UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8–K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

September 3, 2014

Date of Report (Date of earliest event reported)

Huron

Consulting Group Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50976 |

|

01-0666114 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification Number) |

550 West Van Buren Street

Chicago, Illinois

60607

(Address of principal executive offices)

(Zip Code)

(312)

583-8700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry Into a Material Definitive Agreement. |

On September 3, 2014, Huron Consulting Group Inc. (the

“Company”) and certain of the Company’s subsidiaries entered into a fifth amendment (the “Fifth Amendment”) to the Amended and Restated Credit Agreement dated as of April 14, 2011 (as amended and modified, the

“Credit Agreement”) by and among the Company, as borrower, certain subsidiaries of the Company, as guarantors, the lenders identified therein and Bank of America, N.A., as administrative agent and collateral agent.

Among other terms, the Fifth Amendment:

| |

• |

|

Grants consent to the issuance of up to $250 million in Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions and Permitted Warrant Transactions, as defined in the Fifth Amendment; |

| |

• |

|

Modifies the consolidated leverage ratio definition (consolidated funded debt/consolidated EBITDA), through September 30, 2015, by subtracting unrestricted cash and cash equivalents in excess of $25 million on

deposit with the administrative agent or lenders from consolidated funded debt; |

| |

• |

|

Clarifies that consolidated funded debt shall not include Permitted Bond Hedge Transactions or Permitted Warrant Transactions for the purpose of the calculation of the consolidated leverage ratio; |

| |

• |

|

Amends the consolidated fixed charges definition to exclude the upfront premiums payable in respect of the Permitted Bond Hedge Transactions and any share repurchases; |

| |

• |

|

Eliminates the $75 million aggregate restriction on permitted acquisitions; |

| |

• |

|

Decreases the unsecured indebtedness basket from $250 million to $150 million; |

| |

• |

|

Permits investments consisting of Permitted Bond Hedge Transactions and Permitted Warrant Transactions entered into in connection with Permitted Convertible Indebtedness; and |

| |

• |

|

Permits payments to be made in respect of Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions and Permitted Warrant Transactions. |

A copy of the Fifth Amendment is attached hereto as Exhibit 10.1 and is incorporated by reference herein. The foregoing description of the Fifth Amendment is

qualified in its entirety by reference to the full text of the Fifth Amendment.

A copy of the press release announcing the Fifth Amendment is attached

hereto as Exhibit 99.1 to this Form 8-K.

Intention to Offer Convertible Senior Notes

On September 3, 2014, the Company issued a press release announcing its intention to offer $225 million aggregate principal amount of convertible senior

notes due 2019 in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended.

A copy of the

press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Potential Legal Claim

In 2011, Huron Consulting Services LLC (“Huron”) was engaged to design and implement new processes, software, tools, and techniques to assist

Physiotherapy Associates, Inc. (“PA”) in reducing older accounts receivable levels and optimizing cash flow. The engagement agreement specifically provides that Huron will not be auditing financial statements and that Huron’s services

are not designed, and should not be relied on, to disclose weaknesses in internal controls, financial statement errors, irregularities, illegal acts, or disclosure deficiencies.

In November 2013, Physiotherapy Holdings, Inc., and certain subsidiaries and affiliates (including PA) filed a voluntary petition for bankruptcy pursuant to

Chapter 11 of the Bankruptcy Code, which resulted in part from claims related to an alleged overstatement of PA’s revenues and profitability in connection with the sale of PA in 2012. The Joint Prepackaged Plan of Reorganization (the

“Plan”), which was confirmed by the Bankruptcy Court in December 2013, establishes and funds a Litigation Trust to pursue certain claims on behalf of certain beneficiaries. The Plan discloses a lengthy list of potential defendants

and witnesses regarding these claims, including but not limited to the debtors’ officers, directors, certain employees, former owners, investment bankers, auditors, and various consultants. This list of potential defendants and witnesses

includes Huron, as well as three of Huron’s current or former employees.

The Plan suggests that Huron, among others, was involved in “actively marketing PA” for sale and

provided opinions to unnamed parties “defending the quality of PA’s earnings.” The Plan further states that the damages to be sought by the Litigation Trust will exceed $300 million. The Litigation Trust has not specified against

which potential defendants it will bring claims, if any. Huron believes the Litigation Trust’s allegations with respect to Huron are without merit and will vigorously defend itself should any claim arising out of these alleged facts and

circumstances be asserted against it by the Litigation Trust.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Amendment No.5 of the Credit Agreement, dated as of September 3, 2014, by and among Huron Consulting Group Inc., as Borrower, certain subsidiaries as Guarantors, and Bank of America, N.A., as Administrative Agent for and on

behalf of the Lenders. |

|

|

| 99.1 |

|

Press release dated September 3, 2014, announcing the Fifth Amendment. |

|

|

| 99.2 |

|

Press release dated September 3, 2014, announcing the intention to offer convertible senior notes. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Huron Consulting Group Inc. |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: |

|

September 3, 2014 |

|

|

|

/s/ C. Mark Hussey |

|

|

|

|

|

|

C. Mark Hussey |

|

|

|

|

|

|

Executive Vice President, Chief Operating Officer,

Chief Financial Officer, and Treasurer |

Exhibit 10.1

AMENDMENT NO. 5

THIS AMENDMENT

NO. 5, dated as of September 3, 2014 (this “Amendment”), of the Credit Agreement referenced below by and among HURON CONSULTING GROUP INC., a Delaware corporation, as Borrower, the Guarantors identified herein, and BANK OF

AMERICA, N.A., as Administrative Agent for and on behalf of the Lenders. Capitalized terms used but not otherwise defined herein shall have the meanings provided in the Credit Agreement.

