0000917520false00009175202024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

INTEGRA LIFESCIENCES HOLDINGS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 0-26224 | 51-0317849 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (IRS Employer Identification No.) |

1100 Campus Road

Princeton, NJ 08540

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (609) 275-0500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Securities Registered Pursuant to Section12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on Which Registered |

| Common Stock, Par Value $.01 Per Share | IART | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Integra LifeSciences Holdings Corporation (the “Company”) held its 2024 Annual Meeting of Stockholders (the “Annual Meeting”) on May 9, 2024. At the Annual Meeting, the Company’s stockholders approved, among other things, Amendment No. 1 to the Integra LifeSciences Holdings Corporation Fifth Amended and Restated 2003 Equity Incentive Plan (the “Plan Amendment”) to (i) increase the number of shares of common stock available for awards under the plan by 1,900,000 shares and (ii) remove a provision in the plan which permits shares withheld for taxes with respect to an award to continue to be available for issuance under the plan.

A description of the Plan Amendment is included in the section entitled “Proposal 5 – Approval of Amendment No. 1 to the Integra LifeSciences Holdings Corporation Fifth Amended and Restated 2003 Equity Incentive Plan” in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 4, 2024 (the “Proxy Statement”), which description is incorporated herein by reference. Such description does not purport to be complete and is qualified in its entirety by reference to the complete text of the Plan Amendment, a copy of which is attached hereto as Exhibit 10.1.

Item 5.07. Submission of Matters to a Vote of Security Holders

The Annual Meeting of the Company was held on May 9, 2024. The proposals considered at the Annual Meeting are described in detail in the Proxy Statement. The final results of the matters submitted to a vote of stockholders at the Annual Meeting are as follows:

Item No. 1: All of the nominees for director of the Board of Directors (the “Board”) of the Company were elected to serve until the Company’s 2025 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified, by the votes set forth below.

| | | | | | | | | | | | | | |

| Nominees | For | Against | Abstain | Broker Non-Vote |

| Keith Bradley, Ph.D. | 67,216,246 | 4,649,295 | 247,151 | 2,554,795 |

| Shaundra D. Clay | 71,423,197 | 442,770 | 246,725 | 2,554,795 |

| Jan De Witte | 70,674,999 | 1,148,858 | 288,835 | 2,554,795 |

| Stuart M. Essig, Ph.D. | 70,184,418 | 1,688,607 | 239,667 | 2,554,795 |

| Jeffrey A. Graves, Ph.D. | 71,320,630 | 546,018 | 246,044 | 2,554,795 |

| Barbara B. Hill | 70,230,225 | 1,642,410 | 240,057 | 2,554,795 |

| Renee W. Lo | 71,295,583 | 571,590 | 245,519 | 2,554,795 |

| Raymond G. Murphy | 70,601,816 | 1,264,003 | 246,873 | 2,554,795 |

| Christian S. Schade | 67,413,163 | 4,450,099 | 249,430 | 2,554,795 |

Item No. 2: The stockholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year, by the votes set forth below.

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 73,739,121 | 682,073 | 246,293 | 0 |

| | | |

Item No. 3: The stockholders approved, on an advisory, non-binding basis, the compensation of the Company’s named executive officers, by the votes set forth below.

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 71,007,250 | 857,177 | 248,265 | 2,554,795 |

Item No. 4: The stockholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended, to limit the liability of certain officers of the Company as permitted by recent amendments to the General Corporation Law of the State of Delaware, by the votes set forth below:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 62,560,249 | 9,312,392 | 240,051 | 2,554,795 |

Item No. 5: The stockholders approved the Plan Amendment, by the votes set forth below:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Vote |

| 70,526,856 | 1,337,287 | 248,549 | 2,554,795 |

Item 8.01. Other Events

The Company is planning a $50 million share repurchase as a part of a previous approval by the Board. The Company may repurchase shares at its discretion, subject to applicable regulatory and other legal requirements. The number of shares to be repurchased and the timing of such transactions will depend on a variety of factors, including market conditions, regulatory requirements, and other corporate considerations, and could be suspended or discontinued at any time as determined by management. Commencement of share repurchases is expected to occur in the second quarter of 2024 and the Company may utilize various methods to effect the repurchases, including open market transactions, privately negotiated transactions, transactions structured through investment banking institutions, including accelerated share repurchases, or a combination of the foregoing, some of which may be effected through Rule 10b5-1 plans.

