false000070612900007061292023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2023

HORIZON BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

Indiana

|

000-10792

|

35-1562417

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

515 Franklin Street

Michigan City, Indiana 46360

(Address of principal executive offices, including zip code)

(219) 879-0211

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, no par value

|

HBNC

|

The NASDAQ Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors and Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Changes in Senior Management

On November 7, 2023, Horizon Bancorp, Inc. (the “Company”)

announced a succession plan for its chief financial officer and a restructuring of its mortgage and consumer lending leadership.

The Company and Mark E. Secor have agreed that he

will transition from his role as Executive Vice President and Chief Financial Officer (“CFO”) of the Company and the Bank. Mr. Secor will continue in the role of

Executive Vice President and CFO until a successor is appointed and support the transition process through April 30, 2024. The Company has initiated a search process to identify the Company’s next CFO.

The Company also announced that as part of a previously disclosed strategy to shift resources to higher-yielding businesses, Noe S. Najera,

Executive Vice President, Senior Retail & Mortgage Lending Officer of the Bank, will be departing the Company, effective immediately. The leadership change reflects the ongoing restructuring of its mortgage and consumer lending divisions that

aligns with client demand.

The Company’s related press release is attached hereto as Exhibit 99.1.

Retention Agreement with Mark E. Secor

In connection with Mr. Secor’s transition, the Company and the Bank entered into an Employment Agreement (the “Employment Agreement”) with

Mr. Secor, effective as of November 6, 2023, to grant certain retention incentives to Mr. Secor and to ensure his continued service to the Bank during the term of the agreement. The term of the Employment Agreement began as of November 6, 2023 and

will end on April 30, 2024 (the “Term”). Pursuant to the Employment Agreement, during the Term, Mr. Secor will continue to serve as the Chief Financial Officer (“CFO”) of the Bank and the Company until a successor is appointed to the CFO position.

The Employment Agreement generally provides for a continuation of Mr. Secor’s current compensation and benefits during the Term and also

includes a retention bonus if Mr. Secor stays through the end of the Term. Specifically, the Employment Agreement provides for, among other things, (i) an annual base salary of $347,109.88 (which is Mr. Secor’s current annual base salary) through the

end of the Term, (ii) Mr. Secor will continue to be eligible to receive a cash bonus for 2023 pursuant to the Company’s Executive Officer Bonus Plan (the “2023 Bonus”), subject to approval by the compensation committee of the Board, (iii) Mr. Secor

will be entitled to a cash bonus for 2024 of $46,281.31 (the “2024 Bonus”) if he remains employed on the last day of the Term, and (iv) if Mr. Secor remains employed on April 30, 2024, the Company shall pay to Mr. Secor an amount equal to $173,554.94

(the “Stay Bonus”). Pursuant to the Employment Agreement, in the event Mr. Secor’s employment is terminated by the Company for Cause, by Mr. Secor without Good Reason, or in the event of termination due to the death or disability, prior to the

payment of any bonus, including the 2023 Bonus and the 2024 Bonus, then such bonus shall not be payable to Mr. Secor.

Pursuant to the Employment Agreement, Mr. Secor will continue to be entitled to participate in the Company’s benefit plans and programs

that are generally available to executive officers during the Term, including health, dental and vision insurance; life and disability insurance; sick leave; holidays; and 401(k) plan participation, except that he will only be entitled to participate

in other incentive compensation plans and programs in effect from time to time (including the Company’s long-term equity incentive compensation plans and the Supplemental Executive Retirement Plan) during 2023, subject to the terms and conditions of

such plans and programs.

The Employment Agreement provides that if the Company terminates Mr. Secor’s employment without “Cause” (as defined in the Employment

Agreement), or if Mr. Secor terminates his employment with “Good Reason” (as defined in the Employment Agreement), Mr. Secor will be entitled to: (i) all base salary earned through the termination, (ii) that remaining portion of Mr. Secor’s annual

base salary to be paid through the end of the Term, (iii) an amount equal to the Stay Bonus, and (iv) a pro-rated amount of the: (A) 2023 Bonus, if earned and applicable, and (B) 2024 Bonus based upon the actual number of days Mr. Secor was employed

by the Company during 2024, if applicable. All options and other equity incentive awards held by Mr. Secor at such time shall be treated in accordance with the applicable plan and award agreement(s) governing such awards.

In addition, Mr. Secor has agreed that, if his employment ends during the Term for any reason, he will reasonably cooperate with the

Company, without additional consideration, in his usual and customary areas of responsibility, including relating to the transition of his work on behalf of the Company.

Further, if Mr. Secor is terminated for any reason, other than for Cause, the two-year post-employment non-competition covenants contained

in Mr. Secor’s existing Change in Control Agreement, and any other similar non-compete restrictions in any other agreements to which Mr. Secor is bound, shall automatically be terminated.

All amounts payable to Mr. Secor under the Employment Agreement are subject to FDIC restrictions on golden parachutes and indemnification,

as well as subject to Internal Revenue Code Section 409A requirements and the deductibility limits of Internal Revenue Code Section 280G.

The foregoing description of the Employment Agreement is not complete and is qualified in its entirety by reference to the complete copy of

the Employment Agreement, which is attached as Exhibit 10.1, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

Location

|

|

10.1

|

|

|

|

Attached

|

|

99.1

|

|

|

|

Attached

|

|

104

|

|

Cover Page Interactive Data File (Embedded within the Inline XBRL document)

|

|

Within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 7, 2023

|

HORIZON BANCORP, INC.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Thomas M. Prame

|

| |

|

Thomas M. Prame,

|

| |

|

Chief Executive Officer and President

|

Exhibit

10.1

Employment

Agreement

(Mark E. Secor)

This Employment Agreement (the “Agreement”) is made and entered into to be effective as of November 6, 2023 (the “Effective Date”), by and among Horizon Bank

(the “Bank”), an Indiana state‑chartered bank, Horizon Bancorp, Inc. (the “Holding Company”), an Indiana corporation and a registered bank holding company, and Mark E. Secor (the “Executive”). The Bank

and the Holding Company are referred to herein jointly as the “Company.”

