0001289419false00012894192024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 29, 2024

MORNINGSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Illinois (State or other jurisdiction of incorporation) | 000-51280 (Commission File Number)

| 36-3297908 (I.R.S. Employer Identification No.) |

| | 22 West Washington Street Chicago, Illinois (Address of principal executive offices) |

60602 (Zip Code) |

| | (312) 696-6000 (Registrant’s telephone number, including area code) | |

|

N/A | | |

(Former name or former address, if changed since last report) __________________________________

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common stock, no par value | MORN | The Nasdaq Stock Market LLC |

Item 2.02. Results of Operations and Financial Condition.

On February 29, 2024, Morningstar, Inc. (the “Company” or “we”) published a Supplemental Presentation Update. A copy of the Supplemental Presentation Update is attached hereto as Exhibit 99.1. The Supplemental Presentation Update shall be deemed furnished, not filed, for purposes of this Current Report on Form 8-K (this “Report”).

On February 29, 2024, the Company also updated its presentation of reportable segments for the three and nine months ended September 30, 2023 and September 30, 2022 (the “Updated Segment Presentation”) in alignment with its reportable segment reporting for the fiscal year ended December 31, 2023. The Updated Segment Presentation is attached to this Report as Exhibit 99.2 and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

The information set forth under Item 2.02, “Results of Operations and Financial Condition,” relating to the Supplemental Presentation Update is incorporated herein by reference.

Item 8.01 Other Events.

The information set forth under Item 2.02, “Results of Operations and Financial Condition,” relating to the Updated Segment Presentation is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Report contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “prospects,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For the Company, these risks and uncertainties include, among others, failing to maintain and protect our brand, independence, and reputation; failure to prevent and/or mitigate cybersecurity events and the failure to protect confidential information, including personal information about individuals; compliance failures, regulatory action, or changes in laws applicable to our credit ratings operations, investment advisory, ESG and index businesses; failing to innovate our product and service offerings, or anticipate our clients’ changing needs; the impact of artificial intelligence and related technologies on our business, legal and regulatory exposure profile and reputation; failing to detect errors in our products or the failure of our products to perform properly due to defects, malfunctions or similar problems; failing to recruit, develop, and retain qualified employees; prolonged volatility or downturns affecting the financial sector, global financial markets, and the global economy and its effect on our revenue from asset-based fees and our credit ratings business; failing to scale our operations, increase productivity in order to implement our business plans and strategies; liability for any losses that result from errors in our automated advisory tools or errors in the use of the information and data we collect; inadequacy of our operational risk management and business continuity programs and insurance coverage in the event of a material disruptive event; failing to efficiently integrate and leverage acquisitions and other investments, which may not realize the expected business or financial benefits, to produce the results we anticipate; failing to maintain growth across our businesses in today's fragmented geopolitical, regulatory and cultural world; liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are produced by our software products; the potential adverse effect of our indebtedness on our cash flows and financial and operational flexibility; challenges in accounting for tax complexities in the global jurisdictions which we operate in and their

effect on our tax obligations and tax rates; and failing to protect our intellectual property rights or claims of intellectual property infringement against us. A more complete description of these risks and uncertainties can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. If any of these risks and uncertainties materialize, our actual future results and other future events may vary significantly from what we expect. We do not undertake to update our forward-looking statements as a result of new information or future events. You are, however, advised to review any further disclosures we make on related subjects, and about new or additional risks, uncertainties and assumptions in our future filings with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K.

Item 9.01. Financial Statements and Exhibits.

Include the following information:

