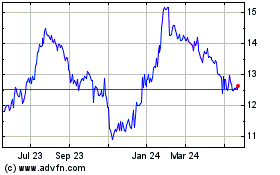

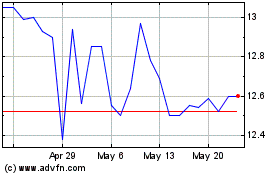

Provident Financial Holdings, Inc. (“Company”), NASDAQ GS: PROV,

the holding company for Provident Savings Bank, F.S.B. (“Bank”),

today announced earnings for the second quarter of the fiscal year

ending June 30, 2024.

The Company reported net income of $2.14

million, or $0.31 per diluted share (on 6.98 million average

diluted shares outstanding for the quarter ended December 31,

2023), down 10 percent from net income of $2.37 million, or $0.33

per diluted share (on 7.24 million average diluted shares

outstanding), in the comparable period a year ago. The decrease in

earnings was due to a $611,000 decrease in net interest income, a

$546,000 increase in non-interest expenses and an $81,000 decrease

in non-interest income, partly offset by a $911,000 change in the

provision for credit losses resulting from a $720,000 recovery of

credit losses in the quarter, in contrast to a $191,000 provision

for credit losses in the comparable quarter a year ago.

"We are closely monitoring the prevailing

uncertain economic climate and adjusting our short-term strategies

accordingly. We were encouraged by Federal Reserve Chairman

Powell’s prepared remarks on December 13, 2023, subsequent to the

Federal Open Market Committee meeting, where he outlined the

progress made to reduce inflation from its highs without a

significant increase in unemployment. We welcome the Committee’s

decision to pause implementing more restrictive monetary policies,

resulting in lower interest rates in the market generally," stated

Donavon P. Ternes, President and Chief Executive Officer of the

Company. "As we look ahead, there is a possibility that 2024 may

offer a more favorable environment for growth, allowing us to

return to less restrictive operating strategies and resume growing

our loan portfolio at a reasonable pace. Regardless, we remain

prepared to respond to improving, similar, or worsening operating

conditions," Ternes concluded.

Return on average assets for the second quarter

of fiscal 2024 was 0.66 percent, down from 0.75 percent for the

same period of fiscal 2023. Return on average stockholders’ equity

for the second quarter of fiscal 2024 was 6.56 percent, down from

7.27 percent for the comparable period of fiscal 2023.

On a sequential quarter basis, the $2.14 million

net income for the second quarter of fiscal 2024 reflects a 22

percent increase from $1.76 million in the first quarter of fiscal

2024. The increase was primarily attributable to the $1.27 million

impact from the change in the provision for credit losses resulting

from the $720,000 recovery of credit losses in the current quarter,

in contrast to a $545,000 provision for credit losses in the prior

sequential quarter and a $124,000 increase in non-interest income

(mainly due to loan prepayment fees and other income), partly

offset by a $365,000 decrease in net interest income and a $488,000

increase in non-interest expense (mainly as a result of salaries

and employee benefits, attributable to a higher adjustment for the

supplemental executive retirement plans). The recovery of credit

losses was primarily attributable to a shorter estimated life of

the loan portfolio resulting from lower market interest rates and

higher prepayment estimates. Diluted earnings per share for the

second quarter of fiscal 2024 were $0.31 per share, up 24 percent

from $0.25 per share in the first quarter of fiscal 2024. Return on

average assets was 0.66 percent for the second quarter of fiscal

2024, compared to 0.54 percent in the first quarter of fiscal 2024.

Return on average stockholders’ equity for the second quarter of

fiscal 2024 was 6.56 percent, compared to 5.40 percent for the

first quarter of fiscal 2024.

Net income decreased $558,000, or 13 percent, to

$3.90 million for the six months ended December 31, 2023 from $4.46

million in the comparable period in 2022. Diluted earnings per

share for the six months ended December 31, 2023 decreased eight

percent to $0.56 per share (on 7.00 million average diluted shares

outstanding) from $0.61 per share (on 7.27 million average diluted

shares outstanding) for the comparable six-month period last year.

The decrease in earnings was primarily attributable to a $437,000

decrease in net-interest income, a $333,000 decrease in

non-interest income (mainly due to loan prepayment fees) and a

$461,000 increase in non-interest expense (mainly as a result of

salaries and employee benefits, premises and occupancy expenses and

deposit insurance premiums and regulatory assessments), partly

offset by a $436,000 change in the provision for credit losses

resulting from the $175,000 recovery of credit losses for the six

months ended December 31, 2023, in contrast to the $261,000

provision for credit losses for the comparable six-month period

last year.

In the second quarter of fiscal 2024, net

interest income decreased $611,000, or seven percent, to $8.77

million from $9.39 million for the same quarter last year. The

decrease was primarily due to a lower net interest margin, partly

offset by a higher average balance of interest-earning assets. The

net interest margin during the second quarter of fiscal 2024

decreased 27 basis points to 2.78 percent from 3.05 percent in the

same quarter last year. The average yield on interest-earning

assets increased 70 basis points to 4.33 percent in the second

quarter of fiscal 2024 from 3.63 percent in the same quarter last

year while the average cost of interest-bearing liabilities

increased by 106 basis points to 1.69 percent in the second quarter

of fiscal 2024 from 0.63 percent in the same quarter last year. The

average balance of interest-earning assets increased three percent

to $1.26 billion in the second quarter of fiscal 2024 from $1.23

billion in the same quarter last year, primarily due to increases

in the average balance of loans receivable, partly offset by a

decrease in the average balance of investment securities.

Interest income on loans receivable increased

$2.27 million, or 22 percent, to $12.51 million in the second

quarter of fiscal 2024 from $10.24 million in the same quarter of

fiscal 2023. The increase was due to a higher average loan yield

and, to a lesser extent, a higher average loan balance. The average

yield on loans receivable increased 65 basis points to 4.66 percent

in the second quarter of fiscal 2024 from 4.01 percent in the same

quarter last year. Adjustable-rate loans of approximately $89.3

million repriced upward in the second quarter of fiscal 2024 by

approximately 97 basis points from a weighted average rate of 6.34

percent to 7.31 percent. The average balance of loans receivable

increased $53.0 million, or five percent, to $1.07 billion in the

second quarter of fiscal 2024 from $1.02 billion in the same

quarter last year. Total loans originated for investment in the

second quarter of fiscal 2024 were $20.2 million, down 73 percent

from $74.3 million in the same quarter last year. Loan principal

payments received in the second quarter of fiscal 2024 were $17.8

million, down 36 percent from $28.0 million in the same quarter

last year.

