SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14D-9

(Amendment No 2)

Rule 14d-101

SOLICITATION/RECOMMENDATION STATEMENT

Under Section 14(d)(4)

of the Securities Exchange Act of 1934

MCCORMICK & SCHMICK’S SEAFOOD RESTAURANTS, INC.

(Name of Subject Company)

MCCORMICK & SCHMICK’S SEAFOOD RESTAURANTS, INC.

(Name of Person(s) Filing Statement)

Common Stock,

par value $0.001 per share

(Title of Class of Securities)

579793100

(CUSIP Number of Class of Securities)

William T.

Freeman

Chief Executive Officer

1414 NW Northrup Street, Suite 700

Portland, Oregon 97209

(503) 226-3440

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of the Person(s) Filing Statement)

With copies to:

|

|

|

|

|

Marcus J. Williams, Esq.

Davis Wright Tremaine LLP

1201 Third Avenue Suite 2200

Seattle, Washington 98101

(206) 622-3150

|

|

Thomas W. Christopher, Esq.

Joshua M. Zachariah, Esq.

Kirkland & Ellis LLP

601 Lexington Avenue

New York, New York 10022

(212) 446-4800

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Introduction

This Amendment No. 2 (“

Amendment

”) amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9, originally filed with the Securities and Exchange Commission

(“

Commission

”) on November 22, 2011, as subsequently amended on December 6, 2011 (as so amended and as further amended hereby, the “

Statement

”) by McCormick & Schmick’s Seafood Restaurants,

Inc., a Delaware corporation (the “

Company

”). The Statement relates to the tender offer (the “

Offer

”) by Landry’s MSA Co., Inc. (“

Purchaser

”), a Delaware corporation and a wholly owned

subsidiary of Landry’s Inc. (“

Landry’s

” or “

Parent

”), disclosed in a Tender Offer Statement on Schedule TO dated November 22, 2011 (such statement, as heretofore amended and as further amended from

time to time, the “

Schedule TO

”), to purchase all of the issued and outstanding shares (each, a “

Share

” and collectively, the “

Shares

”) of the Company’s common stock, par value $0.001 per share

(the “

Company Common Stock

”) at a price of $8.75 per Share, net to the seller in cash, without interest thereon and less any required withholding tax (the “

Offer Price

”). The terms and conditions of the tender offer

(the “

Offer

”) are set forth in the Schedule TO and the related offer to purchase (the “

Offer to Purchase

”) and letter of transmittal (“

Letter of Transmittal

”). Capitalized terms used and not

otherwise defined in this Amendment No. 2 shall have the meanings assigned to such terms in the Statement as originally filed with the Commission on November 22, 2011, as heretofore amended.

|

Item 3.

|

Past Contacts, Transactions, Negotiations and Agreements

.

|

(a) The Company, its Executive Officers or Affiliates

Directors’ Compensation.

Under the Company’s director compensation policy, only directors who are not employees of the Company receive compensation for their services as directors.

Non-employee directors receive an annual retainer of $20,000, plus a fee of $1,250 for each Company Board and committee meeting attended, and each receives an annual award of restricted stock having a grant date fair value of $35,000. In addition,

the members of the Audit Committee receive an additional $5,000 annual retainer and the Chairman of the Audit Committee receives an additional $20,000 annual retainer. The members of the Nominating and Governance Committee and the Compensation

Committee receive an additional $5,000 annual retainer, and the Chairs of the Nominating and Governance Committee and the Compensation Committee receive an additional $10,000 annual retainer. The Company Board adopted a program in 2008 to allow

directors to elect to receive their cash compensation for service as a director in the form of Shares, with the number of Shares to be received determined by the closing price of the Company Common Stock as of the last trading day of each fiscal

quarter related to that quarter’s Company Board fee payments. Elections to receive compensation in the form of Company Common Stock must be made during an open trading window.

In addition to the foregoing, the Company Board has assigned two directors, J. Rice Edmonds and James R. Parish, to assume certain

additional responsibilities associated with (i) evaluating and responding to the Offer, including assisting management in preparing and reviewing projections, coordinating with and overseeing the Company’s financial, legal and other

advisors, and otherwise day-to-day responsibilities for managing the Company’s response to the Offer; (ii) overseeing the management of the Company’s exploration of strategic alternatives; and (iii) overseeing the negotiation of

the Merger and the transactions contemplated in connection therewith. As compensation for these services, on May 5, 2011 a committee of the Company Board consisting of Elliott Jurgensen and Christine Deputy determined to pay to Messrs. Parish

and Edmonds $45,000 and $20,000, respectively, for services rendered during the period from April 4, 2011 through April 30, 2011. Commencing May 1, 2011, this committee determined to pay to Messrs. Parish and Edmonds additional

compensation including a monthly fee of $15,000 (for Mr. Parish) and $10,000 (for Mr. Edmonds), and an additional

- 2 -

$1,250 per day (for Mr. Parish) and $1,000 per day (for Mr. Edmonds) for each day during which

those directors spent more than four hours in the exercise of their duties, subject to (i) a monthly cap of $30,000 (for Mr. Parish) and $22,000 (for Mr. Edmonds) and (ii) periodic review by the committee and reports to the

Company Board at each subsequent regular meeting thereof. The time that Messrs. Parish and Edmonds spend at Company Board meetings does not count towards the four hour requirement described in the preceding sentence. In addition, these directors are

entitled to reimbursement of expenses. As of December 13, 2011 the total amounts paid to Messrs. Parish and Edmonds, respectively, as compensation pursuant to this arrangement were $187,500 and $98,000.

|

Item 4.

|

The Solicitation or Recommendation.

|

Item 4, “The Solicitation or Recommendation – Background of the Offer and Reasons for Recommendation” is amended and supplemented to read in its entirety as follows:

Background of the Offer and Reasons for Recommendation

Background of the Offer and Merger

The Company’s entry into

the Merger Agreement represents the culmination of an auction process that began formally on May 2, 2011, when the Company announced that the Company Board had decided to engage in a sale process as well as a broad evaluation of the

Company’s other strategic alternatives. This determination by the Company Board was, in part, a response to an unsolicited tender offer by LSRI Holdings, Inc. (“

LSRI

”), a Delaware corporation and a wholly owned subsidiary of

Landry’s, announced on April 4, 2011 and formally commenced on April 7, 2011.

On March 12, 2009,

Mr. Fertitta filed a report of beneficial ownership on Schedule 13D with the Securities and Exchange Commission (the “

SEC

”) disclosing that he personally had purchased 1,326,033 shares of Company Common Stock, constituting 9.0%

of the then outstanding Company Common Stock. The Schedule 13D indicated that Mr. Fertitta initially acquired shares for investment purposes and that he did not then have any plans or proposals with respect to an acquisition of the

Company. However, Mr. Fertitta reserved the right subsequently to devise or implement plans or proposals that related to, or would result in, an acquisition of the Company. Following this announcement, in March 2009, the Company retained the

investment banking firm of Piper Jaffray & Co. (“

Piper Jaffray

”) to advise the Company Board in connection with the Company’s response to such actions. In connection with this engagement Piper Jaffray advised the

Company Board regarding the possible adoption of a stockholder rights plan that could be used to allow the Company Board the time and ability to respond to any potential unsolicited or hostile transactions. The Company paid Piper Jaffray a fee of

$75,000 and reimbursed certain of Piper Jaffray’s expenses in connection with this engagement. On November 24, 2010, Mr. Fertitta and Fertitta Entertainment, LLC, of which Mr. Fertitta is the managing member, filed an amendment

to his Schedule 13D with the SEC disclosing that Mr. Fertitta had purchased additional shares of Company Common Stock, resulting in combined ownership of 1,476,281 shares, or 9.9%, of the then outstanding Company Common Stock.