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

_____________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | MORNINGSTAR, INC. |

| Date: February 29, 2024 | | By:/s/ Jason Dubinsky |

| | Name: Jason Dubinsky |

| | Title: Chief Financial Officer |

Fourth Quarter 2023 Supplemental Presentation Update February 29, 2024 This presentation dated February 29, 2024 includes an update (the “Update”) to the Morningstar Fourth Quarter 2023 Supplemental Presentation dated February 22, 2024 (the “Original Supplemental Materials”) to provide detail on the reporting segments reflected in Morningstar’s Annual Report on Form 10-K for the year ended December 31, 2023. Except for the Update, the Original Supplemental Materials remain unchanged. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “prospects,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. More information about factors that could affect Morningstar’s business and financial results are in our filings with the SEC, including our most recent Forms 8-K, 10-K, and 10-Q. Morningstar undertakes no obligation to publicly update any forward-looking statements as a result of new information, future events, or otherwise, except as required by law. In addition, this presentation references non-GAAP financial measures including, but not limited to, organic revenue, adjusted operating income, adjusted operating margin, adjusted operating expense, and free cash flow. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is provided in the appendix to this presentation and in our filings with the SEC, including our most recent Forms 8-K, 10-K and 10-Q. 2 2 Morningstar Reportable Segments and Representative Products* The Company also reports a Corporate and All Other category that includes unallocated corporate expenses, as well as adjusted operating income/loss from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, and other management-related costs that are not considered when segment performance is evaluated. 3 3 Morningstar Data and Analytics Provides investors comprehensive data, research and insights, and investment analysis to empower investment decision-making. Morningstar Retirement Offers products to help individuals reach their retirement goals with highly personalized savings and investment advice at the employee level and scalable investment advisory and risk mitigation services at the employer and advisor level. Morningstar Credit Provides investors with credit ratings, research, data, and credit analytics solutions that contribute to the transparency of international and domestic credit markets. * Morningstar Wealth Brings together our model portfolios and wealth platform, practice and portfolio management software for registered investment advisers (RIAs); data aggregation and enrichment capabilities; and our individual investor platform. PitchBook Morningstar Data Morningstar Direct Morningstar Advisor Workstation Morningstar Research Distribution Provides investors with access to a broad collection of data and research covering the private capital markets, including venture capital, private equity, private credit and bank loans, and merger and acquisition (M&A) activities. Investors can also access Morningstar’s data and research on public equities. PitchBook Platform LCD Investment Management/Managed Portfolios Morningstar.com Morningstar Office Morningstar DBRS Morningstar Credit (Credit data and analytics) Managed Accounts Morningstar Data and Analytics Q4 23Q4 22 Morningstar Data and Analytics Full-Year 2023 Organic Revenue Drivers Morningstar Data (+10.3%) and Morningstar Direct (+9.2%) were the primary contributors. Morningstar Data and Morningstar Direct benefited from higher revenue across major geographies. Managed investment data (including fund data) helped drive increased growth for Morningstar Data. Morningstar Direct licenses increased 0.8%. Organic revenue is a non-GAAP measure. See reconciliation table in the appendix to this Update. $176.0 $192.7 4 4 Revenue ($mil) FY 23FY 22 $696.6 $747.2 +9.5% Reported +8.1% Organic +7.3% Reported +7.4% Organic

Morningstar Data and Analytics Morningstar Data and Analytics Full-Year 2023 Adjusted Operating Income Drivers Revenue growth outpaced expense growth, driving increases in adjusted operating income and adjusted operating margin. Expense growth was primarily driven by higher compensation costs. Segment adjusted operating income reflects the impact of direct segment expenses as well as certain allocated centralized costs such as information technology, sales and marketing, and research and data. See reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income in the appendix to this Update. 5 5 Q4 23Q4 22 $82.0 $90.4 Adjusted Operating Income ($mil) FY 23FY 22 $313.3 $339.8 +10.2% +8.5% 46.6% 46.9% 45.0% 45.5%Adj. Operating Margin PitchBook Q4 23Q4 22 PitchBook Full-Year 2023 Organic Revenue Drivers The PitchBook product area (+21.0%), which includes the PitchBook Platform and direct data, was the primary contributor. Growth was primarily driven by strength in PitchBook’s core investor and advisor clients, which offset some continued softness in the company (corporate) market segments. PitchBook Platform licenses grew 14.0%. Organic revenue is a non-GAAP measure. See reconciliation table in the appendix to this Update. $127.7 $144.4 6 6 Revenue ($mil) FY 23FY 22 $450.7 $551.9 +13.1% Reported +13.1% Organic +22.5% Reported +17.6% Organic PitchBook PitchBook Full-Year 2023 Adjusted Operating Income Drivers Revenue growth outpaced expense growth, driving increases in adjusted operating income and adjusted operating margin. Expense growth was primarily driven by higher compensation costs, partially offset by a decrease in stock-based compensation expense in 2023 compared to 2022. Higher stock-based compensation costs in 2022 reflected the overachievement of targets under the PitchBook management bonus plan. Segment adjusted operating income reflects the impact of direct segment expenses as well as certain allocated centralized costs such as information technology, sales and marketing, and research and data. See reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income in the appendix to this Update. 7 7 Q4 23Q4 22 $16.7 $41.4 Adjusted Operating Income ($mil) FY 23FY 22 $71.5 $148.1 +147.9% +107.1% 13.1% 28.7% 15.9% 26.8%Adj. Operating Margin Morningstar Wealth Q4 23Q4 22 Morningstar Wealth Full-Year 2023 Organic Revenue Drivers Morningstar Wealth revenue decreased 1.6% on an organic basis, due primarily to lower ad sales revenue for Morningstar.com. Investment Management revenue was roughly flat on an organic basis, reflecting market headwinds in the first half of the year. Investment Management’s average AUMA increased 2.0% compared with the prior-year period, supported by stronger market performance which drove higher asset values and positive net flows to Managed Portfolios. Organic revenue is a non-GAAP measure. See reconciliation table in the appendix to this Update. $55.8 $61.2 8 8 Revenue ($mil) FY 23FY 22 $228.9 $229.9 +9.7% Reported +9.1% Organic +0.4% Reported -1.6% Organic