W I T N E S S E T H

WHEREAS, a $450 million credit facility consisting of a $247.5 million revolving credit facility and a $202.5 million term loan facility has

been established in favor of the Borrower pursuant to the terms of that certain Amended and Restated Credit Agreement dated as of April 14, 2011 (as amended and modified, the “Credit Agreement”) by and among Huron Consulting

Group Inc., a Delaware corporation, as Borrower, certain subsidiaries of Huron Consulting Group Inc., as Guarantors, the Lenders identified therein and Bank of America, N.A., as Administrative Agent and Collateral Agent;

WHEREAS, the Borrower has requested amendment of the Credit Agreement in certain respects; and

WHEREAS, the Lenders have agreed to the requested amendments on the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the premises contained herein and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

Section 1. Consent

to Convertible Bond Transaction. The Borrower plans to issue up to $250 million in Permitted Convertible Indebtedness, and Permitted Bond Hedge Transactions and Permitted Warrant Transactions relating thereto (each as hereinafter defined).

Consent is hereby given to the issuance of such Permitted Convertible Indebtedness, and Permitted Bond Hedge Transactions and Permitted Warrant Transactions relating thereto, as hereinafter provided.

Section 2. Amendment. The Credit Agreement is amended in the following respects:

2.1. In Section 1.01 (Defined Terms) the following terms are amended or added to read as follows:

“Amendment No. 5” means Amendment No. 5, dated as of September 3, 2014, to this Credit Agreement.

“Amendment No. 5 Effective Date” means September 3, 2014.

“Cash Equivalents” means, as at any date, (a) securities issued or directly and fully guaranteed or insured by the

United States or any agency or instrumentality thereof (provided that the full faith and credit of the United States is pledged in support thereof) having maturities of not more than twelve months from the date of acquisition, (b) Dollar

denominated time deposits and certificates of deposit of (i) any Lender, (ii) any domestic commercial bank of recognized standing having capital and surplus in excess of $500,000,000 or (iii) any bank whose short-term commercial paper rating from S&P is at least A-2 or the equivalent thereof or from Moody’s is at least P-2 or the

equivalent thereof (any such bank being an “Approved Bank”), in each case with maturities of not more than one year from the date of

acquisition, (c) commercial paper and variable or fixed rate notes issued by any Approved Bank (or by the parent company thereof) or any commercial paper and variable or fixed rate notes

issued by, or guaranteed by, any domestic corporation rated A-2 (or the equivalent thereof) or better by S&P or P-2 (or the equivalent thereof) or better by

Moody’s and maturing within six months of the date of acquisition, (d) repurchase agreements entered into by any Person with a bank or trust company (including any of the Lenders) or recognized securities dealer having capital and surplus

in excess of $500,000,000 for direct obligations issued by or fully guaranteed by the United States in which such Person shall have a perfected first priority security interest (subject to no other Liens) and having, on the date of purchase thereof,

a fair market value of at least 100% of the amount of the repurchase obligations and (e) investments, classified in accordance with GAAP as current assets, in money market investment programs registered under the Investment Company Act of 1940

which are administered by reputable financial institutions having capital of at least $500,000,000 and the portfolios of which are limited to Investments of the character described in the foregoing subdivisions (a) through (d).

“Change of Control” means the occurrence of any of the following events: (a) any Person or group of Persons (within the

meaning of Section 13 or 14 of the Securities Exchange Act of 1934 (the “Act”), shall acquire beneficial ownership (within the meaning of Rule 13d-3 promulgated under such Act) of

more than twenty-five percent (25%) of the outstanding securities (on a fully diluted basis and taking into account any securities or contract rights exercisable, exchangeable or convertible into equity securities) of the Borrower having voting

rights in the election of directors under normal circumstances; (b) a majority of the members of the Board of Directors of the Borrower shall cease to be Continuing Members; (c) the Borrower shall cease to, directly or indirectly, own and

control sixty-six percent (66%) of each class of the outstanding Capital Securities of any Wholly-Owned Domestic Subsidiary; or (d) the occurrence of a “change of control”,

“fundamental change” or similar occurrence in respect of Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions or Permitted Warrant Transactions and giving rise to a right to payment or purchase prior to scheduled maturity

or an exercise of rights and remedies thereunder or in respect thereof. For purposes of the foregoing, “Continuing Member” means a member of the Board of Directors of the Borrower who either (i) was a member of the

Borrower’s Board of Directors on the day before the Closing Date and has been such continuously thereafter or (ii) became a member of such Board of Directors after the day before the Closing Date and whose election or nomination for

election was approved by a vote of the majority of the Continuing Members then members of the Borrower’s Board of Directors.

“Consolidated Fixed Charges” means, for any period for the Borrower and its Subsidiaries, the sum of (a) the cash

portion of Consolidated Interest Expense (excluding any amounts paid as financing or amendment fees or expenses), plus (b) scheduled principal payments made on Consolidated Funded Debt, plus (c) rent and lease expense in

accordance with GAAP, plus (d) the aggregate amount of Restricted Payments (but excluding, in any event, for purposes hereof, the upfront premiums payable in respect of the Permitted Bond Hedge Transactions and any share repurchases by

the Borrower) actually paid in cash during the period to Persons other than the Borrower or any domestic Wholly-Owned Subsidiary, in each case on a consolidated basis determined in accordance with GAAP. Except

as otherwise expressly provided, the applicable period shall be the four consecutive fiscal quarters ending as of the date of determination.

“Consolidated Funded Debt” means Funded Indebtedness of the Borrower and its Subsidiaries determined on a consolidated basis

in accordance with GAAP. For the avoidance of doubt, “Consolidated Funded Debt” shall not include Permitted Bond Hedge Transactions or Permitted Warrant Transactions.

“Consolidated Leverage Ratio” means, as of the last day of each fiscal quarter, the ratio of (i) the difference of

Consolidated Funded Debt minus, for the period from the Amendment No. 5 Effective Date through September 30, 2015, but only for such period, unrestricted cash and Cash Equivalents (which

2

shall not include amounts on deposit in respect of the discharge or defeasance of Indebtedness) on deposit with the Administrative Agent or Lenders in excess of $25 million on such date, to

(ii) Consolidated EBITDA for the period of four consecutive fiscal quarters ending as of such day.

“Equity

Interests” means, with respect to any Person, all of the shares of capital stock of (or other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of

shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or

options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, member or trust interests therein), whether voting or

nonvoting, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination. For the avoidance of doubt, “Equity Interests” shall not include Permitted Convertible Indebtedness or

Permitted Warrant Transactions.