W I T N E S E T H:

WHEREAS, Bank is a wholly-owned subsidiary of the Holding Company; and

WHEREAS, the Company desires to continue to employ the Executive in accordance with the provisions of this Agreement,

and the Executive desires to continue to be employed by the Company in accordance with the provisions of this Agreement; and

WHEREAS, in addition to the employment provisions contained herein, the Company and the Executive have agreed to

certain restrictions, covenants, agreements and severance payments, as set forth in this Agreement; and

WHEREAS, the Executive is willing to perform such services for the Company upon the terms and conditions set forth

herein.

NOW, THEREFORE,

in consideration of the foregoing premises, the mutual covenants, agreements and obligations contained herein, the employment of the Executive by the Company pursuant to this Agreement and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the Company and the Executive, each intending to be legally bound, hereby agree as follows:

Section 1. Employment; Term.

(a) Employment. The

Company hereby agrees to continue to employ the Executive, and the Executive hereby agrees to continue to be employed by the Company, in accordance with the provisions of this Agreement.

(b) Term. Unless

terminated earlier as provided herein, the term of the Executive’s employment will begin on the Effective Date of this Agreement and will end on April 30, 2024 (the term of this Agreement is hereinafter referred to as the “Term”).

Section 2. Position; Duties; Responsibilities.

(a) Position. Subject

to Section 2(b), during the Term, the Executive will continue to serve as the Chief Financial Officer (“CFO”) of the Bank and the Holding Company

until a successor is appointed to the CFO position by the boards of directors of the Bank and the Holding Company or until either or both of the boards of directors of the Bank and the Holding Company decide to change the Executives titles or duties,

which they may do at any time in their sole discretion.

(b) Duties and Responsibilities.

During the Term, the Executive will devote substantially all business time, attention and energy, and reasonable best efforts, to the interests and business of the Bank, the Holding Company and their affiliates and subsidiaries (collectively “Affiliates”) and to the performance of the Executive’s duties and responsibilities on behalf of the Company and any Affiliate which shall be

established by the board of directors of the Bank and/or the Holding Company and/or the Chief Executive Officer of the Bank and the Holding Company (the “CEO”

or “Chief Executive Officer”)), from time to time. In addition, the Executive’s duties and responsibilities shall include providing expertise,

insight and guidance in support of the orderly transition of the Executive’s work and responsibilities on behalf of the Company, including, but not limited to, the orderly transfer of any such work and institutional knowledge to a new Chief Financial

Officer (or such other persons as may be designated by the Company or the CEO) (in either case, the “CFO Transition”). During the Term, the

Executive will not serve on the board of directors of any for-profit organization without the prior consent of the Holding Company’s board of directors (the “Board”).

Section 3. Compensation and Employee Benefits.

(a) Base Salary.

Beginning on the Effective Date and during the Term, for all services rendered to or on behalf of the Company by the Executive in all capacities pursuant to this Agreement or otherwise, the Company will pay to the Executive an annual base salary

equal to $347,109.88 (the “Base Salary”). The Base Salary will be paid to the Executive in accordance with the Bank’s usual and customary payroll

practices applicable to its employees generally. The Executive shall not be entitled to a merit increase in Base Salary for 2024, unless otherwise approved by the Board.

(b) 2023 Bonus. The

Executive will continue to be eligible to receive a cash bonus for 2023 pursuant to the Company’s Executive Officer Bonus Plan, subject to approval by the Compensation Committee of the Board (the “2023 Bonus”). Any earned 2023 Bonus pursuant to the Executive Officer Bonus Plan shall be payable in accordance with the Company’s historical timing, subject to Committee approval and upon obtaining

an unqualified opinion on the Holding Company’s annual audited financial statements for such period.

(c) 2024 Bonus. For the

period between January 1, 2024, to the end of the Term, and provided the Executive is employed on the last day of the Term, the Executive will also to be entitled to a cash bonus for 2024 of $46,281.31 (the “2024 Bonus”). Any earned 2024 Bonus shall be payable in accordance with the Company’s historical payroll practices and within thirty (30) days after April 30, 2024.

(d) Stay Bonus. If the

Executive is employed on April 30, 2024, the Company shall pay to the Executive an amount equal to fifty-percent (50%) of the Executive’s Base Salary (or $173,554.94) (the “Stay Bonus”), which shall be payable in a lump sum on the next payroll date and otherwise in accordance with the Company’s historical payroll practices and within thirty (30) days after April 30, 2024.

(e) Forfeiture of Bonuses.

In the event the Executive’s employment is terminated by the Company for Cause pursuant to Section 4(a), by the Executive without Good Reason pursuant to Section 4(d), or in the event of termination due to the death or Disability of the Executive

pursuant to Section 4(e), prior to the payment of any bonus, including the 2023 Bonus, the 2024 Bonus, and the Stay Bonus, then such bonus shall not be payable to the Executive.

(f) Other Incentive Compensation.

During calendar year 2023 only, the Executive will be entitled to participate in all other incentive compensation plans and programs in effect from time to time and generally available to executive officers of the Company (including the Company’s

long-term equity incentive compensation plans and the Supplemental Executive Retirement Plan), subject to the terms and conditions of such plans and programs, including all enrollment and approval requirements and deadlines. The Executive will not be

entitled to participate in any such incentive compensation plans and programs (including the Company’s long-term equity incentive compensation plans and the Supplemental Executive Retirement Plan) beginning January 1, 2024.

