UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

SCHEDULE TO

(RULE 14d-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 4)

_______________________________________

Performance

Shipping Inc.

(Name of Subject Company (Issuer))

_______________________________________

Sphinx

Investment Corp.

(Offeror)

Maryport

Navigation Corp.

(Parent of Offeror)

George

Economou

(Affiliate of Offeror)

(Names of Filing Persons)

_______________________________________

Common

shares, $0.01 par value

(including

the associated Preferred stock purchase rights)

(Title of Class of Securities)

Y67305105

(CUSIP Number of Class of Securities)

_______________________________________

Kleanthis Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor,

Office 21

1066 Nicosia, Cyprus

+35 722 010610

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

_______________________________________

With a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

_______________________________________

| |

¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| x |

third-party tender offer subject to Rule 14d-1. |

| ¨ |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| x |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment

reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

As permitted by General Instruction G to Schedule

TO, this Schedule TO is also Amendment No. 9 to the Schedule 13D filed by Sphinx Investment Corp. (the “Offeror”),

Maryport Navigation Corp. and Mr. George Economou on August 25, 2023 (and amended on August 31, 2023, September 5, 2023 and September

15, 2023, amended twice on each of October 11, 2023 and October 30, 2023, and amended on November 15, 2023) in respect of the Common

Shares of the Company.

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at November 28, 2023 in Amendment

No. 4 to its Solicitation/Recommendation Statement on Schedule 14D-9, filed with the United States Securities and Exchange Commission

(the “SEC”) on November 30, 2023 (as amended, the “Schedule

14D-9”).

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at November 28, 2023 in its Schedule

14D-9.

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.5%** |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,152,559

Common Shares stated by the Issuer as being outstanding as at November 28, 2023 in its Schedule

14D-9.

This Amendment No. 4 (this

“Amendment No. 4”) is filed by the Offeror (as defined below), Maryport (as defined below) and Mr. George Economou

and amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the

“SEC”) on October 11, 2023 and amended and supplemented pursuant to Amendment No. 1 and Amendment No. 2, each of which

was filed with the SEC on October 30, 2023 and Amendment No. 3 which was filed with the SEC on November 15, 2023 (such original Tender

Offer Statement on Schedule TO as so amended and supplemented (including any exhibits and annexes attached thereto), the “Original

Schedule TO”), and as hereby amended and supplemented (including by the exhibits and annexes hereto), together with any subsequent

amendments and supplements thereto, this “Schedule TO”) by Sphinx Investment Corp., a corporation organized under the

laws of the Republic of the Marshall Islands (the “Offeror”), Maryport Navigation Corp., a corporation organized under

the laws of the Republic of Liberia that is the direct parent of the Offeror (“Maryport”), and Mr. George Economou,

who directly owns Maryport and controls each of the Offeror and Maryport. This Schedule TO relates to the tender offer by the Offeror

to purchase all of the issued and outstanding common shares, par value $0.01 per share (the

“Common Shares”), of Performance Shipping Inc., a corporation organized under the laws of the

Republic of the Marshall Islands (the “Company”) (including the associated preferred stock purchase rights (the

“Rights”, and together with the Common Shares, the “Shares”) issued pursuant to the Stockholders’

Rights Agreement, dated as of December 20, 2021, between the Company and Computershare

Inc. as Rights Agent (as it may be amended from time to time)), for $3.00 per Share in cash, without interest, less any applicable

withholding taxes, upon the terms and subject to the conditions set forth in (a) the Amended and Restated Offer to Purchase, dated October

30, 2023, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(G) (the “Offer to Purchase”), (b) the related

revised Letter of Transmittal, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(H) (the “Letter of Transmittal”),

and (c) the related revised Notice of Guaranteed Delivery, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(I) (the “Notice

of Guaranteed Delivery”) (which three documents, including any amendments or supplements thereto, collectively constitute the

“Offer”).

As permitted by General Instruction

G to Schedule TO, this Schedule TO is also Amendment No. 9 to the Schedule 13D filed by the Offeror, Maryport and Mr. Economou on August

25, 2023 (and amended on August 31, 2023, September 5, 2023 and September 15, 2023, amended twice on each of October 11, 2023 and October

30, 2023, and amended on November 15, 2023) in respect of the Common Shares.

This Amendment No. 4 is being

filed to amend and supplement the Schedule TO. Except as amended hereby to the extent specifically provided herein, all terms of the Offer

and all other disclosures set forth in the Schedule TO and the Exhibits thereto remain unchanged and are hereby expressly incorporated

into this Amendment No. 4 by reference. Capitalized terms used and not otherwise defined in this Amendment No. 4 shall have the meanings

assigned to such terms in the Schedule TO and the Offer to Purchase.

Items 1 through 9 and Item 11

All information contained

in the Supplement to the Amended and Restated Offer to Purchase, a copy of which is attached hereto as Exhibit (a)(1)(O), is hereby

incorporated herein by reference in response to Items 1 through 9 and Item 11 in this Schedule TO.

Item 12. Exhibits.

Item 12 of the Schedule TO

is hereby amended and supplemented by adding the following text thereto:

SIGNATURES

After due inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 5, 2023

| |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

George Economou |

| |

|

| |

/s/ George Economou |

| |

George Economou |

EXHIBIT INDEX

| Exhibit | |

Description |

|

| | |

|

| (a)(1)(A) | |

Offer

to Purchase* |

| | |

|

| (a)(1)(B) | |

Form

of Letter of Transmittal* |

| | |

|

| (a)(1)(C) | |

Form

of Notice of Guaranteed Delivery* |

| | |

|

| (a)(1)(D) | |

Form

of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| | |

|

| (a)(1)(E) | |

Form

of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| | |

|

| (a)(1)(F) | |

Form

of Summary Advertisement as published in the New York Times on October 11, 2023 * |

| | |

|

| (a)(1)(G) | |

Amended

and Restated Offer to Purchase* |

| | |

|

| (a)(1)(H) | |

Form

of revised Letter of Transmittal* |

| | |

|

| (a)(1)(I) | |

Form

of revised Notice of Guaranteed Delivery* |

| | |

|

| (a)(1)(J) | |

Form

of revised Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| | |

|

| (a)(1)(K) | |

Form

of revised Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| | |

|

| (a)(1)(L) | |

Complaint

filed by Sphinx Investment Corp. in the Supreme Court of the State of New York located in the County of New York* |

| | |

|

| (a)(1)(M) | |

Press

Release issued by Sphinx Investment Corp. on October 30, 2023* |

| | |

|

| (a)(1)(N) | |

Press

Release issued by Sphinx Investment Corp. on November 15, 2023* |

| | |

|

| (a)(1)(O) | |

Supplement

to Amended and Restated Offer to Purchase dated December 5, 2023** |

| | |

|

| (b) | |

Not

applicable. |

| | |

|

| (d) | |

Not

applicable. |

| | |

|

| (g) |

| Not

applicable. |

| |

| |

| (h) |

| Not

applicable. |

| |

| |

| 107 |

|

Filing Fee Table* |

* Previously filed

** Filed herewith

Exhibit (a)(1)(O)

Supplement

to the

Amended and Restated Offer to Purchase for Cash

All of the Outstanding Common Shares

(Including the Associated Preferred Stock Purchase

Rights)

of

Performance

Shipping Inc.

