false0001000209DEFA14A00010002092023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

|

Definitive Proxy Statement |

|

|

☒ |

|

Definitive Additional Materials |

|

|

☐ |

|

Soliciting Material Pursuant under §240.14a-12 |

MEDALLION FINANCIAL CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

☒ |

|

No fee required. |

|

|

☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies: |

|

|

(2) |

|

Aggregate number of securities to which transaction applies: |

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

|

Proposed maximum aggregate value of transaction: |

|

|

(5) |

|

Total fee paid: |

|

|

☐ |

|

Fee paid previously with preliminary materials. |

|

|

☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid: |

|

|

(2) |

|

Form, Schedule or Registration Statement No.: |

|

|

(3) |

|

Filing Party: |

|

|

(4) |

|

Date Filed: |

Medallion Financial Corp. will begin distribution of the following letter to shareholders:

May 13, 2024

Dear Fellow Medallion Financial Shareholder,

Your vote at the Annual Meeting of Shareholders of Medallion Financial Corp. (the “Company”) to be held on June 11, 2024, is more important than ever. Please vote today “FOR” only Robert M. Meyer and David L. Rudnick to be elected to the Board of Directors on the BLUE proxy card.

An activist investor, Stephen Hodges of ZimCal Asset Management, who holds only approximately 0.3% of our shares, is attempting to replace these two highly experienced directors who have overseen a successful transformation of the Company’s businesses that positions it for future growth. In their place, he wants to add himself and another hand-picked nominee, Judd Deppisch, both of whom have conflicts of interest, and little, if any, relevant experience.

YOUR COMPANY IS PERFORMING EXCEPTIONALLY WELL UNDER THE CURRENT BOARD AND MANAGEMENT AND DELIVERING SIGNIFICANT SHAREHOLDER VALUE

Together with your management team, the Board has successfully delivered substantial value, transformed the Company into a growing consumer lending business and positioned it for future growth.

Medallion has transformed from its historic taxi medallion lending business to its current consumer lending business. And, contrary to Mr. Hodges’ misrepresentations, the results speak for themselves.

✓In 2023, the Company achieved the highest annual total earnings and highest annual earnings per share since its initial public offering in 1996, with each of its businesses meaningfully contributing to its success.

✓In the past three years, the Company has:

✓Generated over $153 million of earnings,

✓Reinstated and raised its quarterly dividend to $0.10 per share,

✓Returned over $36 million to shareholders in the form of dividends and stock repurchases, and

✓Reflecting these successes, the Company has produced a strong cumulative total shareholder return, including over 128% over the last five years and 44% over the last year, significantly above the median of the Company’s proxy peers.1 2

✓On an unaffected basis prior to ZimCal’s campaign, the Company has similarly outperformed its peers with a total shareholder return of nearly 26% over the last five years and over 22% over the last year.3

Medallion has consistently outperformed the median TSR

of our peers over 1-, 3- and 5-year periods.

|

|

|

|

Total Shareholder Return based on fiscal year end (December 31, 2023) |

|

1 year |

3 year |

5 year |

Medallion Financial Corp. |

44.00% |

118.51% |

128.29% |

Median TSR of 2023 Compensation Peer Group |

6.37% |

3.26% |

13.06% |

|

|

|

|

Total Shareholder Return based on unaffected share price (April 9, 2024) |

|

1 year |

3 year |

5 year |

Medallion Financial Corp. |

22.52% |

15.84% |

25.95% |

Median TSR of 2023 Compensation Peer Group |

19.49% |

-22.33% |

0.33% |

The Company’s strong performance is a direct result of management’s execution of your Board’s strategic priorities, including:

•Stronger focus on our core consumer lending businesses, as well as our commercial lending business.

•Divestures of various non-core businesses and investments.

•Targeted cost reduction, including shutting down various offices since 2021 and reducing our corporate headcount, which resulted in leaner operations. We have substantially reduced our operating costs as a function of net interest income from 54%4 in 2019 to 40% in 2023.

•Increased investments in our technology both in how we originate and approve loans and manage our portfolios.

_________________

1 Measured as of the end of the Company’s Fiscal Year on December 31, 2023.

2 Peer group selected and approved by the Compensation Committee as a reference for the 2023 short-term incentive cash awards and 2023 compensation program and pay decisions. See proxy statement filed by Medallion Financial Corp. on April 29, 2024, for full list of peers.

3 Measured as of April 9, 2024, the last trading day prior to the first announcement by ZimCal of its campaign against the Company.