(g) Employee Benefit Plans.

During the Term, the Executive will be entitled to participate in all other employee benefit plans and programs in effect from time to time and generally available to employees of the Company, subject to the terms and conditions of such plans and

programs. Currently, such plans and programs include health, dental and vision insurance; life and disability insurance; sick leave; holidays; and 401(k) plan participation.

(h) Other Policies. All

other matters relating to the employment of the Executive by the Company not specifically addressed in this Agreement, or in the plans and programs referenced above (including, without limitation, vacation, sick and other paid time off), will be

subject to the employee handbooks, rules, policies and procedures of the Company in effect from time to time, including, but not limited to, the Company’s compensation recovery (also referred to as “clawback”) policies.

(i) Taxes and Other Amounts.

All taxes (other than the Company’s portion of FICA taxes) on the Base Salary and other amounts payable to the Executive pursuant to this Agreement or any plan or program will be paid by the Executive. The Company will be entitled to withhold from

the Base Salary and all other amounts payable to the Executive pursuant to this Agreement or any plan or program (i) applicable withholding taxes, and (ii) such other amounts as may be authorized by the Executive in writing.

(j) Acknowledgment by the Executive.

Notwithstanding anything herein to the contrary, the Executive hereby understands, acknowledges and agrees that the Bank or Holding Company may, each in its sole discretion, amend, modify, freeze, suspend or terminate any or all of the incentive

compensation, equity compensation, employee benefit and other plans and programs referenced herein at any time and from time to time in the future as provided in such plans and programs. Any such amendment, modification, freezing, suspension or

termination will not affect any of the Executive’s vested or accrued benefits under any such plans or programs.

Section 4. Termination of Employment.

Subject to the respective continuing obligations of the parties hereto set forth in this Agreement, the Executive’s

employment with the Company may be terminated during the Term in any of the following ways:

(a) Termination by the Company for

Cause. The Company, upon written notice to the Executive, may terminate the Executive’s employment with the Company immediately (except as otherwise expressly provided herein with respect to the Executive’s limited right to cure) for

Cause. For purposes of this Agreement, “Cause” is defined as any of the following actions:

(i) An intentional act of fraud, embezzlement, theft, or personal dishonesty; willful misconduct, or breach of fiduciary duty

involving personal profit by the Executive in the course of the Executive’s employment; provided, however, that (A) no act or failure to act will be deemed to have been intentional or willful if it was due primarily to an error in judgment or

negligence; and (B) an act or failure to act will only be considered intentional or willful if it is not in good faith and if it is without a reasonable belief that the action or failure to act is in the best interest of the Company or any Affiliate;

(ii) Intentional damage by the Executive to the business or property of the Company or any Affiliate, causing material harm to the

Company or any Affiliate;

(iii) Material breach by the Executive of any provision of this Agreement or any change in control or similar agreement the Executive

is a party to;

(iv) (A) Gross negligence, willful misconduct or insubordination by the Executive in the performance of the Executive’s duties, or

(B) a good faith determination by the Chief Executive Officer of the Bank or Holding Company of the Executive’s substandard performance of the Executive’s duties or responsibilities, including, but not limited to, failure by the Executive to devote

substantially all of Executive’s working time to the business of the Company and its Affiliates, or (C) the Executive’s refusal or failure to carry out lawful directives of the Chief Executive Officer of the Bank or Holding Company or the board of

directors of the Bank or Holding Company;

(v) A willful and material violation of the Company’s or any Affiliate’s written policies or codes of conduct or laws, including

written policies or laws related to discrimination, harassment, or illegal or unethical conduct;

(vi) Engagement in conduct (including on-line posting, messaging, blogging or similar forms of electronic communication) that

causes, or is reasonably likely to cause, the Company or any Affiliate negative publicity, public disgrace, embarrassment, or disrepute;

(vii) A conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime

that constitutes a misdemeanor involving dishonesty, breach of trust or moral turpitude; or

(viii) Removal or permanent prohibition of the Executive from participating in the conduct of the affairs of Bank or Holding Company

or any Affiliate by an order issued under subsection 8(e)(4) or 8(g)(1) of the Federal Deposit Insurance Act, 12 USC §§ 1818(e)(4) and (g)(1).

(b) Termination by the Company

Without Cause. The Company, upon not less than 30 days’ prior written notice to the Executive, may terminate the Executive’s employment with the Company without Cause.

(c) Termination by the Executive

for Good Reason. The Executive, upon written notice to the Company, may terminate his employment with the Company immediately (except as otherwise expressly provided herein with respect to the Company’s limited right to cure) for Good

Reason. For purposes of this Agreement, “Good Reason” is defined as a material breach by the Company of any provision of this Agreement during the

Term, other than a breach justifying termination pursuant to any other provision of this Agreement. Notwithstanding anything in the foregoing to the contrary, any change in the Executive’s authority, duties or responsibilities in connection with a

CFO Transition shall not constitute “Good Reason” hereunder.

(d) Termination by the Executive

Without Good Reason. The Executive, upon not less than 60 days’ prior written notice to the Bank, may terminate his employment with the Company without Good Reason.