for

$3.00 Per Common Share (including the Associated

Preferred Stock Purchase Right)

by

Sphinx

Investment Corp.

| THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 11:59 p.m., NEW YORK CITY TIME, ON March 28, 2024, UNLESS THE OFFER IS EXTENDED (SUCH DATE AND TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION DATE and Time”). |

This Supplement, dated December 5, 2023 (this

“Supplement”), supplements and amends certain portions of the Amended and Restated Offer to Purchase, dated October 30,

2023 and filed with the United States Securities and Exchange Commission (the “SEC”) on such same date (as amended

and supplemented prior to the filing of this Supplement, the “Amended and Restated Offer to Purchase”, and as amended

and supplemented by this Supplement, the “Offer to Purchase”), relating to the Offer (as defined below) by Sphinx Investment

Corp., a corporation organized under the laws of the Republic of the Marshall Islands (the “Offeror”, “we”,

“us” or “our”) to purchase all of the issued and outstanding Common Shares, par value $0.01 per

share (the “Common Shares”) of Performance Shipping Inc., a corporation organized under the laws of the Republic of

the Marshall Islands (the “Company” or “Performance”) (including the associated preferred stock

purchase rights (the “Rights”, and together with the Common Shares, the “Shares”) issued pursuant

to the Stockholders’ Rights Agreement, dated as of December 20, 2021, between the Company and Computershare Inc. as Rights

Agent (as it may be amended from time to time, the “Rights Agreement”) for $3.00 per share in cash, without interest,

less any applicable withholding taxes (the “Offer Price”) upon the terms and subject to the conditions set forth in

the Offer to Purchase. The Offer to Purchase, together with the related Letter of Transmittal, dated October 30, 2023 (the “Letter

of Transmittal”) and the related Notice of Guaranteed Delivery, dated October 30, 2023 (the “Notice of Guaranteed

Delivery”) (as each may be further revised, amended or supplemented), collectively constitute the “Offer”.

UNDER NO CIRCUMSTANCES WILL INTEREST BE PAID ON THE OFFER PRICE FOR THE SHARES, REGARDLESS OF ANY EXTENSION OF THE OFFER. Unless

the context otherwise requires, capitalized terms used in this Supplement but not otherwise defined herein shall have the meanings ascribed

to them in the Offer to Purchase.

The purpose of this Supplement is to amend certain

terms of the Offer, including the Offer Conditions, and to provide certain supplemental disclosures.

Questions and requests for assistance or additional

copies of the Offer to Purchase, the Letter of Transmittal, and the Notice of Guaranteed Delivery may be directed to the information agent

for the Offer, Innisfree M&A Incorporated (whom we refer to as the “Information Agent”) at the location and

telephone number set forth on the back cover of this Supplement. Shareholders may also contact their broker, dealer, commercial bank or

trust company for assistance concerning the Offer.

You should read (i) the entire Offer to

Purchase, including this Supplement, (ii) the Letter of Transmittal and (iii) the Notice of Guaranteed Delivery carefully before

deciding whether to tender your Shares in the Offer. This transaction has not been approved or

disapproved by the SEC or any state securities commission or the securities regulatory authorities of any other jurisdiction, nor has

the SEC or any state securities commission or the securities regulatory authorities of any other jurisdiction passed upon the fairness

or merits of such transaction or upon the accuracy or adequacy of the information contained in the Offer to Purchase, the Letter of Transmittal

or the Notice of Guaranteed Delivery. Any representation to the contrary is unlawful.

No person has been authorized to give any information or make any

representation on behalf of the Offeror or its affiliates not contained in the Offer to Purchase or in the related Letter of Transmittal

and Notice of Guaranteed Delivery, and, if given or made, such information or representations must not be relied upon as having been

authorized by the Offeror or any of its affiliates.

Although the Letter of Transmittal and Notice

of Guaranteed Delivery previously circulated refer only to the Amended and Restated Offer to Purchase, shareholders using such Letter

of Transmittal and Notice of Guaranteed Delivery to tender their Shares will nevertheless be deemed to be tendering pursuant to the Offer

on the terms and subject to the conditions set forth in the Amended and Restated Offer to Purchase as amended and supplemented by this

Supplement (and as it may be further amended and supplemented from time to time).

As amended and supplemented by this Supplement,

the Offer is subject to the satisfaction or waiver, at or before the Expiration Date and Time, of certain conditions set forth in the

Offer to Purchase, including, among other things, the following conditions:

| |

● |

Minimum Tender Condition: there shall have been validly tendered into the Offer and not withdrawn a number of Shares which, together with any Shares then-owned by the Offeror, represents at least a majority of the issued and outstanding Shares on a fully-diluted basis (assuming the exercise or conversion of all then-outstanding Options (as defined below) and other derivative securities regardless of the exercise or conversion price, the vesting schedule or other terms and conditions thereof) (the “Minimum Tender Condition”); |

| |

● |

Poison Pill Condition: either (a) the Rights Agreement shall have been validly terminated and the Rights shall have been redeemed, and the Certificate of Designation, Preferences and Rights of Series A Participating Preferred Stock (such certificate, the “Series A Certificate” and such stock, the “Series A Preferred Stock”) shall have been validly cancelled and no Series A Preferred Stock shall be outstanding, or (b) the Rights Agreement shall have been otherwise made inapplicable to the Offer and the Offeror and its affiliates (the applicable of clause (a) and clause (b), the “Poison Pill Condition”); |

| |

● |

Article K Condition: the Board shall have validly waived the applicability of Article K of the Company’s Amended and Restated Articles of Incorporation (“Article K”) to the purchase of the Shares by the Offeror in the Offer so that the provisions of Article K would not, at or at any time following consummation of the Offer, prohibit, restrict or apply to any “business combination”, as defined in Article K, involving the Company and the Offeror or any affiliate or associate of the Offeror (the “Article K Condition”); |

| |

● |

Equity Condition: the Company shall not have any securities outstanding, authorized or proposed for issuance other than (a) the Shares, (b) authorized Series A Preferred Stock (none of which shall have been issued), (c) the number of shares of Series B Convertible Cumulative Perpetual Preferred Stock (the “Series B Preferred Stock”) outstanding as of October 10, 2023, (d) the warrants outstanding as of October 10, 2023 (which shall not be exercisable in the aggregate for more than the 7,904,221 Shares disclosed by the Company in its Form 6-K on September 29, 2023, and the terms of which such warrants shall not have been amended on or after October 11, 2023), (e) (1) the options to purchase Shares under the Company’s Amended and Restated 2015 Equity Incentive Plan (as such plan was in effect as of October 10, 2023) (the “Equity Incentive Plan”) outstanding, and subject to the terms as in effect, as of October 10, 2023, and (2) any options to purchase Shares under the Equity Incentive Plan that are issued pursuant to the Equity Incentive Plan on or after October 11, 2023 in the ordinary and usual course of business, consistent with past practice (clause (1) and clause (2), collectively, the “Options”); (f) Shares authorized for issuance but not yet subject to awards under the Equity Incentive Plan (none of which shall, on or after October 11, 2023, have been issued other than in the ordinary and usual course of business, consistent with past practice); (g) the Remedial Rights (as defined below) and the Remedial Shares (as defined below) (with none of the Remedial Shares having been issued); and (h) solely in the event that the Series C Condition (as defined below) is satisfied through clause (b) thereof, the number of shares of the Series C Convertible Cumulative Redeemable Perpetual Preferred Stock (the “Series C Preferred Stock”) outstanding on October 10, 2023 (the “Equity Condition”); |