Interest income from investment securities

decreased four percent to $524,000 in the second quarter of fiscal

2024 from $548,000 for the same quarter of fiscal 2023. This

decrease was attributable to a lower average balance, partly offset

by a higher average yield. The average balance of investment

securities decreased $28.0 million, or 16 percent, to $147.2

million in the second quarter of fiscal 2024 from $175.2 million in

the same quarter last year. The decrease in the average balance was

due to scheduled principal payments on and prepayments of the

investment securities. The average yield on investment securities

increased 17 basis points to 1.42 percent in the second quarter of

fiscal 2024 from 1.25 percent for the same quarter last year. The

increase in the average yield was primarily attributable to a lower

premium amortization during the current quarter in comparison to

the same quarter last year ($137,000 vs. $203,000) due to lower

total principal repayments ($5.9 million vs. $7.6 million) and, to

a lesser extent, the upward repricing of adjustable-rate

mortgage-backed securities.

In the second quarter of fiscal 2024, the

Federal Home Loan Bank – San Francisco (“FHLB”) distributed

$197,000 in cash dividends to the Bank on its FHLB stock, up 36

percent from $145,000 in the same quarter last year, resulting in

an average yield on FHLB stock of 8.29 percent in the second

quarter of fiscal 2024 compared to 7.04 percent in the same quarter

last year. The average balance of FHLB – San Francisco stock in the

second quarter of fiscal 2024 was $9.5 million, up from $8.2

million in the same quarter of fiscal 2023.

Interest income from interest-earning deposits,

primarily cash deposited at the Federal Reserve Bank of San

Francisco, was $435,000 in the second quarter of fiscal 2024, up 80

percent from $241,000 in the same quarter of fiscal 2023. The

increase was due to a higher average yield and, to a lesser extent,

a higher average balance. The average yield earned on

interest-earning deposits in the second quarter of fiscal 2024 was

5.41 percent, up 152 basis points from 3.89 percent in the same

quarter last year. The increase in the average yield was due to a

higher average interest rate on the Federal Reserve Bank’s reserve

balances resulting from recent increases in the targeted federal

funds rate. The average balance of the Company’s interest-earning

deposits increased $7.3 million, or 30 percent, to $31.5 million in

the second quarter of fiscal 2024 from $24.2 million in the same

quarter last year.

Interest expense on deposits for the second

quarter of fiscal 2024 was $2.27 million, a 379 percent increase

from $475,000 for the same period last year. The increase in

interest expense on deposits was attributable to a higher weighted

average cost, partly offset by a lower average balance. The average

cost of deposits was 0.99 percent in the second quarter of fiscal

2024, up 79 basis points from 0.20 percent in the same quarter last

year. The increase in the average cost of deposits was primarily

attributable to an increase in higher costing time deposits,

particularly brokered certificates of deposit. The average balance

of deposits decreased $47.8 million, or five percent, to $914.6

million in the second quarter of fiscal 2024 from $962.4 million in

the same quarter last year.

Transaction account balances or “core deposits”

decreased $72.0 million, or 10 percent, to $657.6 million at

December 31, 2023 from $729.6 million at June 30, 2023, while time

deposits increased $33.4 million, or 15 percent, to $254.3 million

at December 31, 2023 from $220.9 million at June 30, 2023. The

increase in time deposits was primarily due to an increase in

brokered certificates of deposits. As of December 31, 2023,

brokered certificates of deposit totaled $122.7 million with a

weighted average cost of 5.26 percent (including broker fees), up

15 percent from $106.4 million with a weighted average cost of 4.78

percent at June 30, 2023.

Interest expense on borrowings, consisting of

FHLB – San Francisco advances, for the second quarter of fiscal

2024 increased $1.31 million, or 100 percent, to $2.62 million from

$1.31 million for the same period last year. The increase in

interest expense on borrowings was primarily the result of a higher

average balance and a higher average cost. The average balance of

borrowings increased $76.8 million, or 50 percent, to $230.5

million in the second quarter of fiscal 2024 from $153.7 million in

the same quarter last year and the average cost of borrowings

increased by 113 basis points to 4.51 percent in the second quarter

of fiscal 2024 from 3.38 percent in the same quarter last year.

At December 31, 2023, the Bank had approximately

$266.5 million of remaining borrowing capacity at the FHLB – San

Francisco. Additionally, the Bank has an unused secured borrowing

facility of approximately $183.0 million with the Federal Reserve

Bank of San Francisco and an unused unsecured federal funds

borrowing facility of $50.0 million with its correspondent bank.

The total available borrowing capacity across all sources totaled

approximately $499.5 million at December 31, 2023.

The Bank continues to work with both the FHLB -

San Francisco and Federal Reserve Bank of San Francisco to ensure

that borrowing capacity is continuously reviewed and updated in

order to be accessed seamlessly should the need arise.

During the second quarter of fiscal 2024, the

Company recorded a recovery of credit losses of $720,000 (which

includes a $41,000 recovery for unfunded commitment reserves), as

compared to a $191,000 provision for credit losses recorded during

the same period last year and a $545,000 provision for credit

losses recorded in the first quarter of fiscal 2024 (sequential

quarter). The recovery of credit losses recorded in the second

quarter of fiscal 2024 was primarily attributable to a shorter

estimated life of the loan portfolio resulting from lower market

interest rates and higher loan prepayment estimates, while the

outstanding balance of loans held for investment at December 31,

2023 remained virtually unchanged from September 30, 2023.