Morningstar Wealth Morningstar Wealth Full-Year 2023 Adjusted Operating Loss Drivers Expense growth drove an increase in adjusted operating loss and a lower adjusted operating margin. Expense growth was primarily driven by higher compensation costs from headcount largely added during 2022, and reflected significant investments to build out the U.S. and international wealth platforms. Expenses also included $1.8 million in severance related to targeted reorganizations in Morningstar Wealth primarily in the third quarter, which had a negative 0.8 percentage point impact on adjusted operating margin in 2023. Segment adjusted operating loss reflects the impact of direct segment expenses as well as certain allocated centralized costs such as information technology, sales and marketing, and research and data. See reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income in the appendix to this Update. 9 9 Q4 23Q4 22 ($7.5) ($5.3) Adjusted Operating Loss ($mil) FY 23FY 22 ($14.3) ($40.4) (13.4%) (8.7%) (6.2%) (17.6%)Adj. Operating Margin Morningstar Credit Q4 23Q4 22 Morningstar Credit Full-Year 2023 Organic Revenue Drivers Revenue declined 8.5% on an organic basis primarily driven by weakness in the first half of the year, reflecting ongoing softness in U.S. CMBS ratings activity, and, to a lesser extent, declines in RMBS-related revenue. These declines were partially offset by an increase in asset-backed securities ratings revenues and gains in corporate ratings revenues. Revenue related to data licensing products increased. Organic revenue is a non-GAAP measure. See reconciliation table in the appendix to this Update. $50.7 $61.5 10 10 Revenue ($mil) FY 23FY 22 $236.9 $215.4 +21.3% Reported +20.0% Organic -9.1% Reported -8.5% Organic Morningstar Credit Q4 23Q4 22 Morningstar Credit Full-Year 2023 Adjusted Operating Income Drivers The decline in revenue and higher expenses drove decreases in adjusted operating income and adjusted operating margin. Expenses included $8.0 million related to the DBRS SEC settlements and $1.7 million in severance related to the targeted reorganizations, both incurred in the second and third quarters, which collectively had a negative 4.5 percentage point impact on adjusted operating margin in 2023. The remaining expense growth was primarily driven by higher compensation costs. Segment adjusted operating income reflects the impact of direct segment expenses as well as certain allocated centralized costs such as information technology, sales and marketing, and research and data. See reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income in the appendix to this Update. $10.5 $17.9 11 11 Adjusted Operating Income ($mil) FY 23FY 22 $59.1 $21.7 +70.5% (63.3%) 20.7% 29.1% 24.9% 10.1%Adj. Operating Margin Morningstar Retirement Q4 23Q4 22 Morningstar Retirement Full-Year 2023 Organic Revenue Drivers Morningstar Retirement increased 6.3% on an organic basis. Average AUMA increased 5.9% compared with the prior year, supported by strong market performance. Net inflows to Managed Accounts over the trailing 12 months also contributed to higher AUMA, supported by participant growth, including the impact of the addition of large employer plans during 2023. Organic revenue is a non-GAAP measure. See reconciliation table in the appendix to this Update. $26.0 $30.2 12 12 Revenue ($mil) FY 23FY 22 $104.0 $110.5 +16.2% Reported +16.2% Organic +6.3% Reported +6.3% Organic

Morningstar Retirement Q4 23Q4 22 Morningstar Retirement Full-Year 2023 Adjusted Operating Income Drivers Expense growth outpaced revenue growth, as adjusted operating income increased and adjusted operating margin declined. Expense growth was primarily driven by increases in compensation costs, which were partially offset by lower professional fees. Segment adjusted operating income reflects the impact of direct segment expenses as well as certain allocated centralized costs such as information technology, sales and marketing, and research and data. See reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income in the appendix to this Update. $13.2 $14.8 13 13 Adjusted Operating Income ($mil) FY 23FY 22 $51.4 $54.1 +12.1% +5.3% Adj. Operating Margin 50.8% 49.0% 49.4% 49.0% Appendix Reconciliation from Reported to Organic Revenue Change by Segment Organic revenue is a non-GAAP measure. 15 15 Reconciliation from Reported to Organic Revenue Change by Segment Organic revenue is a non-GAAP measure. 16 16

Reconciliation from Consolidated Adjusted Operating Income to Consolidated Operating Income ($mil) Adjusted operating income is a non-GAAP measure. (1) Corporate and All Other includes unallocated corporate expenses, as well as adjusted operating income/loss from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, and other management-related costs that are not considered when segment performance is evaluated. (2) Reflects non-recurring expenses related to M&A activity including pre-deal due diligence, transaction costs, and post-close integration costs. (3) Reflects the impact of M&A-related earn-outs included in operating expense. (4) Reflects costs associated with the significant reduction of the company's operations in Shenzhen, China and the shift of work related to its global business functions to other Morningstar locations. 17 Fourth Quarter 2023 Supplemental Presentation February 22, 2024 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “prospects,” or “continue.” These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. More information about factors that could affect Morningstar’s business and financial results are in our filings with the SEC, including our most recent Forms 8-K, 10-K, and 10-Q. Morningstar undertakes no obligation to publicly update any forward-looking statements as a result of new information, future events, or otherwise, except as required by law. In addition, this presentation references non-GAAP financial measures including, but not limited to, organic revenue, adjusted operating income, adjusted operating margin, adjusted operating expense, and free cash flow. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is provided in the appendix to this presentation and in our filings with the SEC, including our most recent Forms 8-K, 10-K and 10-Q. 19 19 Q4 2023 Financial Performance ($mil) $94.4$35.5 2322 $113.0 +13.4% +70.2% 2322 $538.7$475.0 2322 $66.4 $107.8 2322 $67.4 Operating Income Free Cash Flow** Revenue Adjusted Operating Income* * 20 20 Adjusted operating income is a non-GAAP measure and excludes intangible amortization expense, other merger and acquisition (M&A) related expenses and earn-outs, and items related to the significant reduction and shift of the Company’s operations in China. **Free cash flow is a non-GAAP measure and is defined as cash provided by or used for operating activities less capital expenditures. See reconciliation tables in the appendix of this presentation. +59.9%+165.9%