“Indebtedness” means, as to any Person at a particular time, without duplication, all of

the following, whether or not included as indebtedness or liabilities in accordance with GAAP:

(a) all Funded

Indebtedness;

(b) the Swap Termination Value of any Swap Contract;

(c) all obligations in respect of the deferred purchase price of property or services (including all earn-out obligations,

whether or not contingent, regardless of treatment under GAAP, but excluding trade accounts payable in the ordinary course of business);

(d) all Guarantees with respect to outstanding Indebtedness of the types specified in clauses (a) and (b) above of

any other Person; and

(e) all Indebtedness of the types referred to in clauses (a) through (c) above of any

partnership or joint venture (other than a joint venture that is itself a corporation or limited liability company) in which such Person is a general partner or joint venturer, unless such Indebtedness is expressly made non-recourse to such Person;

provided, however, that for the avoidance of doubt, “Indebtedness” shall not include Permitted Bond Hedge Transactions or Permitted Warrant

Transactions.

“Obligations” means, with respect to each Loan Party, without duplication, (a) all advances to, and

debts, liabilities, obligations, covenants and duties of, any Loan Party arising under any Loan Document or otherwise with respect to any Loan or Letter of Credit, whether direct or indirect (including those acquired by assumption), absolute or

contingent, due or to become due, now existing or hereafter arising and including interest and fees that accrue after the commencement by or against any Loan Party or any Affiliate thereof of any proceeding under any Debtor Relief Laws naming such

Person as the debtor in such proceeding, regardless of whether such interest and fees are allowed claims in such proceeding, (b) all obligations under any Swap Contract between the Borrower or any of its Subsidiaries, on the one hand, and any

Lender or Affiliate of a Lender, on the other hand, to the extent permitted hereunder and (c) all obligations under any Treasury Management Agreement between the Borrower or any of its Subsidiaries, on the one hand, and any Lender or Affiliate

of a Lender, on the other hand; provided, however, that (i) the “Obligations” of a Guarantor shall exclude any Excluded Swap Obligations with respect to such Guarantor, and (ii) for the avoidance of doubt,

“Obligations” shall not include Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions or Permitted Warrant Transactions.

3

“Permitted Acquisition” means an Investment consisting of an Acquisition by the

Borrower or any Subsidiary, provided that (a) no Default or Event of Default shall exist immediately before or immediately after giving effect thereto on a Pro Forma Basis, (b) the property acquired (or the property of the Person

acquired) in such Acquisition is used or useful in the same or a similar line of business as the Borrower and its Subsidiaries were engaged in on the Closing Date (or any reasonable extensions or expansions thereof), (c) in the case of an

Acquisition of the Equity Interests of another Person, the board of directors (or other comparable governing body) of such other Person shall have duly approved such Acquisition, (d) the Consolidated Leverage Ratio shall be at least 0.25 times

less than (at least one-quarter turn inside) the maximum Consolidated Leverage Ratio then in effect under Section 8.11(b) after giving effect thereto on a Pro Forma Basis, (e) in the case of any Acquisition, or series of related

Acquisitions, with Acquisition Consideration in excess of $30 million the Borrower shall have delivered to the Administrative Agent a Pro Forma Compliance Certificate demonstrating that the Loan Parties will be in compliance with the financial

covenants set forth in Section 8.11 as of the end of the period of the four fiscal quarters most recently ended for which the Borrower has delivered financial statements pursuant to Section 7.01(a) or (b) after

giving effect to such Acquisition on a Pro Forma Basis, (f) the representations and warranties made by the Loan Parties in each Loan Document shall be true and correct in all material respects at and as if made as of the date of such

Acquisition (after giving effect thereto), and (g) if such transaction involves the purchase of an interest in a partnership between any Loan Party as a general partner and entities unaffiliated with the Borrower as the other partners, such

transaction shall be effected by having such equity interest acquired by a corporate holding company directly or indirectly wholly-owned by such Loan Party newly formed for the sole purpose of effecting such

transaction.

“Permitted Bond Hedge Transactions” means any call or capped call option (or substantively equivalent

derivative transaction) relating to Borrower’s common stock (or other securities or property following a merger event or other change of the common stock of Borrower) purchased by Borrower in connection with the issuance of any Permitted

Convertible Indebtedness; provided that the purchase price for such Permitted Bond Hedge Transactions, less the proceeds received by Borrower from the sale of any related Permitted Warrant Transactions, does not exceed the net proceeds

received by Borrower from the issuance of such Permitted Convertible Indebtedness in connection with such Permitted Bond Hedge Transactions.

“Permitted Convertible Indebtedness” means indebtedness of Borrower that is convertible into common stock of Borrower (or

other securities or property following a merger event or other change of the common stock of Borrower) and/or cash (in an amount determined by reference to the price of such common stock).

“Permitted Warrant Transactions” means any call option, warrant or right to purchase (or substantively equivalent derivative

transaction) relating to Borrower’s common stock (or other securities or property following a merger event or other change of the common stock of Borrower) sold by Borrower substantially concurrently in connection with any purchase by Borrower

of a related Permitted Bond Hedge Transactions.

“Pro Forma Basis” means, with respect to any transaction, for purposes

of determining the Consolidated Leverage Ratio (including for purposes of determining the applicable pricing level for the “Applicable Percentage”), that such transaction shall be deemed to have occurred as of the first day of the period

of four consecutive fiscal quarters ending as of the end of the most recent fiscal quarter for which annual or quarterly financial statements shall have been delivered in accordance with the provisions hereof. Further, for purposes of making

calculations on a Pro Forma Basis hereunder, (a) in the case of

4

Dispositions and Recovery Events, (i) income and cash flow statement items (whether positive or negative) attributable to the property, entities or business units that are the subject

thereof shall be excluded to the extent relating to any period prior to the date of such transaction, and (ii) Funded Indebtedness paid or retired in connection therewith shall be deemed to have been paid and retired as of the first day of the

applicable period; (b) in the case of any Acquisition, (i) income statement items (whether positive or negative) attributable to the property, entities or business units that are the subject thereof shall be included to the extent relating

to any period prior to the date thereof and (ii) Funded Indebtedness incurred in connection therewith shall be deemed to have been incurred as of the first day of the applicable period (provided that interest expense need not be imputed for the

applicable period); and (c) in the case of incurrence of Funded Indebtedness hereunder, the Funded Indebtedness shall be deemed to have been incurred as of the first day of the applicable period (provided that interest expense need not be

imputed for the applicable period).