(e) Termination in the Event of

Death or Disability. The Executive’s employment hereunder will terminate immediately upon the death of the Executive. The Executive’s employment with the Company may be terminated by the Company in the event of the occurrence of a

Disability of the Executive. For purposes hereof, a “Disability” is defined as the Executive’s inability to engage in any substantial gainful

activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months. If, by reason of any medically

determinable physical or mental impairment that can be expected to result in death or last for a continuous period of not less than twelve (12) months, the Executive is receiving income replacement benefits for a period of not less than three (3)

months under an accident and health plan sponsored by the Company, the Executive will be deemed to be Disabled. The Compensation Committee of the Board, in its reasonable discretion, will be the sole and final judge of whether the Executive is

Disabled for purposes of this Agreement, after consideration of any evidence it may require, including the reports of any physician or physicians it may designate.

(f) Notice and Date of Termination.

Any termination of the Executive’s employment with the Company as contemplated by this Section 4, except in the event of the Executive’s death, will be communicated in writing by the terminating party to the other party hereto. Any notice of

termination will indicate the specific provisions of this Agreement relied upon and, if applicable, will set forth in reasonable detail the facts and circumstances claimed to provide a basis for such termination. The last day of the Executive’s

employment with the Company will be referred to herein as the “Date of Termination.”

(g) Limited Right to Cure by the

Company and the Executive.

(i) In the event that the Company desires to terminate the Executive’s employment for Cause pursuant to subsection 4(a)(iii), the

Company, upon written notice to the Executive, may terminate the Executive’s employment for Cause, which will terminate the Executive’s employment and right to compensation immediately, except in the limited case expressly provided herein with

respect to Causes that are curable. The written notice will (A) indicate the specific provisions of this Agreement relied upon for such termination; (B) set forth in reasonable detail the facts and circumstances claimed to provide a basis for such

termination; (C) state whether the board of directors of the Holding Company has determined in good faith that the issue is curable; and (D) if the issue has been deemed curable, describe the steps, actions, events or other items that must be taken,

completed or followed by the Executive to correct or cure the basis for such termination. If (but only if) the basis for termination has been deemed curable by the board of directors, then the Executive will have thirty (30) days following the

effective date of such notice to fully correct and cure the basis for the termination of the Executive’s employment. If the Executive does not fully correct and cure the basis for the termination of the Executive’s employment within such 30-day

period, then the Company will have the right to terminate the Executive’s employment immediately for Cause upon delivering to the Executive a second written notice of termination and without any further cure period. Unless otherwise specified in the

written notice, the Date of Termination shall be the date of the first written notice, in the case of an uncurable Cause, and shall be the date of the second written notice, in the case of a curable but uncured Cause. Notwithstanding the foregoing,

the Executive will be entitled to so correct and cure only a maximum of two times during any calendar year.

(ii) In the event that the Executive desires to terminate the Executive’s employment with the Company for Good Reason pursuant to

subsection 4(c), all of the following must timely occur: (A) within ninety (90) days immediately following the first occurrence of such event, the Executive must deliver to the Company a written notice describing, in reasonable detail, the Good

Reason event and the proposed cure to such event; (B) the Company must fail to cure such event during the thirty (30) days from the date of receipt of such notice; and (C) a second written notice of termination must be delivered by the Executive to

the Company within ninety (90) days following the day on which the 30-day cure period set forth in the preceding clause (B) expires. The Executive’s employment with the Company will terminate immediately upon delivery of the second written notice of

termination. Notwithstanding the foregoing, the Company will be entitled to so correct and cure only a maximum of two times during any calendar year.

(h) Regulatory Restrictions.

(i) If Executive is removed and/or permanently prohibited from participating in the conduct of the Bank’s affairs by an order

issued under Sections 8(e)(4) or 8(g)(1) of the Federal Deposit Insurance Act (“FDIA”) (12 U.S.C. 1818(e)(4) and (g)(1)), all obligations of the

Company under this Agreement shall terminate as of the effective date of the order, but vested rights of the parties shall not be affected.

(ii) If the Bank is in default (as defined in Section 3(x)(1) of FDIA), all obligations of the Company under this Agreement shall

terminate as of the date of default; however, this subsection shall not affect the vested rights of the parties.

(iii) All obligations under this Agreement shall terminate, except to the extent determined that continuation of this Agreement is

necessary for the continued operation of the Bank: (A) by the Indiana Department of Financial Institutions (the “DFI”) or its designee, or the

Bank’s primary federal regulator at the time that the Federal Deposit Insurance Corporation (“FDIC”) enters into an agreement to provide assistance

to or on behalf of the Bank under the authority contained in Section 13(c) of FDIA; or (B) by the DFI, or its designee, or the Bank’s primary federal regulator, at the time that the DFI, or its designee, or the Bank’s primary federal regulator,

approves a supervisory merger to resolve problems related to the operation of the Bank or when the Bank is determined by the DFI, or the Bank’s primary federal regulator, to be in an unsafe or unsound condition. Any such action shall not affect any

vested rights of the parties.

(iv) If a notice served under Section 8(e)(3) or (g)(1) of the FDIA (12 U.S.C. 1818(e)(3) or (g)(1)) suspends and/or temporarily

prohibits Executive from participating in the conduct of the Bank’s affairs, the Company’s obligations under this Agreement shall be suspended as of the effective date of such notice, unless stayed by appropriate proceedings. If the charges in the

notice are dismissed, the Company may, in its sole discretion, (A) pay Executive all or part of the compensation withheld while its contract obligations were suspended, and/or (B) reinstate (in whole or in part) any of its obligations which were

suspended.