4 Excludes operating costs of RPAC Racing LLC, a complete divestiture of which occurred in December 2021.

A CHANGE IN STRATEGY AND LEADERSHIP WOULD RISK DISRUPTING THE COMPANY’S SUCCESS AND JEOPARDIZE FUTURE SHAREHOLDER VALUE CREATION

Your Board and management team are building off the successful strategic transformation of Medallion Financial and continuing to execute on the value creation strategy that has delivered strong results. Changing course now would not be in the best interest of ALL Medallion Financial shareholders.

The key elements of our current strategy to grow our consumer lending and commercial lending businesses and increase their profitability include:

•Focus on niche industries and our expertise in these niche fields, including consumer recreational equipment and home improvement.

•Employ disciplined underwriting policies and maintain rigorous portfolio monitoring.

•Leverage the skills and contacts of our experienced management team.

•Seek strategic acquisitions in other financing businesses and related portfolios, and specialty finance companies.

•Expand our strategic partnership program.

A SIGNIFICANT DEBTHOLDER LIKE STEPHEN HODGES DOES NOT HAVE THE BEST INTERESTS OF ALL SHAREHOLDERS IN MIND

Unlike you, Mr. Hodges has not been a beneficiary of the Board’s actions described above because he has nearly the entirety of his holdings in your company as a debt holder: $15 million principal amount of preferred trust securities, a form of subordinated debt, compared to only 70,000 shares (0.3% of outstanding shares, equivalent to approximately $550,000 in market value) that he acquired between December 2023 and April 2024. In fact, what Mr. Hodges does not tell you is that this $15 million principal amount does not represent the amount he invested in the Company, which, we have been informed, is only approximately 45% of such principal amount.

Mr. Hodges indicated that he would sell these trust securities back to the Company. The Company engaged with Mr. Hodges in good faith on a repurchase of these securities at a fair market-based price; however, his demands of a significantly above market price were rejected as unreasonable, as it was merely an attempt to gouge the Company and failed to account for the various terms of the securities that benefit our shareholders, including their advantageous interest rate, lack of financial covenants, subordination to our debt, and maturity date of 2037, our parent company’s longest maturity date.

Unlike Mr. Hodges, your Board is firmly aligned with YOUR interests: your directors and management in aggregate own nearly 5 million shares (21% of outstanding shares). Moreover, a majority of the members of the Board, including Board nominee David Rudnick, individually own more stock in the Company than Mr. Hodges and his investment firm. Your Board has acted, and will continue to act, in YOUR best interests.

HODGES AND HIS OTHER NOMINEE LACK RELEVANT EXPERIENCE

Mr. Hodges claims that he and his fellow nominee have “relevant banking, capital markets and lending experience”. No such details have been provided, and according to Mr. Hodges’ own biography, Mr. Hodges has experience in making illiquid debt investments in banks and other credit investments. It appears that he has never worked for any bank or in the banking industry. He also fails to disclose how his substantial debt investment inherently conflicts with the best interests of our common shareholders.

While Mr. Hodges claims that Mr. Deppisch has some banking experience, it is not at all clear how this experience is in any way pertinent to our specialty finance company. His consumer lending experience is limited at best. In addition, Mr. Deppisch is affiliated with Nelnet, Inc., a provider of consumer loans and parent company to Nelnet Bank, a Utah industrial bank. The Board is therefore concerned that there may be conflicts of interest between Mr. Deppisch, on the one hand, and the Company and Medallion Bank, our Utah industrial bank subsidiary that provides consumer loans. These conflicts of interest could arise to the extent that the Company (together with Medallion Bank) and Nelnet, Inc. (together with Nelnet Bank) currently or in the future compete for market share in consumer lending. Further, the Board is concerned that there may be prohibitions on the appointment of Mr. Deppisch as a director under banking and antitrust laws.

MEDALLION’S BOARD HAS TAKEN ACTION TO FURTHER STRENGTHEN GOVERNANCE IN RECENT YEARS

Medallion’s Board includes the right balance of skills, experience and fresh perspectives to effectively oversee our growth strategy to drive shareholder value. In recent years, the Board has taken deliberate action to further strengthen the Company’s corporate governance to benefit shareholders and more closely align the Company’s governance with industry best practices. These actions include adding a Lead Independent Director in 2022 and five new independent directors over the past seven years.