“Restricted Payment” means (a) any dividend or other distribution (whether in

cash, securities or other property) with respect to any Equity Interests of any Person, (b) any payment (whether in cash, securities or other property), including any sinking fund or similar deposit, on account of the purchase, redemption,

retirement, defeasance, acquisition, cancellation or termination of any such Equity Interests or on account of any return of capital to such Person’s stockholders, partners or members (or the equivalent Person thereof), or any option, warrant

or other right to acquire any such dividend or other distribution or payment, (c) the initial premium amount for a Permitted Bond Hedge Transaction and the sales proceeds from a Permitted Warrant Transaction in connection with Permitted

Convertible Indebtedness, taken together as a single transaction, on a net basis, (d) any payment made in cash to holders of Permitted Convertible Indebtedness in excess of the original principal (or notional) amount thereof and interest on

such excess amount, unless and to the extent that a corresponding amount is received in cash (whether through a direct cash payment or a settlement in shares of stock that are immediately sold for cash) substantially contemporaneously from the other

parties to a Permitted Bond Hedge Transaction relating to such Permitted Convertible Indebtedness, and (e) any cash payment made in connection with the settlement of a Warrant Transaction solely to the extent the Borrower has the option of

satisfying such payment obligation through the issuance of shares of common stock.

“Swap Contract” means (a) any

and all rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond index swaps

or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency

rate swap transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or

subject to any master agreement, and (b) any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps

and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement (any such master agreement, together with any related schedules, a “Master Agreement”), including any such

obligations or liabilities under any Master Agreement; provided that, for the avoidance of doubt, “Swap Contract” shall not include any Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions or Permitted Warrant

Transactions.

2.2. Section 1.03(c) is amended to read as follows:

(c) Calculations. Notwithstanding the above, the parties hereto acknowledge and agree that:

5

(i) all calculations of the Consolidated Leverage Ratio (and its components)

(including for purposes of determining applicable pricing level for the Applicable Percentage) shall be made on a Pro Forma Basis giving effect to Acquisitions, Dispositions and Recovery Events occurring during the applicable period;

(ii) all references herein to consolidated financial statements of the Borrower and its Subsidiaries or to the determination of

any amount for the Borrower and its Subsidiaries on a consolidated basis or any similar reference shall, in each case, be deemed to include each variable interest entity that the Borrower is required to consolidate pursuant to FASB ASC 810 as if

such variable interest entity were a Subsidiary as defined herein;

(iii) all Indebtedness shall be carried at 100% of the

outstanding principal amount thereof regardless whether GAAP may permit any such Indebtedness to be carried at some lesser amount under FASB ASC 825 and FASB ASC 470-20 or otherwise; and

(iv) for purposes of all calculations hereunder, the principal amount of Permitted Convertible Indebtedness shall be the

outstanding principal (or notional) amount thereof, valued at par.

2.3. Section 7.01 is amended to read as follows:

7.01 Financial Statements. Deliver to the Administrative Agent, in form and detail reasonably satisfactory to the

Administrative Agent:

(a) as soon as available, but in any event within ninety days after the end of each fiscal year or,

if earlier, 15 days after the date required to be filed with the SEC (without giving effect to any extension permitted by the SEC)), commencing with the fiscal year ending December 31, 2011, consolidated financial statements for the Borrower

and its Subsidiaries, including a balance sheet as at the end of such fiscal year, and the related statements of income or operations, changes in cash flows and changes in shareholders’ equity (on a consolidated basis only) for such fiscal

year, all in reasonable detail and prepared in accordance with GAAP, and in the case of such consolidated statements, audited and accompanied by a report and opinion of an independent certified public accountant of nationally recognized standing

reasonably acceptable to the Administrative Agent, which report and opinion shall be prepared in accordance with generally accepted auditing standards and shall not be subject to any “going concern” or like qualification or exception or

any qualification or exception as to the scope of such audit; and

(b) as soon as available, but in any event within,

forty-five days after the end of each of the first three fiscal quarters (or, if earlier, 5 days after the date required to be filed with the SEC (without giving effect to any extension permitted by the SEC)), commencing with the fiscal quarter

ending March 31, 2011, consolidated financial statements for the Borrower and its Subsidiaries, including a balance sheet as at the end of such fiscal quarter, and the related statements of income or operations, changes in cash flows and

changes in shareholders’ equity (on a consolidated basis only) for the fiscal quarter and portion of the fiscal year then ended, all in reasonable detail and in the case of such consolidated statements certified by the chief executive officer,

chief financial officer, treasurer or controller of the Borrower as fairly presenting the financial condition,

6

results of operations, shareholders’ equity and cash flows of the Borrower and its Subsidiaries in accordance with GAAP, subject only to normal year-end audit adjustments and the absence of

footnotes.

As to any information contained in materials furnished pursuant to Section 7.02(d), the Borrower shall not be

separately required to furnish such information under clause (a) or (b) above, but the foregoing shall not be in derogation of the obligation of the Borrower to furnish the information and materials described in clauses (a) and

(b) above at the times specified therein.