On January 10, 2011, Mr. Fertitta filed an initial statement of beneficial ownership on Form 3 disclosing that he had purchased

additional shares of Company Common Stock, bringing his ownership to 1,496,281 shares, or 10.1%, of the then outstanding Company Common Stock.

On April 4, 2011 Mr. Fertitta issued a press release announcing that he intended to commence a tender offer (the “

Prior Offer

”) through LSRI pursuant to which he would acquire

not less than 90% and as much as 100% of the outstanding Company Common Stock for $9.25 per Share. This announcement

- 3 -

also stated that, upon consummation of the Prior Offer, Landry’s intended to complete a second step merger that would result in the acquisition of all shares of the Company Common Stock not

acquired in response to the Prior Offer or previously owned by Mr. Fertitta or his affiliates. Also on this date, Mr. Fertitta sent electronic messages to the Chairman of the Company Board, Douglas L. Schmick, Chief Executive Officer

William T. Freeman, and Director James R. Parish, in which Mr. Fertitta proposed to meet with these individuals. These communications are summarized briefly below, and the full text of these communications, and certain other facts relating to

the Prior Offer, are set forth in the Company’s Solicitation/Recommendation Statement on Schedule 14D-9, filed by the Company on April 20, 2011 (as subsequently amended, the “

Prior Schedule 14D-9

”). Certain portions of the

Prior Schedule 14D-9, constituting the sections entitled “Past Contacts, Transactions, Negotiations and Agreements,” and “The Solicitation or Recommendation – Background of the Offer and Reasons for the Recommendation” are

attached hereto as Exhibit (e)(8) and are incorporated herein by this reference.

Also on April 4, 2011, the Company

Board held a telephonic meeting that included the Company’s legal counsel, Davis Wright Tremaine LLP (“

Davis Wright Tremaine

”) and Morris, Nichols, Arsht & Tunnell LLP (“

Morris Nichols

”). At this

meeting the Company Board authorized the engagement of Piper Jaffray to act as the Company’s financial advisor based upon Piper Jaffray’s familiarity with the Company in light of its advisory relationship in 2009, as well as the

firm’s overall expertise in advising restaurant companies.

On April 7, 2011, Landry’s formally commenced the

Prior Offer, with LSRI filing a Tender Offer Statement on Schedule TO on its own behalf and on behalf of certain of its affiliates identified therein.

On April 8, 2011, the Company Board held a special meeting that included Piper Jaffray and Davis Wright Tremaine. Piper Jaffray presented its initial analysis of the Prior Offer and a qualitative

description of various strategic alternatives available to the Company. Also on this date, the Company Board received a letter from Mr. Fertitta in which Mr. Fertitta sought to engage in discussions with the Company Board regarding the

Prior Offer.

On April 12, 2011, the Company Board held a special meeting that included Piper Jaffray and Davis Wright

Tremaine. Piper Jaffray presented additional analysis of the Prior Offer. Piper Jaffray also presented background materials regarding stockholder rights plans.

On April 13, 2011, the Company issued a press release stating that, consistent with its fiduciary duties and as required by applicable law, the Company Board was reviewing the Offer to determine the

course of action that it believed was in the best interests of the Company and its stockholders. The Company advised its stockholders to take no action at that time pending conclusion of the review of the Offer by the Company Board. Also on this

date, the Company retained Kirkland & Ellis LLP (“

Kirkland & Ellis

”) to provide additional legal advice in connection with the Offer.

On April 15, 2011, Landry’s filed a Proxy Statement (the “

Withhold Proxy

”) in connection with the 2011 Annual Meeting of Stockholders of MSSR (the “

2011 Annual

Meeting

”), seeking stockholders’ authority to withhold their respective votes from being present and counting toward a quorum at the 2011 Annual Meeting, in order to prevent MSSR from conducting business at the 2011 Annual Meeting

prior to engaging in discussions with Landry’s with respect to the Prior Offer. Mr. Fertitta and his affiliates initiated various communications in connection with this solicitation until May 4, 2011, when that effort was abandoned.

- 4 -

On April 16, 2011, the Company Board held a special meeting that included Davis Wright

Tremaine. At this meeting the Company Board reviewed and discussed with management the Company’s recent financial performance and management’s expectations for future performance. Also, management presented a report on the status of the

Company’s branding and reinvestment initiatives, various financial metrics, on the Company’s capital expenditure plans and on recent operating results.

On April 17, 2011, the Company Board again convened a special meeting for the purpose of determining the recommendation, if any, to be made to the Company’s stockholders in response to the Prior

Offer. At this meeting the Company Board received a report from Piper Jaffray analyzing the Prior Offer using certain valuation methodologies for the Company and reviewing the financial terms and conditions of the Prior Offer. The directors also

received a briefing from Davis Wright Tremaine regarding the terms and conditions of the Prior Offer. The Company Board and its advisors discussed the fact that the bidder did not have a committed source of funds to consummate the transaction, and

that the Prior Offer was accompanied by a number of conditions that, in the view of the Company Board, created significant risk and uncertainty as to whether and when the Prior Offer would be consummated. Specifically, many of the conditions of the

Prior Offer were subject to the bidder’s sole discretion and many established a

de minimis

materiality standard, or none at all, making it easy for the bidder to claim that a condition was not satisfied, regardless of its significance to

the overall conditions of the Prior Offer, and thereby decline to close the Prior Offer (or, implicitly, to reduce the price or change the terms of that offer). In addition, some conditions permitted the bidder to decline to close the Prior Offer

even if it was the bidder itself that caused the failure of the condition to be satisfied. Furthermore, the Company Board determined that the Prior Offer, based on the advice of Piper Jaffray, undervalued the Company’s then-current business and

future prospects. The directors then received a briefing from Davis Wright Tremaine, Morris Nichols and Kirkland & Ellis regarding the terms of a proposed stockholder rights plan, and the fiduciary considerations arising in connection with

the adoption of such a plan. Following extensive discussion the Company Board unanimously determined that the Prior Offer was not in the best interests of the Company and its stockholders, and determined to recommend that the stockholders reject the

Prior Offer. The primary reasons for this rejection included the fact that the Prior Offer was highly conditional, placing the Company and its stockholders at substantial risk that the Prior Offer would not be consummated. As to the matter of

consummation risk, the Company Board was concerned that accepting or recommending in favor of the Prior Offer might put the Company in a position of having accepted an offer and agreed to due diligence without having a firm commitment in price or a

committed financing source, and allowing Landry’s and Mr. Fertitta to negotiate aggressively to the detriment of the Company’s stockholders on the basis of information purportedly discovered in such a due diligence investigation. The

Company Board also believed that the Prior Offer undervalued the Company’s current business and future prospects, noting, among other things, that the Company had recently announced and begun to implement a strategic revitalization plan that,

if executed according to management’s expectations, indicated a higher value for the Company. The Company Board resolved to continue to consult with its advisors regarding potential and appropriate next steps that would best serve the interests

of the Company and its stockholders.

Further, in order to provide the Company adequate time to fully evaluate the strategic

alternatives that might be available to and in the best interests of the stockholders, including continuing to pursue the Company’s business strategy, the Company Board voted unanimously to adopt the Company’s Stockholder Rights Plan,

dated as of April 20, 2011 between the Company and Computershare Trust Company, N.A., as rights agent (the “

Rights Plan

”), the form of which was previously filed as Exhibit (e)(9) to this statement. The Rights Plan was intended

to afford the Company time and latitude to explore its alternatives fully during the pendency of the Prior Offer and any competing proposals not previously approved by the Company Board. The adoption of the Rights Plan was announced in a Current

Report on Form 8-K filed on April 21, 2011. The Company Board also approved retention bonuses for certain key personnel, contingent upon those persons remaining employed with the Company through October 20, 201,1 and change of control

payments payable to certain of the Company’s named executive officers and certain other personnel in the event that within twelve (12) months of a change of control of the Company

- 5 -

such officer or employee is terminated without “cause” or for “good reason.” The total

amount of retention bonus payments authorized under this plan was $1,773,550, which included stay bonuses of $430,000 and change of control payments of $1,343,550.