| |

● |

Series C Condition: either (a) (1) Section 4 of the Certificate of Designation, preferences and rights of the Series C Preferred Stock (the “Series C Certificate”) shall no longer be in effect, (2) any and all shares of the Series C Preferred Stock held as of October 11, 2023 by any of Mango Shipping Corp. (“Mango”), Mitzela Corp. (“Mitzela”), and Giannakis (John) Evangelou, Antonios Karavias, Christos Glavanis, and Reidar Brekke, or by any “affiliate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the United States Securities and Exchange Act of 1934, as amended (the “Exchange Act”) of any of the foregoing (collectively, the “Insider Holders”), and any and all Shares purported to have been issued pursuant to the purported conversion of any such shares of the Series C Preferred Stock, shall have been validly cancelled for no consideration and (3) no other shares of the Series C Preferred Stock shall be outstanding; or (b) (1) there shall have been issued upon each Share outstanding from time to time an uncertificated right (which such right shall be stapled to the associated Share and shall, immediately and solely following the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, be freely exercisable at any time in exchange for nominal consideration (and shall not be exercisable prior to the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, and shall not be subject to involuntary redemption or repurchase)) (each, a “Remedial Right”) to purchase such number of shares of the Series C Preferred Stock (and/or such number of shares of a new class of preferred stock of the Company) (the “Remedial Shares”) that would, once issued to the holder of such Share, put the holder of such Share in the same economic, voting, governance and other position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration (with the holder of such Share having been deemed for purposes of this condition to have been put in the same (x) economic position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration if, upon the issuance of the Remedial Shares pursuant to the exercise of the Remedial Rights, the Series C Preferred Stock issued to the Insider Holders would not in the aggregate be entitled to receive more than 0.1% of any dividend or other payment made by the Company to Company securityholders and (y) voting and governance position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration if, upon the issuance of the Remedial Shares pursuant to the exercise of the Remedial Rights, the Series C Preferred Stock issued to the Insider Holders would not in the aggregate constitute more than 0.1% of any Company securities entitled to vote (as a single class or otherwise) on or consent (as a single class or otherwise) to any matter (including without limitation pursuant to Section 4(b) of the Series C Certificate)), (2) no Remedial Shares (or rights to acquire Remedial Shares other than the Remedial Rights) shall have been issued to any Insider Holder or any “associate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of an Insider Holder and (3) any Remedial Right beneficially owned from time to time by any Insider Holder, any “associate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of

an Insider Holder or any direct or indirect transferee of an Insider Holder or of any such “associate” shall be rendered unexercisable pursuant to the definitive documentation for such Remedial Rights (the applicable of clause (a) and clause (b), the “Series C Condition”); |

| |

● |

Series B Condition: the Certificate of Designation, Preferences and Rights of Series B Preferred Stock (the “Series B Certificate”) either (a) shall have been validly cancelled or (b) shall not have been amended (the applicable of clause (a) and clause (b), the “Series B Condition”); and |

| |

● |

Board Representation Condition: the size of the Board shall remain fixed at five members, with at least three of such authorized five Board seats either (a) then-being occupied by persons having been designated by us, (b) then-being vacant, with the company having publicly committed on a binding basis to fill such vacancies with persons designated by us or (c) then-being occupied by directors who shall have publicly submitted their irrevocable resignations from the Board, effective no later than the Offeror’s purchase of the Shares tendered in the Offer, which such resignations shall have been publicly accepted by the Company (with the Company having publicly committed on a binding basis to fill the resulting vacancies with persons designated by us) (the applicable of clause (a), clause (b) and clause (c), the “Board Representation Condition”). |

As amended and supplemented by this Supplement,

the Offer is also subject to the satisfaction or waiver of other customary conditions set forth in the Offer to Purchase. See Section 14

of the Offer to Purchase -– “CONDITIONS OF THE OFFER” of the Offer to Purchase (as amended and supplemented by this

Supplement), which is included as so amended and supplemented on page 5 of this Supplement. The conditions to the Offer must

be satisfied at or before the Expiration Date and Time, as it may be extended.

The Offer to Purchase refers to a proxy solicitation.

The Offer to Purchase is not intended to and does not constitute (i) a solicitation of any proxy, consent or authorization for or

with respect to the Company’s 2024 Shareholder Meeting or any other meeting of company shareholders or (ii) a solicitation

of any consent or authorization in the absence of any such meeting. Any such solicitation is being or will be made only pursuant to proxy

or consent solicitation materials that comply with the applicable provisions of Marshall Islands Law. Shareholders are advised to read

the proxy statement that was furnished on Schedule 13D on October 11, 2023 as it may be amended or supplemented from time to

time (the “Proxy Statement”) and (as, when and if they become available) any other documents related to the solicitation

of proxies by the Offeror and its affiliates from the shareholders of the company for use at the 2024 Shareholder Meeting, because they

will contain important information. A Proxy Statement and a form of proxy is available at no charge at the sec’s website at

http://www.sec.gov.

Subject to applicable law, the Offeror reserves

the right to further amend the Offer in any respect (including amending the Offer Price).

The Amended and Restated Offer to Purchase (i) amended

and restated the Offer to Purchase dated October 11, 2023 and filed with the SEC on such same date (the “Original Offer

to Purchase”) and (ii) is further amended and supplemented by this Supplement. In the event that any of the information

in the Original Offer to Purchase is different from or in conflict with any of the information in the Amended and Restated Offer to Purchase

(as it has been amended and supplemented by this Supplement and as it may be further amended and supplemented from time to time), the

information provided in the Amended and Restated Offer to Purchase (as so amended and supplemented) governs.

The Information Agent for this Offer is:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders May Call Toll Free: (877) 800-5190

Banks and Brokers May Call Collect: (212)

750-5833

The date of this Supplement is December 5, 2023

FORWARD-LOOKING

STATEMENTS

This

Supplement contains certain forward-looking statements with respect to certain of the Offeror’s, Maryport Navigation Corp.’s

and Mr. George Economou’s current expectations and projections about future events. These statements, which sometimes use words

such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “project,”

“strategy,” “opportunity,” “future,” “plan,” “will likely result,” “will,”

“shall,” “may,” “aim,” “predict,” “should,” “would,” “continue,”

and words of similar meaning and/or other similar expressions that are predictions of or indicate future events and/or future trends,

reflect the beliefs and expectations of the applicable of the Offeror, Maryport and Mr. George Economou at the date of this Supplement

and involve a number of risks, uncertainties and assumptions that could cause actual results and performance to differ materially from

any expected future results or performance expressed or implied by the forward-looking statement.

Any or all forward-looking statements may turn

out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Statements contained in

this Supplement regarding past trends or activities should not be taken as a representation that such trends or activities will continue

in the future. Except as required by applicable law, none of the Offeror, Maryport, Mr. George Economou or any of their respective

affiliates assumes any responsibility or obligation to publicly correct, update or review any of the forward-looking statements contained

in this Supplement. You should not place undue reliance on such forward-looking statements, which speak only as of the date of this Supplement.