2.4. Section 8.02(k) is amended to read as follows:

(k) Investments consisting of (i) Swap Contracts permitted by Section 8.03(d) and (ii) Permitted Bond

Hedge Transactions and Permitted Warrant Transactions entered into in connection with Permitted Convertible Indebtedness;

2.5. Section 8.03 (Indebtedness) is amended to read as follows:

8.03 Indebtedness. Create, incur, assume or suffer to exist any Indebtedness, except:

(a) Indebtedness under the Loan Documents;

(b) Indebtedness set forth in Schedule 8.03 and renewals, refinancings and extensions thereof; provided that

(i) the amount of such Indebtedness is not increased at the time of such renewal, refinancing or extension except by an amount equal to a reasonable premium or other reasonable amount paid, and fees and expenses reasonably incurred, in

connection with such refinancing and by an amount equal to any existing commitments unutilized thereunder and (ii) the material terms taken as a whole of such renewal, refinancing or extension are not materially less favorable to the Loan

Parties and their Subsidiaries than the terms of the Indebtedness being renewed, refinanced or extended;

(c) intercompany

Indebtedness permitted under Section 8.02;

(d) obligations (contingent or otherwise) existing or arising under

any Swap Contract, provided that (i) such obligations are (or were) entered into by such Person in the ordinary course of business for the purpose of directly mitigating risks associated with liabilities, commitments, investments,

assets, or property held or reasonably anticipated by such Person, or changes in the value of securities issued by such Person, and not for purposes of speculation or taking a “market view;” and (ii) such Swap Contract does not

contain any provision exonerating the non-defaulting party from its obligation to make payments on outstanding transactions to the defaulting party;

(e) purchase money Indebtedness (including obligations in respect of Capital Leases or Synthetic Leases) hereafter incurred to

finance the purchase of fixed assets, and renewals, refinancings and extensions thereof, provided that (i) the aggregate outstanding principal amount of all such Indebtedness shall not exceed $10 million at any one time outstanding; and

(ii) such Indebtedness when incurred shall not exceed the purchase price of the asset(s) financed;

(f) contingent

liabilities relating to customary indemnification obligations in favor of sellers and purchasers in respect of Acquisitions and Dispositions permitted hereunder;

7

(g) deferred purchase price obligations (including earn-out payments) in respect

of Permitted Acquisitions;

(h) Indebtedness acquired or assumed in connection with an Acquisition permitted hereunder,

provided that (i) the Indebtedness was not was not incurred in connection with or in anticipation of such Acquisition, and (ii) no Default or Event of Default shall exist immediately before or immediately after giving effect thereto on a

Pro Forma Basis;

(i) unsecured Permitted Convertible Indebtedness in an original (or notional) aggregate principal amount

not to exceed $250 million, and Permitted Bond Hedge Transactions and Permitted Warrant Transactions relating thereto; provided that (i) no Default or Event of Default shall exist immediately before or immediately after giving effect thereto on

a Pro Forma Basis, and (ii) the Borrower shall deliver a certificate from a Responsible Officer in form and detail reasonably satisfactory to the Administrative Agent confirming the foregoing and demonstrating compliance with the financial

covenants after giving effect thereto on a Pro Forma Basis;

(j) unsecured Indebtedness for borrowed money of the Borrower

in an aggregate principal amount not to exceed $150 million, provided that (i) no Default or Event of Default shall exist immediately before or immediately after giving effect thereto on a Pro Forma Basis, (ii) the Borrower shall deliver a

certificate from a Responsible Officer in form and detail reasonably satisfactory to the Administrative Agent confirming the foregoing and demonstrating compliance with the financial covenants after giving effect thereto on a Pro Forma Basis, and

(iii) the covenants, terms and conditions of such Indebtedness shall not be more restrictive, in any material respect, than the covenants, terms and conditions hereunder;

(k) Guarantees with respect to Indebtedness permitted under this Section 8.03;

(l) Indebtedness which may be deemed to exist pursuant to any performance, surety, statutory, appeal bonds or similar

obligations incurred in the ordinary course of business;

(m) Indebtedness arising from the honoring by a bank or other

financial institution of a check, draft or similar instrument, in each case, drawn against insufficient funds in the ordinary course of business, provided, that such Indebtedness is extinguished within 5 Business Days of its incurrence;

(n) Indebtedness incurred in favor of insurance companies (or their financing affiliates) in connection with financing of

insurance premiums; provided that the total of all such Indebtedness shall not exceed the aggregate amount of such unpaid insurance premiums;

(o) other Indebtedness not specified above, provided, that the principal amount of such Indebtedness does not exceed $5 million

in the aggregate at any time outstanding.

2.6. Section 8.06 (Restricted Payments) is amended to read as follows:

8.06 Restricted Payments. Declare or make, directly or indirectly, any Restricted Payment, or incur any obligation

(contingent or otherwise) to do so, except that:

(a) each Subsidiary may declare and make Restricted Payments to Persons

that own Equity Interests in such Subsidiary, ratably according to their respective holdings of the type of Equity Interest in respect of which such Restricted Payment is being made;

8

(b) the Borrower and its Subsidiaries may declare and make dividend payments or

other distributions payable solely in common Equity Interests of such Person; and

(c) the Borrower may make payments

required under and in respect of the Permitted Convertible Indebtedness, and Permitted Bond Hedge Transactions and Permitted Warrant Transactions relating thereto; and

(d) the Borrower may declare and make other Restricted Payments; provided that (i) no Default or Event of Default

shall exist immediately before or immediately after giving effect thereto on a Pro Forma Basis, (ii) the Borrower shall deliver a certificate from a Responsible Officer in form and detail reasonably satisfactory to the Administrative Agent

confirming the foregoing and demonstrating compliance with the financial covenants after giving effect thereto on a Pro Forma Basis, and (iii) the aggregate amount of such Restricted Payments shall not exceed an amount equal to the sum of

(A) $50,000,000 plus (B) 50% of cumulative Consolidated Net Income from the Closing Date, plus (C) 50% of the Net Cash Proceeds from Equity Issuances after the Closing Date.

Notwithstanding anything to the contrary above or elsewhere contained herein, the entry into (including any payments of premiums in connection

therewith), performance of obligations under (including any payments of interest), and conversion, exercise, repurchase, redemption, settlement or early termination or cancellation of (whether in whole or in part and including by netting or set-off)

(in each case, whether in cash, common or other securities or property), any Permitted Convertible Indebtedness, any Permitted Bond Hedge Transactions and any Permitted Warrant Transactions are not prohibited, limited or constrained hereunder.