Non-performing assets, comprised solely of

non-accrual loans with underlying collateral located in California,

increased $450,000 or 35 percent to $1.8 million, or 0.13 percent

of total assets, at December 31, 2023, compared to $1.3 million, or

0.10 percent of total assets, at June 30, 2023. The non-performing

loans at December 31, 2023 were comprised of eight single-family

loans, while the non-performing loans at June 30, 2023 were

comprise of six single-family loans. At both December 31, 2023 and

June 30, 2023, there was no real estate owned and no accruing loans

past due 90 days or more. There were no net loan charge-offs for

the quarter ended December 31, 2023, as compared to $1,000 of net

loan recoveries for the quarter ended December 31, 2022.

Classified assets were $2.6 million at December

31, 2023 consisting of $866,000 of loans in the special mention

category and $1.7 million of loans in the substandard category.

Classified assets at June 30, 2023 were $2.3 million, consisting of

$509,000 of loans in the special mention category and $1.8 million

of loans in the substandard category.

The allowance for credit losses on gross loans

held for investment was $7.0 million, or 0.65 percent of gross

loans held for investment, at December 31, 2023, up from the $5.9

million, or 0.55 percent of gross loans held for investment, at

June 30, 2023. The increase in the allowance for credit losses was

due primarily to the adoption of the Current Expected Credit Losses

(“CECL”) methodology on July 1, 2023, which resulted in a $1.2

million increase in our allowance for credit losses, partly offset

by a $175,000 recovery of credit losses in the first six months of

fiscal 2024 (which included a $32,000 recovery for unfunded

commitment reserves). Results for reporting periods beginning after

July 1, 2023 are presented under CECL while prior period amounts

continue to be reported in accordance with previously applicable

accounting standards. Management believes that, based on currently

available information, the allowance for credit losses is

sufficient to absorb potential losses inherent in loans held for

investment at December 31, 2023 under the CECL methodology.

Non-interest income decreased by $81,000, or

eight percent, to $875,000 in the second quarter of fiscal 2024

from $956,000 in the same period last year, due primarily to

decreases in deposit account fees, card and processing fees and

other non-interest income. On a sequential quarter basis,

non-interest income increased $124,000 or 17 percent, primarily due

to higher loan servicing and other fees.

Non-interest expenses increased $546,000, or

eight percent, to $7.34 million in the second quarter of fiscal

2024 from $6.80 million for the same quarter last year, primarily

due to higher salaries and employee benefits, premises and

occupancy and professional expenses. On a sequential quarter basis,

non-interest expenses increased $488,000, or seven percent, to

$7.34 million in the second quarter of fiscal 2024 from $6.86

million in the first quarter of fiscal 2024, primarily due to an

increase in salaries and employee benefits, attributable to a

higher adjustment for the supplemental executive retirement plans,

partly offset by lower incentive compensation expenses.

The Company’s efficiency ratio, defined as

non-interest expense divided by the sum of net interest income and

non-interest income, in the second quarter of fiscal 2024 was 76.11

percent, up from 65.74 percent in the same quarter last year and

69.32 percent in the first quarter of fiscal 2024. The

deterioration in the efficiency ratio compared to both the

sequential quarter and the comparable quarter last year was due to

higher non-interest expense, coupled with a decline in revenues,

during the current quarter.

The Company’s provision for income taxes was

$884,000 for the second quarter of fiscal 2024, down 10 percent

from $981,000 in the same quarter last year but up 22 percent from

$727,000 for first quarter of fiscal 2024. The decrease during the

current quarter compared to the same quarter last year was due to a

decrease in pre-tax income, while the increase compared to the

first quarter of 2024 was due to an increase in pre-tax income. The

effective tax rate in the second quarter of fiscal 2024 was 29.2

percent as compared to 29.3 percent in the same quarter last year

and 29.2 percent for the first quarter of fiscal 2024.

The Company repurchased 62,710 shares of its

common stock at an average cost of $11.96 per share during the

quarter ended December 31, 2023, pursuant to its current stock

repurchase program. As of December 31, 2023, a total of 287,643

shares remain available for future purchase under the Company’s

current repurchase program, which expires on September 28,

2024.

The Bank currently operates 13 retail/business

banking offices in Riverside County and San Bernardino County

(Inland Empire).

The Company will host a conference call for

institutional investors and bank analysts on Tuesday, January 30,

2024 at 9:00 a.m. (Pacific) to discuss its financial results. The

conference call can be accessed by dialing 1-888-412-4131 and

referencing Conference ID number 3610756. An audio replay of the

conference call will be available through Tuesday, February 6, 2024

by dialing 1-800-770-2030 and referencing Conference ID number

3610756.

For more financial information about the Company

please visit the website at www.myprovident.com and click on the

“Investor Relations” section.

Safe-Harbor Statement

This press release contains statements that the

Company believes are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements relate to the Company’s financial condition,

liquidity, results of operations, plans, objectives, future

performance or business. You should not place undue reliance on

these statements as they are subject to various risks and

uncertainties. When considering these forward-looking statements,

you should keep in mind these risks and uncertainties, as well as

any cautionary statements the Company may make. Moreover, you

should treat these statements as speaking only as of the date they

are made and based only on information then actually known to the

Company. There are a number of important factors that could cause

future results to differ materially from historical performance and

these forward-looking statements. Factors which could cause actual

results to differ materially from the results anticipated or

implied by our forward-looking statements include, but are not

limited to: potential adverse impacts to economic conditions in our

local market areas, other markets where the Company has lending

relationships, or other aspects of the Company's business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth; changes

in the interest rate environment, including the past increases in

the Board of Governors of the Federal Reserve Board (the “Federal

Reserve”) benchmark rate and duration at which such increased

interest rate levels are maintained, which could adversely affect

our revenues and expenses, the value of assets and obligations, and

the availability and cost of capital and liquidity; the impact of

continuing inflation and the current and future monetary policies

of the Federal Reserve in response thereto; the effects of any

federal government shutdown; increased competitive pressures;

changes in the interest rate environment; changes in general

economic conditions and conditions within the securities markets;

fluctuations in deposits; liquidity issues, including our ability

to borrow funds or raise additional capital, if necessary; the

impact of bank failures or adverse developments at other banks and

related negative press about the banking industry in general on

investor and depositor sentiment; legislative and regulatory

changes, including changes in banking, securities and tax law, in

regulatory policies and principles, or the interpretation of

regulatory capital or other rules; disruptions, security breaches,

or other adverse events, failures or interruptions in, or attacks

on, our information technology systems or on the third-party

vendors who perform several of our critical processing functions;

the effects of climate change, severe weather events, natural

disasters, pandemics, epidemics and other public health crises,

acts of war or terrorism, and other external events on our

business; and other factors described in the Company’s latest

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and

other reports filed with and furnished to the Securities and

Exchange Commission (“SEC”) - which are available on our website at

www.myprovident.com and on the SEC’s website at www.sec.gov. We do

not undertake and specifically disclaim any obligation to revise

any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements whether as a result of new information, future

events or otherwise. These risks could cause our actual results for

fiscal 2024 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of us and could

negatively affect our operating and stock price performance.