SUMMARY

TERM SHEET

The Summary Term Sheet set forth in the Amended

and Restated Offer to Purchase is hereby amended and restated in its entirety as follows:

The information contained herein is a summary

only, is not complete, and is not meant as a substitute for the more detailed descriptions and information contained elsewhere in the

Offer to Purchase and in the related Letter of Transmittal (as deemed amended by the Supplement) and Notice of Guaranteed Delivery (as

deemed amended by the Supplement). You are urged to read carefully, in its entirety, each of the Offer to Purchase and the related Letter

of Transmittal and Notice of Guaranteed Delivery, which contain additional important information. The information concerning Performance

contained herein and elsewhere in the Offer to Purchase has been taken from or is based upon publicly available documents or records of

Performance on file and freely available from the SEC, or other public sources at the time of the filing of the Offer to Purchase. Questions

or requests for assistance may be directed to the Information Agent at the address and telephone number set forth for the Information

Agent on the back cover of the Offer to Purchase. Unless otherwise indicated in the Offer to Purchase or the context otherwise

requires, all references in the Offer to Purchase to “we”, “our” or “us” refer to the Offeror.

| Securities Sought: |

|

All of the issued and outstanding Shares. Each Share is comprised of one Common Share of Performance, par value $0.01, together with one associated Right issued pursuant to the Rights Agreement. |

| |

|

|

| Offer Price Per Share: |

|

$3.00 per Share, without interest, in cash, less any applicable withholding taxes (the “Offer Price”), for each Share validly tendered and accepted for payment in the Offer. |

| |

|

|

| Scheduled Expiration Date and Time of the Offer: |

|

11:59 P.M., New York City time, on March 28, 2024, unless extended. |

| |

|

|

| Offeror: |

|

Sphinx Investment Corp., a corporation organized under the laws of the Republic of the Marshall Islands. |

The remainder of this Summary Term Sheet includes

some of the questions that you, as a holder of Shares, may have about the Offer, along with answers to those questions. As stated in more

detail above, we urge you to read carefully the remainder of the Offer to Purchase and the Letter of Transmittal and Notice of Guaranteed

Delivery because the information in this summary term sheet is a summary only, is not complete, and is not meant as a substitute for the

more detailed descriptions and information contained elsewhere in the Offer to Purchase and in the related Letter of Transmittal and Notice

of Guaranteed Delivery.

WHO IS OFFERING TO BUY MY SHARES?

Sphinx Investment Corp., a corporation organized

under the laws of the Republic of the Marshall Islands (the “Offeror”), is offering to buy your Shares. The Offeror

is a wholly-owned direct subsidiary of Maryport Navigation Corp., a corporation organized under the laws of the Republic of Liberia (“Maryport”),

which itself is directly wholly-owned by Mr. George Economou, who controls both of the Offeror and Maryport. The Offeror is the sole

bidder in the Offer. The Offeror, Maryport and Mr. Economou beneficially own an aggregate of approximately 8.5% of the issued and

outstanding Shares, based on the number of Shares publicly disclosed by the Company as outstanding as of November 28, 2023. See “Introduction”

to the Offer to Purchase and Section 8 of the Offer to Purchase — “CERTAIN INFORMATION CONCERNING THE OFFEROR”.

WHAT ARE THE CLASSES AND AMOUNTS OF SECURITIES

SOUGHT IN THE OFFER?

We are offering to purchase all of the issued

and outstanding Shares. Each Share is comprised of one Common Share, par value $0.01, of Performance, together with one associated Right

issued pursuant to the Rights Agreement. See the “Introduction” of the Offer to Purchase and Section 1 of the Offer to

Purchase — “TERMS OF THE OFFER”.

According to Amendment

No. 4 to the Company’s Solicitation/Recommendation Statement on Schedule 14D-9, which was filed by the Company with the

SEC on November 30, 2023 (“Amendment No. 4 to Company

Recommendation”), there were 12,152,559 Common Shares outstanding as of November

28, 2023.

WHAT ARE THE ASSOCIATED RIGHTS?

The associated Rights are preferred stock purchase

rights issued pursuant to the Rights Agreement, dated December 20, 2021, between Performance and Computershare Inc., as Rights Agent,

that are issued and outstanding. The Rights were issued to all of the holders of Common Shares, but (insofar as we are aware based on

the Company’s current disclosures) currently are not represented by separate certificates. A tender of your Shares will include

a tender of both your Common Shares and the associated Rights, unless certificates representing the Rights have been issued as provided

in the Rights Agreement prior to the completion of the Offer, in which circumstance your Rights must be validly tendered alongside your

Common Shares in order for you to validly tender into the Offer.

WHAT ARE THE REMEDIAL RIGHTS?

Currently, no Remedial Rights exist. In

the Series C Condition, we are providing optionality for the Series C Condition to be satisfied, in lieu of cancellation of

the shares of the Series C Preferred Stock (the “Series C Preferred Shares”) held by the Insider Holders,

via the issuance of Remedial Rights, which would for nominal consideration be exercisable for Remedial Shares that would put the holder

thereof in the same economic, voting, governance and other position as it would have been in had the Series C Preferred Stock issued

to the Insider Holders been cancelled. Whether any Remedial Rights are issued will be at the discretion of the Company and the members

of its Board or, in the alternative, a court of competent jurisdiction, and it is possible that no Remedial Rights are ever issued (including

without limitation due to the Series C Condition having been satisfied through a cancellation of the Series C Preferred Shares

issued to the Insider Holders).

In order to satisfy the Series C Condition,

any Remedial Right that is issued would be required to be uncertificated and “stapled” to the associated Share, meaning that

it could not be traded or otherwise transferred independently from the associated Share, but would, in the event that the associated Share

is transferred to a new holder, transfer to such new holder along with the associated Share. Consequently, if Remedial Rights were

issued and you tendered your Shares into the Offer, you would also be tendering the associated Remedial Rights into the Offer for no additional

consideration. If Remedial Rights are issued, for your Shares to be validly tendered into the Offer, the tender of your Shares must

be accompanied by a tender of the associated Remedial Rights. Since the Remedial Rights, if issued, are required by the terms of the Offer

to be uncertificated and stapled to the associated Shares, the valid tender of such Shares into the Offer shall also constitute a valid

tender of such Remedial Right into the Offer.

The U.S. federal income tax treatment of the issuance

of Remedial Rights, and the issuance of Remedial Shares on exercise of the Remedial Rights, is uncertain, and may be a taxable event to

U.S. holders. For a more detailed explanation of certain U.S. federal income tax considerations relevant to an issuance of Remedial

Rights and the Remedial Shares, see Section 5 of the Offer to Purchase — “TAX CONSIDERATIONS — MATERIAL UNITED

STATES FEDERAL INCOME TAX CONSIDERATIONS —Treatment of the Issuance of Remedial Rights and Remedial Shares”.

If

Remedial Rights are issued, can I tender my Shares into the Offer and keep the Remedial Rights?

No. Since the Remedial Rights, if issued,

are required by the terms of the Offer to be uncertificated and stapled to the associated Shares, if the Remedial Rights are issued, the

valid tender of a Share into the Offer shall also constitute a valid tender of such Remedial Right into the Offer and the valid withdrawal

from the Offer of a Share shall also constitute a valid withdrawal from the Offer of the associated Remedial Right.

