false

0000799167

0000799167

2023-12-13

2023-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 13, 2023

MARTEN TRANSPORT, LTD.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

0-15010

|

|

39-1140809

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

129 Marten Street

Mondovi, Wisconsin

|

|

54755

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(715) 926-4216

(Registrant’s telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

Trading symbol: |

Name of each exchange on which registered: |

|

COMMON STOCK, PAR VALUE

$.01 PER SHARE

|

MRTN |

THE NASDAQ STOCK MARKET LLC

(NASDAQ GLOBAL SELECT MARKET)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 5 – Corporate Governance and Management

Item 5.02 Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 13, 2023, the Board of Directors of Marten Transport, Ltd. (the “Company”) approved the appointment of Adam Phillips as its Executive Vice President and Chief Operating Officer.

Mr. Phillips, age 46, has been Marten’s Chief Operating Officer since March 2023 and served as the Company’s President of Western Operations and MRTN de Mexico from August 2019 to March 2023, Vice President of Regional and Mexico Operations from January 2014 to August 2019, Senior Director of Regional Operations from April 2010 to January 2014, and Director of Regional Operations from January 2008 to April 2010. Mr. Phillips served in various operational and management capacities for Knight Transportation Inc. from 2001 to 2008.

In connection with his appointment as Executive Vice President and Chief Operating Officer, beginning on December 13, 2023, Mr. Phillips will receive a base salary of $310,000 per year. Upon appointment as an executive officer, the Company reimburses individuals for all accumulated vacation pay prior to their participation in the executive program. Mr. Phillips will receive a payment of $26,539 for accumulated vacation pay.

Mr. Phillips will also be eligible to receive a cash bonus award under the Company’s Second Amended and Restated Executive Officer Performance Incentive Plan. The actual bonus award Mr. Phillips may receive for fiscal year 2023 will be prorated based on his service as Executive Vice President and Chief Operating Officer. Under the plan a bonus pool will be established based upon the percentage change in award year net income being at least 105% of an established net income goal, which is the Company’s net income for the prior year, or such other net income goal selected by the Company’s Compensation Committee. To the extent the percentage change in award year net income equals or exceeds 105% of the established net income goal, the size of the bonus pool will be determined by a multiplier related to the amount of such increase that results in the aggregate available bonus pool being between 5% and 100% of the aggregate base salary for executive officers. The Compensation Committee makes an annual determination of the executive officer participants in the plan and, at the end of each year, based on the recommendation of the Chief Executive Officer for all officers other than the Chief Executive Officer, the allocation of the bonus pool among the participants. The foregoing summary of the plan does not purport to be complete and is qualified in its entirety by reference to the Second Amended and Restated Executive Officer Performance Incentive Plan, a copy of which is included as Exhibit 10.1 to the Current Report on Form 8-K filed August 18, 2017 and is incorporated herein by reference.

In connection with his appointment as Executive Vice President and Chief Operating Officer, the Company and Mr. Phillips entered into a Change in Control Severance Agreement similar to the agreements executed with the Company’s other executive officers. Under the terms of the proposed agreement, Mr. Phillips is entitled to certain benefits if he is terminated either within 24 months of the effective date of a change in control or before the effective date of the change in control if the termination was either a condition to the change in control or was at the request or insistence of a person related to the change in control. He will not be considered “terminated” for purposes of the agreement if he dies or is terminated for cause. He will, however, be considered “terminated” if he voluntarily leaves the Company’s employ for “good reason.” “Good reason” means any of the following: (1) a material diminution in the authority, duties or responsibilities as an executive officer (not including any such change directly attributable to the fact that the Company is no longer a public company); (2) a material diminution in base compensation; (3) a material diminution in the authority, duties, or responsibilities of the supervisor to whom the executive reports; (4) a material diminution in the budget over which the executive retains authority; (5) a material change in the geographic location at which the Company requires the executive to be based; and (6) any other action or inaction by the Company that constitutes a material breach of any employment agreement with the executive; provided any act or omission will not constitute a “good reason” unless the executive gives written notice within 90 days of its initial existence and the Company fails to cure the act or omission within 30 days.

Upon a termination in connection with a change in control, Mr. Phillips will be entitled to receive a lump sum cash payment of 100% of his base salary, plus one times his highest bonus in the preceding three calendar years. In addition, he will receive welfare benefits for a period of 12 months.

The foregoing summary of the agreement does not purport to be complete and is qualified in its entirety by reference to the Form of Amended and Restated Change in Control Severance Agreement, a copy of which is included as Exhibit 10.1 to the Current Report on Form 8-K filed August 15, 2007, as amended by the First Amendment, a copy of which is included as Exhibit 10.18 to the Annual Report on Form 10-K for the year ended December 31, 2008, and amended by the Second Amendment, a copy of which is included as Exhibit 10.2 to the Current Report on Form 8-K filed March 8, 2011, and is incorporated herein by reference.