On April 20, 2011, the Company formally entered into the Rights Plan and filed the Prior Schedule 14D-9, recommending that stockholders refrain from tendering their Company Common Stock in response

to the Prior Offer. The Prior Schedule 14D-9 noted that the Prior Offer was highly conditional, containing a number of conditions to closing that gave Landry’s extensive latitude as to whether, and at what price, to consummate the Prior Offer.

The Prior Schedule 14D-9 also noted that the offer price was inadequate, inasmuch as it had been timed to coincide with a trough in the recent price of the Company’s Common Stock, and at a time when the Company had begun a restaurant refinement

and service initiative that the Company Board believed would lead to significant enhancements in the Company’s financial performance.

At a special meeting of the Company Board held on April 20, 2011, the Company Board determined that it was in the best interests of the Company and all of its stockholders to engage in a sale process

as well as a broad evaluation of the Company’s other strategic alternatives such as the continuation of the Company’s existing business strategy (including the previously announced revitalization program), an acquisition of or combination

with one or more other strategic partners, or a return of capital to stockholders. Also at this meeting, the Company Board designated two directors, James R. Parish and J. Rice Edmonds, to coordinate with management and with the Company’s legal

and financial advisors in responding to the Prior Offer and the Company’s actions in connection therewith. These decisions were announced in a Current Report on Form 8-K filed on April 21, 2011, and in an amendment to the Prior Schedule

14D-9 filed on May 10, 2011.

On April 21, 2011, Mr. Fertitta issued a press release in response to the

Company’s announcement that the Company Board had rejected the Prior Offer and entered into the Rights Agreement. Mr. Fertitta requested the Company’s stockholders to authorize Landry’s to withhold their vote at the 2011 Annual

Meeting.

On April 22, 2011, the Company filed with the SEC a letter to Company stockholders recommending that Company

stockholders reject the Prior Offer and ignore the Withhold Proxy.

On April 26, 2011, Mr. Fertitta issued a press

release urging stockholders to stop, look and listen before signing or returning any proxy card distributed by the Company in connection with the 2011 Annual Meeting.

The Company Board held a regularly scheduled meeting on April 26-27, 2011. At this meeting, management provided an update to the Company Board and to Piper Jaffray regarding the Company’s

performance, including updated information regarding first-quarter financial performance against internal forecasts and analysts’ estimates. Piper Jaffray subsequently presented an analysis of the Company’s strategic alternatives. As part

of its analysis, Piper Jaffray, among other things, prepared a discounted cash flow analysis assuming discount rates for the Company ranging from 13.6% to 18.6%. Also at this meeting the Company Board resolved to delegate to Messrs. Parish and

Edmonds day to day responsibilities for oversight of the Company’s sale process and exploration of strategic alternatives, with an obligation to update the Company Board regularly regarding ongoing developments, and with Mr. Parish taking

primary responsibility. In reaching this decision the Company Board considered these directors’ experience in industry and transactional matters, their disinterest with respect to potential strategic alternatives, and their independence with

respect to management and change-of-control arrangements. Messrs. Parish and Edmonds were then excused, and the remaining directors discussed the

- 6 -

appropriateness and amount of special compensation to be paid to Messrs. Parish and Edmonds. The directors determined that Messrs. Parish and Edmonds should receive special compensation for the

services, and delegated to a committee consisting of Mr. Jurgensen and Ms. Deputy the responsibility for determining the amount of such compensation.

On May 2, 2011, the Company announced its financial results for the quarter ended March 30, 2011, which reflected a net loss of $0.7 million on revenues of $84.0 million, representing a decline

of approximately 1% in comparison to 2010. The Company’s earnings per share, or EPS, reflected a loss of ($0.04) per Share, falling short of analysts’ consensus estimates of break-even.

On May 5, 2011, this committee determined to pay to Messrs. Parish and Edmonds additional compensation including a monthly fee of

$15,000 (for Mr. Parish) and $10,000 (for Mr. Edmonds), and an additional $1,250 per day (for Mr. Parish) and $1,000 per day (for Mr. Edmonds) for each day during which those directors spent more than four hours in the exercise

of their duties, subject to (i) a monthly cap of $30,000 (for Mr. Parish) and $22,000 (for Mr. Edmonds) and (ii) periodic review by the committee and reports to the Company Board at each subsequent regular meeting thereof. The

committee also determined that the time that Messrs. Parish and Edmonds spend at Company Board meetings does not count towards the four hour requirement described in the preceding sentence. The daily compensation has subsequently been approved and

extended to continue through the closing of the Merger, and is in addition to expenses to be reimbursed to these directors. This determination was disclosed in a Current Report on Form 8-K filed by the Company on May 10, 2011 and in an

amendment to the Prior Schedule 14D-9 filed that same day.

Beginning on April 28, 2011, the Company, in consultation

with Piper Jaffray, and its legal advisors, Davis Wright Tremaine, Kirkland & Ellis and Morris Nichols, commenced an evaluation of the Company’s strategic alternatives. These alternatives included a return of capital to stockholders by

means of a special dividend or a stock repurchase program; a sale of the Company through an auction process; the acquisition of one or more companies that might be complementary to the Company’s business; and a stand-alone strategy whereby the

Company would continue to pursue and, as necessary, refine and adapt, its previously announced business strategy. The Company Board determined that it would be in the best interests of the Company and its stockholders to evaluate these various

alternatives simultaneously. Also on this date, with respect to the auction process, representatives of Piper Jaffray commenced preparation of a confidential information memorandum in collaboration with the Company’s management.

On May 2, 2011, the Company issued a press release announcing that the Company Board had determined to engage in a sale process as

well as a broad evaluation of the Company’s other strategic alternatives, with the assistance of its financial and legal advisors, to enhance value for all of the Company’s stockholders.

On May 4, 2011, the Company filed with the SEC an investor presentation in connection with the Prior Offer. Also on May 4,

2011, the Company issued a press release announcing the filing of the investor presentation and reiterating its recommendation that Company stockholders reject the Prior Offer and vote for the Company Board at the 2011 Annual Meeting.

Also on May 4, 2011, Mr. Fertitta and Landry’s sent a letter to the Company Board and issued a press release in response

to the Company’s announcement that it had begun a sale process. In the letter and press release, Mr. Fertitta and Landry’s announced that Landry’s would participate in the sale process and withdraw its Withhold Proxy.

- 7 -

The confidential information memorandum was completed on June 9, 2011. The

Company’s legal advisors prepared a form of nondisclosure and standstill agreement to be delivered to prospective bidders, and beginning on June 8, 2011, Piper Jaffray contacted a total of 118 prospective buyers, consisting of 16

prospective strategic buyers and 102 prospective financial buyers.

Of those 118 prospective buyers, a total of 50, which

included 46 prospective financial buyers and 4 prospective strategic buyers, executed a nondisclosure and standstill agreement and received and reviewed a copy of the confidential information memorandum. Among these was Landry’s, with which the

Company negotiated a nondisclosure and standstill agreement dated July 14, 2011 that required Landry’s and its affiliates (including LSRI, bidder in the Prior Offer) to withdraw the Prior Offer. The nondisclosure and standstill agreement

provided that the standstill would terminate upon the earlier of (i) March 31, 2012, (ii) the announcement that MSSR has entered into a written agreement with a third party for the sale of the Company, and (iii) the execution by

Landry’s and the Company of a definitive agreement for the sale of the Company; provided that the clauses of the standstill relating to the nomination of directors would expire 10 days prior to the nomination deadline for stockholders to elect

directors at the Company’s 2012 annual meeting of stockholders, to the extent not already expired. Landry’s had previously extended the Prior Offer from its original expiration date of May 31, 2011 to July 29, 2011; however,

pursuant to the standstill agreement, Landry’s withdrew the Prior Offer on July 15, 2011 and issued a press release announcing the withdrawal.