2023 Financial Performance ($mil) $230.6$167.8 2322 $326.5 +9.0% +9.2% 2322 $2,038.6$1,870.6 2322 $298.9 $197.3 2322 $168.3 Operating Income Free Cash Flow** Revenue Adjusted Operating Income* * 21 21 Adjusted operating income is a non-GAAP measure. Operating and adjusted operating income include the impact of $9.0 million in severance costs for targeted reorganizations not related to the Company's shift of China operations and $8.0 million in expense related to the Morningstar DBRS SEC settlements. **Free cash flow is a non-GAAP measure. Excluding the $4.5 million LCD contingent consideration payment within operating cash flow, payments related to the Termination Agreement of $59.9 million, $26.4 million of severance and other costs paid related to the Company's China activities, and comparable items in the prior year, free cash flow would have increased by 36.7%. See reconciliation tables in the appendix of this presentation. +17.2%+37.4% Q4 2023 Revenue Walk Organic revenue, a non-GAAP measure, excludes revenue from acquisitions for a period of 12 months upon completion of the acquisition, accounting changes, and the effect of foreign currency translations. See reconciliation tables in the appendix of this presentation. **Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. The calculation of organic revenue growth by type compares fourth quarter 2023 revenue to fourth quarter 2022 revenue on the basis of the updated classification. 22 22 * +13.4% Reported Revenue Growth +12.6% Organic Revenue Growth** License-Based 10.3% Asset-Based 19.8% Transaction-Based 18.0% Organic Revenue Growth* –0.8% Currency Impact Quarterly Revenue Trend: Revenue Type ($mil) Bars represent reported revenue. Percentages represent YOY organic revenue growth (decline), which is a non-GAAP measure. *Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. The calculation of organic revenue growth by revenue type compares quarterly revenue in 2023 to respective quarterly revenue in 2022, based on the updated classifications. 23 23 YTD 2023 Organic Revenue Walk* ($mil) 24 24 * YTD Q4 2022 Reported Revenue M&A and foreign currency adjustments PitchBook Morningstar Data Morningstar Direct Morningstar Sustainalytics Morningstar Indexes Morningstar Advisor Workstation Investment Management Morningstar DBRS Morningstar Retirement** Other products YTD Q4 2023 Reported Revenue $1,870.6 27.7 85.7 26.1 17.1 12.314.4 5.0 –20.0 $2,038.6 Organic revenue is a non-GAAP measure. Product area bars represent organic revenue growth and may not match changes in reported revenue. See reconciliation table in the appendix of this presentation. **In 2023, Workplace Solutions was rebranded to Morningstar Retirement. –6.6 6.5 –0.2

Q4 2023 Revenue Drivers: License-Based Revenue Trend* ($mil) +12.4% Reported + 10.3% Organic 2322 License-Based Q4 23 Organic Revenue Drivers: PitchBook (+19.1%), Morningstar Data (+12.4%), Morningstar Direct (+8.2%), and Morningstar Sustainalytics’ licensed-based products (+12.3%) were the primary contributors. Strength in PitchBook’s core investor and advisor segments offset some continued softness in the company (corporate) segments. Morningstar Data and Morningstar Direct benefited from higher revenue across major geographies. Morningstar Sustainalytics’ license-based revenue growth was primarily driven by EMEA, supported by demand for regulatory and compliance products. Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. The bars represent reported revenue. *Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. The calculation of organic revenue growth by revenue type compares fourth quarter 2023 revenue to fourth quarter 2022 revenue on the basis of the updated classifications. $349.7 $393.0 25 25 Q4 2023 Revenue Drivers: Asset-Based Revenue Trend* ($mil) Asset-Based Q4 23 Organic Revenue Drivers: Investment Management (+16.3%), Morningstar Retirement** (+16.2%), and Morningstar Indexes’ asset-based products (+37.9%), all contributed to organic revenue growth supported by higher AUM driven by market gains and positive net flows across multiple products. +14.4% Reported +19.8% Organic 2322 $66.0 $75.5 26 26 Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. The bars represent reported revenue. *Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. The calculation of organic revenue growth by revenue type compares fourth quarter 2023 revenue to fourth quarter 2022 revenue on the basis of the updated classifications. **In 2023, Workplace Solutions was rebranded to Morningstar Retirement. Q4 2023 Revenue Drivers: Transaction-Based Revenue Trend* ($mil) Transaction-Based Q4 23 Organic Revenue Drivers: Morningstar DBRS revenue increased 20.0% on an organic basis, with a 20.4% increase in transaction- based revenue, driven by higher asset-backed securities, corporate, and residential mortgage-backed securities ratings revenue. +18.4% Reported +18.0% Organic 2322 $59.3 $70.2 27 27 Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. The bars represent reported revenue. *Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. The calculation of organic revenue growth by revenue type compares fourth quarter 2023 revenue to fourth quarter 2022 revenue on the basis of the updated classifications. Quarterly Product Trends PitchBook* ($mil) 28 28 Morningstar Data ($mil) Organic revenue is a non-GAAP measure. See reconciliation table in the appendix of this presentation. *PitchBook licenses totaled 107,840 as of the end of the fourth quarter of 2023, compared to 94,628 in the prior-year quarter. License counts reflect active users, including Morningstar active users. The timing of activities, such as user maintenance, user audits, provisioning access, shutting off of users, and updates to the user lists when enterprise clients renew, results in fluctuations in license counts over time. As a result, license growth trends are best assessed on a rolling 12-month basis.