WHAT ARE YOUR PURPOSES FOR THE OFFER AND PLANS

FOR THE COMPANY AFTER THE OFFER IS COMPLETED?

The Offeror believes that

the Shares are currently undervalued due in part to the Company’s current dual class capital structure. The purpose of the Offer

is to acquire at least a majority, and up to 100%, of the issued and outstanding Shares on a fully-diluted basis (assuming the exercise

or conversion of all then-outstanding Options and other derivative securities regardless of the exercise or conversion price, the vesting

schedule or other terms and conditions thereof), which would following the consummation of the Offer represent at least a majority of

the voting power of the Company securities, and (if the Series C Condition is satisfied pursuant to clause (a) thereof) the

Shares will be the sole Company securities outstanding having the right or purporting to have the right to vote with respect to the election

of directors. Following the successful consummation of the Offer (assuming it is consummated), the Offeror, Maryport and Mr. George

Economou will have acquired beneficial ownership of a majority of the issued and outstanding Shares on a fully-diluted basis and will

have designated a majority of the Board, and may be deemed to control the Company.

If, and to the extent

that, the Offeror acquires control of the Company, the Offeror intends to conduct a review, subject to applicable law, of the

Company and its assets, corporate structure, capitalization, operations, properties, policies, management and personnel and consider

and determine what, if any, changes would be desirable in light of the circumstances which then exist, which may include selling all

or any portion of the Shares acquired by the Offeror in the Offer and/or causing the Company to sell all or any portion of the

assets of the Company or conduct one or more strategic transactions. In addition, if the Offeror acquires control of the Company,

the Offeror expects to take further steps to improve the governance and management of the Company, which may among other things

include making changes to the composition of the management team of the Company and/or making changes to the organizational

documents of the Company, including, without limitation, the Company’s Amended and Restated Articles of Incorporation (the

“Articles”) and the Amended and Restated Bylaws (the “Bylaws”). See also the immediately

following the Q&A entitled “Mr. George Economou directly or indirectly owns

or controls other companies in the shipping industry. If the Offer is consummated, will the Company or any Company assets be

integrated or combined with or sold to any such other shipping companies?”

If we consummate the Offer,

the Offeror further expects to seek to implement the declassification of the Board and to seek to effect the removal and replacement of

all current members of the Board remaining on the Board. See Section 11 of the Offer to Purchase — “PURPOSE OF THE OFFER;

PLANS FOR THE COMPANY”.

If we consummate the Offer,

depending upon the number of Shares we acquire and other factors relevant to our equity ownership in the Company, we may in our discretion

(but do not undertake any obligation to), subsequent to completion of the Offer, seek to acquire additional Shares through open market

purchases, privately negotiated transactions, further tender or exchange offers or other transactions or a combination of the foregoing

on such terms and at such prices as we shall determine, which may be more or less favorable than those of the Offer. We also reserve the

right to dispose of the Shares that we have acquired and/or may acquire at any time for any reason or no reason, subject to any applicable

legal restrictions.

The Offer is subject to the satisfaction or waiver,

at or before the Expiration Date and Time, of the Offer conditions set forth in the Q&A entitled “WHAT ARE THE MOST SIGNIFICANT

OFFER CONDITIONS?” as reproduced in this Supplement, along with the other Offer conditions described in Section 14 of the Offer

to Purchase as reproduced in this Supplement (such other conditions described in Section 14 of the Offer to Purchase, together with

the conditions set forth below, the “Offer Conditions”).

See Section 11 of the Offer to Purchase —

“PURPOSE OF THE OFFER; PLANS FOR THE COMPANY” and (as reproduced in this Supplement) Section 14 of the Offer to

Purchase — “CONDITIONS OF THE OFFER”.

MR. GEORGE ECONOMOU DIRECTLY OR INDIRECTLY

OWNS OR CONTROLS OTHER COMPANIES IN THE SHIPPING INDUSTRY. IF THE OFFER IS CONSUMMATED, WILL THE COMPANY OR ANY COMPANY ASSETS BE INTEGRATED

OR COMBINED WITH OR SOLD TO ANY OF SUCH OTHER SHIPPING COMPANIES?

None of the Offeror, Maryport or Mr. George

Economou has made any final decision as to whether, if the Offer is consummated, the Company or any Company assets will be transferred

to or combined or integrated with any other assets directly or indirectly owned or controlled by any of them; however, they reserve the

right to do so in accordance with applicable law. Whether or not the Offeror, Maryport or Mr. George Economou would determine to

do so would depend, among other things, on their assessment of the outcome of the post-Offer review of the Company and its assets, corporate

structure, capitalization, operations, properties, policies, management and personnel referred to above. See the Q&A directly above

entitled “What are your purposes for the Offer and plans for the Company after the Offer

is completed?”

HOW MUCH ARE YOU OFFERING TO PAY, AND WHAT

IS THE FORM OF PAYMENT?

We are offering to pay $3.00

per Share, without interest, in cash, less any applicable withholding taxes, for each Share validly tendered and accepted for payment

in the Offer. If Remedial Rights are issued, the valid tender of each Share into the Offer shall also constitute a valid tender of the

associated Remedial Right into the Offer for no additional consideration. See the “Introduction” and Section 11 —

“PURPOSE OF THE OFFER; PLANS FOR THE COMPANY”.

IS THERE AN AGREEMENT GOVERNING THE OFFER?

No, there is no agreement governing the Offer.

WHAT IS THE MARKET VALUE OF MY SHARES AS OF

A RECENT DATE?

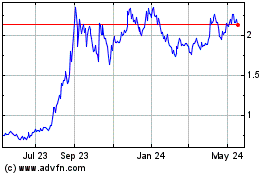

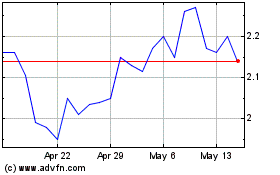

On October 10, 2023, the last full trading

day before the commencement of the Offer, the closing price of the Shares on the Nasdaq Capital Market was $1.68 per Share. On December

4, 2023, the last full trading day before the filing of this Supplement on an amendment to the Schedule TO filed by the Offeror in connection

with the Offer, the closing price of Common Shares reported on the Nasdaq Capital Market was $2.18

per Share. The Offer represents a premium of 78.6% over the Company’s closing Share price on October 10, 2023, and a premium

of 37.6% over the Company’s closing Share price on December 4, 2023. We advise you to obtain a recent quotation for the Shares and

further consult with your financial and other advisors in deciding whether to tender your Shares. See Section 6 of the Offer to Purchase

— “PRICE RANGE OF THE SHARES; DIVIDENDS”.

WILL I HAVE TO PAY ANY FEES OR COMMISSIONS?

If you are the record owner of your Shares and

you tender your Shares to the Offeror in the Offer, you will not have to pay brokerage fees or similar expenses to tender your Shares.

If you own or hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, and your broker, dealer, commercial

bank, trust company or other nominee tenders your Shares on your behalf, your broker, dealer, commercial bank, trust company or other

nominee may charge you a fee for doing so, which may reduce the net proceeds you would receive from tendering into the Offer. You should

consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply. See “Introduction”

to the Offer to Purchase.