Contacts:

Donavon P. TernesPresident and Chief

Executive Officer

Tam B. NguyenSenior Vice President andChief

Financial Officer(951) 686-6060

|

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of Financial

Condition(Unaudited –In Thousands, Except Share and Per

Share Information) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

| |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

46,878 |

|

|

$ |

57,978 |

|

|

$ |

65,849 |

|

|

$ |

60,771 |

|

|

$ |

24,840 |

|

|

Investment securities - held to maturity, at cost with no allowance

for credit losses |

|

|

141,692 |

|

|

|

147,574 |

|

|

|

154,337 |

|

|

|

161,336 |

|

|

|

168,232 |

|

|

Investment securities - available for sale, at fair value with no

allowance for credit losses |

|

|

1,996 |

|

|

|

2,090 |

|

|

|

2,155 |

|

|

|

2,251 |

|

|

|

2,377 |

|

|

Loans held for investment, net of allowance for credit losses of

$7,000; $7,679; $5,946; $6,001 and $5,830, respectively; includes

$1,092; $1,061; $1,312; $1,352 and $1,345 of loans held at fair

value, respectively |

|

|

1,075,765 |

|

|

|

1,072,170 |

|

|

|

1,077,629 |

|

|

|

1,077,704 |

|

|

|

1,040,337 |

|

|

Accrued interest receivable |

|

|

4,076 |

|

|

|

3,952 |

|

|

|

3,711 |

|

|

|

3,610 |

|

|

|

3,343 |

|

|

FHLB – San Francisco stock |

|

|

9,505 |

|

|

|

9,505 |

|

|

|

9,505 |

|

|

|

8,239 |

|

|

|

8,239 |

|

|

Premises and equipment, net |

|

|

9,598 |

|

|

|

9,426 |

|

|

|

9,231 |

|

|

|

9,193 |

|

|

|

8,911 |

|

|

Prepaid expenses and other assets |

|

|

11,583 |

|

|

|

10,420 |

|

|

|

10,531 |

|

|

|

12,176 |

|

|

|

14,763 |

|

|

Total assets |

|

$ |

1,301,093 |

|

|

$ |

1,313,115 |

|

|

$ |

1,332,948 |

|

|

$ |

1,335,280 |

|

|

$ |

1,271,042 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing deposits |

|

$ |

94,030 |

|

|

$ |

105,944 |

|

|

$ |

103,007 |

|

|

$ |

108,479 |

|

|

$ |

108,891 |

|

|

Interest-bearing deposits |

|

|

817,950 |

|

|

|

825,187 |

|

|

|

847,564 |

|

|

|

874,567 |

|

|

|

836,411 |

|

|

Total deposits |

|

|

911,980 |

|

|

|

931,131 |

|

|

|

950,571 |

|

|

|

983,046 |

|

|

|

945,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings |

|

|

242,500 |

|

|

|

235,009 |

|

|

|

235,009 |

|

|

|

205,010 |

|

|

|

180,000 |

|

|

Accounts payable, accrued interest and other liabilities |

|

|

16,952 |

|

|

|

17,770 |

|

|

|

17,681 |

|

|

|

17,818 |

|

|

|

16,499 |

|

|

Total liabilities |

|

|

1,171,432 |

|

|

|

1,183,910 |

|

|

|

1,203,261 |

|

|

|

1,205,874 |

|

|

|

1,141,801 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value (2,000,000 shares authorized; none

issued and outstanding) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.01 par value; (40,000,000 shares authorized;

18,229,615; 18,229,615; 18,229,615; 18,229,615 and 18,229,615

shares issued respectively; 6,946,348; 7,007,058; 7,043,170;

7,033,963 and 7,132,270 shares outstanding, respectively) |

|

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

Additional paid-in capital |

|

|

99,565 |

|

|

|

99,554 |

|

|

|

99,505 |

|

|

|

98,962 |

|

|

|

98,732 |

|

|

Retained earnings |

|

|

208,396 |

|

|

|

207,231 |

|

|

|

207,274 |

|

|

|

206,449 |

|

|

|

205,117 |

|

|

Treasury stock at cost (11,283,267; 11,222,557; 11,186,445;

11,195,652 and 11,097,345 shares, respectively) |

|

|

(178,476 |

) |

|

|

(177,732 |

) |

|

|

(177,237 |

) |

|

|

(176,163 |

) |

|

|

(174,758 |

) |

|

Accumulated other comprehensive loss, net of tax |

|

|

(7 |

) |

|

|

(31 |

) |

|

|

(38 |

) |

|

|

(25 |

) |

|

|

(33 |

) |

|

Total stockholders’ equity |

|

|

129,661 |

|

|

|

129,205 |

|

|

|

129,687 |

|

|

|

129,406 |

|

|

|

129,241 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,301,093 |

|

|

$ |

1,313,115 |

|

|

$ |

1,332,948 |

|

|

$ |

1,335,280 |

|

|

$ |

1,271,042 |

|

|

|

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of

Operations(Unaudited - In Thousands, Except Per Share

Information) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, net |

|

$ |

12,509 |

|

|

$ |

10,237 |

|

$ |

24,685 |

|

|

$ |

19,337 |

|

|

Investment securities |

|

|

524 |

|

|

|

548 |

|

|

1,048 |

|

|

|

1,084 |

|

|

FHLB – San Francisco stock |

|

|

197 |

|

|

|

145 |

|

|

376 |

|

|

|

268 |

|

|

Interest-earning deposits |

|

|

435 |

|

|

|

241 |

|

|

898 |

|

|

|

380 |

|

|

Total interest income |

|

|

13,665 |

|

|

|

11,171 |

|

|

27,007 |

|

|

|

21,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking and money market deposits |