2.7. Section 9.01(e) is amended to read as follows:

(e) Cross-Default. (i) The Borrower or any of its Subsidiaries fails to make any payment when due (whether by

scheduled maturity, required prepayment, acceleration, demand, or otherwise) in respect of any Material Indebtedness; (ii) the Borrower or any of its Subsidiaries fails to observe or perform any other agreement or condition relating to any

Material Indebtedness or contained in any instrument or agreement evidencing, securing or relating thereto, or any other event occurs, the effect of which default or other event is to cause, or to permit the holder or holders of such Material

Indebtedness (or a trustee or agent on behalf of such holder or holders) to cause, with the giving of notice if required, such Material Indebtedness to be demanded or to become due or to be repurchased, prepaid, defeased or redeemed (automatically

or otherwise), or an offer to repurchase, prepay, defease or redeem such Material Indebtedness to be made, prior to its stated maturity; (iii) there occurs under any Swap Contract an Early Termination Date (as defined in such Swap Contract)

resulting from (A) any event of default under such Swap Contract as to which the Borrower or any of its Subsidiaries is the Defaulting Party (as defined in such Swap Contract) or (B) any Termination Event (as so defined) under such Swap

Contract as to which the Borrower or any of its Subsidiaries is an Affected Party (as so defined) and, in either event, the Swap Termination Value owed by the Borrower or such Subsidiary as a result thereof is greater than $15,000,000; or

(iv) there occurs under any Permitted Bond Hedge Transactions or Permitted Warrant Transactions an Early Termination Date (as defined therein) resulting from any event of default thereunder as to which the Borrower

9

or any of its Subsidiaries is the Defaulting Party (as defined therein) and the termination value owed by the Borrower or such Subsidiary as a result thereof, taken together, is greater than

$15,000,000; or

Section 3. Representations and Warranties, No Default. Each of the Loan Parties hereby represents and

warrants that as of the effective date of this Amendment, (i) no Default or Event of Default exists and is continuing, and (ii) all representations and warranties contained in the Credit Agreement are true and correct in all material

respects on and as of the date hereof, as though made on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct in all material

respects as of such earlier date.

Section 4. Effectiveness. This Amendment shall become effective on the date that the

following conditions have been satisfied:

4.1. Consents. The Administrative Agent shall have received

(a) signed consents to this Amendment from the Required Lenders, and (b) executed signature pages hereto from each Loan Party;

4.2. Fees and Expenses. The Administrative Agent shall have received all fees required to be paid, and all expenses

(including the reasonable fees and expenses of legal counsel), on or before the Amendment No. 5 Effective Date;

4.3.

Legal Opinions. The Administrative Agent shall have received a favorable legal opinion from Barnes & Thornburg, LLP, counsel to the Loan Parties, covering such matters as the Administrative Agent may reasonably request and otherwise

reasonably satisfactory to the Administrative Agent; and

4.4. Closing Certificates. The Administrative Agent shall

have received from the Loan Parties certified copies of resolutions and Organization Documents, or “no change” certifications from the deliveries made on the Closing Date, and updated incumbency certificates and specimen signatures, as

appropriate.

Section 5. Guarantor Acknowledgment. Each Guarantor acknowledges and consents to all of the terms and conditions

of this Amendment, affirms its Guaranteed Obligations under and in respect of the Loan Documents and agrees that this Amendment and all documents executed in connection herewith do not operate to reduce or discharge any Guarantor’s obligations

under the Loan Documents, except as expressly set forth therein.

Section 6. Counterparts. This Amendment may be executed in

any number of counterparts and by different parties hereto on separate counterparts, each of which when so executed and delivered shall be deemed to be an original, but all of which when taken together shall constitute a single instrument. Delivery

of an executed counterpart of a signature page of this Amendment by facsimile or any other electronic transmission shall be effective as delivery of a manually executed counterpart hereof.

Section 7. Applicable Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF

ILLINOIS.

Section 8. Expenses. The Borrower agrees to pay all reasonable costs and expenses of the Administrative Agent in

connection with the preparation, execution and delivery of this Amendment, including the reasonable fees and expenses of Moore & Van Allen PLLC.

10

Section 9. Headings. The headings of this Amendment are for purposes of reference

only and shall not limit or otherwise affect the meaning hereof.

Section 10. Effect of Amendment. Except as expressly set

forth herein, (i) this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders, the Administrative Agent, any other Agent, the Swing Line Lender or the L/C

Issuer, in each case under the Credit Agreement or any other Loan Document, and (ii) shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any

other provision of either such agreement or any other Loan Document. Except as expressly set forth herein, each and every term, condition, obligation, covenant and agreement contained in the Credit Agreement or any other Loan Document is hereby

ratified and re-affirmed in all respects and shall continue in full force and effect. Each Loan Party reaffirms its obligations under the Loan Documents to which it is party and the validity of the Liens granted by it pursuant to the Collateral

Documents. This Amendment shall constitute a Loan Document for purposes of the Credit Agreement and from and after the effective date hereof, all references to the Credit Agreement in any Loan Document and all references in the Credit Agreement to

“this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement, shall, unless expressly provided otherwise, refer to the Credit Agreement as amended by this Amendment. Each of the Loan

Parties hereby consents to this Amendment and confirms that all obligations of such Loan Party under the Loan Documents to which such Loan Party is a party shall continue to apply to the Credit Agreement as amended hereby.

[Signature pages follow]

11

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the

date first above written.

|

|

|

|

|

| BORROWER: |

|

HURON CONSULTING GROUP INC.,

a Delaware corporation |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

|

|

| GUARANTORS: |

|

HURON CONSULTING GROUP HOLDINGS LLC,

a Delaware limited liability company |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

|

|

|

|

HURON CONSULTING SERVICES LLC,

a Delaware limited liability company |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

|

|

|

|

HURON MANAGEMENT SERVICES LLC,

formerly known as WELLSPRING MANAGEMENT SERVICES LLC, a Delaware limited liability company |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

|

|

|

|

HURON DEMAND LLC, a

Delaware limited liability company |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

|

|

|

|

HURON TECHNOLOGIES INC.,

a Delaware corporation |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

AMENDMENT NO. 5

HURON CONSULTING GROUP INC.

|

|

|

|

|

|

|

|

|

LEGALSOURCE LLC, a Delaware

limited liability company |

|

|

|

|

|

By: |

|

/s/ C. Mark Hussey |

|

|

Name: |

|

C. Mark Hussey |

|

|

Title: |

|

EVP, COO, CFO and Treasurer |

AMENDMENT NO. 5

HURON CONSULTING GROUP INC.

|

|

|

|

|

| ADMINISTRATIVE

AGENT: |

|

BANK OF AMERICA, N.A., as

Administrative Agent and Collateral Agent |

|

|

|

|

|

By: |

|

/s/ Maria A. McClain |

|

|

Name: |

|

Maria A. McClain |

|

|

Title: |

|

Vice President |

AMENDMENT NO. 5

HURON CONSULTING GROUP INC.