The Company Board held a regularly scheduled meeting on July 27-28, 2011, with representatives of Piper Jaffray and Davis Wright Tremaine present. At this meeting management offered a detailed update

on the Company’s financial performance and projections, and management and the Company Board engaged in extensive discussions about the current status of the Company’s exploration of strategic alternatives. Management reported that the

Company’s financial performance had continued to fall short of management’s expectations, and the directors asked questions of management and the Company’s advisors about the advisability of a potential stand-alone strategy whereby

the Company would continue to pursue and, as necessary, to refine and adapt, its previously announced business strategy, as well as the risks and uncertainties associated with such a strategy. These risks and uncertainties included the continuing

general economic weakness on the Company’s business and target customers, as well as management’s recent difficulties in predicting the Company’s future performance and meeting established operating targets. Representatives of Piper

Jaffray communicated to the Company Board that based on the results of the auction process at that time, none of the strategic buyers contacted in the process, other than Landry’s, had expressed significant interest in pursuing a transaction

with the Company. Piper Jaffray also described its analysis of the other strategic alternatives available to the Company. In evaluating the return of capital to stockholders by means of an extraordinary dividend, leveraged recapitalization, or stock

repurchase plan, Piper Jaffray noted that the success of any such strategy would depend, at least in part, on improvements in the Company’s financial performance.

On August 4, 2011 the Company announced its earnings for the three- and six-month periods ended June 29, 2011. Second quarter revenues declined 1.1% in comparison to the same quarter of 2010,

resulting in part in a 2.7% decline in same-store sales. Adjusted for costs associated with the sale process and exploration of alternatives, net income was $1.4 million in the second quarter of 2011 compared to net income of $1.3 million in the

same period of 2010.

Of the 49 prospective buyers that executed nondisclosure and standstill agreements and reviewed the

confidential information memorandum, 44 failed or declined to submit a first round expression of interest. Written expressions of interest were received from four prospective buyers in late July, 2011, with one additional strategic buyer verbally

indicating interest in the Company. Beginning on August 15, 2011, each of the remaining five prospective acquirors was granted access to an electronic datasite

- 8 -

containing detailed business, financial and legal information about the Company and its operations. Access to this datasite was granted to Landry’s on August 15, 2011. The five bidders,

consisting of Landry’s, one other prospective strategic buyer, and three prospective private equity buyers, participated in management meetings with William T. Freeman, the Company’s Chief Executive Officer, and Michelle M. Lantow, the

Company’s Chief Financial Officer, during the weeks of August 16 and August 22, 2011. This series of meetings included a meeting between Mr. Freeman and Ms. Lantow with executives of Landry’s senior management team on

August 18, 2011.

Following management meetings, three of the prospective buyers, including the other prospective

strategic buyer, indicated that they did not have an interest in pursuing a transaction. Beginning on September 8, 2011, Piper Jaffray transmitted final bid instruction letters and a draft merger agreement to the remaining interested parties,

including Landry’s, with instructions that the final bids were due on September 23, 2011. Landry’s received these materials on September 16, 2011. Of the two remaining parties, one indicated that it did not have an interest in

pursuing a transaction after receiving the final bid instruction letter. Landry’s, the sole remaining interested party, submitted an indicative bid of $8.75 per share on September 25, 2011, accompanied by a mark-up of the draft merger

agreement. This proposal contemplated that the acquisition would be structured as a merger without an initial tender offer. The proposal also was conditioned upon further due diligence, and included a request for a two-week exclusivity period during

which confirmatory due diligence would be completed. The Landry’s proposal also included an undertaking to deliver a debt financing commitment letter at the time of entry into a binding definitive merger agreement.

After discussing this bid with Messrs. Parish and Edmonds and with the Company’s legal advisors, representatives of Piper Jaffray

contacted Landry’s financial advisor on September 28, 2011 to express disappointment with the bid and to inquire as to the reasons for the price reduction to $8.75 per share from the $9.25 per share figure contained in the Prior Offer.

Piper Jaffray also discussed with Landry’s financial advisor the Company Board’s concerns about the consummation risk posed by Landry’s lack of committed financing for the transaction. Piper Jaffray also conveyed the Company

Board’s position that Landry’s proposed two-week exclusivity period was unacceptable because of the continuing discussions on price, the lack of committed financing and continuing negotiations regarding the terms proposed by Landry’s.

Landry’s representative indicated that the decrease in price resulted from a decline in the Company’s financial performance during the first and second quarter of 2011. On September 27, 2011, a financial acquirer that had not

submitted an expression of interest, verbally conveyed to Piper Jaffray that a business combination involving the Company and a restaurant company in which the financial acquirer was contemplating a significant investment might be possible. At the

direction of the Company Board, Piper Jaffray pursued discussions with this party through October, but the party finally indicated that there was low likelihood of the business combination materializing in the near-term or perhaps at all, and

discussions with that prospective financial acquiror then terminated. In a subsequent call with Piper Jaffray on September 29, 2011, Landry’s financial advisor indicated Landry’s willingness to deliver to the Company and its advisors

a draft of Landry’s financing commitment letter with Jefferies & Co.

On October 2, 2011 the Company Board

held a meeting via teleconference to discuss the most recent Landry’s bid with the Company’s legal and financial advisors. The Company Board also received a preliminary report from management regarding the Company’s third-quarter

financial performance, which indicated that comparable-store sales for the quarter had been disappointing. Nonetheless, the Company Board determined that the Landry’s bid of $8.75 per share did not represent a compelling offer for the holders

of the Shares, particularly in light of the lack of committed financing for the transaction and the fact that both Landry’s and its financing sources required further diligence on the Company. After a briefing by Kirkland & Ellis

regarding the merger agreement terms proposed by Landry’s, the Company

- 9 -

Board also determined that a number of those proposed terms were unacceptable to the Company, particularly

to the extent they created conditionality for the transaction and thus posed an unacceptable risk of non-consummation of a transaction at an acceptable price and within an acceptable time. The Company Board directed Piper Jaffray to communicate

these matters to Landry’s, and directed the Company’s legal advisors to negotiate with Landry’s counsel in an effort to resolve the primary outstanding issues under the merger agreement.

Piper Jaffray contacted Landry’s financial advisor on October 2, 2011 and communicated the Company Board’s concerns

regarding Landry’s proposal. After conferring with Landry’s, Landry’s financial advisor informed Piper Jaffray on October 3, 2011 that Landry’s would not propose an increase in its offer price unless the Company indicated

what price would be acceptable. Further, Kirkland & Ellis communicated the material concerns over Landry’s draft of the merger agreement to Landry’s counsel on October 4, 2011, the principal aspects of which were the

potential delays associated with a shift to a merger-only structure and the potential consummation risk that arose based upon certain aspects of Landry’s proposed representations, warranties, covenants and closing conditions.

On October 3, 2011, Landry’s delivered a supplemental letter to the Company Board, reiterating its final and best offer to

acquire the Company for $8.75 per Share. In this letter, Landry’s reiterated that the reduced offer price of $8.75 per Share was based on the continued decline in the Company’s financial performance compared to the projections set forth in

the Company’s confidential offering memorandum and management presentation. In the supplemental letter, Landry’s again requested a two week exclusivity period to complete its confirmatory due diligence and indicated that Landry’s

would deliver a financing commitment letter regarding funding for the transaction at the time of signing a definitive agreement with the Company. Landry’s requested a response from the Company regarding exclusivity by the close of business on

October 5, 2011.

