false

0001644378

0001644378

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

December 19, 2023

Date of Report

(Date of earliest event reported)

The RMR Group Inc.

(Exact Name of Registrant as Specified in

Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation)

| 001-37616 |

8742 |

47-4122583 |

| (Commission File Number) |

(Primary Standard

Industrial |

(IRS Employer |

| |

Classification

Code Number) |

Identification

Number) |

Two Newton Place, 255 Washington Street,

Suite 300, Newton, MA, 02458-1634

(Address of principal executive offices, including zip code)

(617) 796-8230

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

Of Each Class |

|

Trading Symbol |

|

Name

Of Each Exchange On

Which Registered |

| Class A common stock, $0.001 par value per share |

|

RMR |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

As disclosed in the Current Report on Form 8-K filed with the

United States Securities and Exchange Commission (the “SEC”) by The RMR Group Inc. (the “Company”), on July 31,

2023, The RMR Group LLC (“RMR LLC”), a Maryland limited liability company and a majority-owned operating subsidiary of the

Company, entered into an equity purchase agreement (the “Purchase Agreement”), with MPC Partnership Holdings LLC, a Georgia

limited liability company (“MPC”), the sellers set forth on the signature pages thereto (collectively, the “Sellers”),

the seller owners set forth on the signature pages thereto (collectively, the “Seller Owners”), and, solely in his capacity

as the Seller Representative, James A. Rubright. On December 19, 2023, RMR LLC completed its acquisition of the issued and outstanding

equity interests of MPC for $80 million in cash, subject to customary adjustments for MPC’s cash, debt, transaction expenses and

working capital at closing. Pursuant to the Purchase Agreement, the Sellers are eligible to earn up to an additional $20 million of contingent

consideration subject to the deployment of capital remaining in investment funds managed by MPC prior to the end of such fund’s

investment period. In addition, the Sellers retained certain excluded assets (including promotes and co-investment interests in respect

of legacy investment funds managed by MPC) and assumed certain excluded liabilities (including liabilities related to such excluded assets),

in accordance with the Purchase Agreement.

In connection with the transaction, Mr. Patrick Carroll entered

into a business protection agreement providing customary non-competition, non-solicitation and related covenants in favor of RMR LLC.

The foregoing description of the Purchase Agreement and the transactions

contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Purchase

Agreement attached as Exhibit 2.1 to the Current Report on Form 8-K filed with the SEC by the Company on July 31, 2023

and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On December 19, 2023, the Company issued a press release announcing

the Closing. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company undertakes

no obligation to update, supplement or amend the press release attached as Exhibits 99.1.

The information in Exhibits 99.1 is being furnished and shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements of Businesses Acquired.

(a) Financial Statements of Business Acquired.

The financial statements required by this Item, with respect to the

acquisition described in Item 2.01 herein, will be filed by amendment to this Current Report on Form 8-K not later than 71 days after

the date on which this Current Report on Form 8-K is required to be filed pursuant to Item 2.01.

(b) Pro Forma Financial Information.

The unaudited pro forma financial information required by this Item,

with respect to the acquisition described in Item 2.01 herein, will be filed by amendment to this Current Report on Form 8-K as soon

as practicable and in any event not later than 71 days after the date on which this Current Report on Form 8-K is required to be

filed pursuant to Item 2.01.

(d) Exhibits.

| |

2.1 |

|

Equity Purchase Agreement, dated as of July 29, 2023, by and among The RMR Group LLC, MPC Partnership Holdings LLC, the Sellers set forth on the signature pages thereto, the Seller Owners set forth on the signature pages thereto, and James A. Rubright, solely in his capacity as the Seller Representative (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the SEC on July 31, 2023). |

| |

|

|

|

| |

99.1 |

|

Press Release, issued by the Company on December 19, 2023. |

| |

|

|

|

| |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

THE RMR GROUP INC. |

| |

|

| Dated: December 19, 2023 |

By: |

/s/ Matthew P. Jordan |

| |

|

Matthew P. Jordan |

| |

|

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

The RMR Group Completes Acquisition of

CARROLL Multifamily Platform

Accretive

Transaction Expands RMR’s Expertise and Private Capital AUM

Newton, MA. (December 19, 2023): The

RMR Group (Nasdaq: RMR) today announced that it has completed its acquisition of MPC Partnership Holdings, LLC, doing business as CARROLL

(“CARROLL”), a vertically integrated multifamily platform. The acquisition, which was announced on July 31, 2023, expands

RMR’s platform to include multifamily commercial real estate, the only major property sector in which RMR did not have a significant

presence, increases its private capital assets under management and diversifies its roster of private capital clients.

