UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

Form 6-K

____________________________________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-41066

____________________________________________________________

Sono Group N.V.

(Registrant’s name)

____________________________________________________________

Waldmeisterstraße 76

80935 Munich

Germany

(Address of principal executive offices)

____________________________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On February 14, 2023, the Company issued a press release, a copy of which is attached hereto and incorporated by reference herein, regarding the announcement by The Nasdaq Stock Market LLC (“Nasdaq”) on February 13, 2024 that it will file a Form 25 Notification of Delisting with the U.S. Securities and Exchange Commission (“SEC”) to complete the delisting of the Company’s ordinary shares. The delisting will become effective ten days after the Form 25 is filed. Additional information and background on the delist determinations from Nasdaq may be found in the Company’s Form 6-Ks submitted to the SEC on July 18, 2023, September 1, 2023 and December 13, 2023 and in the Company’s Form 20-F for the year ended December 31, 2022.

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

Exhibit Description of Exhibit

99.1 Press release dated February 14, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Sono Group N.V. |

| | | (Registrant) |

| | | |

| | | |

| Date: February 14, 2024 | | /s/ George O'Leary |

| | | George O'Leary |

| | | Managing Director |

| | | |

EXHIBIT 99.1

Sono Group N.V. Charts New Course

- Nasdaq Hearings Panel decision received prior to Sono Group N.V.’s withdrawal of its application for preliminary self-administration proceedings and the recently-announced funding of its investment from YA II PN, Ltd.

- Since the delisting decision, Sono Group N.V. became current on its financial reporting with the SEC, withdrew its application for preliminary self-administration proceedings and received fresh funding

- Following these developments, Sono Group N.V. plans to file the appropriate documentation to become a fully reporting entity on OTCQB and thereafter to work diligently towards meeting the requirements for an initial listing on The Nasdaq Capital Market

- The Company extends its gratitude to all its investors for their continued support and trust

MUNICH, Germany, Feb. 14, 2024 (GLOBE NEWSWIRE) -- The ordinary shares of Sono Group N.V. (the “Company”) have been suspended from trading on Nasdaq since July 21, 2023. Following the recent announcement from The Nasdaq Stock Market (“Nasdaq”) that it will file a Form 25 Notification of Delisting with the U.S. Securities and Exchange Commission (the “SEC”) to formally complete the delisting of the Company’s ordinary shares, the Company is pleased to outline its strategic initiatives considering this development.

As disclosed in the Company’s Form 6-K submitted to the SEC on December 13, 2023, the Company received a decision of the Nasdaq Hearings Panel (the “Panel”) to delist the Company’s ordinary shares from Nasdaq. The Panel’s decision was received prior to the occurrence of certain significant corporate events: the insolvency plan of Sono Motors GmbH, the Company’s sole subsidiary, becoming legally binding, the Company’s decisive action to withdraw its application for preliminary self-administration proceedings, the closing of the investment from YA II PN, Ltd., and the subsequent funding of the first tranche of such investment.

Having become current on its financial reporting with the SEC and having received an initial round of fresh funding, the Company intends to work towards meeting the initial listing requirements of The Nasdaq Capital Market. In the meantime, and in addition to these efforts, Sono Group N.V. is planning to apply for admission to trading on OTCQB. Such a listing would be aimed at generating additional liquidity for the Company’s shares and facilitating investor activity as a fully reporting entity. The Company's leadership believes this step could potentially support and enhance shareholder value during this transition period.

Sono Group N.V. extends its sincerest gratitude to all its investors for their continued support and trust. Sono Group N.V. remains dedicated to its mission of putting “Solar on every vehicle” and to delivering long-term value to its shareholders.

ABOUT SONO MOTORS

Sono Motors is on a pioneering mission to accelerate the revolution of mobility by making every vehicle solar. Sono Motors’ disruptive solar technology has been engineered to be seamlessly integrated into a variety of vehicle architectures — including third-party OEM cars, buses, refrigerated vehicles, and recreational vehicles — to extend range and reduce fuel costs as well as the impact of CO2 emissions, paving the way for climate-friendly mobility.

CONTACT

Press:

press@sonomotors.com | www.sonomotors.com/press

Investors:

ir@sonomotors.com | ir.sonomotors.com

FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements. The words “expect”, “anticipate”, “intend”, “plan”, “estimate”, “aim”, “forecast”, “project”, “target”, “will” and similar expressions (or their negative) identify certain of these forward-looking statements. These forward-looking statements are statements regarding the intentions, beliefs, or current expectations of Sono Group N.V. and Sono Motors GmbH (together, the “companies”). Forward-looking statements involve inherent known and unknown risks, uncertainties and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and could cause the companies’ actual results, performance or achievements to differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and assumptions include, but are not limited to, risks, uncertainties and assumptions with respect to: our expectations regarding the remaining stages of Sono GmbH’s self-administration proceedings; the companies’ ability to maintain relationships with creditors, suppliers, service providers, customers, employees and other third parties as a result of the self-administration proceedings and the related increased performance and credit risks associated with the companies’ constrained liquidity position and capital structure; the companies’ ability to access the external funding required to successfully restructure their business, including by complying with the agreements related to the investment from YA II PN, Ltd. so as to gain access to the funding offered in such transaction; the length of time that Sono Motors GmbH continues to operate under the self-administration proceedings, and the Company’s ability to have its shares admitted to trading on OTCQB, Nasdaq or any other stock exchange in the future, including the Company’s ability to meet the relevant application or initial listing requirements and to pay for the related costs. Many of these risks and uncertainties relate to factors that are beyond the companies’ ability to control or estimate precisely, such as the actions of courts, regulatory authorities and other factors. Readers should therefore not place undue reliance on these statements, particularly not in connection with any contract or investment decision. Except as required by law, the companies assume no obligation to update any such forward-looking statements.

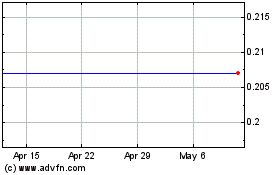

Sono Group NV (NASDAQ:SEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

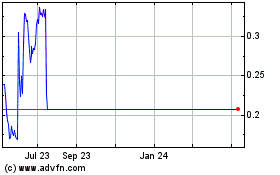

Sono Group NV (NASDAQ:SEV)

Historical Stock Chart

From Apr 2023 to Apr 2024