Kirkland & Ellis communicated the principal concerns regarding Landry’s draft of the

merger agreement to Landry’s counsel on October 4, 2011, including the potential delay associated with a one-step merger structure (as opposed to a two-step tender offer/merger structure) and the potential consummation risk that would

exist if certain aspects of Landry’s proposed representations, warranties, covenants and closing conditions were accepted.

The Company Board convened in a special meeting via teleconference on October 6, 2011 to discuss an appropriate counter-offer to

Landry’s regarding price, and received an analysis from Piper Jaffray regarding the Company’s financial performance and valuation, as well as valuations generally in the restaurant industry. The Company Board also received an update from

management regarding the Company’s third quarter financial performance in which management reported that preliminary data suggested the Company’s comparable store sales, EBITDA (earnings before interest, taxes, depreciation and

amortization) and earnings would fall short of management’s expectations and analysts’ consensus estimates. During the meeting, the Company Board also discussed the conditionality of the proposed transaction with Landry’s and the risk

of non-consummation. The Company Board directed the Company’s counsel and financial advisors to negotiate with Landry’s and its advisors to limit, to the greatest extent possible, the conditionality of Landry’s proposal. In addition,

the Company Board decided to make a counter-offer to Landry’s of $9.50 per share. Piper Jaffray contacted Landry’s financial advisor on the evening of October 6, 2011 to communicate the Company Board’s position, and

Kirkland & Ellis reiterated to Landry’s counsel the Company’s concerns over the conditionality of the proposed transaction and its views regarding the outstanding legal issues that same day.

- 10 -

On October 9, 2011 Landry’s financial advisor informed Piper Jaffray that

Landry’s could not respond to the Company’s $9.50 per share counter-proposal until it had a chance to examine the Company’s third-quarter financial results. This information was provided to Landry’s on October 14, 2011

through Piper Jaffray. On October 17 and October 18, 2011 Landry’s financial advisor raised questions with Piper Jaffray regarding the Company’s third quarter financial performance, and Piper Jaffray responded to those questions

after consulting with the Company’s management.

On October 20, 2011 Landry’s transmitted to Douglas L.

Schmick, the Company’s Chairman, a letter stating that $8.75 per Share was Landry’s “final and best offer.” In the letter, Landry’s indicated that this price was based on Landry’s view that the Company would fail to

achieve its financial projections for 2011, which had previously been provided to Landry’s. Specifically, Landry’s indicated that it believed the Company would fail to meet its 2011 EBITDA target based on the Company’s financial

performance as of September 30, 2011 and Landry’s estimate of the Company’s performance in the fourth quarter of 2011. Landry’s estimated the EBITDA short fall to be between $2.5 million and $3.5 million, equating to a 10%

to 15% decrease in adjusted EBITDA from the 2011 projected EBITDA that was provided in the confidential information memorandum. These projections are discussed below under Item 8—”Additional Information—Certain Company

Projections.” Landry’s again requested a two-week exclusivity period for confirmatory due diligence, but agreed to a two-step tender offer/merger structure. After discussing the contents of this letter with Messrs. Parish and Edmonds and

the Company’s counsel, and based upon prior communications among the Company Board members, Piper Jaffray was directed to respond to Landry’s financial advisor that the $8.75 per Share price continued to be unacceptable. Piper Jaffray

communicated this position to Landry’s representative on October 20, 2011.

On October 21, 2011 Landry’s

financial advisor contacted Piper Jaffray to communicate that Landry’s had agreed to increase its bid price to $8.90 per share, but that this offer would expire at the end of the day on October 21, 2011. Landry’s also agreed to

furnish the Company and its counsel with a draft of a financing commitment letter from Jefferies & Co. Piper Jaffray reported this discussion to Messrs. Parish and Edmonds, who requested that Mr. Schmick convene a special Company Board

meeting for October 23, 2011.

At the October 23, 2011 telephonic board meeting, Messrs. Parish and Edmonds, along

with the Company’s legal and financial advisors, reported to the Company Board on Landry’s latest proposal. During this meeting Piper Jaffray updated the Company Board on the discussions of October 21, 2011 in which Landry’s had

indicated it would raise its offer price to $8.90. Representatives of Kirkland & Ellis reported on the most recent discussions with Landry’s counsel regarding outstanding issues under the merger agreement. The Company Board indicated

that although some progress had been made regarding resolution of the outstanding issues under the agreement, a number of Landry’s proposed terms continued to be unacceptable. The Company Board instructed Piper Jaffray to indicate to

Landry’s that it should submit its best offer and terms to be considered at the regular Company Board meeting scheduled for October 26-27, 2011. Following the telephonic Company Board meeting on October 23, 2011, Piper Jaffray

communicated the Company Board’s position to Landry’s representative and also expressed concerns about the risk of non-consummation represented by the lack of committed financing and Landry’s proposed merger agreement terms.

Landry’s representative indicated that he would convey these concerns to Landry’s and would respond promptly. Landry’s counsel delivered a draft of Jefferies’ financing commitment letter to the Company’s counsel on

October 24, 2011.

During the period from October 24 to October 26, 2011, representatives of

Kirkland & Ellis continued to negotiate with Landry’s counsel regarding provisions of the draft merger agreement that the Company Board believed raised continued consummation and timing risk.

- 11 -

On October 26, 2011, a representative of Landry’s indicated to Piper Jaffray that

Landry’s best offer was $8.90 per share. On October 27, 2011 the Company Board convened in a regular meeting. Present at this meeting were representatives of Piper Jaffray, Davis Wright Tremaine, Kirkland & Ellis and Morris Nichols, along

with members of the Company’s management. Piper Jaffray reviewed the status of negotiations with Landry’s, indicating among other things that Landry’s financial advisor had expressed Landry’s willingness to address the Company

Board’s concerns over consummation risk and a number of other outstanding issues under the merger agreement. Piper Jaffray also presented an analysis of the $8.90 per Share offer from Landry’s and prepared certain financial analyses to

evaluate a return of capital to Company shareholders. These analyses included enacting an ongoing dividend or a share repurchase program. As part of these analyses, Piper Jaffray assumed a cost of equity capital of 14.84%. Piper Jaffray also

prepared a discounted cash flow analysis assuming a discount rate of 10.5% to 15.5% for the Company. Piper also presented an analysis of the $8.90 per Share offer from Landry’s, which included a range of prices paid in comparable transactions,

in which the $8.90 price fell within the range, and a range of prices indicated by the discounted cash flow analysis that was from $10.49 to $14.03 per share. The Company Board instructed Piper Jaffray to indicate to Landry’s representative

that $8.90 per Share would be acceptable if the parties were able to reach agreement on the other terms of the transaction. Piper Jaffray communicated this to Landry’s representative on October 27, 2011.

From October 28 through November 7, 2011, Landry’s and its legal and financial advisors, as well as representatives of

Jefferies & Co., continued confirmatory due diligence. Kirkland & Ellis and Landry’s counsel continued to negotiate to resolve the remaining issues in the merger agreement. Also during this period the Company’s counsel

was afforded an opportunity to review and comment upon Landry’s financing commitment letter, and to review Landry’s financial statements, credit agreement and note indenture. Landry’s conducted meetings at the Company’s offices

with members of the Company’s management and corporate staff during the period from November 2-4, 2011.

On

November 4, 2011, Landry’s representative contacted Piper Jaffray and indicated that as a result of its confirmatory due diligence, it was decreasing its offer price to $8.50 per Share, indicating that this reduced price took into account

concerns over certain potential employment-related claims against the Company discovered during the confirmatory due diligence process and the continuing decline in performance as compared to management’s projections and. Later on

November 4, 2011, Landry’s representative contacted Piper Jaffray and indicated that Landry’s would increase its offer to $8.75 per share.

