

|

| Acquisition-related contingent obligations |

|

|

10,058 |

|

|

|

8,329 |

|

| Deferred tax liability |

|

|

8,167 |

|

|

|

7,168 |

|

| Other long-term liabilities |

|

|

5,709 |

|

|

|

5,965 |

|

| Convertible senior notes |

|

|

93,812 |

|

|

|

91,480 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

209,294 |

|

|

|

217,549 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $0.001 par value; 5,000,000 shares authorized: |

|

|

|

|

|

|

|

|

| Series B junior participating preferred stock, $0.001 par value; 1,500,000 shares authorized; no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

| Series E Convertible Voting Preferred Stock, $0.001 par value and $10,000 stated value; 2,000 shares authorized; 20

shares issued and outstanding at June 30, 2014 and December 31, 2013, respectively (convertible into 40,000 shares of common stock, with aggregate liquidation value of $240) |

|

|

123 |

|

|

|

123 |

|

| Common stock, $0.001 par value; 175,000,000 shares authorized; 65,730,897 and 64,104,173 shares issued and outstanding at

June 30, 2014 and December 31, 2013, respectively |

|

|

66 |

|

|

|

64 |

|

| Additional paid-in capital |

|

|

532,554 |

|

|

|

518,144 |

|

| Accumulated other comprehensive income |

|

|

1,734 |

|

|

|

894 |

|

| Accumulated deficit |

|

|

(268,823 |

) |

|

|

(237,619 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

265,654 |

|

|

|

281,606 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

474,948 |

|

|

$ |

499,155 |

|

|

|

|

|

|

|

|

|

|

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

Non-GAAP Financial Measures

In this press release, Spectrum reports certain historical and expected non-GAAP results. Non-GAAP financial measures are reconciled to the most directly

comparable GAAP financial measure in the tables of this press release and the accompanying footnotes. The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with generally

accepted accounting principles (GAAP). The non-GAAP financial measures presented exclude the items summarized in the below table. Management believes that adjustments for these items assist investors in making comparisons of period-to-period

operating results and that these items are not indicative of the Company’s on-going core operating performance.

Management uses non-GAAP net income

(loss) in its evaluation of the Company’s core after-tax results of operations and trends between fiscal periods and believes that these measures are important components of its internal performance measurement process. Management believes that

providing these non-GAAP financial measures allows investors to view the Company’s financial results in the way that management views the financial results.

The non-GAAP financial measures presented herein have certain limitations in that they do not reflect all of the costs associated with the operations of the

Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance

with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies.

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

SPECTURM PHARMACEUTICALS, INC.

Condensed Consolidated Statements of Operations and Reconciliation of Non-GAAP Adjustments

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| GAAP product sales & license and contract revenue |

|

$ |

46,855 |

|

|

$ |

33,232 |

|

|

$ |

86,979 |

|

|

$ |

71,899 |

|

| Non GAAP adjustments to product sales & license and contract revenue: |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,225 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to product sales & license and contract revenues |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,225 |

) |

| Non-GAAP product sales & license and contract revenue |

|

|

46,855 |

|

|

|

33,232 |

|

|

|

86,979 |

|

|

|

65,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP cost of product sales |

|

|

6,156 |

|

|

|

7,268 |

|

|

|

12,434 |

|

|

|

14,050 |

|

| Non-GAAP adjustments to cost of product sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP cost of product sales |

|

|

6,156 |

|

|

|

7,268 |

|

|

|

12,434 |

|

|

|

14,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP selling, general and administrative expenses |

|

|

25,399 |

|

|

|

22,584 |

|

|

|

48,802 |

|

|

|

44,598 |

|

| Non GAAP adjustments to SG&A: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

(2,163 |

) |

|

|

(2,439 |

) |

|

|

(4,570 |

) |

|

|

(4,512 |

) |

| Shareholder lawsuit |

|

|

(884 |

) |

|

|

(242 |

) |

|

|

(1,263 |

) |

|

|

(578 |

) |

| Talon acquisition legal & professional fees |

|

|

— |

|

|

|

(686 |

) |

|

|

— |

|

|

|

(686 |

) |

| Depreciation expense |

|

|

(572 |

) |

|

|

(481 |

) |

|

|

(817 |

) |

|

|

(815 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to SG&A |

|

|

(3,619 |

) |

|

|

(3,848 |

) |

|

|

(6,650 |

) |

|

|

(6,591 |

) |

| Non-GAAP selling, general and administrative |

|

|

21,780 |

|

|

|

18,736 |

|

|

|

42,152 |

|

|

|

38,007 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP research and development |

|

|

11,335 |

|

|

|

10,460 |

|

|

|

40,832 |

|

|

|

22,343 |

|

| Non-GAAP adjustments to R&D: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