Quarterly Product Trends Morningstar Direct* ($mil) 29 29 Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. *Morningstar Direct licenses totaled 18,562 as of the end of the fourth quarter of 2023, compared to 18,421 in the prior-year quarter. **Revenue for Morningstar Sustainalytics’ license-based products increased 12.3% on an organic basis in the fourth quarter of 2023, while revenue for Morningstar Sustainalytics’ transaction-based products (second-party opinions) increased 29.3% on an organic basis. Morningstar Sustainalytics** ($mil) Quarterly Product Trends Morningstar Advisor Workstation ($mil) 30 30 Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. Quarterly Product Trends: Morningstar DBRS Revenue by Asset Class ($mil) Morningstar DBRS Q4 2023 Organic Revenue Drivers: In Q4 2023, structured finance ratings accounted for 61% of revenue, fundamental ratings accounted for 34% of revenue, and data licensing revenue totaled 5%. Recurring revenue, which is derived primarily from surveillance, research, and other transaction related services, represented 45.0% of total Morningstar DBRS revenue. Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. (1) Structured Finance (Asset-Backed Securities, Commercial Mortgage-Backed Securities, Residential Mortgage-Backed Securities. (2) Fundamental Ratings include Corporate, Financial Institutions, Sovereign, and Other. (3) In quarterly supplemental presentations prior to 4Q 2023, data licensing revenue was included in “Other” under Fundamental Ratings. 31 31 Quarterly Product Trends: Morningstar DBRS Revenue by Geography ($mil) Morningstar DBRS Q4 2023 Organic Revenue Drivers: Organic revenue increased 21.7% in the U.S. primarily due to higher asset-backed securities and residential mortgage-backed securities ratings revenue. Organic revenue increased 11.0% in Canada, primarily due to higher financial institution, asset-backed securities, and corporate ratings revenue. Organic revenue increased 27.4% in EMEA, primarily due to higher corporate and asset-backed securities ratings revenue. Bars represent reported revenue. Percentages represent organic revenue growth (decline). Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. 32 32

Quarterly Product Trends: Investment Management ($bil) Investment Management Q4 2023 AUM/A: Investment Management’s assets under management and advisement grew 9.0%, compared with the prior year, due to strong market performance and positive net flows to its Managed Portfolios product. Flows to Managed Portfolios were driven by strength outside the U.S., while U.S. flows were relatively flat. Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. *Managed Portfolios – Wholesale: Through our distribution sales team, the Company offers investment strategies and services directly to financial advisors in bank, broker dealers with a corporate RIA, who have a corporate RIA insurance, and RIA channels that offer the Company’s investment strategies and services to their clients (the end investor). This remains the Company’s strategic focus. **Managed Portfolios – Non-Wholesale: The Company sells services directly to financial institutions, such as broker dealers, discount brokers, and wirehouses. Our distribution sales team is not involved with the advisors of these firms. 33 33 Morningstar Retirement Q4 2023 AUM/A: Morningstar Retirement’s assets under management and advisement increased 18.4% compared with the prior year, supported by strong market performance. Net inflows to Managed Accounts also contributed to higher AUMA, supported by participant growth, including the impact of the addition of large employer plans during 2023. Quarterly Product Trends: Morningstar Retirement(1) ($bil) Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. (1) In 2023, Workplace Solutions was rebranded to Morningstar Retirement. (2) Managed Accounts include Retirement Manager and Advisor Managed Accounts. (3) Fiduciary Services helps retirement plan sponsors build appropriate investment lineups for their participants. (4) Custom Models/CITs offer customized investment lineups for clients based on plan participant demographics or other specific factors. 34 34 Quarterly Product Trends: Morningstar Indexes ($bil) 35 35 Organic revenue is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. Morningstar Indexes Q4 2023 Assets: Morningstar Indexes revenue increased 43.3% on an organic basis. The increase in revenue was driven in part by higher investable product revenue, as asset value linked to Morningstar Indexes increased 19.6%, compared to the prior year, driven by market performance and strong positive net flows. Licensed data sales also increased. Q4 2023 Operating Margins 36 36 Adjusted operating margin is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. Adjusted Operating Margin Operating Margin 2322 17.5% 21.0% 2322 7.5% 14.1% Operating Margin Drivers: Revenue growth outpaced expense growth in the quarter, supporting increased operating and adjusted-operating margins. Key drivers of the change in operating expense included: Compensation costs increased $23.4 million from the prior-year period. Increases in compensation costs were partially offset by a $14.0 million decline in stock-based compensation, compared to the fourth quarter of 2022 when higher stock-based compensation costs were primarily due to the overachievement of targets under the PitchBook management bonus plan.

