Amended Statement of Beneficial Ownership (sc 13d/a)

June 21 2019 - 5:25PM

Edgar (US Regulatory)

THE

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(

Amendment

No. 2

)*

Neonode

Inc.

(Name

of Issuer)

Common

Stock, par value, $0.001 per share

(Title

of Class of Securities)

64051M709

(CUSIP Number)

Peter Lindell, c/o Neonode Inc., Storgatan

23C, 11455, Stockholm, Sweden

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 11, 2019

(Date of Event Which Requires Filing of this

Statement)

*The

remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 64051M709

|

|

|

|

|

(1)

|

Name of reporting person:

|

|

|

|

|

|

|

|

Peter Lindell

|

|

|

|

|

|

|

(2)

|

Check the appropriate box if a member of a group

(see instructions)

|

|

|

|

|

(a) ☐

|

|

|

|

(b) ☐

|

|

|

|

|

|

(3)

|

SEC use only

|

|

|

|

|

|

|

(4)

|

Source of funds (see instructions): PF

|

|

|

|

|

|

|

(5)

|

Check if disclosure of legal proceedings is

required pursuant to Items 2(d) or 2(e): ☐

|

|

|

|

|

|

|

(6)

|

Citizenship or place of organization:

|

|

|

|

|

|

|

|

Sweden

|

|

|

|

|

|

|

Number of shares beneficially owned

by each reporting person with

|

|

|

|

(7)

|

Sole voting power: 0

|

|

|

|

|

|

|

(8)

|

Shared voting power: 1,651,587*

|

|

|

|

|

|

|

(9)

|

Sole dispositive power: 0

|

|

|

|

|

|

|

(10)

|

Shared dispositive power: 1,651,587*

|

|

(11)

|

Aggregate amount beneficially owned by each

reporting person: 1,651,587*

|

|

|

|

|

|

|

(12)

|

Check if the aggregate amount in row (11) excludes

certain shares (see instructions): ☐

|

|

|

|

|

|

|

(12)

|

Percent of class represented by amount in row

(11): 18.5%

|

|

|

|

|

|

|

(13)

|

Type of reporting person (see instructions):

IN

|

|

|

*

|

The shares are owned directly by Cidro Forvaltning AB,

an entity beneficially owned by Mr. Lindell. Includes warrants exercisable for 116,667 shares.

|

This Amendment on Schedule 13D is filed to report the appointment

of Peter Lindell (the “Reporting Person”) as a director of Neonode Inc. effective June 11, 2019. Mr. Lindell previously

reported his beneficial ownership of shares of common stock of Neonode Inc. on Schedule 13G as filed August 18, 2017 and first

amended on Schedule 13G as filed January 3, 2019.

Item 1. Security and Issuer.

This

statement relates to the common stock (“Common Stock”), of Neonode Inc., a Delaware corporation (the “Issuer”).

The address of the Issuer’s principal executive office is Storgatan 23C, 11455, Stockholm, Sweden.

Item

2. Identity and Background.

(a)

This Schedule 13D is being filed by Peter Lindell (the “Reporting Person”).

(b)

The address of the Reporting Person is c/o Neonode Inc., Storgatan 23C, 11455, Stockholm, Sweden.

(c)

The Reporting Person currently serves as Cidro Holding, a private holding company, and Chairman of Rite Internet Ventures Holding,

Innohome OY, Frank Dandy Holding AB and Acervo AB.

(d)

During the last five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors).

(e)

During the last five years, the Reporting Person has not been party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and, as a result of such proceeding, was not or is not subject to a judgment, decree of final order

enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

(f)

The Reporting Person is a citizen of Sweden.

Item

3. Source and Amount of Funds or Other Consideration.

The

funds for the purchase of the Common Stock beneficially owned by the Reporting Person came from personal funds attributable to

the Reporting Person.

Item

4. Purpose of Transaction.

The

Reporting Person acquired the Common Stock for investment purposes.

The

Reporting Person has no plans or proposals as of the date of this filing which would relate to or would result in: (a) any extraordinary

corporate transaction involving the Issuer; (b) any change in the present Board of Directors or management of the Issuer (other

than as noted in Item 6 below); (c) any material change in the present capitalization or dividend policy of the Issuer; (d) any

material change in the operating policies or corporate structure of the Issuer; (e) any change in the Issuer's charter or by-laws;

(f) the securities of the Issuer ceasing to be authorized to be quoted in the NASDAQ Stock Market; or (g) causing the Issuer to

become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934.

Item

5. Interest in Securities of the Issuer.

The

Reporting Person beneficially owns 1,651,587 shares of Common Stock. The shares are owned directly by Cidro Forvaltning AB, an

entity beneficially owned by the Reporting Person. As a result, the Reporting Person may be deemed to share voting and dispositive

power over the Common Stock with Cidro Forvaltning AB.

The number of shares beneficially owned include

warrants exercisable for 116,667 shares of Common Stock at an as adjusted purchase price of $20.00 per share. The warrants were

acquired on August 8, 2017 and became exercisable on August 8, 2018 and expire on August 8, 2020.

The

number of shares beneficially owned reflects a 1-for-10 reverse split that the Common Stock underwent on October 1, 2018.

The

Reporting Person did not have any trading activity with respect to the Common Stock over the past sixty days.

No

person other than the Reporting Person and Cidro Forvaltning AB is known to have the right to receive, or the power to direct

the receipt of dividends from, or proceeds from the sale of, the Common Stock.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

On June 11, 2019, the Reporting Person was appointed

a member of the Board of Directors of the Issuer.

Item

7. Material to be Filed as Exhibits.

None.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

June 19, 2019

|

By:

|

/s/

Peter Lindell

|

|

|

|

Name: Peter Lindell

|

Attention:

Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001)

5

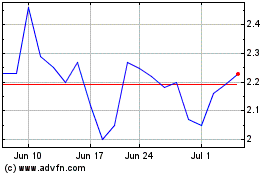

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Apr 2023 to Apr 2024