The Board’s nominees for election at the 2024 annual meeting are:

Robert M. Meyer, who has served as our director and Chair of the Audit Committee since July 2021, and as a member of the Board of Directors and Audit Committee of our subsidiary Medallion Bank since 2016 and 2019, respectively. Mr. Meyer is a longtime banking executive with over 47 years of experience in the banking industry and has over 25 years of experience managing public companies. Replacing Mr. Meyer with Mr. Hodges or Mr. Deppisch would deprive the Board of his valuable banking experience, diminishing its ability to oversee the continued growth of Medallion Bank.

David L. Rudnick, who has served as our director since February 1996 and, as a result, has crucial institutional knowledge of the Company and our business. Mr. Rudnick, an experienced real estate and private equity investor, previously served as a director of West Side Federal Savings & Loan Association, the nation’s largest savings and loan association at the time of his directorship (and now part of Citibank), and Chelsea National Bank (which is now Modern Bank). Replacing Mr. Rudnick with Mr. Hodges or Mr. Deppisch would deprive the Board of his significant experience as a financial services director and investor, including his deep knowledge of the Company.

Our Board strongly urges shareholders to vote “FOR” only Robert Meyer and David Rudnick, the Company nominees, on the enclosed BLUE universal proxy card to support the Company’s successful value creation strategy.

PLEASE VOTE ON THE BLUE UNIVERSAL PROXY CARD TODAY

“FOR” ONLY ROBERT M. MEYER AND DAVID L. RUDNICK, “FOR” THE APPROVAL OF THE 2023 COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS, AND FOR “ONE YEAR” ON THE SAY-ON-FREQUENCY VOTE

|

|

|

Please vote now using one of the following methods: |

Vote by Internet Go to the website identified on the enclosed BLUE proxy card or voting instruction card |

Vote by Phone Call the number on the enclosed BLUE proxy card or voting instruction card |

Vote by Mail Mark, sign, date and return the enclosed BLUE proxy card or voting instruction card in the accompanying postage-paid pre-addressed envelope |

Your vote is important. If you have any questions or need any assistance in voting, please call our proxy solicitors, Alliance Advisors, toll-free at (855) 600-2578.

Thank you for your consideration and continued support.

Sincerely,

|

|

|

|

Alvin Murstein |

Brent O. Hatch |

Chairman and Chief Executive Officer |

Lead Independent Director |

About Medallion Financial Corp.

Medallion Financial Corp. (NASDAQ:MFIN) and its subsidiaries originate and service a growing portfolio of consumer loans and mezzanine loans in various industries. Key industries served include recreation (towable RVs and marine) and home improvement (replacement roofs, swimming pools, and windows). Medallion Financial Corp. is headquartered in New York City, NY, and its largest subsidiary, Medallion Bank, is headquartered in Salt Lake City, Utah. For more information, please visit www.medallion.com.

Forward-Looking Statements

Please note that this letter contains forward-looking statements that involve risks and uncertainties relating to business performance, cash flow, net interest income and expenses, other expenses, earnings, growth, and our growth strategy. These statements are often, but not always, made using words or phrases such as “will” and “continue” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These statements relate to future public announcements of our earnings, the impact of the pending SEC litigation, expectations regarding our loan portfolio, including collections on our medallion loans, the potential for future asset growth, and market share opportunities. Medallion’s actual results may differ significantly from the results discussed in such forward-looking statements. For example, statements about the effects of the current economy, whether inflation or the risk of recession, operations, financial performance and prospects constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond Medallion’s control. In addition to risks relating to the current economy, a description of certain risks to which Medallion is or may be subject, including risks related to the pending SEC litigation, please refer to the factors discussed under the heading “Risk Factors” in Medallion’s 2023 Annual Report on Form 10-K.

Important Additional Information and Where to Find It

Medallion has filed its definitive proxy statement, accompanying BLUE proxy card and other relevant documents with the SEC in connection with the solicitation of proxies for Medallion’s upcoming 2024 Annual Meeting of Shareholders. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING MEDALLION’S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive proxy statement and other documents filed by the Company with the SEC free of charge from the SEC’s website at www.sec.gov. In addition, copies will be available at no charge by visiting the “Investor Relations” section of Medallion’s website at www.medallion.com, as soon as reasonably practicable after such materials are filed with, or furnished to, the SEC.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

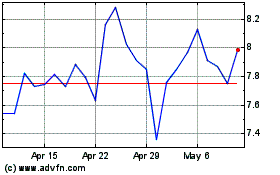

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Apr 2024 to May 2024

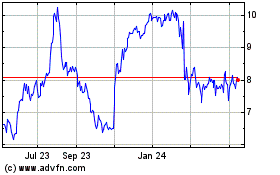

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From May 2023 to May 2024