Exhibit 99.1

FOR IMMEDIATE RELEASE

September 3, 2014

Huron

Consulting Group Amends Senior Secured Credit Facility

CHICAGO – September 3, 2014 - Huron Consulting Group Inc. (NASDAQ: HURN), a leading

provider of business consulting services, today announced it has amended its senior secured credit facility.

Among other terms, the amendment:

| |

• |

|

Grants consent to the issuance of up to $250 million in Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions and Permitted Warrant Transactions, as defined in the amendment |

| |

• |

|

Modifies the consolidated leverage ratio definition (consolidated funded debt/consolidated EBITDA), through September 30, 2015, by subtracting unrestricted cash and cash equivalents in excess of $25 million on

deposit with the administrative agent or lenders from consolidated funded debt |

| |

• |

|

Clarifies that consolidated funded debt shall not include Permitted Bond Hedge Transactions or Permitted Warrant Transactions for the purpose of the calculation of the consolidated leverage ratio |

| |

• |

|

Amends the consolidated fixed charges definition to exclude the upfront premiums payable in respect of the Permitted Bond Hedge Transactions and any share repurchases |

| |

• |

|

Eliminates the $75 million aggregate restriction on permitted acquisitions |

| |

• |

|

Decreases the permitted unsecured indebtedness basket from $250 million to $150 million |

| |

• |

|

Permits investments consisting of Permitted Bond Hedge Transactions and Permitted Warrant Transactions entered into in connection with Permitted Convertible Indebtedness |

| |

• |

|

Permits payments to be made in respect of Permitted Convertible Indebtedness, Permitted Bond Hedge Transactions and Permitted Warrant Transactions |

The Company intends to file a Form 8-K providing additional detail of the amended credit agreement with the Securities and Exchange Commission. When filed,

the Form 8-K will be available on the Company’s website at http://ir.huronconsultinggroup.com.

About Huron Consulting Group

Huron Consulting Group helps clients in diverse industries improve performance, transform the enterprise, reduce costs, leverage technology, process and review

large amounts of complex data, address regulatory changes, recover from distress and stimulate growth. Our professionals employ their expertise in finance, operations, strategy and technology to provide our clients with specialized analyses and

customized advice and solutions that are tailored to address each client’s particular challenges and opportunities to deliver sustainable and measurable results. The Company provides consulting services to a wide variety of both financially

sound and distressed organizations, including healthcare organizations, leading academic institutions, Fortune 500 companies, governmental entities and law firms. Huron has worked with more than 425 health systems, hospitals, and academic medical

centers; more than 400 corporate general counsel; and more than 350 universities and research institutions. Learn more at www.huronconsultinggroup.com.

Statements in this press release that are not historical in nature, including those concerning the Company’s current expectations about its future

requirements and needs, are “forward-looking” statements as defined in

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

identified by words such as “may,” “should,” “expects,” “provides,” “anticipates,” “assumes,” “can,” “will,” “meets,” “could,” “likely,”

“intends,” “might,” “predicts,” “seeks,” “would,” “believes,” “estimates,” “plans” or “continues.” These forward-looking statements reflect our current

expectations about our future requirements and needs, results, levels of activity, performance, or achievements, including, without limitation, current expectations with respect to, among other factors, utilization rates, billing rates, and the

number of revenue-generating professionals; that we are able to expand our service offerings; that we successfully integrate the businesses we acquire; and that existing market conditions continue to trend upward. These statements involve known and

unknown risks, uncertainties and other factors, including, among others, those described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013, that may cause actual results, levels of

activity, performance or achievements to be materially different from any anticipated results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We disclaim any obligation to update or revise

any forward-looking statements as a result of new information or future events, or for any other reason.

Media Contact:

Jennifer Frost Hennagir

312-880-3260

jfrost-hennagir@huronconsultinggroup.com

Investor

Contact:

C. Mark Hussey

or

Ellen Wong

312-583-8722

investor@huronconsultinggroup.com

###

Exhibit 99.2

FOR IMMEDIATE RELEASE

September 3, 2014

Huron

Consulting Group Announces Private Offering

of $225 Million of Convertible Senior Notes Due 2019

CHICAGO – September 3, 2014 – Huron Consulting Group Inc. (NASDAQ: HURN), a leading provider of business consulting services, today announced

that it intends to offer, subject to market conditions and other factors, $225 million aggregate principal amount of convertible senior notes due 2019 (the “Convertible Notes”) in a private offering to qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). The Company expects to grant an option to the initial purchasers to purchase, within a period of 13 days beginning on, and including, the date the

Convertible Notes are first issued, up to an additional $25 million aggregate principal amount of Convertible Notes.

The Convertible Notes are expected

to pay interest semiannually and will be convertible into cash, shares of the Company’s common stock or a combination thereof, at the Company’s election, based on a conversion rate to be determined. The Convertible Notes will mature on

October 1, 2019, unless earlier repurchased or converted in accordance with their terms prior to such date. Prior to July 1, 2019, the Convertible Notes will be convertible only upon the occurrence of certain events and during certain

periods, and thereafter, at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date. The interest rate, conversion rate and certain other terms of the Convertible Notes will be determined

at the time of pricing of the offering.