In connection with his appointment as Executive Vice President and Chief Operating Officer, the Company and Mr. Phillips plan on entering into an Indemnification Agreement similar to the agreements executed with the Company’s other executive officers. Under each indemnification agreement, the Company agrees to indemnify the executive officer against liability arising out of performance of their duties to the Company and to advance expenses, if the requisite standards of conduct are met. The agreement also contains procedural mechanisms and presumptions applicable to any dispute as to whether such standards of conduct are satisfied. The foregoing summary of the agreement does not purport to be complete and is qualified in its entirety by reference to the Form of Indemnification Agreement, a copy of which is included as Exhibit 10.1 to the Current Report on Form 8-K filed February 22, 2010, and is incorporated herein by reference.

Mr. Phillips has no family relationships with any of our executive officers or directors, and there have been no related party transactions between Mr. Phillips and the Company that are reportable under Item 404(a) of Regulation S-K.

On December 13, 2023, the Company issued a press release announcing Mr. Phillips’s appointment to the position of Executive Vice President and Chief Operating Officer, a copy of which is included as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

| |

(a)

|

Financial Statements of Businesses Acquired.

|

Not Applicable.

| |

(b)

|

Pro Forma Financial Information.

|

Not Applicable.

| |

(c)

|

Shell Company Transactions.

|

Not Applicable.

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

MARTEN TRANSPORT, LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: December 18, 2023

|

By:

|

/s/ James J. Hinnendael

|

|

|

|

|

James J. Hinnendael

|

|

|

|

|

Its: Executive Vice President and

|

|

| |

|

Chief Financial Officer |

|

Exhibit 99.1

MARTEN TRANSPORT APPOINTS ADAM PHILLIPS AS EXECUTIVE VICE PRESIDENT AND CHIEF OPERATING OFFICER

MONDOVI, Wis., December 13, 2023 (GLOBE NEWSWIRE) -- Marten Transport, Ltd. (Nasdaq/GS:MRTN) announced that its Board of Directors has appointed Adam D. Phillips to an executive officer as its Executive Vice President and Chief Operating Officer, effective December 13, 2023.

“I’m extremely pleased to announce the appointment of Adam Phillips as our Executive Vice President and Chief Operating Officer. Adam’s appointment is a continuation of our plan to develop and transition to our next generation of leadership,” said Randy Marten, Executive Chairman of the Board of Directors. “Adam will continue to be an integral member of our leadership team involved in our strategic business vision and day-to-day operations enhancement and growth.”

Mr. Phillips has been Marten’s Chief Operating Officer since March 2023 and served as the Company’s President of Western Operations and MRTN de Mexico from August 2019 to March 2023, Vice President of Regional and Mexico Operations from January 2014 to August 2019, Senior Director of Regional Operations from April 2010 to January 2014, and Director of Regional Operations from January 2008 to April 2010. Mr. Phillips served in various operational and management capacities for Knight Transportation Inc. from 2001 to 2008.

Marten Transport, with headquarters in Mondovi, Wis., is a multifaceted business offering a network of refrigerated and dry truck-based transportation capabilities across Marten’s five distinct business platforms - Truckload, Dedicated, Intermodal, Brokerage and MRTN de Mexico. Marten is one of the leading temperature-sensitive truckload carriers in the United States, specializing in transporting and distributing food, beverages and other consumer packaged goods that require a temperature-controlled or insulated environment. The Company offers service in the United States, Mexico and Canada, concentrating on expedited movements for high-volume customers. Marten’s common stock is traded on the Nasdaq Global Select Market under the symbol MRTN.

CONTACTS: Tim Kohl, Chief Executive Officer, Doug Petit, President, and Jim Hinnendael, Executive Vice President and Chief Financial Officer, of Marten Transport, Ltd., 715-926-4216.

v3.23.4

Document And Entity Information

|

Dec. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MARTEN TRANSPORT, LTD.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 13, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-15010

|

| Entity, Tax Identification Number |

39-1140809

|

| Entity, Address, Address Line One |

129 Marten Street

|

| Entity, Address, City or Town |

Mondovi

|

| Entity, Address, State or Province |

WI

|

| Entity, Address, Postal Zip Code |

54755

|

| City Area Code |

715

|

| Local Phone Number |

926-4216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

COMMON STOCK

|

| Trading Symbol |

MRTN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000799167

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

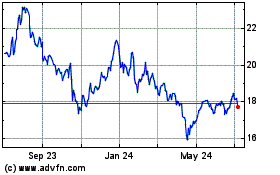

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

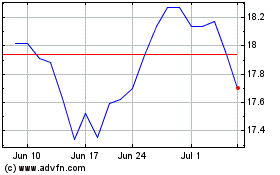

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Apr 2023 to Apr 2024