(v) Notwithstanding anything to the contrary contained herein, Executive acknowledges and agrees that any payments made to

Executive pursuant to this Agreement, or otherwise, are subject to and conditioned upon compliance with the provisions of 12 U.S.C. 1828(k) and Part 359 of the FDIC’s regulations (12 C.F.R. Part 359), which provisions contain certain prohibitions and

limitations on making “golden parachute” and certain indemnification payments by FDIC-insured institutions and their holding companies. In the event any payments to Executive pursuant to this Agreement are prohibited or limited by the provisions of

such statute and/or regulations, Bank and/or Holding Company (A) shall pay the maximum amount that may be paid after applying such limitations; and (B) will use commercially reasonable efforts to obtain the consent of the appropriate regulatory

authorities to the payment of any amount that otherwise cannot be paid due to the application of such limitations. Executive agrees that Bank and/or Holding Company shall not have breached any obligations under this Agreement if they are unable to

pay all or some portion of any payment due to Executive as a result of the application of these limitations.

Section 5. Payment Upon Termination of Employment.

Upon the termination of the Executive’s employment with the Company during the Term pursuant to Section 4, the

Executive will receive the following:

(a) Termination by the Company for

Cause, by the Executive Without Good Reason or Due to Death or Disability of the Executive. Upon the termination of the Executive’s employment by the Company for Cause pursuant to subsection 4(a), by the Executive without Good Reason

pursuant to subsection 4(d) or in the event of termination due to the death or Disability of the Executive pursuant to subsection 4(e), the Company will pay or provide to the Executive (or, in the event of death, the Executive’s estate) the following

amounts and benefits:

(i) that portion of the Executive’s Base Salary earned through the Date of Termination, payable in accordance with normal payroll

practices;

(ii) all amounts that have vested prior to the Date of Termination under all incentive compensation or employee benefit plans of the

Bank or Holding Company in accordance with the provisions of such plans; and

(iii) notwithstanding the foregoing, all options granted to the Executive to purchase shares of common stock of the Holding Company

and all shares of restricted stock and restricted stock units of the Holding Company (whether such options and restricted shares or units are vested or unvested) shall be treated in accordance with the applicable plan and award agreement(s) between

the Holding Company and the Executive.

It is noted that nothing in this Agreement will serve to prevent the Executive from receiving long-term disability payments from the

Company’s long-term disability program, if any, if the Executive is otherwise eligible to receive benefits under such a program.

(b) Termination by the Company

Without Cause or by the Executive With Good Reason. Upon the termination of the Executive’s employment during the Term by the Company without Cause pursuant to subsection 4(b), or by the Executive with Good Reason pursuant to

subsection 4(c), the Company will pay or provide to the Executive the following amounts and benefits:

(i) that portion of the Executive’s Base Salary earned through the Date of Termination;

(ii) that remaining portion of the Executive’s Base Salary to be paid through the end of the Term;

(iii) an amount equal to the Stay Bonus; and

(iv) a pro-rated amount of the: (1) 2023 Bonus, if earned, based on the actual number of days the Executive was employed by the

Company during 2023, if applicable, and (2) 2024 Bonus based upon the actual number of days the Executive was employed by the Company during 2024, if applicable.

The amounts payable pursuant to this Section shall be payable in accordance with the Company’s normal payroll practices, provided, further, that the amounts payable pursuant to Sections 5(b)(ii) - (iv) shall be only be payable after the delivery of the Release (as defined

in Section 5(d)) and the lapse of all applicable revocation periods, or as soon as administratively practicable thereafter.

(c) Delay of Payment of Benefits in Certain Circumstances.

(i) Separation from Service. For

purposes of this subsection (c) only, “Separation from Service” means the date on which the Executive dies, retires or otherwise experiences a

Termination of Employment with the Company; provided, however, a Separation from Service does not occur if the Executive is on military leave,

sick leave or other bona fide leave of absence (such as temporary employment by the government) if the period of such leave does not exceed six (6) months, or if the leave is for a longer period, so long as the Executive’s right to reemployment with

the Company is provided either by statute or by contract. If the period of leave exceeds six (6) months and the Executive’s right to reemployment is not provided either by statute or contract, there will be a Separation from Service on the first day

immediately following such six (6)-month period. With respect to any payment made under this Agreement which constitutes deferred compensation subject to Code Section 409A, the Executive will incur a “Termination of Employment” when a termination of employment is incurred under Treasury Regulation Section 1.409A-1(h)(1)(ii).

(ii) Suspension of Payments to Specified Employees.

To the extent such suspension is required by Code Section 409A or Treasury Regulations issued pursuant to Code Section 409A, if an amount is payable to the Executive due to the Executive’s Separation from Service for a reason other than the

Executive’s death, and if at the time of the Separation from Service the Executive is a “Specified Employee,” payment of all amounts which constitute deferred compensation under Code Section 409A to the Executive under this Agreement will be

suspended for six (6) months following such Separation from Service. The Executive will receive payment of such amounts on the first day following the six (6) month suspension period.

(A) A “Specified Employee” means an individual who is a “Key Employee” of the Company at a time when the Holding

Company’s stock is publicly traded on an established securities market. The Executive will be a Specified Employee on the first day of the fourth month following any “Identification Date” on which the Executive is a Key Employee.

(B) The Executive is a “Key Employee” if at any time during the twelve (12) month period ending on an

Identification Date the Executive is: (i) an officer of the Company having annual compensation greater than $175,000 (as adjusted in accordance with the requirements of Code Section 409A); (ii) a five-percent owner of the Company; or (iii) a

one-percent owner of the Company having an annual compensation greater than $150,000. For purposes of determining whether an Executive is an officer under clause (i), no more than 50 employees (or, if lesser, the greater of three or ten percent of

the employees) will be treated as officers, and those categories of employees listed in Code Section 414(q)(5) will be excluded.

(C) The “Identification Date” for purposes of this Agreement is December 31 of each calendar year.

(d) Certain Limitations.