(511 |

) |

|

|

(485 |

) |

|

|

(955 |

) |

|

|

(1,159 |

) |

| Depreciation expense |

|

|

(11 |

) |

|

|

(19 |

) |

|

|

(49 |

) |

|

|

(49 |

) |

| TopoTarget milestone payment & stock issuance |

|

|

— |

|

|

|

— |

|

|

|

(17,790 |

) |

|

|

|

|

| Amendment of Mundipharma agreement resulting in write off of deferred payment contingency |

|

|

— |

|

|

|

2,431 |

|

|

|

— |

|

|

|

2,431 |

|

| Non-recurring payment related to co-development agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,100 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to R&D |

|

|

(522 |

) |

|

|

1,927 |

|

|

|

(18,794 |

) |

|

|

123 |

|

| Non-GAAP research and development |

|

|

10,813 |

|

|

|

12,387 |

|

|

|

22,038 |

|

|

|

22,466 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP amortization of purchased intangibles |

|

|

5,361 |

|

|

|

5,449 |

|

|

|

10,721 |

|

|

|

9,894 |

|

| Non-GAAP adjustments to purchased intangibles: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

|

(5,361 |

) |

|

|

(5,449 |

) |

|

|

(10,721 |

) |

|

|

(9,894 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to amortization of purchased intangibles |

|

|

(5,361 |

) |

|

|

(5,449 |

) |

|

|

(10,721 |

) |

|

|

(9,894 |

) |

| Non-GAAP amortization of purchased intangibles |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP income from operations |

|

|

(1,396 |

) |

|

|

(12,529 |

) |

|

|

(25,810 |

) |

|

|

(18,986 |

) |

| Non-GAAP adjustments to income from operations |

|

|

9,502 |

|

|

|

7,370 |

|

|

|

36,165 |

|

|

|

10,137 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP income from operations |

|

|

8,106 |

|

|

|

(5,159 |

) |

|

|

10,355 |

|

|

|

(8,849 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP other expense, net |

|

|

(3,468 |

) |

|

|

(163 |

) |

|

|

(6,617 |

) |

|

|

(1,481 |

) |

| Non-GAAP adjustments to other expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Market-to-market of contingent consideration |

|

|

1,005 |

|

|

|

— |

|

|

|

1,729 |

|

|

|

— |

|

| Accretion of discount on 2018 Convertible Notes |

|

|

1,185 |

|

|

|

— |

|

|

|

2,332 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjustments to other expense, net |

|

|

2,190 |

|

|

|

— |

|

|

|

4,061 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP other expense, net |

|

|

(1,278 |

) |

|

|

(163 |

) |

|

|

(2,556 |

) |

|

|

(1,481 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP (provision)/benefit for income taxes |

|

|

1,301 |

|

|

|

2,971 |

|

|

|

1,223 |

|

|

|

5,310 |

|

| Adjustment to (provision)/benefit for income taxes |

|

|

(1,301 |

) |

|

|

(2,971 |

) |

|

|

(1,223 |

) |

|

|

(5,310 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net loss |

|

|

(3,563 |

) |

|

|

(9,721 |

) |

|

|

(31,204 |

) |

|

|

(15,157 |

) |

| Non-GAAP adjustments |

|

|

10,391 |

|

|

|

4,399 |

|

|

|

39,003 |

|

|

|

4,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

|

6,828 |

|

|

|

(5,322 |

) |

|

|

7,799 |

|

|

|

(10,330 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.11 |

|

|

$ |

(0.09 |

) |

|

$ |

0.12 |

|

|

$ |

(0.18 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.09 |

|

|

$ |

(0.09 |

) |

|

$ |

0.10 |

|

|

$ |

(0.18 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

64,609,197 |

|

|

|

58,977,295 |

|

|

|

64,119,441 |

|

|

|

58,995,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

79,260,064 |

|

|

|

58,977,295 |

|

|

|

79,012,587 |

|

|

|

58,995,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11500 S. Eastern Ave.,

Ste. 240 Ÿ Henderson, Nevada

89052 Ÿ Tel: 702-835-6300 Ÿ Fax: 702-260-7405 Ÿ www.sppirx.com

Ÿ NASDAQ:

SPPI

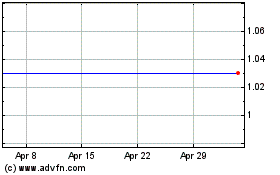

Spectrum Pharmaceuticals (NASDAQ:SPPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

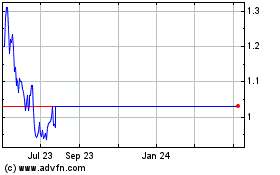

Spectrum Pharmaceuticals (NASDAQ:SPPI)

Historical Stock Chart

From Apr 2023 to Apr 2024