Cautionary Note Regarding Forward-Looking Statements

This Form 8-K contains forward-looking statements, including statements related to the Company’s expectations with respect to the repurchase of common stock, including the timing and manner of any purchases under the Company’s authorized stock repurchase program. These forward-looking statements are covered by the “Safe Harbor for Forward-Looking Statements” provided by the Private Securities Litigation Reform Act of 1995. The Company has tried to identify these forward looking statements by using words such as “expect,” “anticipate,” “estimate,” “plan,” “will,” “would,” “should,” “could,” “intend” or similar expressions, but these words are not the exclusive means for identifying such statements. The Company cautions that a number of risks, uncertainties and other factors could cause the Company’s plans and actual results to differ materially from those expressed in, or implied by, the forward-looking statements. Such factors include, but are not limited to, changes in the market price of the Company’s common stock, general market conditions, applicable securities laws and alternative uses of capital. For a detailed discussion of factors that could affect the Company’s future operating results, please see the Company’s filings with the Securities and Exchange Commission, including the disclosures under “Risk Factors” in those filings. Except as expressly required by the federal securities laws, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events or for any other reason.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the inline XRBL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| INTEGRA LIFESCIENCES HOLDINGS CORPORATION |

| | |

| Date: May 13, 2024 | By: | /s/ Eric I. Schwartz |

| | Eric I. Schwartz |

| Title: | Executive Vice President, Chief Legal Officer and |

| | Secretary |

| | |

| | |

| | |

Exhibit 10.1 AMENDMENT NO. 1 TO THE INTEGRA LIFESCIENCES HOLDINGS CORPORATION FIFTH AMENDED AND RESTATED 2003 EQUITY INCENTIVE PLAN THIS AMENDMENT (this “Amendment”) to the Integra Lifesciences Holdings Corporation Fifth Amended and Restated 2003 Equity Incentive Plan (the “Plan”) is adopted by the Board of Directors (the “Board”) of Integra LifeSciences Holdings Corporation (the “Company”) on March 22, 2024. WHEREAS, Integra LifeSciences Holdings Corporation (the “Company”) sponsors and maintains the Integra Lifesciences Holdings Corporation Fifth Amended and Restated 2003 Equity Incentive Plan (the “Plan”), which was previously adopted by the Board of Directors of the Company (the “Board”) and approved by the stockholders of the Company; WHEREAS, pursuant to Section 9(a) of the Plan, the Board of Directors of the Company (the “Board”) has reserved the right to amend the Plan; WHEREAS, the Board believes that the number of shares of common stock of the Company remaining available for issuance under the Plan has become insufficient for the Company’s anticipated future needs under the Plan; WHEREAS, the Board has determined, following the recommendation of the Compensation Committee (the “Committee”) and the Committee’s independent compensation consultant, that it is in the best interests of the Company and its stockholders to amend the Plan, subject to stockholder approval, to (i) increase the aggregate number of shares of Common Stock available for Awards under the Plan and (ii) eliminate a provision that permits Shares withheld for taxes with respect to an Award to continue to be available for Awards under the Plan; and WHEREAS, the Board has approved the submission of this Amendment to the Company’s stockholders for approval and if, for any reason, the Company’s stockholders fail to approve this Amendment, the existing Plan shall continue in full force and effect. NOW, THEREFORE, the Plan is hereby amended, effective as of the Amendment Effective Date (as defined below), as follows: 1. Shares Subject to the Plan. Section 5 of the Plan is hereby amended and restated to read in its entirety as follows: 5. Shares Subject to the Plan. The aggregate number of Shares that may be delivered under the Plan is 18,500,000 (the “Share Limit”). The maximum number of Shares which may be granted as ISOs is 18,500,000. Further, no Key Employee shall receive Awards for more than 2,000,000 Shares in the aggregate during any calendar year under the Plan. However, the limits in the preceding sentences shall be subject to the adjustment described in Sections 8.3 and 8.4. Shares delivered under the Plan may be authorized but unissued Shares, treasury Shares or reacquired Shares, and the Company may purchase Shares required for this purpose, from time to time, if it deems such purchase to be advisable. Any Shares still subject to an Option which expires or otherwise terminates for any reason whatsoever (including, without limitation, the surrender thereof) without having been exercised in full, any Shares that are still subject to an Award that is forfeited, and the Shares subject to an Award which is payable in Shares or cash and that is satisfied in cash rather than in Shares shall continue to be available for Awards under the Plan.

-2- 2. Effective Date of Amendment. This Amendment to the Plan shall become effective upon the date that it is approved by the Company’s stockholders (the “Amendment Effective Date”) in accordance with applicable laws and regulations. 3. Remaining Provisions. The remaining provisions of the Plan will continue in full force and effect unless and until further modified or amended in accordance with the terms of the Plan. 4. Capitalized Terms. Capitalized terms used in this Amendment that are not specifically defined in this Amendment will have the meanings set forth in the Plan. [Remainder of Page Intentionally Blank]

IN WITNESS WHEREOF, the undersigned Secretary of the Company certifies that the foregoing Amendment to the Plan was duly adopted by the Board of Directors. INTEGRA LIFESCIENCES HOLDINGS CORPORATION By: /s/ Eric Schwartz Name: Eric Schwartz Title: Executive Vice President, Chief Legal Officer and Secretary

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

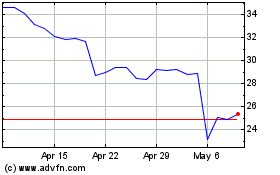

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Apr 2024 to May 2024

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From May 2023 to May 2024