Amounts payable to the Executive pursuant to this Section 5 will be subject to the following limitations:

(i) amounts payable pursuant to this Section will be subject to the terms of subsections 5(c) and 5(e), as applicable, and, except

for payment of amounts required under subsections 5(a) and 5(b)(i), paid only so long as the Executive is not in breach of any of the provisions of this Agreement; and

(ii) payment of all amounts payable pursuant to subsection 5(b), except such amounts to which Executive would be entitled under

subsection 5(a), as applicable, will be made pursuant to this Section only if the Executive executes a full release of claims relating to the Executive’s employment by the Company and/or any Affiliate in favor of such parties in a form reasonably

acceptable to, and provided by, the Company (the “Release”). The Company will set a deadline for return of the Release that will be no later than

sixty (60) days following the termination of employment, and the Release must remain unrevoked during any revocation period.

(e) 280G Cutback.

Anything in this Agreement to the contrary notwithstanding, in the event the Company’s independent public accountants determine that any payment by the Company to or for the benefit of the Executive, whether paid or payable pursuant to the terms of

this Agreement or otherwise, would be non-deductible by the Company for federal income tax purposes because of Section 280G of the Internal Revenue Code of 1986, as amended, the amount payable to or for the benefit of the Executive pursuant to this

Agreement and all other arrangements shall be reduced (but not below zero) in a manner determined by the Company to the Reduced Amount. For purposes of this Section, the “Reduced Amount” shall be the amount which maximizes the amount payable without causing the payment to be non-deductible by the Company because of Section 280G. If two economically equivalent amounts are subject to

reduction but are payable at different times, the amounts shall be reduced (but not below zero) on a pro rata basis.

Section 6. Cooperation After Termination.

(a) Following termination of the Executive's employment for any reason, the Executive agrees to reasonably

cooperate with the Company and its affiliates, without additional consideration, in any matter relating to the transition of the Executive’s work and responsibilities on behalf of the Company, including, but not limited to, the orderly transfer of

any such work and institutional knowledge to a new Chief Financial Officer (or such other persons as may be designated by the Company).

(b) Following termination of the Executive's employment for any reason, the Executive further agrees to reasonably

cooperate with the Company and its affiliates, without additional consideration, in defending any anticipated, threatened, or actual litigation that currently exists or that may arise subsequent to the execution of this Agreement, including, but not

limited to, the putative class action lawsuit entitled Chad Key, et al. v. Horizon Bancorp, Inc., et al., Case No. 1:23-cv-02961 filed against the Company and two of its officers in the U.S. District Court for the Eastern District of New York. Such

cooperation shall include, but is not limited to, meeting with internal Company employees to discuss and review issues in which Executive was directly or indirectly involved with during Executive’s employment with the Company, participating in any

investigation conducted by the Company either internally or by outside counsel or consultants, signing declarations or witness statements, preparing for and serving as a witness in a deposition or at trial in any civil or administrative proceeding,

reviewing documents, and similar activities that the Company deems necessary.

Section 7. Survival of Certain Provisions.

Upon any termination of the Executive’s employment with the Company and/or the termination or expiration of this

Agreement, the Executive and the Company hereby expressly agree that the provisions of Section 5, Section 6, Section 7, Section 8, Section 9, and Section 10 will continue to be in full force and effect and binding upon the Executive and the Company in

accordance with the applicable respective provisions of such Sections.

Section 8. Indemnification.

The Company will indemnify the Executive (and his legal representatives or other successors) to the fullest extent

permitted (including payment of expenses in advance of final disposition of the proceeding) by the Articles of Incorporation and By-Laws of the Company as in effect at such time. The Executive will be entitled to the protection of any insurance

policies the Company may elect to maintain generally for the benefit of its directors and officers, against all costs, charges and expenses whatsoever incurred or sustained by him or his legal representatives in connection with any action, suit or

proceeding to which he (or his legal representatives or other successors) may be made a party by reason of his being or having been a director, officer or employee of the Company or any of its subsidiaries. If any action, suit or proceeding is brought

or threatened against the Executive in respect of which indemnity may be sought against the Company pursuant to the foregoing, the Executive will notify the Company promptly in writing of the institution of such action, suit or proceeding, and the

Company will assume the defense thereof and the employment of counsel and payment of all fees and expenses.

Section 9. Termination of

Non-Competition Restrictions. Effective on the date Executive’s employment with the Bank and the Holding Company is terminated for any reason, other than for Cause, that certain Change in Control Agreement between the Executive and the

Bank dated January 1, 2020 (the “CIC Agreement”) shall automatically be amended to delete Sections 10(b) and (c) in their entirety and any similar

non-competition restrictions in any other agreement Executive is bound by shall also be automatically terminated, deleted and of no further force and effect.

Section 10. Miscellaneous.

(a) Assignment. This

Agreement is personal in nature and no party hereto will, without the prior written consent of the other party hereto, assign or transfer this Agreement or any rights or obligations hereunder, except as provided pursuant to subsection 10(p) or as

otherwise provided herein. Without limiting the foregoing, the Executive’s right to receive compensation hereunder will not be assignable or transferable by the Executive, whether by pledge, creation of a security interest or otherwise, other than a

transfer by the Executive’s will or by the laws of descent, and in the event of any attempted assignment or transfer contrary to this Section, the Company will have no liability to pay any amounts so attempted to be assigned or transferred and such

attempted assignment shall be void and of no effect. Notwithstanding the foregoing or anything herein to the contrary, this Agreement may be assigned by the Company to any Affiliate without the prior consent of the Executive.