WHAT DOES THE BOARD OF DIRECTORS OF PERFORMANCE

THINK OF THE OFFER?

According to the Solicitation/Recommendation Statement

under Section 14(d)(4) of the Exchange Act filed by the Company with the SEC on October 25, 2023, as amended by Amendment

No. 1 thereto filed by the Company with the SEC on November 6, 2023 (“Amendment No. 1 to Company Recommendation”),

Amendment No. 2 to Company Recommendation filed by the Company with the SEC on November 14, 2023 (“Amendment No. 2 to Company

Recommendation”), Amendment No. 3 to Company Recommendation filed by the Company with the SEC on November 15, 2023

(“Amendment No. 3 to Company Recommendation”), and Amendment No. 4 to Company Recommendation (collectively, the “Amended

Company Recommendation”), a special committee of allegedly independent directors, consisting of Alex Papageorgiou, Loïsa

Ranunkel and Mihalis Boutaris (the “Special Committee”) unanimously determined that, in the view of the Special Committee,

the Offer is not in the best interests of the Company or its shareholders and recommended on behalf of the Company that the Company’s

shareholders reject the Offer and not tender any Shares pursuant to the Offer. In support of such recommendation, the Company in the Amended

Company Recommendation gives “reasons” that include the following:

1. The

Special Committee believes that the Company’s net asset value per Common Share, which the Amended Company Recommendation states

was calculated by Newbridge Securities Corporation (“Newbridge”), the Special

Committee’s financial advisor, to be approximately $7.11 per Share, exceeds the consideration represented by the Offer and

that the Offer therefore undervalues the outstanding Shares.

2. The

Special Committee believes that the Offer is illusory, because the (in their view) “highly conditional” nature of the Offer

creates significant doubt that the Offer will be consummated. The Special Committee notes in particular in this respect that the Offer

remains conditioned on the Series C Condition, which, the Special Committee alleges, is not

within the authority of the Board or the Company to satisfy, including because the Special Committee believes that none of the

Company’s governing documents or applicable law grant the Company, the Board or the Special Committee the authority to effect a

cancellation (or nullification through the issuance of Remedial Rights) of the Series C Preferred Stock for no consideration.

The Amended Company Recommendation also states that the Offer is subject to numerous other conditions

which, the Special Committee alleges, “give the Offeror wide latitude not to consummate

the Offer, especially in light of the lengthy extension of the Offer – for a period of more than four months – creating a

greater likelihood of the occurrence of circumstances on the basis of which the Offeror could claim a condition is not satisfied”.

The Offeror strongly disagrees with the Amended

Company Recommendation, and the recommendation and conclusions regarding the Offer and the Company’s characterization of the terms

of the Offer as set forth in the Amended Company Recommendation. See Section 11 of the Offer to Purchase — “PURPOSE

OF THE OFFER; PLANS FOR THE COMPANY” for additional information, including our responses to certain of the statements alleged by

the Special Committee in the Amended Company Recommendation.

THE COMPANY CLAIMS THAT THE SATISFACTION OF

THE SERIES C CONDITION IS NOT WITHIN THE CONTROL OF THE COMPANY, THE BOARD OR THE SPECIAL COMMITTEE. WHAT IS THE OFFEROR’S

POSITION?

The Amended Company Recommendation states that

“the Special Committee believes that none of the Company’s governing documents, including

its Articles of Incorporation and bylaws and the Series C Certificate, or applicable law, including the [Marshall Islands Business

Corporations Act], grant the Company, the Board or the Special Committee the authority to effect

a cancellation of the Series C Preferred Stock for no consideration”. Because the Offeror disagrees, on October 27,

2023, the Offeror initiated legal proceedings in the Supreme Court of the State of New York located in the County of New York against

the Company, Chairperson Aliki Paliou, Company Chief Executive Officer Andreas Michalopoulos, former Company directors Symeon Palios,

Giannakis (John) Evangelou, Antonios Karavias, Christos Glavanis and Reidar Brekke and controlling shareholders Mango and Mitzela, to,

among other things, seek such cancellation. See Section 18 of the Offer to Purchase

– “legal proceedings” for further information regarding this litigation.

DO YOU HAVE THE FINANCIAL RESOURCES TO MAKE

PAYMENT?

Yes. The Offeror has sufficient cash on hand to

purchase all of the Shares validly tendered into the Offer. See Section 9 of the Offer to Purchase — “SOURCE AND AMOUNT

OF FUNDS”.

IS YOUR FINANCIAL CONDITION RELEVANT TO MY

DECISION TO TENDER IN THE OFFER?

We do not think our financial condition is relevant

to your decision whether to tender in the Offer because (i) the Offer is being made for all outstanding Shares (other than the Shares

beneficially owned by the Offeror and its affiliates), (ii) you will receive payment solely in cash for any Shares that you

tender into the Offer, (iii) as stated above, we have all of the financial resources necessary to consummate the Offer, and (iv) the

Offer is not conditioned upon the Offeror obtaining financing. See Section 9 of the Offer to Purchase — “SOURCE AND

AMOUNT OF FUNDS”.

DO YOU INTEND TO CONDUCT A PROXY SOLICITATION

TO REPLACE ANY MEMBERS OF THE PERFORMANCE BOARD OF DIRECTORS OR TO PASS ANY OTHER PROPOSALS?

Yes. As disclosed by the Offeror, Maryport and

Mr. George Economou in the Proxy Statement that was furnished on Schedule 13D on October 11, 2023, we are currently soliciting

proxies (the “Proxy Solicitation”) for the election of the Sphinx Nominee to the Board at the upcoming 2024 Shareholder

Meeting. If elected to the Board, the Sphinx Nominee would succeed Aliki Paliou, chairperson of the Board and sole shareholder of Mango,

the Company’s controlling shareholder, whose current term on the Board expires at the 2024 Shareholder Meeting. We are also currently

soliciting proxies in favor of the Declassification Proposal and the Vote of No Confidence Proposals.

If the Offer is consummated, the Offeror will

have acquired at least a majority of the issued and outstanding Shares on a fully diluted basis (assuming the exercise or conversion

of all then-outstanding Options and other derivative securities regardless of the exercise or conversion price, the vesting schedule or

other terms and conditions thereof), which will represent at least a majority of the voting power of the Company securities, and (if the

Series C Condition is satisfied pursuant to clause (a) thereof) the Shares will be the sole Company securities outstanding having

the right or purporting to have the right to vote with respect to the election of directors. If the Offer is consummated prior to the

record date established for the 2024 Shareholder Meeting, the Offeror intends to vote all of its Shares acquired in the Offer in favor

of the election to the Board of the Sphinx Nominee and in favor of the Declassification Proposal and each Vote of No-Confidence Proposal.

If the Offer is consummated, and irrespective of whether such consummation occurs before or after the record date for the 2024 Shareholder

Meeting, the Offeror expects to seek to implement the declassification of the Board and seek to effect the removal and replacement of

any members of the current Board then-remaining on the Board.

Currently, the Company has a classified Board,

which is divided into three classes, with two directors serving in each of Class I and Class III, and one director serving in

Class II. The term of a Class II director expires at the 2024 Shareholder Meeting. Under the Articles, a director may be removed

only for cause and only by the affirmative vote of the holders of at least two-thirds of the Common Shares. Any vacancies in the

Board for any reason, and any created directorships resulting from any increase in the number of directors, may be filled by the vote

of not less than a majority of the members of the Board then in office.