QTD Adjusted Operating Income(1) Walk Q4 2022 to Q4 2023 ($mil) (1) Adjusted operating income, a non-GAAP measure, excludes intangible amortization expenses, all M&A-related expenses (including M&A earn-outs), and items related to the significant reduction and shift of the Company’s operations in China. Please see reconciliation table in the appendix of this presentation. Changes in this chart reflect these adjustments and may not match changes in reported expenses. (2) Includes infrastructure costs (including 3rd party contracts with data providers, AWS cloud costs, and software subscriptions), facilities, depreciation/amortization, and capitalized labor. (3) Includes salaries, bonus, company-sponsored benefits, and severance not related to targeted reorganizations or the Company’s China activities. 37 37 Q4 2022 Change in Revenue Stock-based Compensation Travel and Related Activities Professional Fees Advertising and Marketing Infrastructure Costs and Other (2) Q4 2023 $66.4 13.8 63.7 2.3 –0.8 $113.0 Sales Commissions –29.9 –1.2 Compensation and Benefits (3) –1.5 0.2 YTD Adjusted Operating Income(1) Walk Q4 2022 to Q4 2023 ($mil) (1) Adjusted operating income, a non-GAAP measure, excludes intangible amortization expenses, all M&A-related expenses (including M&A earn-outs), and items related to the significant reduction and shift of the Company’s operations in China. Please see reconciliation table in the appendix of this presentation. Changes in this chart reflect these adjustments and may not match changes in reported expenses. (2) Expenses related to the settlements between the SEC and DBRS, Inc. (3) Severance from targeted reorganizations not related to the shift of the Company’s China activities. (4) Includes infrastructure costs (including 3rd party contracts with data providers, AWS cloud costs, and software subscriptions), facilities, depreciation/amortization, and capitalized labor. (5) Includes salaries, bonus, company-sponsored benefits, and other severance not related to targeted reorganizations or the Company’s China activities. 38 38 YTD 2022 YOY Revenue Growth Stock-based Compensation Professional Fees Travel and Related Activities Advertising and Marketing Sales Commissions Infrastructure Costs and Other (4) YTD 2023 $298.9 –21.7 31.4 168.0 6.9 –8.0 2.9 –5.3 $326.5 Morningstar DBRS SEC settlements (2) –8.2 –129.4 Compensation and Benefits (5) –9.0 Severance (3) Quarterly Operating Margin Trends Adjusted operating margin is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation. 39 39 Revenue vs. Adjusted Operating Expense Growth 40 40 Adjusted operating expense is a non-GAAP measure. Please see reconciliation table in the appendix of this presentation.

Headcount Trends 41 41 Headcount represents permanent, full-time employees. 2023 Cash Flow and Capital Allocation ($mil) 2 $316.4 $197.3 Operating Cash Flow Free Cash Flow* Capital Allocation 42 42 * ($mil) Debt Reduction 137.5 Capital Expenditures 119.1 Dividends Paid 63.9 Termination Agreement** 59.9 Free cash flow, a non-GAAP measure, is defined as cash provided by or used for operating activities less capital expenditures. Excluding certain items, which together totaled $90.8 million, as well as comparable items in the prior-year period, free cash flow would have been $288.1 million for the year ended December 31, 2023. Please see reconciliation table in the appendix of this presentation. **The termination of the Company's license agreement with Morningstar Japan K.K. (renamed SBI Global Asset Management). Appendix QTD 2023 Operating and Free Cash Flow Excluding Certain Items Free cash flow is a non-GAAP measure and is defined as cash provided by or used for operating activities less capital expenditures. *Relates to the termination of the Company’s license agreement with Morningstar Japan K.K. (renamed SBI Global Asset Management). **Includes the operating cash flow impact of contingent consideration payments related to the LCD earn-out payment in 2023 and Sustainalytics earn-out payment in 2022. Q4 2023 Q4 2022 % Change Cash provided by operating activities $137.8 $103.5 33.1% Capital expenditures (30.0) (36.1) Free cash flow $107.8 $67.4 59.9% Items included in cash provided by operating activities Payments related to the Termination Agreement* — — Severance and related costs paid for reduction and shift of China operations S $0.2 $0.5 Contingent consideration related to acquisitions** — — Cash provided by operating activities, excluding certain items $138.0 $104.0 32.7% Free cash flow, excluding certain items $108.0 $67.9 59.1% 44 44