|

|

72 |

|

|

|

61 |

|

|

129 |

|

|

|

121 |

|

|

Savings deposits |

|

|

73 |

|

|

|

44 |

|

|

111 |

|

|

|

88 |

|

|

Time deposits |

|

|

2,128 |

|

|

|

370 |

|

|

3,918 |

|

|

|

583 |

|

|

Borrowings |

|

|

2,618 |

|

|

|

1,311 |

|

|

4,936 |

|

|

|

1,927 |

|

|

Total interest expense |

|

|

4,891 |

|

|

|

1,786 |

|

|

9,094 |

|

|

|

2,719 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

8,774 |

|

|

|

9,385 |

|

|

17,913 |

|

|

|

18,350 |

|

| (Recovery of) provision for

credit losses |

|

|

(720 |

) |

|

|

191 |

|

|

(175 |

) |

|

|

261 |

|

| Net interest income, after

(recovery of) provision for credit losses |

|

|

9,494 |

|

|

|

9,194 |

|

|

18,088 |

|

|

|

18,089 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan servicing and other fees |

|

|

124 |

|

|

|

115 |

|

|

103 |

|

|

|

223 |

|

|

Deposit account fees |

|

|

299 |

|

|

|

327 |

|

|

587 |

|

|

|

670 |

|

|

Card and processing fees |

|

|

333 |

|

|

|

367 |

|

|

686 |

|

|

|

748 |

|

|

Other |

|

|

119 |

|

|

|

147 |

|

|

250 |

|

|

|

318 |

|

|

Total non-interest income |

|

|

875 |

|

|

|

956 |

|

|

1,626 |

|

|

|

1,959 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

4,569 |

|

|

|

4,384 |

|

|

8,683 |

|

|

|

8,523 |

|

|

Premises and occupancy |

|

|

903 |

|

|

|

796 |

|

|

1,806 |

|

|

|

1,657 |

|

|

Equipment |

|

|

346 |

|

|

|

258 |

|

|

633 |

|

|

|

569 |

|

|

Professional |

|

|

410 |

|

|

|

310 |

|

|

882 |

|

|

|

902 |

|

|

Sales and marketing |

|

|

181 |

|

|

|

175 |

|

|

349 |

|

|

|

322 |

|

|

Deposit insurance premiums and regulatory assessments |

|

|

209 |

|

|

|

139 |

|

|

406 |

|

|

|

274 |

|

|

Other |

|

|

726 |

|

|

|

736 |

|

|

1,441 |

|

|

|

1,492 |

|

|

Total non-interest expense |

|

|

7,344 |

|

|

|

6,798 |

|

|

14,200 |

|

|

|

13,739 |

|

| Income before income

taxes |

|

|

3,025 |

|

|

|

3,352 |

|

|

5,514 |

|

|

|

6,309 |

|

| Provision for income

taxes |

|

|

884 |

|

|

|

981 |

|

|

1,611 |

|

|

|

1,848 |

|

|

Net income |

|

$ |

2,141 |

|

|

$ |

2,371 |

|

$ |

3,903 |

|

|

$ |

4,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

|

$ |

0.31 |

|

|

$ |

0.33 |

|

$ |

0.56 |

|

|

$ |

0.62 |

|

| Diluted earnings per

share |

|

$ |

0.31 |

|

|

$ |

0.33 |

|

$ |

0.56 |

|

|

$ |

0.61 |

|

| Cash dividends per

share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

$ |

0.28 |

|

|

$ |

0.28 |

|

| |

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of

Operations – Sequential Quarters(Unaudited – In Thousands,

Except Per Share Information) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

| |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

| |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

2022 |

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, net |

|

$ |

12,509 |

|

|

$ |

12,176 |

|

|

$ |

11,826 |

|

|

$ |

11,028 |

|

|

$ |

10,237 |

|

|

Investment securities |

|

|

524 |

|

|

|

524 |

|

|

|

537 |

|

|

|

548 |

|

|

|

548 |

|

|

FHLB – San Francisco stock |

|

|

197 |

|

|

|

179 |

|

|

|

142 |

|

|

|

146 |

|

|

|

145 |

|

|

Interest-earning deposits |

|

|

435 |

|

|

|

463 |

|

|

|

410 |

|

|

|

286 |

|

|

|

241 |

|

|

Total interest income |

|

|

13,665 |

|

|

|

13,342 |

|

|

|

12,915 |

|

|

|

12,008 |

|

|

|

11,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking and money market deposits |

|

|

72 |

|

|

|

57 |

|

|

|

50 |

|

|

|

56 |

|

|

|

61 |

|

|

Savings deposits |

|

|

73 |

|

|

|

38 |

|

|

|

38 |

|

|

|

42 |

|

|

|

44 |

|

|

Time deposits |

|

|

2,128 |

|

|

|

1,790 |

|

|

|

1,387 |

|

|

|

781 |

|

|

|

370 |

|

|

Borrowings |

|

|

2,618 |

|

|

|

2,318 |

|

|

|

2,206 |

|

|

|

1,728 |

|

|

|

1,311 |

|

|

Total interest expense |

|

|

4,891 |

|

|

|

4,203 |

|

|

|

3,681 |

|

|

|

2,607 |

|

|

|

1,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

8,774 |

|

|

|

9,139 |

|

|

|

9,234 |

|

|

|

9,401 |

|

|

|

9,385 |

|

| (Recovery of) provision for

credit losses |

|

|

(720 |

) |

|

|

545 |

|

|

|

(56 |

) |

|

|

169 |

|

|

|

191 |

|

| Net interest income, after

(recovery of) provision for credit losses |

|

|

9,494 |

|

|

|

8,594 |

|

|

|

9,290 |

|

|

|

9,232 |

|

|

|

9,194 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan servicing and other fees |