The affirmative vote of the holders of two-thirds

or more of the outstanding Common Shares entitled to vote generally in the election of directors is required to amend, alter, change or

repeal Article I of the Articles relating to the structure and composition of the Board, including the declassification of the Board.

Neither the Offer to Purchase nor the Offer constitutes

(i) a solicitation of any proxy, consent or authorization for or with respect to the 2024 Shareholder Meeting or any other meeting

of Company shareholders or (ii) a solicitation of any consent or authorization in the absence of any such meeting. Any such solicitation

is being or will be made only pursuant to separate proxy or consent solicitation materials that comply with the applicable provisions

of Marshall Islands law. Shareholders are advised to read the Proxy Statement that was furnished by the Offeror on Schedule 13D on October 11,

2023, and (as, when and if they become available) other documents related to the solicitation of proxies by the Offeror and its affiliates

from the shareholders of the Company for use at the 2024 Shareholder Meeting, because they will contain important information. A Proxy

Statement and a form of proxy is being made available at no charge at the SEC’s website at http://www.sec.gov.

IS THE OFFER CONDITIONED UPON THE SPHINX NOMINEE

BEING ELECTED TO THE BOARD?

No. The Offer is not conditioned upon the

Sphinx Nominee being elected to the Board. The Offer and the nomination of the Sphinx Nominee for election to the Board are independent

of each other.

IS THE OFFER CONDITIONED UPON THE PASSAGE OF

ANY OTHER SHAREHOLDER PROPOSAL EXPECTED TO BE MADE BY OFFEROR AT THE 2024 Shareholder MEETING?

No. The Offer is not conditioned upon the

passage of any other shareholder proposal expected to be made by the Offeror at the 2024 Shareholder Meeting, including, without limitation,

the Declassification Proposal or any Vote of No-Confidence Proposal. The Offer and such shareholder proposals are independent of each

other.

WHAT ARE THE MOST SIGNIFICANT OFFER CONDITIONS?

| |

● |

Minimum Tender Condition: We are not obligated to purchase any Shares unless there shall have been validly tendered into the Offer and not withdrawn a number of Shares which, together with any Shares then-owned by the Offeror, represents at least a majority of the issued and outstanding Shares on a fully-diluted basis (assuming the exercise or conversion of all then-outstanding Options and other derivative securities regardless of the exercise or conversion price, the vesting schedule or other terms and conditions thereof) (referred to as the Minimum Tender Condition). |

| |

● |

Poison Pill Condition: We are not obligated to purchase any Shares unless either (a) the Rights Agreement shall have been validly terminated and the Rights shall have been redeemed, and the Series A Certificate shall have been validly cancelled and no Series A Preferred Stock shall be outstanding, or (b) the Rights Agreement shall have been otherwise made inapplicable to the Offer and the Offeror and its affiliates (the applicable of clause (a) and clause (b) is referred to as the Poison Pill Condition). THIS CONDITION IS SOLELY WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

| |

● |

Article K Condition: We are not obligated to purchase any Shares unless the Board shall have validly waived the applicability of Article K to the purchase of the Shares by the Offeror in the Offer so that the provisions of Article K would not, at or at any time following consummation of the Offer, prohibit, restrict or apply to any “business combination”, as defined in Article K, involving the Company and the Offeror or any affiliate or associate of the Offeror (referred to as the Article K Condition). THIS CONDITION IS SOLELY WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

| |

● |

Equity Condition: We are not obligated to purchase any Shares unless the Company shall not have any securities outstanding, authorized or proposed for issuance other than (a) the Shares, (b) authorized Series A Preferred Stock (none of which shall have been issued), (c) the number of shares of Series B Preferred Stock outstanding as of October 10, 2023, (d) the warrants outstanding as of October 10, 2023 (which shall not be exercisable in the aggregate for more than the 7,904,221 Shares disclosed by the Company in its Form 6-K on September 29, 2023, and the terms of which such warrants shall not have been amended on or after October 11, 2023), (e) (1) the Options to purchase Shares under the Equity Incentive Plan outstanding, and subject to the terms as in effect, as of October 10, 2023, and (2) any Options to purchase Shares under the Equity Incentive Plan that are issued pursuant to the Equity Incentive Plan on or after October 11, 2023 in the ordinary and usual course of business, consistent with past practice; (f) Shares authorized for issuance but not yet subject to awards under the Equity Incentive Plan (none of which shall, on or after October 11, 2023, have been issued other than in the ordinary and usual course of business, consistent with past practice); (g) the Remedial Rights and the Remedial Shares (with none of the Remedial Shares having been issued); and (h) solely in the event that the Series C Condition is satisfied through clause (b) thereof, the number of shares of the Series C Preferred Stock outstanding on October 10, 2023 (referred to as the Equity Condition). THIS CONDITION IS SOLELY WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

| |

● |

Series C Condition: We are not obligated to purchase any Shares unless either (a) (1) Section 4 of the Series C Certificate shall no longer be in effect, (2) any and all shares of the Series C Preferred Stock held as of October 11, 2023 by any Insider Holder, and any and all Shares purported to have been issued pursuant to the purported conversion of any such shares of the Series C Preferred Stock, shall have been validly cancelled for no consideration and (3) no other shares of the Series C Preferred Stock shall be outstanding; or (b) (1) there shall have been issued upon each Share outstanding from time to time an uncertificated “Remedial Right” (which such right shall be stapled to the associated Share and shall, immediately and solely following the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, be freely exercisable at any time in exchange for nominal consideration (and shall not be exercisable prior to the Offeror’s deposit with the Tender Offer Agent of the proceeds required to consummate the Offer, and shall not be subject to involuntary redemption or repurchase)) to purchase such number of the Remedial Shares that would, once issued to the holder of such Share, put the holder of such Share in the same economic, voting, governance and other position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration (with the holder of such Share having been deemed for purposes of this condition to have been put in the same (x) economic position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration if, upon the issuance of the Remedial Shares pursuant to the exercise of the Remedial Rights, the Series C Preferred Stock issued to the Insider Holders would not in the aggregate be entitled to receive more than 0.1% of any dividend or other payment made by the Company to Company securityholders and (y) voting and governance position as the holder of such Share would have been in had the Series C Preferred Stock issued to the Insider Holders been cancelled for no consideration if, upon the issuance of the Remedial Shares pursuant to the exercise of the Remedial Rights, the Series C Preferred Stock issued to the Insider Holders would not in the aggregate constitute more than 0.1% of any Company securities entitled to vote (as a single class or otherwise) on or consent (as a single class or otherwise) to any matter (including without limitation pursuant to Section 4(b) of the Series C Certificate)), (2) no Remedial Shares (or rights to acquire Remedial Shares other than the Remedial Rights) shall have been issued to any Insider Holder or any “associate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of an Insider Holder and (3) any Remedial Right beneficially owned from time to time by any Insider Holder, any “associate” (as such term is defined in Rule 12b-2 of the General Rules and Regulations under the Exchange Act) of an Insider Holder or any direct or indirect transferee of an Insider Holder or of any such “associate” shall be rendered unexercisable pursuant to the definitive documentation for such Remedial Rights (the applicable of clause (a) and clause (b) is referred to as the “Series C Condition”). THE OFFEROR BELIEVES THAT THIS CONDITION IS WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD; HOWEVER, THE AMENDED COMPANY RECOMMENDATION STATES THAT THE SPECIAL COMMITTEE BELIEVES THAT IT IS NOT. Because the Offeror disagrees, on October 27, 2023, the Offeror initiated legal proceedings against the company, BOARD Chairperson