YTD 2023 Operating and Free Cash Flow Excluding Certain Items Free cash flow is a non-GAAP measure and is defined as cash provided by or used for operating activities less capital expenditures. *Relates to the termination of the Company’s license agreement with Morningstar Japan K.K. (renamed SBI Global Asset Management). **Includes the operating cash flow impact of contingent consideration payments related to the LCD earn-out payment in 2023 and Sustainalytics earn-out payment in 2022. YTD 2023 YTD 2022 % Change Cash provided by operating activities $316.4 $297.8 6.2% Capital expenditures (119.1) (129.5) Free cash flow $197.3 $168.3 17.2% Items included in cash provided by operating activities Payments related to the Termination Agreement* $59.9 — Severance and related costs paid for reduction and shift of China operations S $26.4 $2.4 Contingent consideration related to acquisitions** $4.5 $40.0 Cash provided by operating activities, excluding certain items $407.2 $340.2 19.7% Free cash flow, excluding certain items $288.1 $210.7 36.7% 45 45 Reconciliation from Reported to Organic Revenue Change by Revenue Type 46 46 Organic revenue is a non-GAAP measure. Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. Reconciliation from Reported to Organic Revenue Change by Revenue Type 47 47 Organic revenue is a non-GAAP measure. Starting with the quarter ended March 31, 2023, the Company updated its revenue-type classifications to account for product areas with more than one revenue type, impacting Morningstar Sustainalytics, Morningstar Indexes, and Morningstar DBRS. Reconciliation from Reported to Organic Revenue Change by Product Area 48 48 Organic revenue is a non-GAAP measure.

Reconciliation from Reported to Organic Revenue Change by Product Area 49 49 Organic revenue is a non-GAAP measure. Reconciliation from Reported to Organic Revenue Change by Product Area 50 50 Organic revenue is a non-GAAP measure. Reconciliation from Consolidated Operating Income to Adjusted Operating Income ($mil) 51 51 Adjusted operating income is a non-GAAP measure. (1) Reflects non-recurring expenses related to M&A activity including pre-deal due diligence, transaction costs, and post-close integration costs. (2) Reflects the impact of M&A-related earn-outs in relation to the Company’s acquisitions of LCD and Morningstar Sustainalytics. (3) Reflects costs associated with the significant reduction of the Company's operations in Shenzhen, China and the shift of work related to its global business functions to other Morningstar locations. Reconciliation from Operating Margin to Adjusted Operating Margin 52 52 Adjusted operating margin is a non-GAAP measure.

Reconciliation from Total Operating Expenses to Adjusted Operating Expense 53 53 Adjusted operating expense is a non-GAAP measure.

The following tables present information about the company’s reportable segments for the three and nine months ended September 30, 2023 and 2022, along with the items necessary to reconcile the segment information to the totals reported in the accompanying consolidated financial statements. Prior period segment information is presented on a comparable basis to the basis on which current period segment information is presented and reviewed by the company’s Chief Operating Decision Maker (“CODM”). Effective in the fourth quarter of 2023, the company changed certain methodology used when allocating corporate function expenses to the operating segments. The change was made to provide the company’s CODM with a more current representation of segment profitability. The 2023 and 2022 amounts presented reflect the impact of this change. Three months ended September 30, Nine months ended September 30, (in millions) 2023 2022 2023 2022 Revenue: Morningstar Data and Analytics $ 188.7 $ 174.1 $ 554.5 $ 520.6 PitchBook 139.6 121.9 407.5 323.0 Morningstar Wealth 58.0 55.2 168.7 173.1 Morningstar Credit 52.9 51.8 153.9 186.2 Morningstar Retirement 27.7 24.9 80.3 78.0 Total Reportable Segments 466.9 427.9 1,364.9 1,280.9 Corporate and All Other (1) 48.6 40.3 135.0 114.7 Total Revenue $ 515.5 $ 468.2 $ 1,499.9 $ 1,395.6 Adjusted Operating Income (Loss): Morningstar Data and Analytics $ 88.4 $ 79.1 $ 249.4 $ 231.3 PitchBook 39.1 26.7 106.7 54.8 Morningstar Wealth (8.2) (7.1) (35.1) (6.8) Morningstar Credit 2.8 10.6 3.8 48.6 Morningstar Retirement 14.7 11.7 39.3 38.2 Total Reportable Segments $ 136.8 $ 121.0 $ 364.1 $ 366.1 Less reconciling items to Operating Income: Corporate and All Other (2) $ (44.8) $ (44.4) $ (150.6) $ (133.6) Intangible amortization expense (3) (17.7) (18.7) (52.9) (48.4) M&A-related expenses (4) (1.7) (4.9) (8.9) (13.7) M&A-related earn-outs (5) — (0.9) — (8.0) Severance and personnel expenses (6) (1.3) (27.0) (5.4) (27.0) Transformation costs (6) (0.6) (3.1) (7.0) (3.1) Asset impairment costs (6) (0.7) — (3.1) — Operating Income 70.0 22.0 136.2 132.3 Non-operating expense, net (12.6) (24.3) (45.0) (32.3) Equity in investments of unconsolidated entities (1.6) (1.3) (4.7) (2.7) Income before income taxes $ 55.8 $ (3.6) $ 86.5 $ 97.3 ______________________________________________________________________ (1) Corporate and All Other provides a reconciliation between revenue from our Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues.