The Company Board convened in a special meeting on November 6, 2011 to consider the revised offer price and the proposed merger agreement. At this meeting, the Company Board received an updated

financial analysis from Piper Jaffray, based upon the offer price of $8.75 and upon management’s updated financial projections summarized below under Item 8 – “Additional Information – Certain Company Projections.” The

Company Board received a thorough briefing from its legal advisors regarding the terms set forth in the Merger Agreement, including the favorable resolution of the terms that had, in the view of the Company Board, given rise to unacceptable

consummation risk. The Company Board also received a briefing from its legal advisors regarding the directors’ fiduciary duties relating to the approval of the Merger Agreement, including the “fiduciary out” provision that, in certain

circumstances, permits the Company to terminate the Merger Agreement and abandon the transaction to accept a superior offer or in light of other unanticipated developments, as well as the related termination fee. As the parties were continuing to

negotiate the final terms of the Merger Agreement, the meeting was adjourned to November 7, 2011.

Prior to the meeting

being re-convened on November 7, Landry’s counsel conveyed a request from Landry’s to permit Landry’s to extend the Offer for one period of ten business days from the original expiration date; provided that Landry’s would

agree to waive certain material closing conditions and would deposit into an escrow account the amount of cash necessary to pay the full purchase price for the Shares. After reporting this proposal to the Company Board, Kirkland & Ellis

negotiated the specific terms regarding this extension right and the related waiver of closing conditions and escrow arrangements. The meeting was re-convened and Kirkland & Ellis updated the Company Board on the

- 12 -

resolution of the remaining outstanding issues under the merger agreement (including the terms of the extension right) and confirmed that the agreement was in final form. Representatives of Piper

Jaffray confirmed that there had arisen no changes in circumstances that would affect the financial analysis presented on November 6. Piper Jaffray then delivered its oral opinion, later confirmed in a written opinion dated November 7,

2011, that the Offer Price was fair, from a financial point of view, to the holders of Shares (other than Landry’s, Purchaser and their respective affiliates). The full text of the written opinion of Piper Jaffray, which sets forth the

assumptions made, procedures followed, matters considered, and limitations on the review undertaken in connection with such opinion, is attached as Annex B. Following this presentation the Company Board unanimously approved the Merger Agreement and

the transactions contemplated thereby, including the Offer and the Merger, and unanimously recommended that the holders of Shares (other than Landry’s, Purchaser and their respective affiliates) tender their Shares in response to the Offer and,

if submitted to a vote of the stockholders, that they vote to adopt the Merger Agreement.

Following the vote of the Company

Board, the Company entered into the Merger Agreement and, on November 7, 2011 the Company and Landry’s issued separate public announcements regarding their entry into the Merger Agreement. Simultaneously, the Company issued its earnings

announcement for the third quarter of 2011, which included a 4.2% decline in net sales and a 1.0% decline in comparable-store sales in comparison to the same quarter of 2010. As a result, the Company recorded a net loss of $2.5 million in the third

quarter of 2011, in comparison to net income of $1.0 million in the same period of 2010. Also on November 7, 2011 the Company announced an amendment to its Fifth Amended and Restated Revolving Credit Agreement which, among other things,

resulted in a reduction of the applicable borrowing limit from $40.0 million to $25.0 million, adjusted certain financial covenants, and provided for certain accommodations relating to costs associated with the Company’s exploration of

strategic alternatives.

The Offer was commenced by Landry’s on November 22, 2011, and this Statement was filed that

same day.

Reasons for Recommendation

In reaching the conclusions and in making the recommendation described in this Statement, the Company Board carefully and thoroughly considered the Offer, consulted with management of the Company and the

Company’s independent financial advisors and legal counsel, and took into account numerous factors, including but not limited to the factors listed below. The Company Board has unanimously determined that the Offer is fair to and in the best

interests of the stockholders other than Landry’s and its affiliates, for the reasons set forth below, and recommends that the stockholders other than Landry’s tender their shares in response to the Offer.

The Company Board unanimously recommends that the stockholders (other than Landry’s and its affiliates) tender their shares in response to the Offer

for the following reasons:

|

|

1.

|

Substantial and Immediate Cash Value.

|

The Company Board unanimously determined that, after a broad and comprehensive evaluation of strategic alternatives, the Offer Price of $8.75 per share offered immediate and certain value and was fair,

from a financial point of view, to the Company’s stockholders other than Landry’s and its affiliates. Among other things, the Company Board noted that although the Company had made progress in implementing management’s previously

announced strategic revitalization plan, the preliminary results of this plan did not indicate the desired increase in revenues, guest traffic

- 13 -

or net income, and in light of the continuing economic uncertainty confronting the upscale casual dining sector in general and the Company in particular, the Offer would allow the Company’s

stockholders to eliminate the risk of failing to achieve management’s intended results. The Company Board’s determination in this regard was based in part on the views of Piper Jaffray. A summary of the analysis performed by Piper Jaffray

is set forth below under “Factors Considered by the Company Board – Opinion of Financial Advisor” and the text of Piper Jaffray’s opinion is set forth in Annex B and incorporated herein by reference.

|

|

2.

|

Opinion of Piper Jaffray.

|

The oral opinion of Piper Jaffray to the Company Board on November 7, 2011, which was subsequently confirmed in writing, that, as of

that date and based upon and subject to the factors and assumptions set forth therein, the $8.75 per Share cash consideration to be paid to the holders (other than Landry’s and its affiliates) of Company Common Stock in the Offer and the Merger

was fair, from a financial point of view, to such holders. The full text of Piper Jaffray’s written opinion is attached hereto as Annex B. For further discussion of the Piper Jaffray opinion, see “—Opinion of Financial Advisor”

below.

|

|

3.

|

Significant Premium to Market Price.

|

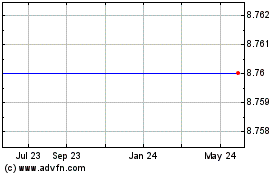

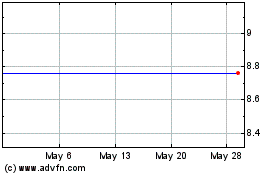

The Company Board noted that the Offer Price of $8.75 per Share in cash represented a significant premium over the market prices at which the Company Common Stock had previously traded, including a

premium of approximately:

|

|

•

|

|

29% over the closing market price of the Shares on November 7, 2011, the last full trading day prior to the date on which the Company Board met to

approve the Offer and the Merger;

|

|

|

•

|

|

28% over the average closing price of the Company Common Stock for the 30-day period prior to November 7, 2011;

|

|

|

•

|

|

31% over the average closing price of the Company Common Stock for the 90-day period prior to November 7, 2011; and

|

|

|

•

|

|

22% over the highest closing price of the Company Common Stock during the 30-day period prior to November 7, 2011.

|

The

fact that the Offer Price and the Merger Consideration to be received by the Company’s stockholders in the Offer and the Merger will consist entirely of cash, for which Landry’s has arranged financing, which will provide liquidity and

certainty of value to the Company’s stockholders.

|

|

5.

|

Likelihood of Consummation.

|

The Offer does not contain a number of the conditions and contingencies included in the Prior Offer that had led the Company Board to reject the Prior Offer, including a financing condition, a financing

commitment which gave the financing party wide latitude to refuse to provide the financing, a 90% minimum tender condition and additional conditions that gave Landry’s the right to refuse to consummate the transaction based on determinations

made in its own judgment, as well as broad-based discretionary termination rights. The Merger Agreement also contains a number of remedies in favor of the Company in the event of various breaches by Landry’s or Purchaser, including the

availability of specific performance.