Aliki Paliou, Company Chief Executive Officer Andreas Michalopoulos, former Company directors Symeon Palios, Giannakis (John) Evangelou, Antonios Karavias, Christos Glavanis and Reidar Brekke and controlling shareholders Mango and Mitzela. See section 18 of the Offer to Purchase – “legal proceedings” for further information regarding this litigation. |

| |

● |

Series B Condition: We are not obligated to purchase any Shares unless the Series B Certificate either (a) shall have been validly cancelled or (b) shall not have been amended (the applicable of clause (a) and clause (b), is referred to as the Series B Condition). THIS CONDITION IS SOLELY WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

| |

● |

Board Representation Condition: We are not obligated to purchase any Shares unless the size of the Board shall remain fixed at five members, with at least three of such authorized five Board seats either (a) then-being occupied by persons having been designated by us, (b) then-being vacant, with the company having publicly committed on a binding basis to fill such vacancies with persons designated by us or (c) then-being occupied by directors who shall have publicly submitted their irrevocable resignations from the Board, effective no later than the Offeror’s purchase of the Shares tendered in the Offer, which such resignations shall have been publicly accepted by the Company (with the Company having publicly committed on a binding basis to fill the resulting vacancies with persons designated by us) (the applicable of clause (a), clause (b) and clause (c) is referred to as the Board Representation Condition). THIS CONDITION IS SOLELY WITHIN THE CONTROL OF THE COMPANY AND THE MEMBERS OF ITS BOARD. |

The Offer is also subject to other customary conditions;

however, the Offer is not conditioned upon our obtaining financing or any due diligence review of the Company. See Section 14

of the Offer to Purchase — “CONDITIONS OF THE OFFER”.

The Offer Conditions must be satisfied at or before

the Expiration Date and Time, as it may be extended.

Does

the Offeror require any approvals from any governmental authorities in order to acquire the Shares pursuant to the Offer?

The Offeror is not aware of any approvals from

any governmental authorities being required in order to acquire the Shares pursuant to the Offer. However, as of the date of this Supplement,

the Company has not made available to the Offeror the non-public information that the Offeror would require in order to definitely confirm

that no such approvals are required. If we later determine that any such approval is required, we reserve the right to amend the Offer

accordingly.

Are

there any limitations on the number of Shares that may be validly tendered in the Offer?

No. There are no limitations on the

number of Shares that may be validly tendered into the Offer.

IF I DECIDE NOT TO TENDER, HOW WILL THE OFFER

AFFECT MY SHARES?

If all of the Offer Conditions as set forth in

Section 14 — “CONDITIONS OF THE OFFER” are satisfied or waived and we consummate the Offer, the number of shareholders

and the number of Shares that are held by the public will be reduced and such number of shareholders and such number of Shares may be

so small that there may no longer be an active public trading market (or, possibly, there may not be any public trading market) for the

Shares, and to the extent that any such trading market exists, it may have more limited liquidity. Also, it is possible that Performance

may no longer be required to make filings with the SEC or otherwise comply with the rules of the SEC relating to publicly held companies,

and it may determine not to do so.

If we consummate the Offer, the Offeror will

have designated a majority of the members of the Board and have acquired at least a majority of the issued and outstanding Shares on

a fully diluted basis (assuming the exercise or conversion of all then-outstanding Options and other derivative securities

regardless of the exercise or conversion price, the vesting schedule or other terms and conditions thereof), which will represent at

least a majority of the voting power of the Company securities, and (if the Series C Condition is satisfied pursuant to clause

(a) thereof) the Shares will be the sole Company securities outstanding having the right or purporting to have the right to

vote with respect to the election of directors. As a result, we may be determined to have acquired control of the Company, and the

ability of the shareholders other than us to exercise influence over Company decision-making may be limited. If, and to the extent

that, the Offeror acquires control of the Company, the Offeror intends to conduct a review, subject to applicable law, of the

Company and its assets, corporate structure, capitalization, operations, properties, policies, management and personnel and consider

and determine what, if any, changes would be desirable in light of the circumstances which then exist, which may include selling all

or any portion of the Shares acquired by the Offeror in the Offer and/or causing the Company to sell all or any portion of the

assets of the Company or conduct one or more strategic transactions. In addition, if the Offeror acquires control of the Company,

the Offeror expects to take further steps to improve the governance and management of the Company, which may among other things

include making changes to the composition of the management team of the Company and/or making changes to the organizational

documents of the Company, including, without limitation, the Articles and the Bylaws.

In addition, if the Offeror and its affiliates

acquire a majority of the voting power of the Company’s outstanding securities, such control, among other things, would allow the

Offeror and its affiliates to determine the outcome of the election of directors, subject to the provisions of the Articles which provide

for a classified Board divided into three classes (to the extent that the Company continues to have a classified Board). If the Offer

is consummated, the Offeror expects to seek to implement the declassification of the Board and to seek to effect the removal and replacement

of any current members of the Board who are then-remaining on the Board.

Further, if the Offeror acquires at least two

thirds of the issued and outstanding Shares (assuming the exercise or conversion of all then-outstanding Options and other derivative

securities regardless of the exercise or conversion price, the vesting schedule or other terms and conditions thereof) and therefore at

least two-thirds of the voting power of the Company securities, the Offeror may be able to effect or determine the outcome of additional

actions (either alone or, in some cases, with the cooperation of the Board), including, without limitation, the removal of any director

or the entire Board for cause, and the amendment, alteration, change or repeal of Article I of the Articles relating to the structure

and composition of the Board. Further, if the Offer is successfully consummated but the Offeror does not acquire at least two thirds of

the voting power of the Company’s securities, the Offeror would nonetheless have the ability to block the taking by the Company

of any action that would require the affirmative vote of at least two thirds of the voting power of the Company’s securities.

If you do not validly tender your Shares into

the Offer and the Offer is nonetheless successfully consummated, you will remain a minority shareholder in the Company immediately following

the Offer and you may have a limited ability, if any, to influence the outcome of any matters that are or may be subject to shareholder

approval. As further stated above and elsewhere in the Offer to Purchase, there can be no assurance that following a successful consummation

of the Offer, the Offeror will seek to acquire any additional Shares, and your ability to sell your Shares to third parties on terms that

you find attractive may be limited.

See the “Introduction” and Section 12

— “CERTAIN EFFECTS OF THE OFFER”. See also the Q&As above entitled “What

are your purposes for the Offer and plans for the Company after the Offer is completed?” and “Mr. George

Economou directly or indirectly owns or controls other companies in the shipping industry. If the Offer is consummated, will the Company

or any Company assets be integrated or combined with or sold to any such other shipping companies?”

HOW LONG DO I HAVE TO DECIDE WHETHER TO TENDER

IN THE OFFER?

You will have until 11:59 P.M., New York City

time, on March 28, 2024, unless the Offer is extended, to tender your Shares in the Offer. If you cannot deliver everything that