Facebook Warns That Skyrocketing Usage Won't Lead to Increased Revenue

March 24 2020 - 5:28PM

Dow Jones News

By Jeff Horwitz and Suzanne Vranica

Facebook Inc. warned that its business is expected to take a

hit, even as its products are seeing unprecedented usage as the

result of the novel coronavirus pandemic.

The tech giant's announcement is the latest sign of the major

blow expected for companies that lean heavily on online

advertising, where spending has rapidly dried up in recent

weeks.

In a post on Tuesday afternoon, Facebook said total messaging

across the platform's services has increased 50% in countries hit

hard by the virus, with video messaging more than doubling. In

Italy, which has undertaken some of the most intense and sustained

restrictions on public life of any country outside China, video

calling is up by more than 1000% from a month ago.

But the company said the higher usage wouldn't shield it from

expected declines in digital advertising across the globe.

"We don't monetize many of the services where we're seeing

increased engagement, and we've seen a weakening in our ads

business in countries taking aggressive actions to reduce the

spread of COVID-19," wrote Alex Schultz, Facebook's vice president

of analytics, and Jay Parikh, vice president of engineering.

The company didn't formally restate its earnings guidance but

said "our business is being adversely affected like so many others

around the world."

Facebook's announcement -- which also detailed steps the company

is taking to increase capacity and reduce the strain that

heightened video and calling traffic puts on communications

structure -- is in keeping with other recent announcements by

advertising-based tech platforms and media of reduced financial

targets.

Write to Jeff Horwitz at Jeff.Horwitz@wsj.com and Suzanne

Vranica at suzanne.vranica@wsj.com

(END) Dow Jones Newswires

March 24, 2020 17:13 ET (21:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

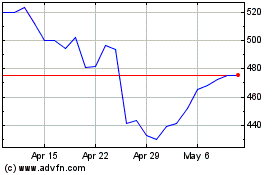

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

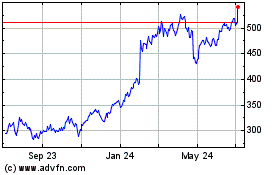

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024