In connection with the pricing of the Convertible Notes, the Company intends to enter into one or more privately

negotiated convertible note hedge transactions with one or more of the initial purchasers or their respective affiliates (in this capacity, the “hedge counterparties”). The convertible note hedge transactions will cover, subject to

customary anti-dilution adjustments, the number of shares of common stock that will initially underlie the Convertible Notes sold in the offering. The Company also intends to enter into one or more separate, privately negotiated warrant transactions

with the hedge counterparties relating to the same number of shares of the Company’s common stock, subject to customary anti-dilution adjustments. The warrants evidenced by the warrant transactions will be settled on a net-share basis.

The convertible note hedge transactions are intended to generally reduce the potential dilution with respect to the Company’s common stock and/or offset

any potential cash payments the Company is required to make in excess of the principal amount of converted notes, as the case may be, upon any conversion of the Convertible Notes in the event that the price per share of the Company’s common

stock is greater than the strike price of the convertible note hedge transactions. The warrant transactions could separately have a dilutive effect with respect to the Company’s common stock to the extent that the price per share of the

Company’s common stock exceeds the strike price of the warrants evidenced by the warrant transactions.

If the initial purchasers exercise their option to purchase additional notes, the Company intends to enter into

additional convertible note hedge transactions and additional warrant transactions with the hedge counterparties, which will initially cover, subject to customary anti-dilution adjustments, the number of shares of the Company’s common stock

that will initially underlie the additional notes sold to the initial purchasers.

The Company intends to use:

| |

• |

|

a portion of the net proceeds of the offering to fund the cost of entering into the convertible note hedge transactions (after such cost is partially offset by the proceeds that it receives from entering into the

warrant transactions); |

| |

• |

|

up to $25 million of the net proceeds of the offering to repurchase shares of the Company’s common stock concurrently with the offering; and |

| |

• |

|

the remainder of the net proceeds of the offering for working capital and general corporate purposes. |

The

Company may also use a portion of the net proceeds to acquire businesses through one or more acquisitions or other strategic transactions. However, the Company has no current commitments or obligations with respect to any acquisitions or other

strategic transactions.

If the initial purchasers exercise their option to purchase additional notes, the Company intends to use a portion of the

additional net proceeds to fund the cost of entering into additional convertible note hedge transactions with the hedge counterparties (which cost will be partially offset by the proceeds that it expects to receive from entering into additional

warrant transactions). The remainder of additional net proceeds will be used for working capital, acquisitions, and general corporate purposes.

The

Company has been advised by the hedge counterparties that in connection with establishing their initial hedge position with respect to the convertible note hedge transactions and warrant transactions, the hedge counterparties and/or their respective

affiliates expect to enter into various derivative transactions with respect to the Company’s common stock and/or purchase shares of the Company’s common stock in privately negotiated transactions and/or open market transactions

concurrently with, or shortly after, the pricing of the Convertible Notes. This activity could increase (or reduce the size of any decrease in) the market price of the Company’s common stock or the Convertible Notes at that time.

The Company has also been advised by the hedge counterparties that the hedge counterparties or their respective affiliates are likely to modify their hedge

positions by entering into or unwinding various derivative transactions with respect to the Company’s common stock and/or purchasing or selling the Company’s common stock or other of the Company’s securities or instruments, including

the Convertible Notes in secondary market transactions following the pricing of the Convertible Notes and prior to the maturity of the Convertible Notes.

This press release is neither an offer to sell nor a solicitation of an offer to buy the Convertible Notes or any shares of common stock issuable upon

conversion of the Convertible Notes, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of

any such state or jurisdiction.

The offer and sale of the Convertible Notes and any common stock issuable upon conversion of the Convertible Notes have

not been registered under the Securities Act, or the securities laws of any other jurisdiction, and the Convertible Notes and any such shares may not be offered or sold in the United States, or to U.S. persons, absent registration or an applicable

exemption from registration requirements. The offering is being made to qualified institutional buyers pursuant to Rule 144A under the Securities Act.

The convertible note hedge transactions and warrant transactions have not been and will not be registered under

the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States without registration or an applicable exemption from registration requirements.

About Huron Consulting Group

Huron Consulting Group

helps clients in diverse industries improve performance, transform the enterprise, reduce costs, leverage technology, process and review large amounts of complex data, address regulatory changes, recover from distress and stimulate growth. Our

professionals employ their expertise in finance, operations, strategy and technology to provide our clients with specialized analyses and customized advice and solutions that are tailored to address each client’s particular challenges and

opportunities to deliver sustainable and measurable results. The Company provides consulting services to a wide variety of both financially sound and distressed organizations, including healthcare organizations, leading academic institutions,

Fortune 500 companies, governmental entities and law firms. Huron has worked with more than 425 health systems, hospitals, and academic medical centers; more than 400 corporate general counsel; and more than 350 universities and research

institutions.

Statements in this press release that are not historical in nature, including those concerning the Company’s current expectations

about its future requirements and needs, are “forward-looking” statements as defined in Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Private Securities Litigation Reform Act of

1995. Forward-looking statements are identified by words such as “may,” “should,” “expects,” “provides,” “anticipates,” “assumes,” “can,” “will,” “meets,”

“could,” “likely,” “intends,” “might,” “predicts,” “seeks,” “would,” “believes,” “estimates,” “plans” or “continues.” These forward-looking

statements reflect our current expectations about our future requirements and needs, results, levels of activity, performance, or achievements, including, without limitation, current expectations with respect to, among other factors, utilization

rates, billing rates, and the number of revenue-generating professionals; that we are able to expand our service offerings; that we successfully integrate the businesses we acquire; and that existing market conditions continue to trend upward. These

statements involve known and unknown risks, uncertainties and other factors, including, among others, those described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013, that may cause

actual results, levels of activity, performance or achievements to be materially different from any anticipated results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We disclaim any

obligation to update or revise any forward-looking statements as a result of new information or future events, or for any other reason.

###

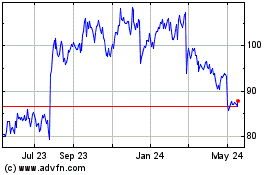

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

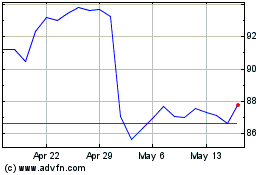

Huron Consulting (NASDAQ:HURN)

Historical Stock Chart

From Apr 2023 to Apr 2024