|

|

124 |

|

|

|

(21 |

) |

|

|

87 |

|

|

|

104 |

|

|

|

115 |

|

|

Deposit account fees |

|

|

299 |

|

|

|

288 |

|

|

|

298 |

|

|

|

328 |

|

|

|

327 |

|

|

Card and processing fees |

|

|

333 |

|

|

|

353 |

|

|

|

416 |

|

|

|

361 |

|

|

|

367 |

|

|

Other |

|

|

119 |

|

|

|

131 |

|

|

|

334 |

|

|

|

188 |

|

|

|

147 |

|

|

Total non-interest income |

|

|

875 |

|

|

|

751 |

|

|

|

1,135 |

|

|

|

981 |

|

|

|

956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

4,569 |

|

|

|

4,114 |

|

|

|

4,855 |

|

|

|

4,359 |

|

|

|

4,384 |

|

|

Premises and occupancy |

|

|

903 |

|

|

|

903 |

|

|

|

947 |

|

|

|

843 |

|

|

|

796 |

|

|

Equipment |

|

|

346 |

|

|

|

287 |

|

|

|

304 |

|

|

|

279 |

|

|

|

258 |

|

|

Professional |

|

|

410 |

|

|

|

472 |

|

|

|

355 |

|

|

|

260 |

|

|

|

310 |

|

|

Sales and marketing |

|

|

181 |

|

|

|

168 |

|

|

|

118 |

|

|

|

182 |

|

|

|

175 |

|

|

Deposit insurance premiums and regulatory assessments |

|

|

209 |

|

|

|

197 |

|

|

|

192 |

|

|

|

191 |

|

|

|

139 |

|

|

Other |

|

|

726 |

|

|

|

715 |

|

|

|

836 |

|

|

|

810 |

|

|

|

736 |

|

|

Total non-interest expense |

|

|

7,344 |

|

|

|

6,856 |

|

|

|

7,607 |

|

|

|

6,924 |

|

|

|

6,798 |

|

| Income before income

taxes |

|

|

3,025 |

|

|

|

2,489 |

|

|

|

2,818 |

|

|

|

3,289 |

|

|

|

3,352 |

|

| Provision for income

taxes |

|

|

884 |

|

|

|

727 |

|

|

|

1,010 |

|

|

|

966 |

|

|

|

981 |

|

| Net income |

|

$ |

2,141 |

|

|

$ |

1,762 |

|

|

$ |

1,808 |

|

|

$ |

2,323 |

|

|

$ |

2,371 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

|

$ |

0.31 |

|

|

$ |

0.25 |

|

|

$ |

0.26 |

|

|

$ |

0.33 |

|

|

$ |

0.33 |

|

| Diluted earnings per

share |

|

$ |

0.31 |

|

|

$ |

0.25 |

|

|

$ |

0.26 |

|

|

$ |

0.33 |

|

|

$ |

0.33 |

|

| Cash dividends per

share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.14 |

|

| |

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands, Except Share and Per Share Information) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of and For the |

|

| |

|

Quarter Ended |

|

Six Months Ended |

|

| |

|

December 31, |

|

December 31, |

|

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| SELECTED FINANCIAL

RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.66 |

% |

|

0.75 |

% |

|

0.60 |

% |

|

0.72 |

% |

| Return on average

stockholders' equity |

|

|

6.56 |

% |

|

7.27 |

% |

|

5.98 |

% |

|

6.85 |

% |

| Stockholders’ equity to total

assets |

|

|

9.97 |

% |

|

10.17 |

% |

|

9.97 |

% |

|

10.17 |

% |

| Net interest spread |

|

|

2.64 |

% |

|

3.00 |

% |

|

2.70 |

% |

|

3.01 |

% |

| Net interest margin |

|

|

2.78 |

% |

|

3.05 |

% |

|

2.83 |

% |

|

3.05 |

% |

| Efficiency ratio |

|

|

76.11 |

% |

|

65.74 |

% |

|

72.68 |

% |

|

67.65 |

% |

| Average interest-earning

assets to average interest-bearing liabilities |

|

|

110.27 |

% |

|

110.14 |

% |

|

110.22 |

% |

|

110.34 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED FINANCIAL

DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.31 |

|

$ |

0.33 |

|

$ |

0.56 |

|

$ |

0.62 |

|

| Diluted earnings per

share |

|

$ |

0.31 |

|

$ |

0.33 |

|

$ |

0.56 |

|

$ |

0.61 |

|

| Book value per share |

|

$ |

18.67 |

|

$ |

18.12 |

|

$ |

18.67 |

|

$ |

18.12 |

|

| Shares used for basic EPS

computation |

|

|

6,968,460 |

|

|

7,184,652 |

|

|

6,992,565 |

|

|

7,229,015 |

|

| Shares used for diluted EPS

computation |

|

|

6,980,856 |

|

|

7,236,451 |

|

|

7,004,042 |

|

|

7,273,470 |

|

| Total shares issued and

outstanding |

|

|

6,946,348 |

|

|

7,132,270 |

|

|

6,946,348 |

|

|

7,132,270 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS ORIGINATED FOR

INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family |

|

$ |

8,660 |

|

$ |

57,079 |

|

$ |

21,112 |

|

$ |

114,128 |

|

|

Multi-family |

|

|

6,608 |

|

|

8,663 |

|

|

11,721 |

|

|

32,859 |

|

|

Commercial real estate |

|

|

4,936 |

|

|

7,025 |

|

|

5,875 |

|

|

10,350 |

|

|

Construction |

|

|

— |

|

|

1,388 |

|

|

— |

|

|

1,388 |

|

| Commercial business loans |

|

|

— |

|

|

190 |

|

|

— |

|

|

190 |

|

|

Total loans originated for investment |

|

$ |

20,204 |

|

$ |

74,345 |

|

$ |

38,708 |

|

$ |

158,915 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands, Except Share and Per Share Information) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of and For the |

