Orgenesis Reports 143% Increase in Revenue and 316% Increase in Gross Profit for the Third Quarter of Fiscal 2018

October 15 2018 - 8:30AM

CDMO segment achieves operating profit of $2.1

million

Orgenesis Inc. (Nasdaq:ORGS), a manufacturer, service provider and

developer of advanced cell therapies, today reported financial

results and provided a business update for the fiscal third quarter

ended August 31, 2018.

Fiscal Q3 2018 financial highlights

include:

- Revenue increased 143% to $6.2 million, as compared to $2.6

million for the same period last year.

- Gross profit increased 310% to $2.9 million, as compared to

$695,000 for the same period last year.

- Gross margin increased to 45.7%, versus 27.1% for the third

quarter of 2017.

- CDMO segment recorded an operating profit of $2.1 million.

- Quarter ended with $16.7 million of cash and approximately $30

million of shareholders’ equity.

Vered Caplan, CEO of Orgenesis, commented, “We

continue to generate strong growth and achieved record revenue of

$6.2 million for the third quarter of 2018. At the same time,

we continue to expand our gross margin, and generated gross profit

of $2.9 million, a 310% increase over the same period last

year. We attribute this growth to the traction our CDMO

segment is gaining within the marketplace, among both new

customers, as well as expanded services among our existing

customers. I am especially pleased to report that our CDMO segment

achieved an operating profit of $2.1 million for the third quarter

of 2018. On the heels of our recent financing with a leading

healthcare fund, we now have over $16.7 million of cash, positive

working capital and approximately $30 million of shareholders’

equity. Overall, we believe that we are well positioned

heading into the fourth quarter and 2019.”

“In addition to our strong financial

performance, we achieved a number of important operational

milestones as we further evolve our business. Specifically,

we are aligning ourselves with regional partners in order to set up

a network of leading healthcare facilities with interest in

developing our autologous cell therapy products. Our goal is

to leverage our IP, technical and manufacturing expertise to allow

a closed system manufacturing approach for our development stage

products. Towards this end, we announced a collaboration with

Secant Group to develop and commercialize biodegradable and

injectable scaffold technologies. We also announced a

partnership with BGN Technologies and the National Institute for

Biotechnology in the Negev, both affiliates of Ben-Gurion

University of the Negev, to develop and commercialize a novel

alginate scaffold technology for cell transplantation, with an

initial focus on autoimmune diseases. We are expanding our

geographic focus and recently announced a license agreement with

HekaBio K.K. to collaborate in the clinical development and

commercialization of regeneration and cell and gene therapeutic

products in Japan. Over the next few quarters, we look

forward to further elaborating on our efforts to develop a

point-of-care collaboration model, including partnerships to expand

our footprint, licensing of new therapies, and the addition of new

production technologies.”

Financial Results

Revenue for the three months ended August 31,

2018 increased 143% to $6.2 million, as compared to $2.6 million

for the three months ended August 31, 2017. Gross profit

increased to $2.9 million for the three months ended August 31,

2018, as compared to $695,000 for the same period last year.

Operating loss was $645,000 for the three months ended August 31,

2018, as compared to $3.4 million for the same period last

year. The Company achieved an operating profit of $2.1

million within its CDMO segment compared to an operating loss of

$124,000 for the same period last year. Net loss for the

three months ended August 31, 2018 was $5 million, or $0.35 per

diluted share, as compared to $3.9 million or $0.40 per diluted

share for the three months ended August 31, 2017.

As of August 31, 2018, the Company reported

$16.7 million of cash and $30 million of shareholders’ equity.

Complete financial results are available in the

Company’s Quarterly report on Form 10-Q filed with the Securities

and Exchange Commission on October 12, 2018, which is available on

the Company’s website at www.orgenesis.com or at www.sec.gov.

About Orgenesis

Orgenesis is a vertically-integrated

biopharmaceutical company with expertise and unique experience in

cell therapy development and manufacturing. Through its

Israeli subsidiary, Orgenesis Ltd., Orgenesis is developing

technology designed to successfully reprogram human liver cells

into glucose-responsive, fully functional, Insulin Producing Cells

(IPCs). Orgenesis believes that converting the diabetic

patient's own tissue into insulin-producing cells has the potential

to overcome the significant issues of donor shortage, cost and

exposure to chronic immunosuppressive therapy associated with islet

cell transplantation. Through its Masthercell Global

subsidiary, a global contract development and manufacturing

organization (CDMO), Orgenesis is able to deliver optimized process

industrialization capacities to cell therapy organizations and

speed up the arrival of their therapies onto the market. From

technology selection to business modeling, GMP manufacturing,

process development, quality management and assay development,

Masthercell’s teams are fully committed to helping their clients

fulfill their objective of providing sustainable and affordable

therapies to their patients. Masthercell operates in a

validated and flexible facility located in the strategic center of

Europe within the Walloon healthcare cluster, Biowin. This

integrated approach supports the Company's business philosophy of

bringing to market significant life-improving medical

treatments. For more information, visit

www.orgenesis.com.

Notice Regarding Forward-Looking

Statements

This press release contains forward-looking

statements which are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended and Section

21E of the Securities and Exchange Act of 1934, as amended.

These forward-looking statements involve substantial uncertainties

and risks and are based upon our current expectations, estimates

and projections and reflect our beliefs and assumptions based upon

information available to us at the date of this release. We

caution readers that forward-looking statements are predictions

based on our current expectations about future events. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and assumptions that are

difficult to predict. Our actual results, performance or

achievements could differ materially from those expressed or

implied by the forward-looking statements as a result of a number

of factors, including, but not limited to, the success of our

reorganized CDMO operations, the success of our partnership with

Great Point, our ability to achieve and maintain overall

profitability, the sufficiency of working capital to realize our

business plans, the development of our transdifferentiation

technology as therapeutic treatment for diabetes which could, if

successful, be a cure for Type 1 Diabetes; our technology not

functioning as expected; our ability to retain key employees; our

ability to satisfy the rigorous regulatory requirements for new

procedures; our competitors developing better or cheaper

alternatives to our products and the risks and uncertainties

discussed under the heading "RISK FACTORS" in Item 1 of our Annual

Report on Form 10-K for the fiscal year ended November 30, 2017,

and in our other filings with the Securities and Exchange

Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

ContactsDavid WaldmanCrescendo

Communications, LLCTel: 212-671-1021Orgs@crescendo-ir.com

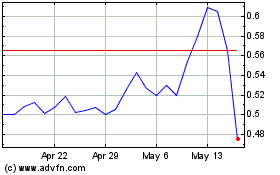

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

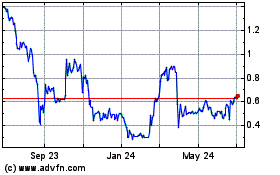

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Apr 2023 to Apr 2024