(2) Corporate and All Other includes unallocated corporate expenses of $36.3 million and $34.9 million for the three months ended September 30, 2023 and 2022, respectively, and $111.4 million and $100.4 million for the nine months ended September 30, 2023 and 2022, respectively, as well as adjusted operating income/loss from Morningstar Sustainalytics and Morningstar Indexes. Unallocated corporate expenses include finance, human resources, legal, and other management-related costs that are not considered when segment performance is evaluated. (3) Excludes finance lease amortization expense of $0.1 million and $0.2 million for the three months ended September 30, 2023 and 2022, respectively, and $1.0 million and $1.6 million for the nine months ended September 30, 2023 and 2022, respectively. (4) Reflects non-recurring expenses related to M&A activity including pre-deal due diligence, transaction costs, and post-close integration costs. (5) Reflects the impact of M&A-related earn-outs included in operating expense. (6) Reflects costs associated with the significant reduction of the company's operations in Shenzhen, China and the shift of work related to its global business functions to other Morningstar locations. Severance and personnel expenses include severance charges, incentive payments related to early signing of severance agreements, transition bonuses, and stock-based compensation related to the accelerated vesting of restricted stock unit (RSU) and market stock unit (MSU) awards. In addition, the reversal of accrued sabbatical liabilities is included in this category. Transformation costs include professional fees and the temporary duplication of headcount. As the company hired replacement roles in other markets and shifted capabilities, it employed certain Shenzhen-based staff through the transition period, which resulted in elevated compensation costs on a temporary basis. Asset impairment costs include the write-off or accelerated depreciation of fixed assets in the Shenzhen, China office that were not redeployed, in addition to lease abandonment costs as the company downsized its office space prior to the lease termination date. The following tables present segment revenue disaggregated by revenue type: Three months ended September 30, 2023 (in millions) Morningstar Data and Analytics PitchBook Morningstar Wealth Morningstar Credit Morningstar Retirement Total Reportable Segments Corporate and All Other (7) Total Revenue by Type: (8) License-based $ 188.7 $ 139.6 $ 20.2 $ 3.0 $ 0.5 $ 352.0 $ 32.5 $ 384.5 Asset-based — — 31.2 — 27.2 58.4 13.1 71.5 Transaction- based — — 6.6 49.9 — 56.5 3.0 59.5 Total $ 188.7 $ 139.6 $ 58.0 $ 52.9 $ 27.7 $ 466.9 $ 48.6 $ 515.5 Nine months ended September 30, 2023 (in millions) Morningstar Data and Analytics PitchBook Morningstar Wealth Morningstar Credit Morningstar Retirement Total Reportable Segments Corporate and All Other (7) Total Revenue by Type: (8) License-based $ 553.1 $ 407.5 $ 60.6 $ 8.7 $ 1.4 $ 1,031.3 $ 93.2 $ 1,124.5 Asset-based — — 90.2 — 78.7 168.9 35.2 204.1 Transaction- based 1.4 — 17.9 145.2 0.2 164.7 6.6 171.3 Total $ 554.5 $ 407.5 $ 168.7 $ 153.9 $ 80.3 $ 1,364.9 $ 135.0 $ 1,499.9

Three months ended September 30, 2022 (in millions) Morningstar Data and Analytics PitchBook Morningstar Wealth Morningstar Credit Morningstar Retirement Total Reportable Segments Corporate and All Other (7) Total Revenue by Type: (8) License-based $ 174.0 $ 121.9 $ 19.9 $ — $ 0.5 $ 316.3 $ 26.3 $ 342.6 Asset-based — — 29.1 — 24.4 53.5 13.8 67.3 Transaction- based 0.1 — 6.2 51.8 — 58.1 0.2 58.3 Total $ 174.1 $ 121.9 $ 55.2 $ 51.8 $ 24.9 $ 427.9 $ 40.3 $ 468.2 Nine months ended September 30, 2022 (in millions) Morningstar Data and Analytics PitchBook Morningstar Wealth Morningstar Credit Morningstar Retirement Total Reportable Segments Corporate and All Other (7) Total Revenue by Type: (8) License-based $ 519.2 $ 323.0 $ 61.3 $ — $ 1.6 $ 905.1 $ 76.9 $ 982.0 Asset-based — — 89.9 — 76.2 166.1 37.3 203.4 Transaction- based 1.4 — 21.9 186.2 0.2 209.7 0.5 210.2 Total $ 520.6 $ 323.0 $ 173.1 $ 186.2 $ 78.0 $ 1,280.9 $ 114.7 $ 1,395.6 ______________________________________________________________________ (7) Corporate and All Other provides a reconciliation between revenue from our Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues. (8) Starting with the quarter ended March 31, 2023, the company updated its revenue-type classifications to account for product areas with more than one revenue type. Prior periods have not been restated to reflect the updated classifications. Revenue from Morningstar Sustainalytics' second-party opinions product was reclassified from license-based to transaction-based. Revenue from Morningstar Indexes data and services products was reclassified from asset-based to license-based. Revenue from Morningstar DBRS and Morningstar Credit data products was reclassified from transaction-based to license-based.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

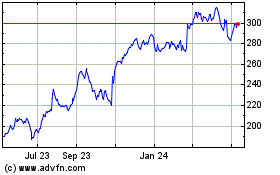

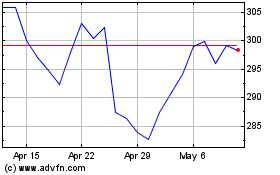

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Apr 2023 to Apr 2024