(b) Waiver. Either

party hereto may, by a writing signed by the waiving party, waive the performance by the other party of any of the covenants or agreements to be performed by such other party under this Agreement. The waiver by either party hereto of a breach of or

noncompliance with any provision of this Agreement will not operate or be construed as a continuing waiver or a waiver of any other or subsequent breach or noncompliance hereunder. The failure or delay of either party at any time to insist upon the

strict performance of any provision of this Agreement or to enforce its rights or remedies under this Agreement will not be construed as a waiver or relinquishment of the right to insist upon strict performance of such provision, or to pursue any of

its rights or remedies for any breach hereof, at a future time.

(c) Amendment. This

Agreement may be amended, modified or supplemented only by a written agreement executed by all of the parties hereto.

(d) Headings. The

headings in this Agreement have been inserted solely for ease of reference and will not be considered in the interpretation or construction of this Agreement.

(e) Severability. In

case any one or more of the provisions (or any portion thereof) contained herein will, for any reason, be held to be invalid, illegal or unenforceable in any respect, such invalidity, illegality or unenforceability will not affect any other provision

of this Agreement, but this Agreement will be construed as if such invalid, illegal or unenforceable provision or provisions (or portion thereof) had never been contained herein.

(f) Counterparts. This

Agreement may be executed in any number of counterparts, each of which will be an original, but such counterparts will together constitute one and the same agreement.

(g) Construction. This

Agreement will be deemed to have been drafted by both parties hereto. This Agreement will be construed in accordance with the fair meaning of its provisions and its language will not be strictly construed against, nor will ambiguities be resolved

against, any party.

(h) Review and Consultation.

The Executive hereby acknowledges and agrees that he (i) has read this Agreement in its entirety prior to executing it, (ii) understands the provisions, effects and restrictions of this Agreement, (iii) has consulted with such of his own attorneys,

accountants and financial and other advisors as he has deemed appropriate in connection with his execution of this Agreement, and (iv) has executed this Agreement voluntarily. THE EXECUTIVE HEREBY UNDERSTANDS, ACKNOWLEDGES AND AGREES THAT HE HAS NOT RECEIVED ANY ADVICE, COUNSEL OR RECOMMENDATION WITH RESPECT TO THIS AGREEMENT FROM ANY DIRECTOR OR EMPLOYEE OF, OR ANY ATTORNEY, ACCOUNTANT OR

ADVISOR FOR, THE BANK OR THE HOLDING COMPANY.

(i) Attorneys’ Fees.

Each party hereto will pay the other party’s reasonable costs and expenses (including, without limitation, reasonable attorneys’ fees and disbursements) in connection with such other party successfully enforcing any provision or provisions of this

Agreement (except as otherwise provided herein) against the breaching party (whether by litigation, arbitration, mediation, settlement or negotiation).

(j) Entire Agreement.

This Agreement supersedes and novates all other prior understandings, commitments, representations, negotiations, contracts and agreements, whether oral or written, between the parties hereto relating to the matters contemplated hereby and

constitutes the entire understanding and agreement between the parties hereto relating to the subject matter hereof; provided, however, that the parties agree that, except as otherwise expressly provided in this Agreement, nothing in this Agreement

shall amend or terminate the CIC Agreement, as it may be amended from time to time.

(k) Certain References.

Whenever in this Agreement a singular word is used, it also will include the plural wherever required by the context and vice-versa. All references to the masculine, feminine or neuter genders herein will include any other gender, as the context

requires. Unless expressly provided otherwise, all references in this Agreement to days will mean calendar, not business, days.

(l) Governing Law. This

Agreement will be governed by and construed in accordance with the laws of the State of Indiana applicable to contracts made and to be performed therein, without regard to any laws that might be applicable under conflicts of laws principles.

(m) Notices. All

notices, requests and other communications hereunder will be in writing (which will include facsimile communication) and will be deemed to have been duly given if (i) delivered by hand; (ii) sent by certified United States Mail, return receipt

requested, first class postage pre-paid; (iii) sent by overnight delivery service; or (iv) sent by facsimile transmission if such fax is confirmed immediately thereafter by also mailing a copy of such notice, request or other communication by regular

United States Mail, first class postage pre-paid, as follows:

| |

If to the Company or the Bank:

|

|

Horizon Bancorp, Inc.

Attention: Chairman of the Board of Directors

515 Franklin Street

Michigan City, IN 46360

Telephone: (219) 879-0211

Facsimile: (219) 873-2628

|

| |

|

|

|

| |

and

|

|

|

| |

|

|

|

| |

|

|

Todd A. Etzler

Executive Vice President and Chief Legal Risk Officer

Horizon Bank

515 Franklin Street

Michigan City, IN 46360

Telephone: (219) 873-2639

Facsimile: (219) 874-9280

|

| |

|

|

|

| |

If to the Executive:

|

|

Mark E. Secor

Redacted for privacy

|

or to such other address or facsimile number as any party hereto may have furnished to the other parties in writing in accordance

herewith, except that notices of change of address or facsimile number will be effective only upon receipt.

All such notices, requests and other communications will be effective (i) if delivered by hand, when delivered; (ii) if sent by mail in

the manner provided herein, two business days after deposit with the United States Postal Service; (iii) if sent by overnight express delivery service, on the next business day after deposit with such service; or (iv) if sent by facsimile transmission,

on the date indicated on the fax confirmation page of the sender if such fax also is confirmed by mail in the manner provided herein.

(n) Jurisdiction and Venue.

The parties hereto hereby agree that all demands, claims, actions, causes of action, suits, proceedings and litigation between or among the parties relating to this Agreement, will be filed, tried and litigated only in a federal or state court

located in the State of Indiana. In connection with the foregoing, the parties hereto irrevocably consent to the jurisdiction and venue of such court and expressly waive any claims or defenses of lack of jurisdiction of or proper venue by such

court.