Adam Portnoy, President and Chief Executive Officer

of RMR, made the following statement:

“With the CARROLL acquisition, RMR was able to implement

our growth strategy of leveraging our strong balance sheet to make strategic acquisitions. Today, we acquired a vertically integrated

organization that expands our scale, diversifies our platform, substantially increases our private capital assets under management and

is financially accretive. I welcome the experienced and talented CARROLL team to RMR and look forward to working with them to further

expand our multifamily platform.

“With more than $200 million in cash remaining after

completing the CARROLL acquisition and no debt, RMR is well-positioned to pursue additional growth opportunities that deliver attractive

risk adjusted returns for our shareholders.”

Transaction Details

RMR acquired 100% of the equity interests in CARROLL

for $80 million in cash, subject to customary purchase price adjustments, with the potential for incremental earnout consideration up

to $20 million based on the deployment of the remaining capital commitments of the existing CARROLL investment funds. Consents approving

the transaction were received from all limited partners, joint venture partners and lenders to the extent that their consent was required

in connection with the transaction.

Advisors

The CenterCap Group, LLC served as exclusive financial

advisor and Skadden, Arps, Slate, Meagher & Flom LLP acted as legal advisor to RMR on this transaction. UBS Investment Bank served

as exclusive financial advisor and King & Spalding LLP served as legal advisor to CARROLL.

About The RMR Group:

The RMR Group is a leading U.S. alternative asset

management company, unique for its focus on commercial real estate (CRE) and related businesses. RMR’s vertical integration is supported

by over 600 real estate professionals in more than 30 offices nationwide who manage approximately $36 billion in assets under management

and leverage more than 35 years of institutional experience in buying, selling, financing and operating CRE. RMR benefits from a scalable

platform, a deep and experienced management team and a diversity of direct real estate strategies across its clients. RMR is headquartered

in Newton, MA and was founded in 1986. For more information, please visit www.rmrgroup.com.

WARNING REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements

that are within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to subject

to risks and uncertainties. These statements may include words such as “believe,” “could,” “driving,”

“estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,”

“seek,” “should,” “will,” “would,” “considering,” and negative or derivatives

of these or similar expressions. Forward-looking statements include, without limitation, statements regarding the transaction, prospective

performance, future plans, events, expectations, performance, objectives and opportunities and the outlook for CARROLL’s business

and the accuracy of any assumptions underlying any of the foregoing. Investors are cautioned that any such forward-looking statements

are not guarantees of future performance and involve risks and uncertainties and are cautioned not to place undue reliance on these forward-looking

statements. Actual results may differ materially from those currently anticipated due to a number of risks and uncertainties. The transaction

is subject to various additional risks, including: the risk that the business will not be integrated successfully or that the integration

will be more costly or more time-consuming and complex than anticipated; the risk that cost savings and synergies anticipated to be realized

by the transaction may not be fully realized or may take longer to realize than expected; risks related to future opportunities, plans

and strategy for CARROLL, including the uncertainty of expected future financial performance, expected access to capital, timing of accretion

and operating results of RMR following completion of the transaction and the challenges facing the industries in which RMR and CARROLL

operate; the risk that the transaction will divert management’s attention from RMR’s ongoing business operations; risks associated

with the impact of general economic, political and market factors on us, CARROLL or the transaction; and other matters. These factors

should not be construed as exhaustive and should be read in conjunction with other cautionary statements that are included in RMR’s

periodic filings. The information contained in RMR’s filings with the Securities and Exchange Commission (“SEC”), including

under the caption “Risk Factors” in its periodic reports, or incorporated therein, identifies important factors that could

cause differences from the forward-looking statements in this press release. RMR’s filings with the SEC are available on its website

and at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, RMR undertakes no obligation

to update any forward-looking statement, whether as a result of new information, future events or otherwise.

| |

Contact: |

| |

Kevin Barry, Senior Director, Investor Relations |

| |

(617) 658-0776 |

| |

|

| |

(end) |

v3.23.4

Cover

|

Dec. 19, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2023

|

| Entity File Number |

001-37616

|

| Entity Registrant Name |

RMR Group Inc.

|

| Entity Central Index Key |

0001644378

|

| Entity Tax Identification Number |

47-4122583

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Two Newton Place

|

| Entity Address, Address Line Two |

255 Washington Street

|

| Entity Address, Address Line Three |

Suite 300

|

| Entity Address, City or Town |

Newton

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02458-1634

|

| City Area Code |

617

|

| Local Phone Number |

796-8230

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value per share

|

| Trading Symbol |

RMR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

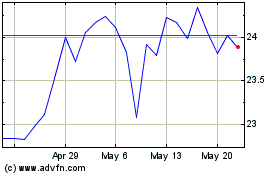

RMR (NASDAQ:RMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

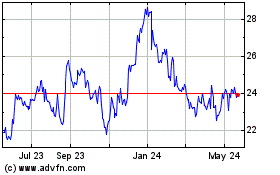

RMR (NASDAQ:RMR)

Historical Stock Chart

From Apr 2023 to Apr 2024