|

| |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

| |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

| |

|

12/31/23 |

|

09/30/23 |

|

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

| SELECTED FINANCIAL

RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.66 |

% |

|

0.54 |

% |

|

0.55 |

% |

|

0.72 |

% |

|

0.75 |

% |

| Return on average

stockholders' equity |

|

|

6.56 |

% |

|

5.40 |

% |

|

5.52 |

% |

|

7.12 |

% |

|

7.27 |

% |

| Stockholders’ equity to total

assets |

|

|

9.97 |

% |

|

9.84 |

% |

|

9.73 |

% |

|

9.69 |

% |

|

10.17 |

% |

| Net interest spread |

|

|

2.64 |

% |

|

2.75 |

% |

|

2.76 |

% |

|

2.90 |

% |

|

3.00 |

% |

| Net interest margin |

|

|

2.78 |

% |

|

2.88 |

% |

|

2.88 |

% |

|

3.00 |

% |

|

3.05 |

% |

| Efficiency ratio |

|

|

76.11 |

% |

|

69.32 |

% |

|

73.36 |

% |

|

66.69 |

% |

|

65.74 |

% |

| Average interest-earning

assets to average interest-bearing liabilities |

|

|

110.27 |

% |

|

110.17 |

% |

|

110.18 |

% |

|

110.23 |

% |

|

110.14 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED FINANCIAL

DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.31 |

|

$ |

0.25 |

|

$ |

0.26 |

|

$ |

0.33 |

|

$ |

0.33 |

|

| Diluted earnings per

share |

|

$ |

0.31 |

|

$ |

0.25 |

|

$ |

0.26 |

|

$ |

0.33 |

|

$ |

0.33 |

|

| Book value per share |

|

$ |

18.67 |

|

$ |

18.44 |

|

$ |

18.41 |

|

$ |

18.40 |

|

$ |

18.12 |

|

| Average shares used for basic

EPS |

|

|

6,968,460 |

|

|

7,016,670 |

|

|

7,031,674 |

|

|

7,080,817 |

|

|

7,184,652 |

|

| Average shares used for

diluted EPS |

|

|

6,980,856 |

|

|

7,027,228 |

|

|

7,071,644 |

|

|

7,145,583 |

|

|

7,236,451 |

|

| Total shares issued and

outstanding |

|

|

6,946,348 |

|

|

7,007,058 |

|

|

7,043,170 |

|

|

7,033,963 |

|

|

7,132,270 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS ORIGINATED FOR

INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family |

|

$ |

8,660 |

|

$ |

12,452 |

|

$ |

12,271 |

|

$ |

39,543 |

|

$ |

57,079 |

|

|

Multi-family |

|

|

6,608 |

|

|

5,113 |

|

|

6,804 |

|

|

10,660 |

|

|

8,663 |

|

|

Commercial real estate |

|

|

4,936 |

|

|

939 |

|

|

5,207 |

|

|

3,422 |

|

|

7,025 |

|

|

Construction |

|

|

— |

|

|

— |

|

|

— |

|

|

260 |

|

|

1,388 |

|

| Commercial business loans |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

190 |

|

|

Total loans originated for investment |

|

$ |

20,204 |

|

$ |

18,504 |

|

$ |

24,282 |

|

$ |

53,885 |

|

$ |

74,345 |

|

|

|

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

|

As of |

|

|

As of |

|

|

As of |

|

|

As of |

|

| |

|

12/31/23 |

|

|

09/30/23 |

|

|

06/30/23 |

|

|

03/31/23 |

|

|

12/31/22 |

|

| ASSET QUALITY RATIOS

AND DELINQUENT LOANS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recourse reserve for loans

sold |

|

$ |

31 |

|

|

$ |

33 |

|

|

$ |

33 |

|

|

$ |

160 |

|

|

$ |

160 |

|

| Allowance for credit losses on

loans held for investment |

|

$ |

7,000 |

|

|

$ |

7,679 |

|

|

$ |

5,946 |

|

|

$ |

6,001 |

|

|

$ |

5,830 |

|

| Non-performing loans to loans

held for investment, net |

|

|

0.16 |

% |

|

|

0.13 |

% |

|

|

0.12 |

% |

|

|

0.09 |

% |

|

|

0.09 |

% |

| Non-performing assets to total

assets |

|

|

0.13 |

% |

|

|

0.10 |

% |

|

|

0.10 |

% |

|

|

0.07 |

% |

|

|

0.08 |

% |

| Allowance for credit losses to

gross loans held for investment |

|

|

0.65 |

% |

|

|

0.72 |

% |

|

|

0.55 |

% |

|

|

0.56 |

% |

|

|

0.56 |

% |

| Net loan charge-offs

(recoveries) to average loans receivable (annualized) |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

|

|

— |

% |

| Non-performing loans |

|

$ |

1,750 |

|

|

$ |

1,361 |

|

|

$ |

1,300 |

|

|

$ |

945 |

|

|

$ |

956 |

|

| Loans 30 to 89 days

delinquent |

|

$ |

340 |

|

|

$ |

74 |

|

|

$ |

1 |

|

|

$ |

963 |

|

|

$ |

4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

|

12/31/23 |

|

09/30/23 |

|

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

(Recovery) recourse provision for loans sold |

|

$ |

(2 |

) |

|

$ |

— |

|

|

$ |

(127 |

) |

|

$ |

— |

|

|

$ |

— |

|

| (Recovery of) provision for

credit losses |

|

$ |

(720 |

) |

|

$ |

545 |

|

|

$ |

(56 |

) |

|

$ |

169 |

|

|

$ |

191 |

|

| Net loan charge-offs

(recoveries) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(1 |

) |

|

$ |

(2 |

) |

|

$ |

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

As of |

|

As of |

|

As of |

|

As of |

|

| |

|

12/31/2023 |

|

09/30/2023 |

|

06/30/2023 |

|

03/31/2023 |

|

12/31/2022 |

|

| REGULATORY CAPITAL

RATIOS (BANK): |

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 leverage ratio |

|

9.48 |

% |

9.25 |

% |

9.59 |

% |

9.59 |

% |

9.55 |

% |

| Common equity tier 1 capital

ratio |

|

18.20 |

% |

17.91 |

% |

18.50 |

% |

17.90 |

% |

17.87 |

% |

| Tier 1 risk-based capital

ratio |

|

18.20 |

% |

17.91 |

% |

18.50 |

% |

17.90 |

% |

17.87 |

% |

| Total risk-based capital

ratio |

|

19.24 |

% |

19.06 |

% |

19.38 |

% |

18.78 |

% |

18.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

Balance |

|

Rate(1) |

|

|

Balance |

|

Rate(1) |

|

| INVESTMENT

SECURITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Held to maturity (at

cost): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. SBA securities |

|

$ |

630 |

|

|

5.85 |

% |

|

$ |

713 |

|

|

3.60 |

% |

| U.S. government sponsored

enterprise MBS |

|

|

137,205 |

|

|

1.50 |

|

|

|

163,612 |

|

|

1.40 |

|

| U.S. government sponsored

enterprise CMO |

|

|

3,857 |

|

|

2.17 |

|

|

|

3,907 |

|

|

2.20 |

|

|

Total investment securities held to maturity |

|

$ |

141,692 |

|

|

1.54 |

% |

|

$ |

168,232 |

|

|

1.43 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Available for sale (at

fair value): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. government agency