- 14 -

|

|

6.

|

Comprehensive Review of Strategic Alternatives.

|

The results of the comprehensive evaluation of the Company’s strategic alternatives conducted by the Company Board in consultation with the Company’s financial and legal advisors. These

alternatives included a return of capital to stockholders by means of a special dividend or a stock repurchase program; a sale of the Company through an auction process (which included the active solicitation of 118 parties and the participation of

49 prospective buyers in the diligence process); the acquisition of one or more companies that might be complementary to the Company’s business; or a stand-alone strategy whereby the Company would continue to pursue and, as necessary, to refine

and adapt, its previously announced business strategy. The Company Board discussed the potential benefits to the Company’s stockholders of these alternatives, and the timing and the likelihood of accomplishing the goals of such alternatives, as

well as the Company Board’s assessment that none of these alternatives was reasonably likely to present superior opportunities for creating greater value for the Company’s stockholders, taking into account risks of execution as well as

business, competitive, industry and market risks.

|

|

7.

|

The Company’s Operating and Financial Condition; Prospects of the Company.

|

The fact that in determining that the $8.75 per Share offer is fair to the Company’s stockholders, the Company Board also took into

account the Company’s and the restaurant industry’s recent financial performance and future prospects, general business and economic conditions and higher commodity inflation. In particular, the Company Board considered that the Company

has experienced only modest growth in revenues, per-customer check size and comparable store sales since beginning to implement its strategic revitalization plan earlier in 2011, and the continued implementation of the plan involved significant

additional work and considerable execution risk. The Company Board considered that the Company’s financial performance and future prospects, as well as the likelihood that the Company would successfully implement its strategic revitalization

plan, had diminished since the Company Board had recommended, in April 2011, that Company stockholders not accept Landry’s unsolicited Prior Offer of $9.25 per Share in cash. The Company Board also considered that the transaction with

Landry’s would allow stockholders to receive a significant premium to recent trading prices while eliminating the risks and uncertainties inherent in the Company’s ongoing standalone business plan.

|

|

8.

|

Ability to Accept Superior Transaction.

|

The terms and conditions of the Merger Agreement, including the Company’s ability to consider and respond to, under certain circumstances specified in the Merger Agreement, a written proposal for an

acquisition transaction from a third party prior to the Acceptance Time, and the Company Board’s right, after complying with the terms of the Merger Agreement, to terminate the Merger Agreement in order to enter into an agreement with respect

to a superior proposal, upon payment of a termination fee of $3.9 million (approximately 3% of the equity value of the transaction), which is within the customary range of termination fees payable in similar transactions.

- 15 -

|

|

9.

|

Tender Offer Structure.

|

The fact that the transaction is structured as a tender offer, which can be completed, and the cash Offer Price can be delivered to the

Company’s stockholders, on a prompt basis, reducing the period of uncertainty during the pendency of the contemplated transactions, and the fact that the Merger Agreement requires Purchaser, if it acquires a majority of the fully-diluted

outstanding Shares in the Offer, to consummate a second-step Merger in which the Company’s stockholders who do not tender their Shares in the Offer will receive cash consideration equal to the Offer Price. If a certain number of shares of

Company Common Stock are tendered, the Purchaser will exercise the Top-Up to purchase additional number of shares of Company Common Stock sufficient to cause the Purchaser to own 90% of the shares of Company Common Stock outstanding after the Offer,

which would permit the Purchaser to close the Merger (as a short-form merger under Delaware law) more quickly than alternative structures.

The

fact the Merger Agreement contains limited rights to terminate the Offer, and otherwise requires Purchaser to extend the Offer beyond the initial expiration date if the conditions to Purchaser’s obligations to close the Offer were not satisfied

as of such date. If Purchaser extends the Offer under certain circumstances, prior to the public announcement of such extension, Landry’s and Purchaser must: (i) irrevocably waive (A) all of the conditions to the Offer (other than

(1) the Minimum Tender Condition, which may be waived by Landry’s and Purchaser only with the prior written consent of the Company, and (2) the condition that there not be any legal restraint in effect enjoining or otherwise

preventing or prohibiting the consummation of the Offer or the Merger), (B) Landry’s right to terminate for the Company’s breach of a representation, warranty or covenant under the Merger Agreement, and (C) the condition that the

waiting period applicable to the Merger under the HSR Act and applicable foreign antitrust laws shall have expired or been terminated, and (ii) deposit into an escrow account, the aggregate funds necessary to consummate the Offer and the

Merger, the release of which shall be conditioned only upon the occurrence of the acceptance for payment by Purchaser of shares of Company Common Stock pursuant to the Offer.

The

availability of statutory appraisal rights under the DGCL in the Merger for the Company’s stockholders who do not tender their Shares in the Offer and who otherwise comply with all the required procedures under Delaware law.

The Company Board also considered a variety of potentially negative factors in its deliberations concerning the Offer, the Merger and the

Merger Agreement, including the following:

|

|

1.

|

No Stockholder Participation in Future Growth or Earnings.

|

The nature of the transaction as a cash transaction would prevent the Company’s stockholders from participating in any future earnings or growth of the Company and benefiting from any appreciation in

the value of the Company.

|

|

2.

|

Taxable Consideration.

|

The fact that the all-cash consideration in the transaction would be generally taxable to the Company’s stockholders.

- 16 -

|

|

3.

|

Effects of Failure to Complete Transactions.

|

The risks and costs to the Company if the Offer does not close, including the diversion of management and employee attention, employee attrition and the effect on the Company’s relationships with

vendors, customers and others that do business with the Company, among other potential negative effects on the Company if the Offer is not completed.

|

|

4.

|

Interim Restrictions on Business.

|

The operational restrictions imposed on the Company pursuant to the Merger Agreement between signing and closing (which may delay or prevent the Company from undertaking business opportunities that may

arise pending the completion of the transaction).

|

|

5.

|

Potential Conflicts of Interest.

|

The fact that the executive officers and directors of the Company may have interests in the transactions contemplated by the Merger Agreement that are different from, or in addition to, those of the

Company’s stockholders.

The

terms and conditions of the Merger Agreement providing for a termination fee of $3.9 million that could become payable by the Company under certain circumstances, including if the Company terminates the Merger Agreement to accept a superior

proposal.

The

terms and conditions of the Merger Agreement restricting the Company’s ability to solicit competing proposals.

The

Company Board concluded that the risks and other potentially negative factors associated with the Offer and the Merger were outweighed by the potential benefits of the Offer and the Merger.

The foregoing discussion of the information and factors considered by the Company Board is not meant to be exhaustive, but includes the material information, factors and analyses considered by the Company

Board in reaching its conclusions and recommendations. The members of the Company Board evaluated the various factors listed above in light of their knowledge of the business, financial condition and prospects of the Company and considered the

advice of the Company’s financial and legal advisors as well as management forecasts. In light of the number and variety of factors that the Company Board considered, the members of the Company Board did not find it practicable to assign

relative weights to the foregoing factors. However, the recommendation of the Company Board was made after considering the totality of the information and factors involved. In addition, individual members of the Company Board may have given

different weight to different factors. In light of the factors described above, the Company Board has unanimously determined that the Offer is in the best interest of the Company and its stockholders and unanimously recommends that the stockholders

accept the Offer and tender their Shares pursuant to the Offer.

Intent to Tender

To the Company’s knowledge, after making reasonable inquiry, all of the Company’s executive officers, directors and affiliates

currently intend to tender or cause to be tendered all Shares of Company Common Stock held of record or beneficially by them pursuant to the Offer (other than Shares of Company Common Stock as to which such holder does not have discretionary

authority, Shares of Company Common Stock which may be retained in order to facilitate estate and tax planning dispositions and Shares underlying the Common Stock Options) and, if necessary, to vote such shares in favor of the adoption of the Merger

Agreement.