(o) Recitals. The

recitals contained on page one of this Agreement are expressly incorporated into and made a part of this Agreement.

(p) Successors. The

Company will require any successor (whether direct or indirect, by purchase, merger, consolidation, share exchange, combination or otherwise) to all or substantially all of the business, assets or voting securities of the Bank or the Holding Company

to expressly assume and agree, in writing, to perform this Agreement in, and any successor will absolutely and unconditionally assume all of the Company’s obligations hereunder to, the same manner and extent, and upon the same terms and conditions,

that the Company would be required to perform it if no such succession had taken place. Failure of the Company to obtain such agreement prior to the effectiveness of any such succession will be a material breach of this Agreement by the Company and

will entitle the Executive to terminate his employment with the Company for Good Reason pursuant to subsection 4(c). As used in this Agreement, the Company will mean the Company as hereinbefore defined and any successor to their business, assets or

voting securities as aforesaid.

[Remainder of page intentionally left blank]

In Witness

Whereof, the parties hereto have executed this Agreement on the Effective Date.

|

HORIZON BANK

|

|

Attest

|

| |

|

|

|

|

|

By:

|

/s/ Thomas M. Prame |

|

By:

|

/s/ Peter L. Pairitz |

| |

Thomas M. Prame, Chief Executive Officer and President

|

|

|

Peter L. Pairitz, Chairperson of the Compensation Committee of the Board of Directors of Horizon Bancorp, Inc.

|

| |

|

|

|

|

| |

|

|

|

|

|

HORIZON BANCORP, INC.

|

|

EXECUTIVE

|

| |

|

|

|

|

|

By:

|

/s/ Todd A. Etzler |

|

By:

|

/s/ Mark E. Secor |

| |

Todd A. Etzler, Executive Vice President and Chief Legal Risk Officer

|

|

|

Mark E. Secor

|

16

Exhibit 99.1

|

Contact:

|

Thomas Prame

|

| |

Chief Executive Officer

|

|

Phone:

|

219-814-5983

|

|

Date:

|

November 7, 2023

|

Horizon Bancorp, Inc. Announces Key Leadership Changes

MICHIGAN CITY, Ind., November 7, 2023 (GLOBE NEWSWIRE) -- (NASDAQ GS: HBNC) – Horizon Bancorp, Inc. (“Horizon” or the “Company”) announced the succession plan

for its chief financial officer (“CFO”) and a restructuring of its mortgage and consumer lending leadership.

Horizon and Mark Secor have agreed that he will transition from his role as Executive Vice President and CFO of the Company and Horizon Bank. Mr. Secor will

continue in the role of Executive Vice President and CFO until a successor is appointed and provide transitional support through April 30, 2024.

“On behalf of the entire organization, I want to thank Mark for his many contributions to the Company over the last 16 years, including leading our finance

teams through a period of significant expansion. During his tenure, Horizon grew by nearly six-fold to become the $8 billion bank holding company it is today,” President and Chief Executive Officer Thomas Prame said. “As we commence a national search

for a new CFO, we are fortunate to have the benefit of Mark’s continued leadership and counsel. I look forward to working closely with him during the transition and exploring how Mark can continue to help accelerate Horizon’s strategic growth plans.”

Consistent with Horizon’s communicated strategy to shift resources to higher-yielding businesses, the Company announced a restructuring of its mortgage and

consumer lending division. Noe Najera, Executive Vice President, Senior Retail & Mortgage Lending Officer of the Bank, has departed the Company with the divisional teams reporting to other experienced leaders within Horizon.

“We appreciate Noe’s efforts since joining Horizon in 2016, and we wish him the very best in his future endeavors,” Prame said. “Our organization has a strong

and tenured depth of leadership in our mortgage, warehouse and consumer lending divisions. I am confident in their continued success and ability to exceed the needs of the clients and communities we serve.”

Prame added, “Horizon is proud of its longstanding history of attracting and developing talented leaders that can position the company to continue its 150

year tradition of success. As we evolve as an organization, our core community banking values will remain and continue to focus on the success of our clients, communities and shareholders.”

About Horizon Bancorp, Inc.

Celebrating 150 years, Horizon Bancorp, Inc. (NASDAQ GS: HBNC) is the $8.0 billion–asset commercial bank holding company for Horizon Bank, which serve

customers across diverse and economically attractive Midwestern markets through convenient digital and virtual tools, as well as its Indiana and Michigan branches. Horizon Bank’s retail offerings include prime residential, indirect auto, and other

consumer lending to in–market customers, as well as a range of personal banking and wealth management solutions. Horizon also provides a comprehensive array of in-market business banking and treasury management services, with commercial lending

representing over half of total loans. More information on Horizon, headquartered in Northwest Indiana’s Michigan City, is available at horizonbank.com and investor.horizonbank.com.

Forward Looking Statements

This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon

Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward–looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this

press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward–looking statements provide current

expectations or forecasts of future events and are not guarantees of future performance. The forward–looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible,

to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management

believes that the expectations reflected in such forward–looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ

materially include those risks and uncertainties that are discussed in Horizon’s reports (such as the Annual Report on Form 10–K, Quarterly Reports on Form 10–Q, and Current Reports on Form 8–K) filed with the SEC and available at the SEC’s website

(www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that

may be made to update any forward–looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

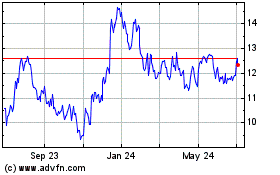

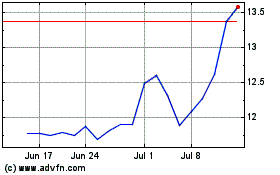

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024