MBS |

|

$ |

1,314 |

|

|

3.47 |

% |

|

$ |

1,533 |

|

|

2.48 |

% |

| U.S. government sponsored

enterprise MBS |

|

|

584 |

|

|

5.61 |

|

|

|

742 |

|

|

3.55 |

|

| Private issue CMO |

|

|

98 |

|

|

4.67 |

|

|

|

102 |

|

|

3.02 |

|

|

Total investment securities available for sale |

|

$ |

1,996 |

|

|

4.16 |

% |

|

$ |

2,377 |

|

|

2.84 |

% |

|

Total investment securities |

|

$ |

143,688 |

|

|

1.57 |

% |

|

$ |

170,609 |

|

|

1.45 |

% |

|

|

|

(1) Weighted-average yield earned on all instruments

which are included in the balance of the respective line item. |

|

|

| |

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands) |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

Balance |

|

Rate(1) |

|

|

Balance |

|

Rate(1) |

|

| LOANS HELD FOR

INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family (1 to 4 units) |

|

$ |

521,944 |

|

|

4.32 |

% |

|

$ |

479,730 |

|

|

3.82 |

% |

|

Multi-family (5 or more units) |

|

|

458,502 |

|

|

5.00 |

|

|

|

465,350 |

|

|

4.33 |

|

|

Commercial real estate |

|

|

88,640 |

|

|

6.20 |

|

|

|

88,200 |

|

|

5.08 |

|

|

Construction |

|

|

2,534 |

|

|

8.88 |

|

|

|

2,388 |

|

|

4.69 |

|

|

Other |

|

|

102 |

|

|

5.25 |

|

|

|

112 |

|

|

5.25 |

|

| Commercial business loans |

|

|

1,616 |

|

|

10.50 |

|

|

|

1,358 |

|

|

9.21 |

|

| Consumer loans |

|

|

68 |

|

|

18.50 |

|

|

|

75 |

|

|

17.13 |

|

|

Total loans held for investment |

|

|

1,073,406 |

|

|

4.79 |

% |

|

|

1,037,213 |

|

|

4.17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Advance payments of

escrows |

|

|

106 |

|

|

|

|

|

|

176 |

|

|

|

|

| Deferred loan costs, net |

|

|

9,253 |

|

|

|

|

|

|

8,778 |

|

|

|

|

| Allowance for credit

losses |

|

|

(7,000 |

) |

|

|

|

|

|

(5,830 |

) |

|

|

|

|

Total loans held for investment, net |

|

$ |

1,075,765 |

|

|

|

|

|

$ |

1,040,337 |

|

|

|

|

| Purchased loans serviced by

others included above |

|

$ |

10,239 |

|

|

5.59 |

% |

|

$ |

10,876 |

|

|

3.86 |

% |

| |

(1) Weighted-average yield

earned on all instruments, which are included in the balance of the

respective line item.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

Balance |

|

Rate(1) |

|

|

Balance |

|

Rate(1) |

|

|

DEPOSITS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Checking accounts – non

interest-bearing |

|

$ |

94,030 |

|

|

— |

% |

|

$ |

108,891 |

|

|

— |

% |

| Checking accounts –

interest-bearing |

|

|

275,396 |

|

|

0.04 |

|

|

|

331,132 |

|

|

0.04 |

|

| Savings accounts |

|

|

256,578 |

|

|

0.14 |

|

|

|

321,909 |

|

|

0.05 |

|

| Money market accounts |

|

|

31,637 |

|

|

0.82 |

|

|

|

39,807 |

|

|

0.20 |

|

| Time deposits |

|

|

254,339 |

|

|

3.76 |

|

|

|

143,563 |

|

|

1.18 |

|

|

Total deposits(2)(3) |

|

$ |

911,980 |

|

|

1.13 |

% |

|

$ |

945,302 |

|

|

0.22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brokered CDs included in time

deposits above |

|

$ |

122,700 |

|

|

5.26 |

% |

|

$ |

31,237 |

|

|

2.90 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BORROWINGS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Overnight |

|

$ |

— |

|

|

— |

% |

|

$ |

— |

|

|

— |

% |

| Three months or less |

|

|

67,500 |

|

|

4.35 |

|

|

|

95,000 |

|

|

4.52 |

|

| Over three to six months |

|

|

32,500 |

|

|

5.00 |

|

|

|

10,000 |

|

|

2.25 |

|

| Over six months to one

year |

|

|

40,000 |

|

|

5.21 |

|

|

|

35,000 |

|

|

3.74 |

|

| Over one year to two

years |

|

|

67,500 |

|

|

4.14 |

|

|

|

20,000 |

|

|

2.50 |

|

| Over two years to three

years |

|

|

20,000 |

|

|

4.72 |

|

|

|

20,000 |

|

|

2.70 |

|

| Over three years to four

years |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

| Over four years to five

years |

|

|

15,000 |

|

|

4.41 |

|

|

|

— |

|

|

— |

|

| Over five years |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

Total borrowings(4) |

|

$ |

242,500 |

|

|

4.55 |

% |

|

$ |

180,000 |

|

|

3.82 |

% |

(1) Weighted-average rate paid on all

instruments, which are included in the balance of the respective

line item.(2) Includes uninsured deposits of

approximately $140.3 million and $177.9 million at December 31,