- 17 -

Factors Considered by the Company Board

Opinion of Financial Advisor

Pursuant to an engagement letter dated April 7, 2011, the Company retained Piper Jaffray & Co. to deliver its opinion as to the fairness, from a financial point of view, to the holders of

Shares of the consideration to be received in the Offer and the Merger. At a meeting of the Company Board on November 7, 2011, Piper Jaffray issued its oral opinion to the Company Board, later confirmed in a written opinion of the same date,

that based upon and subject to the assumptions, procedures, considerations and limitations set forth in the written opinion and based upon such other factors as Piper Jaffray considered relevant, the Offer Price is fair, from a financial point of

view, to the holders of Shares (other than Landry’s and any of its affiliates) as of the date of the opinion.

The

full text of the written opinion of Piper Jaffray, dated November 7, 2011, which sets forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken by Piper

Jaffray in rendering its opinion, is attached as Annex B and is incorporated by reference herein. The Piper Jaffray opinion addresses only the fairness, from a financial point of view and as of the date of the opinion, of the Offer Price to the

holders of Shares, other than Landry’s and any of its affiliates. Piper Jaffray’s opinion was directed solely to the Company Board in connection with its consideration of the Offer and the Merger and was not intended to be, and does not

constitute, a recommendation to any holders of Shares as to how such holders should act or tender their Shares in the Offer or how any such holder of Shares should vote at the stockholders’ meeting, if any, held in connection with the Merger or

any other matter.

In connection with rendering the opinion described above and performing its financial analyses, Piper

Jaffray, among other things:

|

|

•

|

|

reviewed and analyzed the financial terms of the Merger Agreement dated November 7, 2011;

|

|

|

•

|

|

reviewed and analyzed certain financial and other data with respect to the Company which was publicly available;

|

|

|

•

|

|

reviewed and analyzed certain information, including financial forecasts, relating to the business, earnings, cash flow, assets, liabilities and

prospects of the Company that were publicly available, as well as those that were furnished to Piper Jaffray by the Company;

|

|

|

•

|

|

conducted discussions with members of senior management and representatives of the Company concerning the two immediately preceding matters described

above, as well as its business and prospects before and after giving effect to the Offer and the Merger;

|

|

|

•

|

|

reviewed the current and historical reported prices and trading activity of the Shares and similar information for certain other companies deemed by

Piper Jaffray to be comparable to the Company;

|

|

|

•

|

|

reviewed valuation multiples and other financial data for the Company and compared them to certain publicly traded companies which Piper Jaffray

believed were similar to the Company’s size and business profile;

|

- 18 -

|

|

•

|

|

compared the financial performance of the Company with that of certain other publicly traded companies that Piper Jaffray deemed relevant; and

|

|

|

•

|

|

reviewed the financial terms, to the extent publicly available, of certain business combination transactions that Piper Jaffray deemed relevant.

|

In addition, Piper Jaffray conducted such other analyses, examinations and inquiries and considered such

other financial, economic and market criteria as Piper Jaffray deemed necessary in arriving at its opinion.

The following is

a summary of the material financial analyses performed by Piper Jaffray in connection with the preparation of its fairness opinion, which was reviewed with, and formally delivered to, the Company Board at a meeting held on November 7, 2011. The

preparation of analyses and a fairness opinion is a complex analytic process involving various determinations as to the most appropriate and relevant methods of financial analysis and the application of those methods to the particular circumstances.

Therefore, this summary does not purport to be a complete description of the analyses performed by Piper Jaffray or of its presentation to the Company Board on November 7, 2011.

This summary includes information presented in tabular format, which tables must be read together with the text of each analysis summary

and considered as a whole in order to fully understand the financial analyses presented by Piper Jaffray. The tables alone do not constitute a complete summary of the financial analyses. The order in which these analyses are presented below, and the

results of those analyses, should not be taken as any indication of the relative importance or weight given to these analyses by Piper Jaffray or the Company Board. Except as otherwise noted, the following quantitative information, to the extent

that it is based on market data, is based on market data as it existed on or before November 7, 2011, and is not necessarily indicative of current market conditions.

For purposes of its analyses, Piper Jaffray calculated (i) the Company’s equity value implied by the Offer Price to be approximately $131.6 million, based on approximately 15.0 million

shares of common stock and common stock equivalents outstanding, consisting of options and restricted stock, calculated using the treasury stock method, and (ii) the Company’s enterprise value (“

EV

”) (for the purposes of

this analysis, implied EV equates to implied equity value, plus debt and capital leases, less cash) to be approximately $133.2 million.

Financial Analyses

Selected Public

Companies Analysis

Piper Jaffray reviewed selected historical financial data of the Company and compared them to

corresponding financial data, where applicable, for public companies in the restaurant industry sector which Piper Jaffray believed were similar to the Company’s business and financial profile. Piper Jaffray selected companies based on

information obtained by searching SEC filings, public company disclosures, press releases, industry and popular press reports, databases and other sources and by applying the following criteria:

|

|

•

|

|

casual and fine dining restaurant companies that primarily operate company-owned restaurants; and

|

|

|

•

|

|

companies that have an enterprise value less than $1.0 billion.

|

Based on these criteria, Piper Jaffray identified and analyzed the following selected companies:

- 19 -

|

|

•

|

|

Bravo Brio Restaurant Group

|

|

|

•

|

|

Morton’s Restaurant Group

|

|

|

•

|

|

P.F. Chang’s China Bistro

|

|

|

•

|

|

Red Robin Gourmet Burgers

|

|

|

•

|

|

Ruth’s Hospitality Group

|

For the selected public companies analysis, Piper Jaffray compared last twelve months (“

LTM

”) valuation multiples as implied by the Offer Price and the Company’s corresponding EBITDA

(calculated throughout as earnings before interest, taxes, depreciation and amortization and stock-based compensation), on the one hand, to valuation multiples for the selected public companies derived from their closing prices per share on

November 7, 2011 and corresponding EBITDA, on the other hand. Also, for the selected public companies analysis, Piper Jaffray compared LTM valuation multiples as implied by the Offer Price and the Company’s corresponding earnings per

share, on the one hand, to valuation multiples for the selected public companies derived from their closing prices per share on November 7, 2011 and corresponding earnings per share, on the other hand.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Restaurant Public Companies

|

|

|

|

MSSR (1)

|

|

Min

|

|

1st Quartile

|

|

Mean

|

|

Median

|

|

3rd Quartile

|

|

Max

|

|

|

|

|

|

|

|

|

|

|

Enterprise Value / LTM EBITDA (2) (3)

|

|

6.9x

|

|

5.0x

|

|

5.7x

|

|

6.4x

|

|

6.1x

|

|

6.6x

|

|

9.8x

|

|

|

|

|

|

|

|

|

|

|

LTM P/E Multiple (2) (4)

|

|

39.8x

|

|

12.0x

|

|

14.2x

|

|

17.3x

|

|

17.6x

|

|

19.8x

|

|

23.4x

|

|

(1)

|

Based on the Offer Price.

|

|

(2)

|

LTM EBITDA and EPS for the Company was for the twelve months ended September 28, 2011. LTM EBITDA and EPS for the selected restaurant public companies were for the

twelve months ended based on the most recent 10-Q or 10-K filed as of the date of Piper Jaffray’s opinion.

|

|

(3)

|

EBITDA for the Company and for the selected restaurant public companies were adjusted for certain non-recurring and one-time items.

|

|

(4)

|

Piper Jaffray determined that the Price/Earnings ratios were not meaningful, and therefore omitted them, if they were negative. Accordingly, the results of one selected

restaurant public company were omitted from the LTM Price/Earnings multiple.

|

The selected public companies

analysis showed that, based on the estimates and assumptions used in the analysis, the implied valuation multiples of the Company based on the Offer Price were within or above the range of valuation multiples of the selected companies when comparing